MeridianLink to Highlight Company’s Digital Progression Model at Jack Henry Connect 2024

01 Oktober 2024 - 4:47PM

Business Wire

Wes Zauner will share recent successes from

financial institutions that have adopted a data-driven

decision-making approach to boost growth and improve consumer

satisfaction.

MeridianLink®, (NYSE: MLNK), a leading provider of modern

software platforms for financial institutions and consumer

reporting agencies, today announced that Wes Zauner, Vice President

of Product, will be presenting during the second day of Jack Henry™

Connect at the Phoenix Convention Center in Phoenix, AZ. Attendees

can join the session titled "Getting Ready for Tomorrow: Practical

Steps to Digital Progression" at 11 a.m. on October 8, where Zauner

will showcase how financial institutions of all sizes and at

different levels of digital maturity can realize the full potential

of adopting a digital ecosystem using the Company’s recently

launched Digital Progression Model.

With an innovative framework built on 25 years of experience,

data, and marketplace partnerships, MeridianLink’s Digital

Progression Model enables banks and credit unions to assess their

current digital state, identify growth opportunities, and chart

their path to achieve that growth — all while effectively meeting

the expectations of modern consumers.

“I look forward to sharing practical steps to the digital

progression journey with the industry’s leading players at Jack

Henry Connect,” said Zauner. “MeridianLink’s Digital Progression

Model allows financial institutions to plot a sustainable path

toward successful digital growth, enabling them to optimize the

consumer experience and to drive share-of-wallet growth through

best practices like instant decisioning, process automation, and

becoming a data-first organization. It will be a valuable resource

for the industry, and I’m looking forward to the opportunity to

showcase it with the attendees at Connect.”

The presentation will provide attendees with actionable insights

and strategies to address the five key areas instrumental for

enabling continued digital growth:

- Consumer Experience: Enhancing the overall consumer journey and

satisfaction through digital tools.

- Data-Centricity: Collecting, analyzing, and using data to help

drive informed business decisions, optimize workflows, enhance

experiences, and support compliance in a data-first culture.

- Share-of-Wallet Growth: Adopting technology that increases the

share of financial products held by existing customers.

- Instant Decisioning: Improving the speed and accuracy of

decision-making processes.

- Process Automation: Streamlining operations through advanced

automation techniques.

MeridianLink is looking forward to participating in Jack Henry

Connect, a premier conference that convenes leaders from across the

financial services industry to network, attend engaging sessions,

and hear from well-known keynote speakers. With a partnership

spanning over 15 years, MeridianLink and Jack Henry have

collaboratively served a broad cross-section of the bank and credit

union market segment. Together, the companies provide financial

institutions with innovative solutions to enhance key processes

such as account opening, loan origination, and cross-selling. These

efforts help institutions drive revenue growth, maximize

operational efficiencies, expand accountholder relationships,

improve regulatory compliance, and transform insights into

revenue-generating campaigns.

Conference attendees are invited to meet the MeridianLink team

at Booth 919 to discover how they can drive growth, enhance

efficiency, and reduce risk through a proven process and tailored

solutions that align with their unique priorities, resources, and

timelines.

To learn more about how MeridianLink's products can drive

digital progression for financial institutions, visit:

meridianlink.com

About MeridianLink

MeridianLink® (NYSE: MLNK) empowers financial institutions and

consumer reporting agencies to drive efficient growth.

MeridianLink’s cloud-based digital lending, account opening,

background screening, and data verification solutions leverage

shared intelligence from a unified data platform, MeridianLink®

One, to enable customers of all sizes to identify growth

opportunities, effectively scale up, and support compliance

efforts, all while powering an enhanced experience for staff and

consumers alike.

For more than 25 years, MeridianLink has prioritized the

democratization of lending for consumers, businesses, and

communities. Learn more at www.meridianlink.com.

About Jack Henry & Associates, Inc.

Jack Henry™ (Nasdaq: JKHY) is a well-rounded financial

technology company that strengthens connections between financial

institutions and the people and businesses they serve. We are an

S&P 500 company that prioritizes openness, collaboration, and

user centricity – offering banks and credit unions a vibrant

ecosystem of internally developed modern capabilities as well as

the ability to integrate with leading fin techs. For more than 48

years, Jack Henry has provided technology solutions to enable

clients to innovate faster, strategically differentiate, and

successfully compete while serving the evolving needs of their

accountholders. We empower approximately 7,500 clients with

people-inspired innovation, personal service, and insight-driven

solutions that help reduce the barriers to financial health.

Additional information is available at

http://www.jackhenry.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001354864/en/

PRESS CONTACT Sydney Wishnow meridianlinkPR@clyde.us

(508) 808-9060

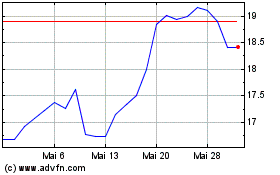

MeridianLink (NYSE:MLNK)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

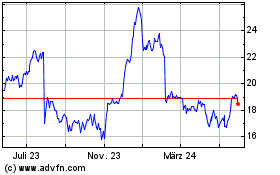

MeridianLink (NYSE:MLNK)

Historical Stock Chart

Von Jan 2024 bis Jan 2025