OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden

hours per response.....18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21321

Pioneer Municipal High Income Trust

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Dorothy E. Bourassa, Pioneer Investment Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 742-7825

Date of fiscal year end: April 30

Date of reporting period: May 1, 2008 through April 30, 2009

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW,

Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO SHAREOWNERS.

Pioneer Municipal High

Income Trust

Annual Report | April 30, 2009

Ticker Symbol: MHI

[LOGO] PIONEER

Investments(R)

visit us: pioneerinvestments.com

Table of Contents

Letter to Shareowners 2

Portfolio Management Discussion 4

Portfolio Summary 8

Prices and Distributions 9

Performance Update 10

Schedule of Investments 11

Financial Statements 20

Financial Highlights 23

Notes to Financial Statements 25

Report of Independent Registered Public Accounting Firm 32

Approval of Investment Advisory Agreement 35

Trustees, Officers and Service Providers 38

|

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 1

President's Letter

Dear Shareowner,

Stock and bond markets around the globe have been experiencing one of their

most tumultuous periods in history. Investors have witnessed volatility of a

magnitude that many have never before seen. Distance often provides the best

vantage point for perspective. Still, we believe that the benefits of basic

investment principles that have stood the test of time -- even in the midst of

market turmoil -- cannot be underestimated.

First, invest for the long term. The founder of Pioneer Investments, Philip L.

Carret, began his investment career during the 1920s. One lesson he learned is

that while great prosperity affords an advantageous time for selling stocks,

extreme economic slumps can create opportunities for purchase. Indeed, many of

our portfolio managers, who follow the value-conscious investing approach of

our founder, are looking at recent market conditions as an opportunity to buy

companies whose shares we believe have been unjustifiably beaten down by

indiscriminate selling, but that we have identified as having strong prospects

over time. While investors may be facing a sustained market downturn, we

continue to believe that patience, along with staying invested in the market,

are important considerations for long-term investors.

A second principle is to stay diversified across different types of

investments. The global scope of the current market weakness poses challenges

for this basic investment axiom. But the turbulence makes now a good time to

reassess your portfolio and make sure that your investments continue to meet

your needs. We believe you should work closely with your financial advisor to

find the mix of stocks, bonds and money market assets that is best aligned to

your particular risk tolerance and investment objective.

As the investment markets sort through the continuing crisis in the financial

industry, we are staying focused on the fundamentals and risk management. With

more than 80 years of experience behind us, we have learned how to navigate

turbulent markets. At Pioneer Investments, risk management has always been a

critical part of our culture -- not just during periods of extraordinary

volatility. Our investment process is based on fundamental research,

quantitative analysis and active portfolio management. This three-pillared

process, which we apply to each of our portfolios, is supported by an

integrated team approach and is designed to carefully balance risk and reward.

While we

2 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

see potential chances for making money in many corners of the market, it takes

research and experience to separate solid investment opportunities from

speculation.

We invite you to learn more about Pioneer and our time-tested approach to

investing by consulting with your financial advisor or visiting us online at

www.pioneerinvestments.com. Thank you for investing with Pioneer.

Sincerely,

/s/ Daniel K. Kingsbury

Daniel K. Kingsbury

President and CEO

Pioneer Investment Management USA Inc.

|

Any information in this shareowner report regarding market or economic trends

or the factors influencing the Trust's historical or future performance are

statements of the opinion of Trust management as of the date of this report.

These statements should not be relied upon for any other purposes. Past

performance is no guarantee of future results, and there is no guarantee that

market forecasts discussed will be realized.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 3

Portfolio Management Discussion | 4/30/09

In the following interview, David Eurkus, who is responsible for the daily

management of the Pioneer Municipal High Income Trust, discusses some of the

factors that had an impact on the municipal bond market and the Trust over the

12-month period ended April 30, 2009.

Q How did the Trust perform over the 12 months ended April 30, 2009?

A For the 12-month period ended April 30, 2009, Pioneer Municipal High Income

Trust produced a total return of -13.94% at net asset value and -18.85% at

market price. As of April 30, 2009, the Trust was selling at a discount of

market price to net asset value of -7.0%. The Barclays Capital (formerly

Lehman Brothers) Municipal Bond Index, which tracks the performance of

investment-grade bonds, returned 3.11% for the same 12 months ended April

30, 2009, while the Barclays Capital High Yield Municipal Bond Index

returned -17.71%. The indices are not leveraged. While the Trust invested

in municipal securities with a broad range of maturities and credit

ratings, it maintained a dollar-weighted average portfolio credit quality

of A- as of April 30, 2009. At the end of the 12 months ended April 30,

2009, the Trust held 116 issues in 37 states, territories and the District

of Columbia. The Trust's 30-day SEC yield was 10.87% and the distribution

rate, based on the market close on April 30, 2009 was 8.65%, based on the

most recent monthly dividend.

Q What was the investment environment like during the 12-month period ended

April 30, 2009?

A It was an environment of substantial market unrest, as the credit crisis led

to one of the most volatile and illiquid periods in the history of the

fixed-income markets. The seizing up of the credit markets, the bankruptcy

of Lehman Brothers, the AIG fiasco, and the mergers of Merrill Lynch with

Bank of America and Bear Stearns with JPMorgan Chase were just some of the

events that led to the great disruption in the financial markets. In this

environment, the municipal bond market saw liquidity dry up, new issuance

come to a halt, forced selling by several financial institutions and a huge

number of redemptions as investors fled to the safety of the Treasury

market. As a result of this turmoil, municipal bond yields rose to historic

levels above Treasury yields. Never in history has the ratio of municipal

bond yields to Treasury yields been so high. Typically, the 30-year rate of

municipal yields to Treasury yields has been approximately 90%. In December

2008, the ratio increased to over 200%. During the first four months of

2009, the municipal bond market rebounded. There was improvement in

4 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

liquidity, and municipal bond yields declined, although they remained above

Treasury yields.

Q What factors affected the Trust's performance during the 12-month period

ended April 30, 2009?

A The Trust's performance was affected by defaults in some of its holdings,

including: exposure to Lehman Brothers through a municipal bond issued by

Main Street Natural Gas in Georgia; a position in the Las Vegas Monorail

System; and the default of the St. Louis Convention Center. The Trust's

position in airline/airport bonds also held back returns. Despite the steep

decline in fuel prices, airline/airport bonds lost value, reflecting

concerns that airline/airport revenues would continue to contract in the

weak global economy. In the final weeks of the 12-month period, we saw a

modest upturn in the value of airline/airport bonds. Some of the Trust's

hospital bonds, which are rated A/Baa, also dampened performance, as their

long duration in a rising interest-rate environment had a negative impact

during the final quarter of 2008.

The Trust's return at net asset value trailed the Barclays Capital

Municipal Bond Index by a significant margin, partially due to the effects

of the Trust's strategy to use leverage, or borrowed funds, to invest. This

is a normal part of our investment strategy. We obtain financing by issuing

auction rate preferred shares, which is a low-cost way of borrowing money.

Leverage tends to exaggerate performance both when the market is producing

positive returns and when it is producing negative returns. During the

Trust's fiscal year, the use of leverage exacerbated the effects of the

declining prices of high-yield bonds.

Because of the crisis in the credit markets, the market for auction rate

preferred shares was frozen over the 12 months ended April 30, 2009. That

made it difficult for investors holding auction rate preferred shares to

sell their shares, and it increased the borrowing costs incurred by the

Trust because of the terms outlined by the documents authorizing issuance

of preferred shares. At the end of the fiscal year, the Trust's leverage

ratio was 28.9%, an increase from the 24.5% level at the start of the

12-month period on May 1, 2008.While the amount of borrowed funds had not

increased, the declining values of the bonds in the Trust's portfolio

increased the proportion of leverage.

While the Trust had a setback over the past 12 months, its portfolio is

comprised of what we believe are solid investments that should weather the

problems in the economy and financial markets. As always has been the case

at Pioneer, our investment decisions are based on a value-oriented, risk-

managed investment approach that uses a bottom-up security selection

process and top-down economic and market analysis.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 5

Q How did you manage the Trust during the 12-month period ended April 30, 2009?

A We made no material changes to the Trust's portfolio and maintained an

emphasis on sectors that underpin the U.S. economy. Some of the Trust's

sector positions included health care (31.3% of the total investment

portfolio), tobacco bonds (11.9% of the total investment portfolio),

airport revenue (10.7% of the total investment portfolio), pollution

control bonds (4.6% of the total investment portfolio), facilities revenue

(4.3% of the total investment portfolio) and transportation revenue (4.0%

of the total investment portfolio).

In terms of credit quality, at April 30, 2009, 44.3% of the Trust's total

investment portfolio was invested in investment-grade bonds, and 55.7% of

the total investment portfolio was invested in below-investment-grade

bonds.

Q What is your outlook?

A The municipal bond market has begun to recover from the turmoil of the past

12 months. Investors are returning to the market, and we have seen prices

increase and yields decline. Over the first four months of the year, as of

April 30, 2009, the Barclays Capital Municipal Bond Index and the Barclays

Capital High Yield Municipal Bond Index rose by 6.31% and 10.00%,

respectively.

As we look ahead, we believe the municipal market should continue to be

attractive as states and municipalities receive Federal government stimulus

money that can be used for infrastructure repair, education and health care

programs. We are monitoring closely developments in Washington regarding

the health care sector. "Build America Bonds" are also part of the

government's stimulus. Under this program, the U.S. Treasury will subsidize

35% of issuers' net interest costs. We believe this program will result in

a large amount of new issuance of taxable municipal debt and a reduction in

the new issuance of tax-exempt debt. This could be positive for tax-exempt

municipal bonds. At a time when tax rates are likely to rise, we expect to

see demand increase and supply contract. This supply/demand dynamic could

increase the value of tax-exempt municipal bonds.

Please refer to the Schedule of Investments on pages 11-19 for a full listing

of Trust securities.

Investments in high-yield or lower-rated securities are subject to

greater-than-average risk. The Trust may invest in securities of issuers that

are in default or that are in bankruptcy.

A portion of income may be subject to state, federal, and/or alternative

minimum tax. Capital gains, if any, are subject to a capital gains tax. When

interest rates rise, the prices of fixed-income securities held by the Trust

will generally fall. Conversely, when interest rates fall the prices of

fixed-income securities held by the

6 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

Trust generally will rise. By concentrating in municipal securities, the Trust

is more susceptible to adverse economic, political or regulatory developments

than is a portfolio that invests more broadly. Investments in the Trust are

subject to possible loss due to the financial failure of underlying securities

and their inability to meet their debt obligations.

The Trust uses leverage through the issuance of preferred shares with an

aggregate liquidation preference of up to 25% of the Trust's total assets after

such issuance. Leverage creates significant risks, including the risk that the

Trust's income or capital appreciation will not be sufficient to cover the cost

of leverage, which may adversely affect the return for the holders of common

shares.

The Trust is required to maintain certain regulatory and rating agency asset

coverage requirements in connection with its outstanding preferred shares. In

order to maintain required asset coverage levels, the Trust may be required to

alter the composition of its investment portfolio or take other actions, such

as redeeming preferred shares with the proceeds from portfolio transactions, at

what might be inopportune times in the market. Such actions could reduce the

net earnings or returns to holders of the Trust's common shares over time.

Risks of investing in the Trust are discussed in greater detail in the Trust's

original offering prospectus relating to its common shares.

Past performance is no guarantee of future results, and there is no guarantee

that market forecasts discussed will be realized.

Any information in this shareowner report regarding market or economic trends

or the factors influencing the Trust's historical or future performance are

statements of the opinion of Trust management as of the date of this report.

These statements should not be relied upon for any other purposes.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 7

Portfolio Summary | 4/30/09

Portfolio Diversification

(As a percentage of total investment portfolio)

[THE FOLLOWING DATA WAS REPRESENTED AS A PIE CHART IN THE PRINTED MATERIAL]

Health Revenue 31.3%

Other Revenue 12.9%

Tobacco Revenue 11.9%

Airport Revenue 10.7%

Insured 10.6%

Pollution Control Revenue 4.6%

Facilities Revenue 4.3%

Transportation Revenue 4.0%

Education Revenue 3.7%

Development Revenue 3.6%

Utilities Revenue 1.0%

Gaming Revenue 0.7%

Airline Revenue 0.4%

Housing Revenue 0.3%

|

Portfolio Quality

(As a percentage of total investment portfolio; based on S&P ratings)

[THE FOLLOWING DATA WAS REPRESENTED AS A PIE CHART IN THE PRINTED MATERIAL]

AAA 20.2%

AA 3.5%

A 3.0%

BBB 17.6%

BB 3.2%

B 7.4%

CCC 1.7%

Not Rated 43.4%

|

10 Largest Holdings

------------------------------------------------------------------------------------------------------------------------------------

(As a percentage of long-term holdings)*

1. Allegheny County Hospital Development Authority Revenue, 9.25%, 11/15/30 4.12%

------------------------------------------------------------------------------------------------------------------------------------

2. Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue, 0.0%, 6/15/22 3.67

------------------------------------------------------------------------------------------------------------------------------------

3. Tobacco Settlement Financing Corp., 6.75%, 6/1/39 3.51

------------------------------------------------------------------------------------------------------------------------------------

4. Connecticut Health & Educational Facilities Authority Revenue, RIB, 12.542%,

7/1/42 (144A) 3.25

------------------------------------------------------------------------------------------------------------------------------------

5. North Texas Tollway Authority Revenue, 5.75%, 1/1/33 2.77

------------------------------------------------------------------------------------------------------------------------------------

6. New Jersey Economic Development Authority Revenue, 6.25%, 9/15/29 2.53

------------------------------------------------------------------------------------------------------------------------------------

7. New York State Dormitory Authority Revenue, RIB, 14.095%, 7/1/26 (144A) 2.50

------------------------------------------------------------------------------------------------------------------------------------

8. Golden State Tobacco Securitization Corp., 7.875%, 6/1/42 2.48

------------------------------------------------------------------------------------------------------------------------------------

9. Johnson City Health & Educational Facilities Board Hospital Revenue, 7.5%, 7/1/33 2.33

------------------------------------------------------------------------------------------------------------------------------------

10. Washington State General Obligation, 0.0%, 6/1/22 2.30

------------------------------------------------------------------------------------------------------------------------------------

|

* This list excludes temporary cash. The Trust is actively managed, and

currently holdings may be different. The holdings listed should not be

considered recommendations to buy or sell any security listed.

8 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

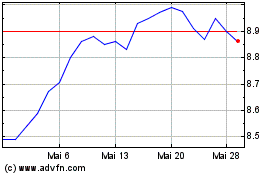

Prices and Distributions | 4/30/09

Market Value per Common Share

--------------------------------------------------------------------------------

4/30/09 4/30/08

--------------------------------------------------------------------------------

$ 10.40 $ 13.88

--------------------------------------------------------------------------------

|

Net Asset Value per Common Share

--------------------------------------------------------------------------------

4/30/09 4/30/08

--------------------------------------------------------------------------------

$ 11.18 $ 14.07

--------------------------------------------------------------------------------

|

Distributions per Common Share: 5/1/08-4/30/09

--------------------------------------------------------------------------------

Net

Investment Short-Term Long-Term

Income Capital Gains Capital Gains

--------------------------------------------------------------------------------

$ 0.8500 $ -- $ --

--------------------------------------------------------------------------------

|

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 9

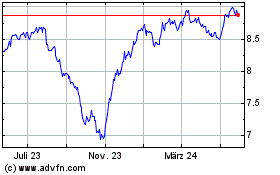

Performance Update | 4/30/09

Investment Returns

The mountain chart on the right shows the change in market value, including

reinvestment of dividends and distributions, of a $10,000 investment made in

common shares of Pioneer Municipal High Income Trust, compared to that of the

Barclays Capital Municipal Bond Index and Barclays Capital High Yield Municipal

Bond Index.

Cumulative Total Returns

(As of April 30, 2009)

--------------------------------------------------------------------------------

Net Asset Market

Period Value ("NAV") Price

--------------------------------------------------------------------------------

Life-of-Class

(7/17/2003) 14.25% 1.53%

5 Years 5.66 5.89

1 Year -13.94 -18.85

--------------------------------------------------------------------------------

|

[THE FOLLOWING DATA WAS REPRESENTED AS A LINE/MTN CHART IN THE PRINTED MATERIAL]

Value of $10,000 Investment

--------------------------------------------------------------------------------

Barclays Barclays

Pioneer Capital High Capital

Municipal High Yield Municipal Municipal

Income Trust Bond Index Bond Index*

--------------------------------------------------------------------------------

8/03 10000 10000 10000

4/04 10813 10441 9895

4/05 12399 11153 10202

4/06 12794 11394 10047

4/07 14265 12052 10056

4/08 13275 12388 10039

4/09 10153 12773 10218

|

* Index comparison begins July 31, 2003

Call 1-800-225-6292 or visit www.pioneerinvestments.com for the most recent

month-end performance results. Current performance may be lower or higher than

the performance data quoted.

Performance data shown represents past performance. Past performance is no

guarantee of future results. Investment return and market price will fluctuate,

and your shares may trade below net asset value ("NAV") due to such factors as

interest rate changes and the perceived credit quality of borrowers.

Total investment return does not reflect broker sales charges or commissions.

All performance is for common shares of the Trust.

Closed-end funds, unlike open-end funds, are not continuously offered. There is

a one-time public offering and once issued, shares of closed-end funds are sold

in the open market through a stock exchange and frequently trade at prices

lower than their NAV. NAV is total assets less total liabilities which includes

preferred shares, divided by the number of common shares outstanding.

When NAV is lower than market price, dividends are assumed to be reinvested at

the greater of NAV or 95% of the market price. When NAV is higher, dividends

are assumed to be reinvested at prices obtained under the Trust's dividend

reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes

that a shareowner would pay on Trust distributions or the sale of Trust shares.

The Barclays Capital Municipal Bond Index is a broad measure of the municipal

bond market. The Barclays Capital High Yield Municipal Bond Index totals over

$26 billion in market value and maintains over 1300 securities. Municipal bonds

in this index have the following requirements: maturities of one year or

greater, sub investment grade (below Baa or non-rated), fixed coupon rate,

issued after 12/31/90, deal size over $20 million, and maturity size of at

least $3 million. Index returns are calculated monthly, assume reinvestment of

dividends and, unlike Trust returns, do not reflect any fees, expenses or sales

charges. The indices are not leveraged. You cannot invest directly in the

indices.

10 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

Schedule of Investments | 4/30/09

-----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

-----------------------------------------------------------------------------------------------------

TAX EXEMPT OBLIGATIONS -- 134.9% of Net Assets

Alabama -- 0.7%

$ 1,000,000 NR/NR Huntsville-Redstone Village Special Care Facilities

Financing Authority, 5.5%, 1/1/28 $ 662,220

2,000,000 NR/NR Huntsville-Redstone Village Special Care Facilities

Financing Authority, 5.5%, 1/1/43 1,166,940

------------

$ 1,829,160

-----------------------------------------------------------------------------------------------------

Arizona -- 2.2%

5,000,000 BBB-/Baa3 Apache County Industrial Development Authority,

5.85%, 3/1/28 $ 4,459,750

970,000 NR/Baa3 Pima County Industrial Development Authority,

7.25%, 7/1/31 721,845

500,000 NR/Baa2 Yavapai County Industrial Development Authority,

6.0%, 8/1/33 394,465

------------

$ 5,576,060

-----------------------------------------------------------------------------------------------------

California -- 12.3%

2,425,000 A/A2 California State, 5.75%, 4/1/31 $ 2,467,049

7,885,000(a) AAA/NR California State University Revenue, RIB, 10.858%,

11/1/39 (144A) 7,464,256

4,500,000 NR/NR California Statewide Communities Development

Authority Environmental Facilities Revenue,

9.0%, 12/1/38 3,532,455

1,000,000 BB+/NR California Statewide Communities Development

Authority Revenue, 7.25%, 10/1/38 769,050

5,150,000+ AAA/Aaa Golden State Tobacco Securitization Corp.,

7.8%, 6/1/42 6,220,273

7,000,000+ AAA/Aaa Golden State Tobacco Securitization Corp.,

7.875%, 6/1/42 8,474,130

1,000,000 AA/Aa1 University of California Revenue, 5.0%, 5/15/25 1,017,900

655,000 C/NR Valley Health System Hospital Revenue,

6.5%, 5/15/25 414,418

------------

$ 30,359,531

-----------------------------------------------------------------------------------------------------

Connecticut -- 5.5%

10,335,000(a) NR/Aaa Connecticut Health & Educational Facilities Authority

Revenue, RIB, 12.542%, 7/1/42 (144A) $ 11,121,287

5,000,000 B+/NR Mohegan Tribe Indians Gaming Authority,

6.25%, 1/1/31 2,500,150

------------

$ 13,621,437

-----------------------------------------------------------------------------------------------------

Delaware -- 0.4%

765,000 NR/NR Sussex County Delaware Revenue, 5.9%, 1/1/26 $ 555,864

600,000 NR/NR Sussex County Delaware Revenue, 6.0%, 1/1/35 387,600

------------

$ 943,464

-----------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 11

Schedule of Investments | 4/30/09 (continued)

---------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

---------------------------------------------------------------------------------------------------

District of Columbia -- 3.4%

$ 5,000,000 BBB/Baa3 District of Columbia Tobacco Settlement Financing

Corp., 6.5%, 5/15/33 $ 3,817,600

6,000,000 BBB/Baa3 District of Columbia Tobacco Settlement Financing

Corp., 6.75%, 5/15/40 4,647,360

------------

$ 8,464,960

---------------------------------------------------------------------------------------------------

Florida -- 5.3%

1,700,000 NR/NR Beacon Lakes Community Development,

6.9%, 5/1/35 $ 1,211,131

2,000,000 A-/A3 Brevard County Health Facilities Authority Revenue,

5.0%, 4/1/36 1,539,840

2,500,000 NR/NR Liberty County Subordinate Revenue,

8.25%, 7/1/28 2,062,800

2,500,000 A-/A2 Miami-Dade County Aviation Revenue,

5.5%, 10/1/41 2,370,250

1,000,000 NR/NR St. Johns County Industrial Development Authority

Revenue, 5.25%, 1/1/26 650,780

2,000,000 NR/NR St. Johns County Industrial Development Authority

Revenue, 5.375%, 1/1/40 1,129,480

5,000,000 NR/Baa2 Tallahassee Health Facilities Revenue,

6.375%, 12/1/30 4,220,150

------------

$ 13,184,431

---------------------------------------------------------------------------------------------------

Georgia -- 3.0%

4,240,000(a) NR/Aa3 Atlanta Georgia Water & Waste Revenue, RIB,

7.682%, 11/1/43 (144A) $ 3,779,366

2,400,000 NR/NR Fulton County Residential Care Facilities Revenue,

5.0%, 7/1/27 1,493,880

2,600,000 NR/NR Fulton County Residential Care Facilities Revenue,

5.125%, 7/1/42 1,403,376

1,000,000 NR/NR Rockdale County Development Authority Revenue,

6.125%, 1/1/34 663,890

------------

$ 7,340,512

---------------------------------------------------------------------------------------------------

Guam -- 1.5%

5,000,000 NR/NR Northern Mariana Islands, 5.0%, 10/1/22 $ 3,614,550

---------------------------------------------------------------------------------------------------

Idaho -- 1.7%

5,000,000 BBB/Baa2 Power County Industrial Development Corp.,

6.45%, 8/1/32 $ 4,313,250

---------------------------------------------------------------------------------------------------

Illinois -- 8.5%

2,000,000(b) NR/NR Centerpoint Intermodal Center, 10.0%,

6/15/23 (144A) $ 1,564,120

1,000,000 NR/NR Illinois Finance Authority Revenue, 6.0%, 11/15/27 696,780

2,000,000 AA+/Aa2 Illinois Finance Authority Revenue, 6.0%, 8/15/39 2,041,340

4,000,000 NR/NR Illinois Finance Authority Revenue, 6.0%, 11/15/39 2,391,000

---------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

12 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

-----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

-----------------------------------------------------------------------------------------------------

Illinois -- (continued)

$ 1,500,000(c) NR/NR Illinois Health Facilities Authority Revenue,

6.9%, 11/15/33 $ 661,350

16,880,000(d) AAA/A2 Metropolitan Pier & Exposition Authority Dedicated

State Tax Revenue, 0.0%, 6/15/22 12,566,316

1,800,000 NR/NR Southwestern Illinois Development Authority

Revenue, 5.625%, 11/1/26 1,170,090

------------

$ 21,090,996

-----------------------------------------------------------------------------------------------------

Indiana -- 4.6%

5,000,000 A+/A2 Indiana Health & Educational Facility Financing

Authority Hospital Revenue, 5.0%, 2/15/39 $ 3,820,450

1,000,000 BBB+/Baa1 Indiana State Development Finance Authority

Revenue, 5.6%, 12/1/32 839,400

4,300,000 BBB+/NR Indiana State Development Finance Authority

Revenue, 5.75%, 10/1/11 4,105,081

2,500,000(b) BBB/Baa2 Rockport Pollution Control Revenue, 6.25%, 6/1/25 2,558,725

------------

$ 11,323,656

-----------------------------------------------------------------------------------------------------

Louisiana -- 1.9%

1,500,000 BB+/Ba3 Louisiana Local Government Environmental Facilities

Revenue, 6.75%, 11/1/32 $ 1,044,075

5,000,000 NR/A3 Louisiana Public Facilities Authority Revenue,

5.5%, 5/15/47 3,706,800

------------

$ 4,750,875

-----------------------------------------------------------------------------------------------------

Massachusetts -- 4.1%

2,440,000 NR/NR Massachusetts Development Finance Agency

Revenue, 7.1%, 7/1/32 $ 1,883,826

3,500,000 BBB/Baa3 Massachusetts Health & Educational Facilities

Authority Revenue, 6.25%, 7/1/22 3,070,970

2,500,000 NR/NR Massachusetts Health & Educational Facilities

Authority Revenue, 6.5%, 1/15/38 1,656,150

5,000,000 BB-/NR Massachusetts Health & Educational Facilities

Authority Revenue, 6.75%, 10/1/33 3,629,300

------------

$ 10,240,246

-----------------------------------------------------------------------------------------------------

Michigan -- 2.2%

950,000 NR/NR Doctor Charles Drew Academy, 5.7%, 11/1/36 $ 518,443

1,700,000 NR/Ba1 Flint Michigan Hospital Building Authority Revenue,

5.25%, 7/1/16 1,400,069

1,500,000 BB/NR John Tolfree Health System Corp., 6.0%, 9/15/23 1,129,050

2,000,000 BB-/Ba3 Michigan State Hospital Finance Authority Revenue,

5.5%, 8/15/23 1,326,220

1,470,000 BBB/NR Star International Academy Certificates of

Participation, 6.125%, 3/1/37 1,057,783

------------

$ 5,431,565

-----------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 13

Schedule of Investments | 4/30/09 (continued)

----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

----------------------------------------------------------------------------------------------------

Minnesota -- 0.6%

$ 1,675,000 BB-/NR Duluth Economic Development Authority Health Care

Facilities Revenue, 7.25%, 6/15/32 $ 1,363,400

----------------------------------------------------------------------------------------------------

Mississippi -- 1.1%

3,000,000 BBB/Ba1 Mississippi Business Finance Corp. Pollution Control

Revenue, 5.9%, 5/1/22 $ 2,745,180

----------------------------------------------------------------------------------------------------

Montana -- 0.1%

1,600,000(c) NR/NR Two Rivers Authority, Inc. Correctional Facility

Improvement Revenue, 7.375%, 11/1/27 $ 312,096

----------------------------------------------------------------------------------------------------

Nebraska -- 0.5%

2,000,000 NR/NR Grand Island Solid Waste Disposal Facilities

Revenue, 7.0%, 6/1/23 $ 1,369,980

----------------------------------------------------------------------------------------------------

Nevada -- 0.1%

2,000,000 NR/NR Nevada State Department of Business & Industry,

7.25%, 1/1/23 $ 140,000

----------------------------------------------------------------------------------------------------

New Jersey -- 10.9%

2,000,000 B/B3 New Jersey Economic Development Authority

Revenue, 6.25%, 9/15/19 $ 1,460,020

13,350,000 B/B3 New Jersey Economic Development Authority

Revenue, 6.25%, 9/15/29 8,653,470

1,000,000 B/B3 New Jersey Economic Development Authority

Revenue, 6.4%, 9/15/23 688,350

6,150,000(b) B/B3 New Jersey Economic Development Authority

Revenue, 7.0%, 11/15/30 4,286,612

10,000,000+ AAA/Aaa Tobacco Settlement Financing Corp.,

6.75%, 6/1/39 12,014,500

------------

$ 27,102,952

----------------------------------------------------------------------------------------------------

New Mexico -- 1.3%

1,500,000 NR/NR Otero County New Mexico Project Revenue,

6.0%, 4/1/23 $ 1,131,915

2,960,000 NR/NR Otero County New Mexico Project Revenue,

6.0%, 4/1/28 2,119,982

------------

$ 3,251,897

----------------------------------------------------------------------------------------------------

New York -- 10.9%

2,500,000 BBB+/Baa2 Albany New York Industrial Development Agency

Civic Facilities Revenue, 5.25%, 11/15/27 $ 2,036,025

3,000,000 NR/NR Dutchess County Industrial Development Agency

Revenue, 7.5%, 3/1/29 2,690,580

2,000,000 NR/NR Nassau County New York Industrial Development

Agency Revenue, 6.7%, 1/1/43 1,479,940

2,000,000 NR/Baa1 New York City Industrial Development Agency,

5.375%, 6/1/23 1,670,740

----------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

14 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

-----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

-----------------------------------------------------------------------------------------------------

New York -- (continued)

$ 12,990,000 CCC+/Caa2 New York City Industrial Development Agency,

6.9%, 8/1/24 $ 5,001,280

7,040,000(a) NR/Aaa New York State Dormitory Authority Revenue, RIB,

14.095%, 7/1/26 (144A) 8,551,136

2,000,000 NR/NR Suffolk County Industrial Development Agency,

7.25%, 1/1/30 1,586,480

4,000,000 AA-/Aa3 Triborough Bridge & Tunnel Authority Revenue,

5.25%, 11/15/30 4,053,040

------------

$ 27,069,221

-----------------------------------------------------------------------------------------------------

North Carolina -- 2.7%

4,530,000 NR/NR Charlotte North Carolina Special Facilities Revenue,

5.6%, 7/1/27 $ 2,576,936

5,740,000 NR/NR Charlotte North Carolina Special Facilities Revenue,

7.75%, 2/1/28 4,063,289

------------

$ 6,640,225

-----------------------------------------------------------------------------------------------------

Oklahoma -- 5.3%

1,000,000+ AAA/Aaa Oklahoma Development Finance Authority Revenue,

5.625%, 8/15/19 $ 1,023,510

7,000,000+ AAA/Aaa Oklahoma Development Finance Authority Revenue,

5.625%, 8/15/29 7,164,570

1,225,000 B-/Caa2 Tulsa Municipal Airport Revenue, 6.25%, 6/1/20 869,566

4,350,000 B-/Caa2 Tulsa Municipal Airport Revenue, 7.35%, 12/1/11 3,980,250

------------

$ 13,037,896

-----------------------------------------------------------------------------------------------------

Pennsylvania -- 9.4%

3,000,000 BB/Ba3 Allegheny County Hospital Development Authority

Revenue, 5.0%, 11/15/28 $ 1,639,560

1,550,000 NR/Baa2 Allegheny County Hospital Development Authority

Revenue, 5.125%, 5/1/25 1,232,312

12,300,000+ AAA/NR Allegheny County Hospital Development Authority

Revenue, 9.25%, 11/15/30 14,088,666

1,000,000 B-/NR Columbia County Hospital Authority Health Care

Revenue, 5.9%, 6/1/29 676,380

925,000 BBB/Ba2 Hazleton Health Services Authority Hospital Revenue,

5.625%, 7/1/17 740,962

1,280,000 NR/B3 Langhorne Manor Borough Higher Education &

Health Authority Revenue, 7.35%, 7/1/22 907,597

3,900,000 NR/Ba3 Pennsylvania Economic Development Financing

Authority Revenue, 6.75%, 12/1/36 3,587,883

500,000 BBB+/NR Pennsylvania Higher Educational Facilities Authority

Revenue, 5.4%, 7/15/36 397,660

------------

$ 23,271,020

-----------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 15

Schedule of Investments | 4/30/09 (continued)

----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

----------------------------------------------------------------------------------------------------

Rhode Island -- 1.7%

$ 6,000,000 NR/NR Central Falls Detention Facilities Revenue,

7.25%, 7/15/35 $ 4,110,120

----------------------------------------------------------------------------------------------------

South Carolina -- 2.8%

5,185,000+ BBB+/Baa1 South Carolina Jobs Economic Development

Authority Revenue, 6.375%, 8/1/34 $ 6,069,872

665,000+ BBB+/Baa1 South Carolina Jobs Economic Development

Authority Revenue, 6.375%, 8/1/34 771,147

------------

$ 6,841,019

----------------------------------------------------------------------------------------------------

Tennessee -- 5.4%

7,000,000+ NR/A2 Johnson City Health & Educational Facilities Board

Hospital Revenue, 7.5%, 7/1/33 $ 7,964,950

2,480,000 NR/A1 Knox County Health, Educational & Housing Facilities

Board Hospital Revenue, 6.375%, 4/15/22 2,515,737

4,600,000 BBB+/NR Sullivan County Health, Educational & Housing

Facilities Board Hospital Revenue,

5.25%, 9/1/36 2,790,314

------------

$ 13,271,001

----------------------------------------------------------------------------------------------------

Texas -- 14.8%

1,345,000 NR/Ba2 Bexar County Housing Finance Corp.,

8.0%, 12/1/36 $ 965,011

1,000,000 CCC+/Caa2 Dallas-Fort Worth International Airport Revenue,

6.0%, 11/1/14 485,010

4,000,000 NR/NR Decatur Hospital Authority Revenue, 7.0%, 9/1/25 3,222,720

2,000,000 NR/NR Gulf Coast Industrial Development Authority

Revenue, 7.0%, 12/1/36 885,020

3,750,000 B-/B3 Houston Airport System Special Facilities Revenue,

5.7%, 7/15/29 2,199,975

5,340,000 NR/NR Lubbock Health Facilities Development Corp.,

6.625%, 7/1/36 3,728,228

10,000,000 BBB+/A3 North Texas Tollway Authority Revenue,

5.75%, 1/1/33 9,491,800

2,810,000(a) NR/Aa2 Northside Independent School District, RIB,

12.325%, 6/15/33 (144A) 2,962,976

500,000 CCC/Caa2 Sabine River Authority Pollution Control Revenue,

6.15%, 8/1/22 200,355

7,040,000(a) NR/Aa1 Texas State, RIB, 13.248%, 4/1/30 (144A) 7,501,402

1,075,000 NR/NR Willacy County Local Government Corp. Revenue,

6.0%, 9/1/10 1,042,825

5,250,000 NR/NR Willacy County Local Government Corp. Revenue,

6.875%, 9/1/28 3,907,890

------------

$ 36,593,212

----------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

16 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

------------------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

------------------------------------------------------------------------------------------------------------

Utah -- 0.2%

$ 800,000 NR/NR Spanish Fork City Charter School Revenue, 5.55%,

11/15/26 (144A) $ 556,064

------------------------------------------------------------------------------------------------------------

Vermont -- 0.6%

1,500,000 A-/A3 Vermont Educational & Health Buildings Financing

Agency Revenue, 6.0%, 10/1/28 $ 1,544,970

------------------------------------------------------------------------------------------------------------

Virginia -- 0.4%

1,000,000 BBB/Baa2 Peninsula Ports Authority, 6.0%, 4/1/33 $ 880,430

------------------------------------------------------------------------------------------------------------

Washington -- 8.7%

4,710,000 AA-/A2 Spokane Public Facilities District Hotel/Motel Tax

& Sales, 5.75%, 12/1/27 $ 4,884,788

7,025,000 BBB/Baa3 Tobacco Settlement Authority Revenue,

6.625%, 6/1/32 5,583,400

14,315,000 AA+/Aa1 Washington State General Obligation, 0.0%, 6/1/22 7,866,236

5,000,000 NR/NR Washington State Housing Finance Committee

Nonprofit Revenue, 5.625%, 1/1/27 3,278,200

--------------

$ 21,612,624

------------------------------------------------------------------------------------------------------------

Wisconsin -- 0.1%

2,320,000 NR/NR Aztalan Wisconsin Exempt Facilities Revenue,

7.5%, 5/1/18 $ 132,240

------------------------------------------------------------------------------------------------------------

TOTAL TAX-EXEMPT OBLIGATIONS

(Cost $378,068,301) $ 333,930,240

------------------------------------------------------------------------------------------------------------

MUNICIPAL COLLATERALIZED DEBT OBLIGATION -- 2.7%

of Net Assets

10,000,000(b)(e) NR/NR Non-Profit Preferred Funding Trust I,12.0%,

9/15/37 (144A) $ 6,670,400

------------------------------------------------------------------------------------------------------------

TOTAL MUNICIPAL COLLATERALIZED DEBT

OBLIGATION

(Cost $10,000,000) $ 6,670,400

------------------------------------------------------------------------------------------------------------

Shares

------------------------------------------------------------------------------------------------------------

COMMON STOCK -- 0.6% of Net Assets

247,994(f) Delta Air Lines, Inc. $ 1,530,123

------------------------------------------------------------------------------------------------------------

TOTAL COMMON STOCK

(Cost $6,612,756) $ 1,530,123

------------------------------------------------------------------------------------------------------------

TOTAL INVESTMENTS IN SECURITIES -- 138.2%

(Cost $394,681,057)(g)(h) $ 342,130,763

------------------------------------------------------------------------------------------------------------

OTHER ASSETS AND LIABILITIES -- 2.6% $ 6,432,675

------------------------------------------------------------------------------------------------------------

PREFERRED SHARES AT REDEMPTION VALUE,

INCLUDING DIVIDENDS PAYABLE -- (40.8)% $ (101,003,430)

------------------------------------------------------------------------------------------------------------

NET ASSETS APPLICABLE TO COMMON

SHAREOWNERS -- 100.0% $ 247,560,008

------------------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 17

Schedule of Investments | 4/30/09 (continued)

RIB Residual Interest Bonds

NR Security not rated by S&P or Moody's.

(144A) Security is exempt from registration under Rule 144A of the Securities

Act of 1933. Such securities may be resold normally to qualified

institutional buyers in a transaction exempt from registration. At April

30, 2009 the value of these securities amounted to $50,171,007 or 20.3%

of net assets applicable to common shareowners.

+ Prerefunded bonds have been collateralized by U.S. Treasury securities

or U.S. Government Agencies which are held in escrow to pay interest and

principal on the tax exempt issue and to retire the bonds in full at the

earliest refunding date.

(a) The interest rate is subject to change periodically and inversely based

upon prevailing market rates. The interest rate shown is the coupon rate

at April 30, 2009.

(b) The interest rate is subject to change periodically. The interest rate

shown is the coupon rate at April 30, 2009.

(c) Security is in default and is non-income producing.

(d) Debt obligation initially issued at one coupon which converts to a

higher coupon at a specific date. The rate shown is the coupon rate at

April 30, 2009.

(e) Indicates a security that has been deemed illiquid. The aggregate cost

of illiquid securities is $10,000,000. The aggregate value $6,670,400

represents 2.7% of the net assets.

(f) Non-income producing.

(g) The concentration of investments by type of obligation/market sector is

|

as follows (unaudited):

Insured:

NATL-RE 7.4%

FSA 1.1

ACA 0.9

PSF 0.9

AMBAC 0.3

Revenue Bonds:

Health Revenue 31.4

Other Revenue 12.9

Tobacco Revenue 12.0

Airport Revenue 10.8

Pollution Control Revenue 4.6

Facilities Revenue 4.3

Transportation Revenue 4.0

Education Revenue 3.7

Development Revenue 3.7

Utilities Revenue 1.0

Gaming Revenue 0.7

Housing Revenue 0.3

-----

100.0%

=====

|

The accompanying notes are an integral part of these financial statements.

18 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

(h) At January 31, 2009, the net unrealized loss on investments based on

cost for federal income tax purposes of $392,778,850 was as follows:

Aggregate gross unrealized gain for all investments in which there is an

excess of value over tax cost $ 18,463,823

Aggregate gross unrealized loss for all investments in which there is an

excess of tax cost over value (69,111,910)

------------

Net unrealized loss $(50,648,087)

============

|

For financial reporting purposes net unrealized loss on investments was

$52,550,294 and cost of investments aggregated $394,681,057.

Purchases and sales of securities (excluding temporary cash investments) for

the year ended April 30, 2009, aggregated $56,253,960 and $56,236,117,

respectively.

Various inputs are used in determining the value of the Trust's investments.

These inputs are summarized in the three broad levels listed below.

Highest priority is given to Level 1 inputs and lowest priority is given to

Level 3.

Level 1 -- quoted prices in active markets for identical securities

Level 2 -- other significant observable inputs (including quoted prices

for similar securities, interest rates, prepayment speeds, credit

risk, etc.)

Level 3 -- significant unobservable inputs (including the Trust's own

assumptions in determining fair value of investments)

|

The following is a summary of the inputs used as of April 30, 2009, in valuing

the Trust's investments:

--------------------------------------------------------------------------------

Investments

Valuation Inputs in Securities

--------------------------------------------------------------------------------

Level 1 -- Quoted Prices $ 1,530,123

Level 2 -- Other Significant Observable Inputs 340,600,640

Level 3 -- Significant Unobservable Inputs --

--------------------------------------------------------------------------------

Total $342,130,763

================================================================================

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 19

Statement of Assets and Liabilities | 4/30/09

ASSETS:

Investments in securities, at value (cost $394,681,057) $ 342,130,763

Cash 347,811

Receivables --

Investment securities sold 100,000

Interest 8,664,032

Prepaid expenses 32,533

------------------------------------------------------------------------------------------------------------------------------------

Total assets $ 351,275,139

------------------------------------------------------------------------------------------------------------------------------------

LIABILITIES:

Payables --

Investments securities purchased $ 2,415,575

Due to affiliates 180,456

Administration fee payable 19,737

Accrued expenses 95,933

------------------------------------------------------------------------------------------------------------------------------------

Total liabilities $ 2,711,701

------------------------------------------------------------------------------------------------------------------------------------

PREFERRED SHARES AT REDEMPTION VALUE:

$25,000 liquidation value per share applicable to 4,040 shares,

including dividends payable of $3,430 $ 101,003,430

------------------------------------------------------------------------------------------------------------------------------------

NET ASSETS APPLICABLE TO COMMON SHAREOWNERS:

Paid-in capital $ 315,434,908

Undistributed net investment income 7,400,424

Accumulated net realized loss on investments and interest rate swaps (22,725,030)

Net unrealized loss on investments (52,550,294)

------------------------------------------------------------------------------------------------------------------------------------

Net assets applicable to common shareowners $ 247,560,008

------------------------------------------------------------------------------------------------------------------------------------

NET ASSET VALUE PER SHARE:

No par value, (unlimited number of shares authorized)

Based on $247,560,008/22,140,525 common shares $ 11.18

====================================================================================================================================

|

The accompanying notes are an integral part of these financial statements.

20 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

Statement of Operations

For the Year Ended 4/30/09

INVESTMENT INCOME:

Interest $ 27,967,270

------------------------------------------------------------------------------------------------------------------------------------

EXPENSES:

Management fees $ 2,196,502

Administration fees 359,742

Transfer agent fees and expenses 38,031

Auction agent fees 267,789

Custodian fees 59,027

Registration fees 23,819

Professional fees 124,039

Printing expense 23,717

Trustees' fees 13,990

Pricing fees 19,113

Miscellaneous 33,773

------------------------------------------------------------------------------------------------------------------------------------

Total expenses $ 3,159,542

------------------------------------------------------------------------------------------------------------------------------------

Net investment income $ 24,807,728

------------------------------------------------------------------------------------------------------------------------------------

REALIZED AND UNREALIZED GAIN (LOSS) ON

INVESTMENTS AND INTEREST RATE SWAPS:

Net realized loss from:

Investments $ (5,927,111)

Interest rate swaps (462,743) $ (6,389,854)

------------------------------------------------------------------------------------------------------------------------------------

Change in net unrealized gain (loss) from:

Investments $ (61,172,082)

Interest rate swaps 250,905 $(60,921,177)

------------------------------------------------------------------------------------------------------------------------------------

Net loss on investments and interest rate swaps $(67,311,031)

------------------------------------------------------------------------------------------------------------------------------------

DISTRIBUTIONS TO PREFERRED SHAREOWNERS FROM

NET INVESTMENT $ (2,525,210)

------------------------------------------------------------------------------------------------------------------------------------

Net decrease in net assets applicable to common shareowners

resulting from operations $(45,028,513)

====================================================================================================================================

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 21

Statement of Changes in Net Assets

For the Years Ended 4/30/09 and 4/30/08, respectively

Year Year

Ended Ended

4/30/09 4/30/08

FROM OPERATIONS:

Net investment income $ 24,807,728 $ 23,933,484

Net realized loss on investments and interest rate swaps (6,389,854) (2,753,968)

Change in net unrealized gain (loss) on investments and interest

rate swaps (60,921,177) (42,308,635)

Distributions to preferred shareowners from net investment

income (2,525,210) (3,773,609)

------------------------------------------------------------------------------------------------------------------------------------

Net decrease in net assets applicable to common

shareowners resulting from operations $ (45,028,513) $ (24,902,728)

------------------------------------------------------------------------------------------------------------------------------------

DISTRIBUTIONS TO COMMON SHAREOWNERS:

($0.85 and $0.83 per share, respectively) $ (18,817,657) $ (18,449,784)

------------------------------------------------------------------------------------------------------------------------------------

Total distributions to common shareowners $ (18,817,657) $ (18,449,784)

------------------------------------------------------------------------------------------------------------------------------------

FROM TRUST SHARE TRANSACTIONS:

Reinvestment of distributions $ 175,511 $ 96,845

------------------------------------------------------------------------------------------------------------------------------------

Net increase in net assets applicable to common

shareowners resulting from Trust share transactions $ 175,511 $ 96,845

------------------------------------------------------------------------------------------------------------------------------------

Net decrease in net assets applicable to common

shareowners $ (63,670,659) $ (43,255,667)

NET ASSETS APPLICABLE TO COMMON SHAREOWNERS:

Beginning of year 311,230,667 354,486,334

------------------------------------------------------------------------------------------------------------------------------------

End of year $ 247,560,008 $ 311,230,667

------------------------------------------------------------------------------------------------------------------------------------

Undistributed net investment income $ 7,400,424 $ 4,413,468

------------------------------------------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

22 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

Financial Highlights

------------------------------------------------------------------------------------------------------------------------------------

Year Year Year Year Year

Ended Ended Ended Ended Ended

4/30/09 4/30/08 4/30/07 4/30/06 4/30/05

------------------------------------------------------------------------------------------------------------------------------------

Per Common Share Operating Performance

Net asset value, beginning of period $ 14.07 $ 16.02 $ 15.15 $ 15.62 $ 14.76

------------------------------------------------------------------------------------------------------------------------------------

Increase (decrease) from investment operations:(a)

Net investment income $ 1.12 $ 1.08 $ 1.02 $ 1.02 $ 1.14

Net realized and unrealized gain (loss) on investments and

interest rate swaps (3.05) (2.03) 0.78 (0.48) 0.95

Dividends and distributions to preferred shareowners from:

Net investment income (0.11) (0.17) (0.16) (0.12) (0.07)

Net realized gains -- -- -- -- 0.00(b)

------------------------------------------------------------------------------------------------------------------------------------

Net increase (decrease) from investment operations $ (2.04) $ (1.12) $ 1.64 $ 0.42 $ 2.02

Dividends and distributions to common shareowners from:

Net investment income (0.85) (0.83) (0.77) (0.89) (1.07)

Net realized gains -- -- -- -- (0.09)

Capital charge with respect to issuance of:

Common shares -- -- -- -- 0.00(b)

------------------------------------------------------------------------------------------------------------------------------------

Net increase (decrease) in net asset value $ (2.89) $ (1.95) $ 0.87 $ (0.47) $ 0.86

------------------------------------------------------------------------------------------------------------------------------------

Net asset value, end of period(c) $ 11.18 $ 14.07 $ 16.02 $ 15.15 $ 15.62

------------------------------------------------------------------------------------------------------------------------------------

Market value, end of period(c) $ 10.40 $ 13.88 $ 15.05 $ 13.22 $ 14.33

====================================================================================================================================

Total return at market value(d) (18.85)% (2.28)% 20.04% (1.85)% 13.34%

Ratios to average net assets of common shareowners

Net expenses(e) 1.19% 1.03% 1.06% 1.03% 1.04%

Net investment income before preferred share dividends 9.36% 7.17% 6.49% 6.64% 7.60%

Preferred share dividends 0.95% 1.13% 1.01% 0.80% 0.43%

Net investment income available to common shareowners 8.41% 6.04% 5.48% 5.84% 7.17%

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 23

Financial Highlights (continued)

------------------------------------------------------------------------------------------------------------------------------------

Year Year Year Year Year

Ended Ended Ended Ended Ended

4/30/09 4/30/08 4/30/07 4/30/06 4/30/05

------------------------------------------------------------------------------------------------------------------------------------

Portfolio turnover 16% 17% 18% 20% 25%

Net assets of common shareowners, end of period

(in thousands) $ 247,560 $ 311,231 $ 354,486 $ 335,121 $ 345,555

Preferred shares outstanding (in thousands) $ 101,000 $ 101,000 $ 101,000 $ 101,000 $ 101,000

Asset coverage per preferred share, end of period(f) $ 86,278 $ 102,047 $ 112,759 $ 107,962 $ 110,533

Average market value per preferred share $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000

Liquidation value, including dividends payable, per

preferred share $ 25,001 $ 25,010 $ 25,014 $ 25,011 $ 25,000

Ratios to average net assets of common shareowners before

waivers and reimbursement of expenses

Net expenses(e) 1.19% 1.03% 1.06% 1.03% 1.04%

Net investment income before preferred share dividends 9.36% 7.17% 6.49% 6.64% 7.60%

Preferred share dividends 0.95% 1.13% 1.01% 0.80% 0.43%

Net investment income available to common shareowners 8.41% 6.04% 5.48% 5.84% 7.17%

====================================================================================================================================

|

(a) The per common share data presented above is based upon the average common

shares outstanding for the periods presented.

(b) Amount is less than $0.01 per share.

(c) Net asset value and market value are published in Barron's on Saturday, The

Wall Street Journal on Monday and The New York Times on Monday and

Saturday.

(d) Total investment return is calculated assuming a purchase of common shares

at the current market value on the first day and a sale at the current

market value on the last day of the periods reported. Dividends and

distributions, if any, are assumed for purposes of this calculation to be

reinvested at prices obtained under the Trust's dividend reinvestment plan.

Total investment return does not reflect brokerage commissions. Past

performance is not a guarantee of future results.

(e) Expense ratios do not reflect the effect of dividend payments to preferred

shareowners.

(f) Market value is redemption value without an active market.

The information above represents the audited operating performance data for

a common share outstanding, total investment return, ratios to average net

assets and other supplemental data for the periods indicated. This

information has been determined based upon financial information provided

in the financial statements and market value data for the Trust's common

shares. The accompanying notes are an integral part of these financial

statements.

The accompanying notes are an integral part of these financial statements.

24 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

Notes to Financial Statements | 4/30/09

1. Organization and Significant Accounting Policies

Pioneer Municipal High Income Trust (the "Trust") was organized as a Delaware

statutory trust on March 13, 2003. Prior to commencing operations on July 21,

2003, the Trust had no operations other than matters relating to its

organization and registration as a diversified, closed-end management

investment company under the Investment Company Act of 1940, as amended. The

primary investment objective of the Trust is to seek a high level of current

income exempt from regular federal income tax and, as a secondary objective,

the Trust may seek capital appreciation to the extent consistent with its

primary investment objective.

The Trust may invest in both investment and below investment grade (high-yield)

municipal securities with a broad range of maturities and credit ratings. Debt

securities rated below investment grade are commonly referred to as "junk

bonds" and are considered speculative. These securities involve greater risk of

loss, are subject to greater price volatility, and are less liquid, especially

during periods of economic uncertainty or change, than higher rated debt

securities.

Information regarding the Trust's principal risks is contained in the Trust's

original offering prospectus with additional information included in the

Trust's shareowner reports from time to time. Please refer to those documents

when considering the Trust's investment risks. At times, the Trust's

investments may represent industries or industry sectors that are interrelated

or have common risks, making it more susceptible to any economic, political, or

regulatory developments or other risks affecting those industries and sectors.

The Trust's financial statements have been prepared in conformity with U.S.

generally accepted accounting principles that require the management of the

Trust to, among other things, make estimates and assumptions that affect the

reported amounts of assets and liabilities, and the reported amounts of income,

expenses and gains and losses on investments during the reporting year. Actual

results could differ from those estimates.

The following is a summary of significant accounting policies followed by the

Trust in the preparation of its financial statements, which are consistent with

those policies generally accepted in the investment company industry:

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 25

A. Security Valuation

Security transactions are recorded as of trade date. Securities are valued at

prices supplied by independent pricing services, which consider such factors

as Treasury spreads, yields, maturities and ratings. Valuations may be

supplemented by values obtained from dealers and other sources, as required.

The values of interest rate swaps are determined by obtaining dealer

quotations. Securities for which there are no other readily available

valuation methods are valued using fair value methods pursuant to procedures

adopted by the Board of Trustees ("board determined"). The Trust may also use

fair value methods to value a security including a non-U.S. security, when

the closing market price on the principal exchange where the security is

traded no longer reflects the value of the security. At April 30, 2009, there

were no securities that were board determined.

Dividend income is recorded on the ex-dividend date, except that certain

dividends from foreign securities where the ex-dividend date may have passed

are recorded as soon as the Trust becomes aware of the ex-dividend data in

the exercise of reasonable diligence. Discount and premium on debt securities

are accreted or amortized, respectively, daily on an effective yield to

maturity basis and are included in interest income. Interest income,

including interest bearing cash accounts, is recorded on an accrual basis.

Gains and losses on sales of investments are calculated on the identified

cost method for both financial reporting and federal income tax purposes.

B. Federal Income Taxes

It is the Trust's policy to comply with the requirements of the Internal

Revenue Code applicable to regulated investment companies and to distribute

all of its taxable income and net realized capital gains, if any, to its

shareowners. Therefore, no federal income tax provision is required. Tax

years for the prior three fiscal years remain subject to examination by tax

authorities.

The amounts and characterizations of distributions to shareowners for

financial reporting purposes are determined in accordance with federal income

tax rules. Therefore, the sources of the Trust's distributions may be shown

in the accompanying financial statements as from or in excess of net

investment income or as from net realized gain (loss) on investment

transactions, or as from paid in-capital, depending on the type of book/tax

differences that may exist.

At April 30, 2009, the Trust reclassified $477,905 to decrease undistributed

net investment income and decrease net realized loss on investments to

reflect permanent book/tax differences. The reclassification has no impact on

the net asset value of the Trust and presents the Trust's capital accounts on

a tax basis.

26 Pioneer Municipal High Income Trust | Annual Report | 4/30/09

At April 30, 2009, the Trust had a net capital loss carryforward of

$15,079,753 which is comprised of $6,354,842 which will expire in 2014,

$4,138,757 which will expire in 2015 and $4,586,154 which will expire in

2017, if not utilized.

The Trust has elected to defer approximately $7,564,631 in capital losses

realized between November 1, 2008 and April 30, 2009 to its fiscal year

ending April 30, 2010.

The tax character of distributions paid to common and preferred shareowners

during the years ended April 30, 2009 and April 30, 2008 were as follows:

--------------------------------------------------------------------------------

2009 2008

--------------------------------------------------------------------------------

Distributions paid from:

Tax exempt income $21,171,440 $21,567,992

Ordinary income 171,427 655,401

--------------------------------------------------------------------------------

Total $21,342,867 $22,223,393

--------------------------------------------------------------------------------

|

The following shows the components of distributable earnings on a federal

income tax basis at April 30, 2009.

--------------------------------------------------------------------------------

2009

--------------------------------------------------------------------------------

Distributable earnings:

Undistributed tax-exempt income $ 5,302,103

Undistributed ordinary income 118,898

Capital loss carryforward (15,079,753)

Post-October loss deferred (7,564,631)

Dividend payable (3,430)

Unrealized depreciation (50,648,087)

--------------------------------------------------------------------------------

Total $ (67,874,900)

--------------------------------------------------------------------------------

|

The difference between book-basis and tax-basis unrealized depreciation is

primarily attributable to the difference between book and tax amortization

methods for premiums and discounts on fixed income securities, book/tax

difference in the accrual of income on securities in default and other

temporary differences.

C. Automatic Dividend Reinvestment Plan

All common shareowners automatically participate in the Automatic Dividend

Reinvestment Plan (the "Plan"), under which participants receive all

dividends and capital gain distributions (collectively, "dividends") in full

and fractional common shares of the Trust in lieu of cash. Shareowners may

elect not to participate in the Plan. Shareowners not participating in the

Plan receive all dividends and capital gain distributions in cash.

Participation in the Plan is completely voluntary and may be terminated or

resumed at any time without penalty by notifying American Stock Transfer &

Trust

Pioneer Municipal High Income Trust | Annual Report | 4/30/09 27

Company, the agent for shareowners in administering the Plan (the "Plan

Agent"), in writing prior to any dividend record date; otherwise such

termination or resumption will be effective with respect to any subsequently

declared dividend or other distribution.

Whenever the Trust declares a dividend on common shares payable in cash,

participants in the Plan will receive the equivalent in common shares

acquired by the Plan Agent either (i) through receipt of additional unissued

but authorized common shares from the Trust or (ii) by purchase of

outstanding common shares on the New York Stock Exchange or elsewhere. If, on

the payment date for any dividend, the net asset value per common share is

equal to or less than the market price per share plus estimated brokerage

trading fees ("market premium"), the Plan Agent will invest the dividend

amount in newly issued common shares. The number of newly issued common

shares to be credited to each account will be determined by dividing the

dollar amount of the dividend by the net asset value per common share on the

date the shares are issued, provided that the maximum discount from the then

current market price per share on the date of issuance does not exceed 5%.

If, on the payment date for any dividend, the net asset value per common

share is greater than the market value ("market discount"), the Plan Agent

will invest the dividend amount in common shares acquired in open-market

purchases. There are no brokerage charges with respect to newly issued common

shares.

However, each participant will pay a pro rata share of brokerage trading fees

incurred with respect to the Plan Agent's open-market purchases.

Participating in the Plan does not relieve shareowners from any federal,

state or local taxes which may be due on dividends paid in any taxable year.

Shareowners holding Plan shares in a brokerage account may not be able to

transfer the shares to another broker and continue to participate in the

Plan.

2. Management Agreement

Pioneer Investment Management, Inc. ("PIM"), a wholly owned indirect subsidiary

of UniCredit S.p.A. ("UniCredit"), manages the Trust's portfolio. Management

fees payable under the Trust's Advisory Agreement with PIM are calculated daily