UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08238

Morgan Stanley India Investment Fund, Inc.

(Exact name of registrant as specified in charter)

| 1585 Broadway, New York, New York |

|

10036 |

| (Address of principal executive offices) |

|

(Zip

code) |

John H. Gernon

1585 Broadway, New York, New York 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-762-1886

Date of fiscal year end: December 31,

Date of reporting period: December 31, 2023

Item 1 - Report to Shareholders

Morgan Stanley Investment Management Inc.

Adviser

Morgan Stanley India Investment Fund, Inc. NYSE: IIF

Annual Report

December 31, 2023

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Table of Contents (unaudited)

|

Letter to Stockholders |

|

|

3 |

|

|

|

Performance Summary |

|

|

8 |

|

|

|

Portfolio of Investments |

|

|

10 |

|

|

|

Statement of Assets and Liabilities |

|

|

12 |

|

|

|

Statement of Operations |

|

|

13 |

|

|

|

Statements of Changes in Net Assets |

|

|

14 |

|

|

|

Financial Highlights |

|

|

15 |

|

|

|

Notes to Financial Statements |

|

|

16 |

|

|

|

Report of Independent Registered Public Accounting Firm |

|

|

24 |

|

|

|

Portfolio Management |

|

|

25 |

|

|

|

Investment Policy |

|

|

26 |

|

|

|

Principal Risks |

|

|

34 |

|

|

|

Additional Information Regarding the Fund |

|

|

45 |

|

|

|

Dividend Reinvestment and Cash Purchase Plan |

|

|

46 |

|

|

|

Potential Conflicts of Interest |

|

|

47 |

|

|

|

Important Notices |

|

|

50 |

|

|

|

U.S. Customer Privacy Notice |

|

|

51 |

|

|

|

Directors and Officers Information |

|

|

54 |

|

|

2

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Letter to Stockholders (unaudited)

Performance

For the year ended December 31, 2023, the Morgan Stanley India Investment Fund, Inc. (the "Fund") had total returns of 23.41%, based on net asset value, and 20.58% based on market value per share (including reinvestment of distributions), compared to its benchmark, the MSCI India Index (the "Index"), which returned 20.81%. On December 31, 2023, the closing price of the Fund's shares on the New York Stock Exchange was $21.47, representing a 19.38% discount to the Fund's net asset value per share. Past performance is no guarantee of future results.

Please keep in mind that double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions.

Factors Affecting Performance

• The Fund outperformed the Index for the year ended December 31, 2023. The main contributors to relative performance were the Fund's underweight position in utilities, stock selection in industrials and overweight position in consumer discretionary.

• Negative contributions to relative performance came from an overweight allocation to financials, underweight in communication services, and stock selection in the real estate and energy sectors.

Management Strategies

• We started 2023 with the macroeconomic issues outside of India still playing a big role in driving market movements. For the first half of the year, the driving themes were that of a liquidity squeeze resulting in U.S. bank collapses and fears of a U.S. recession, and supply chain disruptions led by the ongoing Russia-Ukraine war still playing out. However, nearer to the final quarter of 2023, emerging markets (EM) assets delivered positive returns, turning on the back of the dovish tilt by major global central banks. After two years of battling what could be called a "great inflation" threat, finally the squeeze from tight financial conditions appeared to be easing, and the prospects of a "Fed pivot" have brightened, with the U.S. Federal Reserve (Fed) signaling that it had reached peak policy rates and could begin rate cuts in 2024. Furthermore, a decisive mandate in favor of the Bharatiya Janata Party in the states of Chhattisgarh, Madhya Pradesh and Rajasthan in December 2023 sparked confidence. Throughout most of 2023, India remained a bright spot within the EM universe, with December 2023 seeing approximately $7 billioni of equity inflows from foreign institutional investors — the highest among large EMs.

The Indian central bank has been proactive over 2022-23, and has done the heavy lifting to ensure price stability. The Monetary Policy Committee's commitment to ensuring that the headline consumer price index (CPI) gradually converges to its medium-term target of 4% has remained undeterred. The government also took steps such as approving a subsidy on liquefied petroleum gas (LPG) cylinders, focusing on supply-side measures through invigorating capital expenditure and staying on its growth-oriented path. These measures along with healthy private sector balance sheets have been instrumental in supporting resilience in the domestic economy, and we expect policy support to remain favorable.

3

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Letter to Stockholders (unaudited) (cont'd)

India's current account balance remained in deficit, albeit a narrowing one. On a four-quarter annualized basis, the current account deficit narrowed further to 1% of gross domestic product (GDP) in the quarter ended September 2023, its lowest since December 2021, falling from 1.7% of GDP in the quarter ended June 2023.ii The GDP data release for the quarter ended September 2023 surprised on the upside, for the third consecutive quarter, and indicated underlying strength in certain segments of the economy. The headline CPI for November 2023 was better than expected and within the Reserve Bank of India's stated comfort band (target band of 2% to 6%), even as it rose sequentially due to sticky food inflation. For the full fiscal-year 2023, the headline CPI remained mostly out of the Reserve Bank of India's comfort zone. Strong domestic demand and easing inflation fears toward the end of the year helped India emerge as one of the best performing markets for 2023. After aggressive selling in 2022, there was a resurgence in foreign institutional investor (FII) inflows, mainly post March 2023. FII inflows stood at $21.2 billion in 2023 compared with an outflow of $17 billion in 2022.iii The equity market ended the year with broad-based strength, with most sectors outperforming except for utilities, materials, energy, information technology and financials, which minorly underperformed the index.

• Buoyant domestic demand, external risk, expect continued resilience but with noise around elections: The early part of 2023 saw inflationary pressures and heightened geopolitical risks. By the second half of the year, oil prices falling to more favorable levels, buoyant services exports and strong capital inflows kept the balance of payments and system liquidity in check. Strong earnings supported tax collections, which allowed government capital expenditure to be an impactful tailwind for demand. The September 2023 quarterly GDP data surprised on the upside for the third consecutive quarter, indicating underlying strength in the economy. Production and investment indicators, including consumer durables production and public and private projects under implementation, continued to show strength.

As of the end of the period, we expected some noise around elections in the immediate future, as has been seen historically in election years. We continued to be watchful of any delay in the capital expenditure cycle arising from a weaker-than-expected political mandate and greater-than-expected external weakness. However, we remained constructive in the medium term as structural factors for sustained growth remain in place.

• Broad-based outperformance: The market saw a decent uptick in the second half of the year with the expectation of a soft landing in the U.S. economy and continued resilience of domestic demand. Both the S&P BSE MidCap Index and S&P BSE SmallCap Index outperformed the overall Nifty 50 Index in the 12-month period.iv Looking at sectors for the full-year period, consumer discretionary, consumer staples, health care, communication services, real estate and industrials outperformed the overall Index. The Index's one-year performance rose to 9th (among 24 EM markets represented in the MSCI Emerging Markets Index) versus 12th in 2022 and 5th 2021.v The Index outperformed the MSCI Emerging Markets Index by 11.0 percentage points in 2023, adding to 12.1 percentage points in 2022.v The currency remained well contained with approximately 40 basis points deterioration against the U.S. dollar for the year overall.v FII flows ended the year on a positive note, as did domestic institutional investor flows. Retail participation stayed at elevated levels in 2023, with monthly systematic investment plan inflows touching record high levels in December 2023.

4

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Letter to Stockholders (unaudited) (cont'd)

• Political stability and reform focus: Since 2019, the incumbent government has announced policies to lift the share of profits in GDP. It started with a meaningful reduction in the corporate tax rate, making the regime comparable to the rest of Asia. The rate was reduced from 34.9% (effective) to 25.2%, and a special lower rate of 17% was announced for new manufacturing companies.vi Furthermore, the government took calibrated, sector-specific steps and, during the pandemic, has undertaken further policies directed at lifting the share of profits in GDP, including production-linked incentive schemes and increased infrastructure investment. These changes implemented since 2019 came on top of some tough reforms in the preceding five years, including the Goods and Services Tax law, the Real Estate (Regulation and Development) Act and the Insolvency and Bankruptcy Code.

Even as growth headwinds began to build in 2022 and early 2023, policy makers have remained steadfast in their commitment to focus on reforming the supply side, incorporating the use of subsidies if necessary.

As of the close of the period, we believed this lifting of profits with the objective of kickstarting the investment cycle will remain in focus and is critical for India's medium-term growth prospects.

• Growth outlook: At the period-end, we remained constructive in the medium term on the India investment story. India has continued to show positive growth (in U.S. dollar terms) through periods of global uncertainty, and structural factors — such as favorable demographics, a large domestic consumption base, increasing digitalization, a capital expenditure thrust and prudent fiscal position — remain as key support factors for sustained buoyancy. As of the close of the period, we were cautiously monitoring near-term dynamics including geopolitical uncertainties, external demand weakness and the outcome of elections both domestically and in other key global markets. While the liquidity squeeze was the driving theme for the early part of 2023, we expect the rate cycle to have peaked. We have drawn confidence from the Reserve Bank of India's aggressive approach to tackling inflation, as core inflation has continued to ease.

The funding of the current account deficit has remained manageable as the capital account remains healthy and the balance of payments has been in surplus over the past three quarters. Further, the inclusion of India's local bonds in the J.P. Morgan Global Bond Index — Emerging Marketsvii beginning in June 2024 will likely be a positive catalyst to trigger capital flows and further enhance external balance sheet strength. Although many structural reforms have been undertaken in the past seven years (Goods and Services Tax, Insolvency and Bankruptcy Code, etc.), we continue to expect the government to undertake the deep-rooted factor market reforms required to provide a positive impulse to the growth momentum.

2023 had a volatile first quarter, and equities showed sustained pickup from March through the end of the year. Looking beyond the elections in 2024, we expect domestic themes of consumption, improved corporate profitability (gradually improving liquidity and balance sheet repair), supply chain shifts, digitalization, and import substitution to help drive performance.

5

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Letter to Stockholders (unaudited) (cont'd)

Sincerely,

John H. Gernon

President and Principal Executive Officer January 2024

i Source: CLSA Research, as of 17 January 2024.

ii Source: Morgan Stanley Research, as of 27 December 2023.

iii Source: BNP Paribas as of 18 January 2024.

iv The S&P BSE (Bombay Stock Exchange) MidCap Index measures the mid-cap segment of India's stock market. The S&P BSE SmallCap Index measures the small-cap segment of India's stock market. The NIFTY 50 Index measures the performance of 50 large-cap stocks from 13 sectors. It is not possible to invest directly in an index.

v Source: Morgan Stanley Research, as of 18 December 2023. The MSCI Emerging Markets Net Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance of emerging markets. The term "free float" represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The MSCI Emerging Markets Index currently consists of 24 emerging-market country indices. The performance of the index is listed in U.S. dollars and assumes reinvestment of net dividends. The index does not include any expenses, fees or sales charges, which would lower performance.

vi Source: Morgan Stanley Research, as of 31 October 2022.

vii The J.P. Morgan Global Bond Index — Emerging Markets (GBI EM) is a broad-based index measuring the performance of local currency denominated, fixed rate, government debt issued in emerging markets.

6

(This page has been left blank intentionally.)

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Performance Summary (unaudited)

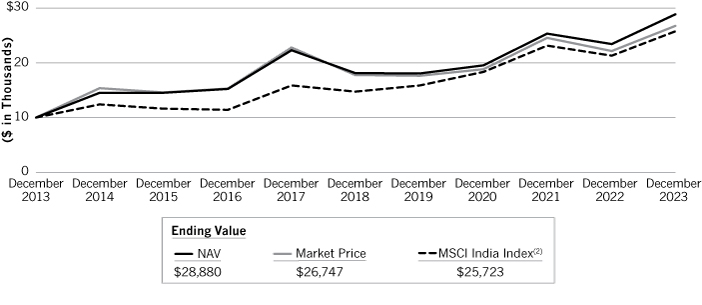

Performance of $10,000 Investment as of December 31, 2023

Over 10 Years

8

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Average Annual Total Returns as of December 31, 2023(1) (unaudited)

|

|

|

One Year |

|

Five Years |

|

Ten Years |

|

|

NAV |

|

|

23.41 |

% |

|

|

9.73 |

% |

|

|

11.19 |

% |

|

|

Market price |

|

|

20.58 |

% |

|

|

8.51 |

% |

|

|

10.34 |

% |

|

|

MSCI India Index(2) |

|

|

20.81 |

% |

|

|

11.78 |

% |

|

|

9.91 |

% |

|

Performance data quoted on the graph and table represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested at prices obtained under the Fund's dividend reinvestment plan. For the most recent month-end performance figures, please visit www.morganstanley.com/im/closedendfundsshareholderreports. Investment returns and principal value will fluctuate so that Fund shares, when sold, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The Fund's total returns are based upon the market value and net asset value on the last business day of the period.

|

Distributions |

|

|

Total Distributions per share for the period |

|

$ |

3.14 |

|

|

|

Distribution Rate at NAV(3) |

|

|

11.78 |

% |

|

|

Distribution Rate at Market Price(3) |

|

|

14.61 |

% |

|

|

% Premium/(Discount) to NAV(4) |

|

|

(19.38 |

)% |

|

(1) All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

(2) The MSCI India Index is a free-float adjusted market capitalization weighted index that is designed to measure the performance of the large and mid cap segments of the Indian market. The performance of the Index is calculated in U.S. dollars and assumes reinvestment of net dividends. It is not possible to invest directly in an index.

(3) The Distribution Rate is based on the Fund's last regular distribution per share in the period (annualized) divided by the Fund's NAV or market price at the end of the period. The Fund's distributions may be comprised of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends, capital gains and non-dividend distributions, also known as return of capital. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. The Fund's distributions are determined by the investment adviser based on its current assessment of the Fund's long-term return potential. Fund distributions may be affected by numerous factors including changes in Fund performance, the cost of financing for leverage, portfolio holdings, realized and projected returns, and other factors. As portfolio and market conditions change, the rate of distributions paid by the Fund could change.

(4) The shares of the Fund often trade at a discount or premium to their net asset value. The discount or premium may vary over time and may be higher or lower than what is quoted in this report.

9

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

|

|

|

Shares |

|

Value

(000) |

|

|

COMMON STOCKS (102.7%) |

|

|

Air Freight & Logistics (1.3%) |

|

|

Delhivery Ltd. (a) |

|

|

716,492 |

|

|

$ |

3,349 |

|

|

|

Automobile Components (1.9%) |

|

Samvardhana Motherson

International Ltd. |

|

|

4,153,403 |

|

|

|

5,085 |

|

|

|

Automobiles (5.9%) |

|

|

Bajaj Auto Ltd. |

|

|

60,671 |

|

|

|

4,954 |

|

|

|

Mahindra & Mahindra Ltd. |

|

|

518,593 |

|

|

|

10,771 |

|

|

|

|

|

|

|

|

15,725 |

|

|

|

Banks (24.0%) |

|

|

Axis Bank Ltd. |

|

|

1,134,522 |

|

|

|

15,015 |

|

|

|

Federal Bank Ltd. |

|

|

2,821,509 |

|

|

|

5,290 |

|

|

|

ICICI Bank Ltd. |

|

|

2,349,745 |

|

|

|

28,079 |

|

|

|

IndusInd Bank Ltd. |

|

|

272,923 |

|

|

|

5,239 |

|

|

|

State Bank of India |

|

|

1,277,129 |

|

|

|

9,845 |

|

|

|

|

|

|

|

|

63,468 |

|

|

|

Beverages (1.8%) |

|

|

United Breweries Ltd. |

|

|

225,620 |

|

|

|

4,837 |

|

|

|

Capital Markets (1.7%) |

|

|

HDFC Asset Management Co. Ltd. |

|

|

118,455 |

|

|

|

4,560 |

|

|

|

Chemicals (4.2%) |

|

|

Aarti Industries Ltd. |

|

|

569,179 |

|

|

|

4,440 |

|

|

|

Pidilite Industries Ltd. |

|

|

208,491 |

|

|

|

6,799 |

|

|

|

|

|

|

|

|

11,239 |

|

|

|

Construction & Engineering (6.5%) |

|

|

Happy Forgings Ltd. Anchor (a)(b) |

|

|

180,472 |

|

|

|

2,154 |

|

|

|

KEC International Ltd. |

|

|

616,730 |

|

|

|

4,364 |

|

|

|

Larsen & Toubro Ltd. |

|

|

255,153 |

|

|

|

10,805 |

|

|

|

|

|

|

|

|

17,323 |

|

|

|

Consumer Finance (9.4%) |

|

|

Bajaj Finance Ltd. |

|

|

128,498 |

|

|

|

11,307 |

|

|

Cholamandalam Investment &

Finance Co. Ltd. |

|

|

531,954 |

|

|

|

8,046 |

|

|

Mahindra & Mahindra Financial

Services Ltd. |

|

|

1,685,047 |

|

|

|

5,598 |

|

|

|

|

|

|

|

|

24,951 |

|

|

|

Electrical Equipment (0.6%) |

|

|

Hitachi Energy India Ltd. |

|

|

25,983 |

|

|

|

1,643 |

|

|

|

Financial Services (1.6%) |

|

|

Aavas Financiers Ltd. (a) |

|

|

226,730 |

|

|

|

4,171 |

|

|

|

|

|

Shares |

|

Value

(000) |

|

|

Food Products (1.2%) |

|

|

Bikaji Foods International Ltd. |

|

|

495,421 |

|

|

$ |

3,249 |

|

|

|

Health Care Providers & Services (2.6%) |

|

|

Apollo Hospitals Enterprise Ltd. |

|

|

99,727 |

|

|

|

6,832 |

|

|

|

Hotels, Restaurants & Leisure (5.2%) |

|

|

MakeMyTrip Ltd. (a) |

|

|

90,237 |

|

|

|

4,239 |

|

|

|

Restaurant Brands Asia Ltd. (a) |

|

|

2,335,296 |

|

|

|

3,135 |

|

|

|

Zomato Ltd. (a) |

|

|

4,273,279 |

|

|

|

6,343 |

|

|

|

|

|

|

|

|

13,717 |

|

|

|

Household Durables (2.9%) |

|

|

Cello World Ltd. (a) |

|

|

189,339 |

|

|

|

1,791 |

|

|

|

Cello World Ltd. Anchor (a)(b) |

|

|

114,773 |

|

|

|

1,058 |

|

|

Crompton Greaves Consumer

Electricals Ltd. |

|

|

1,293,054 |

|

|

|

4,829 |

|

|

|

|

|

|

|

|

7,678 |

|

|

|

Information Technology Services (8.2%) |

|

|

Infosys Ltd. |

|

|

1,170,405 |

|

|

|

21,665 |

|

|

|

Insurance (6.1%) |

|

ICICI Prudential Life Insurance

Co. Ltd. |

|

|

794,760 |

|

|

|

5,103 |

|

|

|

SBI Life Insurance Co. Ltd. |

|

|

463,783 |

|

|

|

7,982 |

|

|

Star Health & Allied Insurance

Co. Ltd. (a) |

|

|

469,279 |

|

|

|

3,013 |

|

|

|

|

|

|

|

|

16,098 |

|

|

|

Office REITs (1.3%) |

|

|

Embassy Office Parks REIT |

|

|

851,771 |

|

|

|

3,324 |

|

|

|

Oil, Gas & Consumable Fuels (5.9%) |

|

|

Reliance Industries Ltd. |

|

|

503,962 |

|

|

|

15,642 |

|

|

|

Personal Care Products (3.2%) |

|

|

Godrej Consumer Products Ltd. |

|

|

616,404 |

|

|

|

8,376 |

|

|

|

Pharmaceuticals (4.1%) |

|

|

Alkem Laboratories Ltd. |

|

|

44,277 |

|

|

|

2,767 |

|

|

|

Mankind Pharma Ltd. (a) |

|

|

218,770 |

|

|

|

5,211 |

|

|

|

Piramal Pharma Ltd. (a) |

|

|

1,774,178 |

|

|

|

2,957 |

|

|

|

|

|

|

|

|

10,935 |

|

|

|

Real Estate Management & Development (1.6%) |

|

|

Keystone Realtors Ltd. (a) |

|

|

556,139 |

|

|

|

4,278 |

|

|

|

Transportation Infrastructure (1.5%) |

|

|

JSW Infrastructure Ltd. (a) |

|

|

1,625,240 |

|

|

|

4,068 |

|

|

|

TOTAL COMMON STOCKS (Cost $188,788) |

|

|

|

|

272,213 |

|

|

The accompanying notes are an integral part of the financial statements.

10

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Portfolio of Investments (cont'd)

|

|

|

Shares |

|

Value

(000) |

|

|

SHORT-TERM INVESTMENT (9.8%) |

|

|

Investment Company (9.8%) |

|

Morgan Stanley Institutional

Liquidity Funds — Government

Portfolio — Institutional Class

(See Note E) (Cost $25,906) |

|

|

25,906,180 |

|

|

$ |

25,906 |

|

|

|

TOTAL INVESTMENTS (112.5%) (Cost $214,694) (c)(d) |

|

|

|

|

298,119 |

|

|

|

LIABILITIES IN EXCESS OF OTHER ASSETS (-12.5%) |

|

|

|

|

(33,230 |

) |

|

|

NET ASSETS (100.0%) |

|

|

|

$ |

264,889 |

|

|

(a) Non-income producing security.

(b) This security is subject to restriction on resale and at December 31, 2023 amounted to approximately $3,212,000, which represents 1.2% of net assets of the Fund.

(c) The approximate fair value and percentage of net assets, $258,903,000 and 97.7%, respectively, represent the securities that have been fair valued under the fair valuation policy for international investments as described in Note A-1 within the Notes to Financial Statements.

(d) At December 31, 2023, the aggregate cost for federal income tax purposes is approximately $222,352,000. The aggregate gross unrealized appreciation is approximately $76,088,000 and the aggregate gross unrealized depreciation is approximately $10,981,000, resulting in net unrealized appreciation of approximately $65,107,000.

REIT Real Estate Investment Trust.

Portfolio Composition

|

Classification |

|

Percentage of

Total Investments |

|

|

Other* |

|

|

32.6 |

% |

|

|

Banks |

|

|

21.3 |

|

|

|

Short-Term Investment |

|

|

8.7 |

|

|

|

Consumer Finance |

|

|

8.4 |

|

|

|

Information Technology Services |

|

|

7.3 |

|

|

|

Construction & Engineering |

|

|

5.8 |

|

|

|

Insurance |

|

|

5.4 |

|

|

|

Automobiles |

|

|

5.3 |

|

|

|

Oil, Gas & Consumable Fuels |

|

|

5.2 |

|

|

|

Total Investments |

|

|

100.0 |

% |

|

* Industries and/or investment types representing less than 5% of total investments.

The accompanying notes are an integral part of the financial statements.

11

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

|

Statement of Assets and Liabilities |

|

December 31, 2023

(000) |

|

|

Assets: |

|

|

Investments in Securities of Unaffiliated Issuers, at Value (Cost $188,788) |

|

$ |

272,213 |

|

|

|

Investment in Security of Affiliated Issuer, at Value (Cost $25,906) |

|

|

25,906 |

|

|

|

Total Investments in Securities, at Value (Cost $214,694) |

|

|

298,119 |

|

|

|

Foreign Currency, at Value (Cost $8,684) |

|

|

8,682 |

|

|

|

Receivable from Affiliate |

|

|

44 |

|

|

|

Dividends Receivable |

|

|

— |

@ |

|

|

Other Assets |

|

|

12 |

|

|

|

Total Assets |

|

|

306,857 |

|

|

|

Liabilities: |

|

|

Dividends Payable |

|

|

31,191 |

|

|

|

Deferred Capital Gain Country Tax |

|

|

10,416 |

|

|

|

Payable for Advisory Fees |

|

|

256 |

|

|

|

Payable for Custodian Fees |

|

|

56 |

|

|

|

Payable for Professional Fees |

|

|

22 |

|

|

|

Payable for Administration Fees |

|

|

8 |

|

|

|

Payable for Stockholder Servicing Agent Fees |

|

|

2 |

|

|

|

Other Liabilities |

|

|

17 |

|

|

|

Total Liabilities |

|

|

41,968 |

|

|

|

Net Assets |

|

|

Applicable to 9,946,873 Issued and Outstanding $0.01 Par Value Shares (1,000,000 Shares Authorized) |

|

$ |

264,889 |

|

|

|

Net Asset Value Per Share |

|

$ |

26.63 |

|

|

|

Net Assets Consist of: |

|

|

Common Stock |

|

$ |

99 |

|

|

|

Paid-in-Capital |

|

|

190,731 |

|

|

|

Total Distributable Earnings |

|

|

74,059 |

|

|

|

Net Assets |

|

$ |

264,889 |

|

|

@ Amount is less than $500.

The accompanying notes are an integral part of the financial statements.

12

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Financial Statements (cont'd)

|

Statement of Operations |

|

Year Ended

December 31, 2023

(000) |

|

|

Investment Income: |

|

|

Dividends from Securities of Unaffiliated Issuers (Net of $491 of Foreign Taxes Withheld) |

|

$ |

1,960 |

|

|

|

Dividends from Security of Affiliated Issuer (Note E) |

|

|

180 |

|

|

|

Total Investment Income |

|

|

2,140 |

|

|

|

Expenses: |

|

|

Advisory Fees (Note B) |

|

|

2,912 |

|

|

|

Custodian Fees (Note D) |

|

|

217 |

|

|

|

Administration Fees (Note C) |

|

|

212 |

|

|

|

Professional Fees |

|

|

182 |

|

|

|

Stockholder Reporting Expenses |

|

|

45 |

|

|

|

Stockholder Servicing Agent Fees |

|

|

15 |

|

|

|

Directors' Fees and Expenses |

|

|

6 |

|

|

|

Other Expenses |

|

|

54 |

|

|

|

Total Expenses |

|

|

3,643 |

|

|

|

Waiver of Administration Fees (Note C) |

|

|

(123 |

) |

|

|

Rebate from Morgan Stanley Affiliate (Note E) |

|

|

(6 |

) |

|

|

Net Expenses |

|

|

3,514 |

|

|

|

Net Investment Loss |

|

|

(1,374 |

) |

|

|

Realized Gain (Loss): |

|

|

Investments Sold (Net of $4,162 of Capital Gain Country Tax) |

|

|

30,806 |

|

|

|

Foreign Currency Translation |

|

|

(42 |

) |

|

|

Net Realized Gain |

|

|

30,764 |

|

|

|

Change in Unrealized Appreciation (Depreciation): |

|

|

Investments (Net of Increase in Deferred Capital Gain Country Tax of $2,802) |

|

|

19,904 |

|

|

|

Foreign Currency Translation |

|

|

(6 |

) |

|

|

Net Change in Unrealized Appreciation (Depreciation) |

|

|

19,898 |

|

|

|

Net Realized Gain and Change in Unrealized Appreciation (Depreciation) |

|

|

50,662 |

|

|

|

Net Increase in Net Assets Resulting from Operations |

|

$ |

49,288 |

|

|

The accompanying notes are an integral part of the financial statements.

13

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Financial Statements (cont'd)

|

Statements of Changes in Net Assets |

|

Year Ended

December 31, 2023

(000) |

|

Year Ended

December 31, 2022

(000) |

|

|

Increase (Decrease) in Net Assets: |

|

|

Operations: |

|

|

Net Investment Loss |

|

$ |

(1,374 |

) |

|

$ |

(2,126 |

) |

|

|

Net Realized Gain |

|

|

30,764 |

|

|

|

32,102 |

|

|

|

Net Change in Unrealized Appreciation (Depreciation) |

|

|

19,898 |

|

|

|

(66,221 |

) |

|

|

Net Increase (Decrease) in Net Assets Resulting from Operations |

|

|

49,288 |

|

|

|

(36,245 |

) |

|

|

Dividends and Distributions to Stockholders |

|

|

(31,191 |

) |

|

|

(41,854 |

) |

|

|

Capital Share Transactions: |

|

|

Repurchase of Shares (560,864 and 537,487 shares) |

|

|

(11,696 |

) |

|

|

(12,900 |

) |

|

|

Net Decrease in Net Assets Resulting from Capital Share Transactions |

|

|

(11,696 |

) |

|

|

(12,900 |

) |

|

|

Total Increase (Decrease) |

|

|

6,401 |

|

|

|

(90,999 |

) |

|

|

Net Assets: |

|

|

Beginning of Period |

|

|

258,488 |

|

|

|

349,487 |

|

|

|

End of Period |

|

$ |

264,889 |

|

|

$ |

258,488 |

|

|

The accompanying notes are an integral part of the financial statements.

14

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Financial Highlights

Selected Per Share Data and Ratios

|

|

|

Year Ended December 31, |

|

|

|

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

2019 |

|

|

Net Asset Value, Beginning of Period |

|

$ |

24.60 |

|

|

$ |

31.64 |

|

|

$ |

25.25 |

|

|

$ |

23.39 |

|

|

$ |

23.52 |

|

|

|

Net Investment Income (Loss)(1) |

|

|

(0.13 |

) |

|

|

(0.20 |

) |

|

|

(0.21 |

) |

|

|

(0.08 |

) |

|

|

0.02 |

|

|

|

Net Realized and Unrealized Gain (Loss) |

|

|

5.04 |

|

|

|

(3.10 |

) |

|

|

7.50 |

|

|

|

1.92 |

|

|

|

(0.17 |

) |

|

|

Total from Investment Operations |

|

|

4.91 |

|

|

|

(3.30 |

) |

|

|

7.29 |

|

|

|

1.84 |

|

|

|

(0.15 |

) |

|

|

Distributions from and/or in Excess of: |

|

|

Net Investment Income |

|

|

— |

|

|

|

(0.20 |

) |

|

|

— |

|

|

|

(0.00 |

)(2) |

|

|

— |

|

|

|

Net Realized Gain |

|

|

(3.14 |

) |

|

|

(3.78 |

) |

|

|

(1.00 |

) |

|

|

— |

|

|

|

(0.03 |

) |

|

|

Total Distributions |

|

|

(3.14 |

) |

|

|

(3.98 |

) |

|

|

(1.00 |

) |

|

|

(0.00 |

)(2) |

|

|

(0.03 |

) |

|

|

Anti-Dilutive Effect of Share Repurchase Program |

|

|

0.26 |

|

|

|

0.24 |

|

|

|

0.10 |

|

|

|

0.02 |

|

|

|

0.05 |

|

|

|

Net Asset Value, End of Period |

|

$ |

26.63 |

|

|

$ |

24.60 |

|

|

$ |

31.64 |

|

|

$ |

25.25 |

|

|

$ |

23.39 |

|

|

|

Per Share Market Value, End of Period |

|

$ |

21.47 |

|

|

$ |

20.30 |

|

|

$ |

26.70 |

|

|

$ |

21.21 |

|

|

$ |

19.89 |

|

|

|

TOTAL INVESTMENT RETURN:(3) |

|

|

Market Value |

|

|

20.58 |

% |

|

|

(9.70 |

)% |

|

|

30.42 |

% |

|

|

6.65 |

% |

|

|

(0.66 |

)% |

|

|

Net Asset Value |

|

|

23.41 |

% |

|

|

(7.66 |

)% |

|

|

29.82 |

% |

|

|

7.97 |

% |

|

|

(0.42 |

)% |

|

|

RATIOS TO AVERAGE NET ASSETS AND SUPPLEMENTAL DATA: |

|

|

Net Assets, End of Period (Thousands) |

|

$ |

264,889 |

|

|

$ |

258,488 |

|

|

$ |

349,487 |

|

|

$ |

285,779 |

|

|

$ |

313,383 |

|

|

|

Ratio of Expenses Before Expenses Waived by Administrator |

|

|

1.38 |

% |

|

|

1.37 |

% |

|

|

1.33 |

% |

|

|

1.41 |

% |

|

|

1.33 |

% |

|

|

Ratio of Expenses After Expenses Waived by Administrator |

|

|

1.33 |

%(4) |

|

|

1.32 |

%(4) |

|

|

1.28 |

%(4) |

|

|

1.37 |

%(4) |

|

|

1.28 |

%(4) |

|

|

Ratio of Net Investment Income (Loss) |

|

|

(0.52 |

)%(4) |

|

|

(0.68 |

)%(4) |

|

|

(0.73 |

)%(4) |

|

|

(0.40 |

)%(4) |

|

|

0.10 |

%(4) |

|

|

Ratio of Rebate from Morgan Stanley Affiliates |

|

|

0.00 |

%(5) |

|

|

0.00 |

%(5) |

|

|

0.00 |

%(5) |

|

|

0.00 |

%(5) |

|

|

0.00 |

%(5) |

|

|

Portfolio Turnover Rate |

|

|

38 |

% |

|

|

23 |

% |

|

|

41 |

% |

|

|

46 |

% |

|

|

57 |

% |

|

(1) Per share amount is based on average shares outstanding.

(2) Amount is less than $0.005 per share.

(3) Total investment return based on net asset value per share reflects the effects of changes in net asset value on the performance of the Fund during each period, and assumes dividends and distributions, if any, were reinvested. This percentage is not an indication of the performance of a stockholder's investment in the Fund based on market value due to differences between the market price of the stock and the net asset value per share of the Fund. Total returns are based upon the market value and net asset value on the last business day of each period.

(4) The Ratio of Expenses After Expenses Waived by Administrator and Ratio of Net Investment Income (Loss) reflect the rebate of certain Fund expenses in connection with the investments in Morgan Stanley affiliates during the period. The effect of the rebate on the ratios is disclosed in the above table as "Ratio of Rebate from Morgan Stanley Affiliates."

(5) Amount is less than 0.005%.

The accompanying notes are an integral part of the financial statements.

15

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements

The Morgan Stanley India Investment Fund, Inc. (the "Fund") was incorporated in Maryland on December 22, 1993, and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the "Act"). The adviser, Morgan Stanley Investment Management Inc. (the "Adviser"), and Morgan Stanley Investment Management Company (the "Sub-Adviser"), seek long-term capital appreciation through investments primarily in equity securities of Indian issuers.

The Fund applies investment company accounting and reporting guidance Accounting Standards Codification ("ASC") Topic 946. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the Fund's Statement of Assets and Liabilities through the date that the financial statements were issued.

A. Significant Accounting Policies: The following significant accounting policies are in conformity with U.S. generally accepted accounting principles ("GAAP"). Such policies are consistently followed by the Fund in the preparation of its financial statements. GAAP may require management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates.

1. Security Valuation: (1) An equity portfolio security listed or traded on an exchange is valued at its latest reported sales price (or at the exchange official closing price if such exchange reports an official closing price), and if there were no sales on a given day and if there is no official exchange closing price for that day, the security is valued at the mean between the last reported bid and asked prices if such bid and asked prices are available on the relevant exchanges. If only bid prices are available then the latest bid price may be used. Listed equity securities not traded on the valuation date with no reported bid and asked prices available on the exchange are valued at the mean between the current bid and asked prices obtained from one or

more reputable brokers/dealers. In cases where a security is traded on more than one exchange, the security is valued on the exchange designated as the primary market; (2) all other equity portfolio securities for which over-the-counter ("OTC") market quotations are readily available are valued at the latest reported sales price (or at the market official closing price if such market reports an official closing price), and if there was no trading in the security on a given day and if there is no official closing price from relevant markets for that day, the security is valued at the mean between the last reported bid and asked prices if such bid and asked prices are available on the relevant markets. An unlisted equity security that does not trade on the valuation date and for which bid and asked prices from the relevant markets are unavailable is valued at the mean between the current bid and asked prices obtained from one or more reputable brokers/dealers; (3) fixed income securities may be valued by an outside pricing service/vendor approved by the Fund's Board of Directors (the "Directors"). The pricing service/vendor may employ a pricing model that takes into account, among other things, bids, yield spreads and/or other market data and specific security characteristics. If the Adviser and Sub-Adviser, each a wholly-owned subsidiary of Morgan Stanley, determines that the price provided by the outside pricing service/vendor does not reflect the security's fair value or is unable to provide a price, prices from reputable brokers/dealers may also be utilized. In these circumstances, the value of the security will be the mean of bid and asked prices obtained from reputable brokers/dealers; (4) when market quotations are not readily available, as defined by Rule 2a-5 under the Act, including circumstances under which the Adviser or Sub-Adviser determines that the closing price, last sale price or the mean between the last reported bid and asked prices are not reflective of a security's market value, portfolio securities are valued at their fair value as determined in good faith under

16

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements (cont'd)

procedures approved by and under the general supervision of the Directors. Each business day, the Fund uses a third-party pricing service approved by the Directors to assist with the valuation of foreign equity securities. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities to more accurately reflect their fair value as of the close of regular trading on the NYSE; (5) foreign exchange transactions ("spot contracts") and foreign exchange forward contracts ("forward contracts") are valued daily using an independent pricing vendor at the spot and forward rates, respectively, as of the close of the NYSE; and (6) investments in mutual funds, including the Morgan Stanley Institutional Liquidity Funds, are valued at the net asset value ("NAV") as of the close of each business day.

In connection with Rule 2a-5 of the Act, the Directors have designated the Fund's Adviser as its valuation designee. The valuation designee has responsibility for determining fair value and to make the actual calculations pursuant to the fair valuation methodologies previously approved by the Directors. Under procedures approved by the Directors, the Fund's Adviser, as valuation designee, has formed a Valuation Committee whose members are approved by the Directors. The Valuation Committee provides administration and oversight of the Fund's valuation policies and procedures, which are reviewed at least annually by the Directors. These procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

2. Fair Value Measurement: Financial Accounting Standards Board ("FASB") ASC 820, "Fair Value Measurement" ("ASC 820"), defines fair value as the price that would be received to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 establishes a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions market participants would use in valuing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs); and (2) inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in valuing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Fund's investments. The inputs are summarized in the three broad levels listed below:

• Level 1 – unadjusted quoted prices in active markets for identical investments

• Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs including the Fund's own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer's financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

17

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements (cont'd)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities and the determination of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to each security.

The following is a summary of the inputs used to value the Fund's investments as of December 31, 2023:

|

Investment Type |

|

Level 1

Unadjusted

quoted

prices

(000) |

|

Level 2

Other

significant

observable

inputs

(000) |

|

Level 3

Significant

unobservable

inputs

(000) |

|

Total

(000) |

|

|

Assets: |

|

|

Common Stocks |

|

Air Freight &

Logistics |

|

$ |

— |

|

|

$ |

3,349 |

|

|

$ |

— |

|

|

$ |

3,349 |

|

|

Automobile

Components |

|

|

— |

|

|

|

5,085 |

|

|

|

— |

|

|

|

5,085 |

|

|

|

Automobiles |

|

|

— |

|

|

|

15,725 |

|

|

|

— |

|

|

|

15,725 |

|

|

|

Banks |

|

|

— |

|

|

|

63,468 |

|

|

|

— |

|

|

|

63,468 |

|

|

|

Beverages |

|

|

— |

|

|

|

4,837 |

|

|

|

— |

|

|

|

4,837 |

|

|

Capital

Markets |

|

|

— |

|

|

|

4,560 |

|

|

|

— |

|

|

|

4,560 |

|

|

|

Chemicals |

|

|

— |

|

|

|

11,239 |

|

|

|

— |

|

|

|

11,239 |

|

|

Construction &

Engineering |

|

|

— |

|

|

|

17,323 |

|

|

|

— |

|

|

|

17,323 |

|

|

Consumer

Finance |

|

|

— |

|

|

|

24,951 |

|

|

|

— |

|

|

|

24,951 |

|

|

Electrical

Equipment |

|

|

— |

|

|

|

1,643 |

|

|

|

— |

|

|

|

1,643 |

|

|

Financial

Services |

|

|

— |

|

|

|

4,171 |

|

|

|

— |

|

|

|

4,171 |

|

|

|

Food Products |

|

|

— |

|

|

|

3,249 |

|

|

|

— |

|

|

|

3,249 |

|

|

Health Care

Providers &

Services |

|

|

— |

|

|

|

6,832 |

|

|

|

— |

|

|

|

6,832 |

|

|

Hotels,

Restaurants &

Leisure |

|

|

4,239 |

|

|

|

9,478 |

|

|

|

— |

|

|

|

13,717 |

|

|

Household

Durables |

|

|

1,791 |

|

|

|

5,887 |

|

|

|

— |

|

|

|

7,678 |

|

|

|

Investment Type |

|

Level 1

Unadjusted

quoted

prices

(000) |

|

Level 2

Other

significant

observable

inputs

(000) |

|

Level 3

Significant

unobservable

inputs

(000) |

|

Total

(000) |

|

|

Assets: (cont'd) |

|

|

Common Stocks (cont'd) |

|

Information

Technology

Services |

|

$ |

— |

|

|

$ |

21,665 |

|

|

$ |

— |

|

|

$ |

21,665 |

|

|

|

Insurance |

|

|

— |

|

|

|

16,098 |

|

|

|

— |

|

|

|

16,098 |

|

|

|

Office REITs |

|

|

— |

|

|

|

3,324 |

|

|

|

— |

|

|

|

3,324 |

|

|

Oil, Gas &

Consumable

Fuels |

|

|

— |

|

|

|

15,642 |

|

|

|

— |

|

|

|

15,642 |

|

|

Personal Care

Products |

|

|

— |

|

|

|

8,376 |

|

|

|

— |

|

|

|

8,376 |

|

|

|

Pharmaceuticals |

|

|

— |

|

|

|

10,935 |

|

|

|

— |

|

|

|

10,935 |

|

|

Real Estate

Management &

Development |

|

|

— |

|

|

|

4,278 |

|

|

|

— |

|

|

|

4,278 |

|

|

Transportation

Infrastructure |

|

|

4,068 |

|

|

|

— |

|

|

|

— |

|

|

|

4,068 |

|

|

Total Common

Stocks |

|

|

10,098 |

|

|

|

262,115 |

|

|

|

— |

|

|

|

272,213 |

|

|

|

Short-Term Investment |

|

Investment

Company |

|

|

25,906 |

|

|

|

— |

|

|

|

— |

|

|

|

25,906 |

|

|

|

Total Assets |

|

$ |

36,004 |

|

|

$ |

262,115 |

|

|

$ |

— |

|

|

$ |

298,119 |

|

|

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment's valuation changes.

3. Foreign Currency Translation and Foreign Investments: The books and records of the Fund are maintained in U.S. dollars. Amounts denominated in Indian rupees are translated into U.S. dollars as follows:

— investments, other assets and liabilities at the prevailing rate of exchange on the valuation date;

— investment transactions and investment income at the prevailing rates of exchange on the dates of such transactions.

18

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements (cont'd)

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held at period end. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of securities sold during the period. Accordingly, realized and unrealized foreign currency gains (losses) on investments in securities are included in the reported net realized and unrealized gains (losses) on investment transactions and balances.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from sales and maturities of foreign currency forward exchange contracts, disposition of foreign currency, currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amount of investment income and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent amounts actually received or paid. The change in unrealized currency gains (losses) on foreign currency transactions for the period is reflected in the Statement of Operations.

A significant portion of the Fund's net assets consist of Indian securities which involve certain considerations and risks not typically associated with investments in the United States. In addition to its smaller size, less liquidity and greater volatility, the Indian securities market is less developed than the U.S. securities market and there is often substantially less publicly available information about Indian issuers than there is about U.S. issuers. Settlement mechanisms are also less developed and are accomplished, in certain cases, only through physical delivery, which may

cause the Fund to experience delays or other difficulties in effecting transactions.

4. Indemnifications: The Fund enters into contracts that contain a variety of indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

5. Dividends and Distributions to Stockholders: Dividends and distributions to stockholders are recorded on the ex-dividend date. Dividends from net investment income, if any, are declared and paid annually. Net realized capital gains, if any, are distributed at least annually.

6. Other: Security transactions are accounted for on the date the securities are purchased or sold. Investments in new Indian securities are made by making applications in the public offerings. The issue price, or a portion thereof, is paid at the time of application and reflected as share application money on the Statement of Assets and Liabilities, if any. Upon allotment of the securities, this amount plus any remaining amount of issue price is recorded as cost of investments. Realized gains (losses) on the sale of investment securities are determined on the specific identified cost basis. Interest income is recognized on the accrual basis, if any. Dividend income and distributions are recorded on the ex-dividend date (except certain dividends which may be recorded as soon as the Fund is informed of such dividends) net of applicable withholding taxes

B. Advisory/Sub-Advisory Fees: The Adviser, a wholly-owned subsidiary of Morgan Stanley, provides the Fund with advisory services under the terms of an Investment Advisory Agreement, calculated weekly and payable monthly, at an annual rate of 1.10% of the Fund's average weekly net assets.

The Adviser has entered into a Sub-Advisory Agreement with the Sub-Adviser, a wholly-owned subsidiary of Morgan Stanley.

19

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements (cont'd)

The Sub-Adviser provides the Fund with advisory services subject to the overall supervision of the Adviser and the Fund's Officers and Directors. The Adviser pays the Sub-Adviser on a monthly basis a portion of the net advisory fees the Adviser receives from the Fund.

C. Administration Fees: The Adviser also serves as Administrator to the Fund and provides administrative services pursuant to an Administration Agreement for an annual fee, accrued daily and paid monthly, of 0.08% of the Fund's average weekly net assets. The Adviser has agreed to limit the administration fee through a waiver so that it will be no greater than the previous administration fee of 0.02435% of the Fund's average weekly net assets plus $24,000 per annum. This waiver may be terminated at any time. For the year ended December 31, 2023, approximately $123,000 of administration fees were waived pursuant to this arrangement.

Under a Sub-Administration Agreement between the Administrator and State Street Bank and Trust Company ("State Street"), State Street provides certain administrative services to the Fund. For such services, the Administrator pays State Street portion of the fee the Administrator receives from the Fund.

D. Custodian Fees: State Street (the "Custodian") also serves as Custodian for the Fund in accordance with a Custodian Agreement. The Custodian holds cash, securities and other assets of the Fund as required by the Act. Custody fees are payable monthly based on assets held in custody, investment purchases and sales activity and account maintenance fees, plus reimbursement for certain out-of-pocket expenses.

E. Security Transactions and Transactions with Affiliates: For the year ended December 31, 2023, purchases and sales of investment securities for the Fund, other than long-term U.S. Government securities and short-term investments were approximately $100,717,000 and $149,206,000, respectively.

There were no purchases and sales of long-term U.S. Government securities for the year ended December 31, 2023.

The Fund invests in the Institutional Class of the Morgan Stanley Institutional Liquidity Funds — Government Portfolio (the "Liquidity Fund"), an open-end management investment company managed by the Adviser. Advisory fees paid by the Fund are reduced by an amount equal to its pro-rata share of the advisory and administration fees paid by the Fund due to its investment in the Liquidity Fund. For the year ended December 31, 2023, advisory fees paid were reduced by approximately $6,000 relating to the Fund's investment in the Liquidity Fund.

A summary of the Fund's transactions in shares of affiliated investments during the year ended December 31, 2023 is as follows:

Affiliated

Investment

Company |

|

Value

December 31,

2022

(000) |

|

Purchases

at Cost

(000) |

|

Proceeds

from Sales

(000) |

|

Dividend

Income

(000) |

|

|

Liquidity Fund |

|

$ |

42,206 |

|

|

$ |

39,758 |

|

|

$ |

56,058 |

|

|

$ |

180 |

|

|

Affiliated

Investment

Company (cont'd) |

|

Realized

Gain (Loss)

(000) |

|

Change in

Unrealized

Appreciation

(Depreciation)

(000) |

|

Value

December 31,

2023

(000) |

|

|

Liquidity Fund |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

25,906 |

|

|

The Fund is permitted to purchase and sell securities ("cross-trade") from and to other Morgan Stanley funds as well as other funds and client accounts for which the Adviser or an affiliate of the Adviser serves as investment adviser, pursuant to procedures approved by the Directors in compliance with Rule 17a-7 under the Act (the "Rule"). Each cross-trade is executed at the current market price in compliance with provisions of the Rule. For the year ended December 31, 2023, the Fund did not engage in any cross-trade transactions.

20

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements (cont'd)

F. Federal Income Taxes: It is the Fund's intention to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued based on net investment income, net realized gains and net unrealized appreciation as such income and/or gains are earned. Taxes may also be based on transactions in foreign currency and are accrued based on the value of investments denominated in such currency.

FASB ASC 740-10, "Income Taxes — Overall", sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. Management has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in "Interest Expense" and penalties in "Other Expenses" in the Statement of Operations. The Fund files tax returns with the U.S. Internal Revenue Service, New York and various states. Generally, each of the tax years in the four-year period ended December 31, 2023 remains subject to examination by taxing authorities.

The tax character of distributions paid may differ from the character of distributions shown for GAAP purposes due to short-term capital gains being treated as ordinary income for tax purposes. The tax character of distributions paid during fiscal years 2023 and 2022 was as follows:

2023 Distributions

Paid From: |

|

2022 Distributions

Paid From: |

|

Ordinary

Income

(000) |

|

Long-term

Capital

Gain

(000) |

|

Ordinary

Income

(000) |

|

Long-term

Capital

Gain

(000) |

|

|

$ |

2,832 |

|

|

$ |

28,359 |

|

|

$ |

2,351 |

|

|

$ |

39,503 |

|

|

The amount and character of income and gains to be distributed are determined in accordance with income tax regulations which may differ from GAAP. These book/tax differences are either considered temporary or permanent in nature.

Temporary differences are attributable to differing book and tax treatments for the timing of the recognition of gains (losses) on certain investment transactions and the timing of the deductibility of certain expenses.

The Fund had no permanent differences causing reclassifications among the components of net assets for the year ended December 31, 2023.

At December 31, 2023, the components of distributable earnings for the Fund on a tax basis were as follows:

Undistributed Ordinary

Income

(000) |

|

Undistributed

Long-term Capital Gain

(000) |

|

|

$ |

1,737 |

|

|

$ |

7,217 |

|

|

G. Other: Future economic and political developments in India could adversely affect the liquidity or value, or both, of securities in which the Fund is invested. In addition, the Fund's ability to hedge its currency risk is limited and accordingly, the Fund may be exposed to currency devaluation and other exchange rate fluctuations.

As permitted by the Fund's offering prospectus, on August 10, 1998, the Fund commenced a share repurchase program for purposes of enhancing stockholder value and reducing the discount at which the Fund's shares trade from their NAV. During the year ended December 31, 2023, the Fund repurchased 560,864 of its shares at an average discount of 18.50% from NAV. Since the inception of the program, the Fund has repurchased 14,195,199 of its shares at an average discount of 20.36% from NAV. The Directors regularly monitor the Fund's share repurchase program as part of their review and consideration of the Fund's premium/discount history. The

21

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements (cont'd)

Fund expects to continue to repurchase its outstanding shares at such time and in such amounts as it believes will further the accomplishment of the foregoing objectives, subject to review by the Directors.

At December 31, 2023, the Fund had record owners of 10% or greater. Investment activities of these shareholders could have a material impact on the Fund. The aggregate percentage of such owners was 10.4%.

H. Results of Annual Meeting of Stockholders (unaudited): On June 22, 2023, an annual meeting of the Fund's stockholders was held for the purpose of voting on the following matter, the results of which were as follows:

Election of Directors by all stockholders:

|

|

|

For |

|

Against |

|

|

Nancy C. Everett |

|

|

7,435,701 |

|

|

|

838,332 |

|

|

|

Eddie A. Grier |

|

|

7,456,123 |

|

|

|

817,910 |

|

|

I. Market Risk: The value of an investment in the Fund is based on the values of the Fund's investments, which change due to economic and other events that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments. The risks associated with these developments may be magnified if certain social, political, economic and other conditions and events adversely interrupt the global economy and financial markets. Securities in the Fund's portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters and extreme weather events, health emergencies (such as epidemics and pandemics), terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, health emergencies, social and political (including geopolitical) discord and tensions or debt crises and downgrades, among others, may result in market

volatility and may have long term effects on both the U.S. and global financial markets. It is difficult to predict when events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects (which may last for extended periods). These events may negatively impact broad segments of businesses and populations and have a significant and rapid negative impact on the performance of the Fund's investments, and exacerbate pre-existing risks to the Fund. The occurrence, duration and extent of these or other types of adverse economic and market conditions and uncertainty over the long term cannot be reasonably projected or estimated at this time. The ultimate impact of public health emergencies or other adverse economic or market developments and the extent to which the associated conditions impact the Fund and its investments will also depend on other future developments, which are highly uncertain, difficult to accurately predict and subject to change at any time. The financial performance of the Fund's investments (and, in turn, the Fund's investment results) as well as their liquidity may be adversely affected because of these and similar types of factors and developments, which may in turn impact valuation, the Fund's ability to sell securities and/or its ability to meet redemptions.

22

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Notes to Financial Statements (cont'd)

Federal Tax Notice (unaudited)

For federal income tax purposes, the following information is furnished with respect to the distributions paid by the Fund during its taxable year ended December 31, 2023.

The Fund designated and paid approximately $28,359,000 as a long-term capital gain distribution.

For federal income tax purposes, the following information is furnished with respect to the Fund's earnings for its taxable year ended December 31, 2023. When distributed, certain earnings may be subject to a maximum tax rate of 15% as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The Fund designated up to a maximum of approximately $2,272,000 as taxable at this lower rate.

The Fund intends to pass through foreign tax credits of approximately $4,648,000 and has derived net income from sources within foreign countries amounting to approximately $6,616,000.

In January, the Fund provides tax information to shareholders for the preceding calendar year.

23

Morgan Stanley India Investment Fund, Inc.

December 31, 2023

Report of Independent Registered Public Accounting Firm

To the Stockholders and the Board of Directors of

Morgan Stanley India Investment Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Morgan Stanley India Investment Fund, Inc. (the "Fund"), including the portfolio of investments, as of December 31, 2023, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.