First Trust Advisors Announces Approval of Interim Advisory and Sub-Advisory Agreements for Closed-End Funds

21 September 2010 - 2:31PM

Business Wire

First Trust Advisors L.P. (“FTA”) announced today that the

following FTA-advised closed-end funds (each, a “Fund” and

collectively, the “Funds”) will enter into interim investment

management agreements with FTA and interim investment sub-advisory

agreements with FTA and its current sub-advisor(s):

Energy Income and Growth Fund (NYSE Amex: FEN)

First Trust/Aberdeen Emerging Opportunity Fund (NYSE: FEO)

First Trust/Aberdeen Global Opportunity Income Fund (NYSE:

FAM)

First Trust Active Dividend Income Fund (NYSE: FAV)

First Trust Enhanced Equity Income Fund (NYSE: FFA)

First Trust/FIDAC Mortgage Income Fund (NYSE: FMY)

First Trust Specialty Finance and Financial Opportunities Fund

(NYSE: FGB)

First Trust Strategic High Income Fund (NYSE: FHI)

First Trust Strategic High Income Fund II (NYSE: FHY)

First Trust Strategic High Income Fund III (NYSE: FHO)

Macquarie/First Trust Global Infrastructure/Utilities Dividend

& Income Fund (NYSE: MFD)

On August 24, 2010, James A. Bowen, President of FTA, entered

into a stock purchase agreement to purchase 100% of the general

partnership interest of FTA (the “Transaction”). The Transaction is

scheduled to be completed in October 2010 and is subject to normal

closing conditions. The consummation of the Transaction may be

deemed to be an “assignment” (as defined in the Investment Company

Act of 1940, as amended) of the investment management agreement

between each Fund and FTA and the sub-advisory agreement among each

Fund, FTA and its current sub-advisor(s), which would result in the

automatic termination of the agreements. The Board of Trustees of

each Fund has approved the interim investment management and

interim sub-advisory agreements, which will be entered into

effective upon the closing of the Transaction and will be in effect

for a maximum period of 150 days. New investment management

and investment sub-advisory agreements will be submitted to

shareholders of each Fund for approval and would take effect upon

such shareholder approval. The new agreements will be substantially

similar to each Fund’s current agreements. The Transaction will not

impact the day-to-day operations of any of the Funds, and the

portfolio managers of the Funds will remain the same. A special

shareholder meeting of each Fund to vote on proposals to approve

the new investment management and investment sub-advisory

agreements is expected to be held later this year. There can be no

assurance that the necessary percentage of the shareholders of the

Funds will vote to approve the new investment management or new

investment sub-advisory agreements.

For additional information about any closed-end fund advised by

FTA, including risks, charges and expenses, please see the Fund’s

annual and semi-annual shareholder reports or contact your

financial advisor. Each Fund’s daily closing price and daily net

asset value, as well as other information, are available to

www.ftportfolios.com or by calling 1-800-988-5891.

FTA and its affiliate First Trust Portfolios L.P. are

privately-held companies which provide a variety of investment

services, including asset management, financial advisory services,

and municipal and corporate investment banking, with collective

assets under management or supervision of over $32 billion as

of August 31, 2010 through closed-end funds, unit investment

trusts, mutual funds, separate managed accounts and exchange-traded

funds.

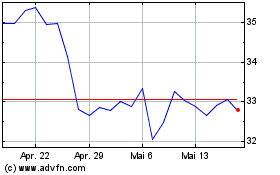

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

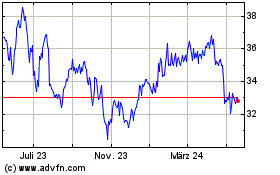

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024