The Eaton Vance closed-end funds listed below released today the

estimated sources of their November distributions (each a “Fund”).

This press release is issued as required by the Funds’ managed

distribution plan (Plan) and an exemptive order received from the

U.S. Securities and Exchange Commission. The Board of Trustees has

approved the implementation of the Plan to make monthly, as noted

below, cash distributions to common shareholders, stated in terms

of a fixed amount per common share. This information is sent to you

for informational purposes only and is an estimate of the sources

of the November distribution. It is not determinative of the tax

character of a Fund’s distributions for the 2022 calendar year.

Shareholders should note that each Fund’s total regular

distribution amount is subject to change as a result of market

conditions or other factors.

IMPORTANT DISCLOSURE: You

should not draw any conclusions about each Fund’s investment

performance from the amount of this distribution or from the terms

of each Fund’s Plan. Each Fund estimates that it has distributed

more than its income and net realized capital gains; therefore, a

portion of your distribution may be a return of capital. A return

of capital may occur for example, when some or all of the money

that you invested in each Fund is paid back to you. A return of

capital distribution does not necessarily reflect each Fund’s

investment performance and should not be confused with “yield” or

“income.” The amounts and sources of distributions reported in this

notice are only estimates and are not being provided for tax

reporting purposes. The actual amounts and sources of the amounts

for accounting and/or tax reporting purposes will depend upon each

Fund’s investment experience during the remainder of its fiscal

year and may be subject to changes based on tax regulations. Each

Fund will send you a Form 1099-DIV for the calendar year that will

tell you how to report these distributions for federal income tax

purposes.

The following tables set forth estimates of the sources of each

Fund’s November distribution and its cumulative distributions paid

for its fiscal year through November 30, 2022, and information

relating to each Fund’s performance based on its net asset value

(NAV) for certain periods.

Eaton Vance

Enhanced Equity Income Fund (NYSE: EOI)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.1095

Distribution Frequency:

Monthly

Fiscal Year End:

September

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0045

4.10%

$0.0115

5.30%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.0389

17.70%

Return of Capital or Other Capital

Source(s)

$0.1050

95.90%

$0.1686

77.00%

Total per common share

$0.1095

100.00%

$0.2190

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

8.59%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

8.56%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

7.65%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

9.27%

Eaton Vance

Enhanced Equity Income Fund II (NYSE: EOS)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.1152

Distribution Frequency:

Monthly

Fiscal Year End:

December

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0000

0.00%

$0.0000

0.00%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.1863

12.50%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.7505

50.40%

Return of Capital or Other Capital

Source(s)

$0.1152

100.00%

$0.5514

37.10%

Total per common share

$0.1152

100.00%

$1.4882

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

8.39%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

10.13%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-26.10%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

8.44%

Eaton Vance

Risk-Managed Diversified Equity Income Fund (NYSE:

ETJ)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.0579

Distribution Frequency:

Monthly

Fiscal Year End:

December

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0030

5.10%

$0.0308

3.80%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.5684

69.50%

Return of Capital or Other Capital

Source(s)

$0.0549

94.90%

$0.2187

26.70%

Total per common share

$0.0579

100.00%

$0.8179

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

5.96%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

11.15%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-14.16%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

9.29%

Eaton Vance

Tax-Advantaged Dividend Income Fund (NYSE: EVT)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.1488

Distribution Frequency:

Monthly

Fiscal Year End:

October

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0128

8.60%

$0.0128

8.60%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.1360

91.40%

$0.1360

91.40%

Return of Capital or Other Capital

Source(s)

$0.0000

0.00%

$0.0000

0.00%

Total per common share

$0.1488

100.00%

$0.1488

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

8.65%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

8.19%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-10.19%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

8.19%

Eaton Vance

Tax-Advantaged Global Dividend Opportunities Fund (NYSE:

ETO)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.1374

Distribution Frequency:

Monthly

Fiscal Year End:

October

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0112

8.10%

$0.0112

8.10%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0938

68.30%

$0.0938

68.30%

Return of Capital or Other Capital

Source(s)

$0.0324

23.60%

$0.0324

23.60%

Total per common share

$0.1374

100.00%

$0.1374

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

6.34%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

9.78%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-23.80%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

9.78%

Eaton Vance

Tax-Managed Buy-Write Income Fund (NYSE: ETB)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.0932

Distribution Frequency:

Monthly

Fiscal Year End:

December

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0116

12.40%

$0.0777

6.60%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0780

6.70%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.8050

68.60%

Return of Capital or Other Capital

Source(s)

$0.0816

87.60%

$0.2125

18.10%

Total per common share

$0.0932

100.00%

$1.1732

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

4.57%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

9.85%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-13.98%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

8.21%

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund (NYSE: ETV)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.0949

Distribution Frequency:

Monthly

Fiscal Year End:

December

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0084

8.90%

$0.0421

3.50%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.1468

12.20%

Return of Capital or Other Capital

Source(s)

$0.0865

91.10%

$1.0140

84.30%

Total per common share

$0.0949

100.00%

$1.2029

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

5.71%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

10.80%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-17.38%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

9.00%

Eaton Vance

Tax-Managed Diversified Equity Income Fund (NYSE:

ETY)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.0805

Distribution Frequency:

Monthly

Fiscal Year End:

October

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0038

4.70%

$0.0038

4.70%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0075

9.30%

$0.0075

9.30%

Return of Capital or Other Capital

Source(s)

$0.0692

86.00%

$0.0692

86.0%

Total per common share

$0.0805

100.00%

$0.0805

100.0%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

7.82%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

9.81%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-13.55%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

9.81%

Eaton Vance

Tax-Managed Global Buy-Write Opportunities Fund (NYSE:

ETW)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.0582

Distribution Frequency:

Monthly

Fiscal Year End:

December

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0131

22.50%

$0.0929

11.80%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0838

10.70%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.4563

58.10%

Return of Capital or Other Capital

Source(s)

$0.0451

77.50%

$0.1522

19.40%

Total per common share

$0.0582

100.00%

$0.7852

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

2.56%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

10.63%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-18.62%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

8.86%

Eaton Vance

Tax-Advantaged Global Dividend Income (NYSE: ETG)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.1001

Distribution Frequency:

Monthly

Fiscal Year End:

October

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0000

0.00%

$0.0000

0.00%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0934

93.30%

$0.0934

93.30%

Return of Capital or Other Capital

Source(s)

$0.0067

6.70%

$0.0067

6.70%

Total per common share

$0.1001

100.00%

$0.1001

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

5.15%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

9.74%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-22.92%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

9.74%

Eaton Vance

Tax-Managed Global Diversified Equity Income Fund (NYSE:

EXG)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.0553

Distribution Frequency:

Monthly

Fiscal Year End:

October

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0037

6.60%

$0.0037

6.60%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Return of Capital or Other Capital

Source(s)

$0.0516

93.40%

$0.0516

93.40%

Total per common share

$0.0553

100.00%

$0.0553

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

5.67%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

10.59%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-17.25%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

10.59%

Eaton Vance

Tax-Managed Buy-Write Strategy Fund (NYSE: EXD)

Distribution Period:

November- 2022

Distribution Amount per Common Share:

$0.0708

Distribution Frequency:

Monthly

Fiscal Year End:

December

Source

Current Distribution

% of Current

Distribution

Cumulative

Distributions

for the Fiscal

Year-to-Date

% of the Cumulative

Distributions for the

Fiscal Year-to-Date

Net Investment Income

$0.0035

4.90%

$0.0078

1.00%

Net Realized Short-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Net Realized Long-Term Capital Gains

$0.0000

0.00%

$0.0000

0.00%

Return of Capital or Other Capital

Source(s)

$0.0673

95.10%

$0.7710

99.00%

Total per common share

$0.0708

100.00%

$0.7788

100.00%

Average annual total return at NAV for the

5-year period ended on October 31, 2022 1

3.19%

Annualized current distribution rate

expressed as a percentage of NAV as of October 31, 2022 2

9.19%

Cumulative total return at NAV for the

fiscal year through October 31, 2022 3

-17.94%

Cumulative fiscal year to date

distribution rate as a percentage of NAV as of October 31, 2022

4

7.66%

1

Average annual total return at

NAV represents the change in NAV of the Fund, with all

distributions reinvested, for the 5-year period ended on October

31, 2022

2

The annualized current

distribution rate is the cumulative distribution rate annualized as

a percentage of the Fund's NAV as of October 31, 2022.

3

Cumulative total return at NAV is

the percentage change in the Fund's NAV for the period from the

beginning of its fiscal year to October 31, 2022 including

distributions paid and assuming reinvestment of those

distributions.

4

Cumulative fiscal year

distribution rate for the period from the beginning of its fiscal

year to October 31, 2022 measured on the dollar value of the

distributions in year-to-date period as a percentage of the Fund's

NAV as of October 31, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221130005987/en/

Investors: (800) 262-1122

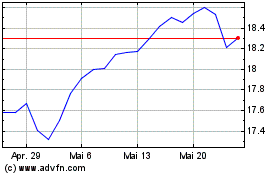

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

Von Jan 2024 bis Jan 2025