Form 8-K - Current report

29 Februar 2024 - 10:02PM

Edgar (US Regulatory)

false 0001531978 0001531978 2024-02-29 2024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 29, 2024

Paragon 28, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-40902 |

|

27-3170186 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

| 14445 Grasslands Drive Englewood, Colorado |

|

|

|

80112 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (720) 912-1332

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

FNA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 29, 2024, Paragon 28, Inc. (the “Company”) issued a press release announcing certain financial results for the fourth quarter and full year ended December 31, 2023. A copy of the Company’s press release is furnished as Exhibit 99.1 hereto.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such a filing.

| Item 7.01 |

Regulation FD Disclosure. |

On February 29, 2024, the Company posted a presentation to its website relating to the Company’s quarterly and full year discussion of its financial profile, market strategy, products and recent developments. A copy of the presentation is attached as Exhibit 99.2 to this Current Report on Form 8-K.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PARAGON 28, INC. |

|

|

|

|

| Date: February 29, 2024 |

|

|

|

By: |

|

/s/ Robert S. McCormack |

|

|

|

|

|

|

General Counsel & Corporate Secretary |

Exhibit 99.1

Paragon 28 Reports Fourth Quarter and Full Year 2023 Financial Results

and Provides 2024 Net Revenue Guidance

ENGLEWOOD, CO., February 29, 2024 – Paragon 28, Inc. (NYSE: FNA) (“Paragon 28” or “Company”), a leading medical device

company exclusively focused on the foot and ankle orthopedic market, today reported financial results for the quarter and year ended December 31, 2023 and provided 2024 Net Revenue guidance.

Fourth Quarter and Full Year 2023 Financial Results

| |

• |

|

Consolidated net revenue for the fourth quarter of 2023 was $60.6 million, representing 17.6% and 17.3%

reported and constant currency growth, respectively, compared to the fourth quarter of 2022. Consolidated net revenue for the full year 2023 was $216.4 million, representing 19.3% and 19.7% reported and constant currency growth, respectively,

compared to the full year 2022. |

| |

• |

|

U.S. net revenue for the fourth quarter and full year 2023 was $51.7 million and $183.5 million,

respectively, representing 14.1% and 16.1% reported growth, respectively, compared to the prior year periods. |

| |

• |

|

International net revenue for the fourth quarter and full year 2023 was $8.9 million and $32.9 million,

respectively, representing 43.1% and 41.3% reported growth, respectively, and 40.7% and 44.1% constant currency growth, respectively, compared to the prior year periods. |

| |

• |

|

Gross profit margin was 74.5% for the fourth quarter of 2023 compared to 81.5% in the fourth quarter of 2022.

Gross profit margin was 79.9% for the full year 2023, compared to 82.1% for the full year 2022. Related to the recent inventory stockpiling, during the fourth quarter of 2023 the Company recorded inventory write-downs totaling $4.0 million which

reduced fourth quarter and full year 2023 gross profit margins by 6.6 and 1.8 percentage points, respectively. |

| |

• |

|

Research and development expenses and selling, general, and administrative expenses increased by 10.5% to

$56.4 million for the fourth quarter of 2023, compared to $51.0 million for the fourth quarter of 2022. The increase was driven by additional investments in new product development and selling and marketing initiatives. Research and

development expenses and selling, general, and administrative expenses increased by 14.2% to $210.1 million for the full year 2023, compared to $184.0 million for the fourth quarter of 2022. The increase was driven by further investments

in new product development, selling and marketing initiatives, as well as investments in corporate and operations infrastructure. |

| |

• |

|

Net loss was $19.6 million for the fourth quarter of 2023, compared to a net loss of $38.8 million for

the fourth quarter of 2022. Net loss was $47.8 million for the full year 2023, compared to a net loss of $67.3 million for the full year 2022. |

| |

• |

|

Adjusted EBITDA for the fourth quarter of 2023, negatively impacted by the $4.0 million of inventory write

downs, was a $4.4 million loss compared to a $1.5 million loss in the fourth quarter of 2022. Adjusted EBITDA for the full year 2023, negatively impacted by the $4.0 million of inventory write downs during the fourth quarter 2023, was

a $9.7 million loss compared to a $10.7 million loss for the full year 2022. |

“Our team ended the year with solid

performances across each foot and ankle segment both in the U.S. and International markets.” said Albert DaCosta, Chairman and Chief Executive Officer. “Turning to 2024, we are incredibly excited to launch several new and high-impact

solutions to start the year. Our continued growth is proof of our ability to address unmet needs in the foot and ankle market by committing to innovation and improving patient outcomes.”

2024 Net Revenue Guidance

The Company expects 2024 net revenue to be $249 million to $259 million, representing 15.1% and 19.7% reported growth compared to 2023.

The Company’s 2024 net revenue guidance assumes foreign currency translation rates remain consistent with current foreign currency translation rates.

Webcast and Conference Call Information

Paragon 28

will host a conference call to discuss fourth quarter and full year 2023 financial results on Thursday, February 29, 2024, at 2:30 p.m. Mountain Time / 4:30 p.m. Eastern Time. Investors interested in listening to the conference call may do so

by dialing (833-470-1428) for domestic callers or (404-975-4839) for international

callers, using conference ID: 593140. Live audio of the webcast will be available on the “Investors” section of the company’s website at: ir.paragon28.com. The webcast will be archived and available for replay for at least 90 days

after the event.

About Paragon 28, Inc.

Based in

Englewood, Colo., Paragon 28, is a leading medical device company exclusively focused on the foot and ankle orthopedic market and is dedicated to improving patient lives. From the onset, Paragon

28® has provided innovative orthopedic solutions, procedural approaches and instrumentation that cover a wide range of foot and ankle ailments including fracture fixation, forefoot, ankle,

progressive collapsing foot deformity (PCFD) or flatfoot, charcot foot and orthobiologics. The company designs products with both the patient and surgeon in mind, with the goal of improving outcomes, reducing ailment recurrence and complication

rates, and making the procedures simpler, consistent, and reproducible.

Forward Looking Statements

Except for the historical information contained herein, the matters set forth in this press release are forward-looking statements within the meaning of the

“safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to: Paragon 28’s potential to shape a better future for foot and ankle patients and its estimated net revenue for full year

2024. You are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements are only predictions based on our current expectations, estimates, and assumptions, valid only as of the date they are made, and

subject to risks and uncertainties, some of which we are not currently aware. Forward-looking statements should not be read as a guarantee of future performance or results and may not necessarily be accurate

indications of the times at, or by, which such performance or results will be achieved. These forward-looking statements are based on Paragon 28’s current expectations and inherently involve significant

risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These risks and

uncertainties are described more fully in the section titled “Risk Factors” in Paragon 28’s filings with the Securities and Exchange Commission (the “SEC”), including Paragon 28’s annual report on Form 10-K filed with the SEC on February 29, 2024. Paragon 28 does not undertake any obligation to update forward-looking statements and expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any forward-looking statements contained herein. These forward-looking statements should not be relied upon as representing Paragon 28’s views

as of any date subsequent to the date of this press release. Paragon 28’s results for the quarter ended December 31, 2023 are not necessarily indicative of our operating results for any future periods.

2

Use of Non-GAAP Financial Measures and Their Limitations

In addition to our results and measures of performance determined in accordance with U.S. GAAP presented in this press release, we believe that certain non-GAAP financial measures are useful in evaluating and comparing our financial and operational performance over multiple periods, identifying trends affecting our business, formulating business plans and making

strategic decisions.

Adjusted EBITDA is a key performance measure that our management uses to assess our financial performance and is also used for

internal planning and forecasting purposes. We define Adjusted EBITDA as earnings (loss) before interest expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, employee stock purchase plan expense, non-recurring expenses and certain other non-cash expenses.

We believe that

Adjusted EBITDA, together with a reconciliation to net income, helps identify underlying trends in our business and helps investors make comparisons between our company and other companies that may have different capital structures, tax rates, or

different forms of employee compensation. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past

performance and future prospects, and allowing for greater transparency with respect to a key financial metric used by our management in its financial and operational decision-making. Our use of Adjusted EBITDA has limitations as an analytical tool,

and you should not consider these measures in isolation or as a substitute for analysis of our financial results as reported under U.S. GAAP. Some of these potential limitations include:

| |

• |

|

other companies, including companies in our industry which have similar business arrangements, may report

Adjusted EBITDA, or similarly titled measures but calculate them differently, which reduces their usefulness as comparative measures; |

| |

• |

|

although depreciation and amortization expenses are non-cash charges, the

assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditures for such replacements or for new capital expenditure requirements; |

| |

• |

|

Adjusted EBITDA also does not reflect changes in, or cash requirements for, our working capital needs or the

potentially dilutive impact of stock-based compensation; and |

| |

• |

|

Adjusted EBITDA does not reflect the interest expense, or the cash requirements necessary to service interest or

principal payments, on our debt that we may incur. |

Additionally, we report revenue growth on a constant-currency basis in order to

facilitate period-to-period comparisons of results without regard to the impact of fluctuating foreign currency exchange rates. The term foreign currency exchange rates

refers to the exchange rates used to translate the company’s operating results for all countries where the functional currency is not the U.S. dollar into U.S. dollars. Because we are a global company, foreign currency exchange rates used for

translation may have a significant effect on our reported results. References to revenue growth on a constant-currency basis means without the impact of foreign currency exchange rate fluctuations.

The company believes disclosure of constant-currency revenue growth rates is helpful to investors because it facilitates period-to-period comparisons. However, constant-currency revenue growth rates are non-GAAP financial measures and are not meant to be considered as an alternative or

substitute for comparable measures prepared in accordance with GAAP. Constant-currency growth has no standardized meaning prescribed by GAAP and should be read in conjunction with our consolidated financial statements prepared in accordance with

GAAP. We calculate constant-currency growth rates by translating local currency amounts in the current period at actual foreign exchange rates for the prior period.

Because of these and other limitations, you should consider our non-GAAP measures only as supplemental to other

GAAP-based financial measures.

Investor Contact:

Matt Brinckman

Senior Vice President, Strategy and Investor

Relations

mbrinckman@paragon28.com

3

PARAGON 28, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2023 |

|

|

December 31, 2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

75,639 |

|

|

$ |

38,468 |

|

| Trade receivables |

|

|

37,323 |

|

|

|

37,687 |

|

| Inventories, net |

|

|

98,062 |

|

|

|

60,948 |

|

| Income taxes receivable |

|

|

794 |

|

|

|

615 |

|

| Other current assets |

|

|

3,997 |

|

|

|

4,658 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

215,815 |

|

|

|

142,376 |

|

| Property and equipment, net |

|

|

74,122 |

|

|

|

61,938 |

|

| Intangible assets, net |

|

|

21,674 |

|

|

|

22,387 |

|

| Goodwill |

|

|

25,465 |

|

|

|

25,465 |

|

| Deferred income taxes |

|

|

705 |

|

|

|

148 |

|

| Other assets |

|

|

2,918 |

|

|

|

1,795 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

340,699 |

|

|

$ |

254,109 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES & STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

21,696 |

|

|

$ |

14,939 |

|

| Accrued expenses |

|

|

27,781 |

|

|

|

26,807 |

|

| Accrued legal settlement |

|

|

— |

|

|

|

22,000 |

|

| Other current liabilities |

|

|

883 |

|

|

|

3,844 |

|

| Current maturities of long-term debt |

|

|

640 |

|

|

|

728 |

|

| Income taxes payable |

|

|

243 |

|

|

|

184 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

51,243 |

|

|

|

68,502 |

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

| Long-term debt net, less current maturities |

|

|

109,799 |

|

|

|

42,182 |

|

| Other long-term liabilities |

|

|

1,048 |

|

|

|

1,628 |

|

| Deferred income taxes |

|

|

233 |

|

|

|

342 |

|

| Income taxes payable |

|

|

635 |

|

|

|

527 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

162,958 |

|

|

|

113,181 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock, $0.01 par value, 300,000,000 shares authorized;

83,738,974 and 78,684,107 shares

issued, and 82,825,455 and 77,770,588

shares outstanding as of December 31, 2023 and December 31, 2022,

respectively |

|

|

827 |

|

|

|

776 |

|

| Additional paid in capital |

|

|

298,394 |

|

|

|

213,956 |

|

| Accumulated deficit |

|

|

(115,630 |

) |

|

|

(67,789 |

) |

| Accumulated other comprehensive income (loss) |

|

|

132 |

|

|

|

(33 |

) |

| Treasury stock, at cost; 913,519 shares as of December 31, 2023 and December 31,

2022 |

|

|

(5,982 |

) |

|

|

(5,982 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

177,741 |

|

|

|

140,928 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities & stockholders’ equity |

|

$ |

340,699 |

|

|

$ |

254,109 |

|

|

|

|

|

|

|

|

|

|

4

PARAGON 28, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net revenue |

|

$ |

60,561 |

|

|

$ |

51,508 |

|

|

$ |

216,389 |

|

|

$ |

181,383 |

|

| Cost of goods sold |

|

|

15,440 |

|

|

|

9,537 |

|

|

|

43,598 |

|

|

|

32,457 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

45,121 |

|

|

|

41,971 |

|

|

|

172,791 |

|

|

|

148,926 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development costs |

|

|

8,102 |

|

|

|

6,550 |

|

|

|

30,078 |

|

|

|

24,650 |

|

| Selling, general, and administrative |

|

|

48,249 |

|

|

|

44,466 |

|

|

|

180,022 |

|

|

|

159,323 |

|

| Legal settlement |

|

|

— |

|

|

|

27,000 |

|

|

|

— |

|

|

|

27,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

56,351 |

|

|

|

78,016 |

|

|

|

210,100 |

|

|

|

210,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(11,230 |

) |

|

|

(36,045 |

) |

|

|

(37,309 |

) |

|

|

(62,047 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expense) income |

|

|

(860 |

) |

|

|

(1,824 |

) |

|

|

154 |

|

|

|

(1,214 |

) |

| Loss on early extinguishment of debt |

|

|

(5,308 |

) |

|

|

— |

|

|

|

(5,308 |

) |

|

|

— |

|

| Interest expense, net |

|

|

(2,038 |

) |

|

|

(1,264 |

) |

|

|

(5,165 |

) |

|

|

(4,129 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense |

|

|

(8,206 |

) |

|

|

(3,088 |

) |

|

|

(10,319 |

) |

|

|

(5,343 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(19,436 |

) |

|

|

(39,133 |

) |

|

|

(47,628 |

) |

|

|

(67,390 |

) |

| Income tax expense (benefit) |

|

|

123 |

|

|

|

(370 |

) |

|

|

213 |

|

|

|

(64 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(19,559 |

) |

|

$ |

(38,763 |

) |

|

$ |

(47,841 |

) |

|

$ |

(67,326 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

PARAGON 28, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(47,841 |

) |

|

$ |

(67,326 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

15,542 |

|

|

|

13,728 |

|

| Allowance for doubtful accounts |

|

|

614 |

|

|

|

155 |

|

| Excess and obsolete inventories |

|

|

(352 |

) |

|

|

485 |

|

| Loss on early extinguishment of debt |

|

|

1,881 |

|

|

|

— |

|

| Stock-based compensation |

|

|

12,364 |

|

|

|

10,365 |

|

| Change in fair value |

|

|

(791 |

) |

|

|

1,280 |

|

| Other |

|

|

984 |

|

|

|

704 |

|

| Changes in other assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(161 |

) |

|

|

(12,013 |

) |

| Inventories |

|

|

(36,595 |

) |

|

|

(21,512 |

) |

| Accounts payable |

|

|

6,742 |

|

|

|

1,895 |

|

| Accrued expenses |

|

|

6,428 |

|

|

|

2,317 |

|

| Accrued legal settlement |

|

|

(22,000 |

) |

|

|

22,000 |

|

| Income tax receivable/payable |

|

|

(50 |

) |

|

|

391 |

|

| Other assets and liabilities |

|

|

(655 |

) |

|

|

(1,650 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(63,890 |

) |

|

|

(49,181 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Purchase of office building |

|

|

— |

|

|

|

(18,300 |

) |

| Purchases of property and equipment |

|

|

(26,716 |

) |

|

|

(22,813 |

) |

| Proceeds from sale of property and equipment |

|

|

1,043 |

|

|

|

897 |

|

| Purchases of intangible assets |

|

|

(1,314 |

) |

|

|

(1,973 |

) |

| Acquisitions, net of cash received |

|

|

— |

|

|

|

(18,504 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(26,987 |

) |

|

|

(60,693 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Proceeds from draw on term loan |

|

|

— |

|

|

|

20,000 |

|

| Proceeds from issuance of long-term debt |

|

|

100,000 |

|

|

|

16,000 |

|

| Payments on long-term debt |

|

|

(30,727 |

) |

|

|

(570 |

) |

| Payments of debt issuance costs |

|

|

(4,423 |

) |

|

|

(732 |

) |

| Proceeds from issuance of common stock, net of issuance costs |

|

|

68,453 |

|

|

|

— |

|

| Proceeds from exercise of stock options |

|

|

2,406 |

|

|

|

5,271 |

|

| Proceeds from employee stock purchase plan |

|

|

944 |

|

|

|

518 |

|

| Payments on earnout liability |

|

|

(8,000 |

) |

|

|

(1,000 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

|

128,653 |

|

|

|

39,487 |

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

|

(605 |

) |

|

|

(497 |

) |

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash |

|

|

37,171 |

|

|

|

(70,884 |

) |

| Cash at beginning of period |

|

|

38,468 |

|

|

|

109,352 |

|

|

|

|

|

|

|

|

|

|

| Cash at end of period |

|

$ |

75,639 |

|

|

$ |

38,468 |

|

|

|

|

|

|

|

|

|

|

6

PARAGON 28, INC. AND SUBSIDIARIES

RECONCILIATION OF NET LOSS TO NON-GAAP ADJUSTED EBITDA

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

(in thousands) |

|

| Net loss |

|

$ |

(19,559 |

) |

|

$ |

(38,763 |

) |

|

$ |

(47,841 |

) |

|

$ |

(67,326 |

) |

| Interest expense, net |

|

|

2,038 |

|

|

|

1,264 |

|

|

|

5,165 |

|

|

|

4,129 |

|

| Income tax expense (benefit) |

|

|

123 |

|

|

|

(370 |

) |

|

|

213 |

|

|

|

(64 |

) |

| Depreciation and amortization expense |

|

|

4,940 |

|

|

|

4,104 |

|

|

|

15,542 |

|

|

|

13,728 |

|

| Stock based compensation expense |

|

|

2,070 |

|

|

|

3,313 |

|

|

|

12,364 |

|

|

|

10,365 |

|

| Employee stock purchase plan expense |

|

|

54 |

|

|

|

113 |

|

|

|

322 |

|

|

|

213 |

|

| Loss on early extinguishment of debt

(1) |

|

|

5,308 |

|

|

|

— |

|

|

|

5,308 |

|

|

|

— |

|

| Change in fair value (2) |

|

|

603 |

|

|

|

1,855 |

|

|

|

(791 |

) |

|

|

1,280 |

|

| Legal Settlement (3) |

|

|

— |

|

|

|

27,000 |

|

|

|

— |

|

|

|

27,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

(4,423 |

) |

|

$ |

(1,484 |

) |

|

$ |

(9,718 |

) |

|

$ |

(10,675 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Represents non-recurring expenses related to the write-off of unamortized debt issuance costs and fees incurred to exit the MidCap Credit Agreements early |

| (2) |

Represents a non-cash change in the fair value of earnout liabilities

for all periods presented and interest rate swap contract for the three months and year ended December 31, 2023 |

| (3) |

Represents non-recurring expenses in connection with the Wright Medical

litigation settlement |

7

PARAGON 28, INC. AND SUBSIDIARIES

Constant-Currency Revenue Growth

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

Change |

|

|

December 31, |

|

|

Change |

|

| |

|

2023 |

|

|

2022 |

|

|

% |

|

|

2023 |

|

|

2022 |

|

|

% |

|

| Total Consolidated Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As Reported |

|

$ |

60,561 |

|

|

$ |

51,508 |

|

|

|

17.6 |

% |

|

$ |

216,389 |

|

|

$ |

181,383 |

|

|

|

19.3 |

% |

| Impact of foreign currency exchange rates |

|

|

(151 |

) |

|

|

— |

|

|

|

|

* |

|

|

652 |

|

|

|

— |

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Constant-currency net revenues |

|

$ |

60,410 |

|

|

$ |

51,508 |

|

|

|

17.3 |

% |

|

$ |

217,041 |

|

|

$ |

181,383 |

|

|

|

19.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total International Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As Reported |

|

$ |

8,849 |

|

|

$ |

6,184 |

|

|

|

43.1 |

% |

|

$ |

32,884 |

|

|

$ |

23,278 |

|

|

|

41.3 |

% |

| Impact of foreign currency exchange rates |

|

|

(151 |

) |

|

|

— |

|

|

|

|

* |

|

|

652 |

|

|

|

— |

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Constant-currency net revenues |

|

$ |

8,698 |

|

|

$ |

6,184 |

|

|

|

40.7 |

% |

|

$ |

33,536 |

|

|

$ |

23,278 |

|

|

|

44.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

4Q and Full Year 2023 Update February

29, 2024 Exhibit 99.2

Forward Looking Statements Except for

the historical information contained herein, the matters set forth in this presentation are forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including, but not

limited to: Paragon 28’s potential to shape a better future for foot and ankle patients and its estimated net revenue for full year 2024. You are cautioned not to place undue reliance on these forward-looking statements. Forward-looking

statements are only predictions based on our current expectations, estimates, and assumptions, valid only as of the date they are made, and subject to risks and uncertainties, some of which we are not currently aware. Forward‐looking

statements should not be read as a guarantee of future performance or results and may not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. These forward‐looking statements are

based on Paragon 28’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward‐looking statements as a result

of these risks and uncertainties. These risks and uncertainties are described more fully in the section titled “Risk Factors” in Paragon 28’s filings with the Securities and Exchange Commission (the “SEC”), including

Paragon 28’s annual report on Form 10-K filed with the SEC on February 29, 2024. Paragon 28 does not undertake any obligation to update forward‐looking statements and expressly disclaims any obligation or undertaking to release publicly

any updates or revisions to any forward‐looking statements contained herein. These forward-looking statements should not be relied upon as representing Paragon 28’s views as of any date subsequent to the date of this presentation.

Paragon 28’s results for the quarter and fiscal year ended December 31, 2023 are not necessarily indicative of our operating results for any future periods. 2

Non-GAAP Financial Measures In

addition to our results and measures of performance determined in accordance with U.S. GAAP presented in this press release, we believe that certain non-GAAP financial measures are useful in evaluating and comparing our financial and operational

performance over multiple periods, identifying trends affecting our business, formulating business plans and making strategic decisions. Adjusted EBITDA is a key performance measure that our management uses to assess our financial performance

and is also used for internal planning and forecasting purposes. We define Adjusted EBITDA as earnings (loss) before interest expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, employee stock

purchase plan expense, non-recurring expenses and certain other non-cash expenses. We believe that Adjusted EBITDA, together with a reconciliation to net income, helps identify underlying trends in our business and helps investors make

comparisons between our company and other companies that may have different capital structures, tax rates, or different forms of employee compensation. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others

in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to a key financial metric used by our management in its

financial and operational decision-making. Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider these measures in isolation or as a substitute for analysis of our financial results as reported under U.S.

GAAP. Some of these potential limitations include: other companies, including companies in our industry which have similar business arrangements, may report Adjusted EBITDA, or similarly titled measures but calculate them differently, which reduces

their usefulness as comparative measures; although depreciation and amortization expenses are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital

expenditures for such replacements or for new capital expenditure requirements; Adjusted EBITDA also does not reflect changes in, or cash requirements for, our working capital needs or the potentially dilutive impact of stock-based compensation; and

Adjusted EBITDA does not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt that we may incur. Additionally, we report revenue growth on a constant-currency basis in order

to facilitate period-to-period comparisons of results without regard to the impact of fluctuating foreign currency exchange rates. The term foreign currency exchange rates refers to the exchange rates used to translate the company's operating

results for all countries where the functional currency is not the U.S. dollar into U.S. dollars. Because we are a global company, foreign currency exchange rates used for translation may have a significant effect on our reported results. References

to revenue growth on a constant-currency basis means without the impact of foreign currency exchange rate fluctuations. The company believes disclosure of constant-currency revenue growth rates is helpful to investors because it facilitates

period-to-period comparisons. However, constant-currency revenue growth rates are non-GAAP financial measures and are not meant to be considered as an alternative or substitute for comparable measures prepared in accordance with GAAP.

Constant-currency growth has no standardized meaning prescribed by GAAP and should be read in conjunction with the our consolidated financial statements prepared in accordance with GAAP. We calculate constant-currency growth rates by translating

local currency amounts in the current period at actual foreign exchange rates for the prior period. Because of these and other limitations, you should consider our non-GAAP measures only as supplemental to other GAAP-based financial measures.

4Q and Full Year 2023 Update –

Table of Contents 4Q and FY 2023 Highlights 5 4Q and FY 2023 Net Revenue 6 FY 2024 Net Revenue Guidance 7 2020 – 2023 Operating Cash Flow Trends and Implications for 2024 8 The Global Foot & Ankle Market 9 Continued Strong Product Launch

Cadence & Pipeline 10

4Q and FY 2023 Highlights Above Market

Revenue Growth Continued in 4Q 2023; Providing 2024 Net Revenue Guidance Net Revenue Performance & Guidance Key Operational and Financial Details Strategic Highlights Global Net Revenue (YoY Growth): 4Q: $60.6M (+17.6% reported; +17.3% CC) | FY

2023: $216.4M (+19.3% reported; +19.7% CC) U.S. Net Revenue (YoY Growth): 4Q: $51.7M (+14.1% reported) | FY 2023: $183.5M (+16.1% reported) International Net Revenue (YoY Growth): 4Q: $8.9M (+43.1% reported; +40.7% CC) | FY 2023: $32.9M (+41.3%

reported; +44.1% CC) 2024 Net Revenue Guidance: Full-year 2024 guidance of $249M to $259M (+15.1% to +19.7% YoY) Strong growth across all 5 foot and ankle subsegments U.S. producing sales representatives increased 13.7% YoY to 266 U.S. surgeon

customers increased 8.8% YoY to a record 2,215 4Q 2023 aEBITDA declined from ($1.5M) to ($4.5M); FY2023 aEBITDA improved by $1.0M to ($9.7M); both negatively impacted by $4.0M of inventory write-downs recorded in the fourth quarter Expect positive

aEBITDA for Full-year 2024 2 full product launches in 4Q2023: JAWS Great White Nitinol Staple System and BEAST Cortical Fiber Bone Graft 5 full product launches in 2024 YTD in high growth forefoot, minimally invasive and soft tissue markets:

Grappler® Knotless Anchor System, Bridgeline™ Adaptive Tape, Mister Tendon™ Harvester System, FJ200™ Power Console and Burr System, PRECISION® MIS Bunion System Limited market release and first cases completed using

Bun-Yo-Matic™ Lapidus clamp system

4Q and FY 2023 Net Revenue 4Q Net

Revenue Sustained performance through 4Q 2023 with significant momentum across key leading indicators to drive future growth FY 2023 Net Revenue Consolidated Growth: + 17.6% Reported + 17.3% Constant Currency Int’l: + 43.1% Rep. + 40.7% CC

U.S.: + 14.1% Rep. Consolidated Growth: + 19.3% Reported + 19.7% Constant Currency Int’l: + 41.3% Rep. + 44.1% CC U.S.: + 16.1% Rep.

FY 2024 Net Revenue Guidance 2024

Quarterly Growth Rate Expectations Normalized seasonality to continue 1Q 2024 is expected to be the lowest quarterly year-over-year growth percentage as 1Q 2023 was the highest growth quarter of 2024 (27% constant currency) and 1Q 2024 has one less

billing day We expect quarterly growth rates for the rest of the year to be higher than 1Q 2024, given dynamics of year-over-year growth rate comparisons and timing of 2024 new product launches Normalizing Supply Chain Environment United States: New

product contributions, sales force expansion, sales force productivity gains. Customer expansion and penetration International: Continued growth in top markets of the U.K., Australia, and South Africa, with increasing momentum in other markets FY

2024 Net Revenue Guidance Range 2024 Net Revenue Growth Commentary Low-End Mid-Point High-End Global Net Revenue $249M $254M $259M Implied YoY Growth 15.1% 17.4% 19.7%

Solid foundation of investments in

place to drive P28 towards future profitability and positive cash flow. 2022 – 2023 Cumulative Operating Cash Use Normalized operating cash use of $23.0M from 1/1/22 through 12/31/23. Significant improvements in operating cash flow expected

for 2024 and beyond. Key drivers: expected annual revenue growth at multiples of F&A market, reductions in inventory stockpile, completion of legal settlement, and annual positive adjusted EBITDA P28 2020 – 2023 Operating Cash Flow Trends

Increase in operating cash use compared to 2020 and 2021 driven by temporal and non-recurring drivers. See detailed waterfall à Approximately break-even operating cash flow in both 2020 and 2021 (1) FY 2023 DIOH 786 days (excludes write-down

adjustment of $4.0M included in 4Q23 COGS) compared to 4Q 2021 at 463 days. Inventory stockpile in 2022 and 2023 is calculated based on FY 2023 DIOH in excess of 4Q 2021 DIOH. 2020 – 2023 Operating Cash Flow Trends

The Global Foot & Ankle Market

Global Foot & Ankle Market(1) Market Sub-segments(1) Estimated 2023 Global Market(2) CAGR: 7.1% Source: iData Research and Company estimates. Source: Company filings, SmartTrak, and management estimates. Fast Growing Market with Several Key

Differentiators Paragon 28 Market Highlights Highly complex anatomy Generally active and younger patient populations Significant opportunity for innovation to drive improved outcomes Well over 100 indications with wide variety of causes

(activity-based, trauma, genetic predisposition, etc.) Well balanced portfolio spanning each sub-segment effectively YTD growth across all sub-segments Substantial opportunity to expand footprint in U.S. and International Long runway for growth in

existing and new international markets

Continued Strong Product Launch

Cadence & Pipeline 2 Product Launches in Q4 2023 and 6 Product Launches in 2024 YTD(1) Robust Pipeline 25+ Active Projects in Development Balanced Across Portfolio 5-10 Annual Launches Expected In Next Three Years 1st Smart28 Module Planned for

Mid-2024(3) January 5, 2024: Grappler® Knotless Anchor System January 17, 2024 (LMR)(2): Bun-Yo-Matic™ Lapidus Clamp System January 30, 2024: FJ2000™ Power Console and Burr System February 1, 2024: PRECISION® MIS Bunion System

Q4 2023 2024 YTD January 5, 2024: Bridgeline™ Adaptive Tape January 26, 2024: Mister Tendon™ Harvester System November 2023: JAWS Great White Nitinol Staple System November 2023: BEAST Cortical Fiber Bone Graft Excludes simple line

extensions. Includes products launched and on limited market release as of 12/31/2023. Some products span multiple segments. “Limited market release”. Subject to regulatory clearance.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

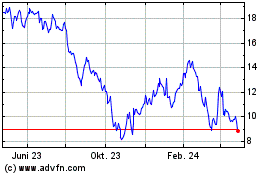

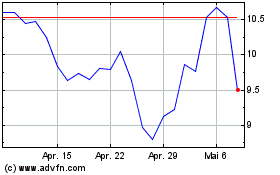

Paragon 28 (NYSE:FNA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Paragon 28 (NYSE:FNA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024