0001650132false00016501322024-09-172024-09-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 17, 2024 |

Four Corners Property Trust, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-37538 |

47-4456296 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

591 Redwood Highway Suite 3215 |

|

Mill Valley, California |

|

94941 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (415) 965-8030 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

FCPT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On September 17, 2024, Four Corners Property Trust, Inc. (the “Company”) entered into an amendment (the “Amendment”) to the Transition Agreement with Gerald R. Morgan, the Company’s former Chief Financial Officer.

Under the Amendment, Mr. Morgan’s employment will terminate on September 30, 2024 (rather than on October 31, 2024) and, accordingly, Mr. Morgan’s consulting start date will begin on October 1, 2024 (rather than November 1, 2024). In addition, the Amendment includes a standard customer non-solicitation restriction, effective during Mr. Morgan’s employment and consultancy with the Company and thereafter.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

FOUR CORNERS PROPERTY TRUST, INC. |

|

|

|

|

Date: |

September 19, 2024 |

By: |

/s/ James L. Brat |

|

|

|

James L. Brat

Chief Transaction Officer, General Counsel and Secretary

|

FIRST AMENDMENT TO

TRANSITION AGREEMENT

THIS FIRST AMENDMENT TO TRANSITION AGREEMENT (this “First Amendment”), is made as of September 17, 2024 (the “Amendment Effective Date”), by and between Four Corners Property Trust, Inc. (the “Company”) and Gerald R. Morgan (“Executive”). Capitalized terms used and not otherwise defined herein shall have the meanings ascribed to such terms in the Transition Agreement (as defined below).

RECITALS

A. The Company and Executive have entered into that certain Transition Agreement, dated March 7, 2024 (the “Transition Agreement”).

B. The parties hereto wish to amend certain terms of the Transition Agreement.

AMENDMENT

The parties hereto hereby amend the Transition Agreement as follows, effective as of the Amendment Effective Date.

1.Section 1(a). The second sentence of Section 1(a) of the Transition Agreement is hereby deleted and replaced in its entirety as follows:

“Provided Executive is not terminated for Cause (as hereinafter defined) prior to the Effective Date, effective as of the Effective Date, (1) Executive hereby resigns as the Chief Financial Officer of the Company and all other offices, directorships or equivalent positions held at the Company and its subsidiaries and (2) Executive shall remain employed by the Company as an employee at-will on a part-time basis serving in the non-executive officer role of Advisor on the terms contained herein through the earlier of September 30, 2024 and the actual date of Executive’s termination of employment (such period, the “Transition Period” and such earlier date, the “Employment Termination Date”).”

2.Section 1(b). Section 1(b) of the Transition Agreement is hereby deleted and replaced in its entirety as follows:

“(b) Employment Termination at end of Transition Period. Effective as of the Employment Termination Date, Executive’s employment with the Company and all of its affiliates shall terminate, and, if the Employment Termination Date is September 30, 2024, Executive shall become a consultant of the Company effective October 1, 2024.”

3.Section 3(a). The first sentence of Section 3(a) of the Transition Agreement is hereby deleted and replaced in its entirety as follows:

“Subject to the provisions for earlier termination hereinafter provided, and unless Executive’s service and this Agreement are previously terminated by the Company or by Executive, then for the period commencing as of October 1, 2024 (the “Consulting Commencement Date”) and ending on

the earlier of February 28, 2026 and the actual date of Executive’s termination of service (such period, the “Consulting Period” and such earlier date, the “Final End Date”), Executive shall remain in service with the Company as a consultant and provide, remotely, the following agreed-upon consulting services with regard to the business and operations of the Company, its subsidiaries and its affiliates, as requested by the Company for up to eight hours per month: (i) consultation and participation with Company matters as reasonably requested by the Company; and (ii) consultation and assistance with respect to services performed during the course of Executive’s employment with the Company (collectively, the “Services”).”

4.Section 3(b)(iii). Section 3(b)(iii) of the Transition Agreement is hereby deleted and replaced in its entirety as follows:

“(iii) COBRA Benefits. During the Consulting Period or, if earlier, until the date that Executive becomes eligible for healthcare coverage from another employer, subject to Executive’s valid election to continue healthcare coverage under Section 4980B of the Internal Revenue Code of 1986, as amended (the “Code”) and the regulations thereunder, the Company shall reimburse Executive and Executive’s dependents, with respect to each month during the Consulting Period, an amount equal to the monthly premiums for coverage under its group health plan at the same or reasonably equivalent levels in effect on the Employment Termination Date based on Executive’s elections in effect on the Employment Termination Date (the “COBRA Benefits”); provided, however, that if (i) any plan pursuant to which such benefits are provided is not, or ceases prior to the expiration of the Consulting Period to be, exempt from the application of Section 409A (as defined below) under Treasury Regulation Section 1.409A-1(a)(5), (ii) the Company is otherwise unable to continue to cover Executive or Executive’s dependents under its group health plans, or (iii) the Company cannot provide the benefit without violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), then, in any such case, an amount equal to each remaining COBRA reimbursement shall thereafter be paid to Executive in substantially equal monthly installments over the remaining portion of the Consulting Period (or applicable shorter period).”

5.Section 5. Section 5 of the Transition Agreement is hereby deleted and replaced in its entirety as follows:

5. Restrictive Covenants.

(a) Reaffirmation of Restrictive Covenants. Executive acknowledges that Executive previously agreed to certain restrictive covenants (collectively, the “Restrictive Covenant Arrangements”), including relating to non-disparagement, cooperation, non-disclosure (confidentiality) and non-solicitation contained in Section 11 (“Restrictive Covenants”) of the Employment Agreement and any award agreement evidencing Company equity-based awards held by Executive as of the Effective Date, and Executive hereby acknowledges and agrees that such

provisions shall remain in full force and effect in accordance with their terms and that Executive shall be bound by their terms and conditions.

(b) Non-Solicitation. During each of the Transition Period and Consulting Period and thereafter, Executive shall not, on behalf of Executive or any other individual, corporation, partnership, limited liability company, association, trust or any other entity or organization (including a government or political subdivision or an agency or instrumentality thereof), directly or by assisting others, use any trade secret of the Company to solicit, induce, or encourage any customer, client, vendor, or other party doing business with any member of the Company to terminate its relationship therewith or transfer its business from any member of the Company and Executive shall not initiate discussion with any such person for any such purpose or authorize or knowingly cooperate with the taking of any such actions by any other individual or entity.

6.This First Amendment shall be and, as of the Amendment Effective Date, is hereby incorporated in and forms a part of, the Transition Agreement.

7.Except as expressly provided herein, all terms and conditions of the Transition Agreement shall remain in full force and effect.

(Signature page follows)

IN WITNESS WHEREOF, the parties hereto have executed this First Amendment as of the date first written above.

|

|

|

FOUR CORNERS PROPERTY TRUST, INC. By: /s/William H. Lenehan Name: William H. Lenehan Title: Chief Executive Officer EXECUTIVE /s/ Gerald R. Morgan Gerald R. Morgan |

[Signature Page to First Amendment to Transition Agreement]

v3.24.3

Document And Entity Information

|

Sep. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 17, 2024

|

| Entity Registrant Name |

Four Corners Property Trust, Inc.

|

| Entity Central Index Key |

0001650132

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37538

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

47-4456296

|

| Entity Address, Address Line One |

591 Redwood Highway

|

| Entity Address, Address Line Two |

Suite 3215

|

| Entity Address, City or Town |

Mill Valley

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94941

|

| City Area Code |

(415)

|

| Local Phone Number |

965-8030

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

FCPT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

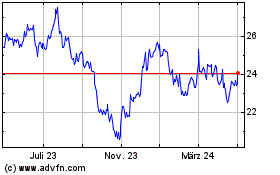

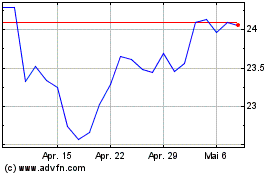

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

Von Sep 2024 bis Okt 2024

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

Von Okt 2023 bis Okt 2024