First Trust Strategic High Income Fund Decreases its Monthly Common Share Distribution to $0.025 Per Share for August

21 Juli 2009 - 12:00AM

Business Wire

First Trust Strategic High Income Fund (the "Fund") (NYSE: FHI)

today decreased its regularly scheduled monthly common share

distribution to $0.025 per share from $0.06 per share. The

distribution will be payable on August 17, 2009 to shareholders of

record as of August 5, 2009. The ex-dividend date is expected to be

August 3, 2009. The monthly distribution and cash balance

information for the Fund appears below.

First Trust Strategic High Income Fund

(FHI):

� Distribution per share: $0.025 Distribution Rate based on the

July 17, 2009 NAV of $2.99: 10.03% Distribution Rate based on the

July 17, 2009 closing market price of $3.54: 8.47% Decrease from

previous distribution of $0.06: -58.33% Cash Balance on July 17,

2009: $1,099,978 or 4.03% of Net Assets

During the Fund�s current fiscal year there have been

significant principal write-downs by issuers of securities

sensitive to residential mortgages and other structured securities

within the Fund�s portfolio. The decrease in the dividend is a

necessary adjustment as a result of these write-downs and the

continued credit deterioration of the underlying income producing

portfolio positions. In determining the distribution policy, the

Fund seeks an amount that it views as sustainable based on the

long-term income potential of the portfolio.

The majority, and possibly all, of this distribution will

consist of return of capital. A portion of this distribution may

come from net investment income. The final determination of the

source and tax status of all distributions paid in 2009 will be

made after the end of 2009.

The Fund is a diversified, closed-end management investment

company that seeks to provide a high level of current income. As a

secondary objective, the Fund seeks to provide capital growth. The

Fund pursues these investment objectives by investing at least 80%

of its managed assets in a diversified portfolio of high income

producing securities that the investment sub-advisor believes offer

attractive yield and capital appreciation potential.

First Trust Advisors L.P., the Fund�s investment advisor, along

with its affiliate First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management, financial advisory services, and municipal and

corporate investment banking, with collective assets under

management or supervision of over $20 billion as of June 30, 2009

through closed-end funds, unit investment trusts, mutual funds,

separate managed accounts and exchange-traded funds.

Hyperion Brookfield Asset Management, Inc., the Fund�s

investment sub-advisor (�Hyperion Brookfield�) is a registered

investment advisor headquartered in New York City. The firm was

founded in 1989 to provide relative value driven fixed income

investment strategies, such as core fixed income, high yield, and

specialized MBS. Hyperion Brookfield manages approximately $16

billion as of June 30, 2009 for a client base that includes pension

funds, financial institutions, mutual funds, closed-end funds,

insurance companies and foundations. Hyperion Brookfield is a

subsidiary of Brookfield Asset Management Inc., a global asset

manager focused on property, power and other infrastructure assets

with $80 billion of assets under management as of June 30,

2009.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost.

Principal Risk Factors: Investment in this Fund involves

investment and market risk, management risk, value investing risk,

below-investment grade securities risk, fixed-income securities

risk, mortgage-backed securities risk, asset-backed securities

risk, convertible securities risk, municipal securities risk,

non-U.S. securities risk, non-U.S. government securities risk,

equity securities risk, currency risk, distressed securities risk,

preferred stock risk, inflation/deflation risk, market discount

risk, leverage risk, derivatives risk, market disruption risk,

portfolio turnover risk, and illiquid/restricted securities risk.

The risks of investing in the Fund are spelled out in the

prospectus, shareholder report and other regulatory filings.

The Fund�s daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

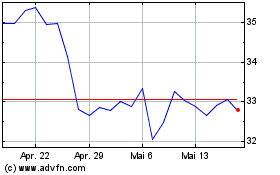

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

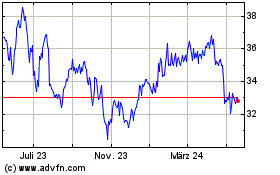

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024