0001856589

false

0001856589

2023-09-11

2023-09-11

0001856589

MBSC:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemablePublicWarrantMember

2023-09-11

2023-09-11

0001856589

MBSC:ClassCommonStockParValue0.0001PerShareMember

2023-09-11

2023-09-11

0001856589

MBSC:PublicWarrantsEachWholePublicWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-09-11

2023-09-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 11, 2023

M3-BRIGADE ACQUISITION III CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40946 |

|

86-3185502 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 1700 Broadway, 19th Floor |

| New York, New York 10019 |

| (Address of principal executive offices, including zip code) |

(212) 202-2200

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

●

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one share of Class A common stock and one-third of one redeemable public warrant |

|

MBSC.U |

|

New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

MBSC |

|

New York Stock Exchange |

| Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

MBSC WS |

|

New York Stock Exchange |

●

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

●

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.07 Submission of Matters to a Vote of Security Holders.

Special Meeting of its Stockholders

On September 11, 2023, M3-Brigade Acquisition III

Corp. (“MBSC” or the “Company”) held a special meeting of stockholders (the “Stockholders Meeting”)

in connection with that certain Business Combination Agreement, dated December 14, 2022, by and among MBSC, Greenfire Resources Ltd.,

an Alberta corporation (“PubCo”), DE Greenfire Merger Sub Inc., a Delaware corporation and a direct, wholly-owned subsidiary

of PubCo, 2476276 Alberta ULC, an Alberta unlimited liability corporation and a direct, wholly-owned subsidiary of PubCo, and Greenfire

Resources Inc. (“Greenfire”), an Alberta corporation (as amended on April 21, 2023, June 15, 2023 and September 5, 2023, and

as may be further amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement,” and

the transactions contemplated thereby, the “Business Combination”), as described in the definitive proxy statement on Schedule

14A filed by the Company with the Securities and Exchange Commission (the “SEC”) on August 14, 2023 (the “Proxy Statement”).

Present at the Stockholders Meeting were holders

of 28,878,044 shares of the Company’s common stock (the “Common Stock”) virtually or by proxy, representing 77% of the

voting power of the Common Stock as of July 31, 2023, the record date for the Stockholders Meeting (the “Stockholders Meeting Record

Date”), and constituting a quorum for the transaction of business. As of the Stockholders Meeting Record Date, there were 37,500,000

shares of Common Stock issued and outstanding.

At the Special Meeting, the Company’s stockholders

approved the Business Combination Proposal, as defined and described in greater detail in the Proxy Statement. The Adjournment Proposal,

as defined and described in greater detail in the Proxy Statement, was not presented to the Company’s stockholders as the Business

Combination Proposal received a sufficient number of votes for approval.

Set forth below are the final voting results for

the Business Combination Proposal:

|

For |

|

Against |

|

Abstain |

| 26,130,268 |

|

1,321,722 |

|

1,426,054 |

Special Meeting of its Warrantholders

On September 11, 2023, the Company held a special

meeting (the “Warrantholders Meeting”) of holders of public warrants to purchase shares of the Company’s Class A common

stock, par value $0.0001 per share (“MBSC Public Warrants,” and such holders, the “Public Warrantholders”), at

which the Public Warrantholders voted on an amendment to that certain Public Warrant Agreement, dated October 21, 2021, between MBSC

and Continental Stock Transfer and Trust Company, as warrant agent, in the form attached as Annex M to the Proxy Statement, to provide

that, upon the Closing (as defined in the Proxy Statement), each MBSC Public Warrant will be exchanged by such holder with MBSC for cash

in the amount of $0.50 per MBSC Public Warrant.

Present at the Warrantholders Meeting were holders

of 6,970,136 of the MBSC Public Warrants, virtually or by proxy, representing 69.70% of the voting power of the MBSC Public Warrants as

of July 31, 2023, the record date for the Warrantholders Meeting (the “Warrantholders Meeting Record Date”), and constituting

a quorum for the transaction of business. As of the Warrantholders Meeting Record Date, there were 10,000,000 MBSC Public Warrants issued

and outstanding.

At the Warrantholders Meeting, the Company’s

Public Warrantholders approved the Warrant Amendment Proposal, as defined and described in greater detail in the Proxy Statement. The

Adjournment Proposal, as defined and described in greater detail in the Proxy Statement, was not presented to the Public Warrantholders

as the Warrant Amendment Proposal received a sufficient number of votes for approval.

Set forth below are the final voting results for

the Warrant Amendment Proposal:

|

For |

|

Against |

|

Abstain |

| 5,483,269 |

|

1,352,651 |

|

134,216 |

Closing of the Business Combination

As previously disclosed, Greenfire is seeking to consummate a potential

refinancing (the “Potential Refinancing”) of Greenfire’s 12.000% Senior Secured Notes due 2025 prior to or concurrently

with the closing of the transactions contemplated by the Business Combination Agreement (the “Closing”).

All conditions to Closing have been met (other

than those conditions that by their nature are to be satisfied at the Closing, but subject to satisfaction or waiver of such conditions),

subject to receipt of Aggregate Transaction Proceeds (as defined in the Business Combination Agreement) equal to or greater than $100,000,000.

The Company expects the Closing to occur on the earlier of the closing of the Potential Refinancing and September 27, 2023.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain certain forward-looking statements

within the meaning of the federal securities laws with respect to the proposed transaction between PubCo, MBSC, Greenfire and the other

parties thereto. These forward-looking statements generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions,

projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject

to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in

this communication, including but not limited to: (i) the timing to complete the proposed business combination by MBSC’s business

combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by MBSC; (ii) the

occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreements relating

to the proposed business combination; (iii) the outcome of any legal, regulatory or governmental proceedings that may be instituted against

PubCo, MBSC, Greenfire or any investigation or inquiry following announcement of the proposed business combination, including in connection

with the proposed business combination; (iv) the inability to complete the proposed business combination due to the failure to obtain

approval of MBSC’s stockholders or the inability to receive approval of the proposed plan of arrangement in connection with the

proposed business combination; (v) Greenfire’s and PubCo’s success in retaining or recruiting, or changes required in, its

officers, key employees or directors following the proposed business combination; (vi) the ability of the parties to obtain the listing

of PubCo’s common shares and warrants on the New York Stock Exchange upon the closing of the proposed business combination; (vii)

the risk that the proposed business combination disrupts current plans and operations of Greenfire; (viii) the ability to recognize the

anticipated benefits of the proposed business combination; (ix) unexpected costs related to the proposed business combination; (x) the

amount of redemptions by MBSC’s public stockholders being greater than expected; (xi) the management and board composition of PubCo

following completion of the proposed business combination; (xii) limited liquidity and trading of PubCo’s securities; (xiii) geopolitical

risk and changes in applicable laws or regulations; (xiv) the possibility that Greenfire or MBSC may be adversely affected by other economic,

business, and/or competitive factors; (xv) operational risks; (xvi) the possibility that the COVID-19 pandemic or another major disease

disrupts Greenfire’s business; (xvii) litigation and regulatory enforcement risks, including the diversion of management time and

attention and the additional costs and demands on Greenfire’s resources; (xix) the risks that the consummation of the proposed

business combination is substantially delayed or does not occur; (xx) risks associated with the oil and gas industry in general (e.g.,

operational risks in development, exploration and production; disruptions to the Canadian and global economy resulting from major public

health events, the Russian-Ukrainian war and the impact on the global economy and commodity prices; the impacts of inflation and supply

chain issues and steps taken by central banks to curb inflation; pandemic, war, terrorist events, political upheavals and other similar

events; events impacting the supply and demand for oil and gas including the COVID-19 pandemic and actions taken by the OPEC + group;

delays or changes in plans with respect to exploration or development projects or capital expenditures); (xxi) the uncertainty of reserve

estimates; (xxii) the uncertainty of estimates and projections relating to production, costs and expenses; (xxiii) health, safety and

environmental risks; (xxiv) commodity price and exchange rate fluctuations; (xxv) changes in legislation affecting the oil and gas industry;

(xxvi) uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital

expenditures; and (xxvii) the risk that the Potential Refinancing is unsuccessful or does not occur. The foregoing list of factors is

not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk

Factors” section of MBSC’s registration on Form S-1 (Registration Nos. 333-256017 and 333-260423), MBSC’s annual report

on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 31, 2023, MBSC’s quarterly report on Form 10-Q for

the quarter ended March 31, 2023 filed with the SEC on June 2, 2023, the Registration Statement and definitive proxy statement/prospectus

of PubCo, effective August 14, 2023, including those under “Risk Factors” therein, MBSC’s quarterly report on Form

10-Q for the quarter ended June 30, 2023 filed with the SEC on August 18, 2023, and other documents filed by MBSC or PubCo from time

to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they

are made. Readers are cautioned not to put undue reliance on forward-looking statements, and PubCo, MBSC and Greenfire assume no obligation

and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither PubCo, MBSC nor Greenfire gives any assurance that either PubCo, MBSC nor Greenfire will achieve its expectations.

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

M3-BRIGADE ACQUISITION III CORP. |

| |

|

|

| Date: September 12, 2023 |

By: |

/s/ Mohsin Y. Meghji |

| |

|

Name: |

Mohsin Y. Meghji |

| |

|

Title: |

Executive Chairman of the Board of Directors |

3

v3.23.2

Cover

|

Sep. 11, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 11, 2023

|

| Entity File Number |

001-40946

|

| Entity Registrant Name |

M3-BRIGADE ACQUISITION III CORP.

|

| Entity Central Index Key |

0001856589

|

| Entity Tax Identification Number |

86-3185502

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1700 Broadway

|

| Entity Address, Address Line Two |

19th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

202-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A common stock and one-third of one redeemable public warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A common stock and one-third of one redeemable public warrant

|

| Trading Symbol |

MBSC.U

|

| Security Exchange Name |

NYSE

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

MBSC

|

| Security Exchange Name |

NYSE

|

| Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

MBSC WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBSC_UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemablePublicWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBSC_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBSC_PublicWarrantsEachWholePublicWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

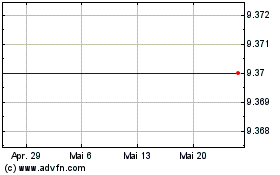

M3 Brigade Acquisition III (NYSE:MBSC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

M3 Brigade Acquisition III (NYSE:MBSC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024