UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 9, 2024

Myers Industries, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

Ohio |

|

001-8524 |

|

34-0778636 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

1293 South Main Street, Akron, Ohio 44301

(Address of Principal Executive Offices, and Zip Code)

(330) 253-5592

Registrant’s Telephone Number, Including Area Code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, without par value |

|

MYE |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On September 9, 2024, Myers Industries, Inc. (the “Company”) issued a press release announcing the departure of Michael McGaugh, President and Chief Executive Officer, as an officer and director of the Company effective immediately, and the appointment by the Board of Directors of Dave Basque to serve as Interim President and Chief Executive Officer until a new President and Chief Executive Officer is appointed. The Board of Directors has engaged a global executive search firm to assist in identifying the new President and Chief Executive Officer.

Mr. Basque, age 67, served as the Company’s Vice President, Integration and Vice President, Material Handling Segment – Injection Molding, from August 17, 2020 until September 1, 2024, when he was named Vice President, Special Projects. Prior to joining the Company, Mr. Basque spent more than 35 years with The Dow Chemical Company (NYSE: DOW) in various commercial and technical leadership roles, focusing on growing Dow’s specialty businesses. In his last position with Dow, Mr. Basque served as Vice President of Dow Global Technologies, Inc. and was the leader of several acquisition integration teams.

Mr. Basque will be provided (a) a monthly stipend of $50,000 during the period in which he serves as Interim President and Chief Executive Officer in addition to his base salary in effect as of September 1, 2024, and (b) a cash bonus of $500,000 upon completion of his interim role, conditioned on his continued employment until that time. Following completion of his interim role, Mr. Basque will continue to be employed by the Company at his current base salary until August 31, 2025 to help ensure a smooth transition. The Company and Mr. Basque entered into an agreement dated September 9, 2024, reflecting these understandings (the “Agreement”). The foregoing description of the Agreement is not intended to be complete and is qualified in its entirety by reference to the text of the Agreement, a copy of which is attached to this current report on Form 8-K as Exhibit 10.1 and incorporated herein by reference. Mr. Basque is also subject to the terms and conditions of the Non-Competition, Non-Solicitation and Confidentiality Agreement for Executive Officers, the form of which was filed as Exhibit 10.1 to the Company’s quarterly report on Form 10-Q filed with the Securities and Exchange Commission on November 1, 2023.

To help ensure stability in executive management during this leadership transition, the Board also approved an executive retention program for certain executive officers, including Grant Fitz, Executive Vice President and Chief Financial Officer, and Jeff Baker, Senior Vice President, Shared Services, who has been named President, Distribution Segment, effective October 1, 2024, as previously announced. Under this program, eligible executives were provided on September 9, 2024 an executive cash bonus retention award equal to 75% of their respective current base salaries, payable on the first anniversary of the award, conditioned on their respective continued employment until that time. The foregoing summary of the cash bonus retention award is not complete and is qualified in its entirety by reference to the full and complete terms of the award, the form of which is attached to this Current Report on Form 8-K as Exhibit 10.2, and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

As described in “Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers” above, on September 9, 2024, the Company issued a press release announcing that Michael McGaugh, President and Chief Executive Officer, was departing the Company effective immediately and that the Board of Directors has appointed Dave Basque to serve as Interim President and Chief Executive Officer until a new President and Chief Executive Officer is appointed. The Company also announced that the Board of Directors has engaged a global executive search firm to assist in identifying a new President and Chief Executive Officer. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 7.01 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. Furthermore, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”), except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Myers Industries, Inc.

By: /s/ Grant E. Fitz

Executive Vice President and

Chief Financial Officer

Date: September 9, 2024

[MYERS LOGO]

September 9, 2024

Dave Basque

1293 South Main Street

Akron, OH 44301

Dear Dave:

This letter agreement (the “Agreement”) sets forth the terms of your service as Interim President and Chief Executive Officer (“CEO”) of Myers Industries, Inc. (the “Company”). You agree to serve as Interim President and CEO during the period beginning on September 9, 2024 and continuing until the date the Board of Directors of the Company (the “Board”) appoints a permanent President and/or CEO, subject to the terms and conditions set forth in this Agreement (the “Interim Period”). During the Interim Period, you also shall continue to hold your position as the Company’s Vice President – Special Projects.

1. Duties as Interim President and CEO. In your capacity as Interim President and CEO, you will perform such duties and have such responsibilities for leadership of the Company and as may be assigned to you from time to time by the Board.

2. Cash Stipend. As compensation for your increased responsibilities during the Interim Period, in addition to your current base salary, you will receive a monthly cash stipend of $50,000 (the “Cash Stipend”), prorated for any partial months of your service as Interim President and CEO during the Interim Period. The Cash Stipend will be subject to any applicable taxes and withholdings and paid in accordance with the Company’s normal payroll procedures. For the avoidance of doubt, the Cash Stipend shall be in addition to any other compensation you are currently eligible to receive from the Company.

3. Retention Bonus. If you remain continuously employed as Interim President and CEO during the Interim Period, the Company will pay you a Retention Bonus of $500,000 (“Retention Bonus”). The Retention Bonus will be paid, net of applicable taxes and withholdings, as of the first payroll date following the date the Board appoints a permanent President and/or CEO.

4. Termination of Service During Interim Period.

(a) If, during the Interim Period, your service as Interim President and CEO ends due to (i) your death, (ii) termination of your employment by the Company without Cause or by you for Good Reason, or (iii) your removal from that position by the Board, determined in its sole discretion, while you continue to remain employed as Vice President – Special Projects, then you will be entitled to receive the full Retention Bonus, net of applicable taxes and withholdings, payable within 30 days after the date of such death, termination, or removal. You will also receive the prorated amount of your current base salary and Cash Stipend earned through the date of death, termination, or removal.

(b) If your service as Interim President and CEO ends during the Interim Period due to (i) the termination of your employment by you or the Company for any reason other than as set forth in Section 4(a), or (ii) you resign as Interim President and CEO but remain employed as Vice President, Special Projects, you will forfeit the entire amount of the Retention Bonus and it will not be paid to you. You will only receive the prorated amount of your current base salary and Cash Stipend earned through the date of termination.

5. Employment following Interim Period or Removal. Following the end of the Interim Period or the Board’s decision to remove you as Interim President and CEO while you retain your employment, the Company will permit you to continue in your position as Vice President – Special Projects, at your current base salary, through August 31, 2025. You will not receive the Cash Stipend after the Interim Period or date of removal from the Interim President and CEO position with continued employment.

6. Treatment of 2024 Award of Performance Stock Units (“PSUs”). If before August 31, 2025, your employment with the Company is terminated by the Company without Cause or by you for Good Reason, the outstanding and unvested PSUs granted to you in 2024 pursuant to the Myers Industries, Inc. 2024 Long-Term Incentive Plan (the “LTIP”), as amended from time to time, and the related Performance Stock Unit Award Agreement (the “Award Agreement”) will become immediately vested. Such PSUs will remain subject to all other terms and conditions of the LTIP and the Award Agreement. In the event that your employment terminates for any other reason before August 31, 2025, your right to any outstanding PSUs granted pursuant to the LTIP and the 2024 Award Agreement will be governed by the terms and conditions of the LTIP and the Award Agreement. All other grants of restricted stock units or performance stock units shall remain subject to the terms and conditions of the respective award agreements under which such grants were made.

7. Cause and Good Reason. For purposes of this Agreement the terms “Cause” and “Good Reason” shall have the meanings and conditions ascribed to those terms in the Myers Industries, Inc. Senior Officer Severance Plan, as amended and restated

effective April 26, 2023, and as amended October 25, 2023 (the “Plan”). For purposes of clarity, the Plan’s definitions of “Cause” and “Good Reason” apply to this Agreement, but you are no longer an officer who is eligible to participate in the Plan and therefore you are not entitled to benefits under the Plan.

8. Acknowledgment and Section 409A Compliance.

(a) You acknowledge that neither the Company nor any of the Company’s affiliates, officers, shareholders, employees, agents or representatives has provided or is providing you with tax advice regarding this Agreement or any other matter, and the Company has advised you to consult with your own tax advisor with respect to the tax consequences associated with this Agreement.

(b) It is intended that this Agreement and the payments and benefits hereunder comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and this Agreement and the terms hereof shall be interpreted and administered in a manner consistent with such intent. Notwithstanding the foregoing, in no event whatsoever will the Company or any of its affiliates be liable for any additional tax, interest or penalty that may be imposed on you by Section 409A of the Code or for damages for failing to comply with Section 409A of the Code or the Treasury Regulations thereunder. For purposes of this Agreement, termination of employment means a “separation from service” within the meaning of Treasury Regulation Section 1.409A-1(h).

(c) Whenever payment under this Agreement specifies a payment period with reference to a number of days, the actual date of payment within the specified period will be determined solely by the Company.

(d) If you are a “specified employee” within the meaning of Section 409A of the Code at the time of your “separation from service” within the meaning of Section 409A of the Code, then any payment otherwise required to be made under this Agreement on account of your separation from service, to the extent such payment (after taking into account all exclusions applicable to such payment under Section 409A of the Code) is properly treated as deferred compensation subject to Section 409A of the Code, shall not be made until the first business day after (i) the expiration of six months from the date of your separation from service, or (ii) if earlier, the date of your death.

9. Entire Agreement. This Agreement sets forth the entire agreement between the parties with respect to your appointment as Interim President and CEO, and supersedes and replaces any and all prior or contemporaneous representations or agreements, whether oral or written, relating thereto, with the exception that your Non-Competition, Non-Solicitation and Confidentiality Agreement effective August 31, 2023 shall remain in effect. For purposes of clarification, except as specified in Section 5 of this Agreement, the treatment of all outstanding stock options, restricted stock, restricted stock units, performance stock units or similar awards granted to you under the Company’s equity-based incentive plans shall remain subject to the terms and conditions of the respective award agreement.

10. Severability. In the event that any provision of this Agreement shall be held to be invalid or unenforceable for any reason whatsoever, it is agreed such invalidity or unenforceability shall not affect any other provision of this Agreement and the remaining covenants, restrictions and provisions hereof shall remain in full force and effect and any court of competent jurisdiction may so modify the objectionable provision as to make it valid, reasonable and enforceable.

11. Modifications. No modification or amendment of this Agreement will be effective unless the same be in a writing duly executed by all the parties hereto.

12. No Other Benefits. The Cash Stipend and Retention Bonus each are special incentive payments and shall not be taken into account in computing the amount of your salary or compensation for purposes of determining any bonus, incentive, pension, retirement, death or other benefit under any bonus, incentive, pension, retirement, insurance or other employee benefit plan of the Company or its subsidiaries or affiliates, unless such plan expressly provides otherwise.

13. Governing Law. This Agreement will be governed by and construed exclusively in accordance with the laws of the State of Ohio, regardless of choice of law requirements.

14. Counterparts. This Agreement may be executed in one or more counterparts, which together will constitute one and the same agreement.

We are excited to extend this opportunity to you. Please sign below to indicate your agreement with the terms of this Agreement.

Sincerely,

/s/ F. Jack Liebau, Jr._________________________

F. Jack Liebau, Jr.

Chairman of the Board of Directors

Accepted and Agreed to by:

/s/ Dave Basque_____________________________ September 9, 2024___________

Dave Basque Date

[MYERS LOGO]

September 9, 2024

[Executive name]

1293 South Main Street

Akron, OH 44301

Re: Notice of Award of Executive Retention Cash Bonus (“Notice”)

Dear [first name]:

Executive Retention Bonus. Myers Industries, Inc. (the “Company”) is offering to pay you (the “Executive”) the “Executive Retention Bonus” set forth in the table below if you remain in the employ of the Company through the first anniversary of this Notice (the “Retention Date”). The Executive Retention Bonus will be paid, net of applicable taxes and withholdings, as of the first payroll date following the Retention Date, subject to the terms of this Notice.

Retention Date 12 month anniversary

Executive Retention Bonus $[75% base salary]

Termination During Retention Period. If your employment with the Company is terminated (i) by reason of your death or disability, or (ii) by the Company without Cause or by you for Good Reason prior to the Retention Date (an “Acceleration Event”), then you will be entitled to receive the full Executive Retention Bonus, net of applicable taxes and withholdings, payable within 30 days after the date of such termination, and calculated without reduction for the accelerated payment. If your employment terminates for any other reason prior to the Retention Date, your right to the Executive Retention Bonus will be forfeited and you will not be entitled to receive the Executive Retention Bonus. For purposes of this Notice, “disability” shall mean a physical or mental incapacity that prevents the Executive from performing his or her duties for a period of one hundred eighty (180) consecutive days.

No Right of Employment. Nothing in this Notice shall confer upon the Executive any right to continue in the employ or service of the Company or any of its subsidiaries or interfere with or restrict in any way with the right of the Company or any such subsidiary to terminate the Executive’s employment at any time for any reason whatsoever, with or without Cause.

Acknowledgment and Section 409A Compliance.

(a) Executive acknowledges that neither the Company nor any of the Company’s affiliates, officers, shareholders, employees, agents or representatives has provided or is providing the Executive with tax advice regarding the Executive Retention Bonus subject to this Notice or any other matter, and the Company has urged the Executive to consult with his or her own tax advisor with respect to the tax consequences associated with the Executive Retention Bonus.

(b) It is intended that this Notice and the Executive Retention Bonus comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and this Notice and the terms hereof shall be interpreted and administered in a manner consistent with such intent, although in no event shall the Company or any of its affiliates have any liability to the Executive if this Notice or the terms hereof are determined not to comply with Section 409A of the Code. For purposes of this Agreement, termination of employment means a “separation from service” within the meaning of Treasury Regulation Section 1.409A-1(h).

(c) Whenever payment under this Notice specifies a payment period with reference to a number of days (e.g., payment may be made within thirty (30) days after the Retention Date), the actual date of payment within the specified period will be determined solely by the Company.

(d) If the Executive is a “specified employee” within the meaning of Section 409A of the Code at the time of his or her “separation from service” within the meaning of Section 409A of the Code, then any payment otherwise required to be made to Executive under this Agreement on account of his or her separation from service, to the extent such payment (after taking into account all exclusions applicable to such payment under Section 409A of the Code) is properly treated as deferred compensation subject to Section 409A of the Code, shall not be made until the first business day after (i) the expiration of six months from the date of the Executive’s separation from service, or (ii) if earlier, the date of the Executive’s death.

Cause and Good Reason. For purposes of this Notice, the terms “Cause” and “Good Reason” shall have the meanings and conditions ascribed to those terms in the Myers Industries, Inc. Senior Officer Severance Plan, as amended and restated effective April 26, 2023, and as amended October 25, 2023.

Waiver and Modification. The provisions of this Notice may not be waived, modified or amended unless such waiver, modification or amendment is in writing and signed by the parties hereto.

Interpretation. All decisions or interpretations made by the Compensation Committee of the Company’s Board of Directors with regard to any question arising under this Notice shall be binding and conclusive on the Company and the Executive.

Governing Law. This Notice shall be governed by and construed exclusively in accordance with the laws of the State of Ohio, regardless of choice of law requirements.

Please sign below to indicate your agreement with the terms and conditions of this Notice.

Sincerely,

/s/ F. Jack Liebau, Jr.

F. Jack Liebau, Jr.

Chairman of the Board of Directors

Accepted and Agreed to by:

Signed:

Name:

Dated:

[MYERS LOGO]

Myers Industries Announces CEO Leadership Transition Plan

Dave Basque, Vice President of Special Projects and Former Vice President in Myers’ Material Handling Segment, Named Interim President and CEO

Board Has Initiated a Search for a New CEO

AKRON, Ohio, September 9, 2024 – Myers Industries Inc. (NYSE: MYE), a leading manufacturer of a wide range of polymer and metal products and distributor for the tire, wheel and under-vehicle service industry, today announced a leadership transition to support the continued transformation of the Company. The Board of Directors has appointed Dave Basque, Myers Industries’ Vice President, Special Projects, to the additional role of Interim President and CEO, replacing Mike McGaugh, effective immediately. Dave Basque will serve in that role until a new CEO is appointed. Until September 1, 2024, Dave served as the Company’s Vice President, Integration and Vice President, Material Handling Segment – Injection Molding. The Board has engaged a nationally recognized executive search firm to help identify a new Chief Executive Officer.

F. Jack Liebau Jr., Chairman of the Myers Industries Board stated, “Mike has been the driver of our transformation efforts for four and a half years as our CEO. We are a better Company, with a better leadership team, than we were when Mike joined us. He built a strong platform for our growth for which we are grateful. On behalf of the Board, I want to thank Mike for his valuable leadership and contributions to Myers.”

Mike McGaugh stated “I’d like to thank the Board of Directors for the opportunity to have led Myers Industries over these past several years. I believe the Company is well positioned for long term success in the future. I am confident that Dave and the Myers team will continue to drive Myers’ transformation and create shareholder value.”

Dave Basque commented, “I am very pleased to be named Interim President and CEO of Myers Industries and look forward to working closely with the Board and our senior leadership team to continue to drive the business forward.”

Mr. Liebau continued, “Dave is an industry veteran who has been a critical part of our leadership team since joining the Company in 2020. Before joining Myers, Dave spent over 35 years in senior operational and acquisition integration roles with The Dow Chemical Company. In addition to leading the injection molding division of Myers’ Material Handling business segment, Dave has been building the Company’s capability in acquisition integrations. Under his leadership, the Company will remain focused on executing our strategy with an emphasis on operational excellence to drive improved profitability and increased cash flow generation. The Board and management team are dedicated to delivering share value improvement and committed to ensuring a smooth transition. I look forward to working closely with Dave throughout this process.”

About Dave Basque

Mr. Basque joined Myers Industries in August 2020 as Vice President, Integration and Vice President, Material Handling Segment – Injection Molding. In addition to overseeing the Company’s injection molding platform operations, Mr. Basque was responsible for the Company’s acquisition integrations. Mr. Basque spent more than 35 years with The Dow Chemical Company in commercial and technical leadership roles, focusing on growing Dow’s specialty businesses. In his most recent position at Dow, Mr. Basque served as Vice President of Dow Global Technologies, Inc. and was the leader of several acquisition integration teams.

About Myers Industries

Myers Industries Inc., based in Akron, Ohio, is a manufacturer of sustainable plastic and metal products for industrial, agricultural, automotive, commercial, and consumer markets. The Company is also the largest distributor of tools, equipment and supplies for the tire, wheel, and under-vehicle service industry in the United States. Visit www.myersindustries.com to learn more.

Caution on Forward-Looking Statements

Statements in this release include contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including information regarding the Company’s financial outlook, future plans, objectives, business prospects and anticipated financial performance. Forward-looking statements can be identified by words such as "will," "believe," "anticipate," "expect," "estimate," "intend," "plan," or variations of these words, or similar expressions. These forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future,

these statements inherently involve a wide range of inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. The Company’s actual actions, results, and financial condition may differ materially from what is expressed or implied by the forward-looking statements.

Specific factors that could cause such a difference on our business, financial position, results of operations and/or liquidity include, without limitation, raw material availability, increases in raw material costs, or other production costs; risks associated with our strategic growth initiatives or the failure to achieve the anticipated benefits of such initiatives; unanticipated downturn in business relationships with customers or their purchases; competitive pressures on sales and pricing; changes in the markets for the Company’s business segments; changes in trends and demands in the markets in which the Company competes; operational problems at our manufacturing facilities or unexpected failures at those facilities; future economic and financial conditions in the United States and around the world; inability of the Company to meet future capital requirements; claims, litigation and regulatory actions against the Company; changes in laws and regulations affecting the Company; unforeseen events, including natural disasters, unusual or severe weather events and patterns, public health crises, geopolitical crises, and other catastrophic events; and other risks and uncertainties detailed from time to time in the Company’s filings with the SEC, including without limitation, the risk factors disclosed in Item 1A, "Risk Factors," in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. Given these factors, as well as other variables that may affect our operating results, readers should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, nor use historical trends to anticipate results or trends in future periods. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. The Company expressly disclaims any obligation or intention to provide updates to the forward-looking statements and the estimates and assumptions associated with them.

Investor Contact:

Meghan Beringer

Senior Director Investor Relations

252-536-5651

Source: Myers Industries, Inc.

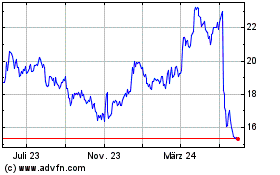

Myers Industries (NYSE:MYE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

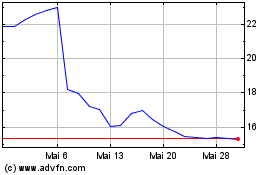

Myers Industries (NYSE:MYE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024