false000091007300009100732024-02-062024-02-060000910073us-gaap:CommonStockMember2024-02-062024-02-060000910073nycb:BifurcatedOptionNotesUnitSecuritiesMember2024-02-062024-02-060000910073nycb:FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember2024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

NEW YORK COMMUNITY BANCORP, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-31565 | | 06-1377322 |

(State or Other Jurisdiction

of Incorporation | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 102 Duffy Avenue, | Hicksville, | New York | 11801 |

| (Address of principal executive offices) |

(516) 683-4100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | NYCB | | New York Stock Exchange |

| Bifurcated Option Note Unit Securities SM | | NYCB PU | | New York Stock Exchange |

| Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, $0.01 par value | | NYCB PA | | New York Stock Exchange |

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On February 6, 2024, New York Community Bancorp, Inc. (the “Company”) issued a press release providing additional disclosure regarding updated financial figures as of February 5, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The press release will also be available in the Investor Relations portion of the Company's website, ir.myNYCB.com, upon issuance.

The press release is being furnished pursuant to Item 7.01 of this Current Report on Form 8-K. and the information contained therein shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed subject to the requirements of amended Item 10 of Regulation S-K, nor shall it be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The furnishing of this information hereby shall not be deemed an admission as to the materiality of any such information.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Attached as Exhibit 99.1 is a press release issued by the Company on February 6, 2024 to report updated financial figures.

Exhibit Index

| | | | | | | | | | | |

| Exhibit Number | | Description | |

| |

| Exhibit 99.1 | | |

| Exhibit 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | NEW YORK COMMUNITY BANCORP, INC. |

| | | | |

| Dated: | February 6, 2024 | | | | By: | | /s/ Salvatore J. DiMartino |

| | | | | | | Salvatore J. DiMartino |

| | | | | | | Executive Vice President |

| | | | | | | Chief of Staff to the CEO |

| | | | | | | | | | | | | | | | | |

| NEWS RELEASE |

| | s |

| 102 Duffy Avenue, Hicksville, NY 11801 ● Phone: (516) 683-4420 ● www.myNYCB.com |

|

| FOR IMMEDIATE RELEASE | Investor/Media Contact: | | Salvatore J. DiMartino |

| | | | (516) 683-4286 |

NEW YORK COMMUNITY BANCORP, INC. ISSUES CURRENT LIQUIDITY AND DEPOSIT INFORMATION

Hicksville, N.Y., February 6, 2024 – New York Community Bancorp, Inc. (NYSE: NYCB) (the “Company”) today reported updated financial (unaudited) information (all figures as of 2/5/2024):

•Deposit Stability

oTotal deposits of approximately $83.0 billion, which is up from year end 2023

oTotal insured and collateralized deposits represent 72% of total deposits

oTotal uninsured deposits, excluding collateralized and internal deposits, are $22.9 billion

oWe maintain over $10 billion of reciprocal deposit capacity to offer expanded deposit insurance to our clients

o90% of the balances in our top 20 deposit relationships are fully insured or collateralized

•Ample Liquidity

oTotal liquidity of $37.3 billion which exceeds uninsured deposits, with a coverage ratio of 163%

oCash held on balance sheet of approximately $17.0 billion

oUnencumbered securities of approximately $6.1 billion lendable value

oFully collateralized credit facility with available capacity from the Federal Reserve Bank of New York and excess lendable value of collateral at the Federal Home Loan Bank of New York totaling $14.2 billion

President and Chief Executive Officer, Thomas R. Cangemi stated, “We took decisive actions to fortify our balance sheet and strengthen our risk management processes during the fourth quarter. Our actions are an investment in enhancing a risk management framework commensurate with the size and complexity of our bank and providing a solid foundation going forward. Despite the Moody’s ratings downgrade, our deposit ratings from Moody’s, Fitch and DBRS remain investment grade. The Moody’s downgrade is not expected to have a material impact on our contractual arrangements.

“Finally, as part of the bank’s enhancements to its risk management processes we have been engaged in an orderly process of bringing in a new chief risk officer and chief audit executive with large bank experience and we currently have qualified personnel filling those positions on an interim basis.”

Cautionary Statements Regarding Forward-Looking Information

This press release may include forward‐looking statements by the Company pertaining to such matters as our goals, intentions, and expectations regarding revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; and our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction, and our transition to a $100 billion plus bank.

Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and

uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results.

Our forward‐looking statements are subject to the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios; changes in future allowance for credit losses requirements under relevant accounting and regulatory requirements; the ability to pay future dividends at currently expected rates; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; changes in competitive pressures among financial institutions or from non‐financial institutions; changes in legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction: the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10‐K for the year ended December 31, 2022, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this news release, on our conference call, during investor presentations, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

About New York Community Bancorp, Inc.

New York Community Bancorp, Inc. is the parent company of Flagstar Bank, N.A., one of the largest regional banks in the country. The Company is headquartered in Hicksville, New York. At December 31, 2023, the Company had $116.3 billion of assets, $85.8 billion of loans, deposits of $81.4 billion, and total stockholders’ equity of $10.8 billion.

Flagstar Bank, N.A. operates 420 branches, including strong footholds in the Northeast and Midwest and exposure to high growth markets in the Southeast and West Coast. Flagstar Mortgage operates nationally through a wholesale network of approximately 3,000 third-party mortgage originators. In addition, the Bank has 134 private banking teams located in over 10 cities in the metropolitan New York City region and on the West Coast, which serve the needs of high-net worth individuals and their businesses.

New York Community Bancorp, Inc. has market-leading positions in several national businesses, including multi-family lending, mortgage origination and servicing, and warehouse lending. The Company is the 2nd largest multi-family portfolio lender in the country and the leading multi-family portfolio lender in the New York City market area, where it specializes in rent-regulated, non-luxury apartment buildings. Flagstar Mortgage is the 7th largest bank originator of residential mortgages for the 12-months ending December 31, 2023, while we are the industry’s 5th largest sub-servicer of mortgage loans nationwide, servicing 1.4 million accounts with $382 billion in unpaid principal balances. Additionally, the Company is the 2nd largest mortgage warehouse lender nationally based on total commitments.

v3.24.0.1

Document and Entity Information

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity Registrant Name |

NEW YORK COMMUNITY BANCORP, INC.

|

| Entity Central Index Key |

0000910073

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

06-1377322

|

| Entity Address, City or Town |

Hicksville,

|

| Entity Address, Postal Zip Code |

11801

|

| City Area Code |

516

|

| Local Phone Number |

683-4100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

1-31565

|

| Entity Address, Address Line One |

102 Duffy Avenue,

|

| Entity Address, State or Province |

NY

|

| Document Information [Line Items] |

|

| Document Period End Date |

Feb. 06, 2024

|

| Document Type |

8-K

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

NYCB

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

NYCB

|

| Bifurcated Option Note Unit Securities [Member] |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Bifurcated Option Note Unit Securities SM

|

| Trading Symbol |

NYCB PU

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Bifurcated Option Note Unit Securities SM

|

| Trading Symbol |

NYCB PU

|

| Fixed To Floating Rate Series A Noncumulative Perpetual Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, $0.01 par value

|

| Trading Symbol |

NYCB PA

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, $0.01 par value

|

| Trading Symbol |

NYCB PA

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_BifurcatedOptionNotesUnitSecuritiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

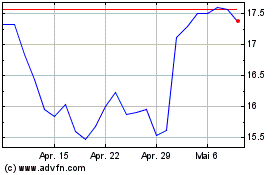

New York Community Bancorp (NYSE:NYCB-A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

New York Community Bancorp (NYSE:NYCB-A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024