0001110805false00011108052024-02-152024-02-150001110805ns:CommonLimitedPartnerMember2024-02-152024-02-150001110805ns:SeriesAPreferredLimitedPartnerMember2024-02-152024-02-150001110805ns:SeriesBPreferredLimitedPartnerMember2024-02-152024-02-150001110805ns:SeriesCPreferredLimitedPartnerMember2024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024

NuStar Energy L.P.

| | | | | | | | |

| Delaware | 001-16417 | 74-2956831 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

19003 IH-10 West

San Antonio, Texas 78257

(Address of principal executive offices)

(210) 918-2000

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Units | | NS | | New York Stock Exchange |

| 8.50% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units | | NSprA | | New York Stock Exchange |

| 7.625% Series B Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units | | NSprB | | New York Stock Exchange |

| 9.00% Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units | | NSprC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 15, 2024, NuStar Energy L.P., a Delaware limited partnership, issued a press release announcing financial results for the quarter ended December 31, 2023. A copy of the press release announcing the financial results is furnished with this report as Exhibit 99.01 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Exhibit |

| | |

| | Press Release dated February 15, 2024. |

| Exhibit 104 | | Cover Page Interactive Data File - formatted in Inline XBRL and included as Exhibit 101 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| NUSTAR ENERGY L.P. | |

| | | | |

| By: | Riverwalk Logistics, L.P. |

| | its general partner |

| | | | |

| | By: | NuStar GP, LLC |

| | | its general partner |

| | | | |

Date: February 15, 2024 | | | By: | /s/ Amy L. Perry |

| | | Name: | Amy L. Perry |

| | | Title: | Executive Vice President-Strategic Development and General Counsel |

NuStar Energy L.P. Reports Solid Fourth Quarter and Full-Year 2023 Earnings Results

SAN ANTONIO, February 15, 2024 - NuStar Energy L.P. (NYSE: NS) today announced solid results for the fourth quarter and full-year 2023 fueled by strong revenues and volumes in its refined products pipelines and strong performance in its Fuels Marketing Segment.

NuStar reported net income of $70 million for the fourth quarter of 2023, or $0.37 per unit, compared to net income of $92 million, or $0.18 per unit, for the fourth quarter of 2022. Results for the fourth quarter of 2022 include a gain from insurance proceeds to rebuild tanks at its Selby terminal. Earnings per unit (EPU) for the fourth quarter of 2022 also included a $0.31 per unit premium related to the repurchase of a portion of the Series D preferred units. Excluding the effects of these items, adjusted net income was $75 million for the fourth quarter of 2022, or $0.34 per unit. For full-year 2023, NuStar reported net income of $274 million, or $0.72 per unit, compared to net income of $223 million, or $0.36 per unit, for the year ended 2022.

Excluding the gain related to the sale of a portion of NuStar’s corporate headquarters in 2023, non-cash charges and insurance proceeds in 2022, as well as the EPU impact from the repurchases of the Series D preferred units in 2023 and 2022, our full-year 2023 adjusted net income was $233 million, or $0.92 per unit, compared to 2022 adjusted net income of $250 million, or $0.92 per unit.

It is important to note that earnings before interest, taxes, depreciation and amortization (EBITDA) were not impacted by the premium associated with the accelerated repurchase of the Series D preferred units, and we reported EBITDA of $199 million for the fourth quarter of 2023, compared to fourth quarter of 2022 adjusted EBITDA of $197 million. Our adjusted EBITDA for full-year 2023 was $735 million – up compared to 2022 adjusted EBITDA of $722 million.

Distributable Cash Flow (DCF) was $87 million for the fourth quarter of 2023, compared to fourth quarter of 2022 adjusted DCF of $89 million. The distribution coverage ratio was 1.73 times for the fourth quarter of 2023.

Adjusted DCF was $354 million for full-year 2023, compared to adjusted DCF of $357 million in 2022. The adjusted distribution coverage ratio was 1.86 times for full-year 2023.

“I am pleased to report that we have delivered another quarter of solid earnings results and made significant progress on many of our strategic initiatives in 2023,” said NuStar Chairman and CEO Brad Barron.

Operations Continue to Perform Well

NuStar’s Pipeline Segment generated operating income of $130 million and EBITDA of $174 million in the fourth quarter of 2023, compared to operating income of $132 million and EBITDA of $176 million in the fourth quarter of 2022, as increased revenues and throughputs across refined products systems were offset by decreases from the Permian Crude System and Corpus Christi Crude System.

The Permian Crude System’s fourth quarter of 2023 volumes averaged 528,000 BPD, down compared to the fourth quarter of 2022 but up slightly from the third quarter of 2023.

“As we have said on prior calls, our Permian volumes reflected some producer-specific operational issues and delays in 2023, which were largely resolved over the course of the year,” said Barron.

For full-year 2023, NuStar’s Pipeline Segment generated operating income of $483 million compared to operating income of $439 million in 2022 and EBITDA of $659 million in 2023, compared to EBITDA of $617 million in 2022, an improvement of 7%.

“Our refined products systems, along with our Ammonia System, generated solid, dependable revenue in 2023 as total throughputs were up compared to 2022, reflecting the strength of these assets and our strong position in the markets we serve in the mid-Continent and throughout Texas,” said Barron.

“Our McKee System also performed very well this year, with higher revenues and throughputs versus last year, and almost all our pipeline systems benefitted from annual rate escalations linked to either the FERC index or PPI.”

NuStar’s Storage Segment generated operating income of $26 million and EBITDA of $45 million in the fourth quarter of 2023, compared to operating income of $22 million and EBITDA of $41 million in the fourth quarter of 2022, largely driven by the solid performance of the West Coast region and the continuing growth from our West Coast Renewables Strategy.

For full-year 2023, NuStar’s Storage Segment generated operating income of $88 million and EBITDA of $163 million, compared to operating income of $61 million and adjusted EBITDA of $180 million in 2022. While West Coast region revenues continued to increase, an amendment and an extension of a customer contract at the Corpus Christi North Beach terminal combined with customer transitions and required tank maintenance at the St. James terminal contributed to the decrease in adjusted EBITDA.

Barron also highlighted the strong performance of NuStar’s Fuels Marketing Segment.

“After a near record-breaking 2022, our Fuels Marketing Segment has turned in another strong quarter, generating operating income and EBITDA of $12 million in the fourth quarter of 2023, which is comparable to the segment’s strong fourth quarter of 2022 results,” said Barron. For full-year 2023, NuStar’s Fuels Marketing Segment generated operating income and EBITDA of $33 million, comparable to 2022 operating income and EBITDA of $34 million.

Even with the acceleration of our Series D redemptions in 2023, we ended the fourth quarter of 2023 with a healthy debt-to-EBITDA ratio of 3.85 times and $652 million available on our $1.0 billion unsecured revolving credit facility.

Positive Outlook for 2024

Although the pending merger with Sunoco LP is expected to close as early as the second quarter of 2024, we want to provide our 2024 financial expectations for NuStar on a stand-alone basis. We expect to generate full-year 2024 net income in the range of $220 to $260 million and full-year 2024 EBITDA in the range of $720 to $780 million.

NuStar once again expects to self-fund all of its operational expenses, growth capital and distributions, and continues to target a healthy year-end debt-to-EBITDA ratio below four times.

Conference Call Details

In light of the merger announced on January 22, 2024, NuStar no longer plans to host its previously scheduled earnings call.

About NuStar Energy L.P.

NuStar Energy L.P., through its subsidiaries (collectively, “NuStar” or the “Partnership”), is an independent liquids terminal and pipeline operator. NuStar has approximately 9,500 miles of pipeline and 63 terminal and storage facilities that store and distribute crude oil, refined products, renewable fuels, ammonia and specialty liquids. The Partnership’s combined system has approximately 49 million barrels of storage capacity, and NuStar has operations in the United States and Mexico. For more information, visit NuStar Energy L.P.’s website at www.nustarenergy.com and its Sustainability page at https://sustainability.nustarenergy.com/.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes forward-looking statements regarding future events and expectations, such as NuStar’s future performance, plans and expenditures. All forward-looking statements are based on NuStar’s beliefs as well as assumptions made by and information currently available to NuStar. These statements reflect NuStar’s current views with respect to future events and are subject to various risks, uncertainties and assumptions. These risks, uncertainties and assumptions are discussed in NuStar Energy L.P.’s 2022 annual report on Form 10-K and subsequent filings with the Securities and Exchange Commission. Actual results may differ materially from those described in the forward-looking statements. Except as required by law, NuStar does not intend, or undertake any obligation, to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

NuStar Energy L.P. and Subsidiaries

Consolidated Financial Information

(Unaudited, Thousands of Dollars, Except Unit, Per Unit and Ratio Data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Statement of Income Data: | | | | | | | |

| Revenues: | | | | | | | |

| Service revenues | $ | 304,989 | | | $ | 299,497 | | | $ | 1,155,567 | | | $ | 1,120,249 | |

| Product sales | 146,697 | | | 130,463 | | | 478,620 | | | 562,974 | |

| Total revenues | 451,686 | | | 429,960 | | | 1,634,187 | | | 1,683,223 | |

| Costs and expenses: | | | | | | | |

| Costs associated with service revenues: | | | | | | | |

| Operating expenses | 95,112 | | | 92,353 | | | 371,689 | | | 364,989 | |

| Depreciation and amortization expense | 63,183 | | | 63,195 | | | 250,982 | | | 251,878 | |

| Total costs associated with service revenues | 158,295 | | | 155,548 | | | 622,671 | | | 616,867 | |

| Costs associated with product sales | 125,846 | | | 108,730 | | | 407,793 | | | 486,947 | |

| Impairment loss | — | | | — | | | — | | | 46,122 | |

| | | | | | | |

| General and administrative expenses | 34,418 | | | 34,460 | | | 129,846 | | | 117,116 | |

| Other depreciation and amortization expense | 1,056 | | | 1,776 | | | 4,728 | | | 7,358 | |

| | | | | | | |

| | | | | | | |

| Total costs and expenses | 319,615 | | | 300,514 | | | 1,165,038 | | | 1,274,410 | |

| Gain on sale of assets | — | | | — | | | 41,075 | | | — | |

| Operating income | 132,071 | | | 129,446 | | | 510,224 | | | 408,813 | |

| | | | | | | |

| Interest expense, net | (62,698) | | | (55,956) | | | (241,364) | | | (209,009) | |

| | | | | | | |

| Other income, net | 2,917 | | | 19,024 | | | 10,215 | | | 26,182 | |

| Income before income tax expense | 72,290 | | | 92,514 | | | 279,075 | | | 225,986 | |

| Income tax expense | 1,899 | | | 911 | | | 5,412 | | | 3,239 | |

| | | | | | | |

| | | | | | | |

| Net income | $ | 70,391 | | | $ | 91,603 | | | $ | 273,663 | | | $ | 222,747 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and diluted net income per common unit | $ | 0.37 | | | $ | 0.18 | | | $ | 0.72 | | | $ | 0.36 | |

| | | | | | | |

| Basic and diluted weighted-average common units outstanding | 126,205,999 | | | 110,566,272 | | | 116,851,373 | | | 110,341,206 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Non-GAAP Data (Note 1): | | | | | | | |

| Adjusted net income | $ | 70,391 | | | $ | 75,237 | | | $ | 232,588 | | | $ | 249,795 | |

| Adjusted net income per common unit | $ | 0.37 | | | $ | 0.34 | | | $ | 0.92 | | | $ | 0.92 | |

EBITDA | $ | 199,227 | | | $ | 213,441 | | | $ | 776,149 | | | $ | 694,231 | |

| Adjusted EBITDA | $ | 199,227 | | | $ | 197,075 | | | $ | 735,074 | | | $ | 722,423 | |

| DCF | $ | 87,337 | | | $ | 69,937 | | | $ | 287,061 | | | $ | 337,482 | |

| Adjusted DCF | $ | 87,337 | | | $ | 89,216 | | | $ | 353,756 | | | $ | 356,761 | |

| Distribution coverage ratio | 1.73x | | 1.58x | | 1.51x | | 1.91x |

| Adjusted distribution coverage ratio | 1.73x | | 2.01x | | 1.86x | | 2.02x |

| | | | | | | | | | | | | |

| For the Four Quarters Ended December 31, |

| 2023 | | | | 2022 |

| | | | | |

| | | | | |

| | | | | |

Consolidated Debt Coverage Ratio | 3.85x | | | | 3.98x |

NuStar Energy L.P. and Subsidiaries

Consolidated Financial Information - Continued

(Unaudited, Thousands of Dollars, Except Barrel Data) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Pipeline: | | | | | | | |

| Crude oil pipelines throughput (barrels/day) | 1,299,866 | | | 1,410,966 | | | 1,234,051 | | | 1,319,360 | |

Refined products and ammonia pipelines throughput (barrels/day) | 617,909 | | | 611,011 | | | 602,913 | | | 579,240 | |

| Total throughput (barrels/day) | 1,917,775 | | | 2,021,977 | | | 1,836,964 | | | 1,898,600 | |

| | | | | | | |

| Throughput and other revenues | $ | 228,621 | | | $ | 229,935 | | | $ | 873,869 | | | $ | 828,191 | |

| Operating expenses | 54,754 | | | 53,609 | | | 214,751 | | | 210,719 | |

| Depreciation and amortization expense | 44,294 | | | 44,726 | | | 175,930 | | | 178,802 | |

| | | | | | | |

| | | | | | | |

| Segment operating income | $ | 129,573 | | | $ | 131,600 | | | $ | 483,188 | | | $ | 438,670 | |

| Storage: | | | | | | | |

| Throughput (barrels/day) | 489,206 | | | 512,504 | | | 448,331 | | | 480,129 | |

| | | | | | | |

| Throughput terminal revenues | $ | 31,473 | | | $ | 26,288 | | | $ | 104,495 | | | $ | 110,591 | |

| Storage terminal revenues | 54,056 | | | 53,165 | | | 215,104 | | | 223,958 | |

| Total revenues | 85,529 | | | 79,453 | | | 319,599 | | | 334,549 | |

| Operating expenses | 40,358 | | | 38,744 | | | 156,938 | | | 154,270 | |

| Depreciation and amortization expense | 18,889 | | | 18,469 | | | 75,052 | | | 73,076 | |

| | | | | | | |

| Impairment loss | — | | | — | | | — | | | 46,122 | |

| Segment operating income | $ | 26,282 | | | $ | 22,240 | | | $ | 87,609 | | | $ | 61,081 | |

| Fuels Marketing: | | | | | | | |

| Product sales | $ | 137,540 | | | $ | 120,574 | | | $ | 440,725 | | | $ | 520,486 | |

| Cost of goods | 125,401 | | | 107,850 | | | 405,992 | | | 484,477 | |

| Gross margin | 12,139 | | | 12,724 | | | 34,733 | | | 36,009 | |

| Operating expenses | 449 | | | 882 | | | 1,807 | | | 2,473 | |

| | | | | | | |

| | | | | | | |

| Segment operating income | $ | 11,690 | | | $ | 11,842 | | | $ | 32,926 | | | $ | 33,536 | |

| Consolidation and Intersegment Eliminations: | | | | | | | |

| Revenues | $ | (4) | | | $ | (2) | | | $ | (6) | | | $ | (3) | |

| Cost of goods | (4) | | | (2) | | | (6) | | | (3) | |

| | | | | | | |

| Total | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Consolidated Information: | | | | | | | |

| Revenues | $ | 451,686 | | | $ | 429,960 | | | $ | 1,634,187 | | | $ | 1,683,223 | |

| Costs associated with service revenues: | | | | | | | |

| Operating expenses | 95,112 | | | 92,353 | | | 371,689 | | | 364,989 | |

| Depreciation and amortization expense | 63,183 | | | 63,195 | | | 250,982 | | | 251,878 | |

| Total costs associated with service revenues | 158,295 | | | 155,548 | | | 622,671 | | | 616,867 | |

| Costs associated with product sales | 125,846 | | | 108,730 | | | 407,793 | | | 486,947 | |

| | | | | | | |

| Impairment loss | — | | | — | | | — | | | 46,122 | |

| Segment operating income | 167,545 | | | 165,682 | | | 603,723 | | | 533,287 | |

| Gain on sale of assets | — | | | — | | | 41,075 | | | — | |

| General and administrative expenses | 34,418 | | | 34,460 | | | 129,846 | | | 117,116 | |

| Other depreciation and amortization expense | 1,056 | | | 1,776 | | | 4,728 | | | 7,358 | |

| | | | | | | |

| | | | | | | |

| Consolidated operating income | $ | 132,071 | | | $ | 129,446 | | | $ | 510,224 | | | $ | 408,813 | |

NuStar Energy L.P. and Subsidiaries

Reconciliation of Non-GAAP Financial Information

(Unaudited, Thousands of Dollars, Except Ratio Data)

Note 1: NuStar Energy L.P. (the Partnership) utilizes financial measures, such as earnings before interest, taxes, depreciation and amortization (EBITDA), distributable cash flow (DCF) and distribution coverage ratio, which are not defined in U.S. generally accepted accounting principles (GAAP). Management believes these financial measures provide useful information to investors and other external users of our financial information because (i) they provide additional information about the operating performance of the Partnership’s assets and the cash the business is generating, (ii) investors and other external users of our financial statements benefit from having access to the same financial measures being utilized by management and our board of directors when making financial, operational, compensation and planning decisions and (iii) they highlight the impact of significant transactions. We present segment EBITDA to facilitate period-over-period comparisons of the operational performance of our business segments and to understand our business segments’ relative contributions to our consolidated performance. We may also adjust these measures to enhance the comparability of our performance across periods.

Our board of directors and management use EBITDA and/or DCF when assessing the following: (i) the performance of our assets, (ii) the viability of potential projects, (iii) our ability to fund distributions, (iv) our ability to fund capital expenditures and (v) our ability to service debt. In addition, our board of directors uses EBITDA, DCF and a distribution coverage ratio, which is calculated based on DCF, as some of the factors in its compensation determinations. DCF is a financial indicator used by the master limited partnership (MLP) investment community to compare partnership performance. DCF is used by the MLP investment community, in part, because the value of a partnership unit is partially based on its yield, and its yield is based on the cash distributions a partnership can pay its unitholders.

None of these financial measures are presented as an alternative to net income. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP.

The following is a reconciliation of net income to EBITDA, DCF and distribution coverage ratio.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 70,391 | | | $ | 91,603 | | | $ | 273,663 | | | $ | 222,747 | |

| Interest expense, net | 62,698 | | | 55,956 | | | 241,364 | | | 209,009 | |

| Income tax expense | 1,899 | | | 911 | | | 5,412 | | | 3,239 | |

| Depreciation and amortization expense | 64,239 | | | 64,971 | | | 255,710 | | | 259,236 | |

| EBITDA | 199,227 | | | 213,441 | | | 776,149 | | | 694,231 | |

| Interest expense, net | (62,698) | | | (55,956) | | | (241,364) | | | (209,009) | |

| Reliability capital expenditures | (7,504) | | | (8,118) | | | (27,995) | | | (32,775) | |

| Income tax expense | (1,899) | | | (911) | | | (5,412) | | | (3,239) | |

| Long-term incentive equity awards (a) | 3,242 | | | 3,337 | | | 12,919 | | | 11,434 | |

| Preferred unit distributions | (23,335) | | | (32,511) | | | (114,729) | | | (127,589) | |

| | | | | | | |

| Impairment loss | — | | | — | | | — | | | 46,122 | |

| Income tax benefit related to impairment loss | — | | | — | | | — | | | (1,144) | |

| Premium on redemption/repurchase of Series D Cumulative Convertible Preferred Units | — | | | (49,600) | | | (107,770) | | | (49,600) | |

| Other items | (19,696) | | | 255 | | | (4,737) | | | 9,051 | |

| DCF | $ | 87,337 | | | $ | 69,937 | | | $ | 287,061 | | | $ | 337,482 | |

| | | | | | | |

| Distributions applicable to common limited partners | $ | 50,607 | | | $ | 44,328 | | | $ | 189,724 | | | $ | 176,746 | |

| Distribution coverage ratio (b) | 1.73x | | 1.58x | | 1.51x | | 1.91x |

(a)We intend to satisfy the vestings of these equity-based awards with the issuance of our common units. As such, the expenses related to these awards are considered non-cash and added back to DCF. Certain awards include distribution equivalent rights (DERs). Payments made in connection with DERs are deducted from DCF.

(b)Distribution coverage ratio is calculated by dividing DCF by distributions applicable to common limited partners.

NuStar Energy L.P. and Subsidiaries

Reconciliation of Non-GAAP Financial Information - Continued

(Unaudited, Thousands of Dollars, Except Ratio and Per Unit Data)

The following is the reconciliation for the calculation of our Consolidated Debt Coverage Ratio, as defined in our revolving credit agreement (the Revolving Credit Agreement).

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Operating income | $ | 510,224 | | | $ | 408,813 | |

| Depreciation and amortization expense | 255,710 | | | 259,236 | |

| | | |

| Impairment loss | — | | | 46,122 | |

| Amortization expense of equity-based awards | 15,547 | | | 13,781 | |

| Pro forma effect of disposition (a) | — | | | (1,760) | |

| Other | (6,087) | | | (3,607) | |

| Consolidated EBITDA, as defined in the Revolving Credit Agreement | $ | 775,394 | | | $ | 722,585 | |

| | | |

| Long-term debt, less current portion of finance leases | $ | 3,410,338 | | | $ | 3,293,415 | |

| Long-term portion of finance leases | (50,707) | | | (51,127) | |

| Unamortized debt issuance costs | 27,809 | | | 33,252 | |

NuStar Logistics’ floating rate subordinated notes | (402,500) | | | (402,500) | |

| | | |

| Consolidated Debt, as defined in the Revolving Credit Agreement | $ | 2,984,940 | | | $ | 2,873,040 | |

| | | |

| Consolidated Debt Coverage Ratio (Consolidated Debt to Consolidated EBITDA) | 3.85x | | 3.98x |

(a)This adjustment represents the pro forma effect of the disposition of the Point Tupper terminal, which was sold in April 2022.

The following are reconciliations of net income / net income per common unit to adjusted net income / adjusted net income per common unit.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2023 | | 2022 |

| Net income / net income per common unit | | $ | 70,391 | | | $ | 0.37 | | | $ | 91,603 | | | $ | 0.18 | |

| Gain from insurance recoveries | | — | | | — | | | (16,366) | | | (0.15) | |

| Premium on repurchase of Series D Cumulative Convertible Preferred Units | | — | | | — | | | — | | | 0.31 | |

| Adjusted net income / adjusted net income per common unit | | $ | 70,391 | | | $ | 0.37 | | | $ | 75,237 | | | $ | 0.34 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2023 | | 2022 |

| Net income / net income per common unit | | $ | 273,663 | | | $ | 0.72 | | | $ | 222,747 | | | $ | 0.36 | |

| Premium on redemption/repurchase of Series D Cumulative Convertible Preferred Units | | — | | | 0.55 | | | — | | | 0.31 | |

| Gain on sale of assets | | (41,075) | | | (0.35) | | | — | | | — | |

| Impairment loss | | — | | | — | | | 46,122 | | | 0.42 | |

| Income tax benefit related to impairment loss | | — | | | — | | | (1,144) | | | (0.01) | |

| Gain from insurance recoveries | | — | | | — | | | (16,366) | | | (0.15) | |

| Other | | — | | | — | | | (1,564) | | | (0.01) | |

| Adjusted net income / adjusted net income per common unit | | $ | 232,588 | | | $ | 0.92 | | | $ | 249,795 | | | $ | 0.92 | |

NuStar Energy L.P. and Subsidiaries

Reconciliation of Non-GAAP Financial Information - Continued

(Unaudited, Thousands of Dollars, Except Ratio Data)

The following is a reconciliation of EBITDA to adjusted EBITDA.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| EBITDA | $ | 199,227 | | | $ | 213,441 | | | $ | 776,149 | | | $ | 694,231 | |

| Gain on sale of assets | — | | | — | | | (41,075) | | | — | |

| Gain from insurance recoveries | — | | | (16,366) | | | — | | | (16,366) | |

| Impairment loss | — | | | — | | | — | | | 46,122 | |

| Other | — | | | — | | | — | | | (1,564) | |

| Adjusted EBITDA | $ | 199,227 | | | $ | 197,075 | | | $ | 735,074 | | | $ | 722,423 | |

The following is a reconciliation of DCF to adjusted DCF and adjusted distribution coverage ratio.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| DCF | $ | 87,337 | | | $ | 69,937 | | | $ | 287,061 | | | $ | 337,482 | |

| Premium on repurchase/redemption of Series D Cumulative Convertible Preferred Units | — | | | 49,600 | | | 107,770 | | | 49,600 | |

| Gain from insurance recoveries | — | | | (16,366) | | | — | | | (16,366) | |

| Gain on sale of assets | — | | | — | | | (41,075) | | | — | |

| Other | — | | | (13,955) | | | — | | | (13,955) | |

| Adjusted DCF | $ | 87,337 | | | $ | 89,216 | | | $ | 353,756 | | | $ | 356,761 | |

| | | | | | | |

| Distributions applicable to common limited partners | $ | 50,607 | | | $ | 44,328 | | | $ | 189,724 | | | $ | 176,746 | |

| Adjusted distribution coverage ratio (a) | 1.73x | | 2.01x | | 1.86x | | 2.02x |

| | | | | | | |

| | | | | | | |

(a)Adjusted distribution coverage ratio is calculated by dividing adjusted DCF by distributions applicable to common limited partners.

NuStar Energy L.P.

Reconciliation of Non-GAAP Financial Information - Continued

(Unaudited, Thousands of Dollars)

The following are reconciliations for our reported segments of operating income to segment EBITDA and adjusted segment EBITDA. | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| | Pipeline | | Storage | | Fuels Marketing |

| Operating income | $ | 129,573 | | | $ | 26,282 | | | $ | 11,690 | |

| Depreciation and amortization expense | 44,294 | | | 18,889 | | | — | |

| Segment EBITDA | $ | 173,867 | | | $ | 45,171 | | | $ | 11,690 | |

| | | | | |

| Three Months Ended December 31, 2022 |

| Pipeline | | Storage | | Fuels Marketing |

| Operating income | $ | 131,600 | | | $ | 22,240 | | | $ | 11,842 | |

| Depreciation and amortization expense | 44,726 | | | 18,469 | | | — | |

| Segment EBITDA | $ | 176,326 | | | $ | 40,709 | | | $ | 11,842 | |

| | | | | |

| Year Ended December 31, 2023 |

| Pipeline | | Storage | | Fuels Marketing |

| Operating income | $ | 483,188 | | | $ | 87,609 | | | $ | 32,926 | |

| Depreciation and amortization expense | 175,930 | | | 75,052 | | | — | |

| Segment EBITDA | $ | 659,118 | | | $ | 162,661 | | | $ | 32,926 | |

| | | | | |

| Year Ended December 31, 2022 |

| Pipeline | | Storage | | Fuels Marketing |

| Operating income | $ | 438,670 | | | $ | 61,081 | | | $ | 33,536 | |

| Depreciation and amortization expense | 178,802 | | | 73,076 | | | — | |

| Segment EBITDA | 617,472 | | | 134,157 | | | 33,536 | |

| Impairment loss | — | | | 46,122 | | | — | |

| Adjusted segment EBITDA | $ | 617,472 | | | $ | 180,279 | | | $ | 33,536 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

The following is a reconciliation of projected net income to EBITDA.

| | | | | |

| | Projected for the Year Ended December 31, 2024 |

| Net income | $ 220,000 - 260,000 |

| Interest expense, net | 242,000 - 249,000 |

| Income tax expense | 3,000 - 6,000 |

| Depreciation and amortization expense | 255,000 - 265,000 |

| EBITDA | $ 720,000 - 780,000 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ns_CommonLimitedPartnerMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ns_SeriesAPreferredLimitedPartnerMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ns_SeriesBPreferredLimitedPartnerMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ns_SeriesCPreferredLimitedPartnerMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

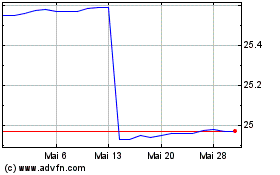

NuStar Energy (NYSE:NS-C)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

NuStar Energy (NYSE:NS-C)

Historical Stock Chart

Von Mai 2023 bis Mai 2024