false 0001110805 0001110805 2024-01-22 2024-01-22 0001110805 us-gaap:CommonStockMember 2024-01-22 2024-01-22 0001110805 ns:Eight50SeriesAFixedToFloatingRateCumulativeRedeemablePerpetualPreferredUnitsMember 2024-01-22 2024-01-22 0001110805 ns:Seven625SeriesBFixedToFloatingRateCumulativeRedeemablePerpetualPreferredUnitsMember 2024-01-22 2024-01-22 0001110805 ns:Nine00SeriesCFixedToFloatingRateCumulativeRedeemablePerpetualPreferredUnitsMember 2024-01-22 2024-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2024

NuStar Energy L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-16417 |

|

74-2956831 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

19003 IH-10 West

San Antonio, Texas 78257

(Address of principal executive offices)

Registrant’s telephone number, including area code: (210) 918-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act

|

|

|

|

|

| Title of each class |

|

Ticker Symbol |

|

Name of each exchange on which registered |

| Common units |

|

NS |

|

New York Stock Exchange |

| 8.50% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

|

NSprA |

|

New York Stock Exchange |

| 7.625% Series B Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

|

NSprB |

|

New York Stock Exchange |

| 9.00% Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

|

NSprC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On January 22, 2024, NuStar Energy L.P., a Delaware limited partnership (“NuStar”), and Sunoco LP, a Delaware limited partnership (“Sunoco”), issued a joint press release announcing their entry into a definitive agreement whereby Sunoco will acquire NuStar in an all-equity transaction.

Additionally, NuStar and Sunoco issued a joint investor presentation in connection with the aforementioned announcement. Copies of such joint press release and joint investor presentation are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

No Offer or Solicitation

This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information about the Merger and Where to Find It

In connection with the potential transaction between Sunoco LP (“Sunoco”) and NuStar Energy L.P. (“NuStar”), Sunoco expects to file a registration statement on Form S-4 with the U.S. Securities and Exchange Commission (“SEC”) containing a preliminary prospectus of Sunoco that also constitutes a preliminary proxy statement of NuStar. After the registration statement is declared effective, NuStar will mail a definitive proxy statement/prospectus to its common unitholders. This communication is not a substitute for the proxy statement/prospectus or registration statement or for any other document that Sunoco or NuStar may file with the SEC and send to NuStar’s common unitholders in connection with the potential transaction. INVESTORS AND SECURITY HOLDERS OF SUNOCO AND NUSTAR ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus (when available) and other documents filed with the SEC by Sunoco or NuStar through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Sunoco will be available free of charge on Sunoco’s website at https://www.sunocolp.com/investors and copies of the documents filed with the SEC by NuStar will be available free of charge on NuStar’s website at https://investor.nustarenergy.com/.

Participants in the Solicitation

Sunoco and NuStar and certain of Sunoco GP’s and NuStar GP’s respective directors and their respective executive officers and other members of management and employees may be considered participants in the solicitation of proxies with respect to the potential transaction under the rules of the SEC. Information about the directors and executive officers of Sunoco GP is set forth in Sunoco’s Annual Report on Form 10-K for the year ended December 31, 2022 under the headings “Item 10. Directors, Executive Officers and Corporate Governance” and “Item 11. Executive Compensation” and “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters”, which was filed with the SEC on February 17, 2023 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1552275/000155227523000010/sun-20221231.htm. Information about the directors and executive officers of NuStar GP is set forth in NuStar’s proxy statement for its 2023 annual meeting under the headings “Information About Our Executive Officers”, “Compensation Discussion and Analysis”, “Summary Compensation Table”, “Pay Ratio”, “Grants of Plan-Based Awards During the Year Ended December 31, 2022”, “Outstanding Equity Awards at December 31, 2022”, “Option Exercises and Units Vested During the Year Ended December 31, 2022”, “Pension Benefits for the Year Ended December 31, 2022”, “Nonqualified Deferred Compensation for the Year Ended December 31, 2022”, “Potential Payments Upon Termination or Change of Control”, “Pay Versus Performance”, “Director Compensation”, “Certain Relationships and Related Party Transactions” and “Security Ownership”, which was filed with the SEC on March 9, 2023 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1110805/000111080523000017/ns-20230309.htm. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such participants in the solicitation of proxies in respect of the potential transaction will be included in the registration statement and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” as defined by federal securities law. These forward-looking statements generally include statements regarding the potential transaction between Sunoco and NuStar, including any statements regarding the expected timetable for completing the potential transaction, the ability to complete the potential transaction, the expected benefits of the potential transaction, projected financial information, future opportunities, and any other statements regarding Sunoco’s and NuStar’s future expectations, beliefs, plans, strategies, objectives, estimates, predictions, projections, assumptions, intentions, resources, results of operations, financial condition and cash flows, future events or performance and the future impact of economic activity and the actions by oil-producing nations on their respective businesses. These forward-looking statements can generally be identified by the words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “targets,” “forecasts,” “projects,” “believes,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “may,” “could,” “should,” “will,” “budgets,” “outlook,” “trends,” “guidance,” “focus,” “on schedule,” “on track,” “is slated,” “goals,” “objectives,” “strategies,” “opportunities,” “poised,” “potential” and similar expressions. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect the current judgment of Sunoco’s and NuStar’s management regarding the direction of their respective businesses, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this communication. Key factors that could cause actual results to differ materially from those projected in the forward-looking statements include the ability to obtain the requisite NuStar unitholder approval; uncertainties as to the timing to consummate the potential transaction; the risk that a condition to closing the potential transaction may not be satisfied; the risk that regulatory approvals are not obtained or are obtained subject to conditions that are not anticipated by the parties; the effects of disruption to Sunoco’s or NuStar’s respective businesses; the effect of the potential transaction on the parties’ unit prices; the effects of industry, market, economic, political or regulatory conditions outside of the parties’ control; transaction costs; Sunoco’s ability to achieve the benefits from the proposed transaction, Sunoco’s ability to promptly, efficiently and effectively integrate acquired operations into its own operations; unknown liabilities; and the diversion of management time on transaction-related issues. Other important factors that could cause actual results to differ materially from those in the forward-looking statements include those described in the “Risk Factors” section of NuStar’s most recent Annual Report on Form 10-K, as it may be updated from time to time by quarterly reports on Form 10-Q and current reports on Form 8-K all of which are available on NuStar’s website at https://investor.nustarenergy.com/sec-filings and on the SEC’s website at http://www.sec.gov, and in the “Risk Factors” section of Sunoco’s most recent Annual Report on Form 10-K, as it may be updated from time to time by quarterly reports on Form 10-Q and current reports on Form 8-K, all of which are available on Sunoco’s website at https://www.sunocolp.com/investors/sec-filings and on the SEC’s website at http://www.sec.gov. Those disclosures are incorporated by reference in this communication. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, the actual results may vary materially from those described in any forward-looking statement. Other unknown or unpredictable factors could also have material adverse effects on future results. Readers are cautioned not to place undue reliance on this forward-looking information, which is as of the date of this communication. Sunoco and NuStar do not intend to update these statements unless required by the securities laws to do so, and Sunoco and NuStar undertake no obligation to publicly release the result of any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NuStar Energy L.P. |

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

Riverwalk Logistics, L.P. |

|

|

|

|

|

|

|

|

its general partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

NuStar GP, LLC |

|

|

|

|

|

|

its general partner |

|

|

|

|

|

|

|

|

|

|

|

| Dated: January 22, 2024 |

|

|

|

By: |

|

/s/ Amy L. Perry |

|

|

|

|

Name: |

|

Amy L. Perry |

|

|

|

|

Title: |

|

Executive Vice President-Strategic Development and General Counsel |

Exhibit 99.1

Sunoco LP to Acquire NuStar Energy L.P. in Transaction Valued at $7.3 Billion

DALLAS, January 22, 2024—Sunoco LP (NYSE: SUN) (“Sunoco” or the “Partnership”) and NuStar Energy L.P. (NYSE: NS)

(“NuStar”) announced today that the parties have entered into a definitive agreement whereby Sunoco will acquire NuStar in an all-equity transaction valued at approximately $7.3 billion,

including assumed debt.

Transaction Details

Under

the terms of the agreement, NuStar common unitholders will receive 0.400 Sunoco common units for each NuStar common unit, implying a 24% premium based on the 30-day VWAP’s of both NuStar and Sunoco as of

January 19, 2024. Sunoco has secured a $1.6 billion 364-day bridge term loan to refinance NuStar’s Series A, B and C Preferred Units, Subordinated Notes, Revolving Credit Facility, and

Receivables Financing Agreement.

The transaction has been unanimously approved by the board of directors of both companies and is expected to close in

the second quarter of 2024 upon the satisfaction of closing conditions, including approval by NuStar’s unitholders and customary regulatory approvals.1

Strategic Rationale

| |

• |

|

Increases Stability: Diversifies business, adds scale, and captures benefits of vertical integration by

combining two stable businesses |

| |

• |

|

Strengthens Financial Foundation: Continues Sunoco’s successful capital allocation strategy on a

larger scale, improving the Partnership’s credit profile, and supporting a growing distribution |

| |

• |

|

Enhances Growth: More cash flow generation for reinvestment and growth across an expanded opportunity set

|

Positive Financial Outlook

| |

• |

|

Accretion: Immediately accretive with 10%+ accretion to distributable cash flow per LP unit by the third

year following close |

| |

• |

|

Synergies: At least $150 million of run-rate synergies by the

third year following close |

| |

• |

|

Financial Savings: Approximately $50 million per year of additional cash flow from refinancing

high-cost floating rate capital |

| |

• |

|

Leverage: Will achieve leverage target of 4.0x within 12-18 months

post close |

| |

• |

|

Distribution Growth: Supports continued distribution growth while maintaining strong coverage

|

| 1 |

Prior to closing, NuStar will make a cash distribution of $0.212 per common unit to its common unitholders.

|

1

Additional details will be made available today in a presentation on the Investor Relations section of

Sunoco’s website at www.SunocoLP.com under Webcasts and Presentations and on the Investor section of NuStar’s website at www.NuStarEnergy.com.

Conference Call Information

Sunoco LP management will

hold a conference call on Monday, January 22 at 10:00 a.m. Eastern Standard Time (9:00 a.m. Central Standard Time) to discuss the transaction. To participate, dial

877-407-6184 (toll free) or 201-389-0877 at least 10 minutes before the call and ask for

the Sunoco LP conference call. The conference call will also be accessible live and for later replay via webcast in the Investor Relations section of Sunoco’s website at www.SunocoLP.com under Webcasts and Presentations.

Advisors

Truist Securities served as the exclusive

financial advisor to Sunoco. Truist and Bank of America provided committed financing. Weil, Gotshal & Manges LLP and Vinson & Elkins LLP acted as Sunoco’s legal advisors.

Barclays served as the exclusive financial advisor to NuStar. Wachtell, Lipton, Rosen & Katz and Sidley Austin LLP acted as NuStar’s legal

advisors.

About Sunoco

Sunoco LP (NYSE: SUN) is a

master limited partnership with core operations that include the distribution of motor fuel to approximately 10,000 convenience stores, independent dealers, commercial customers and distributors located in more than 40 U.S. states and territories as

well as refined product transportation and terminalling assets. SUN’s general partner is owned by Energy Transfer LP (NYSE: ET).

About NuStar

NuStar Energy L.P. (NYSE: NS) is an independent liquids terminal and pipeline operator. NuStar currently has approximately 9,500 miles of

pipeline and 63 terminal and storage facilities that store and distribute crude oil, refined products, renewable fuels, ammonia and specialty liquids. The partnership’s combined system has approximately 49 million barrels of storage

capacity, and NuStar has operations in the United States and Mexico. For more information, visit NuStar Energy L.P.’s website at www.nustarenergy.com and its Sustainability page at https://sustainability.nustarenergy.com/.

Forward-Looking Statements

This communication contains

“forward-looking statements” as defined by applicable securities law. In this context, forward-looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often include, but are

not limited to, words such as “believe,” “expect,” “may,” “will,” “should,” “could,” “would,” “anticipate,” “estimate,” “intend,” “plan,”

“seek,” “see,” “target” or similar expressions,

2

or variations or negatives of these words, but not all forward-looking statements include such words. Forward-looking statements by their nature address matters that are, to different degrees,

uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks,

uncertainties and assumptions, many of which are beyond the control of Sunoco LP (“Sunoco” or “SUN”) and NuStar Energy L.P. (“NuStar” or “NS”), that could cause actual results to differ materially from those

expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: the completion of the proposed transaction on anticipated terms and timing, or at all, including obtaining

regulatory approvals and NuStar unitholder approval; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, prospects,

business and management strategies for the management, expansion and growth of the combined company’s operations, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be

realized within the expected time period; the ability of Sunoco and NuStar to integrate the business successfully and to achieve anticipated synergies and value creation; potential litigation relating to the proposed transaction that could be

instituted against Sunoco, NuStar or the directors of their respective general partners; the risk that disruptions from the proposed transaction will harm Sunoco’s or NuStar’s business, including current plans and operations and that

management’s time and attention will be diverted on transaction-related issues; potential adverse reactions or changes to business relationships, including with employees, suppliers, customers, competitors or credit rating agencies, resulting

from the announcement or completion of the proposed transaction; rating agency actions and Sunoco and NuStar’s ability to access short-and long-term debt markets on a timely and affordable basis; potential business uncertainty, including the

outcome of commercial negotiations and changes to existing business relationships during the pendency of the proposed transaction that could affect Sunoco’s and/or NuStar’s financial performance and operating results; certain restrictions

during the pendency of the merger that may impact NuStar’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business; dilution caused by Sunoco’s issuance of additional units representing

limited partner interests in connection with the proposed transaction; fees, costs and expenses and the possibility that the transaction may be more expensive to complete than anticipated; those risks described in Item 1A of Sunoco’s Annual

Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 17, 2023, and its subsequent Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K; those risks described in Item 1A of NuStar’s Annual Report on Form 10-K, filed with the SEC on February 23, 2023, and its

subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K; and those risks that will be more fully described in the registration statement on Form S-4 and accompanying proxy statement/prospectus that will be filed with the SEC in connection with the proposed transaction. Those disclosures are incorporated by reference in this presentation. While the list of

factors presented here is, and the list of factors to be presented in the registration statement and the proxy statement/prospectus will be, considered representative, no such list should be considered to be a complete statement of all potential

risks and

3

uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Readers are cautioned not to place undue reliance on this

forward-looking information, which is as of the date of this communication. Sunoco and NuStar do not intend to update these statements unless required by the securities laws to do so, and Sunoco and NuStar undertake no obligation to publicly release

the result of any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this communication.

Important Information about the Transaction and Where to Find It

In connection with the proposed transaction between Sunoco and NuStar, Sunoco intends to file a registration statement on Form

S-4 (the “Registration Statement”) that will include a prospectus with respect to Sunoco’s units to be issued in the proposed transaction and a proxy statement for NuStar’s common

unitholders (the “Proxy Statement/Prospectus”), and each party may file other documents regarding the proposed transaction with the SEC. NuStar will mail the definitive Proxy Statement/Prospectus to common unitholders of NuStar. This

communication is not a substitute for the Registration Statement, Proxy Statement/Prospectus or any other document that Sunoco or NuStar (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR

INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SUNOCO AND NUSTAR ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders

may obtain free copies of the Registration Statement and the Proxy statement/Prospectus (when they become available), as well as other filings containing important information about Sunoco or NuStar, without charge at the SEC’s website, at

http://www.sec.gov. Copies of the documents filed with the SEC by Sunoco will be available free of charge on Sunoco’s website at www.sunocolp.com. Copies of the documents filed with the SEC by NuStar will be available free of charge on

NuStar’s website at www.nustarenergy.com. The information included on, or accessible through, Sunoco’s or NuStar’s website is not incorporated by reference into this communication.

Participants in the Solicitation

Sunoco, NuStar and the

directors and certain executive officers of their respective general partners may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of

NuStar’s general partner is set forth in (i) its proxy statement for its 2023 annual meeting of unitholders

(https://www.sec.gov/ix?doc=/Archives/edgar/data/1110805/000111080523000017/ns-20230309.htm), which was filed with the SEC on March 9, 2023, , including under the sections entitled “Information About

Our Executive Officers”, “Compensation Discussion and Analysis”, “Summary Compensation Table”, “Pay Ratio”, “Grants of Plan-Based Awards During the Year Ended December 31, 2022”, “Outstanding

Equity Awards at December 31, 2022”, “Option Exercises and Units Vested During the Year Ended December 31, 2022”, “Pension Benefits for the Year Ended

4

December 31, 2022”, “Nonqualified Deferred Compensation for the Year Ended December 31, 2022”, “Potential Payments Upon Termination or Change of Control”,

“Pay Versus Performance”, “Director Compensation” and “Security Ownership”, (ii) in its Annual Report on Form 10-K for the year ended December 31, 2022 (https://www.sec.gov/ix?doc=/Archives/edgar/data/1110805/000111080523000010/ns-20221231.htm), which was filed with the SEC on February 23, 2023, including under the sections entitled “Item. 10. Directors,

Executive Officers and Corporate Governance,” “Item 11. Executive Compensation,” “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters” and “Item 13. Certain

Relationships and Related Transactions, and Director Independence” and (iii) subsequent statements of changes in beneficial ownership on file with the SEC. Information about the directors and executive officers of Sunoco’s general

partner is set forth in (i) its Annual Report on Form 10-K for the year ended December 31, 2022,

(https://www.sec.gov/ix?doc=/Archives/edgar/data/1552275/000155227523000010/sun-20221231.htm) which was filed with the SEC on February 17, 2023, including under the sections entitled “Item. 10.

Directors, Executive Officers and Corporate Governance,” “Item 11. Executive Compensation,” “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters” and “Item 13. Certain

Relationships and Related Transactions, and Director Independence” and (ii) subsequent statements of changes in beneficial ownership on file with the SEC. Additional information regarding the participants in the proxy solicitation and a

description of their direct or indirect interests, by security holdings or otherwise, will be contained in the Proxy statement/Prospectus and other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for

informational purposes only and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, issuance, exchange,

transfer, solicitation or sale of securities in any jurisdiction in which such offer, issuance, exchange, transfer, solicitation or sale would be in contravention of applicable law. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act.

The information contained in this press release is available on our website

at www.sunocolp.com.

Contacts

|

|

|

| SUN Investors: |

|

NS Investors: |

|

|

| Scott Grischow |

|

Pam Schmidt |

|

|

| (214) 840-5660 |

|

(210) 918-2854 |

|

|

| scott.grischow@sunoco.com |

|

pam.schmidt@nustarenergy.com |

|

|

|

| SUN Media: |

|

NS Media: |

|

|

| Alexis Daniel |

|

Mary Rose Brown |

|

|

| (214) 981-0739 |

|

(210) 918-2314 |

|

|

| alexis.daniel@sunoco.com |

|

maryrose.brown@nustarenergy.com |

5

Sunoco LP to Acquire NuStar Energy

L.P. January 22, 2024 Exhibit 99.2

Forward-Looking Statements This

presentation contains “forward-looking statements” as defined by applicable federal securities laws. In this context, forward-looking statements often address future business and financial events, conditions, expectations, plans or

ambitions, and often include, but are not limited to, words such as “believe,” “expect,” “may,” “will,” “should,” “could,” “would,” “anticipate,”

“estimate,” “intend,” “plan,” “seek,” “see,” “target” or similar expressions, or variations or negatives of these words, but not all forward-looking statements include such

words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking

statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of Sunoco LP (“Sunoco” or “SUN”) and NuStar Energy

L.P. (“NuStar” or “NS”), that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to:

the completion of the proposed transaction on anticipated terms and timing, or at all, including obtaining regulatory approvals and NuStar unitholder approval; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues,

expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, prospects, business and management strategies for the management, expansion and growth of the combined company’s operations, including the

possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; the ability of Sunoco and NuStar to integrate the business successfully and to achieve

anticipated synergies and value creation; potential litigation relating to the proposed transaction that could be instituted against Sunoco, NuStar or the directors of their respective general partners; the risk that disruptions from the proposed

transaction will harm Sunoco’s or NuStar’s business, including current plans and operations and that management’s time and attention will be diverted on transaction-related issues; potential adverse reactions or changes to business

relationships, including with employees, suppliers, customers, competitors or credit rating agencies, resulting from the announcement or completion of the proposed transaction; rating agency actions and Sunoco and NuStar’s ability to access

short- and long-term debt markets on a timely and affordable basis; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the proposed transaction that

could affect Sunoco’s and/or NuStar’s financial performance and operating results; certain restrictions during the pendency of the merger that may impact NuStar’s ability to pursue certain business opportunities or strategic

transactions or otherwise operate its business; dilution caused by Sunoco’s issuance of additional units representing limited partner interests in connection with the proposed transaction; fees, costs and expenses and the possibility that the

transaction may be more expensive to complete than anticipated; those risks described in Item 1A of Sunoco’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 17, 2023, and its

subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K; those risks described in Item 1A of NuStar’s Annual Report on Form 10-K, filed with the SEC on February 23, 2023, and its subsequent Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K; and those risks that will be more fully described in the registration statement on Form S-4 and accompanying proxy statement/prospectus that will be filed with the SEC in connection with the proposed transaction. Those

disclosures are incorporated by reference in this presentation. While the list of factors presented here is, and the list of factors to be presented in the registration statement and the proxy statement/prospectus will be, considered representative,

no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Readers are cautioned not to place

undue reliance on this forward-looking information, which is as of the date of this presentation. Sunoco and NuStar do not intend to update these statements unless required by the securities laws to do so, and Sunoco and NuStar undertake no

obligation to publicly release the result of any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this presentation. Investor Relations Contact Information Pam Schmidt Vice

President Investor Relations (210) 918-2854 Pam.Schmidt@nustarenergy.com Scott Grischow Treasurer, Senior Vice President Investor Relations, M&A (214) 840-5660 scott.grischow@sunoco.com

Transaction Disclosures Important

Information about the Proposed Transaction and Where to Find It In connection with the proposed transaction between Sunoco and NuStar, Sunoco intends to file a registration statement on Form S-4 (the “Registration Statement”) that will

include a prospectus with respect to Sunoco’s units to be issued in the proposed transaction and a proxy statement for NuStar’s unitholders (the “Proxy Statement/Prospectus”), and each party may file other documents regarding

the proposed transaction with the SEC. NuStar will mail the definitive Proxy Statement/Prospectus to unitholders of NuStar. This presentation is not a substitute for the Registration Statement, Proxy Statement/Prospectus or any other document that

Sunoco or NuStar (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SUNOCO AND NUSTAR ARE URGED TO READ THE REGISTRATION STATEMENT,

THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Registration Statement and the Proxy statement/Prospectus (when they become available), as

well as other filings containing important information about Sunoco or NuStar, without charge at the SEC’s website, at http://www.sec.gov. Copies of the documents filed with the SEC by Sunoco will be available free of charge on Sunoco’s

website at www.sunocolp.com under the tab “Investor Relations” and then under the tab “SEC Filings & Financial Reports” or by directing a request to Investor Relations, Sunoco LP, 8111 Westchester Drive, Suite 400,

Dallas, TX 75225, Tel. No. (214) 840-5660 or to IR@SunocoLP.com. Copies of the documents filed with the SEC by NuStar will be available free of charge on NuStar’s website at www.nustarenergy.com under the tab “Investors” and then

under the tab “SEC Filings” or by directing a request to Investor Relations, NuStar Energy LP, 19003 IH-10 West, San Antonio, TX 78257, Tel. No. (800) 866-9060 or to investorrelations@nustarenergy.com or

corporatesecretary@nustarenergy.com. The information included on, or accessible through, Sunoco’s or NuStar’s website is not incorporated by reference into this presentation. Participants in the Solicitation Sunoco, NuStar and the

directors and certain executive officers of their respective general partners may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of

NuStar’s general partner is set forth in (i) its proxy statement for its 2023 annual meeting of unitholders (https://www.sec.gov/ix?doc=/Archives/edgar/data/1110805/000111080523000017/ns-20230309.htm), which was filed with the SEC on March 9,

2023, , including under the sections entitled “Information About Our Executive Officers”, “Compensation Discussion and Analysis”, “Summary Compensation Table”, “Pay Ratio”, “Grants of Plan-Based

Awards During the Year Ended December 31, 2022”, “Outstanding Equity Awards at December 31, 2022”, “Option Exercises and Units Vested During the Year Ended December 31, 2022”, “Pension Benefits for the Year Ended

December 31, 2022”, “Nonqualified Deferred Compensation for the Year Ended December 31, 2022”, “Potential Payments Upon Termination or Change of Control”, “Pay Versus Performance”, “Director

Compensation” and “Security Ownership”, (ii) in its Annual Report on Form 10-K for the year ended December 31, 2022 (https://www.sec.gov/ix?doc=/Archives/edgar/data/1110805/000111080523000010/ns-20221231.htm), which was filed with

the SEC on February 23, 2023, including under the sections entitled “Item. 10. Directors, Executive Officers and Corporate Governance,” “Item 11. Executive Compensation,” “Item 12. Security Ownership of Certain

Beneficial Owners and Management and Related Unitholder Matters” and “Item 13. Certain Relationships and Related Transactions, and Director Independence” and (iii) subsequent statements of changes in beneficial ownership on file

with the SEC. Information about the directors and executive officers of Sunoco’s general partner is set forth in (i) its Annual Report on Form 10-K for the year ended December 31, 2022,

(https://www.sec.gov/ix?doc=/Archives/edgar/data/1552275/000155227523000010/sun-20221231.htm) which was filed with the SEC on February 17, 2023, including under the sections entitled “Item. 10. Directors, Executive Officers and Corporate

Governance,” “Item 11. Executive Compensation,” “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters” and “Item 13. Certain Relationships and Related

Transactions, and Director Independence” and (ii) subsequent statements of changes in beneficial ownership on file with the SEC. Additional information regarding the participants in the proxy solicitation and a description of their direct or

indirect interests, by security holdings or otherwise, will be contained in the Proxy statement/Prospectus and other relevant materials filed with the SEC when they become available. No Offer or Solicitation This presentation is for informational

purposes only and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, issuance, exchange, transfer,

solicitation or sale of securities in any jurisdiction in which such offer, issuance, exchange, transfer, solicitation or sale would be in contravention of applicable law. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act.

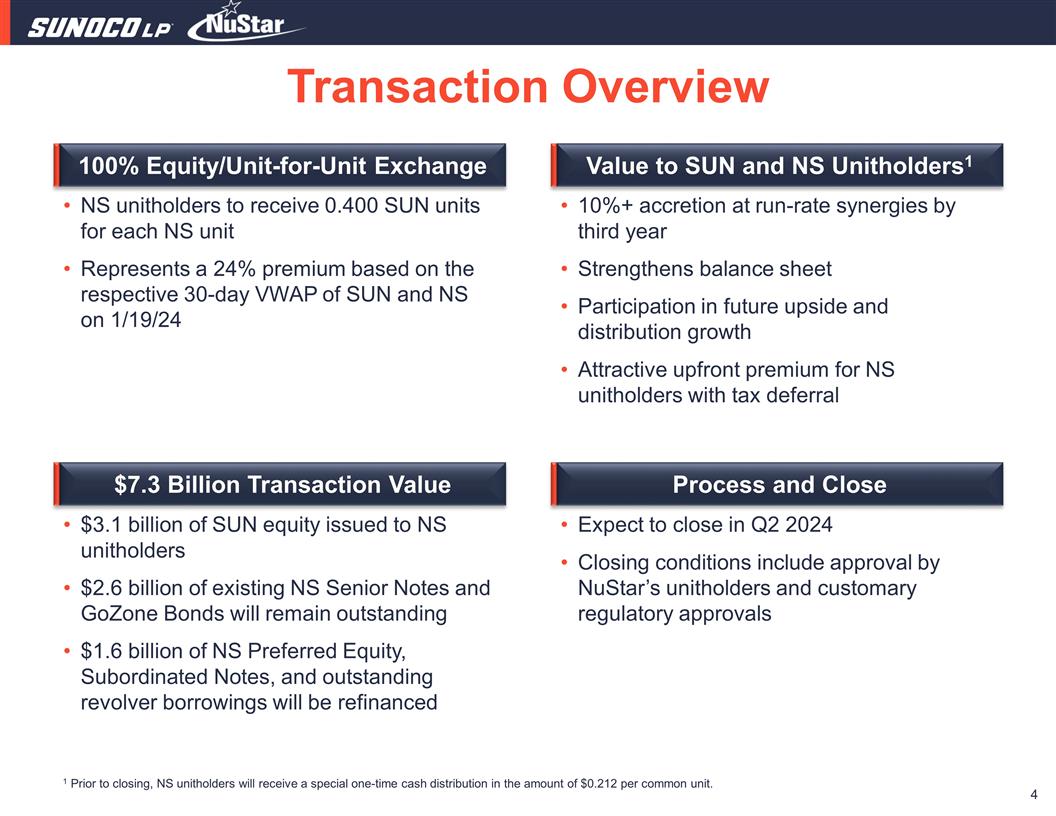

Transaction Overview NS unitholders to

receive 0.400 SUN units for each NS unit Represents a 24% premium based on the respective 30-day VWAP of SUN and NS on 1/19/24 Expect to close in Q2 2024 Closing conditions include approval by NuStar’s unitholders and customary regulatory

approvals $3.1 billion of SUN equity issued to NS unitholders $2.6 billion of existing NS Senior Notes and GoZone Bonds will remain outstanding $1.6 billion of NS Preferred Equity, Subordinated Notes, and outstanding revolver borrowings will be

refinanced 10%+ accretion at run-rate synergies by third year Strengthens balance sheet Participation in future upside and distribution growth Attractive upfront premium for NS unitholders with tax deferral 100% Equity/Unit-for-Unit Exchange Value

to SUN and NS Unitholders1 $7.3 Billion Transaction Value Process and Close 1 Prior to closing, NS unitholders will receive a special one-time cash distribution in the amount of $0.212 per common unit.

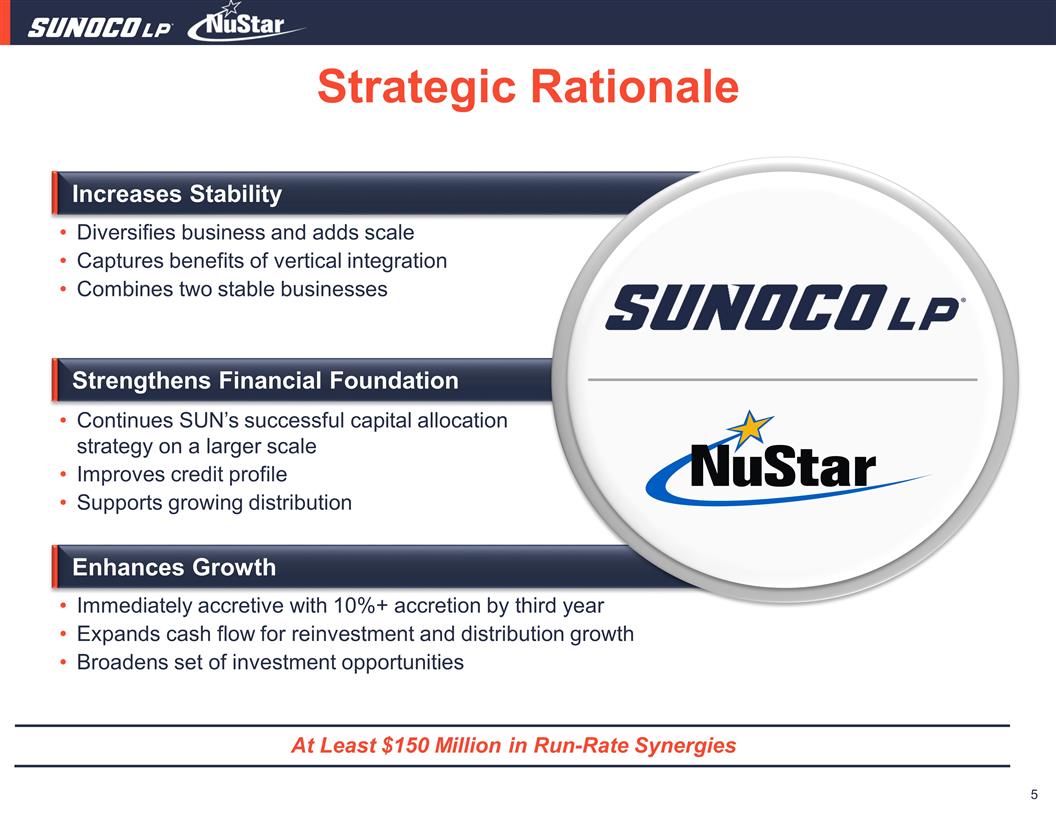

At Least $150 Million in Run-Rate

Synergies Strategic Rationale Immediately accretive with 10%+ accretion by third year Expands cash flow for reinvestment and distribution growth Broadens set of investment opportunities Enhances Growth Continues SUN’s successful capital

allocation strategy on a larger scale Improves credit profile Supports growing distribution Strengthens Financial Foundation Diversifies business and adds scale Captures benefits of vertical integration Combines two stable businesses Increases

Stability

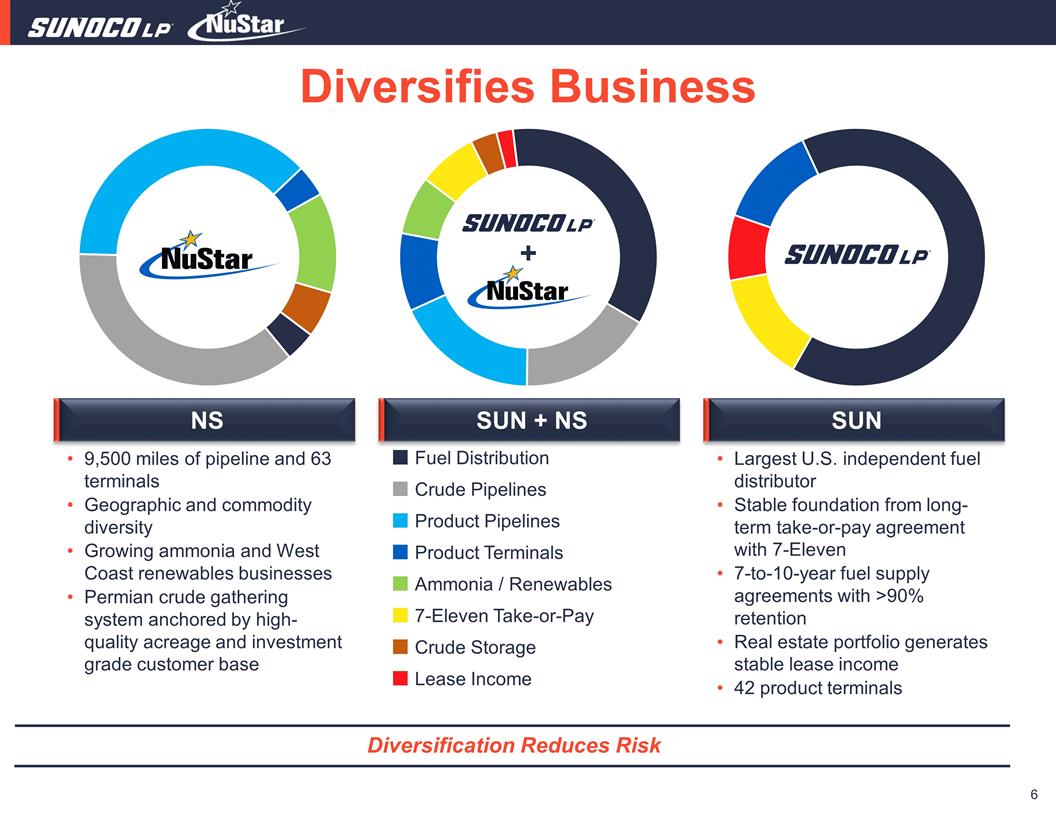

9,500 miles of pipeline and 63

terminals Geographic and commodity diversity Growing ammonia and West Coast renewables businesses Permian crude gathering system anchored by high-quality acreage and investment grade customer base Largest U.S. independent fuel distributor Stable

foundation from long-term take-or-pay agreement with 7-Eleven 7-to-10-year fuel supply agreements with >90% retention Real estate portfolio generates stable lease income 42 product terminals Diversification Reduces Risk Diversifies Business

7-Eleven Take-or-Pay Fuel Distribution Ammonia / Renewables Crude Storage Product Terminals Crude Pipelines Product Pipelines Lease Income + NS SUN + NS SUN

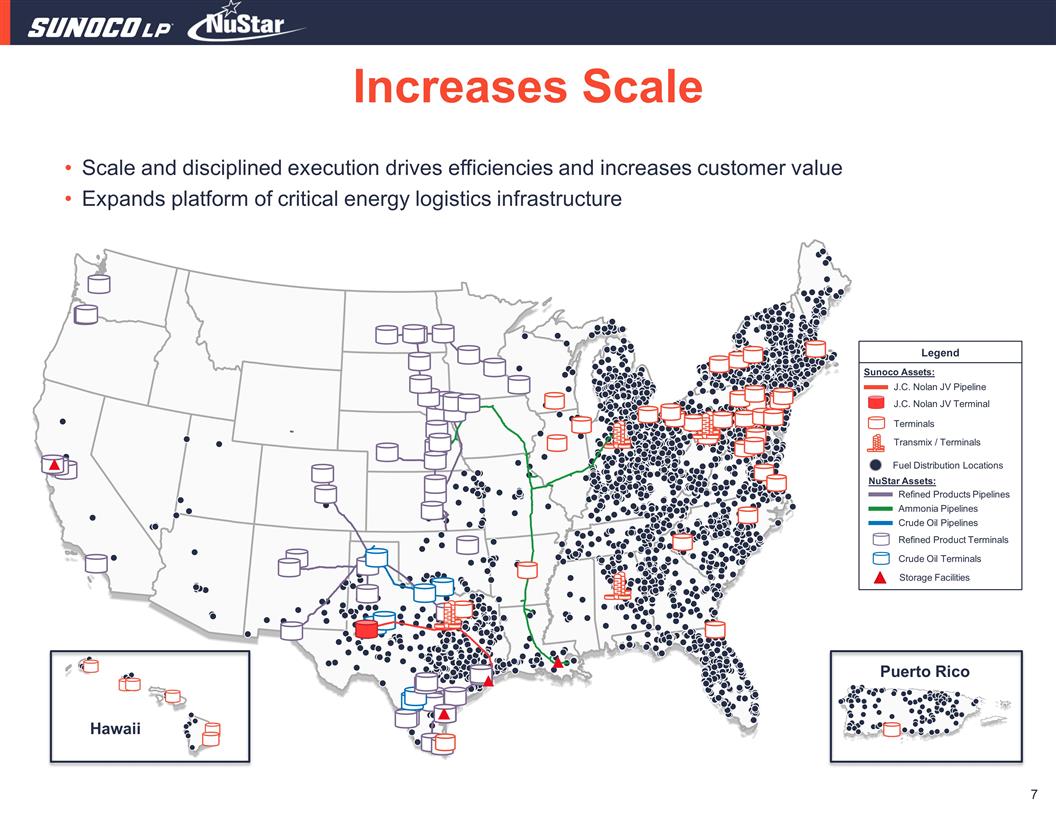

Scale and disciplined execution drives

efficiencies and increases customer value Expands platform of critical energy logistics infrastructure Increases Scale Puerto Rico Hawaii Legend Transmix / Terminals J.C. Nolan JV Pipeline Sunoco Assets: J.C. Nolan JV Terminal Terminals Ammonia

Pipelines Storage Facilities Crude Oil Pipelines Refined Product Terminals Crude Oil Terminals Refined Products Pipelines NuStar Assets: Fuel Distribution Locations

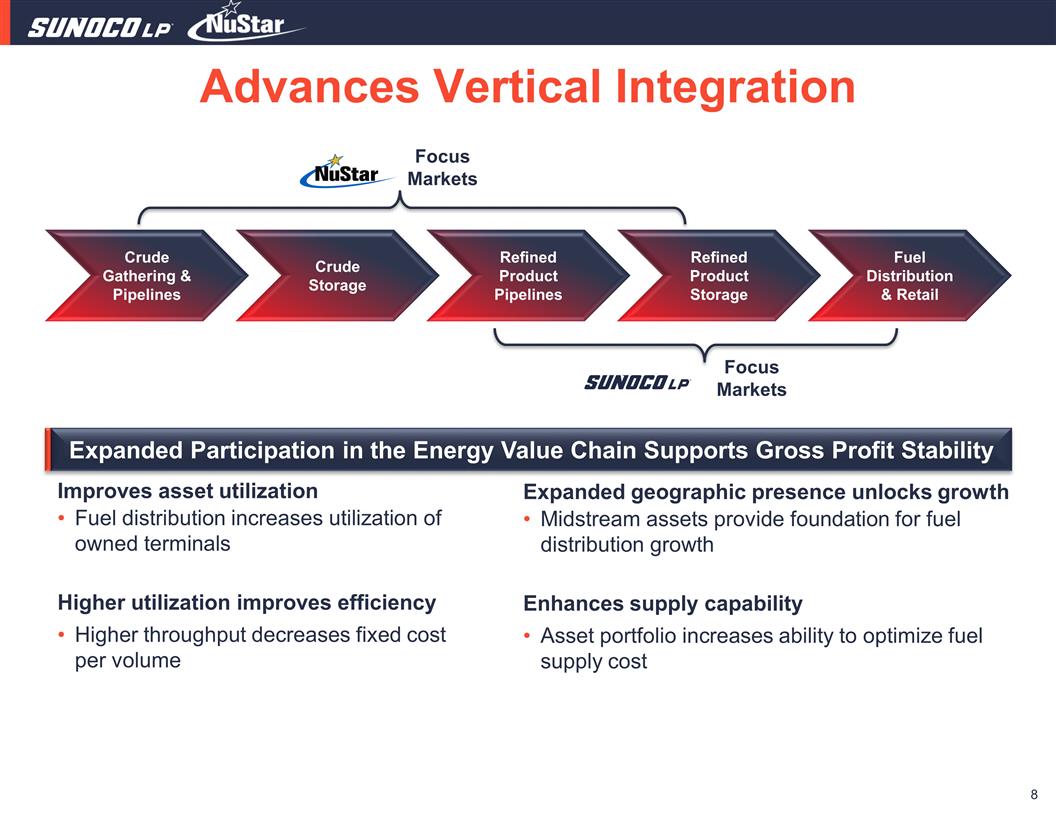

Crude Gathering & Pipelines Focus

Markets Advances Vertical Integration Crude Storage Focus Markets Refined Product Pipelines Refined Product Storage Fuel Distribution & Retail Expanded Participation in the Energy Value Chain Supports Gross Profit Stability Improves asset

utilization Fuel distribution increases utilization of owned terminals Higher utilization improves efficiency Higher throughput decreases fixed cost per volume Expanded geographic presence unlocks growth Midstream assets provide foundation for fuel

distribution growth Enhances supply capability Asset portfolio increases ability to optimize fuel supply cost

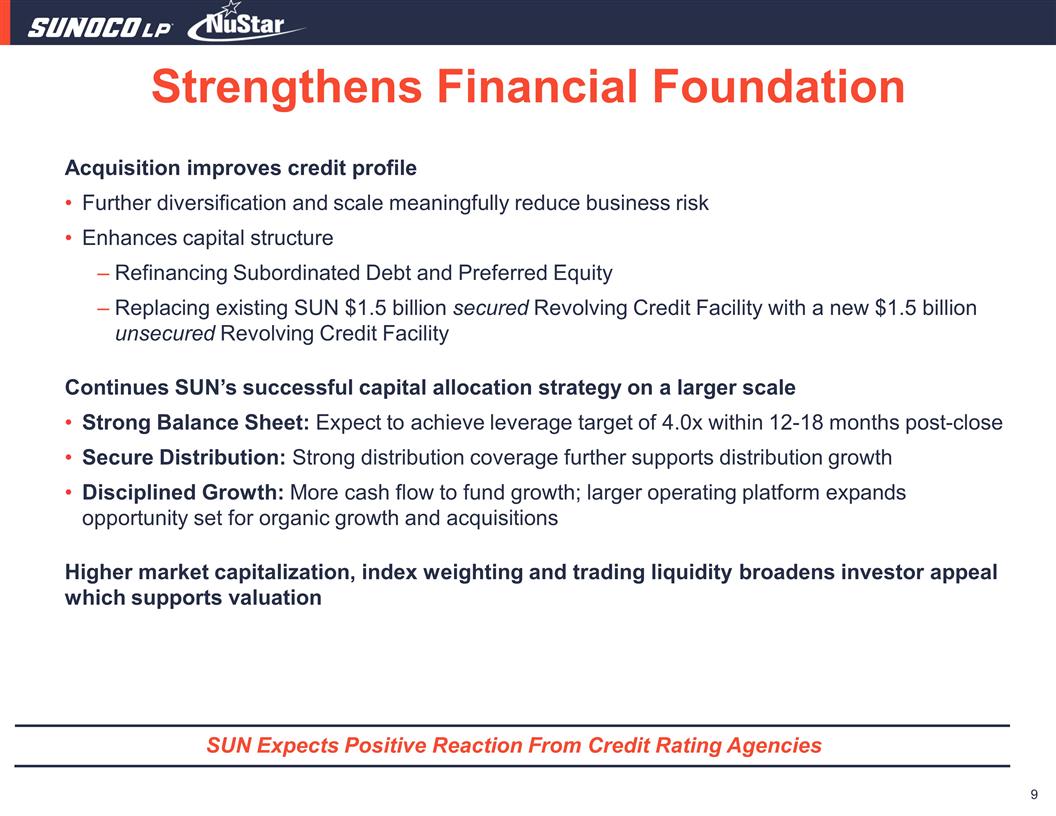

Acquisition improves credit profile

Further diversification and scale meaningfully reduce business risk Enhances capital structure Refinancing Subordinated Debt and Preferred Equity Replacing existing SUN $1.5 billion secured Revolving Credit Facility with a new $1.5 billion unsecured

Revolving Credit Facility Continues SUN’s successful capital allocation strategy on a larger scale Strong Balance Sheet: Expect to achieve leverage target of 4.0x within 12-18 months post-close Secure Distribution: Strong distribution coverage

further supports distribution growth Disciplined Growth: More cash flow to fund growth; larger operating platform expands opportunity set for organic growth and acquisitions Higher market capitalization, index weighting and trading liquidity

broadens investor appeal which supports valuation Strengthens Financial Foundation SUN Expects Positive Reaction From Credit Rating Agencies

At least $150 million of run-rate

synergies Expense Scale generates opportunities for operational efficiencies and cost control strategies Expense management and optimization are core competencies for SUN Since 2018 SUN EBITDA has grown 51% while expenses have declined by 6%

Commercial Vertical integration in refined products business provides opportunities to increase asset utilization while decreasing product cost NS assets provide a platform for fuel distribution growth in expanded geography ~$50 million of

additional cash flow from refinancing high-cost floating rate capital Series A, B, and C Preferred Units Subordinated Notes Expands Cash Flow Higher Cash Flow Generation for Reinvestment and Distribution Growth

Combination Delivers Value for

Unitholders Significant Synergies, High Accretion Increases Stability Strengthens Financial Foundation Enhances Growth

Appendix

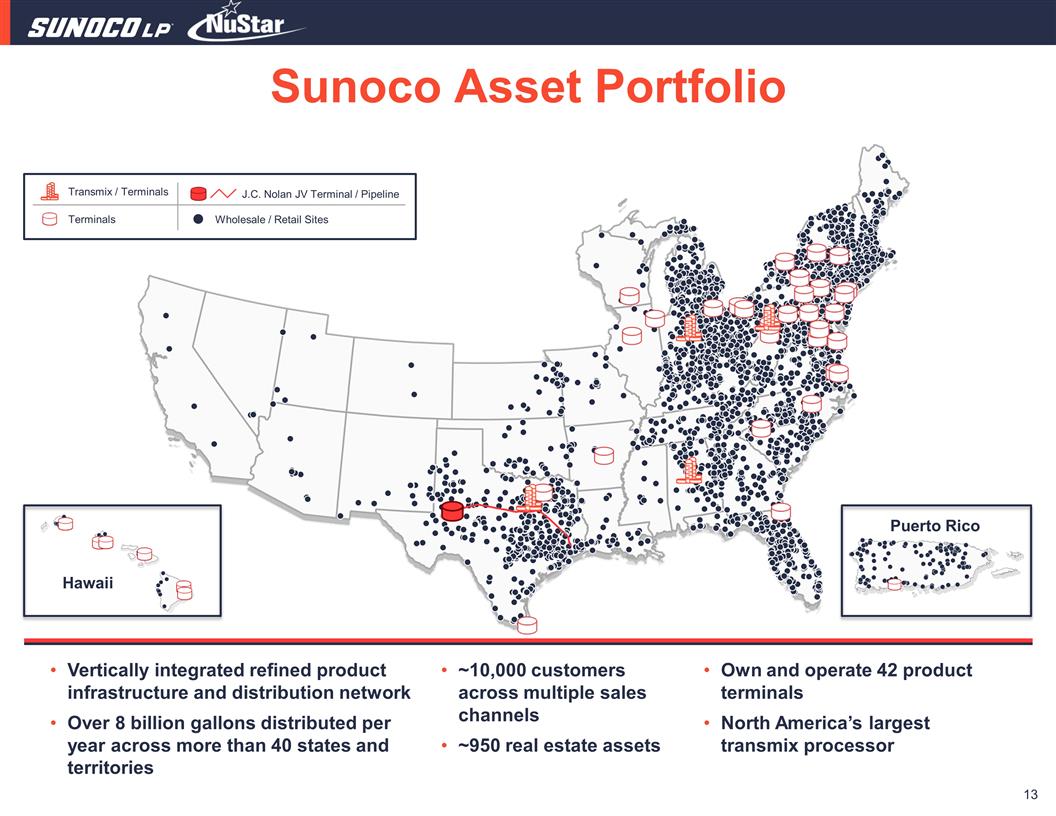

Vertically integrated refined

product infrastructure and distribution network Over 8 billion gallons distributed per year across more than 40 states and territories ~10,000 customers across multiple sales channels ~950 real estate assets Own and operate 42 product terminals

North America’s largest transmix processor Puerto Rico Sunoco Asset Portfolio Hawaii Terminals Transmix / Terminals Wholesale / Retail Sites J.C. Nolan JV Terminal / Pipeline

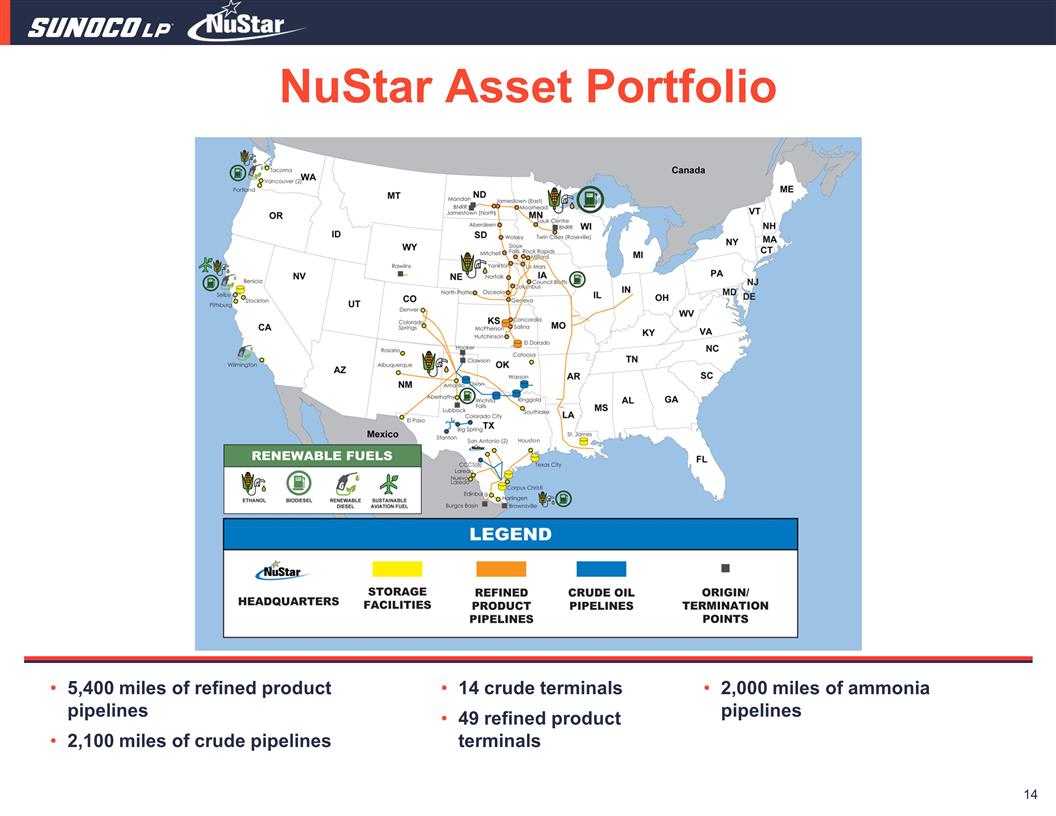

NuStar Asset Portfolio 5,400 miles

of refined product pipelines 2,100 miles of crude pipelines 14 crude terminals 49 refined product terminals 2,000 miles of ammonia pipelines

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ns_Eight50SeriesAFixedToFloatingRateCumulativeRedeemablePerpetualPreferredUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ns_Seven625SeriesBFixedToFloatingRateCumulativeRedeemablePerpetualPreferredUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ns_Nine00SeriesCFixedToFloatingRateCumulativeRedeemablePerpetualPreferredUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

NuStar Energy (NYSE:NS-C)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

NuStar Energy (NYSE:NS-C)

Historical Stock Chart

Von Mai 2023 bis Mai 2024