North American Construction Group Ltd. Announces Regional Services Contract and Outlook for 2025

05 Dezember 2024 - 2:00PM

North American Construction Group Ltd. (“NACG” or “the Company”)

(TSX:NOA.TO/NYSE:NOA) today announced the award of an extended and

amended regional services contract by a major producer in the

Canadian oil sands region and an outlook for the full year of 2025

along with updated estimates for the fourth quarter of 2024.

Regional Services Contract

The extended and amended contract contemplates

the provision of services across various mine sites operated by the

producer. The amendment is effective January 1, 2025 with the

expiry date extended to January 31, 2029 from January 31, 2027.

The agreement includes committed spend of $500

million spread over the term which is primarily related to heavy

equipment rentals but also includes bulk unit rate earthwork

scopes. These committed volumes are estimated to represent

approximately one-third of total work expected to be performed

across the various mine sites including overburden removal,

reclamation, civil construction and other heavy equipment

scopes.

“This is our first multi-year commitment under

this agreement and we look forward to executing on our customer’s

expectations and delivering safe, low-cost services. This award

reaffirms our alignment with our client’s operating goals and our

continued focus on efficiency and costs,” said Joe Lambert,

President and CEO of NACG. “This is an important contract for us

which, together with our client relationships, well maintained

equipment fleet, advancing technology and focus on operational

excellence, will provide ample opportunities to grow our oil sands

business from the current run rate.”

“We are proud to expand our role within this

partnership through this significant contract extension, which

underscores our commitment to delivering exceptional value and

sustainable growth in the oil sands region," said Jeff Epp, Interim

Chief Executive Officer of Mikisew Group. "Our ongoing

collaboration with NACG not only strengthens our ability to serve

our clients with reliability and efficiency but also reinforces our

dedication to supporting the economic development of the Mikisew

Cree First Nation and our broader community. We look forward to

advancing this partnership with a shared focus on safety,

innovation, and operational excellence."

Outlook for 2025

Based on this award, the overall proforma

contractual backlog of $3.6 billion and the heavy equipment fleet

we own and operate, management has provided the following estimates

of key measures and capital allocation for the fourth quarter 2024

and full year 2025.

|

|

2024 Q4 |

Full year 2025 |

|

Key measures |

|

|

|

Combined revenue |

$350 to $375m |

$1.4b to $1.6b |

|

Adjusted EBITDA |

$100m to $110m |

$415m to $445m |

|

Sustaining capital |

$55m to $65m |

$180m to $200m |

|

Adjusted earnings per share |

$1.00 to $1.10 |

$4.15 to $4.45 |

|

Free cash flow |

$45m to $55m |

$130m to $150m |

| |

|

|

|

Capital allocation |

|

|

|

Growth spending |

$30m to $40m |

$45m to $55m |

|

Net debt leverage |

2.0x to 2.2x |

Targeting 1.8x |

|

|

|

|

Key measures

- Combined revenue and adjusted

EBITDA estimates are based on existing contracts in place with the

2024 fourth quarter estimates impacted by the commencement of

certain work scopes in the oil sands region being deferred into the

first quarter of 2025.

- Sustaining capital estimates for

the fourth quarter of 2024 reflect the front-loaded impact of

maintenance costs for a stronger than expected upcoming winter

season in Canada.

- Adjusted earnings per share in 2025

is based on EBITDA less existing depreciation and tax rates with

interest expense expected to decrease from lower interest rates and

debt levels

- Free cash flow in fourth quarter of

2024 reflects the aforementioned factors but also is being impacted

by the deferral of joint venture distributions and the expectation

of higher accounts receivable at year-end resulting from a

projected strong December as well as the discontinuation of a

supply chain finance program with a significant customer.

Capital allocation

- Growth spending in early 2025 based

on continued investments in Australia required for the contracts

awarded in the third quarter of 2024

- Continuation of share purchases

under the existing normal-course issuer bid (NCIB) program is based

on economic returns to shareholders

- Net debt target of 1.8x by end of

2025 excludes potential debenture conversion and is dependent on

the achievement of key measures and activity levels within the

share purchase program

“We view the upcoming year as the culmination of

seven years of growth and are looking forward to a strong year of

project and scope execution,” said Joe Lambert. “We have the

contracted backlog in place as well as the equipment and personnel

for a full twelve months of efficient and effective operations in

Australia, Canada and the United States.”

About Mikisew North American Limited

Partnership (MNALP)The Company carries out heavy civil

construction work in the Athabasca Oil Sands Region as a

subcontractor to MNALP, a limited partnership in which the Company

has a 49% interest, with the Mikisew Group of Companies (“Mikisew

Group”) holding the majority 51% interest.

About Mikisew GroupMikisew

Group is the Independent Economic Development arm of the Mikisew

Cree First Nation. Mikisew Group is comprised of two main operating

entities and ten joint venture partnerships including MNALP. These

entities service the Canadian oil sands in various capacities

including heavy equipment rental, fleet maintenance,

transportation, emergency response, catering services, and

facilities maintenance. For more information about the Mikisew

Group of Companies, visit www.mikisewgroup.com.

About NACGNACG is one of Canada

and Australia’s largest providers of heavy construction and mining

services. For more than 70 years, NACG has provided services to the

mining, resource, and infrastructure construction

markets. For more information about North American

Construction Group Ltd., visit www.nacg.ca.

For further information, please contact:Jason

Veenstra, CPA, CAChief Financial OfficerNorth American Construction

Group Ltd.Phone: (780) 948-2009Email: ir@nacg.ca

The information provided in this release

contains forward-looking statements. Forward-looking statements

include statements preceded by, followed by or that include the

words “expected”, “estimated” or similar expressions, including the

anticipated revenues and backlog to be generated by the contract.

The material factors or assumptions used to develop the above

forward-looking statements and the risks and uncertainties to which

such forward-looking statements are subject are highlighted in the

Company’s MD&A for the year ended December 31, 2023 and quarter

ending September 30, 2024. Actual results could differ materially

from those contemplated by such forward-looking statements because

of any number of factors and uncertainties, many of which are

beyond NACG’s control. Undue reliance should not be placed upon

forward-looking statements and NACG undertakes no obligation, other

than those required by applicable law, to update or revise those

statements. For more complete information about NACG, please read

our disclosure documents filed with the SEC and the CSA. These free

documents can be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedar.com.

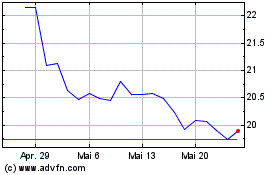

North American Construct... (NYSE:NOA)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

North American Construct... (NYSE:NOA)

Historical Stock Chart

Von Feb 2024 bis Feb 2025