UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-39601

MINISO Group

Holding Limited

8F, M Plaza, No. 109, Pazhou Avenue

Haizhu District, Guangzhou 510000, Guangdong Province

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MINISO Group Holding Limited |

| |

By |

: |

/s/ Jingjing Zhang |

| |

Name |

: |

Jingjing Zhang |

| |

Title |

: |

Chief Financial Officer |

Date: September 24, 2024

Exhibit 99.1

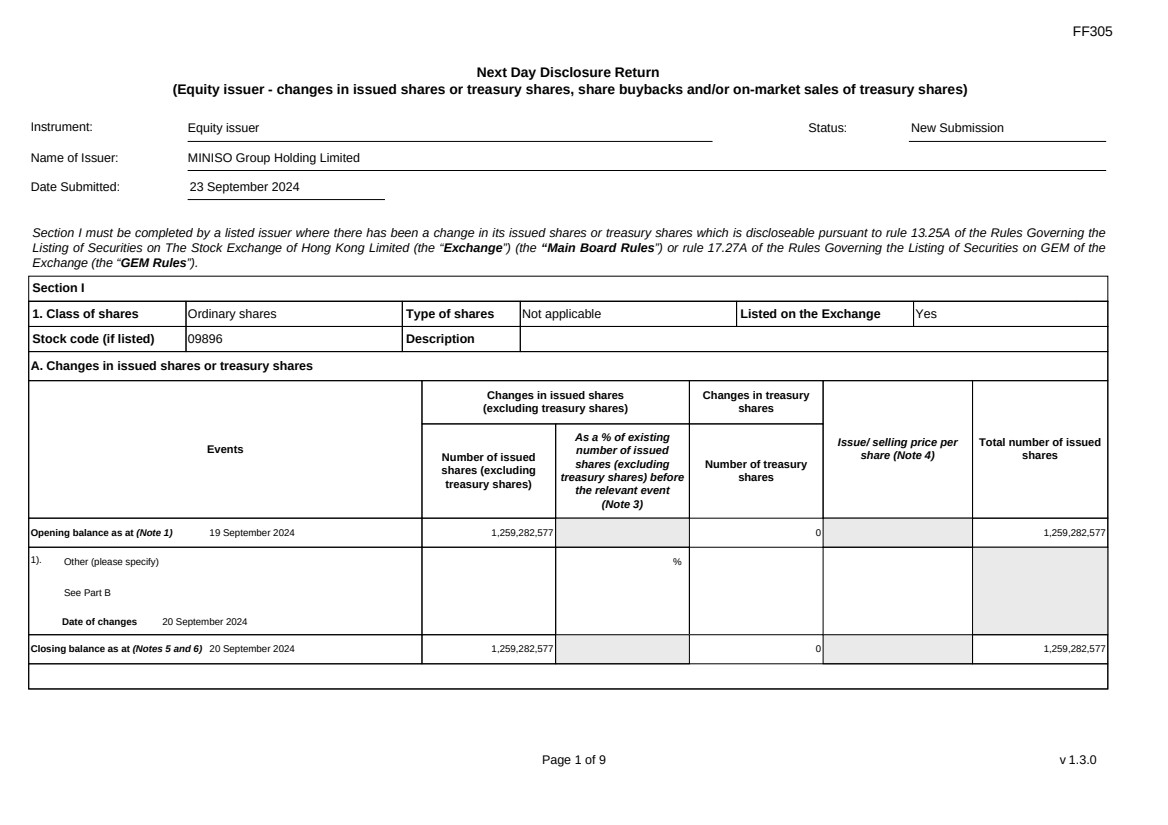

| FF305

Page 1 of 9 v 1.3.0

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: MINISO Group Holding Limited

Date Submitted: 23 September 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares Ordinary shares Type of shares Not applicable Listed on the Exchange Yes

Stock code (if listed) 09896 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 19 September 2024 1,259,282,577 0 1,259,282,577

1). Other (please specify)

See Part B

Date of changes 20 September 2024

%

Closing balance as at (Notes 5 and 6) 20 September 2024 1,259,282,577 0 1,259,282,577

|

| FF305

Page 2 of 9 v 1.3.0

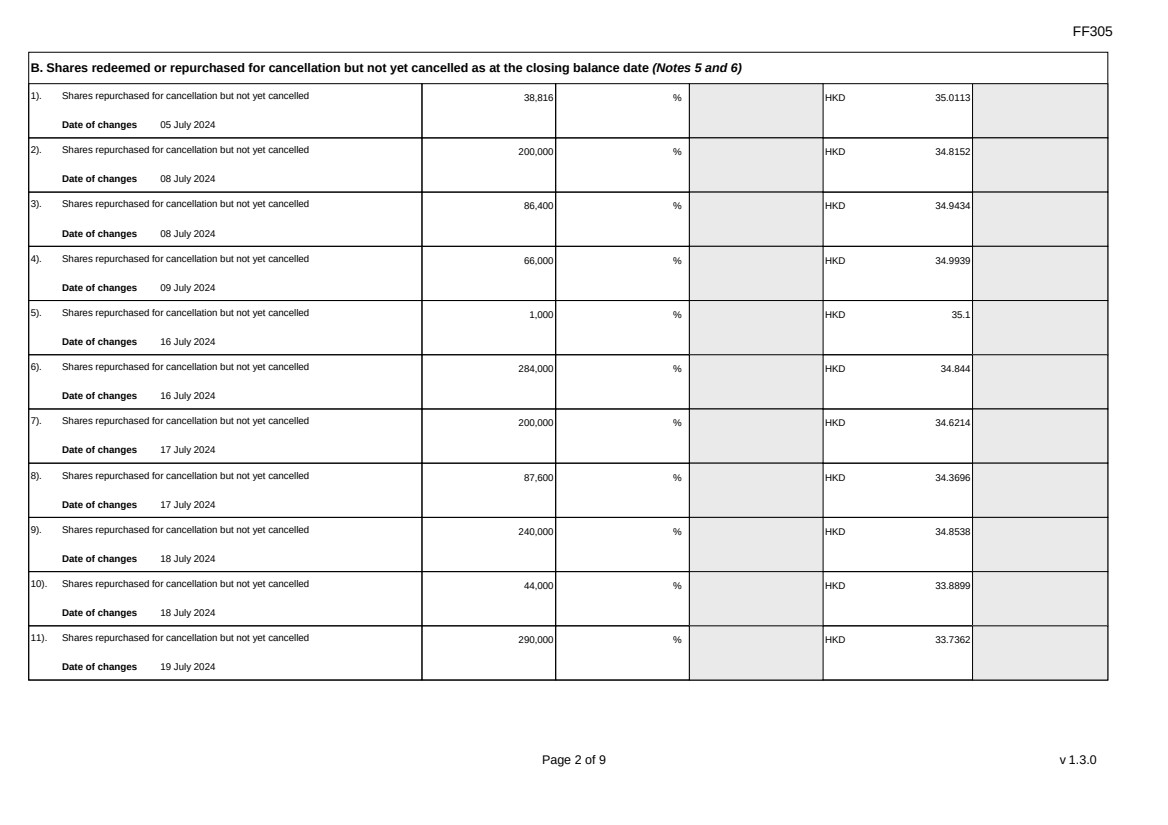

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6)

1). Shares repurchased for cancellation but not yet cancelled

Date of changes 05 July 2024

38,816 % HKD 35.0113

2). Shares repurchased for cancellation but not yet cancelled

Date of changes 08 July 2024

200,000 % HKD 34.8152

3). Shares repurchased for cancellation but not yet cancelled

Date of changes 08 July 2024

86,400 % HKD 34.9434

4). Shares repurchased for cancellation but not yet cancelled

Date of changes 09 July 2024

66,000 % HKD 34.9939

5). Shares repurchased for cancellation but not yet cancelled

Date of changes 16 July 2024

1,000 % HKD 35.1

6). Shares repurchased for cancellation but not yet cancelled

Date of changes 16 July 2024

284,000 % HKD 34.844

7). Shares repurchased for cancellation but not yet cancelled

Date of changes 17 July 2024

200,000 % HKD 34.6214

8). Shares repurchased for cancellation but not yet cancelled

Date of changes 17 July 2024

87,600 % HKD 34.3696

9). Shares repurchased for cancellation but not yet cancelled

Date of changes 18 July 2024

240,000 % HKD 34.8538

10). Shares repurchased for cancellation but not yet cancelled

Date of changes 18 July 2024

44,000 % HKD 33.8899

11). Shares repurchased for cancellation but not yet cancelled

Date of changes 19 July 2024

290,000 % HKD 33.7362 |

| FF305

Page 3 of 9 v 1.3.0

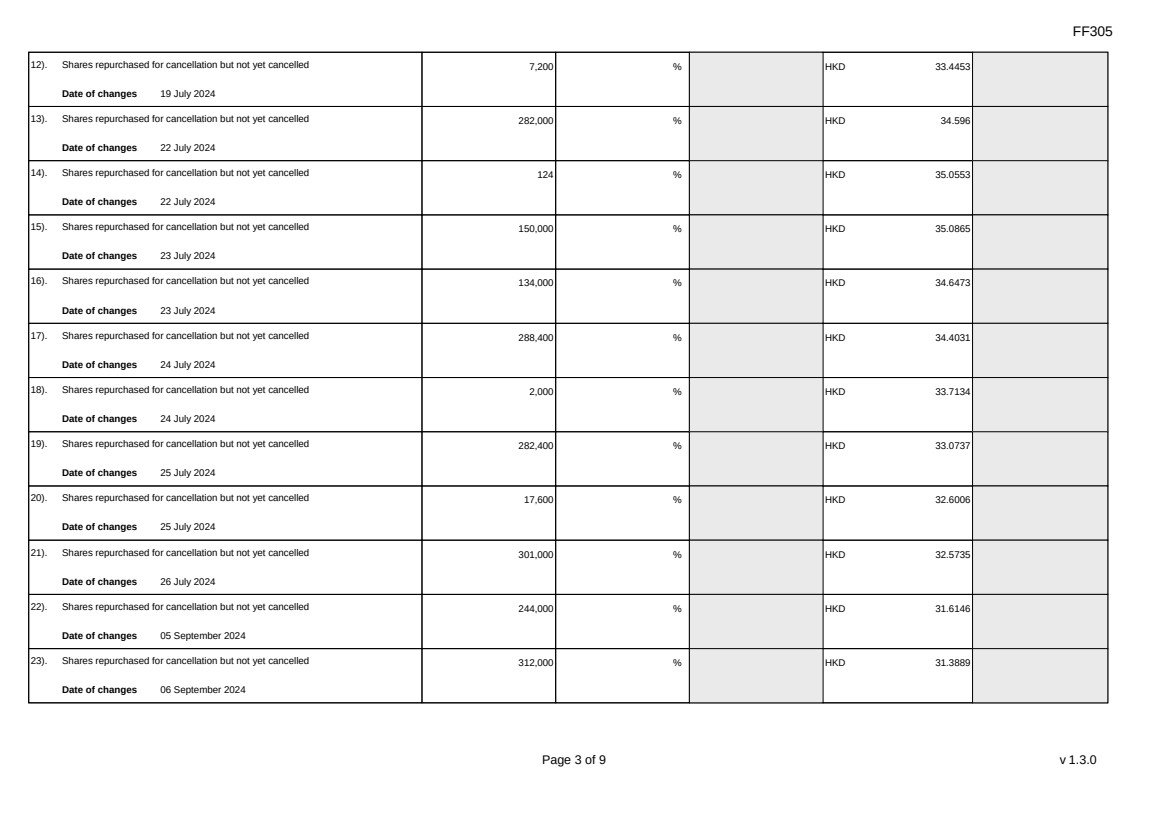

12). Shares repurchased for cancellation but not yet cancelled

Date of changes 19 July 2024

7,200 % HKD 33.4453

13). Shares repurchased for cancellation but not yet cancelled

Date of changes 22 July 2024

282,000 % HKD 34.596

14). Shares repurchased for cancellation but not yet cancelled

Date of changes 22 July 2024

124 % HKD 35.0553

15). Shares repurchased for cancellation but not yet cancelled

Date of changes 23 July 2024

150,000 % HKD 35.0865

16). Shares repurchased for cancellation but not yet cancelled

Date of changes 23 July 2024

134,000 % HKD 34.6473

17). Shares repurchased for cancellation but not yet cancelled

Date of changes 24 July 2024

288,400 % HKD 34.4031

18). Shares repurchased for cancellation but not yet cancelled

Date of changes 24 July 2024

2,000 % HKD 33.7134

19). Shares repurchased for cancellation but not yet cancelled

Date of changes 25 July 2024

282,400 % HKD 33.0737

20). Shares repurchased for cancellation but not yet cancelled

Date of changes 25 July 2024

17,600 % HKD 32.6006

21). Shares repurchased for cancellation but not yet cancelled

Date of changes 26 July 2024

301,000 % HKD 32.5735

22). Shares repurchased for cancellation but not yet cancelled

Date of changes 05 September 2024

244,000 % HKD 31.6146

23). Shares repurchased for cancellation but not yet cancelled

Date of changes 06 September 2024

312,000 % HKD 31.3889 |

| FF305

Page 4 of 9 v 1.3.0

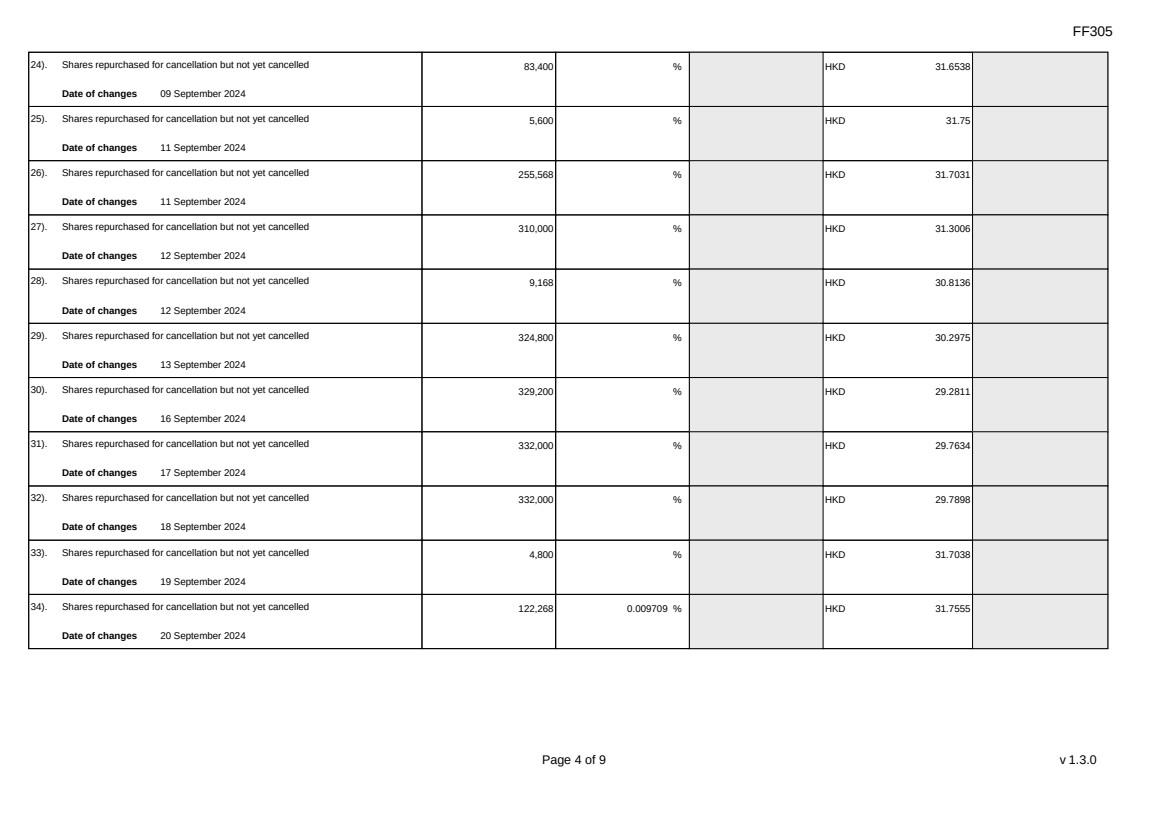

24). Shares repurchased for cancellation but not yet cancelled

Date of changes 09 September 2024

83,400 % HKD 31.6538

25). Shares repurchased for cancellation but not yet cancelled

Date of changes 11 September 2024

5,600 % HKD 31.75

26). Shares repurchased for cancellation but not yet cancelled

Date of changes 11 September 2024

255,568 % HKD 31.7031

27). Shares repurchased for cancellation but not yet cancelled

Date of changes 12 September 2024

310,000 % HKD 31.3006

28). Shares repurchased for cancellation but not yet cancelled

Date of changes 12 September 2024

9,168 % HKD 30.8136

29). Shares repurchased for cancellation but not yet cancelled

Date of changes 13 September 2024

324,800 % HKD 30.2975

30). Shares repurchased for cancellation but not yet cancelled

Date of changes 16 September 2024

329,200 % HKD 29.2811

31). Shares repurchased for cancellation but not yet cancelled

Date of changes 17 September 2024

332,000 % HKD 29.7634

32). Shares repurchased for cancellation but not yet cancelled

Date of changes 18 September 2024

332,000 % HKD 29.7898

33). Shares repurchased for cancellation but not yet cancelled

Date of changes 19 September 2024

4,800 % HKD 31.7038

34). Shares repurchased for cancellation but not yet cancelled

Date of changes 20 September 2024

122,268 0.009709 % HKD 31.7555 |

| FF305

Page 5 of 9 v 1.3.0

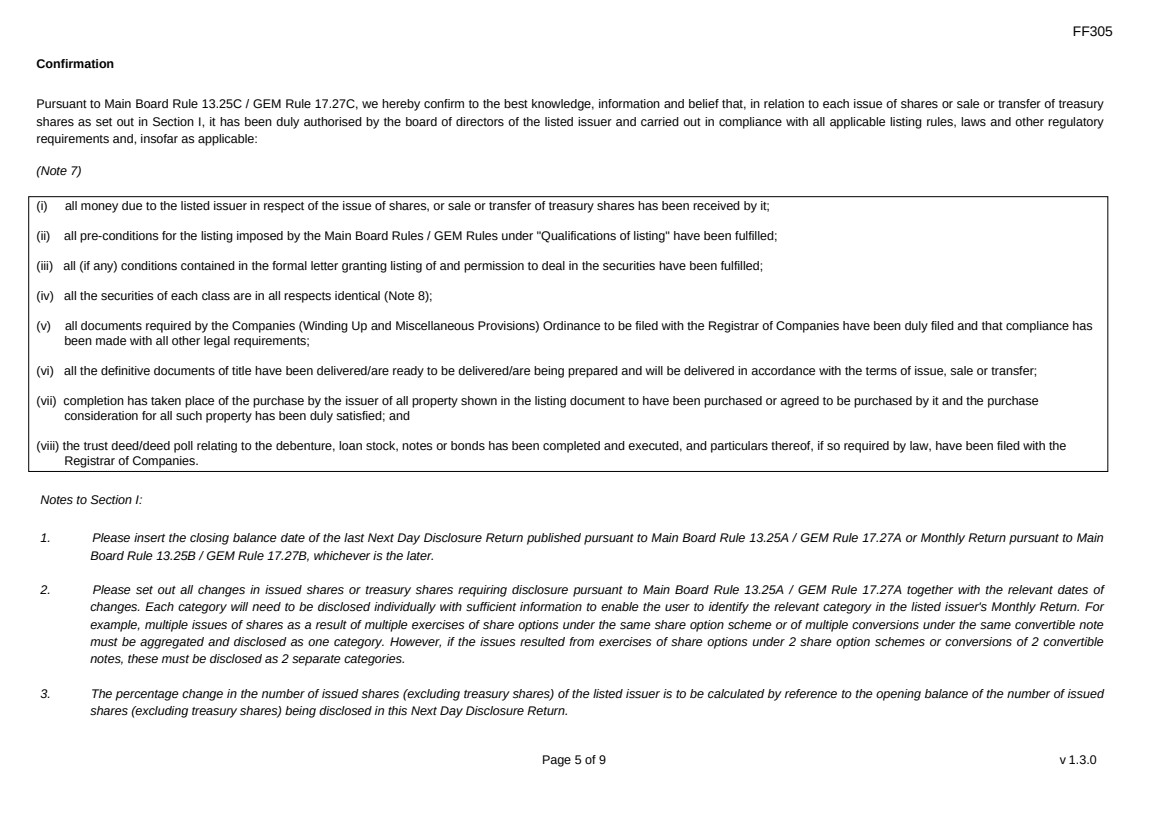

Confirmation

Pursuant to Main Board Rule 13.25C / GEM Rule 17.27C, we hereby confirm to the best knowledge, information and belief that, in relation to each issue of shares or sale or transfer of treasury

shares as set out in Section I, it has been duly authorised by the board of directors of the listed issuer and carried out in compliance with all applicable listing rules, laws and other regulatory

requirements and, insofar as applicable:

(Note 7)

(i) all money due to the listed issuer in respect of the issue of shares, or sale or transfer of treasury shares has been received by it;

(ii) all pre-conditions for the listing imposed by the Main Board Rules / GEM Rules under "Qualifications of listing" have been fulfilled;

(iii) all (if any) conditions contained in the formal letter granting listing of and permission to deal in the securities have been fulfilled;

(iv) all the securities of each class are in all respects identical (Note 8);

(v) all documents required by the Companies (Winding Up and Miscellaneous Provisions) Ordinance to be filed with the Registrar of Companies have been duly filed and that compliance has

been made with all other legal requirements;

(vi) all the definitive documents of title have been delivered/are ready to be delivered/are being prepared and will be delivered in accordance with the terms of issue, sale or transfer;

(vii) completion has taken place of the purchase by the issuer of all property shown in the listing document to have been purchased or agreed to be purchased by it and the purchase

consideration for all such property has been duly satisfied; and

(viii) the trust deed/deed poll relating to the debenture, loan stock, notes or bonds has been completed and executed, and particulars thereof, if so required by law, have been filed with the

Registrar of Companies.

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return. |

| FF305

Page 6 of 9 v 1.3.0

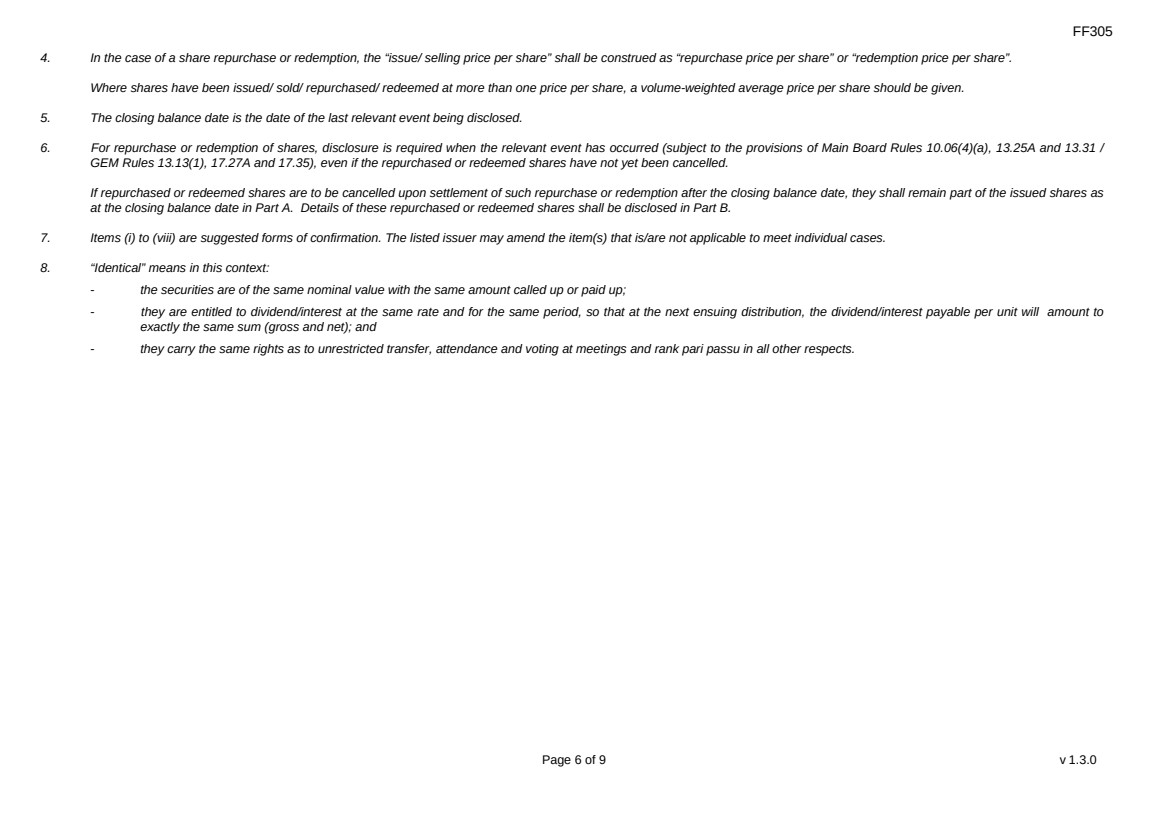

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF305

Page 7 of 9 v 1.3.0

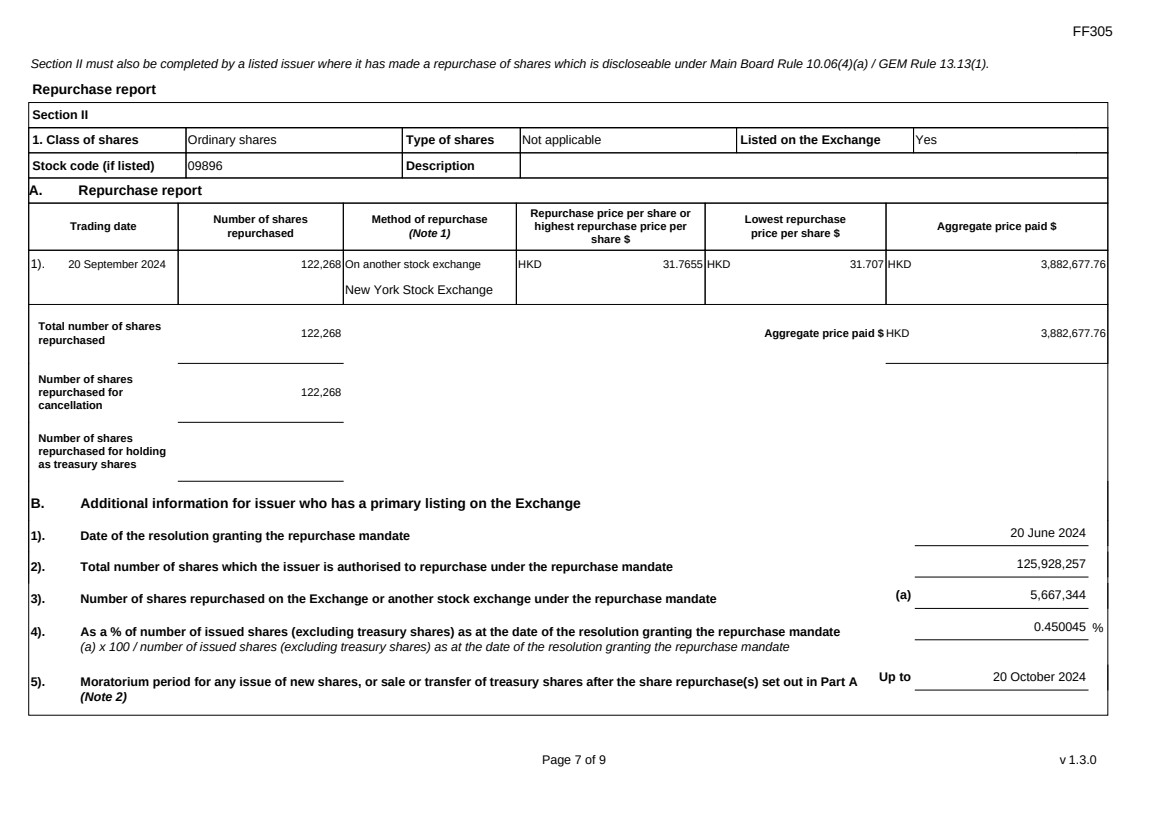

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report

Section II

1. Class of shares Ordinary shares Type of shares Not applicable Listed on the Exchange Yes

Stock code (if listed) 09896 Description

A. Repurchase report

Trading date Number of shares

repurchased

Method of repurchase

(Note 1)

Repurchase price per share or

highest repurchase price per

share $

Lowest repurchase

price per share $ Aggregate price paid $

1). 20 September 2024 122,268 On another stock exchange

New York Stock Exchange

HKD 31.7655 HKD 31.707 HKD 3,882,677.76

Total number of shares

repurchased 122,268 Aggregate price paid $ HKD 3,882,677.76

Number of shares

repurchased for

cancellation

122,268

Number of shares

repurchased for holding

as treasury shares

B. Additional information for issuer who has a primary listing on the Exchange

1). Date of the resolution granting the repurchase mandate 20 June 2024

2). Total number of shares which the issuer is authorised to repurchase under the repurchase mandate 125,928,257

3). Number of shares repurchased on the Exchange or another stock exchange under the repurchase mandate (a) 5,667,344

4). As a % of number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

(a) x 100 / number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

0.450045 %

5). Moratorium period for any issue of new shares, or sale or transfer of treasury shares after the share repurchase(s) set out in Part A

(Note 2)

Up to 20 October 2024 |

| FF305

Page 8 of 9 v 1.3.0

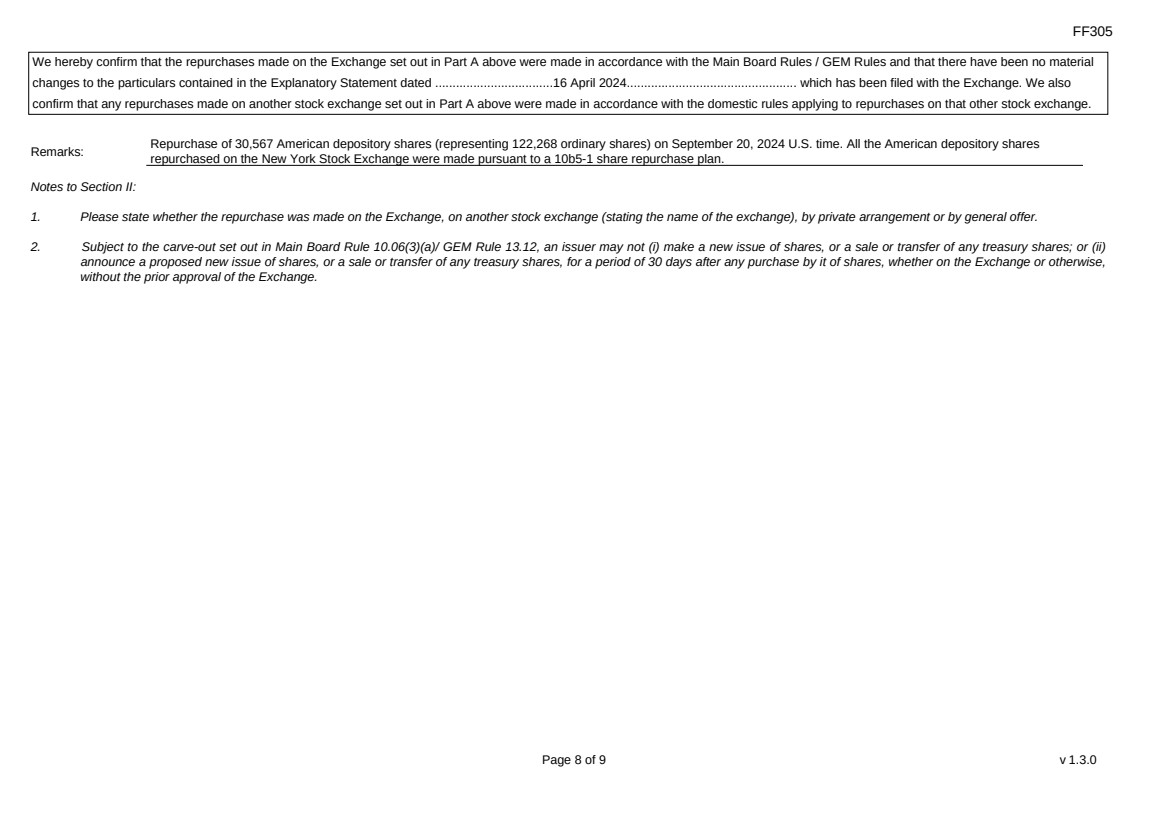

We hereby confirm that the repurchases made on the Exchange set out in Part A above were made in accordance with the Main Board Rules / GEM Rules and that there have been no material

changes to the particulars contained in the Explanatory Statement dated ..................................16 April 2024................................................. which has been filed with the Exchange. We also

confirm that any repurchases made on another stock exchange set out in Part A above were made in accordance with the domestic rules applying to repurchases on that other stock exchange.

Remarks: Repurchase of 30,567 American depository shares (representing 122,268 ordinary shares) on September 20, 2024 U.S. time. All the American depository shares

repurchased on the New York Stock Exchange were made pursuant to a 10b5-1 share repurchase plan.

Notes to Section II:

1. Please state whether the repurchase was made on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

2. Subject to the carve-out set out in Main Board Rule 10.06(3)(a)/ GEM Rule 13.12, an issuer may not (i) make a new issue of shares, or a sale or transfer of any treasury shares; or (ii)

announce a proposed new issue of shares, or a sale or transfer of any treasury shares, for a period of 30 days after any purchase by it of shares, whether on the Exchange or otherwise,

without the prior approval of the Exchange. |

| FF305

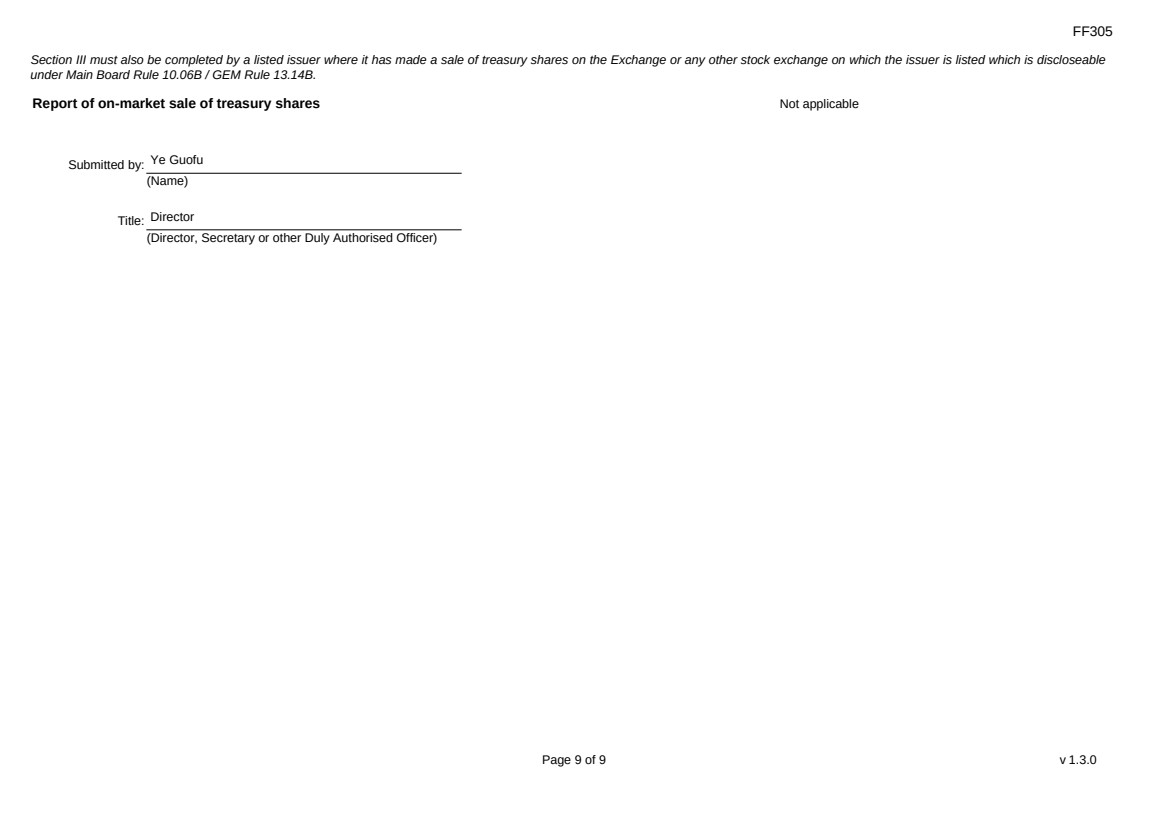

Page 9 of 9 v 1.3.0

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Ye Guofu

(Name)

Title: Director

(Director, Secretary or other Duly Authorised Officer) |

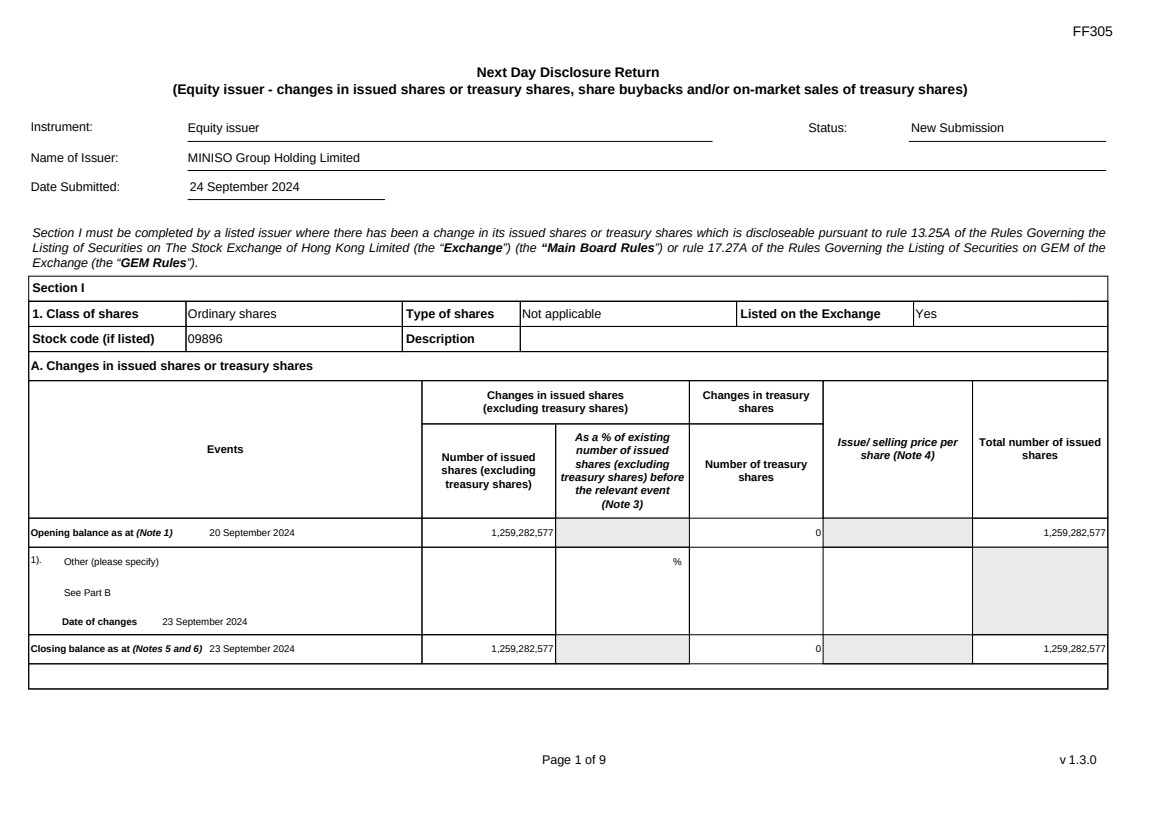

Exhibit 99.2

| FF305

Page 1 of 9 v 1.3.0

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: MINISO Group Holding Limited

Date Submitted: 24 September 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares Ordinary shares Type of shares Not applicable Listed on the Exchange Yes

Stock code (if listed) 09896 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 20 September 2024 1,259,282,577 0 1,259,282,577

1). Other (please specify)

See Part B

Date of changes 23 September 2024

%

Closing balance as at (Notes 5 and 6) 23 September 2024 1,259,282,577 0 1,259,282,577

|

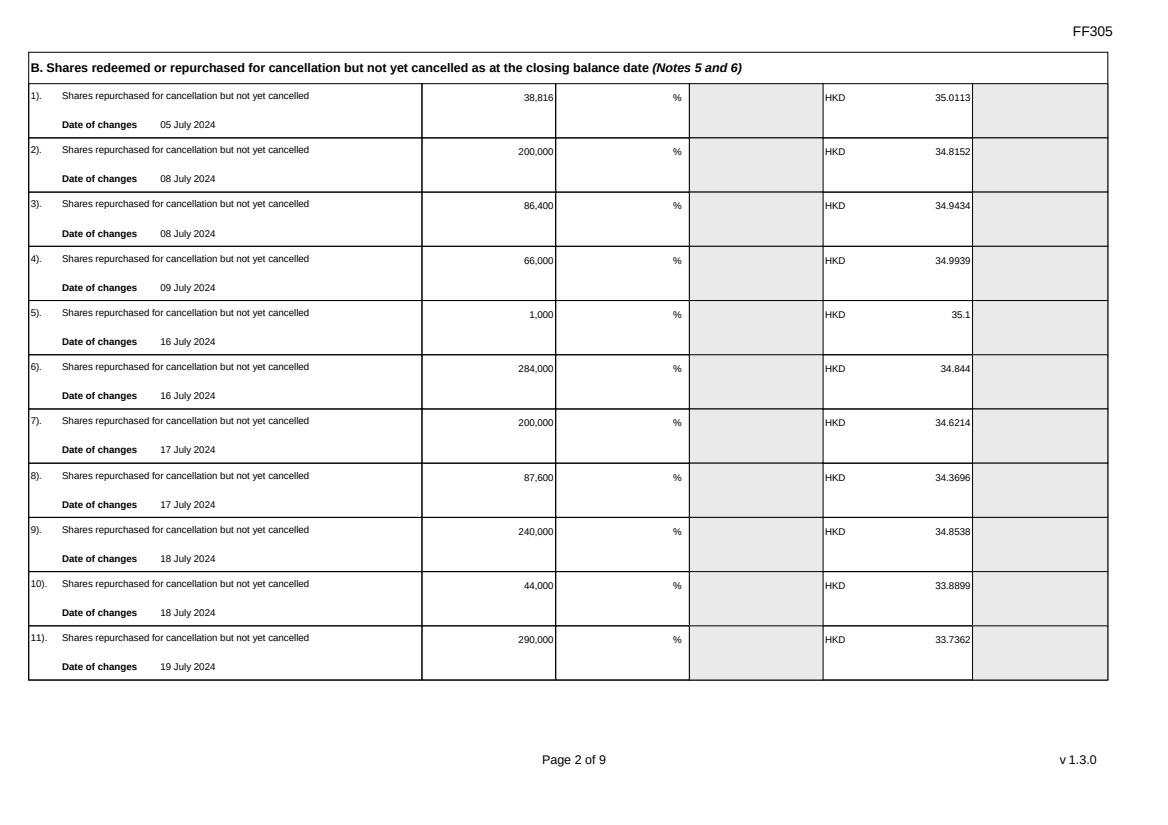

| FF305

Page 2 of 9 v 1.3.0

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6)

1). Shares repurchased for cancellation but not yet cancelled

Date of changes 05 July 2024

38,816 % HKD 35.0113

2). Shares repurchased for cancellation but not yet cancelled

Date of changes 08 July 2024

200,000 % HKD 34.8152

3). Shares repurchased for cancellation but not yet cancelled

Date of changes 08 July 2024

86,400 % HKD 34.9434

4). Shares repurchased for cancellation but not yet cancelled

Date of changes 09 July 2024

66,000 % HKD 34.9939

5). Shares repurchased for cancellation but not yet cancelled

Date of changes 16 July 2024

1,000 % HKD 35.1

6). Shares repurchased for cancellation but not yet cancelled

Date of changes 16 July 2024

284,000 % HKD 34.844

7). Shares repurchased for cancellation but not yet cancelled

Date of changes 17 July 2024

200,000 % HKD 34.6214

8). Shares repurchased for cancellation but not yet cancelled

Date of changes 17 July 2024

87,600 % HKD 34.3696

9). Shares repurchased for cancellation but not yet cancelled

Date of changes 18 July 2024

240,000 % HKD 34.8538

10). Shares repurchased for cancellation but not yet cancelled

Date of changes 18 July 2024

44,000 % HKD 33.8899

11). Shares repurchased for cancellation but not yet cancelled

Date of changes 19 July 2024

290,000 % HKD 33.7362 |

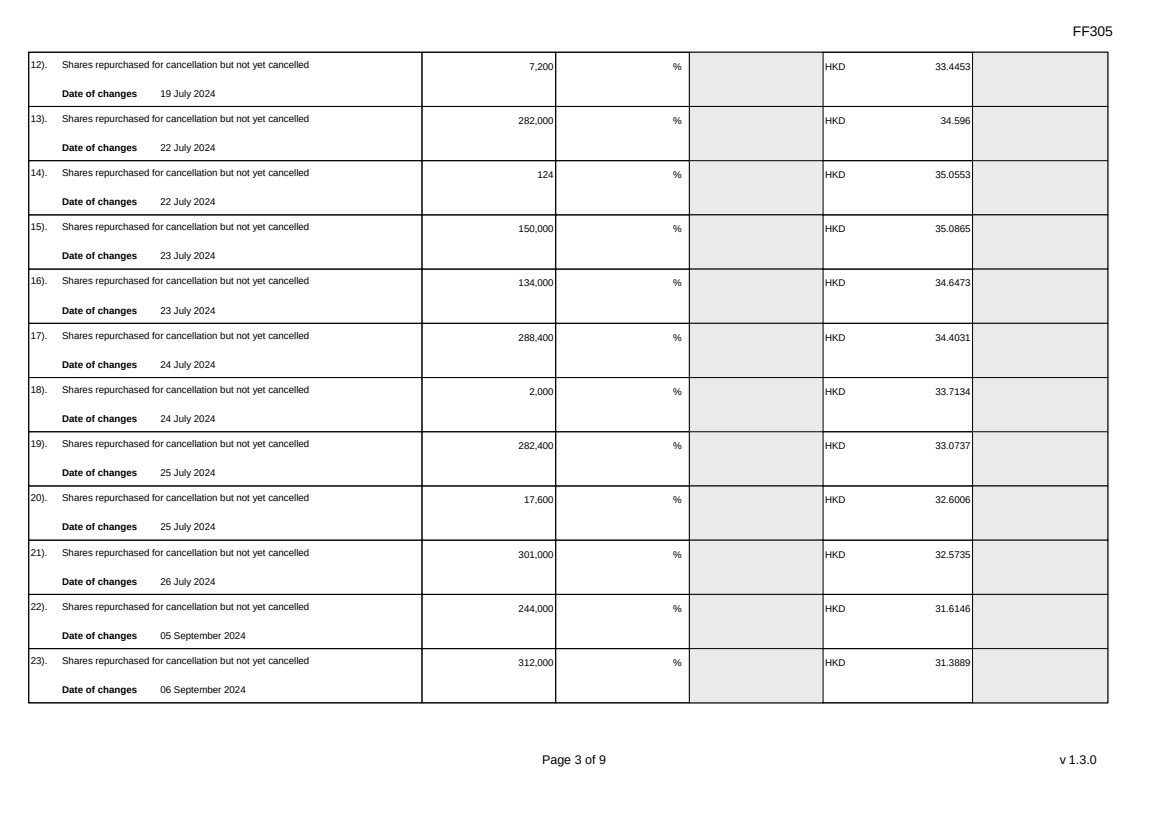

| FF305

Page 3 of 9 v 1.3.0

12). Shares repurchased for cancellation but not yet cancelled

Date of changes 19 July 2024

7,200 % HKD 33.4453

13). Shares repurchased for cancellation but not yet cancelled

Date of changes 22 July 2024

282,000 % HKD 34.596

14). Shares repurchased for cancellation but not yet cancelled

Date of changes 22 July 2024

124 % HKD 35.0553

15). Shares repurchased for cancellation but not yet cancelled

Date of changes 23 July 2024

150,000 % HKD 35.0865

16). Shares repurchased for cancellation but not yet cancelled

Date of changes 23 July 2024

134,000 % HKD 34.6473

17). Shares repurchased for cancellation but not yet cancelled

Date of changes 24 July 2024

288,400 % HKD 34.4031

18). Shares repurchased for cancellation but not yet cancelled

Date of changes 24 July 2024

2,000 % HKD 33.7134

19). Shares repurchased for cancellation but not yet cancelled

Date of changes 25 July 2024

282,400 % HKD 33.0737

20). Shares repurchased for cancellation but not yet cancelled

Date of changes 25 July 2024

17,600 % HKD 32.6006

21). Shares repurchased for cancellation but not yet cancelled

Date of changes 26 July 2024

301,000 % HKD 32.5735

22). Shares repurchased for cancellation but not yet cancelled

Date of changes 05 September 2024

244,000 % HKD 31.6146

23). Shares repurchased for cancellation but not yet cancelled

Date of changes 06 September 2024

312,000 % HKD 31.3889 |

| FF305

Page 4 of 9 v 1.3.0

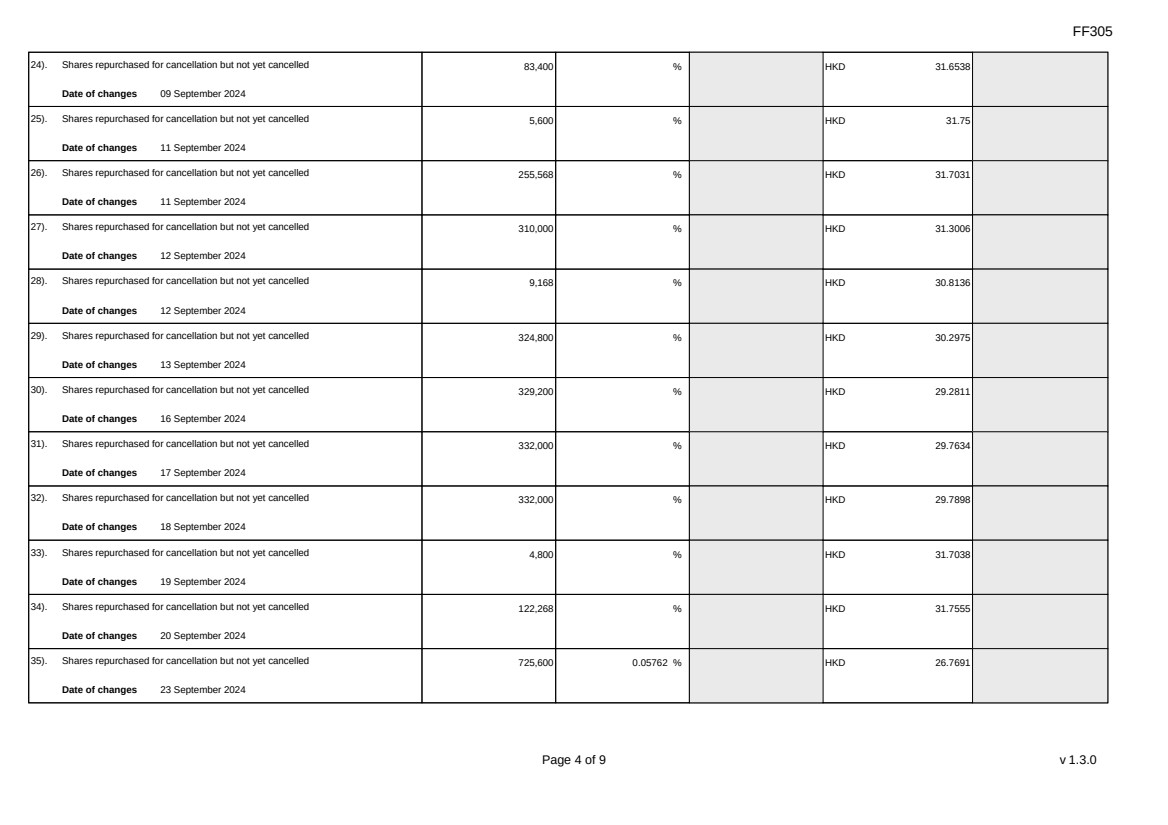

24). Shares repurchased for cancellation but not yet cancelled

Date of changes 09 September 2024

83,400 % HKD 31.6538

25). Shares repurchased for cancellation but not yet cancelled

Date of changes 11 September 2024

5,600 % HKD 31.75

26). Shares repurchased for cancellation but not yet cancelled

Date of changes 11 September 2024

255,568 % HKD 31.7031

27). Shares repurchased for cancellation but not yet cancelled

Date of changes 12 September 2024

310,000 % HKD 31.3006

28). Shares repurchased for cancellation but not yet cancelled

Date of changes 12 September 2024

9,168 % HKD 30.8136

29). Shares repurchased for cancellation but not yet cancelled

Date of changes 13 September 2024

324,800 % HKD 30.2975

30). Shares repurchased for cancellation but not yet cancelled

Date of changes 16 September 2024

329,200 % HKD 29.2811

31). Shares repurchased for cancellation but not yet cancelled

Date of changes 17 September 2024

332,000 % HKD 29.7634

32). Shares repurchased for cancellation but not yet cancelled

Date of changes 18 September 2024

332,000 % HKD 29.7898

33). Shares repurchased for cancellation but not yet cancelled

Date of changes 19 September 2024

4,800 % HKD 31.7038

34). Shares repurchased for cancellation but not yet cancelled

Date of changes 20 September 2024

122,268 % HKD 31.7555

35). Shares repurchased for cancellation but not yet cancelled

Date of changes 23 September 2024

725,600 0.05762 % HKD 26.7691 |

| FF305

Page 5 of 9 v 1.3.0

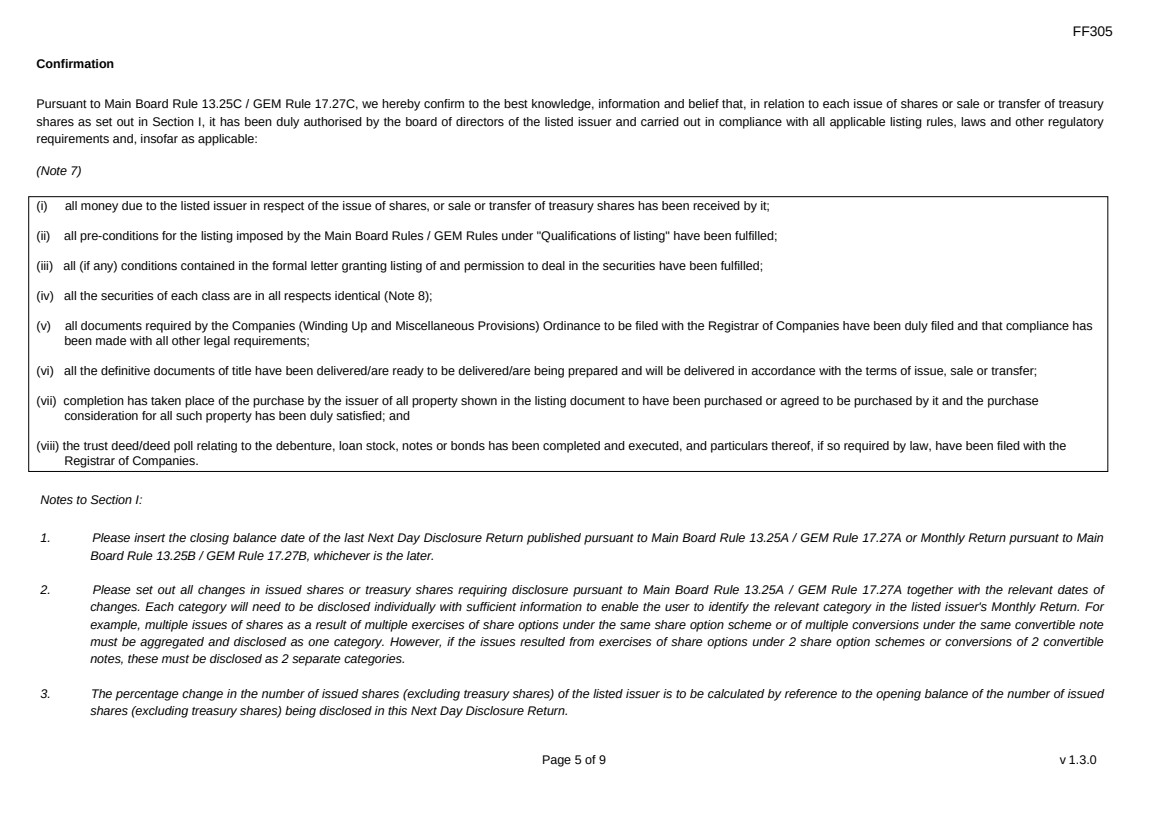

Confirmation

Pursuant to Main Board Rule 13.25C / GEM Rule 17.27C, we hereby confirm to the best knowledge, information and belief that, in relation to each issue of shares or sale or transfer of treasury

shares as set out in Section I, it has been duly authorised by the board of directors of the listed issuer and carried out in compliance with all applicable listing rules, laws and other regulatory

requirements and, insofar as applicable:

(Note 7)

(i) all money due to the listed issuer in respect of the issue of shares, or sale or transfer of treasury shares has been received by it;

(ii) all pre-conditions for the listing imposed by the Main Board Rules / GEM Rules under "Qualifications of listing" have been fulfilled;

(iii) all (if any) conditions contained in the formal letter granting listing of and permission to deal in the securities have been fulfilled;

(iv) all the securities of each class are in all respects identical (Note 8);

(v) all documents required by the Companies (Winding Up and Miscellaneous Provisions) Ordinance to be filed with the Registrar of Companies have been duly filed and that compliance has

been made with all other legal requirements;

(vi) all the definitive documents of title have been delivered/are ready to be delivered/are being prepared and will be delivered in accordance with the terms of issue, sale or transfer;

(vii) completion has taken place of the purchase by the issuer of all property shown in the listing document to have been purchased or agreed to be purchased by it and the purchase

consideration for all such property has been duly satisfied; and

(viii) the trust deed/deed poll relating to the debenture, loan stock, notes or bonds has been completed and executed, and particulars thereof, if so required by law, have been filed with the

Registrar of Companies.

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return. |

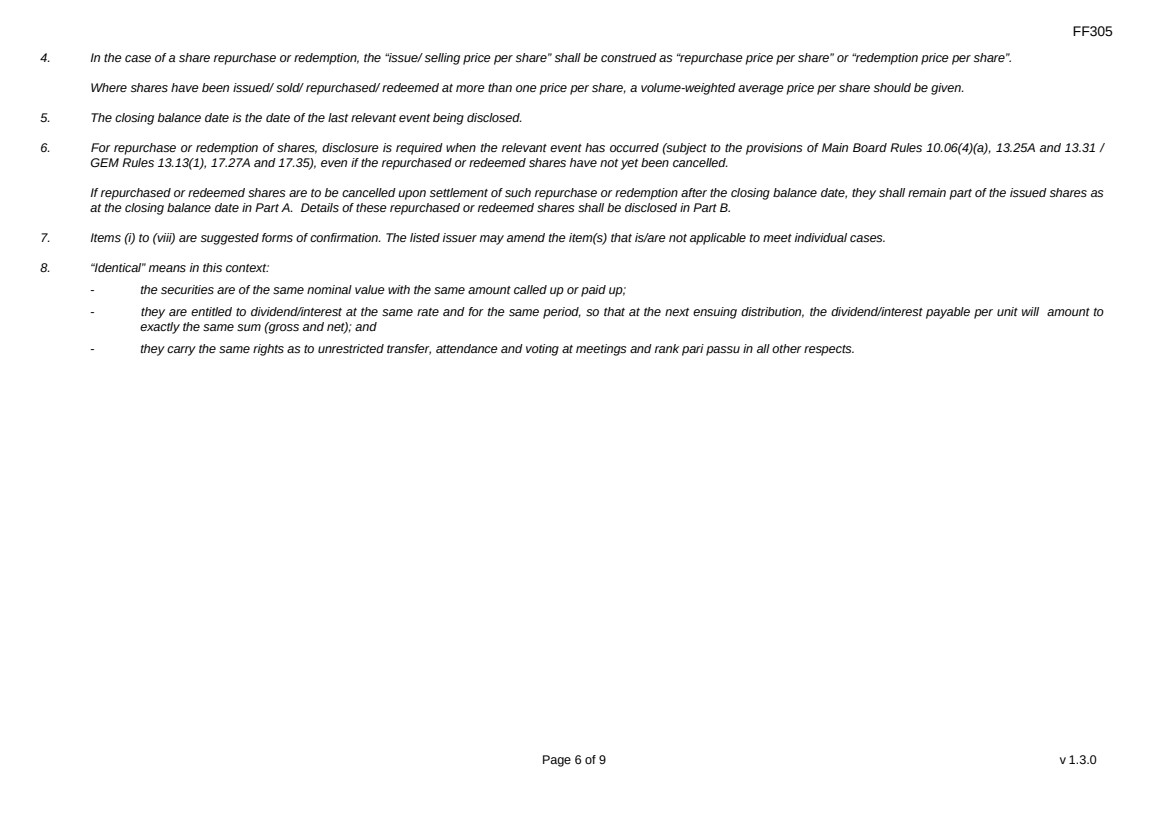

| FF305

Page 6 of 9 v 1.3.0

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF305

Page 7 of 9 v 1.3.0

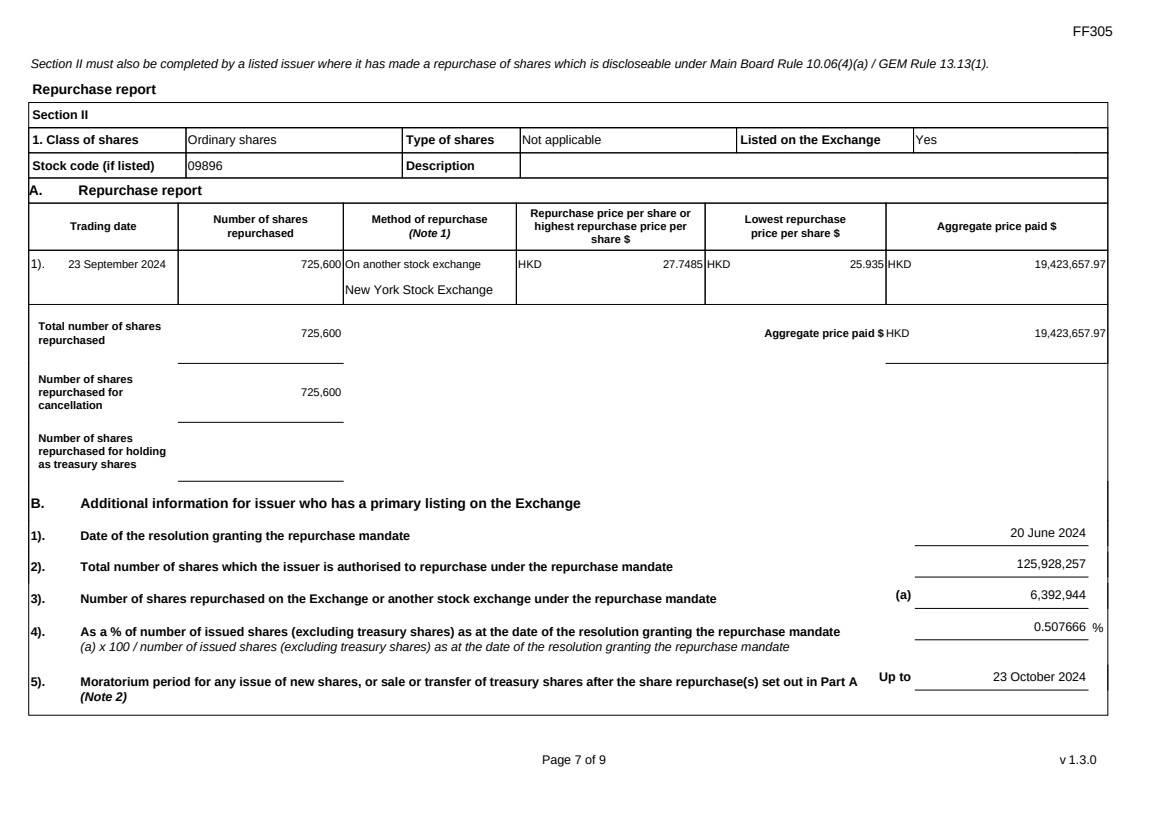

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report

Section II

1. Class of shares Ordinary shares Type of shares Not applicable Listed on the Exchange Yes

Stock code (if listed) 09896 Description

A. Repurchase report

Trading date Number of shares

repurchased

Method of repurchase

(Note 1)

Repurchase price per share or

highest repurchase price per

share $

Lowest repurchase

price per share $ Aggregate price paid $

1). 23 September 2024 725,600 On another stock exchange

New York Stock Exchange

HKD 27.7485 HKD 25.935 HKD 19,423,657.97

Total number of shares

repurchased 725,600 Aggregate price paid $ HKD 19,423,657.97

Number of shares

repurchased for

cancellation

725,600

Number of shares

repurchased for holding

as treasury shares

B. Additional information for issuer who has a primary listing on the Exchange

1). Date of the resolution granting the repurchase mandate 20 June 2024

2). Total number of shares which the issuer is authorised to repurchase under the repurchase mandate 125,928,257

3). Number of shares repurchased on the Exchange or another stock exchange under the repurchase mandate (a) 6,392,944

4). As a % of number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

(a) x 100 / number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

0.507666 %

5). Moratorium period for any issue of new shares, or sale or transfer of treasury shares after the share repurchase(s) set out in Part A

(Note 2)

Up to 23 October 2024 |

| FF305

Page 8 of 9 v 1.3.0

We hereby confirm that the repurchases made on the Exchange set out in Part A above were made in accordance with the Main Board Rules / GEM Rules and that there have been no material

changes to the particulars contained in the Explanatory Statement dated ..................................16 April 2024................................................. which has been filed with the Exchange. We also

confirm that any repurchases made on another stock exchange set out in Part A above were made in accordance with the domestic rules applying to repurchases on that other stock exchange.

Remarks: Repurchase of 181,400 American depository shares (representing 725,600 ordinary shares) on September 23, 2024 U.S. time. All the American depository shares

repurchased on the New York Stock Exchange were made pursuant to a 10b5-1 share repurchase plan.

Notes to Section II:

1. Please state whether the repurchase was made on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

2. Subject to the carve-out set out in Main Board Rule 10.06(3)(a)/ GEM Rule 13.12, an issuer may not (i) make a new issue of shares, or a sale or transfer of any treasury shares; or (ii)

announce a proposed new issue of shares, or a sale or transfer of any treasury shares, for a period of 30 days after any purchase by it of shares, whether on the Exchange or otherwise,

without the prior approval of the Exchange. |

| FF305

Page 9 of 9 v 1.3.0

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Ye Guofu

(Name)

Title: Director

(Director, Secretary or other Duly Authorised Officer) |

Exhibit 99.3

MINISO to Acquire Stake in Yonghui Superstores,

a Leading Chinese Retailer

GUANGZHOU, China, September 23, 2024 /PRNewswire/

-- MINISO Group Holding Limited (NYSE: MNSO; HKEX: 9896) (“MINISO”, “MINISO Group” or the “Company”),

a global value retailer offering a variety of trendy lifestyle products featuring IP design, today announced that it has entered into

share purchase agreements with certain shareholders of Yonghui Superstores Co., Ltd (“Yonghui”), to acquire an aggregate of

29.4% of the issued and outstanding shares of Yonghui for a total cash consideration of approximately RMB6.3 billion. Upon the consummation

of the transaction, the Company expects to become the largest single shareholder of Yonghui.

Yonghui is a leading retail chain operator in

China, listed on the Shanghai Stock Exchange (stock code: 601933) since 2010. It operates approximately 850 supermarkets, offering fresh

produce and daily necessities to consumers across China. Yonghui is one of the first distribution enterprises in the PRC to introduce

fresh produce into modern supermarkets. In terms of sales scale, it has consistently ranked second among the top 100 supermarkets in the

PRC in recent years. In 2023, Yonghui generated approximately RMB78.6 billion in revenue.

The share purchase agreements were entered into

between Guangdong Juncai International Trading Co., Ltd., a wholly owned PRC subsidiary of the Company (“Guangdong Juncai”),

and the respective sellers. The Dairy Farm Company, Limited, the seller under one of the share purchase agreements, is an indirectly wholly-owned

subsidiary of DFI Retail Group Holdings Limited, which is a member of the Jardine Matheson Group. Beijing Jingdong Century Trade Co., Ltd.

and Suqian Hanbang Investment Management Co., Ltd., the sellers under the other share purchase agreement, are both indirectly wholly-owned

subsidiaries of JD.com, Inc. (NASDAQ Trading Symbol: JD; HKEX Stock Codes: 9618 (HKD counter) and 89618 (RMB counter)).

Pursuant to the share purchase agreements, at

the closing of the transaction, Guangdong Juncai will pay to each seller a cash consideration based on a per share price of RMB2.35, which

represents a premium of 3.1% to the closing price of Yonghui’s shares on the Shanghai Stock Exchange on September 20, 2024.

The Company expects to fund the transaction with a combination of internal financial resources and external financing.

Concurrently with the execution of the share purchase

agreements, the Company entered into parent guarantees to guarantee the due performance of Guangdong Juncai of its obligations under the

share purchase agreements. Additionally, Mr. Guofu Ye, Chairman, CEO and the controlling shareholder of the Company, has given an

irrevocable undertaking to each of the sellers under the share purchase agreements to vote in favor of any resolution approving the transaction

at the Company’s shareholder meetings.

Mr. Ye commented, “I firmly believe

that this transaction presents great growth potential for our company and will bring long-term value to our shareholders. With our support

and leveraging our expertise in design-led products, Yonghui will be poised to develop higher-quality self-branded products to cater to

evolving consumer needs. Furthermore, I believe that our collaboration with Yonghui in retail channel upgrade and supply chain will

enable us to share resources to further enhance economies of scale, optimize the cost structure and create value for consumers. This transaction

will also expand our access to the essential goods sector, allowing us to diversify our business and mitigate cyclical risks.”

“Meanwhile, we remain confident in and committed

to the growth of our existing business, and will continue to strategically invest in its development and expansion. We are determined

to achieve MINISO’s five-year development strategy of growing our core business at a compound annual growth rate of no less than

20% over the next five years, excluding the potential impact of this transaction.” Mr. Ye concluded.

The transaction is subject to customary closing

conditions, including obtaining antitrust clearance from the State Administration for Market Regulation of China, securing or completing

other necessary regulatory approvals or procedures, as well as receiving the approval of the Company’s shareholders. The Company

currently expects the transaction to close in the first half of 2025. Under the share purchase agreements, Guangdong Juncai undertakes

to comply with the sell-down restrictions under the applicable laws with respect to the acquired Yonghui shares following the completion

of the transaction.

Conference Call

To further respond to any inquiries in relation

to the transaction and enhance communication with shareholders regarding this matter, the Company’s management will hold a conference

call at 9:00 A.M. Eastern Time on Monday, September 23, 2024 (9:00 P.M. Beijing Time on the same day). Simultaneous interpretation

in English will be provided during the conference call. The conference call can be accessed by the following Zoom link or dialing the

following numbers:

Access 1

Join Zoom meeting.

Zoom link: https://zoom.us/j/97701897671?pwd=QonqKR3bonhLkDOCVkXgRk01NXUvPX.1

Meeting Number: 977 0189 7671

Meeting Passcode: 9896

Access 2

Listeners may access the conference call by dialing

the following numbers with the same meeting number and passcode as access 1.

| United States: |

+1 689 278 1000 (or +1 719 359 4580) |

| Hong Kong, China: |

+852 5803 3730 (or +852 5803 3731) |

| France: |

+33 1 7037 9729 (or +33 1 7037 2246) |

| Singapore: |

+65 3158 7288 (or +65 3165 1065) |

| Canada: |

+1 438 809 7799 (or +1 204 272 7920) |

As the completion of the transaction is subject

to the satisfaction or waiver (where applicable) of certain conditions precedent, the transaction may or may not proceed. Shareholders

and potential investors of the Company are advised to exercise caution when dealing in the securities of the Company.

About MINISO Group

MINISO Group is a global value retailer offering

a variety of trendy lifestyle products featuring IP design. The Company serves consumers primarily through its large network of MINISO

stores, and promotes a relaxing, treasure-hunting and engaging shopping experience full of delightful surprises that appeals to all demographics.

Aesthetically pleasing design, quality and affordability are at the core of every product in MINISO’s wide product portfolio, and

the Company continually and frequently rolls out products with these qualities. Since the opening of its first store in China in 2013,

the Company has built its flagship brand “MINISO” as a globally recognized consuming brand and established a massive store

network worldwide. For more information, please visit https://ir.miniso.com/.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”,

“anticipate”, “aim”, “estimate”, “intend”, “plan”, “believe”,

“is/are likely to”, “potential”, “continue” or other similar expressions. MINISO may also make written

or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”) and

The Stock Exchange of Hong Kong Limited (the “HKEX”), in its annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts,

including statements about MINISO’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement, including but not limited to the following: MINISO’s mission, goals and strategies; future business development, financial

conditions and results of operations of MINISO and Yonghui; the expected growth of the retail market and the markets of branded variety

retail of lifestyle products and fresh produce and necessity goods in China and globally; expectations regarding demand for and market

acceptance of MINISO’s and Yonghui’s products; expectations regarding MINISO’s relationships with consumers, suppliers,

MINISO Retail Partners, local distributors, and other business partners; competition in the industry; and relevant government policies

and regulations relating to MINISO’s and Yonghui’s business and the industry. Further information regarding these and other

risks is included in MINISO’s filings with the SEC and the HKEX. All information provided in this press release and in the attachments

is as of the date of this press release, and MINISO undertakes no obligation to update any forward-looking statement, except as required

under applicable law.

Investor Relations Contact:

Raine Hu

MINISO Group Holding Limited

Email: ir@miniso.com

Phone: +86 (20) 36228788 Ext.8039

Exhibit 99.4

Hong Kong Exchanges and Clearing Limited and

The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its

accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole

or any part of the contents of this announcement.

MINISO Group Holding Limited

名 創 優 品 集 團

控 股 有 限 公 司

(A company incorporated in the Cayman Islands with limited

liability)

(Stock Code: 9896)

VERY SUBSTANTIAL ACQUISITION

IN RELATION TO

THE ACQUISITION OF THE SHARES IN THE TARGET COMPANY

LISTED ON THE SHANGHAI

STOCK EXCHANGE

THE ACQUISITION

The Board is pleased to announce that

on September 23, 2024 (Hong Kong time), the Purchaser (a wholly-owned subsidiary of the Company) entered into the Share Purchase Agreements

with the Sellers, pursuant to which, the Purchaser has conditionally agreed to acquire and the Sellers have conditionally agreed to sell

2,668,135,376 Target Shares (representing approximately 29.4% of the entire issued share capital of the Target Company), at the Consideration

in the amount of RMB6,270,118,134 (equivalent to approximately HK$6,916,461,457). The Consideration shall be satisfied by cash and funded

by the internal financial resources of the Group and by external financing. Upon Completion, the financial results of the Target Group

will not be consolidated into the accounts of the Company, and the financial results of the Target Group will be accounted for as investment

in associates in the financial accounts of the Group.

LISTING RULES IMPLICATIONS

Chapter 14 of the Listing Rules

As one or more of the applicable percentage

ratios (as defined under Rule 14.07 of the Listing Rules) in respect of the Acquisition exceeds 100% on an aggregated basis pursuant

to Rule 14.22 of the Listing Rules, the Acquisition constitutes a very substantial acquisition under Chapter 14 of the Listing Rules

and is therefore subject to the notification, announcement, circular and shareholder’s approval requirements under Chapter 14 of

the Listing Rules.

|

EGM

AND DESPATCH OF CIRCULAR

The EGM will be convened and held for the Shareholders to consider

and, if thought fit, pass ordinary resolution(s) to approve, among other things, the Acquisition and the Share Purchase Agreements. To

the best of the knowledge, information and belief of the Directors having made all reasonable enquiries, no Shareholder has a material

interest in the Acquisition and is required to abstain from voting on the resolution(s) approving the Acquisition and the Share Purchase

Agreements at the EGM.

A circular containing, among other

things, (i) further details of the Acquisition and the Share Purchase Agreements; (ii) financial information and other information of

the Target Group; (iii) the unaudited pro forma financial information of the Group; (iv) other information required under the Listing

Rules; and (v) a notice of the EGM, is expected to be despatched to the Shareholders. As more time is required to prepare the relevant

information to be included in the circular, the circular shall be despatched to the Shareholders in due course.

As the Completion is subject to

the satisfaction or waiver (where applicable) of the Conditions Precedent, the Acquisition may or may not proceed. Shareholders and potential

investors of the Company are advised to exercise caution when dealing in the Shares.

THE ACQUISITION

The Board is pleased to announce that

on September 23, 2024 (Hong Kong time), the Purchaser (a wholly-owned subsidiary of the Company) entered into the Share Purchase Agreements

with the Sellers, pursuant to which, the Purchaser has conditionally agreed to acquire and the Sellers have conditionally agreed to sell

the 2,668,135,376 Target Shares (representing approximately 29.4% of the entire issued share capital of the Target Company), at the Consideration

in the amount of RMB6,270,118,134 (equivalent to approximately HK$6,916,461,457). The Consideration shall be satisfied by cash and funded

by the internal financial resources of the Group and by external financing. Unless otherwise specified, the exchange rate used for illustrative

purpose in this Announcement shall be RMB0.90655 to HK$1.0000.

THE SHARE PURCHASE AGREEMENTS

The principal terms of the Share Purchase Agreements are

set out as follows:

Date

September 23, 2024

Parties to the Share Purchase Agreements

Dairy Farm Share Purchase Agreement

Jingdong Share Purchase Agreement

To the best of the Directors’

knowledge, information and belief having made all reasonable enquiries, the Sellers and their respective ultimate beneficial owners are

third parties independent of the Company and its connected persons (as defined under the Listing Rules) as at the date of this announcement.

Subject Matter of the Acquisition

Pursuant to the terms of the Share Purchase

Agreements, the Purchaser has conditionally agreed to acquire, and the Sellers have conditionally agreed to sell 2,668,135,376 Target

Shares (representing approximately 29.4% of the entire issued share capital of the Target Company) at the Consideration in the amount

of RMB6,270,118,134 (equivalent to approximately HK$6,916,461,457), which comprise (i) 1,913,135,376 Target Shares (representing approximately

21.1% of the entire issued share capital of the Target Company) to be sold by Diary Farm to the Purchaser pursuant to the Dairy Farm Share

Purchase Agreement at the Consideration in the amount of RMB4,495,868,134 (equivalent to approximately HK$4,959,316,236); (ii) 367,227,196

Target Shares (representing approximately 4.0% of the entire issued share capital of the Target Company) to be sold by Jingdong Shimao

to the Purchaser pursuant to the Jingdong Share Purchase Agreement at the Consideration in the amount of RMB862,983,911 (equivalent to

approximately HK$951,942,982); and (iii) 387,772,804 Target Shares (representing approximately 4.3% of the entire issued share capital

of the Target Company) to be sold by Suqian Hanbang to the Purchaser pursuant to the Jingdong Share Purchase Agreement at the Consideration

in the amount of RMB911,266,089 (equivalent to approximately HK$1,005,202,239).

Conditions Precedent of the Share Purchase Agreements

The Acquisition is conditional upon the following conditions,

as applicable, being fulfilled:

| (a) | the relevant Seller having completed the registration procedures with the People’s Bank of China

and the State Administration of Foreign Exchange for the opening of a designated RMB account for receipt of proceeds from sale of A Shares; |

| (b) | the SSE having issued a confirmation form 《(上海證券交易所上市公司股份協議轉讓確認

表》) with respect to the sale and purchase of the Target Shares, and such confirmation form remaining in full force and effect; |

| (c) | the Company having obtained the Hong Kong Stock Exchange’s confirmation on no further comments on

the circular in respect of the purchase of the Target Shares; |

| (d) | the State Administration for Market Regulation of the PRC having issued a decision not to conduct further

review, prohibit, or approve with conditions, with respect to the notification of concentration of undertakings with respect to the sale

and purchase of Target Shares; and |

| (e) | the Company having obtained the necessary Shareholders’ approval for the purchase of the Target

Shares. |

If any of the Conditions Precedent is

not fulfilled within six months from the date of the Share Purchase Agreements (i.e. on or before March 23, 2025, being the long stop

date contemplated under the Share Purchase Agreements for the fulfillment of the above conditions for the Acquisition), which may be extended

for another two months in the case where any of the Conditions Precedent contemplated under (a) to (e) above is not fulfilled for reasons

attributable to the Hong Kong Stock Exchange, the SSE or the relevant authority; or such later date as the parties to the Share Purchase

Agreements may agree in writing, the Share Purchase Agreements may be terminated by either party by written notice to the other party

at any time thereafter.

Guarantee

The Company, which indirectly holds

100% of the shares of the Purchaser, has provided a guarantee to each of the Sellers on the due performance of the Purchaser in respect

of its obligation under the respective Share Purchase Agreements.

CONSIDERATION FOR THE ACQUISITION

With respect to the Acquisition, the

Consideration is in the amount of RMB6,270,118,134 (equivalent to approximately HK$6,916,461,457), representing (i) RMB4,495,868,134 (equivalent

to approximately HK$4,959,316,236) to be paid to Dairy Farm; (ii) RMB862,983,911 (equivalent to approximately HK$951,942,982) to be paid

to Jingdong Shimao; and (iii) RMB911,266,089 (equivalent to approximately HK$1,005,202,239) to be paid to Suqian Hanbang. The Consideration

shall be satisfied by cash and funded by the internal financial resources of the Group and by external financing.

Basis of the Consideration

The Consideration was arrived at based

on normal commercial terms after arm’s length negotiation among the parties to the Share Purchase Agreements after taking into account,

among others, the following:

Historical Trading Price of the Target Shares and its

Trend

In determining the Consideration, the

Directors have considered the historical market price of the Target Shares traded on the SSE as a benchmark to reflect the prevailing

market conditions and recent market sentiment.

Based on the Consideration in the amount of RMB6,270,118,134

for the Target Shares, the price per Target Share, RMB2.35, represents:

| (a) | a premium of 3.5% to RMB2.27, being the volume-weighted average price of the Target Shares on the 20 Trading

Days during the period commencing from August 22, 2024 to September 20, 2024; and |

| (b) | a premium of 3.1% to RMB2.28, being the closing price of the Target Shares on September 20, 2024, being

the Trading Day immediately preceding the date of the Share Purchase Agreements. |

The price per Target Share shall not

be and is not lower than 90% of the closing price of the Target Shares on September 20, 2024, being the Trading Day immediately preceding

the date of the Share Purchase Agreements.

It demonstrates that the Acquisition

represents a valuable opportunity for the Company to gain access to investment asset with high return and growth potential at an attractive

pricing.

Other than the above numeric evaluation

over the Target Shares and the Consideration contemplated under the Acquisition, the Consideration is also arrived at with reference to

(i) the well-established businesses and operations of the Target Group; (ii) the financial performance and prospects of the businesses

operated by the Target Group; and (iii) the reasons and benefits of the Acquisition as stated under the paragraph headed “REASONS

FOR AND BENEFITS OF THE ACQUISITION” in this announcement.

Completion

Completion for the Acquisition shall

take place on the second Trading Day following the satisfaction of the Conditions Precedent, or on such other date as may be agreed between

the parties to the Share Purchase Agreements. Upon Completion, the financial results of the Target Group will not be consolidated into

the accounts of the Company, and the financial results of the Target Group will be accounted for as investment in associates in the financial

accounts of the Group.

For the avoidance of doubt, completion

of the Acquisition pursuant to the Dairy Farm Share Purchase Agreement is not interconditional upon the completion of the Acquisition

pursuant to the Jingdong Share Purchase Agreement, and vice versa.

Undertakings

The Purchaser undertakes to comply with

the sell-down restrictions under the applicable laws with respect to the Target Shares following the Completion, including a six-month

lock-up requirement from the date of the Completion and other relevant sell-down restrictions in accordance with the

Interim Measures for the Administration

of Shareholding Reduction by Shareholders of Listed Companies 《(上市公司股東減持股份管理暫行辦法》)

promulgated by the China Securities

Regulatory Commission.

Each Seller undertakes that, from the

execution of the respective Share Purchase Agreement until immediately before the Purchaser is registered as the owner of the Target Shares,

if any proposal is considered at a shareholders’ meeting or board meeting of the Target Company that would result in a reduction

in the number of voting shares of the Target Company (being any proposal for a reduction in the registered capital of the Target Company

or any new share buyback by the Target Company), each Seller shall, or shall procure the relevant Seller-nominated director(s) of the

Target Company to, to the extent permitted by applicable laws, vote against such proposal at the relevant shareholders’ meeting

or board meeting.

INFORMATION OF THE COMPANY AND THE GROUP

The Company was incorporated in the Cayman Islands

on January 7, 2020, as an exempted company with limited liability under the Companies Law of the Cayman Islands. The principal activity

of the Company is investment holding. The principal businesses of the Group are the retail and wholesale of lifestyle and pop toy products

across the PRC, other parts of Asia, Americas, Europe and certain other countries.

INFORMATION OF THE PURCHASER

Guangdong Juncai International Trading Co., Ltd.*

(廣東駿才國際商貿有限公司) is a limited liability company established

under the laws of the PRC on April 12, 2016. It is an indirectly wholly-owned subsidiary of the Company and is principally engaged in

wholesale and retail.

INFORMATION OF THE SELLERS

THE DAIRY FARM COMPANY, LIMITED (牛奶有限公司),

a limited liability company incorporated under the laws of Hong Kong, is an indirectly wholly-owned subsidiary of DFI Retail Group Holdings

Limited. DFI Retail Group Holdings Limited is incorporated in Bermuda and has a primary listing in the standard segment of the London

Stock Exchange (ticker: DFIB), with secondary listings in Bermuda Stock Exchange (ticker: D01) and Singapore Exchange (ticker: D01).

Beijing Jingdong Century Trade Co., Ltd. (北京京東世紀貿易有限公司)

and Suqian Hanbang Investment Management Co., Ltd.* (宿遷涵邦投資管理有限公司),

both of which are limited

liability companies incorporated under the laws

of the PRC, are indirectly wholly-owned subsidiaries of JD.com, Inc., an exempted company incorporated in the Cayman Islands with limited

liability and the American depositary shares of which have been listed on the Nasdaq Global Select Market under the symbol of “JD”

and the ordinary shares have been listed on the main board of HKEX under the stock codes “9618 (HKD counter)” and “89618

(RMB counter)”.

INFORMATION OF THE TARGET COMPANY AND THE TARGET GROUP

Yonghui Superstores Co., Ltd* (永輝超市股份有限公司),

a joint stock company incorporated in the PRC with limited liability, the shares of which are listed on the SSE (stock code: 601933),

is a retail chain operator featuring fresh produce management, mainly operates hypermarkets, supermarkets and community supermarkets and

has approximately 850 outlets spanning across more than 25 provinces and municipalities across the PRC.

Financial Information of the Target Group

Set out below is the audited consolidated financial

information of the Target Company and its subsidiaries for the years ended December 31, 2022 and December 31, 2023, and the unaudited

consolidated financial information of the Target Company and its subsidiaries for the six months ended June 30, 2024, respectively:

| |

|

For the year ended | |

For the year ended | | |

For the six months | |

| | |

December 31, | | |

December 31, | | |

ended June 30, | |

| | |

2022 | | |

2023 | | |

2024 | |

| | |

(audited) | | |

(audited) | | |

(unaudited) | |

| | |

| (RMB million) | | |

| (RMB million) | | |

| (RMB million) | |

| Revenue | |

| 90,090.82 | | |

| 78,642.17 | | |

| 37,779.19 | |

| Net profit/(loss) before tax | |

| (3,218.48 | ) | |

| (1,361.42 | ) | |

| 323.78 | |

| Net profit/(loss) after tax | |

| (2,999.67 | ) | |

| (1,464.73 | ) | |

| 210.83 | |

| | |

| As at | | |

| As at | | |

| As at | |

| | |

| December 31, | | |

| December 31, | | |

| June 30, | |

| | |

| 2022 | | |

| 2023 | | |

| 2024 | |

| | |

| (audited) | | |

| (audited) | | |

| (unaudited) | |

| | |

| (RMB million) | | |

| (RMB million) | | |

| (RMB million) | |

| Net assets | |

| 7,465.57 | | |

| 5,939.07 | | |

| 6,153.39 | |

REASONS FOR AND BENEFITS OF THE ACQUISITION

The

Target Group is a successful supermarket chain operator in the PRC, primarily engaging in selling selected products through offline

stores and online channels, covering consumers of all ages. As at the date of this announcement, it operates approximately 850

stores, covering more than 25 provinces and municipalities across the PRC. The Target Group is one of the first distribution

enterprises in the PRC to introduce fresh produce into modern supermarkets. In terms of sales scale, it has consistently ranked

second among the top 100 supermarkets in the PRC in recent years.

In recent years, the Target Group has made rapid

progress in supply chain construction to enhance the operational efficiency at each stage. It has been continuously optimizing the product

structure, deepening the source procurement and enhancing the product power, especially by vigorously promoting the development of its

self-brands. In the first half of 2024, its self-brands achieved sales of RMB1.28 billion, accounting for 3.4% of its revenue. In 2023,

its self-brands realized sales of RMB3.54 billion, accounting for 4.5% of its revenue.

Since 2024, the Target Group has continued to

accelerate its transformation, actively learning from its one outstanding peer, deeply engaging in the reform of the supply chain, and

pragmatically building a platform-type enterprise for the food supply chain that adapts to current development.

The Group continues to be optimistic about the development of the

offline retail industry in the PRC. This Acquisition is in line with the Company’s overall strategy and is beneficial to the Shareholders

as a whole. Given that the Target Group is one of the leading supermarket chain operators in the PRC with a high-quality store network,

well-established logistics infrastructure, loyal customer base and strong digital system capabilities, the Group believes that:

| (i) | the Target Group's ongoing adjustment and reform in its stores is a revolutionary attempt to return to

the essence of retail business. This is an inevitable trend in the development of the supermarket industry in the PRC, which will provide

consumers with a positive shopping experience and create a fulfilling working environment for employees. As a result, it will help the

Target Group gain favorable brand image and reputation, ultimately creating significant commercial and social value. This cultural orientation

highly aligns with the Group's corporate mission of “Life is for fun”; |

| (ii) | the Group possesses unique capabilities and experience in developing its self-brands, designs and IP products.

After the Acquisition, the Group can support the Target Group through business collaboration, allowing the Target Group to leverage the

Group's strengths to develop higher quality self-branded products at lower costs. This is expected to enhance the Target Group's differentiated

competitive ability. The Target Group operates approximately 850 retail supermarkets across over 25 provinces and municipalities and has

established a vast store network and supply chain in the PRC. The Group and the Target Group can share resources through business cooperations

to further enhance economies of scale, optimize the cost structure and create more value for consumers, which will thereby enhance the

Group's return on investment; and |

| (iii) | the Acquisition will expand the Group's investment and operational channels in the daily necessities retail

business, enabling the Group to diversify its cyclical business risks, which is of significant strategic importance to the Group. |

For the foregoing reasons, the Directors

are of the view that the Acquisition and the Share Purchase Agreements are on normal commercial terms agreed upon after arm’s length

negotiations between the parties with reference to the prevailing market conditions and are fair and reasonable, and are in the interests

of the Group and the Shareholders as a whole.

None of the Directors has any material

interest in the Acquisition and the Share Purchase Agreements and is required to abstain from voting on the board resolutions approving

the Acquisition and the Share Purchase Agreements.

The Company confirms that it will continue

to operate and expand the existing business of the Group. As a global value retailer offering a variety of trendy lifestyle products featuring

IP design, the Company remains optimistic and will further invest and develop its existing business strategically.

Further, the Company does not have any

current intention or plan to further invest in the Target Company other than the Acquisition as detailed in this announcement. Notwithstanding

the above, in the case where there is any change of intention or circumstances, the Company shall ensure compliance with all the applicable

Listing Rules.

LISTING RULES IMPLICATIONS

Chapter 14 of the Listing Rules

As one or more of the applicable percentage ratios

(as defined under Rule 14.07 of the Listing Rules) in respect of the Acquisition exceeds 100% on an aggregated basis pursuant to Rule

14.22 of the Listing Rules, the Acquisition constitutes a very substantial acquisition under Chapter 14 of the Listing Rules and is therefore

subject to the notification, announcement, circular and shareholder’s approval requirements under Chapter 14 of the Listing Rules.

EGM AND DESPATCH OF CIRCULAR

The EGM will be convened and held for the Shareholders

to consider and, if thought fit, pass ordinary resolution(s) to approve, among other things, the Acquisition and the Share Purchase Agreements.

To the best of the knowledge, information and belief of the Directors having made all reasonable enquiries, no Shareholder has a material

interest in the Acquisition and is required to abstain from voting on the resolution(s) approving the Acquisition and the Share Purchase

Agreements at the EGM.

Further, Mr. Ye, the chairman of the Board, an

executive Director, the chief executive officer and a controlling Shareholder of the Company, has given an irrevocable undertaking to

each of the Sellers, to procure the Controlling Shareholders to vote in favour of any resolution approving the Acquisition at the EGM.

As of the date of this announcement, the Controlling Shareholders are interested in approximately 62.7% of the issued share capital of

the Company.

A circular containing, among other things, (i)

further details of the Acquisition and the Share Purchase Agreements; (ii) financial information and other information of the Target Group;

(iii) the unaudited pro forma financial information of the Group; (iv) other information required under the Listing Rules; and (v) a notice

of the EGM, is expected to be despatched to the Shareholders. As more time is required to prepare the relevant information to be included

in the circular, the circular shall be despatched to the Shareholders in due course.

CONFERENCE CALL

To further respond to any enquiries in relation

to the Acquisition and enhance communication with Shareholders, the Company's management will hold a conference call at 9:00 A.M. Eastern

Time on Monday, September 23, 2024 (9:00 P.M. Beijing Time on the same day). Simultaneous interpretation in English will be provided during

the conference call. The conference call can be accessed by the following Zoom link or dialing the following numbers:

Access 1

Join Zoom meeting.

Zoom link: https://zoom.us/j/97701897671? pwd=QonqKR3bonhLkDOCVkXgRk01NXUvPX.1

Meeting Number: 977 0189 7671

Meeting Passcode: 9896

Access 2

Listeners may access the conference call by dialing

the following numbers with the same meeting number and passcode as access 1.

| United States: |

+1 689 278 1000 (or +1 719 359 4580) |

| Hong Kong, China: |

+852 5803 3730 (or +852 5803 3731) |

| France: |

+33 1 7037 9729 (or +33 1 7037 2246) |

| Singapore: |

+65 3158 7288 (or +65 3165 1065) |

| Canada: |

+1 438 809 7799 (or +1 204 272 7920) |

| |

|

|

|

As the Completion is subject to the satisfaction or waiver

(where applicable) of the Conditions Precedent, the Acquisition may or may not proceed. Shareholders and potential investors of the Company

are advised to exercise caution when dealing in the Shares.

DEFINITIONS

In this announcement, unless the context otherwise requires, the following

expressions shall have the following meanings:

| “A Shares” |

ordinary shares of the Target Company which are listed on the SSE and traded in Renminbi |

| |

|

| “Acquisition” |

the acquisition by the Purchaser of the Target Shares on the terms and subject to the conditions set out in the Share Purchase Agreements |

| |

|

| “Board” |

the board of Directors of the Company |

| |

|

| “Company”, “we”, “us”, or “our” |

MINISO Group Holding Limited (名創優品集團控股有限公司), a company with limited liability incorporated in the Cayman Islands on January 7, 2020 |

| |

|

| “Completion” |

the completion of the Acquisition in accordance with the terms and condition set out in the Share Purchase Agreements |

| |

|

| “Conditions Precedent” |

conditions precedent to the Completion as set out under the paragraph headed “Conditions Precedent of the Share Purchase Agreements” |

| |

|

| “Consideration” |

the consideration for the Acquisition |

| |

|

| “Controlling Shareholders” |

has the meaning ascribed to it under the Listing Rules and unless the context otherwise requires, refers to Mr. Ye, his spouse and the intermediary companies through which Mr. Ye and his spouse have an interest in the Company |

| |

|

| “Dairy Farm” |

THE DAIRY FARM COMPANY, LIMITED (牛奶有限公 司), a limited liability company incorporated under the laws of Hong Kong |

| |

|

| “Dairy Farm Share Purchase Agreement” |

the conditional share purchase agreement entered into by the Purchaser and Dairy Farm, pursuant to which, the Purchaser has conditionally agreed to acquire and Dairy Farm has conditionally agreed to sell the Target Shares |

| |

|

| “Director(s)” |

the director(s) of the Company |

| |

|

| “EGM” |

the extraordinary general meeting of the Company to be convened and held for the Shareholders to consider and, if thought fit, pass ordinary resolution(s) to approve, among other things, the Acquisition and the Share Purchase Agreements |

| “Group”, “our Group”, “the Group”, “we”, “us”, or “our” |

the Company and its subsidiaries from time to time, and where the context requires, in respect of the period prior to our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time |

| |

|

| “HK$” |

Hong Kong dollars, the lawful currency of Hong Kong |

| |

|

| “Hong Kong” |

the Hong Kong Special Administrative Region of the PRC |

| |

|

| “Hong Kong Stock Exchange” or “HKEX” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “Jingdong Share Purchase Agreement” |

the conditional share purchase agreement entered into by the Purchaser, Jingdong Shimao and Suqian Hanbang, pursuant to which, the Purchaser has conditionally agreed to acquire and Jingdong Shimao and Suqian Hanbang has conditionally agreed to sell the Target Shares |

| |

|

| “Jingdong Shimao” |

Beijing Jingdong Century Trade Co., Ltd. (北京京東世紀貿易有限公司), a limited liability company incorporated under the laws of the PRC |

| |

|

| “Listing Rules” |

the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended, supplemented or otherwise modified from time to time |

| |

|

| “Mr. Ye” |

Mr. Ye Guofu, the chairman of the Board, an executive Director, the chief executive officer and a controlling Shareholder of the Company |

| |

|

| “NASDAQ” |

the Nasdaq Stock Market in the United States |

| |

|

| “NYSE” |

the New York Stock Exchange |

| |

|

| “PRC” |

the People’s Republic of China, and for the purpose of this announcement, excluding Hong Kong, Macau Special Administrative Region and Taiwan |

| |

|

| “Purchaser” |

Guangdong Juncai International Trading Co., Ltd.* (廣東駿才 國際商貿有限公司), a company incorporated in the PRC with limited liability and an indirectly wholly-owned subsidiary of the Company |

| |

|

| “RMB” |

Renminbi, the lawful currency of the PRC |

| |

|

| “Sellers” |

Dairy Farm, Jingdong Shimao and Suqian Hanbang |

| |

|

| “Share(s)” |

the ordinary shares of US$0.00001 each in the share capital of the Company |

| “Shareholder(s)” |

holder(s) of our Share(s) |

| |

|

| “Share Purchase Agreement(s)” |

the Dairy Farm Share Purchase Agreement and the Jingdong Share Purchase Agreement |

| |

|

| “SSE” |

the Shanghai Stock Exchange |

| |

|

| “Suqian Hanbang” |

Suqian Hanbang Investment Management Co., Ltd.* (宿遷涵邦 投資管理有限公司), a limited liability company incorporated under the laws of the PRC |

| |

|

| “Target Company” |

Yonghui Superstores Co., Ltd* (永輝超市股份有限公司), a joint stock company incorporated in the PRC with limited liability, the shares of which are listed on the SSE (stock code: 601933) |

| |

|

| “Target Group” |

the Target Company and its subsidiaries |

| |

|

| “Target Shares” |

ordinary share(s) in the share capital of the Target Company, with a nominal value of RMB1 for each A Shares |

| |

|

| “Trading Day” |

a day (i) on which the SSE is open for business and (ii) not a Saturday, a Sunday or a public holiday in Hong Kong or the PRC |

| |

|

| “US$” |

U.S. dollars, the lawful currency of the United States |

| |

|

| “United States” or “U.S.” |

United Stated of America, its territories, its possessions and all areas subject to its jurisdiction |

| |

|

| “%” |

per cent |

* English translations are for reference only.

| |

By Order of the Board |

| |

MINISO Group Holding Limited |

| |

Mr. YE Guofu |

| |

Executive Director and Chairman |

Hong Kong, September 23, 2024

As of the date of this announcement, the board

of directors of the Company comprises Mr. YE Guofu as executive director, Ms. XU Lili, Mr. ZHU Yonghua and Mr. WANG Yongping as independent

non-executive directors.

MINISO (NYSE:MNSO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

MINISO (NYSE:MNSO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024