Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 November 2023 - 6:34PM

Edgar (US Regulatory)

First Trust Enhanced Equity Income Fund

(FFA)

Portfolio of Investments

September 30, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS – 96.0%

|

|

|

| Air Freight & Logistics – 1.6%

|

|

|

| 21,000

|

| FedEx Corp. (a)

|

| $5,563,320

|

|

|

| Automobiles – 0.7%

|

|

|

| 75,000

|

| General Motors Co. (a)

|

| 2,472,750

|

|

|

| Banks – 5.6%

|

|

|

| 350,000

|

| Huntington Bancshares, Inc. (a)

|

| 3,640,000

|

| 76,000

|

| JPMorgan Chase & Co. (a)

|

| 11,021,520

|

| 17,500

|

| PNC Financial Services Group (The), Inc. (a)

|

| 2,148,475

|

| 100,000

|

| Truist Financial Corp. (a)

|

| 2,861,000

|

|

|

|

|

| 19,670,995

|

|

|

| Beverages – 3.3%

|

|

|

| 125,000

|

| Coca-Cola (The) Co. (a)

|

| 6,997,500

|

| 18,500

|

| Constellation Brands, Inc., Class A (a)

|

| 4,649,605

|

|

|

|

|

| 11,647,105

|

|

|

| Biotechnology – 2.2%

|

|

|

| 51,000

|

| AbbVie, Inc. (a)

|

| 7,602,060

|

|

|

| Broadline Retail – 1.5%

|

|

|

| 40,500

|

| Amazon.com, Inc. (a) (b)

|

| 5,148,360

|

|

|

| Capital Markets – 1.2%

|

|

|

| 52,500

|

| Morgan Stanley (a)

|

| 4,287,675

|

|

|

| Chemicals – 2.4%

|

|

|

| 15,000

|

| Air Products & Chemicals, Inc. (a)

|

| 4,251,000

|

| 16,500

|

| Sherwin-Williams (The) Co. (a)

|

| 4,208,325

|

|

|

|

|

| 8,459,325

|

|

|

| Communications Equipment – 1.8%

|

|

|

| 117,500

|

| Cisco Systems, Inc. (a)

|

| 6,316,800

|

|

|

| Consumer Staples Distribution & Retail – 1.6%

|

|

|

| 9,800

|

| Costco Wholesale Corp. (a)

|

| 5,536,608

|

|

|

| Diversified Telecommunication Services – 1.3%

|

|

|

| 112,500

|

| AT&T, Inc. (a)

|

| 1,689,750

|

| 85,000

|

| Verizon Communications, Inc. (a)

|

| 2,754,850

|

|

|

|

|

| 4,444,600

|

|

|

| Electric Utilities – 2.1%

|

|

|

| 100,000

|

| Exelon Corp. (a)

|

| 3,779,000

|

| 155,000

|

| PPL Corp. (a)

|

| 3,651,800

|

|

|

|

|

| 7,430,800

|

|

|

| Entertainment – 2.0%

|

|

|

| 90,000

|

| Cinemark Holdings, Inc. (a) (b) (c)

|

| 1,651,500

|

| 15,000

|

| Electronic Arts, Inc. (a)

|

| 1,806,000

|

| 200,000

|

| Lions Gate Entertainment Corp., Class B (b)

|

| 1,574,000

|

| 14,000

|

| Take-Two Interactive Software, Inc. (b)

|

| 1,965,460

|

|

|

|

|

| 6,996,960

|

|

|

| Financial Services – 0.4%

|

|

|

| 24,000

|

| PayPal Holdings, Inc. (a) (b)

|

| 1,403,040

|

|

|

| Ground Transportation – 1.5%

|

|

|

| 70,000

|

| Canadian Pacific Kansas City, Ltd.

|

| 5,208,700

|

First Trust Enhanced Equity Income Fund

(FFA)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (Continued)

|

|

|

| Health Care Equipment & Supplies – 0.8%

|

|

|

| 53,626

|

| Boston Scientific Corp. (b)

|

| $2,831,453

|

|

|

| Health Care Providers & Services – 2.7%

|

|

|

| 19,000

|

| UnitedHealth Group, Inc. (a)

|

| 9,579,610

|

|

|

| Hotels, Restaurants & Leisure – 3.9%

|

|

|

| 85,000

|

| Carnival Corp. (a) (b) (c)

|

| 1,166,200

|

| 10,000

|

| Domino’s Pizza, Inc. (a) (c)

|

| 3,787,900

|

| 90,000

|

| Las Vegas Sands Corp. (a)

|

| 4,125,600

|

| 52,000

|

| Restaurant Brands International, Inc.

|

| 3,464,240

|

| 47,500

|

| Six Flags Entertainment Corp. (a) (b)

|

| 1,116,725

|

|

|

|

|

| 13,660,665

|

|

|

| Industrial Conglomerates – 1.5%

|

|

|

| 29,000

|

| Honeywell International, Inc. (a)

|

| 5,357,460

|

|

|

| Insurance – 4.1%

|

|

|

| 31,500

|

| Arthur J. Gallagher & Co.

|

| 7,179,795

|

| 34,500

|

| Chubb, Ltd. (a)

|

| 7,182,210

|

|

|

|

|

| 14,362,005

|

|

|

| Interactive Media & Services – 3.8%

|

|

|

| 100,000

|

| Alphabet, Inc., Class C (a) (b)

|

| 13,185,000

|

|

|

| IT Services – 1.3%

|

|

|

| 31,500

|

| International Business Machines Corp. (a)

|

| 4,419,450

|

|

|

| Life Sciences Tools & Services – 3.9%

|

|

|

| 29,800

|

| Danaher Corp. (a)

|

| 7,393,380

|

| 12,000

|

| Thermo Fisher Scientific, Inc. (a)

|

| 6,074,040

|

|

|

|

|

| 13,467,420

|

|

|

| Machinery – 1.4%

|

|

|

| 18,000

|

| Caterpillar, Inc.

|

| 4,914,000

|

|

|

| Metals & Mining – 0.6%

|

|

|

| 54,000

|

| Freeport-McMoRan, Inc.

|

| 2,013,660

|

|

|

| Oil, Gas & Consumable Fuels – 4.9%

|

|

|

| 33,000

|

| Diamondback Energy, Inc. (a)

|

| 5,111,040

|

| 50,000

|

| Exxon Mobil Corp. (c)

|

| 5,879,000

|

| 39,000

|

| Hess Corp. (a) (c)

|

| 5,967,000

|

|

|

|

|

| 16,957,040

|

|

|

| Pharmaceuticals – 4.0%

|

|

|

| 2,500

|

| Eli Lilly & Co. (a)

|

| 1,342,825

|

| 76,000

|

| Merck & Co., Inc.

|

| 7,824,200

|

| 28,000

|

| Zoetis, Inc. (a)

|

| 4,871,440

|

|

|

|

|

| 14,038,465

|

|

|

| Semiconductors & Semiconductor Equipment – 4.8%

|

|

|

| 5,000

|

| Broadcom, Inc.

|

| 4,152,900

|

| 119,000

|

| Intel Corp. (a) (c)

|

| 4,230,450

|

| 47,000

|

| Micron Technology, Inc. (a) (c)

|

| 3,197,410

|

| 12,000

|

| NVIDIA Corp. (c)

|

| 5,219,880

|

|

|

|

|

| 16,800,640

|

|

|

| Software – 12.0%

|

|

|

| 7,000

|

| Adobe, Inc. (a) (b) (c)

|

| 3,569,300

|

First Trust Enhanced Equity Income Fund

(FFA)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (Continued)

|

|

|

| Software (Continued)

|

|

|

| 107,000

|

| Microsoft Corp. (a)

|

| $33,785,250

|

| 10,000

|

| Synopsys, Inc. (a) (b)

|

| 4,589,700

|

|

|

|

|

| 41,944,250

|

|

|

| Specialized REITs – 2.3%

|

|

|

| 34,000

|

| Crown Castle, Inc. (a)

|

| 3,129,020

|

| 107,000

|

| Gaming and Leisure Properties, Inc.

|

| 4,873,850

|

|

|

|

|

| 8,002,870

|

|

|

| Specialty Retail – 0.2%

|

|

|

| 32,500

|

| Foot Locker, Inc. (a)

|

| 563,875

|

|

|

| Technology Hardware, Storage & Peripherals – 10.2%

|

|

|

| 207,000

|

| Apple, Inc. (a)

|

| 35,440,470

|

|

|

| Textiles, Apparel & Luxury Goods – 1.8%

|

|

|

| 41,000

|

| NIKE, Inc., Class B (a)

|

| 3,920,420

|

| 80,000

|

| Tapestry, Inc.

|

| 2,300,000

|

|

|

|

|

| 6,220,420

|

|

|

| Tobacco – 1.7%

|

|

|

| 64,000

|

| Philip Morris International, Inc. (a)

|

| 5,925,120

|

|

|

| Wireless Telecommunication Services – 0.9%

|

|

|

| 23,500

|

| T-Mobile US, Inc. (a) (b)

|

| 3,291,175

|

|

|

| Total Common Stocks

|

| 335,164,146

|

|

|

| (Cost $254,762,885)

|

|

|

| COMMON STOCKS – BUSINESS DEVELOPMENT COMPANIES – 1.2%

|

|

|

| Capital Markets – 1.2%

|

|

|

| 215,000

|

| Ares Capital Corp. (a)

|

| 4,186,050

|

|

|

| (Cost $3,728,891)

|

|

|

| EXCHANGE-TRADED FUNDS – 1.6%

|

| 13,000

|

| SPDR® S&P 500® ETF Trust

|

| 5,557,240

|

|

|

| (Cost $5,691,946)

|

|

|

|

|

| Total Investments – 98.8%

|

| 344,907,436

|

|

|

| (Cost $264,183,722)

|

|

|

| Number of Contracts

|

| Description

|

| Notional Amount

|

| Exercise Price

|

| Expiration Date

|

| Value

|

| WRITTEN OPTIONS – (0.0)%

|

|

|

| Call Options Written – (0.0)%

|

|

|

|

|

|

|

|

|

| (20)

|

| Adobe, Inc.

|

| $(1,019,800)

|

| $610.00

|

| 10/20/23

|

| (320)

|

| (150)

|

| Carnival Corp.

|

| (205,800)

|

| 16.00

|

| 10/20/23

|

| (1,350)

|

| (250)

|

| Carnival Corp.

|

| (343,000)

|

| 17.00

|

| 10/20/23

|

| (1,250)

|

| (250)

|

| Cinemark Holdings, Inc.

|

| (458,750)

|

| 20.00

|

| 10/20/23

|

| (5,500)

|

| (15)

|

| Domino’s Pizza, Inc.

|

| (568,185)

|

| 410.00

|

| 10/20/23

|

| (5,610)

|

| (15)

|

| Domino’s Pizza, Inc.

|

| (568,185)

|

| 430.00

|

| 11/17/23

|

| (4,575)

|

| (75)

|

| Exxon Mobile Corp.

|

| (881,850)

|

| 125.00

|

| 11/17/23

|

| (11,850)

|

| (80)

|

| Hess Corp.

|

| (1,224,000)

|

| 170.00

|

| 10/20/23

|

| (3,200)

|

| (300)

|

| Intel Corp.

|

| (1,066,500)

|

| 41.00

|

| 10/20/23

|

| (1,800)

|

| (250)

|

| Micron Technology, Inc.

|

| (1,700,750)

|

| 75.00

|

| 10/20/23

|

| (6,000)

|

| (25)

|

| NVIDIA Corp.

|

| (1,087,475)

|

| 485.00

|

| 10/20/23

|

| (5,650)

|

| (200)

|

| S&P 500® Index (d)

|

| (85,761,000)

|

| 4,500.00

|

| 10/20/23

|

| (56,000)

|

First Trust Enhanced Equity Income Fund

(FFA)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| Number of Contracts

|

| Description

|

| Notional Amount

|

| Exercise Price

|

| Expiration Date

|

| Value

|

| WRITTEN OPTIONS (Continued)

|

|

|

| Call Options Written (Continued)

|

|

|

|

|

|

|

|

|

| (325)

|

| S&P 500® Index (d)

|

| $(139,361,625)

|

| $4,525.00

|

| 10/20/23

|

| $(53,625)

|

|

|

| Total Written Options

|

| (156,730)

|

|

|

| (Premiums received $502,730)

|

|

|

|

|

|

|

|

|

|

| Net Other Assets and Liabilities – 1.2%

| 4,029,973

|

|

| Net Assets – 100.0%

| $348,937,409

|

| (a)

| All or a portion of these securities are pledged to cover index call options written. At September 30, 2023, the segregated value of these securities amounts to $228,487,549.

|

| (b)

| Non-income producing security.

|

| (c)

| All or a portion of this security’s position represents cover for outstanding options written.

|

| (d)

| Call options on securities indices were written on a portion of the common stock positions that were not used to cover call options written on individual equity

securities held in the Fund’s portfolio.

|

Valuation Inputs

The Fund is subject to

fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

| •

| Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

|

| •

| Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived

from observable market data.)

|

| •

| Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in

pricing the investment.

|

The inputs or

methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

A summary of the inputs

used to value the Fund’s investments as of September 30, 2023 is as follows:

| ASSETS TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Common Stocks*

| $ 335,164,146

| $ 335,164,146

| $ —

| $ —

|

Common Stocks - Business Development Companies*

| 4,186,050

| 4,186,050

| —

| —

|

Exchange-Traded Funds

| 5,557,240

| 5,557,240

| —

| —

|

Total Investments

| $ 344,907,436

| $ 344,907,436

| $—

| $—

|

|

|

| LIABILITIES TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Written Options

| $ (156,730)

| $ (153,530)

| $ (3,200)

| $ —

|

| *

| See Portfolio of Investments for industry breakout.

|

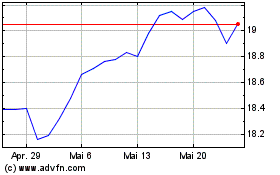

First Trust Enhanced Equ... (NYSE:FFA)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

First Trust Enhanced Equ... (NYSE:FFA)

Historical Stock Chart

Von Mai 2023 bis Mai 2024