Global Unit Case Volume Declined 1%

Net Revenues Declined 1%; Organic Revenues

(Non-GAAP) Grew 9%

Operating Income Declined 23%; Comparable

Currency Neutral Operating Income (Non-GAAP) Grew 14%

Operating Margin Was 21.2% Versus 27.4% in the

Prior Year; Comparable Operating Margin (Non-GAAP) Was 30.7% Versus

29.7% in the Prior Year

EPS Declined 7% to $0.66; Comparable EPS

(Non-GAAP) Grew 5% to $0.77

The Coca-Cola Company today reported third quarter 2024 results.

“Our business continues to demonstrate resilience in the face of a

dynamic external environment,” said James Quincey, Chairman and CEO

of The Coca-Cola Company. “We are encouraged by our year-to-date

performance and our system’s ability to manage near-term challenges

while also remaining focused on long-term growth

opportunities.”

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241023695370/en/

Highlights

Quarterly Performance

- Revenues: Net revenues declined 1% to $11.9 billion, and

organic revenues (non-GAAP) grew 9%. Revenue performance included

10% growth in price/mix and a 2% decline in concentrate sales.

Concentrate sales were 1 point behind unit case volume, primarily

due to the timing of concentrate shipments.

- Operating margin: Operating margin, which includes items

impacting comparability, was 21.2% versus 27.4% in the prior year,

while comparable operating margin (non-GAAP) was 30.7% versus 29.7%

in the prior year. The operating margin decline was driven by items

impacting comparability, including a charge of $919 million related

to the remeasurement of the contingent consideration liability to

fair value in conjunction with the acquisition of fairlife, LLC

(“fairlife”) in 2020, as well as currency headwinds. Comparable

operating margin (non-GAAP) expansion was primarily driven by

strong organic revenue (non-GAAP) growth and the impact of

refranchising bottling operations, partially offset by currency

headwinds.

- Earnings per share: EPS declined 7% to $0.66, while

comparable EPS (non-GAAP) grew 5% to $0.77. EPS performance

included the impact of a 13-point currency headwind, while

comparable EPS (non-GAAP) performance included the impact of a

9-point currency headwind.

- Market share: The company gained value share in total

nonalcoholic ready-to-drink (NARTD) beverages.

- Cash flow: Cash flow from operations and free cash flow

(non-GAAP) were $2.9 billion and $1.6 billion, respectively. Both

decreased versus the prior year, primarily due to a $6.0 billion

payment made to the IRS related to ongoing tax litigation (“IRS tax

litigation deposit”). Free cash flow excluding the IRS tax

litigation deposit (non-GAAP) was $7.6 billion, a decrease of $294

million versus the prior year, largely due to higher other tax

payments, higher capital expenditures and cycling working capital

benefits, partially offset by strong business performance.

Company Updates

- Fulfilling consumer needs with a powerful total beverage

portfolio: In addition to clear leadership within the sparkling

portfolio, the company is using its refreshed resource allocation

capabilities to prioritize growing brands across categories that

add incremental system profit over the long term. The company’s

water, sports and tea offerings consist of 12 billion-dollar brands

and have added nearly $9 billion in incremental brand value since

2020. This year’s Olympic and Paralympic Games demonstrated how the

Coca-Cola system can leverage partnerships to drive business growth

across its non-sparkling portfolio to create connections and drive

recruitment. During the opening and closing ceremonies in Paris, a

special-edition smartwater gold bottle for athletes quickly

garnered 42 million impressions and contributed to smartwater

gaining both volume and value share during the quarter. The company

continued to advance Powerade’s global “Pause is Power” platform,

which is yielding positive results. Outside of the United States,

Powerade is the leading sports beverage brand and, year-to-date,

has expanded distribution and grown value share through global

system activations. Across markets such as Europe and Eurasia and

Middle East, Fuze Tea’s “Made of Fusion” platform has led to

year-to-date retail value growth three times faster than the

industry. Finally, in North America, Topo Chico leads the premium

sparkling water category in both volume and value share. Successful

innovations like Topo Chico Sabores are attracting new consumers to

the brand, leading to an over 20% increase in household penetration

so far this year. The company remains relentlessly consumer centric

and continues to position its total beverage portfolio to meet

evolving consumer needs.

- Scaling digital capabilities to enhance the strategic growth

flywheel: The company is leveraging leading digital

technologies – including generative AI, analytical AI, machine

learning and other tools – to drive agility, productivity and

innovation. In partnership with WPP, the company is an early

adopter of innovative generative AI technology from NVIDIA, which

provides AI-powered capabilities to create customizable, on-demand

advertisements and point-of-sale imagery. This globally scalable

platform offers customers instant access to locally relevant

marketing materials that reflect personalized food preferences and

passion points, resulting in more effective consumer messaging,

faster speed to market and lower costs. To elevate the company's

revenue growth management capabilities, the company is piloting an

AI-based price-pack-channel optimization tool to drive increased

volume and retail sales. Additionally, AI is being used in the

research and development process to enhance product innovation

success rates and speed to launch by more accurately gauging

consumer reactions through multi-sensorial facial coding during

product testing. This data helps the company identify and

incorporate unique flavors and aromas into new product

developments, including the successful reformulations of Sprite and

Fanta. Together, these initiatives demonstrate the company's

commitment to harnessing the power of digital technology as a

capability, a medium and a disruptor to drive sustainable growth

and deliver exceptional value to consumers and customers.

Operating Review – Three

Months Ended September 27, 2024

Revenues and

Volume

Percent Change

Concentrate Sales1

Price/Mix

Currency Impact

Acquisitions, Divestitures and

Structural Changes, Net

Reported Net Revenues

Organic Revenues2

Unit Case Volume3

Consolidated

(2)

10

(5)

(4)

(1)

9

(1)

Europe, Middle East & Africa

(7)

9

(10)

0

(7)

2

(2)

Latin America

2

21

(20)

0

4

24

0

North America

1

11

0

0

12

12

0

Asia Pacific

(4)

7

(7)

0

(4)

3

(2)

Global Ventures4

1

(3)

2

0

0

(2)

1

Bottling Investments

(1)

4

(1)

(32)

(29)

4

(31)

Operating Income and

EPS

Percent Change

Reported Operating Income

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

Operating Income2

Consolidated

(23)

(27)

(10)

14

Europe, Middle East & Africa

(14)

(3)

(9)

(2)

Latin America

(5)

(14)

(23)

32

North America

10

(6)

0

16

Asia Pacific

(7)

(10)

(8)

12

Global Ventures

(5)

(8)

0

3

Bottling Investments

(68)

0

(5)

(63)

Percent Change

Reported EPS

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

EPS2

Consolidated

(7)

(12)

(9)

13

Note: Certain rows may not add due to

rounding.

1

For Bottling Investments, this represents

the percent change in net revenues attributable to the increase

(decrease) in unit case volume computed based on total sales

(rather than average daily sales) in each of the corresponding

periods after considering the impact of structural changes, if

any.

2

Organic revenues, comparable currency

neutral operating income and comparable currency neutral EPS are

non-GAAP financial measures. Refer to the Reconciliation of GAAP

and Non-GAAP Financial Measures section.

3

Unit case volume is computed based on

average daily sales.

4

Due to the combination of multiple

business models in the Global Ventures operating segment, the

composition of concentrate sales and price/mix may fluctuate

materially from period to period. Therefore, the company places

greater focus on revenue growth as the best indicator of underlying

performance of the Global Ventures operating segment.

In addition to the data in the preceding tables, operating

results included the following:

Consolidated

- Unit case volume declined 1%. Growth led by Brazil, the

Philippines and Japan was more than offset by declines in China,

Mexico and Türkiye. Unit case volume performance included the

following:

- Sparkling soft drinks and Trademark Coca-Cola were both even as

growth in Latin America, North America and Asia Pacific was offset

by a decline in Europe, Middle East and Africa. Coca-Cola Zero

Sugar grew 11%, driven by growth across all geographic operating

segments. Sparkling flavors declined 1% as growth in North America

and Asia Pacific was more than offset by declines in Europe, Middle

East and Africa and Latin America.

- Juice, value-added dairy and plant-based beverages declined 3%

as strong growth in fairlife® in the United States was more than

offset by declines in Minute Maid® Pulpy in Asia Pacific and Mazoe®

in Africa.

- Water, sports, coffee and tea declined 4%. Water declined 6%,

driven by declines across all geographic operating segments. Sports

drinks declined 3% as growth in Europe, Middle East and Africa was

more than offset by declines across all other geographic operating

segments. Coffee declined 6%, primarily due to the performance of

Costa® coffee in the United Kingdom. Tea grew 7%, driven by growth

in Asia Pacific, Latin America and Europe, Middle East and

Africa.

- Price/mix grew 10%. Approximately 4 points were driven by

pricing from markets experiencing intense inflation, with the

remainder driven by pricing actions in the marketplace and

favorable mix. Concentrate sales were 1 point behind unit case

volume, primarily due to the timing of concentrate shipments.

- Operating income declined 23%, which included items impacting

comparability and a 15-point currency headwind. Comparable currency

neutral operating income (non-GAAP) grew 14%, primarily driven by

organic revenue (non-GAAP) growth across all geographic operating

segments.

Europe, Middle East &

Africa

- Unit case volume declined 2% as growth in water, sports, coffee

and tea was more than offset by declines in Trademark Coca-Cola,

sparkling flavors and juice, value-added dairy and plant-based

beverages.

- Price/mix grew 9%, primarily driven by pricing from markets

experiencing intense inflation as well as pricing actions across

operating units, partially offset by unfavorable mix. Concentrate

sales were 5 points behind unit case volume, primarily due to the

timing of concentrate shipments.

- Operating income declined 14%, which included items impacting

comparability and a 12-point currency headwind. Comparable currency

neutral operating income (non-GAAP) declined 2%, as organic revenue

(non-GAAP) growth and the timing of marketing investments was more

than offset by higher input costs and operating expenses.

- The company gained value share in total NARTD beverages, led by

share gains in Romania, France and South Africa.

Latin America

- Unit case volume was even as growth in Trademark Coca-Cola was

offset by declines in water, sports, coffee and tea and sparkling

flavors.

- Price/mix grew 21%. Approximately two-thirds of the growth was

driven by the impact of inflationary pricing in Argentina, with the

remainder driven by pricing actions in the marketplace. Concentrate

sales were 2 points ahead of unit case volume, primarily due to the

timing of concentrate shipments.

- Operating income declined 5%, which included items impacting

comparability and a 28-point currency headwind. Comparable currency

neutral operating income (non-GAAP) grew 32%, primarily driven by

strong organic revenue (non-GAAP) growth, partially offset by an

increase in marketing investments and higher operating

expenses.

- The company lost value share in total NARTD beverages, driven

by share losses in Mexico and Brazil.

North America

- Unit case volume was even as growth in Trademark Coca-Cola,

juice, value-added dairy and plant-based beverages and sparkling

flavors was offset by a decline in water, sports, coffee and

tea.

- Price/mix grew 11%, driven by favorable mix and pricing actions

in the marketplace. Concentrate sales were 1 point ahead of unit

case volume, primarily due to the timing of concentrate

shipments.

- Operating income grew 10%, which included items impacting

comparability. Comparable currency neutral operating income

(non-GAAP) grew 16%, primarily driven by strong organic revenue

(non-GAAP) growth, partially offset by higher input costs and an

increase in marketing investments.

- The company gained value share in total NARTD beverages, driven

by share gains in Trademark Coca-Cola and juice, value-added dairy

and plant-based beverages.

Asia Pacific

- Unit case volume declined 2%, as growth in Trademark Coca-Cola

was more than offset by declines in water, sports, coffee and tea,

and juice, value-added dairy and plant-based beverages.

- Price/mix grew 7%, driven by favorable mix and pricing actions

in the marketplace. Concentrate sales were 2 points behind unit

case volume, primarily due to the timing of concentrate

shipments.

- Operating income declined 7%, which included items impacting

comparability and an 18-point currency headwind. Comparable

currency neutral operating income (non-GAAP) grew 12%, driven by

organic revenue (non-GAAP) growth and the timing of marketing

investments, partially offset by higher input costs.

- The company gained value share in total NARTD beverages, led by

share gains in the Philippines, Japan and South Korea.

Global Ventures

- Net revenues were even, and organic revenues (non-GAAP)

declined 2%, as favorable pricing initiatives were offset by

unfavorable product mix.

- Operating income declined 5%, which included items impacting

comparability. Comparable currency neutral operating income

(non-GAAP) grew 3%, driven by product mix.

Bottling Investments

- Unit case volume declined 31%, largely due to the impact of

refranchising bottling operations.

- Price/mix grew 4%, driven by pricing actions across most

markets as well as favorable mix.

- Operating income declined 68%, which included a 4-point

currency headwind and the impact of refranchising bottling

operations. Comparable currency neutral operating income (non-GAAP)

declined 63%.

Operating Review – Nine Months

Ended September 27, 2024

Revenues and

Volume

Percent Change

Concentrate Sales1

Price/Mix

Currency Impact

Acquisitions, Divestitures and

Structural Changes, Net

Reported Net Revenues

Organic Revenues2

Unit Case Volume3

Consolidated

1

11

(6)

(4)

2

12

1

Europe, Middle East & Africa

(3)

19

(17)

0

(1)

16

0

Latin America

4

21

(14)

0

11

25

3

North America

0

10

0

0

10

10

(1)

Asia Pacific

1

4

(5)

0

0

5

0

Global Ventures4

2

(2)

1

0

1

0

2

Bottling Investments

5

6

(2)

(28)

(20)

10

(22)

Operating Income and

EPS

Percent Change

Reported Operating Income

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

Operating Income2

Consolidated

(19)

(24)

(10)

15

Europe, Middle East & Africa

(3)

0

(16)

13

Latin America

6

(3)

(17)

26

North America

(10)

(22)

0

11

Asia Pacific

2

0

(6)

8

Global Ventures

7

(1)

1

7

Bottling Investments

(25)

(1)

(3)

(20)

Percent Change

Reported EPS

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

EPS2

Consolidated

(3)

(9)

(9)

15

Note: Certain rows may not add due to

rounding.

1

For Bottling Investments, this represents

the percent change in net revenues attributable to the increase

(decrease) in unit case volume computed based on total sales

(rather than average daily sales) in each of the corresponding

periods after considering the impact of structural changes, if

any.

2

Organic revenues, comparable currency

neutral operating income and comparable currency neutral EPS are

non-GAAP financial measures. Refer to the Reconciliation of GAAP

and Non-GAAP Financial Measures section.

3

Unit case volume is computed based on

average daily sales.

4

Due to the combination of multiple

business models in the Global Ventures operating segment, the

composition of concentrate sales and price/mix may fluctuate

materially from period to period. Therefore, the company places

greater focus on revenue growth as the best indicator of underlying

performance of the Global Ventures operating segment.

Outlook

The 2024 and 2025 outlook information provided below includes

forward-looking non-GAAP financial measures, which management uses

in measuring performance. The company is not able to reconcile

full-year 2024 projected organic revenues (non-GAAP) to full-year

2024 projected reported net revenues, full-year 2024 projected

comparable net revenues (non-GAAP) to full-year 2024 projected

reported net revenues, full-year 2024 projected underlying

effective tax rate (non-GAAP) to full-year 2024 projected reported

effective tax rate, full-year 2024 projected comparable currency

neutral EPS (non-GAAP) to full-year 2024 projected reported EPS,

full-year 2024 projected comparable EPS (non-GAAP) to full-year

2024 projected reported EPS, full-year 2025 projected comparable

net revenues (non-GAAP) to full-year 2025 projected reported net

revenues, or full-year 2025 projected comparable EPS (non-GAAP) to

full-year 2025 projected reported EPS without unreasonable efforts

because it is not possible to predict with a reasonable degree of

certainty the exact timing and exact impact of acquisitions,

divestitures and structural changes throughout 2024; the exact

timing and exact amount of items impacting comparability throughout

2024 and 2025; and the exact impact of fluctuations in foreign

currency exchange rates throughout 2024 and 2025. The unavailable

information could have a significant impact on the company’s

full-year 2024 and full-year 2025 reported financial results.

Full Year 2024

The company expects to deliver organic revenue (non-GAAP) growth

of approximately 10%, which consists of operating performance at

the high end of the company’s long-term growth model and the

anticipated pricing impact of a number of markets experiencing

intense inflation. — Updated

For comparable net revenues (non-GAAP), the company expects an

approximate 5% currency headwind based on the current rates and

including the impact of hedged positions. Comparable EPS (non-GAAP)

percentage growth is expected to include an approximate 9% currency

headwind based on the current rates and including the impact of

hedged positions. The majority of currency headwinds are due to

devaluation resulting from intense inflation. — Updated

For comparable net revenues (non-GAAP), the company expects a 4%

to 5% headwind from acquisitions, divestitures and structural

changes. Comparable EPS (non-GAAP) is expected to include a 1% to

2% headwind from acquisitions, divestitures and structural changes.

— No Update

The company’s underlying effective tax rate (non-GAAP) is

estimated to be 18.8%. This does not include the impact of ongoing

tax litigation with the U.S. Internal Revenue Service, if the

company were not to prevail. — Updated

The company expects to deliver comparable currency neutral EPS

(non-GAAP) growth of 14% to 15%. — Updated

The company expects comparable EPS (non-GAAP) growth of 5% to

6%, versus $2.69 in 2023. — No Update

The company expects to generate free cash flow excluding the IRS

tax litigation deposit (non-GAAP) of approximately $9.2 billion.

This consists of cash flow from operations excluding the IRS tax

litigation deposit (non-GAAP) of approximately $11.4 billion, less

capital expenditures of approximately $2.2 billion. — No Update

Fourth Quarter 2024

Considerations — New

Comparable net revenues (non-GAAP) are expected to include an

approximate 4% currency headwind based on the current rates and

including the impact of hedged positions, in addition to a 4% to 5%

headwind from acquisitions, divestitures and structural

changes.

Comparable EPS (non-GAAP) percentage growth is expected to

include an approximate 10% currency headwind based on the current

rates and including the impact of hedged positions, in addition to

a 3% to 4% headwind from acquisitions, divestitures and structural

changes.

Full Year 2025

Considerations — New

Comparable net revenues (non-GAAP) are expected to include a low

single-digit currency headwind based on the current rates and

including the impact of hedged positions.

Comparable EPS (non-GAAP) percentage growth is expected to

include a mid single-digit currency headwind based on the current

rates and including the impact of hedged positions.

The company expects elevated interest expense resulting from the

debt issued to pay the IRS tax litigation deposit and the upcoming

fairlife contingent consideration payment.

The company will provide full-year 2025 guidance when it reports

fourth quarter earnings.

Notes

- All references to growth rate percentages and share compare the

results of the period to those of the prior year comparable period,

unless otherwise noted.

- All references to volume and volume percentage changes indicate

unit case volume, unless otherwise noted. All volume percentage

changes are computed based on average daily sales, unless otherwise

noted. “Unit case” means a unit of measurement equal to 192 U.S.

fluid ounces of finished beverage (24 eight-ounce servings), with

the exception of unit case equivalents for Costa non-ready-to-drink

beverage products which are primarily measured in number of

transactions. “Unit case volume” means the number of unit cases (or

unit case equivalents) of company beverages directly or indirectly

sold by the company and its bottling partners to customers or

consumers.

- “Concentrate sales” represents the amount of concentrates,

syrups, beverage bases, source waters and powders/minerals (in all

instances expressed in unit case equivalents) sold by, or used in

finished beverages sold by, the company to its bottling partners or

other customers. For Costa non-ready-to-drink beverage products,

“concentrate sales” represents the amount of beverages, primarily

measured in number of transactions (in all instances expressed in

unit case equivalents) sold by the company to customers or

consumers. In the reconciliation of reported net revenues,

“concentrate sales” represents the percent change in net revenues

attributable to the increase (decrease) in concentrate sales volume

for the geographic operating segments and the Global Ventures

operating segment after considering the impact of structural

changes, if any. For the Bottling Investments operating segment,

this represents the percent change in net revenues attributable to

the increase (decrease) in unit case volume computed based on total

sales (rather than average daily sales) in each of the

corresponding periods after considering the impact of structural

changes, if any. The Bottling Investments operating segment

reflects unit case volume growth for consolidated bottlers

only.

- “Price/mix” represents the change in net operating revenues

caused by factors such as price changes, the mix of products and

packages sold, and the mix of channels and geographic territories

where the sales occurred.

- First quarter 2024 financial results were impacted by one less

day as compared to first quarter 2023, and fourth quarter 2024

financial results will be impacted by two additional days as

compared to fourth quarter 2023. Unit case volume results for the

quarters are not impacted by the variances in days due to the

average daily sales computation referenced above.

Conference Call

The company is hosting a conference call with investors and

analysts to discuss third quarter operating results today, Oct. 23,

2024, at 8:30 a.m. ET. The company invites participants to listen

to a live webcast of the conference call on the company’s website,

http://www.coca-colacompany.com, in the “Investors” section. An

audio replay in downloadable digital format and a transcript of the

call will be available on the website within 24 hours following the

call. Further, the “Investors” section of the website includes

certain supplemental information and a reconciliation of non-GAAP

financial measures to the company’s results as reported under GAAP,

which may be used during the call when discussing financial

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023695370/en/

Investors and Analysts: Robin

Halpern, koinvestorrelations@coca-cola.com Media: Scott Leith, sleith@coca-cola.com

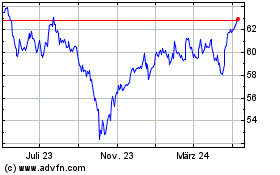

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

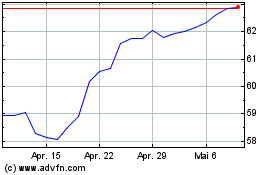

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Nov 2023 bis Nov 2024