Ladder Announces Pricing of $500 Million Senior Notes Offering

20 Juni 2024 - 11:30PM

Business Wire

Ladder Capital Corp (“Ladder,” the “Company,” “we” or “our”)

(NYSE: LADR) announced today that its subsidiaries, Ladder Capital

Finance Holdings LLLP (the “Issuer”) and Ladder Capital Finance

Corporation (the “Co-Issuer” and collectively with the Issuer, the

“Issuers”), have priced a private offering of $500 million in

aggregate principal amount of 7.000% Senior Notes due 2031 (the

“Notes”). The sale of the Notes is expected to be completed on or

about July 5, 2024, subject to customary closing conditions. The

Notes will be the Issuers’ senior unsecured obligations and will be

guaranteed on a senior unsecured basis by the Company and each of

the Issuers’ wholly owned domestic subsidiaries that guarantees the

Issuers’ outstanding notes.

The Issuers intend to use a portion of the net proceeds of this

offering to repay certain existing secured indebtedness, with the

remaining net proceeds to be used for general corporate purposes.

Moody’s Ratings has affirmed the Ba1 long-term corporate family

rating of the Company with outlook revised to positive and upgraded

the backed senior unsecured notes ratings of the Issuer to Ba1.

Fitch Ratings affirmed the long-term issuer default ratings and

senior unsecured debt ratings of the Issuers at BB+ and revised the

rating outlook to positive. S&P Global Ratings raised its

issuer credit and issue ratings on the Issuer and the Issuer’s

senior unsecured notes to BB with a stable outlook.

The Notes were offered to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”), and to

non-U.S. persons outside the United States pursuant to Regulation S

under the Securities Act. The Notes have not been registered under

the Securities Act and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements. This press release does not constitute

an offer to sell the Notes or a solicitation for an offer to

purchase the Notes.

About Ladder

Ladder Capital Corp is an internally-managed commercial real

estate investment trust with $5.3 billion of assets as of March 31,

2024. Our investment objective is to preserve and protect

shareholder capital while producing attractive risk-adjusted

returns. As one of the nation’s leading commercial real estate

capital providers, we specialize in underwriting commercial real

estate and offering flexible capital solutions within a

sophisticated platform.

Ladder originates and invests in a diverse portfolio of

commercial real estate and real estate-related assets, focusing on

senior secured assets. Our investment activities include: (i) our

primary business of originating senior first mortgage fixed and

floating rate loans collateralized by commercial real estate with

flexible loan structures; (ii) owning and operating commercial real

estate, including net leased commercial properties; and (iii)

investing in investment grade securities secured by first mortgage

loans on commercial real estate.

Founded in 2008, Ladder is run by a highly experienced

management team with extensive expertise in all aspects of the

commercial real estate industry, including origination, credit,

underwriting, structuring, capital markets and asset management.

Members of Ladder’s management and board of directors are highly

aligned with the Company’s investors, owning over 11% of the

Company’s equity. Ladder is headquartered in New York City with

regional offices in Miami, Florida and Los Angeles, California.

Forward-Looking Statements

Certain statements in this release may constitute

“forward-looking” statements, including those regarding the Notes

offering and the intended use of proceeds from the Notes offering.

These statements are based on management’s current opinions,

expectations, beliefs, plans, objectives, assumptions or

projections regarding future events or future results. These

forward-looking statements are only predictions, not historical

fact, and involve certain risks and uncertainties, as well as

assumptions. Actual results, levels of activity, performance,

achievements and events could differ materially from those stated,

anticipated or implied by such forward-looking statements. While

Ladder believes that its assumptions are reasonable, it is very

difficult to predict the impact of known factors, and, of course,

it is impossible to anticipate all factors that could affect actual

results on the Company’s business. There are a number of risks and

uncertainties that could cause actual results to differ materially

from forward-looking statements made herein including, most

prominently, market factors affecting the Notes offering and the

risks discussed under the heading “Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, as

well as its consolidated financial statements, related notes, and

other financial information appearing therein, and its other

filings with the U.S. Securities and Exchange Commission. Such

forward-looking statements are made only as of the date of this

release. Ladder expressly disclaims any obligation or undertaking

to release any updates or revisions to any forward-looking

statements contained herein to reflect any change in its

expectations with regard thereto or changes in events, conditions,

or circumstances on which any such statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240620669981/en/

Ladder Capital Corp Investor Relations 917-369-3207

investor.relations@laddercapital.com

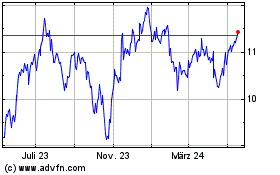

Ladder Capital (NYSE:LADR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Ladder Capital (NYSE:LADR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025