Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Juni 2023 - 5:21PM

Edgar (US Regulatory)

Nuveen

Preferred

&

Income

Securities

Fund

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Principal

Amount

(000)

/

Shares

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

LONG-TERM

INVESTMENTS

-

154.2%

(99.5%

of

Total

Investments)

X

1,181,543,504

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

79.0%

(51.0%

of

Total

Investments)

X

1,181,543,504

Banks

-

35.6%

$

9,300

Bank

of

America

Corp

6.500%

N/A

(3)

BBB+

$

9,271,356

2,861

Bank

of

America

Corp

(4)

8.050%

6/15/27

Baa2

3,109,735

45,134

Bank

of

America

Corp

(4)

6.125%

N/A

(3)

BBB+

43,760,225

5,300

Bank

of

America

Corp

6.100%

N/A

(3)

BBB+

5,200,625

6,800

Bank

of

America

Corp

4.375%

N/A

(3)

BBB+

5,797,000

3,000

Bank

of

Nova

Scotia/The

4.900%

N/A

(3)

BBB-

2,744,827

10,550

Bank

of

Nova

Scotia/The

8.625%

10/27/82

BBB-

10,819,558

19,799

Citigroup

Inc

(4)

4.000%

N/A

(3)

BBB-

17,246,909

8,500

Citigroup

Inc

(4)

4.150%

N/A

(3)

BBB-

6,991,250

20,700

Citigroup

Inc

(5)

3.875%

N/A

(3)

BBB-

17,672,625

4,520

Citigroup

Inc

7.375%

N/A

(3)

BBB-

4,463,500

3,400

Citizens

Financial

Group

Inc

(4)

6.375%

N/A

(3)

Baa3

2,941,000

3,976

Citizens

Financial

Group

Inc

(4)

5.650%

N/A

(3)

Baa3

3,599,080

7,500

Citizens

Financial

Group

Inc

4.000%

N/A

(3)

Baa3

5,831,250

5,000

CoBank

ACB

6.450%

N/A

(3)

BBB+

4,712,111

14,000

CoBank

ACB

(4)

6.250%

N/A

(3)

BBB+

13,178,200

11,030

Comerica

Inc

(4)

5.625%

N/A

(3)

Baa3

9,310,141

6,100

Corestates

Capital

III

(3-Month

LIBOR

reference

rate

+

0.570%

spread),

144A

(4),(6)

5.434%

2/15/27

A1

5,673,539

2,500

Goldman

Sachs

Group

Inc

/The

3.800%

N/A

(3)

BBB-

2,071,875

30,000

HSBC

Capital

Funding

Dollar

1

LP,

144A

(4),(5)

10.176%

N/A

(3)

BBB

36,587,154

11,000

Huntington

Bancshares

Inc

/OH

(4)

5.625%

N/A

(3)

Baa3

9,812,266

24,000

Huntington

Bancshares

Inc

/OH

(4)

4.450%

N/A

(3)

Baa3

19,857,600

4,000

JPMorgan

Chase

&

Co

(4)

6.100%

N/A

(3)

BBB+

3,957,880

33,990

JPMorgan

Chase

&

Co

6.750%

N/A

(3)

BBB+

33,949,212

2,000

JPMorgan

Chase

&

Co

3.650%

N/A

(3)

BBB+

1,753,400

8,000

KeyCorp

Capital

III

(4)

7.750%

7/15/29

Baa2

7,961,495

4,300

M&T

Bank

Corp

3.500%

N/A

(3)

Baa2

2,827,250

6,200

PNC

Financial

Services

Group

Inc

/The

(4)

3.400%

N/A

(3)

Baa2

4,743,463

25,500

PNC

Financial

Services

Group

Inc

/The

6.250%

N/A

(3)

Baa2

23,370,750

3,000

PNC

Financial

Services

Group

Inc

/The

6.000%

N/A

(3)

Baa2

2,782,500

16,325

PNC

Financial

Services

Group

Inc

/The

6.200%

N/A

(3)

Baa2

15,373,376

4,100

PNC

Financial

Services

Group

Inc

/The

(3-Month

LIBOR

reference

rate

+

3.678%

spread)

(6)

3.804%

N/A

(3)

Baa2

4,080,184

2,000

Regions

Financial

Corp

5.750%

N/A

(3)

Baa3

1,890,491

24,100

Standard

Chartered

PLC,

144A

(5)

7.014%

N/A

(3)

BBB-

23,149,641

32,700

Toronto-Dominion

Bank/The

(4)

8.125%

10/31/82

Baa1

33,305,931

35,900

Truist

Financial

Corp

(5)

4.950%

N/A

(3)

Baa2

33,731,640

36,386

Truist

Financial

Corp

(5)

4.800%

N/A

(3)

Baa2

31,610,337

22,580

Wells

Fargo

&

Co

(4)

7.950%

11/15/29

Baa1

25,169,110

47,650

Wells

Fargo

&

Co

(4)

3.900%

N/A

(3)

Baa2

41,464,673

Total

Banks

531,773,159

Capital

Markets

-

9.3%

10,000

Bank

of

New

York

Mellon

Corp/The

3.700%

N/A

(3)

Baa1

8,831,100

35,600

Bank

of

New

York

Mellon

Corp/The

3.750%

N/A

(3)

Baa1

29,748,784

17,533

Bank

of

New

York

Mellon

Corp/The

4.700%

N/A

(3)

Baa1

17,072,759

33,705

Charles

Schwab

Corp/The

(5)

5.375%

N/A

(3)

Baa2

32,082,947

15,500

Charles

Schwab

Corp/The

4.000%

N/A

(3)

Baa2

13,000,935

7,500

Depository

Trust

&

Clearing

Corp/The,

144A

3.375%

N/A

(3)

A

5,632,085

7,600

Goldman

Sachs

Group

Inc

/The

4.950%

N/A

(3)

BBB-

7,105,712

18,000

Goldman

Sachs

Group

Inc

/The

3.650%

N/A

(3)

BBB-

14,703,750

Nuveen

Preferred

&

Income

Securities

Fund

(continued)

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Principal

Amount

(000)

/

Shares

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

Capital

Markets

(continued)

$

12,000

Goldman

Sachs

Group

Inc

/The

5.500%

N/A

(3)

BBB-

$

11,578,434

Total

Capital

Markets

139,756,506

Commercial

Banks

-

0.7%

8,000

HSBC

Capital

Funding

Dollar

1

LP,

Reg

S

10.176%

N/A

(3)

BBB

9,756,574

Total

Commercial

Banks

9,756,574

Consumer

Finance

-

3.5%

8,500

Ally

Financial

Inc

4.700%

N/A

(3)

Ba2

6,268,750

7,400

Ally

Financial

Inc

4.700%

N/A

(3)

Ba2

5,198,500

30,500

American

Express

Co

3.550%

N/A

(3)

Baa2

25,625,465

8,000

Capital

One

Financial

Corp

(4)

3.950%

N/A

(3)

Baa3

5,901,105

10,000

Discover

Financial

Services

(4)

6.125%

N/A

(3)

Ba1

9,466,813

Total

Consumer

Finance

52,460,633

Electric

Utilities

-

2.5%

8,500

American

Electric

Power

Co

Inc

(4)

3.875%

2/15/62

BBB

6,802,750

31,075

Duke

Energy

Corp

4.875%

N/A

(3)

BBB-

29,865,821

91

Emera

Inc

6.750%

6/15/76

BB+

86,669

Total

Electric

Utilities

36,755,240

Financial

Services

-

2.1%

7,500

Citigroup

Inc

(3-Month

LIBOR

reference

rate

+

4.068%

spread)

(6)

9.341%

N/A

(3)

BBB-

7,477,500

12,800

Scentre

Group

Trust

2,

144A

(4)

4.750%

9/24/80

BBB+

11,521,280

12,700

Voya

Financial

Inc

6.125%

N/A

(3)

BBB-

12,232,386

Total

Financial

Services

31,231,166

Food

Products

-

0.4%

6,705

Dairy

Farmers

of

America

Inc

,

144A

(4)

7.125%

N/A

(3)

BB+

5,699,250

Total

Food

Products

5,699,250

Ground

Transportation

-

0.6%

9,500

BNSF

Funding

Trust

I

6.613%

12/15/55

A

9,134,817

Total

Ground

Transportation

9,134,817

Insurance

-

16.3%

3,598

ACE

Capital

Trust

II

(4)

9.700%

4/01/30

BBB+

4,283,680

8,400

Allianz

SE

3.500%

N/A

(3)

A

6,855,853

10,500

Allianz

SE,

144A

(4)

3.500%

N/A

(3)

A

8,569,816

7,200

American

International

Group

Inc

(4)

5.750%

4/01/48

BBB-

6,930,000

2,299

Aon

Corp

(4)

8.205%

1/01/27

BBB

2,344,980

2,100

Argentum

Netherlands

BV

for

Swiss

Re

Ltd

5.625%

8/15/52

BBB+

1,963,500

6,210

Argentum

Netherlands

BV

for

Swiss

Re

Ltd

(4)

5.750%

8/15/50

BBB+

5,953,838

1,550

Cloverie

PLC

for

Zurich

Insurance

Co

Ltd

5.625%

6/24/46

A+

1,526,750

3,989

Corebridge

Financial

Inc

,

144A

6.875%

12/15/52

BBB-

3,611,940

7,900

Legal

&

General

Group

PLC

5.250%

3/21/47

A3

7,464,664

29,600

MetLife

Capital

Trust

IV,

144A

(4)

7.875%

12/15/37

BBB

31,222,703

36,531

MetLife

Inc

,

144A

(4)

9.250%

4/08/38

BBB

43,015,252

11,300

MetLife

Inc

3.850%

N/A

(3)

BBB

10,509,000

3,000

MetLife

Inc

10.750%

8/01/39

BBB

3,898,292

41,904

Nationwide

Financial

Services

Inc

(4)

6.750%

5/15/37

Baa2

40,304,119

20,600

Nippon

Life

Insurance

Co,

144A

(4)

2.750%

1/21/51

A-

17,042,211

3,670

Prudential

Financial

Inc

(4)

5.625%

6/15/43

BBB+

3,662,513

6,500

Prudential

Financial

Inc

3.700%

10/01/50

BBB+

5,570,252

14,900

Sumitomo

Life

Insurance

Co,

144A

(4)

3.375%

4/15/81

A3

12,963,000

8,700

Willow

No

2

Ireland

PLC

for

Zurich

Insurance

Co

Ltd

4.250%

10/01/45

A+

8,050,771

Principal

Amount

(000)

/

Shares

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

Insurance

(continued)

$

23,794

Zurich

Finance

Ireland

Designated

Activity

Co

3.000%

4/19/51

A+

$

18,559,320

Total

Insurance

244,302,454

Machinery

-

0.3%

5,700

Stanley

Black

&

Decker

Inc

(4)

4.000%

3/15/60

BBB+

4,285,002

Total

Machinery

4,285,002

Multi-Utilities

-

4.0%

500

Algonquin

Power

&

Utilities

Corp

4.750%

1/18/82

BB+

404,377

42,533

Dominion

Energy

Inc

(5)

4.650%

N/A

(3)

BBB-

36,968,807

3,233

Dominion

Energy

Inc

4.350%

N/A

(3)

BBB-

2,715,720

20,900

NiSource

Inc

(5)

5.650%

N/A

(3)

BBB-

19,832,010

Total

Multi-Utilities

59,920,914

Oil,

Gas

&

Consumable

Fuels

-

2.6%

5,900

BP

Capital

Markets

PLC

(4)

4.375%

N/A

(3)

Baa1

5,659,939

5,800

Enbridge

Inc

(4)

7.625%

1/15/83

BBB-

5,907,773

16,000

Enbridge

Inc

(4)

5.750%

7/15/80

BBB-

14,646,672

10,934

Enterprise

Products

Operating

LLC

(4)

5.250%

8/16/77

BBB

9,468,844

4,560

Transcanada

Trust

(4)

5.600%

3/07/82

BBB-

3,855,661

Total

Oil,

Gas

&

Consumable

Fuels

39,538,889

Wireless

Telecommunication

Services

-

1.1%

16,516

Vodafone

Group

PLC

7.000%

4/04/79

BB+

16,928,900

Total

Wireless

Telecommunication

Services

16,928,900

Total

$1,000

Par

(or

similar)

Institutional

Preferred

(cost

$1,296,427,206)

1,181,543,504

Principal

Amount

(000)

Description

(1),(7)

Coupon

Maturity

Ratings

(2)

Value

X

779,259,016

CONTINGENT

CAPITAL

SECURITIES

-

52.1%

(33.6%

of

Total

Investments)

X

779,259,016

Banks

-

45.9%

$

2,800

Australia

&

New

Zealand

Banking

Group

Ltd/United

Kingdom,

144A

6.750%

N/A

(3)

Baa2

$

2,701,659

11,800

Banco

Bilbao

Vizcaya

Argentaria

SA

6.125%

N/A

(3)

Ba2

9,405,483

17,800

Banco

Bilbao

Vizcaya

Argentaria

SA

(5)

6.500%

N/A

(3)

Ba2

16,232,353

28,200

Banco

Santander

SA

(4)

7.500%

N/A

(3)

Ba1

27,072,000

6,200

Banco

Santander

SA

4.750%

N/A

(3)

Ba1

4,825,460

26,000

Barclays

PLC

8.000%

N/A

(3)

BBB-

23,982,400

63,300

Barclays

PLC

7.750%

N/A

(3)

BBB-

59,566,566

39,000

BNP

Paribas

SA,

144A

(4)

4.625%

N/A

(3)

BBB

30,611,100

2,500

BNP

Paribas

SA,

144A

7.750%

N/A

(3)

BBB

2,387,500

9,900

BNP

Paribas

SA,

144A

9.250%

N/A

(3)

BBB

10,181,160

38,585

BNP

Paribas

SA,

144A

(4)

7.375%

N/A

(3)

BBB

37,094,480

10,000

BNP

Paribas

SA

7.375%

N/A

(3)

BBB

9,613,705

5,500

BNP

Paribas

SA,

144A

7.000%

N/A

(3)

BBB

4,908,200

2,000

Credit

Agricole

SA,

144A

4.750%

N/A

(3)

BBB

1,538,000

4,466

Credit

Agricole

SA

8.125%

N/A

(3)

BBB

4,424,922

31,550

Credit

Agricole

SA,

144A

8.125%

N/A

(3)

BBB

31,259,803

19,653

Credit

Agricole

SA,

144A

7.875%

N/A

(3)

BBB

19,284,506

11,588

Danske

Bank

A/S

(4)

6.125%

N/A

(3)

BBB-

11,082,879

10,500

Danske

Bank

A/S

7.000%

N/A

(3)

BBB-

9,767,100

5,000

Danske

Bank

A/S

4.375%

N/A

(3)

BBB-

4,248,630

33,192

DNB

Bank

ASA

4.875%

N/A

(3)

BBB

30,951,540

1,600

HSBC

Holdings

PLC

(4)

6.000%

N/A

(3)

BBB

1,413,600

3,000

HSBC

Holdings

PLC

4.600%

N/A

(3)

BBB

2,266,875

4,900

HSBC

Holdings

PLC

8.000%

N/A

(3)

BBB

4,863,250

26,700

ING

Groep

NV

6.500%

N/A

(3)

BBB

24,676,528

Nuveen

Preferred

&

Income

Securities

Fund

(continued)

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1),(7)

Coupon

Maturity

Ratings

(2)

Value

Banks

(continued)

$

10,000

ING

Groep

NV

5.750%

N/A

(3)

BBB

$

8,708,549

9,600

Intesa

Sanpaolo

SpA

,

144A

7.700%

N/A

(3)

BB-

8,734,798

48,428

Lloyds

Banking

Group

PLC

7.500%

N/A

(3)

Baa3

46,578,777

3,000

Lloyds

Banking

Group

PLC

7.500%

N/A

(3)

Baa3

2,844,270

4,500

Lloyds

Banking

Group

PLC

6.750%

N/A

(3)

Baa3

4,144,384

8,500

Lloyds

Banking

Group

PLC

8.000%

N/A

(3)

Baa3

7,773,250

5,075

Macquarie

Bank

Ltd/London,

144A

(4)

6.125%

N/A

(3)

BB+

4,374,872

17,000

NatWest

Group

PLC

6.000%

N/A

(3)

Baa3

15,935,800

14,250

NatWest

Group

PLC

8.000%

N/A

(3)

BBB-

14,106,502

5,000

NatWest

Group

PLC

4.600%

N/A

(3)

Baa3

3,524,450

35,090

Nordea

Bank

Abp

,

144A

(4)

6.125%

N/A

(3)

BBB

32,908,519

18,988

Nordea

Bank

Abp

6.125%

N/A

(3)

BBB+

17,807,551

26,400

Nordea

Bank

Abp

,

144A

6.625%

N/A

(3)

BBB+

24,722,809

10,000

Skandinaviska

Enskilda

Banken

AB

5.125%

N/A

(3)

BBB+

9,119,640

9,000

Societe

Generale

SA

7.875%

N/A

(3)

BB+

8,598,600

4,550

Societe

Generale

SA,

144A

5.375%

N/A

(3)

BB+

3,185,000

73,300

Societe

Generale

SA,

144A

8.000%

N/A

(3)

BB

68,406,858

7,200

Svenska

Handelsbanken

AB

4.375%

N/A

(3)

A-

6,094,800

15,000

UniCredit

SpA

8.000%

N/A

(3)

BB-

14,478,750

Total

Banks

686,407,878

Capital

Markets

-

6.2%

10,800

UBS

Group

AG

5.125%

N/A

(3)

BBB

9,206,546

24,000

UBS

Group

AG,

144A

(5)

4.875%

N/A

(3)

BBB

18,660,000

25,000

UBS

Group

AG,

144A

(4)

3.875%

N/A

(3)

BBB

18,737,834

35,300

UBS

Group

AG

(4)

6.875%

N/A

(3)

BBB

31,814,125

10,000

UBS

Group

AG

(4)

3.875%

N/A

(3)

BBB

7,495,133

7,400

UBS

Group

AG,

144A

(4)

7.000%

N/A

(3)

BBB

6,937,500

Total

Capital

Markets

92,851,138

Total

Contingent

Capital

Securities

(cost

$871,118,403)

779,259,016

Shares

Description

(1)

Coupon

Ratings

(2)

Value

X

229,797,405

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

15.4%

(9.9%

of

Total

Investments)

X

229,797,405

Banks

-

4.2%

233,680

Associated

Banc-Corp

5.625%

Ba1

$

4,720,336

1,327

Bank

of

America

Corp

5.000%

BBB+

29,552

301,095

Bank

of

America

Corp

5.375%

BBB+

7,129,930

31,570

Bank

of

Hawaii

Corp

4.375%

Baa3

494,386

325,947

Citigroup

Inc

6.875%

BBB-

8,269,275

53,000

CoBank

ACB

6.200%

BBB+

5,061,500

64,366

Fifth

Third

Bancorp

6.625%

Baa3

1,576,967

50,000

Fifth

Third

Bancorp

4.950%

Baa3

1,140,000

212,493

Fulton

Financial

Corp

5.125%

Baa3

3,527,384

11,474

JPMorgan

Chase

&

Co

5.750%

BBB+

289,260

679,293

KeyCorp

6.125%

Baa3

15,277,300

189,461

KeyCorp

6.200%

Baa3

4,206,034

188,700

Regions

Financial

Corp

(4)

5.700%

Baa3

4,366,518

35,395

Synovus

Financial

Corp

5.875%

BB-

748,958

15,300

Truist

Financial

Corp

4.750%

Baa2

328,797

300

Washington

Federal

Inc

4.875%

Ba1

4,710

209,175

Wells

Fargo

&

Co

5.850%

Baa2

5,078,769

30,000

Wells

Fargo

&

Co

4.700%

Baa2

592,800

Total

Banks

62,842,476

Capital

Markets

-

2.4%

173,947

Affiliated

Managers

Group

Inc

4.750%

Baa1

3,468,503

112,294

Affiliated

Managers

Group

Inc

4.200%

Baa1

1,971,883

142,027

Affiliated

Managers

Group

Inc

5.875%

Baa1

3,598,964

Shares

Description

(1)

Coupon

Ratings

(2)

Value

Capital

Markets

(continued)

337,275

Goldman

Sachs

Group

Inc

/The

5.500%

BB+

$

8,465,603

604,790

Morgan

Stanley

5.850%

BBB

15,125,798

74,599

Northern

Trust

Corp

4.700%

BBB+

1,678,478

59,294

State

Street

Corp

5.900%

Baa1

1,440,844

3,993

Stifel

Financial

Corp

5.200%

BBB+

91,000

1,179

Stifel

Financial

Corp

4.500%

BB

19,312

Total

Capital

Markets

35,860,385

Consumer

Finance

-

0.3%

131,816

Capital

One

Financial

Corp

(4)

4.800%

Baa3

2,565,139

62,097

Capital

One

Financial

Corp

(4)

5.000%

Baa3

1,274,231

Total

Consumer

Finance

3,839,370

Diversified

Telecommunication

Services

-

0.9%

578,314

AT&T

Inc

4.750%

BBB-

12,075,196

19,067

AT&T

Inc

5.350%

BBB+

452,269

20,680

AT&T

Inc

(4)

5.000%

BBB-

460,337

5,341

AT&T

Inc

5.625%

BBB+

133,846

Total

Diversified

Telecommunication

Services

13,121,648

Electric

Utilities

-

1.5%

69,380

CMS

Energy

Corp

5.875%

BBB-

1,725,481

73,535

DTE

Energy

Co

4.375%

BBB-

1,593,503

153,939

Duke

Energy

Corp

(4)

5.750%

BBB-

3,963,929

3,028

Duke

Energy

Corp

5.625%

BBB-

75,851

57,794

Entergy

Arkansas

LLC

4.875%

A

1,350,068

7,795

Entergy

Louisiana

LLC

4.875%

A

185,209

4,746

Entergy

Mississippi

LLC

4.900%

A

112,955

16,000

Entergy

Texas

Inc

(4)

5.375%

BBB-

396,000

204,489

NextEra

Energy

Capital

Holdings

Inc

(5)

5.650%

BBB

5,251,278

195,057

Southern

Co/The

4.950%

BBB-

4,503,866

86,891

Southern

Co/The

5.250%

BBB-

2,168,799

56,928

Southern

Co/The

4.200%

BBB-

1,153,931

Total

Electric

Utilities

22,480,870

Equity

Real

Estate

Investment

Trusts

-

2.1%

1,030

Digital

Realty

Trust

Inc

5.250%

Baa3

23,216

9,405

Digital

Realty

Trust

Inc

5.200%

Baa3

209,543

123,095

Hudson

Pacific

Properties

Inc

4.750%

Ba1

1,144,783

30,310

Kimco

Realty

Corp

5.250%

Baa2

693,493

5,424

Kimco

Realty

Corp

5.125%

Baa2

123,016

85,281

Prologis

Inc

8.540%

BBB+

4,856,753

124,101

Public

Storage

(4)

4.750%

A3

2,727,740

304,180

Public

Storage

4.000%

A3

5,873,716

127,960

Public

Storage

4.000%

A3

2,392,852

2,293

Public

Storage

5.050%

A3

56,064

6,101

Public

Storage

5.150%

A3

150,268

11,902

Public

Storage

4.700%

A3

259,702

196,121

Public

Storage

4.625%

A3

4,269,554

189,213

Public

Storage

5.600%

A3

4,847,637

24,683

Public

Storage

4.100%

A3

474,160

9,737

Public

Storage

3.950%

A3

179,161

7,735

Public

Storage

3.900%

A3

144,722

4,274

Public

Storage

4.875%

A3

98,217

112,196

Public

Storage

4.125%

A3

2,170,993

7,802

Public

Storage

3.875%

A3

145,741

Total

Equity

Real

Estate

Investment

Trusts

30,841,331

Nuveen

Preferred

&

Income

Securities

Fund

(continued)

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Shares

Description

(1)

Coupon

Ratings

(2)

Value

Financial

Services

-

1.3%

105,300

AgriBank

FCB

6.875%

BBB+

$

10,530,000

248,158

Equitable

Holdings

Inc

(4)

5.250%

BBB-

5,327,952

134,721

Equitable

Holdings

Inc

4.300%

BBB-

2,376,478

54,092

Voya

Financial

Inc

(4)

5.350%

BBB-

1,319,845

Total

Financial

Services

19,554,275

Food

Products

-

0.2%

32,500

Dairy

Farmers

of

America

Inc

,

144A

(5)

7.875%

BB+

2,990,000

Total

Food

Products

2,990,000

Insurance

-

1.6%

342,275

Allstate

Corp/The

8.464%

Baa1

8,710,899

68,848

American

Financial

Group

Inc

/OH

5.625%

Baa2

1,681,957

83,695

American

Financial

Group

Inc

/OH

5.875%

Baa2

2,161,005

18,319

American

Financial

Group

Inc

/OH

4.500%

Baa2

355,022

4,824

American

Financial

Group

Inc

/OH

5.125%

Baa2

110,663

21,825

American

International

Group

Inc

5.850%

BBB-

549,772

34,439

Arch

Capital

Group

Ltd

5.450%

BBB

799,329

1,986

Assurant

Inc

5.250%

Baa3

42,242

985

Globe

Life

Inc

4.250%

BBB+

19,030

3,839

Hartford

Financial

Services

Group

Inc

/The

6.000%

BBB-

95,054

56,568

MetLife

Inc

4.750%

BBB

1,234,879

152,845

Prudential

Financial

Inc

5.950%

BBB+

3,912,832

2,847

Prudential

Financial

Inc

4.125%

BBB+

59,161

79,019

Reinsurance

Group

of

America

Inc

7.125%

BBB+

2,074,249

40,000

RenaissanceRe

Holdings

Ltd

4.200%

BBB

733,200

9,763

RenaissanceRe

Holdings

Ltd

5.750%

BBB+

235,874

20,000

W

R

Berkley

Corp

4.125%

Baa2

359,000

41,233

W

R

Berkley

Corp

4.250%

Baa2

815,176

8,091

W

R

Berkley

Corp

5.100%

BBB

182,047

17,555

W

R

Berkley

Corp

5.700%

Baa2

435,188

Total

Insurance

24,566,579

Multi-Utilities

-

0.9%

174,646

Algonquin

Power

&

Utilities

Corp

6.200%

BB+

3,995,900

17,738

CMS

Energy

Corp

5.875%

BBB-

440,435

2,126

CMS

Energy

Corp

5.625%

BBB-

53,256

11,000

CMS

Energy

Corp

4.200%

BBB-

215,820

101,578

DTE

Energy

Co

4.375%

BBB-

2,196,116

281,710

DTE

Energy

Co

5.250%

BBB-

6,724,418

2,987

NiSource

Inc

6.500%

BBB-

74,526

Total

Multi-Utilities

13,700,471

Total

$25

Par

(or

similar)

Retail

Preferred

(cost

$248,156,719)

229,797,405

Principal

Amount

(000)

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

X

74,147,820

CORPORATE

BONDS

-

5.0%

(3.2%

of

Total

Investments)

X

74,147,820

Banks

-

0.7%

$

7,000

Citizens

Financial

Group

Inc

6.000%

1/06/72

Baa3

$

6,002,500

3,600

JPMorgan

Chase

&

Co

(4)

8.750%

9/01/30

Baa1

4,296,060

Total

Banks

10,298,560

Equity

Real

Estate

Investment

Trusts

-

0.9%

16,100

Scentre

Group

Trust

2,

144A

5.125%

9/24/80

BBB+

13,588,145

Total

Equity

Real

Estate

Investment

Trusts

13,588,145

Investments

in

Derivatives

Principal

Amount

(000)

Description

(1)

Coupon

Maturity

Ratings

(2)

Value

Insurance

-

3.4%

$

30,860

Liberty

Mutual

Group

Inc

,

144A

(4)

7.800%

3/15/37

Baa3

$

32,348,069

6,150

Liberty

Mutual

Insurance

Co,

144A

(4)

7.697%

10/15/97

BBB+

7,103,670

2,600

Lincoln

National

Corp

(3-Month

LIBOR

reference

rate

+

2.040%

spread)

(4),(6)

7.290%

4/20/67

Baa2

1,690,000

2,000

Muenchener

Rueckversicherungs-Gesellschaft

AG

in

Muenchen

5.875%

5/23/42

A

2,006,076

1,000

Nippon

Life

Insurance

Co,

144A

2.900%

9/16/51

A-

822,500

8,000

Zurich

Finance

Ireland

Designated

Activity

Co

3.500%

5/02/52

A+

6,290,800

Total

Insurance

50,261,115

Total

Corporate

Bonds

(cost

$78,660,475)

74,147,820

Shares

Description

(1)

Coupon

Ratings

(2)

Value

X

23,819,133

CONVERTIBLE

PREFERRED

SECURITIES

-

1.6%

(1.0%

of

Total

Investments)

X

23,819,133

Banks

-

1.6%

6,286

Bank

of

America

Corp

7.250%

BBB+

$

7,442,184

14,021

Wells

Fargo

&

Co

7.500%

Baa2

16,376,949

Total

Banks

23,819,133

Total

Convertible

Preferred

Securities

(cost

$28,380,411)

23,819,133

Shares

Description

(1)

Value

16,875,850

INVESTMENT

COMPANIES

-

1.1%

(0.8%

of

Total

Investments)

X

16,875,850

723,135

BlackRock

Credit

Allocation

Income

Trust

$

7,535,067

646,421

John

Hancock

Preferred

Income

Fund

III

9,340,783

Total

Investment

Companies

(cost

$27,993,530)

16,875,850

Total

Long-Term

Investments

(cost

$2,550,736,744)

2,305,442,728

Principal

Amount

(000)

Description

(1)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

0.8% (0.5%

of

Total

Investments)

12,325,208

REPURCHASE

AGREEMENTS

-

0.8%

(0.5%

of

Total

Investments)

X

12,325,208

$

12,325

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

4/28/23,

repurchase

price

$12,326,687,

collateralized

by

$13,748,100,

U.S.

Treasury

Note,

0.750%,

due

5/31/26,

value

$12,571,775

1.440%

5/01/23

$

12,325,208

Total

Repurchase

Agreements

(cost

$12,325,208)

12,325,208

Total

Short-Term

Investments

(cost

$12,325,208)

12,325,208

Total

Investments

(cost

$2,563,061,952

)

-

155.0%

2,317,767,936

Borrowings

-

(20.2)%

(8),(9)

(301,300,000)

Reverse

Repurchase

Agreements,

including

accrued

interest

-

(18.5)%(10)

(276,270,820)

TFP

Shares,

Net

-

(18.0)%(11)

(269,010,941)

Other

Assets

&

Liabilities,

Net

- 1.7%(12)

23,798,885

Net

Assets

Applicable

to

Common

Shares

-

100%

$

1,494,985,060

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(13)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

Capital

Services,

LLC

$

521,000,000

Receive

1-Month

LIBOR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

20,190,699

$

20,190,699

Morgan

Stanley

Capital

Services,

LLC

90,000,000

Receive

1-Month

LIBOR

2.364%

Monthly

7/01/19

7/01/26

7/01/28

2,870,843

2,870,843

Total

unrealized

appreciation

on

interest

rate

swaps

$

23,061,542

Nuveen

Preferred

&

Income

Securities

Fund

(continued)

Portfolio

of

Investments

April

30,

2023

(Unaudited)

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

$1,000

Par

(or

similar)

Institutional

Preferred

$

–

$

1,181,543,504

$

–

$

1,181,543,504

Contingent

Capital

Securities

–

779,259,016

–

779,259,016

$25

Par

(or

similar)

Retail

Preferred

206,359,152

23,438,253

–

229,797,405

Corporate

Bonds

–

74,147,820

–

74,147,820

Convertible

Preferred

Securities

23,819,133

–

–

23,819,133

Investment

Companies

16,875,850

–

–

16,875,850

Short-Term

Investments:

Repurchase

Agreements

–

12,325,208

–

12,325,208

Investments

in

Derivatives:

Interest

Rate

Swaps*

–

23,061,542

–

23,061,542

Total

$

247,054,135

$

2,093,775,343

$

–

$

2,340,829,478

*

Represents

net

unrealized

appreciation

(depreciation).

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(1)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(2)

For

financial

reporting

purposes,

the

ratings

disclosed

are

the

highest

of

Standard

&

Poor’s

Group

(“Standard

&

Poor’s”),

Moody’s

Investors

Service,

Inc.

(“Moody’s”)

or

Fitch,

Inc.

(“Fitch”)

rating.

This

treatment

of

split-rated

securities

may

differ

from

that

used

for

other

purposes,

such

as

for

Fund

investment

policies.

Ratings

below

BBB

by

Standard

&

Poor’s,

Baa

by

Moody’s

or

BBB

by

Fitch

are

considered

to

be

below

investment

grade.

Holdings

designated

N/R

are

not

rated

by

any

of

these

national

rating

agencies.

(3)

Perpetual

security.

Maturity

date

is

not

applicable.

(4)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$303,783,675

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(5)

Investment,

or

portion

of

investment,

is

hypothecated.

The

total

value

of

investments

hypothecated

as

of

the

end

of

the

reporting

period

was

$248,703,902.

(6)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(7)

Contingent

Capital

Securities

(“

CoCos

”)

are

hybrid

securities

with

loss

absorption

characteristics

built

into

the

terms

of

the

security

for

the

benefit

of

the

issuer.

For

example,

the

terms

may

specify

an

automatic

write-down

of

principal

or

a

mandatory

conversion

into

the

issuer’s

common

stock

under

certain

adverse

circumstances,

such

as

the

issuer’s

capital

ratio

falling

below

a

specified

level.

(8)

Borrowings

as

a

percentage

of

Total

Investments

is

13.0%.

(9)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$1,090,869,738

have

been

pledged

as

collateral

for

borrowings.

(10)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

11.9%.

(11)

TFP

Shares,

Net

as

a

percentage

of

Total

Investments

is

11.6%.

(12)

Other

assets

less

liabilities

includes

the

unrealized

appreciation

(depreciation)

of

certain

over-the-counter

("OTC")

derivatives

as

well

as

the

OTC

cleared

and

exchange-traded

derivatives,

when

applicable.

(13)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

LIBOR

London

Inter-Bank

Offered

Rate

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

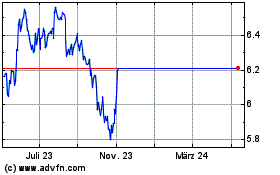

Nuveen Preferred and Inc... (NYSE:JPS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Nuveen Preferred and Inc... (NYSE:JPS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024