First Trust Announces New Investment Sub-Advisor for FHI, FHY and FHO

30 Juni 2009 - 3:04PM

Business Wire

First Trust Advisors L.P. (´┐ŻFirst Trust´┐Ż) today announced that

the Board of Trustees of First Trust Strategic High Income Fund

(NYSE: FHI), First Trust Strategic High Income Fund II (NYSE: FHY)

and First Trust Strategic High Income Fund III (NYSE: FHO) has

voted to approve Hyperion Brookfield Asset Management, Inc.

(´┐ŻHyperion´┐Ż) as investment sub-advisor to the Funds, replacing

Valhalla Capital Partners, LLC. Each Fund has entered into an

interim investment sub-advisory agreement with First Trust and

Hyperion, as investment sub-advisor, effective on June 29, 2009.

The interim sub-advisory agreements will remain in effect until the

earlier of November 26, 2009 or until a new sub-advisory agreement

is approved by the shareholders of each Fund.

Subject to shareholder approval, the Board of Trustees of each

Fund has also approved a change in each Fund´┐Żs industry

concentration policy to provide that each Fund may not purchase any

security if, as a result of the purchase, 25% or more of the Fund´┐Żs

total assets (taken at current value) would be invested in the

securities of borrowers and other issuers having their principal

business activities in the same industry. Currently, each Fund´┐Żs

industry concentration policy states that it will invest at least

25% of its total assets in residential mortgage-backed securities

under normal market conditions.

Shareholders of FHI, FHY and FHO will be asked to vote on a

proposal to approve the new investment sub-advisory agreements with

Hyperion as well as the above-referenced proposal to change the

industry concentration policy for each Fund at a joint special

meeting of shareholders. Any solicitation of proxies made in

connection with this shareholder meeting will only be made pursuant

to separate proxy materials filed with the U.S. Securities and

Exchange Commission (´┐ŻSEC´┐Ż) under applicable federal securities

laws. There can be no assurance that the necessary percentage of

the shareholders of each Fund will vote to approve Hyperion as the

new investment sub-advisor or the change in the industry

concentration policy.

The Board of Trustees of FHI also approved a change in

investment policy so that FHI may invest up to 100% of its managed

assets in below-investment grade debt securities (commonly referred

to as ´┐Żhigh-yield´┐Ż or ´┐Żjunk´┐Ż bonds). This investment policy is

non-fundamental and therefore may be changed by approval of the

Board of Trustees without shareholder approval. The investment

policy will be effective on or about September 1, 2009. Currently

FHI pursues its investment objectives by investing at least 80% of

its managed assets in a diversified portfolio of high income

producing securities that the investment sub-advisor believes offer

attractive yield and capital appreciation potential. High income

producing securities in which the Fund invests consist of

below-investment grade debt securities (high-yield or junk bonds)

and investment grade securities which offer yields comparable to

below-investment grade securities.

Each Fund is a diversified, closed-end management investment

company that seeks to provide a high level of current income. As a

secondary objective, each Fund seeks to provide capital growth.

First Trust has served as the Funds´┐Ż investment advisor since

each Fund´┐Żs inception. First Trust, along with its affiliate First

Trust Portfolios L.P., are privately-held companies which provide a

variety of investment services, including asset management,

financial advisory services, and municipal and corporate investment

banking, with collective assets under management or supervision of

over $19 billion as of May 31, 2009 through closed-end funds, unit

investment trusts, mutual funds, separate managed accounts and

exchange-traded funds.

Hyperion Brookfield Asset Management, Inc. is a registered

investment advisor headquartered in New York City. The firm was

founded in 1989 to provide relative value driven fixed income

investment strategies, such as core fixed income, high yield, and

specialized MBS. Hyperion Brookfield manages approximately $16

billion as of May 31, 2009 for a client base that includes pension

funds, financial institutions, mutual funds, closed-end funds,

insurance companies and foundations. Hyperion Brookfield is a

subsidiary of Brookfield Asset Management Inc., a global asset

manager focused on property, power and other infrastructure assets

with approximately $80 billion of assets under management.

In connection with the solicitation of proxies, the Funds will

file a proxy statement. Because the proxy statement will contain

important information, the Funds´┐Ż shareholders are urged to read it

carefully when it becomes available. When filed with the SEC, the

proxy statement will be available free of charge at the SEC´┐Żs

website, www.sec.gov. The Funds´┐Ż shareholders will also be able to

obtain copies of these documents and other transaction-related

documents, when available, by calling First Trust toll-free at

800-621-1675. The foregoing is not an offer to sell, nor a

solicitation of an offer to buy, shares of any Fund, nor is it a

solicitation of any proxy.

Each Fund´┐Żs daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

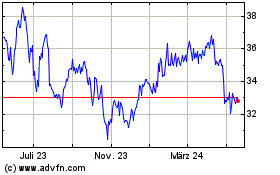

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

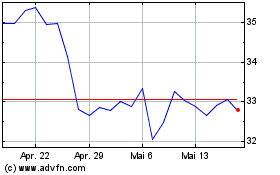

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024