Form 8-K - Current report

22 September 2023 - 11:06PM

Edgar (US Regulatory)

0000074046false00000740462023-09-212023-09-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported) | September 21, 2023 |

OIL-DRI CORPORATION OF AMERICA

(Exact name of the registrant as specified in its charter)

Delaware 001-12622 36-2048898

| | | | | | | | | | | | | | |

| (State or other jurisdiction of incorporation or organization) | | Commission File Number | | (I.R.S. Employer Identification No.) |

410 North Michigan Avenue, Suite 400 60611-4213

Chicago, Illinois (Zip Code)

(Address of principal executive offices)

Registrant's telephone number, including area code (312) 321-1515

| | |

| Not applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | ODC | New York Stock Exchange |

| | | | | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

Effective September 21, 2023 (the “Effective Date”), Oil-Dri Corporation of America (the “Company”) entered into Amendment No. 4 (the “Fourth Amendment”) to the Amended and Restated Note Purchase and Private Shelf Agreement (the “Note Agreement”) with PGIM, Inc. (“Prudential”) and certain existing noteholders affiliated with Prudential named therein.

The Fourth Amendment amends the Note Agreement to, among other things, extend the time frame for issuing and selling Shelf Notes to September 21, 2026.

The foregoing description of the Amendment does not purport to be complete and is subject to, and qualified by, the full text of the Amendment, a copy of which is attached as Exhibit 10.1 to this Form 8-K.

| | | | | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits

| | | | | | | | |

Exhibit

Number | |

Description of Exhibits |

| | | |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | OIL-DRI CORPORATION OF AMERICA | |

| | | | |

| | By: | /s/ Laura G. Scheland | |

| | | Laura G. Scheland | |

| | | Vice President, General Counsel and Secretary | |

| | | | |

Date: September 22, 2023

Execution Version September 21, 2023 OIL-DRI CORPORATION OF AMERICA 410 North Michigan Avenue, Suite 400 Chicago, Illinois 60611 Attention: Chief Financial Officer Re: Amendment No. 4 to Amended and Restated Note Purchase and Private Shelf Agreement Ladies and Gentlemen: Reference is made to the Amended and Restated Note Purchase and Private Shelf Agreement (as amended by Amendment No. 1 to Amended and Restated Note Purchase and Private Shelf Agreement dated as of December 16, 2021, Amendment No. 2 to Amended and Restated Note Purchase and Private Shelf Agreement dated as of June 3, 2022, and Amendment No. 3 to Amended and Restated Note Purchase and Private Shelf Agreement dated as of August 30, 2022, the “Note Agreement”), dated as of May 15, 2020 between Oil-Dri Corporation of America, a Delaware corporation (the “Company”), on the one hand, and PGIM, Inc. (“Prudential”), the Existing Holders, the Effective Date Purchasers named in the Purchaser Schedule attached thereto and each other Prudential Affiliate (as defined therein) which becomes a party thereto, on the other hand. Capitalized terms used herein that are not otherwise defined herein shall have the meaning specified in the Note Agreement. The Company has requested that Prudential and the holders of Notes agree to certain amendments to the Note Agreement as set forth below. Subject to the terms and conditions hereof, Prudential and the holders of Notes are willing to agree to such request. Accordingly, and in accordance with the provisions of paragraph 11C of the Note Agreement, the parties hereto agree as follows: SECTION 1. Amendments to the Note Agreement. From and after the Effective Date (as defined in Section 3 hereof), the Note Agreement is hereby amended as follows: 1.1. Paragraph 2B(2) of the Note Agreement shall be and is hereby amended by amending and restating clause (i) thereof in its entirety to read as follows: “(i) September 21, 2026 (or if such date is not a Business Day, the Business Day next preceding such date),”. 1.2. The Note Agreement is hereby amended to delete each reference to “Schiff Hardin LLP” contained therein and insert “ArentFox Schiff LLP” in lieu thereof.

2 SECTION 2. Representations and Warranties. The Company and each Guarantor represents and warrants that (a) the execution and delivery of this letter by the Company or such Guarantor has been duly authorized by all necessary corporate or limited liability company action on behalf of such Person, this letter has been executed and delivered by a duly authorized officer of such Person, and this letter constitutes legal, valid and binding obligations of such Person, enforceable against such Person in accordance with its terms, except as such enforceability may be limited by (i) bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law), (b) each representation and warranty set forth in paragraph 8 of the Note Agreement and the other Transaction Documents to which it is a party is true and correct as of the date of execution and delivery of this letter by such Transaction Party with the same effect as if made on such date, after giving effect to this letter (except to the extent such representations and warranties expressly refer to an earlier date, in which case they were true and correct as of such earlier date), and (c) no Event of Default or Default exists or has occurred and is continuing on the date hereof, immediately after giving effect to this letter. SECTION 3. Conditions Precedent. The amendments in Section 1 of this letter shall become effective as of the date (the “Effective Date”) that each of the following conditions has been satisfied: 3.1. Documents. Prudential and the holders of Notes shall have received all of the following, in form and substance satisfactory to Prudential or such holder: (i) counterparts of this letter executed by the Company, each Guarantor, Prudential and the Required Holder(s). 3.2. Fees and Expenses. The Company shall have paid (i) the Am. No. 4 Structuring Fee (as defined below) and (ii) the reasonable and documented fees, charges and out-of-pocket disbursements of ArentFox Schiff LLP, special counsel to Prudential and the holders of Notes, incurred in connection with this letter agreement. SECTION 4. Reference to and Effect on Note Agreement; Ratification of Transaction Documents. Upon the effectiveness of the amendments in Section 1 of this letter, each reference to the Note Agreement in any other Transaction Document shall mean and be a reference to the Note Agreement as modified by this letter. Except as specifically set forth in Section 1, the Note Agreement shall remain in full force and effect and is hereby ratified and confirmed in all respects. Except as expressly amended hereby, each of the Note Agreement and the other Transaction Documents are hereby ratified and confirmed in all respects and shall continue in full force and effect. Except as specifically stated in this letter, the execution, delivery and effectiveness of this letter shall not (a) amend the Note Agreement or any other Transaction Document, (b) operate as a waiver of any right, power or remedy of Prudential or any holder of Notes, or (c) constitute a waiver of, or consent to any departure from, any provision of the Note Agreement or any other Transaction Document at any time. The execution, delivery and effectiveness of this letter shall not be construed as a course of dealing or other implication that Prudential or any holder of Notes has agreed to or is prepared to grant any

3 consents or agree to any waiver to the Note Agreement in the future, whether or not under similar circumstances. SECTION 5. Structuring Fee. The Company agrees to pay to Prudential (or at the direction of Prudential) a structuring fee (the “Am. No. 4 Structuring Fee”) equal to $25,000 by wire transfer of immediately available funds. SECTION 6. Expenses. The Company hereby confirms its obligations under the Note Agreement, whether or not the transactions hereby contemplated are consummated, to pay, promptly after request by any holder of the Notes, all reasonable and documented out-of-pocket costs and expenses, including attorneys’ fees and expenses, incurred by any holder of the Notes in connection with this letter agreement or the transactions contemplated hereby, in enforcing any rights under this letter agreement, or in responding to any subpoena or other legal process or informal investigative demand issued in connection with this letter agreement or the transactions contemplated hereby to the extent provided in paragraph 11B of the Note Agreement. The obligations of the Company under this Section 6 shall survive transfer by any holder of any Note and payment of any Note. SECTION 7. Reaffirmation. Each Guarantor hereby consents to the foregoing amendments to the Note Agreement, hereby ratifies and reaffirms all of their payment and performance obligations, contingent or otherwise, under the Guaranty Agreement to which it is a party after giving effect to such amendments. Each Guarantor hereby acknowledges that, notwithstanding the foregoing amendments, that the Guaranty Agreement to which it is a party remains in full force and effect and is hereby ratified and confirmed. Without limiting the generality of the foregoing, each Guarantor agrees and confirms that the Guaranty Agreement to which it is a party continues to guaranty the Guarantied Obligations (as defined in such Guaranty Agreement) arising under or in connection with the Note Agreement, as amended by this letter agreement. The execution of this letter shall not operate as a novation, waiver of any right, power or remedy of any holder of any Note under any Guaranty Agreement. SECTION 8. Governing Law. THIS LETTER SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH, AND THE RIGHTS OF THE PARTIES SHALL BE GOVERNED BY, THE LAW OF THE STATE OF ILLINOIS (EXCLUDING ANY CONFLICTS OF LAW RULES WHICH WOULD OTHERWISE CAUSE THIS LETTER TO BE CONSTRUED OR ENFORCED IN ACCORDANCE WITH, OR THE RIGHTS OF THE PARTIES TO BE GOVERNED BY, THE LAWS OF ANY OTHER JURISDICTION). SECTION 9. Counterparts; Section Titles. This letter may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which when taken together shall constitute but one and the same instrument. Delivery of an executed counterpart of a signature page to this letter by facsimile or electronic transmission (including by “.pdf”) shall be effective as delivery of a manually executed counterpart of this letter. The section titles contained in this letter are and shall be without substance, meaning or content of any kind whatsoever and are not a part of the agreement between the parties hereto.

4 (Signature Pages Follow)

[Signature Page to Amendment No. 4 to Amended and Restated Note Purchase and Private Shelf Agreement] Very truly yours, PGIM, INC. By: _______________________________ Vice President THE PRUDENTIAL INSURANCE COMPANY OF AMERICA By: PGIM, Inc. (as Investment Manager) By: ________________________________ Vice President PRU US PP CREDIT BM FUND By: PGIM Private Placement Investors, L.P., as Investment Advisor By: PGIM Private Placement Investors, Inc., as General Partner By: ________________________________ Vice President PRUDENTIAL TERM REINSURANCE COMPANY By: PGIM, Inc., as investment manager By:_________________________________ Vice President

[Signature Page to Amendment No. 4 to Amended and Restated Note Purchase and Private Shelf Agreement] THE PRUDENTIAL LIFE INSURANCE COMPANY, LTD. By: PGIM Japan Co., Ltd., as Investment Manager By: PGIM, Inc., as Sub-Adviser By:_________________________________ Vice President ZURICH AMERICAN INSURANCE COMPANY By: PGIM Private Placement Investors, L.P. (as Investment Advisor) By: PGIM Private Placement Investors, Inc. (as its General Partner) By:_________________________________ Vice President ZURICH AMERICAN LIFE INSURANCE COMPANY By: PGIM Private Placement Investors, L.P. (as Investment Advisor) By: PGIM Private Placement Investors, Inc. (as its General Partner) By:_________________________________ Vice President

The foregoing letter is hereby accepted as of the date first above written. OIL-DRI CORPORATION OF AMERICA, a Delaware corporation .2:2 Title: Chief Financial Officer OIL-DRI CORPORATION OF GEORGIA, a Georgia corporation By: Name: Susan M. Kreh Title: Vice President i OIL-DRI PRODUCTION COMPANY, a Mississippi corporation By: JName: Susan M. Kreh Title: Vice President MOUNDS PRODUCTION COMPANY, LLC, an lllinois limited liability company By: Mounds Management, Inc., Its Manager i. %t Kt- Name: Susan M. Kreh Title: Vice President By: [Signature Page to Amendment No. 4 to Amended and Restated Note Purchase and Private Shelf Agreement]

MOUNDS MANAGEMENT, INC., a Delaware corporation By: Name: Susan M. Kreh Title: Vice President BLUE MOUNTAIN PRODUCTION COMPANY, a Mississippi corporation ». .hAkúé Name: Susan M. Kreh Title: Vice President TAFT PRODUCTION COMPANY, a Delaware corporation By: Name: Susan M. Kreh Title: Vice President AMLAN INTERNATIONAL, a Nevada corporation » PÉa- Name: Susan M. Kreh Title: Vice President [Signature Page to Amendment No. 4 to Amended and Restated Note Purchase and Private Shelf Agreement]

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

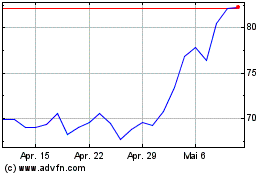

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

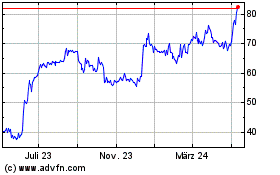

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024