0001856589

false

0001856589

2023-09-20

2023-09-20

0001856589

MBSC:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemablePublicWarrantMember

2023-09-20

2023-09-20

0001856589

MBSC:ClassCommonStockParValue0.0001PerShareMember

2023-09-20

2023-09-20

0001856589

MBSC:PublicWarrantsEachWholePublicWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-09-20

2023-09-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 20, 2023

M3-BRIGADE

ACQUISITION III CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40946 |

|

86-3185502 |

(State or

other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification

No.) |

| 1700 Broadway,

19th Floor |

| New York, New York 10019 |

| (Address of principal executive

offices, including zip code) |

(212)

202-2200

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ☒ | Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ● | Securities registered

pursuant to Section 12(b) of the Act: |

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A common stock and one-third of one redeemable public warrant |

|

MBSC.U |

|

New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

MBSC |

|

New York Stock Exchange |

| Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

MBSC WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Introductory Note

As previously disclosed, on December 14, 2022, M3-Brigade Acquisition

III Corp. (“MBSC”) entered into a Business Combination Agreement (as amended on April 21, 2023, June 15, 2023 and September

5, 2023, the “Business Combination Agreement”, and the transactions contemplated thereby, the “Business Combination”)

with Greenfire Resources Ltd., an Alberta corporation (“PubCo”), DE Greenfire Merger Sub Inc., a Delaware corporation and

a direct, wholly-owned subsidiary of PubCo, 2476276 Alberta ULC, an Alberta unlimited liability corporation and a direct, wholly-owned

subsidiary of PubCo, and Greenfire Resources Inc., an Alberta corporation (“Greenfire”).

On September 20, 2023, the Business Combination was consummated in

accordance with the terms of the Business Combination Agreement. As a result of the Business Combination, MBSC became a wholly-owned subsidiary

of PubCo.

Capitalized terms used but not otherwise defined in this Current Report

on Form 8-K have the meaning set forth in the Business Combination Agreement. The description of the Business Combination Agreement and

related transactions (including, without limitation, the Business Combination) in this Current Report on Form 8-K does not purport to

be complete and is subject, and qualified in its entirety by reference to, the full text of the Business Combination Agreement, which

is attached as Annex A to the definitive proxy statement on Schedule 14A filed by MBSC with the U.S. Securities and Exchange Commission

(the “SEC”) on August 14, 2023 (the “Definitive Proxy Statement”) and Amendment No. 3 thereto is filed as Exhibit

2.1 to the Current Report on Form 8-K filed by MBSC with the SEC on September 5, 2023.

Item 1.01. Entry into a Material Definitive Agreement

As previously disclosed, on September 11, 2023, holders of public

warrants to purchase shares of MBSC’s Class A common stock, par value $0.0001 per share (“MBSC Class A Common Stock,”

and such warrants, “MBSC Public Warrants”) approved an amendment to that certain Public Warrant Agreement, dated October 21,

2021, between MBSC and Continental Stock Transfer and Trust Company (“Continental”), as warrant agent (the “Public

Warrant Agreement”), substantially in the form attached as Annex M to the Definitive Proxy Statement (the “Public Warrant

Amendment”). On September 20, 2023, in connection with the closing of the Business Combination, MBSC and Continental entered into

the Public Warrant Amendment, pursuant to which on September 20, 2023 all MBSC Public Warrants were exchanged for $0.50 per MBSC Public

Warrant.

Item 2.01. Completion of Acquisition or Disposition of Assets

The information set forth under the “Introductory Note”

is incorporated by reference herein.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing

Rule or Standard; Transfer of Listing; Material Modification to Rights of Security Holders

In connection with the Business Combination, on September 20, 2023,

MBSC notified the New York Stock Exchange (“NYSE”) of the consummation of the Business Combination and requested that NYSE

(i) suspend trading of MBSC Class A Common Stock, MBSC Public Warrants and MBSC units comprising one share of MBSC Class A Common Stock

and one MBSC Public Warrant, effective September 20, 2023 and (ii) file with the SEC a Form 25 (the “Form 25”) to delist the

MBSC Securities under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). On September

21, 2023, NYSE filed the Form 25. On or about October 2, 2023, MBSC intends to file a certification on Form 15 with the SEC to deregister

the MBSC Securities and suspend MBSC’s reporting obligations under Sections 13 and 15(d) of the Exchange Act.

Item 5.01. Changes in Control of Registrant

As of the time of the Merger and as a result of the Business Combination,

a change in control of MBSC occurred and MBSC became a wholly-owned subsidiary of PubCo.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

In connection with consummation of the Business Combination, the following

officers of MBSC ceased to hold their respective positions: Chris Chaice ceased to be Executive Vice President; William Gallagher ceased

to be Executive Vice President; Charles Garner ceased to be Executive Vice President and Secretary; Christopher Good ceased to be Chief

Financial Officer; and Matthew Perkal ceased to be Chief Executive Officer; and the following individuals also ceased to be directors

of MBSC: Frederick Arnold; Alan Carr; Benjamin Fader Rattner; Mohsin Y. Meghji; Scott Malpass; William Transier; and Steven Vincent. Matthew

Perkal became a director of PubCo immediately following the Business Combination.

Item 8.01. Other Events

On September 20, 2023, MBSC and Greenfire jointly issued a press release

announcing the closing of the Business Combination, a copy of which is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain certain forward-looking statements within

the meaning of the federal securities laws with respect to the transaction between PubCo, MBSC, Greenfire and the other parties thereto.

These forward-looking statements generally are identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and

other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication.

You should carefully consider the risks and uncertainties described in the “Risk Factors” section of MBSC’s annual report

on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 31, 2023, MBSC’s quarterly report on Form 10-Q for

the quarter ended March 31, 2023 filed with the SEC on June 2, 2023, MBSC’s quarterly report on Form 10-Q for the quarter ended

June 30, 2023 filed with the SEC on August 18, 2023, and the Definitive Proxy Statement, including those under “Risk Factors”

therein, and other documents filed by MBSC or PubCo from time to time with the SEC. These filings identify and address other important

risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and PubCo, MBSC and Greenfire assume no obligation and do not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise. Neither PubCo, MBSC nor Greenfire gives any assurance that either

PubCo or Greenfire will achieve its expectations.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: September 21, 2023 |

M3-BRIGADE ACQUISITION III CORP. |

| |

|

| |

By: |

/s/ Robert Logan |

| |

Name: |

Robert Logan |

| |

Title: |

Chief Executive Officer |

-3-

Exhibit 4.1

Execution Version

AMENDMENT NO. 1 TO PUBLIC

WARRANT AGREEMENT

THIS

AMENDMENT TO THE PUBLIC WARRANT AGREEMENT (this “Amendment”) is made as of September 20, 2023, by and between

M3-Brigade Acquisition III Corp., a Delaware corporation (the “Company”), and Continental Stock Transfer &

Trust Company, a New York limited purpose trust company, as warrant agent (in such capacity, the “Warrant Agent”).

WHEREAS,

on October 26, 2021, the Company consummated its initial public offering (“IPO”) of 30,000,000 units (the “Units”),

with each Unit consisting of one share of Class A common stock, $0.0001 par value per share, and one-third of one warrant

(the “Public Warrants”);

WHEREAS,

the Company and the Warrant Agent are parties to that certain Public Warrant Agreement, dated as of October 21, 2021, and filed with the

United States Securities and Exchange Commission on October 27, 2021 (the “Public Warrant Agreement”), which

governs the Public Warrants (capitalized terms used herein, but not otherwise defined herein, shall have the meanings given to such terms

in the Public Warrant Agreement);

WHEREAS,

on December 14, 2022, the Company entered into that certain Business Combination Agreement (the “Business Combination Agreement”)

by and among the Company, Greenfire Resources Ltd., an Alberta corporation, DE Greenfire Merger Sub Inc., a Delaware corporation and a

direct, wholly-owned subsidiary of Greenfire Resources Ltd,. an Alberta corporation, 2476276 Alberta ULC, an Alberta unlimited liability

corporation and a direct, wholly-owned subsidiary of Greenfire Resources Ltd., and Greenfire Resources Inc., an Alberta corporation;

WHEREAS,

the Company and the Warrant Agent seek to amend the Public Warrant Agreement to provide that, in connection with the consummation of the

transactions contemplated by the Business Combination Agreement, all of the issued and outstanding Public Warrants will be exchanged for

cash in an amount equal to $0.50 per whole Public Warrant and the Public Warrant Agreement will thereafter terminate with respect to such

Public Warrants; and

WHEREAS,

on September 11, 2023, the Company held a special meeting of the holders of the Public Warrants pursuant to which the Company obtained

the required vote of the holders of the Public Warrants to approve this Amendment.

NOW,

THEREFORE, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree as follows.

1. Amendment

to Warrant Agreement. The Company and the Warrant Agent hereby amend the Warrant Agreement to add a new “Section 6.4”

immediately following “Section 6.3” which shall read as follows:

6.4 Mandatory

Redemption of Public Warrants. Notwithstanding anything contained in this Agreement to the contrary, immediately prior to the Effective

Time (as defined in the Business Combination Agreement (as defined below)), but subsequent to the Unit Separation (as defined in the Business

Combination Agreement), each Public Warrant issued and outstanding at such time shall, automatically and without any action by the Registered

Holder thereof, or any prior notice by the Company, be exchanged and deemed transferred by such Registered Holder to the Company, in consideration

for the right to receive payment of cash from the Company in the amount of $0.50 per whole Public Warrant (the “Consideration”)

to be delivered to such Registered Holder by or at the direction of the Company as soon as reasonably practicable after the consummation

of the Merger (as defined in the Business Combination Agreement). Thereafter, each such Registered Holder shall cease to have any rights

with respect to the Public Warrants other than the right to receive the Consideration and this Agreement shall be deemed terminated with

respect to the Public Warrants. “Business Combination Agreement” means that certain Business Combination Agreement,

dated as of December 14, 2022, by and among the Company, Greenfire Resources Ltd., an Alberta corporation, DE Greenfire Merger Sub Inc.,

a Delaware corporation and a direct, wholly-owned subsidiary of Greenfire Resources Ltd., an Alberta corporation, 2476276 Alberta ULC,

an Alberta unlimited liability corporation and a direct, wholly-owned subsidiary of Greenfire Resources Ltd., and Greenfire Resources

Inc., an Alberta corporation.”

2. Miscellaneous

Provisions.

2.1 Termination

of Amendment. Each of the parties hereto agrees that this Amendment shall automatically be terminated and shall be null and void if

the Business Combination Agreement shall be terminated for any reason.

2.2 Successors.

All the covenants and provisions of this Amendment by or for the benefit of the Company or the Warrant Agent shall bind and inure to the

benefit of their respective successors and assigns.

2.3 Severability.

This Amendment shall be deemed severable, and the invalidity or unenforceability of any term or provision hereof shall not affect the

validity or enforceability of this Amendment or of any other term or provision hereof. Furthermore, in lieu of any such invalid or unenforceable

term or provision, the parties hereto intend that there shall be added as a part of this Amendment a provision as similar in terms to

such invalid or unenforceable provision as may be possible and be valid and enforceable.

2.4 Applicable

Law. The validity, interpretation, and performance of this Amendment shall be governed in all respects by the laws of the State of

New York, without giving effect to conflicts of law principles that would result in the application of the substantive laws of another

jurisdiction. The parties hereby agree that any action, proceeding or claim against a party arising out of or relating in any way to this

Amendment shall be brought and enforced in the courts of the State of New York or the United States District Court for the Southern District

of New York, and irrevocably submits to such jurisdiction, which jurisdiction shall be the exclusive forum for any such action, proceeding

or claim. The parties hereby waive any objection to such exclusive jurisdiction and that such courts represent an inconvenient forum.

Notwithstanding the foregoing, the provisions of this paragraph will not apply to suits brought to enforce any liability or duty created

by the Exchange Act or any other claim for which the federal district courts of the United States of America are the sole and exclusive

forum.

2.5 Counterparts.

This Amendment may be executed in any number of original or facsimile counterparts and each of such counterparts shall for all purposes

be deemed to be an original, and all such counterparts shall together constitute but one and the same instrument.

2.6 Effect

of Headings. The section headings herein are for convenience only and are not part of this Amendment and shall not affect the interpretation

thereof.

2.7 Entire

Agreement. The Public Warrant Agreement, as modified by this Amendment, constitutes the entire understanding of the parties and supersedes

all prior agreements, understandings, arrangements, promises and commitments, whether written or oral, express or implied, relating to

the subject matter hereof, and all such prior agreements, understandings, arrangements, promises and commitments are hereby canceled and

terminated.

IN WITNESS WHEREOF, each

of the parties has caused this Agreement to be duly executed as of the date first above written.

| |

M3-BRIGADE ACQUISITION III CORP., as the Company |

| |

|

|

| |

By: |

/s/ Mohsin Y. Meghji |

| |

Name: |

Mohsin Y. Meghji |

| |

Title: |

Executive Chairman of the Board of Directors |

| |

CONTINENTAL STOCK TRANSFER & TRUST COMPANY, as Warrant Agent |

| |

|

|

| |

By: |

/s/ Henry Farrell |

| |

Name: |

Henry Farrell |

| |

Title: |

Vice President |

[Signature Page to Amendment to Public Warrant Agreement]

3

Exhibit 99.1

FINAL

VERSION FOR RELEASE

Greenfire

Resources Closes Business Combination with M3-Brigade Acquisition III Corp., Announces Public Listing on the New York Stock Exchange,

Senior Secured Note Refinancing and New Credit Facilities

CALGARY,

AB, and NEW YORK – September 20, 2023 – Greenfire Resources Inc., a Calgary-based energy company focused on the

sustainable production and development of thermal energy resources from the Athabasca region of Alberta, Canada, is pleased

to announce that it has closed its business combination with M3-Brigade Acquisition III Corp., a New York Stock Exchange (“NYSE”)

listed special purpose acquisition company (“MBSC”), which valued Greenfire at US$950 million (the “Business Combination”)

and was previously announced on December 15, 2022. The newly combined company is named Greenfire Resources Ltd. (“Greenfire”

or the “Company”). The common shares of Greenfire are expected to commence trading on the NYSE under the symbol “GFR”

on September 21, 2023.

Creating

a Public Intermediate Pure Play Producer with Concentrated Tier-1 Oil Sands Assets

Greenfire

currently operates two producing Steam Assisted Gravity Drainage (“SAGD”) bitumen production facilities, Hangingstone Expansion

and Hangingstone Demo. The Company owns a 75% working interest in Hangingstone Expansion (the “Expansion Asset”) and a 100%

working interest in Hangingstone Demo (the “Demo Asset”). The Expansion Asset and Demo Asset (collectively, the “Hangingstone

Facilities”) both produce from the same Tier-1 SAGD reservoir in the McMurray Formation, with the Expansion Asset connected to

expandable pipeline infrastructure for diluted bitumen and diluent.

“Greenfire

successfully assembled some of the highest quality oil sands assets in the industry and has now formalized its publicly listed platform

to pursue additional potential step change value generation opportunities. Listing on the NYSE further expands the Company’s access

to capital, and decisively positions Greenfire as a leading intermediate oil sands operator,” said Robert Logan, President and

Chief Executive Officer of Greenfire. “Supporting the safe, responsible, and efficient development of our world-class assets is

an incredible team of dedicated and talented employees.”

At

the special meeting of MBSC’s shareholders, 95.2% of votes cast approved the Business Combination. “We are pleased to complete

this Business Combination, and we are grateful for the support of both companies’ shareholders,” said Mohsin Y. Meghji, executive

chairman of MBSC.

Greenfire

Equity Issuance

In

connection with the closing of the Business Combination, the parties closed an approximately US$42 million private placement (the “Transaction

Financing”). The common shares issued pursuant to the Transaction Financing were issued at a price of US$10.10 per share. An aggregate

of US$50 million of common shares was subscribed for pursuant to the Transaction Financing but approximately US$8 million was, pursuant

to the subscription agreements entered into in connection with the Transaction Financing (the “Subscription Agreements”),

automatically reduced due to funds remaining in MBSC’s trust account at closing as a result of approximately 2.5% of the shares of MBSC

Class A common not electing to redeem in connection with the Business Combination. The Business Combination also contemplated that Greenfire

would issue up to US$50 million in convertible notes, which would have been convertible into common shares of Greenfire at a conversion

price of US$13.00; however, as a result of completing the New Note (as defined below) financing, the convertible notes were not issued

(pursuant to the terms of the Subscription Agreements) as Greenfire was successful in simplifying and streamlining its capital structure

to better compete as a public company.

On

closing of the Business Combination, former equity holders of Greenfire Resources Inc. hold approximately 87% of the outstanding common

shares of Greenfire after taking into account common shares issued pursuant to the Business Combination.

Greenfire

Substantially Advances its Capital Structure and Liquidity with the Issuance of US$300 million Senior Secured Notes and New C$50 million

Senior Credit Facilities

| ● | New

Notes: Concurrent with the Business Combination, Greenfire closed a private offering

of US$300 million aggregate principal amount of senior secured notes (the “New Notes”),

which were issued at a price of US$980.00 per US$1,000.00 principal amount. The New Notes

mature on October 1, 2028 and have a fixed coupon of 12.0% per annum, paid semi-annually

on April 1 and October 1 of each year, commencing on April 1, 2024. The New Notes provide

certainty for the Company’s ability to reduce debt in the near term by utilizing 75%

of excess cash flow (as defined in the trust indenture) semi-annually to retire the New Notes

at a price of US$1,050.00 per US$1,000.00 principal amount until total indebtedness is less

than US$150 million, at which point it reduces to 25% of excess cash flow until less than

US$100 million of the New Notes remain outstanding. |

| ● | Old

Notes: Greenfire used a portion of the net proceeds from the New Notes to retire Greenfire’s

existing 12.0% Senior Secured Notes due 2025 (the “Old Notes”) pursuant to a

previously announced tender offer (the “Tender Offer”). An aggregate of US$217,934,000

principal amount of the Old Notes, or 99.99954% of the aggregate principal amount outstanding,

were validly tendered pursuant to the Tender Offer. The tender price paid for the Old Notes

was US$1,065.00 per US$1,000 principal amount of the Old Notes validly tendered and accepted

for purchase pursuant to the Tender Offer, plus accrued and unpaid interest up to, but not

including, the settlement date. The remaining Old Notes will be redeemed on or about October

5, 2023 in accordance with a notice of redemption issued by Greenfire on September 5, 2023. |

| ● | New

Senior Credit Facilities: Greenfire has entered into a credit agreement with Bank of

Montreal, as agent, and a syndicate of certain other financial institutions as lenders to

provide for senior secured extendable revolving credit facilities (the “Senior Credit

Facilities”) in an aggregate principal amount of C$50 million, comprised of an operating

facility and a syndicated revolving facility. The Senior Credit Facilities will be guaranteed

and secured on a perfected first-priority basis with a “first out” status. |

| ● | Pro-forma

Liquidity and Financial Positioning: The Company has cash and cash equivalents of approximately

C$43 million as at June 30, 2023, with additional restricted cash of approximately C$47 million,

largely associated with letters of credit for its pipeline transportation agreements. Greenfire

believes that it has materially augmented its liquidity and financial flexibility with its

new undrawn C$50 million Senior Credit Facilities and US$300 million of New Notes. The Company

intends to prioritize debt repayment in the near term to further enhance long-term resiliency. |

The

Company’s Growth Oriented Strategy and Positioning for Future Shareholder Returns

| ● | Long-life

Oil Sands Assets with a Differentiated Tier-1 Reservoir: Compared to most oil and gas

assets, SAGD assets typically have a reserve base that is longer life, with relatively low

decline rates and reliable operating performance. As this relates to Greenfire’s current

assets: |

| | | |

| o | Greenfire

has well-delineated reservoirs in approved developments at the Expansion Asset, with currently

booked Total Proved reserves anticipated to support high facility utilization rates for over

three decades. |

| | | |

| o | The

Company believes that both the Expansion Asset and Demo Asset have Tier-1 SAGD reservoirs,

meaning they have no top gas, bottom water or lean zones (“thief zones”). Other

SAGD reservoirs may have thief zones, which limit reservoir pressure and require the constant

utilization and routine replacement of downhole pumps for production. Tier-1 reservoirs allow

production to flow to the surface with natural lift, which reduces the Company’s capital

and operating expenditure requirements compared to other SAGD producers, which the Company

believes represents a structural cost advantage for Greenfire. |

| | | |

| o | A

noteworthy example of a SAGD asset with a low long-term decline rate is the Demo Asset, which

shares the same Tier-1 reservoir and river channel as the Expansion Asset. Over nearly two

decades, declines at the Demo Asset have remained relatively low without the need for new

well pair drilling or any infill or Refill (as defined below) wells. Under Greenfire’s

operatorship, production per well has increased at the Demo Asset through subcool optimization

and non-condensable gas (“NCG”) co-injection to increase reservoir pressure. |

| ● | Industry

Established Capital Efficient Production Growth Plan: |

| | | |

| o | Since

Greenfire assumed operatorship of the Expansion Asset and the Demo Asset, Greenfire’s

objective has been to maximize free cash flow generation. As such, the Company’s capital

expenditures to date at the Hangingstone Facilities have been relatively limited and primarily

directed towards maintenance, major turnarounds, and quick-payout optimization projects. |

| | | |

| ■ | At

the Expansion Asset, no new well pairs have been drilled since the facility was commissioned

in 2017 and zero infill or Refill wells have been drilled at the Expansion Asset or the Demo

Asset. |

| | | |

| o | The

Company’s current capital expenditure plans include projects designed to increase production

at the Expansion Asset and the Demo Asset. Greenfire anticipates that the implementation

of industry standard drilling techniques as well as surface facility optimizations can lead

to a material increase in production and profitability. |

| | | |

| ■ | At

the Expansion Asset, two core development initiatives are currently being executed to deliver

planned production growth: |

| | | |

| ● | Debottlenecking

facility NCG co-injection capabilities - Greenfire expects to restore higher reservoir

pressure at the Expansion Asset using proven NCG co-injection techniques similar to those

successfully executed by the Company at the adjacent Demo Asset and by other operators in

the industry at various SAGD assets. |

| | | |

| ● | Drilling

redevelopment infill producer (“Refill”) wells - Greenfire is currently drilling

extended reach (targeting 1,600 meters of horizontal length) Refill wells at the Expansion

Asset. Refill wells utilize an existing producer wellhead and casing, with cost savings anticipated

from reduced drilling and facilities as well as an expected acceleration of first production.

The Company expects that Refill wells will enhance the total bitumen recovery of previously

drilled and steamed well pairs by producing incremental pre-heated bitumen between two sets

of well pairs with minimal geological risk and marginal incremental capital expenditure.

The SAGD industry has a long-term track record of consistently and effectively producing

incremental pre-heated bitumen volumes from infill and Refill wells. |

| | | |

| ■ | At

the Demo Asset, near-term development consists of relatively minor capital spending to drill

and commission a second water disposal well to increase water handling capabilities as well

as smaller debottlenecking projects to allow for the reactivation of existing offline well

pairs to increase production. |

| ● | Strong

Free Cash Flow Generation Potential with Material Exposure to Canadian Heavy Oil Pricing:

The capital expenditure profile for SAGD assets is largely spent upfront to build processing

facilities and major infrastructure, with the resulting operating cost structure more fixed

compared to other conventional oil and gas assets. The Company’s structural cost advantages

from its Tier-1 reservoir, combined with its relatively lower forecasted capital expenditure

profile owing to its projected multi-year inventory of Refill well targets at the Hangingstone

Facilities, is anticipated to result in near-term production growth and potential meaningful

free cash flow generation. As the Company’s production is 100% weighted to benchmarks

that are linked to Western Canadian Select (“WCS”), Greenfire has material exposure

to a potential improvement in WCS differentials and Canadian heavy oil pricing. The Company’s

newly advanced capital structure with augmented liquidity was envisioned, among many reasons,

to navigate possible WCS differential volatility as new pipeline infrastructure in Western

Canada progresses toward probable completion in 2024. |

| ● | Debt

Reduction as a Strategic Priority with a Methodical Approach to Commodity Risk Management:

Concurrent with the Company’s near-term production growth plans at the Hangingstone Facilities,

Greenfire will continue to prioritize the deleveraging of its balance sheet. The Company

will reduce debt in the near term by utilizing 75% of excess cash flow to retire the New

Notes until total indebtedness is less than US$150 million. Greenfire will hedge 50% of its

forecasted proved developed producing production on a rolling 12-month basis to strategically

balance downside protection while maintaining a degree of upside exposure in the current

price environment. |

| ● | Positioning

for Shareholder Returns and Future Growth: Greenfire intends to formalize and initiate

a policy to return capital to its shareholders in due course. Greenfire also plans to evaluate

additional potential opportunities for further production growth over time, including external

acquisitions, and will consider opportunities that compete with the expected returns from

its existing Tier-1 assets and is accretive to its shareholders. |

Governance

Greenfire

is committed to maintaining high standards of corporate governance and risk management. Concurrent with the closing of the Business Combination,

Derek Aylesworth and Matthew Perkal have been appointed to Greenfire’s Board of Directors.

Derek

Aylesworth has over 20 years of experience in the Canadian oil and gas industry. He has served as the Chief Financial Officer of Seven

Generations Energy Ltd., an oil and gas producer operating in western Canada, between March 2018 to April 2021. He has previously served

as the CFO of Baytex Energy Corp. between November 2005 until June 2014. Mr. Aylesworth holds a Bachelor of Commerce degree and is a

Chartered Professional Accountant with expertise in taxation and has experience as a tax advisor in both the oil and gas industry and

public practice in Calgary.

Matthew

Perkal is currently Head of Special Situations and SPACs at Brigade Capital Management. He previously served as MBSC’s Chief Executive

Officer and as Executive Vice President of M3 Brigade Acquisition II Corp. and is a member of the management team for Brigade-M3 European

Acquisition Corporation. Prior to joining Brigade, Mr. Perkal worked at Deutsche Bank as an Analyst in the Leveraged Finance Group. Mr.

Perkal received a BS in Economics with a concentration in Finance and Accounting from the University of Pennsylvania’s Wharton

School.

The

Company will benefit from the experience of Julian McIntyre as Chair, Robert Logan, Derek Aylesworth, Jonathan Klesch, Venkat Siva and

Matthew Perkal as directors.

About

Greenfire

Greenfire

is an intermediate, lower-cost and growth-oriented Athabasca oil sands producer with concentrated Tier-1 assets that utilize steam assisted

gravity drainage extraction methods. The Company is focused on responsible and sustainable energy development in Canada, with its

registered office located in Calgary, Alberta. Greenfire is an operationally focused company with an emphasis on an entrepreneurial

environment and employee ownership.

Greenfire

common shares are listed on the New York Stock Exchange under the symbol “GFR”.

For

more information, visit greenfireres.com or find Greenfire on LinkedIn.

Advisors

Carter

Ledyard & Milburn LLP, Burnet, Duckworth & Palmer LLP and Felesky Flynn LLP are acting as counsel to Greenfire. Wachtell, Lipton,

Rosen & Katz and Osler, Hoskin & Harcourt LLP are serving as counsel to MBSC. BDO LLP served as MBSC’s auditor and

Deloitte LLP has served as auditor for Greenfire and will continue as auditor for Greenfire.

Forward-Looking

Statements

This

press release may contain certain forward-looking statements within the meaning of the United States federal securities laws and applicable

Canadian securities laws. These forward-looking statements generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result,” and similar expressions. In addition to other forward-looking statements herein, there are forward-looking

statements in this press release relating to the following matters: the expected timing that the Greenfire common shares will commence

trading on the NYSE; the Company’s intent to pursue potential value generation opportunities; the expectation that listing on the NYSE

will expand Greenfire’s access to capital and range of new investment prospects; the expectation of reducing debt in the near future;

the expectation that the Company has materially augmented its liquidity and financial flexibility; the long term ability to produce bitumen

from the Company’s Hangingstone Facilities; the current capital expenditure plans for the Expansion Asset and the Demo Asset and the

expected benefits from such plans; the expectation that the current capital expenditure plans will enhance bitumen recovery and reduce

costs; the expectation that the Company has structural cost advantages from its Tier 1 reservoir; the expectation that the Company’s

cost advantages combined with its relatively lower forecasted capital expenditure profile owing to its projected multi-year inventory

of Refill well targets at the Hangingstone Facilities, may result in near-term production growth and potential material free cash flow

generation (depending on commodity pricing); the expectation that the Company has exposure to improvements in WCS differentials and Canadian

heavy oil pricing; the expectation that the Company’s capital structure will help navigate possible WCS differential volatility as new

pipeline infrastructure in Western Canada progresses toward probable completion in 2024; the Company’s future hedging plans; the Company’s

future plans for shareholder returns; and Greenfire’s plans to continue to evaluate additional potential opportunities for further

production growth, including external acquisitions.

Forward-looking

statements are predictions, projections and other statements about future events that are based on current expectations and assumptions

and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the

forward-looking statements in this press release, including but not limited to: risks relating to reduced or volatile commodity prices;

risks associated with the oil and gas industry in general (e.g., including operational risks in development, exploration and production;

the impacts of inflation and supply chain issues and steps taken by central banks to curb inflation; pandemic, war, terrorist events,

political upheavals and other similar events; events impacting the supply and demand for oil and gas including actions taken by the OPEC

+ group; delays or changes in plans with respect to exploration or development projects or capital expenditures); the uncertainty of

reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses; health, safety and environmental

risks; exchange rate fluctuations; changes in legislation affecting the oil and gas industry; uncertainties resulting from potential

delays or changes in plans with respect to exploration or development projects or capital expenditures limited liquidity and trading

of the Company’s securities; geopolitical risk and changes in applicable laws or regulations; the possibility that Greenfire may be adversely

affected by other economic, business, and/or competitive factors; litigation and regulatory enforcement risks, including the diversion

of management time and attention and the additional costs and demands on the Company’s resources. The foregoing list of factors is not

exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors”

section of the Company’s registration statement on Form F-4 filed with the United States Securities and Exchange Commission (the “SEC”)

dated April 21, 2023, as amended on June 16, 2023, July 18, 2023, August 7, 2023 and August 11, 2023, including a proxy statement/prospectus,

which was declared effective by the SEC on August 14, 2023 and other documents filed by Greenfire from time to time with the SEC. These

filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially

from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements, and, except as required by applicable laws, Greenfire assumes no obligation

and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Greenfire does not give any assurance that it will achieve its expectations.

Financial

Information

The

financial information and data contained in this press release is unaudited and does not conform to Regulation S-X promulgated under

the United States Securities Act of 1933. While Greenfire’s financial statements are prepared in accordance with International Financial

Reporting Standards (“IFRS”), the financial information and data contained in this press release have not been prepared in

accordance with IFRS. Greenfire believes these measures that are not defined under IFRS provide useful information to management and

investors regarding certain financial and business trends relating to Greenfire’s financial condition and results of operations. Greenfire

believes that the use of these non-IFRS financial measures provides an additional tool for investors to use in evaluating projected operating

results and trends relating to Greenfire’s financial condition and results of operations. These non-IFRS measures may not be indicative

of Greenfire’s historical operating results, nor are such measures meant to be predictive of future results. These measures may not be

comparable to measures under the same or similar names used by other similar companies. Management does not consider these non-IFRS measures

in isolation or as an alternative to financial measures determined in accordance with IFRS.

Oil

and Gas Terms

This

press release uses the term Tier-1 SAGD reservoir to describe the bitumen reservoirs that Greenfire has an interest in. The term Tier-1

SAGD reservoir refers to SAGD reservoirs that have no top gas, bottom water or lean zones, commonly referred to as “thief zones”.

Thief zones provide an unwanted outlet for steam and reservoir pressure. Thief zones require costly downhole pumps and recurring pump

replacements to achieve targeted production rates, leading to higher capital and operating expenditures. Tier-1 wells flow to surface

with natural lift; not requiring downhole pumps or gas lift.

Contact

Information

Greenfire

Resources Ltd.

205

5th Avenue SW

Suite

1900

Calgary,

AB T2P 2V7

greenfireres.com

investors@greenfireres.com

6

| Page

v3.23.3

Cover

|

Sep. 20, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 20, 2023

|

| Entity File Number |

001-40946

|

| Entity Registrant Name |

M3-BRIGADE

ACQUISITION III CORP.

|

| Entity Central Index Key |

0001856589

|

| Entity Tax Identification Number |

86-3185502

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1700 Broadway

|

| Entity Address, Address Line Two |

19th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

202-2200

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A common stock and one-third of one redeemable public warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A common stock and one-third of one redeemable public warrant

|

| Trading Symbol |

MBSC.U

|

| Security Exchange Name |

NYSE

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

MBSC

|

| Security Exchange Name |

NYSE

|

| Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

MBSC WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBSC_UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemablePublicWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBSC_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBSC_PublicWarrantsEachWholePublicWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

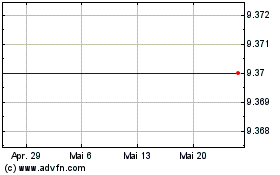

M3 Brigade Acquisition III (NYSE:MBSC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

M3 Brigade Acquisition III (NYSE:MBSC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024