0001045450false00010454502023-10-252023-10-250001045450us-gaap:CommonStockMember2023-10-252023-10-250001045450us-gaap:SeriesCPreferredStockMember2023-10-252023-10-250001045450us-gaap:SeriesEPreferredStockMember2023-10-252023-10-250001045450us-gaap:SeriesGPreferredStockMember2023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

EPR Properties

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-13561 | | 43-1790877 |

(State or other jurisdiction of

incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 909 Walnut Street, | Suite 200 |

| Kansas City, | Missouri | 64106 |

| (Address of principal executive offices) (Zip Code) |

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common shares, par value $0.01 per share | | EPR | | New York Stock Exchange |

| | | | |

| 5.75% Series C cumulative convertible preferred shares, par value $0.01 per share | | EPR PrC | | New York Stock Exchange |

| | | | |

| 9.00% Series E cumulative convertible preferred shares, par value $0.01 per share | | EPR PrE | | New York Stock Exchange |

| | | | |

| 5.75% Series G cumulative redeemable preferred shares, par value $0.01 per share | | EPR PrG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On October 25, 2023, the Company announced its results of operations and financial condition for the third quarter and nine months ended September 30, 2023. The public announcement was made by means of a press release, the text of which is set forth in Exhibit 99.1 hereto and is hereby incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

In addition, on October 25, 2023, the Company made available on its website an investor slide presentation and supplemental operating and financial data for the third quarter and nine months ended September 30, 2023, the text of which are set forth in Exhibits 99.2 and 99.3 hereto, respectively, and are hereby incorporated by reference herein.

The information set forth in Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3, is being “furnished” and shall not be deemed “filed” for the purposes of or otherwise subject to liabilities under Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| | |

Exhibit

No. | | Description |

| |

| | Press Release dated October 25, 2023 issued by EPR Properties announcing its results of operations and financial condition for the third quarter and nine months ended September 30, 2023. |

| |

| | Investor slide presentation for the third quarter and nine months ended September 30, 2023, made available by EPR Properties on October 25, 2023. |

| | |

| | Supplemental Operating and Financial Data for the third quarter and nine months ended September 30, 2023, made available by EPR Properties on October 25, 2023. |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| EPR PROPERTIES |

| | |

| By: | | /s/ Mark A. Peterson |

| | | Mark A. Peterson |

| | | Executive Vice President, Treasurer and Chief Financial

Officer |

Date: October 25, 2023

EPR Properties Reports Third Quarter 2023 Results

Updates 2023 Earnings Guidance

Kansas City, MO, October 25, 2023 -- EPR Properties (NYSE:EPR) today announced operating results for the third quarter ended September 30, 2023 (dollars in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 (2) | | 2022 | | 2023 (2) | | 2022 |

| Total revenue | $ | 189,384 | | | $ | 161,410 | | | $ | 533,687 | | | $ | 479,328 | |

| Net income available to common shareholders | 50,228 | | | 44,766 | | | 109,412 | | | 115,801 | |

| Net income available to common shareholders per diluted common share | 0.66 | | | 0.60 | | | 1.45 | | | 1.54 | |

| | | | | | | |

| | | | | | | |

| Funds From Operations as adjusted (FFOAA)(1) | 113,156 | | | 88,238 | | | 306,954 | | | 260,190 | |

| FFOAA per diluted common share (1) | 1.47 | | | 1.16 | | | 4.00 | | | 3.44 | |

| Adjusted Funds From Operations (AFFO) (1) | 113,333 | | | 92,308 | | | 312,168 | | | 273,541 | |

| AFFO per diluted common share (1) | 1.47 | | | 1.22 | | | 4.07 | | | 3.61 | |

| | | | | | | |

| Note: Each of the measures above include deferred rent and interest collections from cash basis customers that were recognized as revenue of $19.3 million and $35.7 million, and $5.2 million and $11.5 million, for the three and nine months ended September 30, 2023 and 2022, respectively. See further discussion below. |

| (1) A non-GAAP financial measure. |

| (2) Each measure for 2023, except for AFFO and AFFO per diluted share, includes $2.1 million of additional straight-line rent revenue related primarily to recording a straight-line rent receivable for Regal ground leases in connection with reestablishing accrual basis accounting for Regal at August 1, 2023. |

Third Quarter Company Headlines

•Regal Bankruptcy Resolution - As previously announced, the Company entered into a comprehensive restructuring agreement with Regal anchored by a new master lease for 41 of the 57 properties previously leased to Regal that became effective on August 1, 2023. Of the properties surrendered by Regal, five theaters, which are to be operated by third parties, were opened for business in early August and one of the 11 properties to be disposed was sold in September.

•Santikos Acquires Southern Theatres – On July 17, 2023, Santikos Theaters, LLC (“Santikos”) acquired VSS-Southern Theatres (“Southern”) through an asset purchase agreement. The Company has investments in ten theatre properties that were previously operated by Southern and there are no structural changes to existing lease terms. In conjunction with the transaction, Southern paid in full its remaining deferred rent of $11.6 million, which was recognized as rental revenue during the third quarter of 2023.

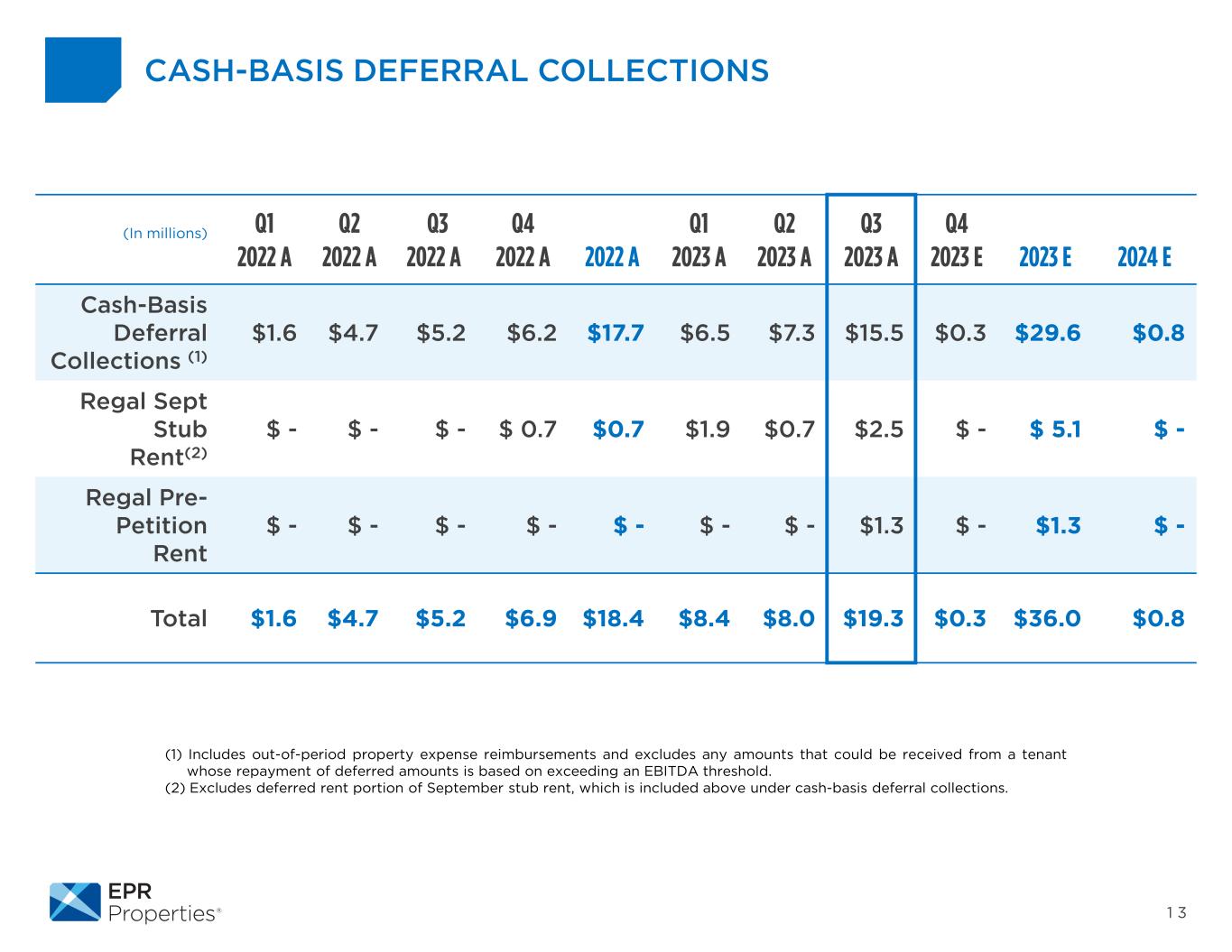

•Solid Deferral Collections - During the third quarter of 2023, the Company collected $19.3 million of deferred rent from cash basis customers that was booked as additional revenue, including the deferred rent discussed above in connection with the Santikos transaction and

deferred amounts received related to the resolution of Regal’s bankruptcy. Through September 30, 2023, the Company has collected over $150.0 million of rent and interest that had been deferred as a result of the COVID-19 pandemic.

•Strong Liquidity Position - As of September 30, 2023, the Company had cash on hand of $173.0 million, no borrowings on its $1.0 billion unsecured revolving credit facility and a consolidated debt profile that is all at fixed interest rates with no maturities in 2023 and only $136.6 million maturing in 2024.

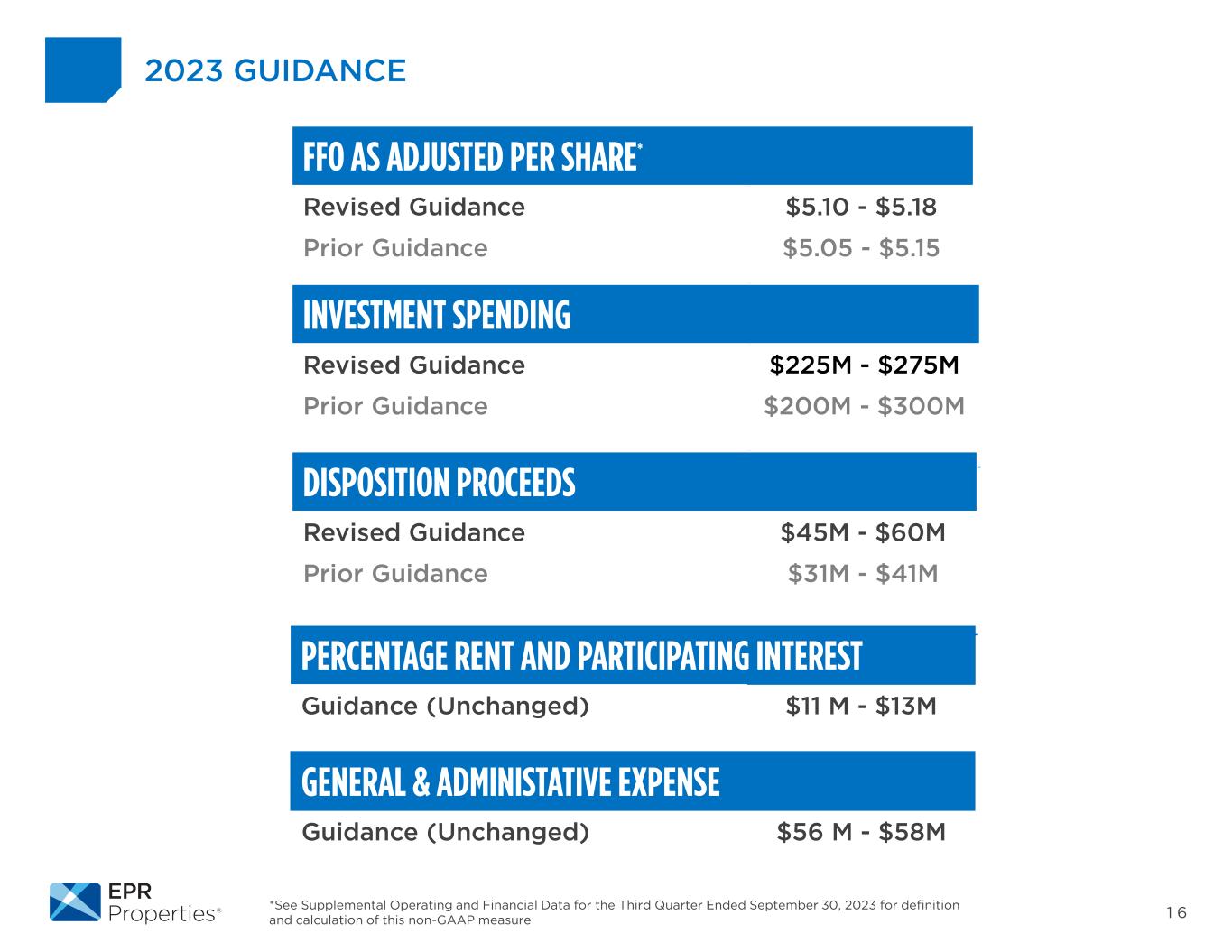

•Updates 2023 Earnings Guidance - The Company is increasing FFOAA per diluted common share guidance for 2023 from a range of $5.05 to $5.15 to a range of $5.10 to $5.18 and narrowing 2023 investment spending guidance from a range of $200.0 million to $300.0 million to a range of $225.0 million to $275.0 million.

“In the third quarter we delivered solid earnings results, with continued strong performance at our experiential properties as well as significant deferral collections, contributing to our increased guidance for the year,” stated Company President and CEO Greg Silvers. “Furthermore, we are pleased to see the ongoing stabilization of our portfolio as the restructured master lease agreement with Regal became effective in the quarter, and we continue to see a strong recovery at the box office. We have an attractive pipeline of committed developments and investment opportunities in experiential projects, and we are being thoughtful in deploying our capital as we selectively pursue growth while maintaining a strong balance sheet position.”

Regal Bankruptcy Resolution

On September 7, 2022, Cineworld Group, plc, Regal Entertainment Group and the Company's other Regal theatre tenants (collectively, “Regal”) filed for protection under Chapter 11 of the U.S. Bankruptcy Code (the “Code”). Regal leased 57 theatres from the Company pursuant to two master leases and 28 single property leases (the “Regal Leases”). Regal's plan of reorganization became effective on July 31, 2023 (the "Effective Date"), and Regal emerged from the Chapter 11 bankruptcy cases.

The Company entered into a comprehensive restructuring agreement with Regal anchored by a new master lease ("Master Lease") for 41 of the 57 properties previously leased to Regal ("Master Lease Properties"), which became effective on the Effective Date. The Master Lease is a triple-net lease with $65.0 million in total annual fixed rent payable beginning on August 1, 2023 that escalates by 10% every five years. The Master Lease has three tranches of properties. The initial terms of the tranches are staggered, expiring on the 11th, 13th and 15th anniversaries from the Effective Date. Additionally, the Master Lease provides for a guaranty from a parent entity of Regal and percentage rents based on gross sales of the Master Lease Properties.

Additionally, as part of the comprehensive restructuring agreement with Regal, Regal surrendered to the Company the remaining 16 properties not included in the Master Lease on the Effective Date. The Company has entered into management agreements whereby Cinemark is managing four and Phoenix Theatres is managing one of the surrendered properties. As discussed further below, the Company sold one of the remaining 11 surrendered properties in the third quarter and plans to also sell the other ten properties. Net proceeds are expected to be used to acquire non-theatre experiential properties.

For more details on the Master Lease and comprehensive restructuring agreement between the Company and Regal, see the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

Santikos Acquisition of Southern Theatres

On July 17, 2023, Santikos acquired Southern through an asset purchase agreement. The combined Santikos entity operates 27 highly amenitized theaters in eight southeastern states. The Company has investments in ten theatre properties that were previously operated by Southern and located in six states and there are no structural changes to existing lease terms. Santikos had investments in ten theaters located in the San Antonio area prior to the transaction and purchased a total of 17 theaters in eight states from Southern, making Santikos the eighth largest theater circuit in North America. Santikos is owned by The San Antonio Area Foundation, one of the nation’s premier Community Foundations. In conjunction with the transaction, Southern paid in full its remaining deferred rent of $11.6 million, which was recognized as rental revenue during the third quarter of 2023.

Solid Deferral Collections

In addition to regular quarterly collections, during the third quarter of 2023, the Company collected $19.3 million of deferred rent from cash basis customers that was booked as additional revenue, including the deferred rent discussed above in connection with the Santikos transaction and deferred amounts received related to the resolution of Regal's bankruptcy. Additionally, during the third quarter of 2023, the Company collected $0.2 million of deferred rent from accrual basis customers that reduced receivables, leaving only $0.8 million of deferred rent receivable remaining on the balance sheet at September 30, 2023. Through September 30, 2023, the Company has collected over $150.0 million of rent and interest that had been deferred as a result of the pandemic.

Strong Liquidity Position

The Company remains focused on maintaining strong liquidity and financial flexibility. The Company had $173.0 million of cash on hand at quarter-end, no borrowings on its $1.0 billion unsecured revolving credit facility and a consolidated debt profile that is all at fixed interest rates with no maturities in 2023 and only $136.6 million due in 2024.

Investment Update

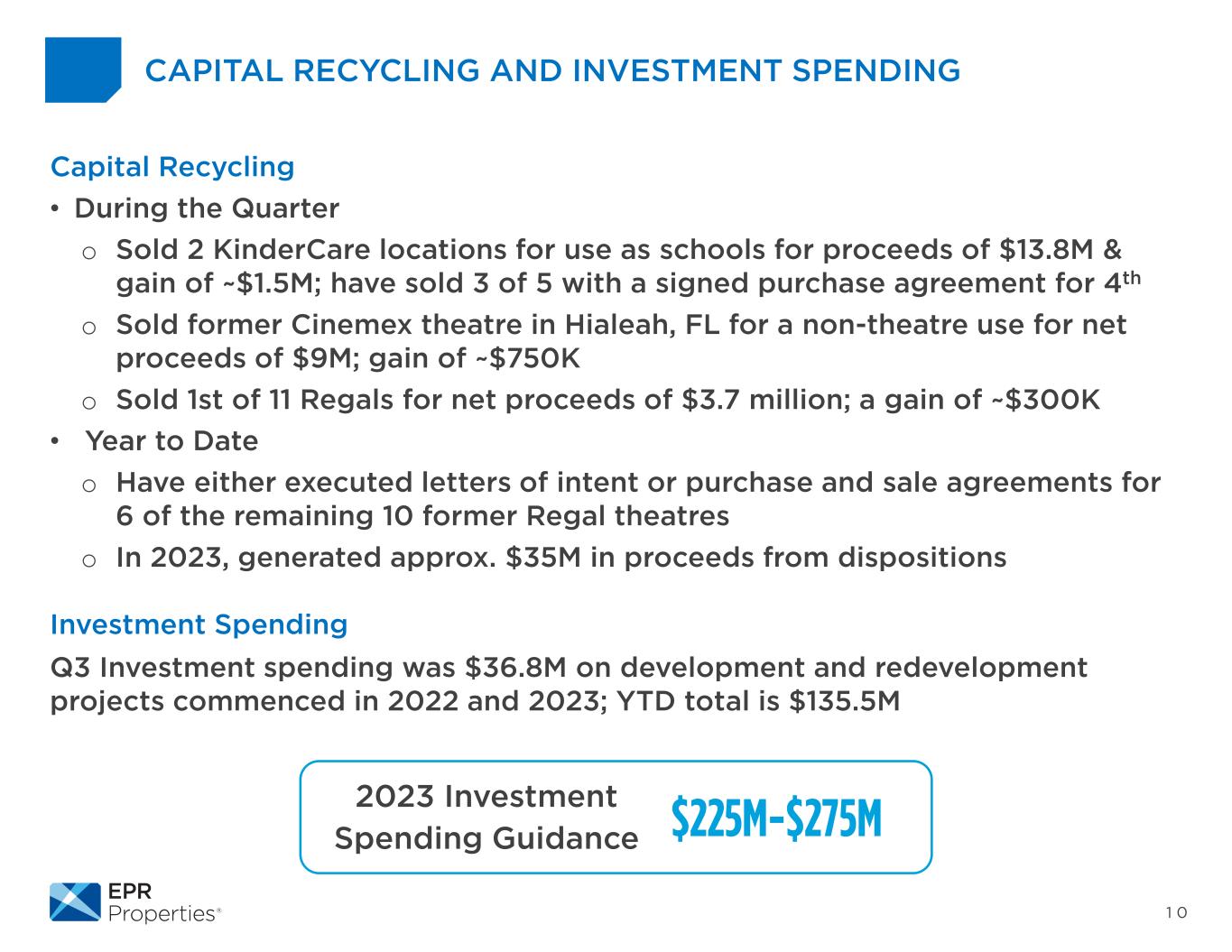

The Company's investment spending during the three months ended September 30, 2023 totaled $36.8 million, bringing the total investment spending for the nine months ended September 30, 2023 to $135.5 million. Investment spending for the quarter was primarily related to experiential build-to-suit development and redevelopment projects.

As of September 30, 2023, the Company has also committed an additional approximately $235.0 million for experiential development and redevelopment projects, which is expected to be funded over the next two years without the need to raise additional capital. The Company will continue to be more selective in making investments, utilizing cash on hand, excess cash flow and borrowings under our line of credit, until such time as the Company's cost of capital returns to acceptable levels.

Capital Recycling

During the third quarter of 2023, the Company completed the sales of two vacant theatre properties and two early childhood education center properties for net proceeds totaling $26.6 million and recognized a gain on sale of $2.6 million for the quarter. Disposition proceeds totaled $35.0 million for the nine months ended September 30, 2023.

Portfolio Update

The Company's total assets were $5.7 billion (after accumulated depreciation of approximately $1.4 billion) and total investments (a non-GAAP financial measure) were approximately $6.7 billion at September 30, 2023, with Experiential investments totaling $6.2 billion, or 92%, and Education investments totaling $0.5 billion, or 8%.

The Company's Experiential portfolio (excluding property under development and undeveloped land inventory) consisted of the following property types (owned or financed) at September 30, 2023:

•169 theatre properties;

•57 eat & play properties (including seven theatres located in entertainment districts);

•24 attraction properties;

•11 ski properties;

•seven experiential lodging properties;

•16 fitness & wellness properties;

•one gaming property; and

•three cultural properties.

As of September 30, 2023, the Company's owned Experiential portfolio consisted of approximately 19.9 million square feet, which includes 0.5 million square feet of properties the Company intends to sell. The Experiential portfolio, excluding the properties the Company intends to sell, was 99% leased and included a total of $101.3 million in property under development and $20.2 million in undeveloped land inventory.

The Company's Education portfolio consisted of the following property types (owned or financed) at September 30, 2023:

•62 early childhood education center properties; and

•nine private school properties.

As of September 30, 2023, the Company's owned Education portfolio consisted of approximately 1.3 million square feet, which includes 0.1 million square feet of properties the Company intends to sell. The Education portfolio, excluding the properties the Company intends to sell, was 100% leased.

The combined owned portfolio consisted of 21.3 million square feet and was 99% leased excluding the 0.6 million square feet of properties the Company intends to sell.

Dividend Information

The Company declared regular monthly cash dividends during the third quarter of 2023 totaling $0.825 per common share. Additionally, the Board declared its regular quarterly dividends to preferred shareholders of $0.359375 per share on both the Company's 5.75% Series C cumulative convertible preferred shares and Series G cumulative redeemable preferred shares and $0.5625 per share on its 9.00% Series E cumulative convertible preferred shares.

2023 Guidance

(Dollars in millions, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| Measure | | Current | Prior |

| Net income available to common shareholders per diluted common share | | $ | 1.98 | | to | $ | 2.06 | | $ | 2.14 | | to | $ | 2.24 | |

| FFOAA per diluted common share | | $ | 5.10 | | to | $ | 5.18 | | $ | 5.05 | | to | $ | 5.15 | |

| Investment spending | | $ | 225.0 | | to | $ | 275.0 | | $ | 200.0 | | to | $ | 300.0 | |

| Disposition proceeds | | $ | 45.0 | | to | $ | 60.0 | | $ | 31.0 | | to | $ | 41.0 | |

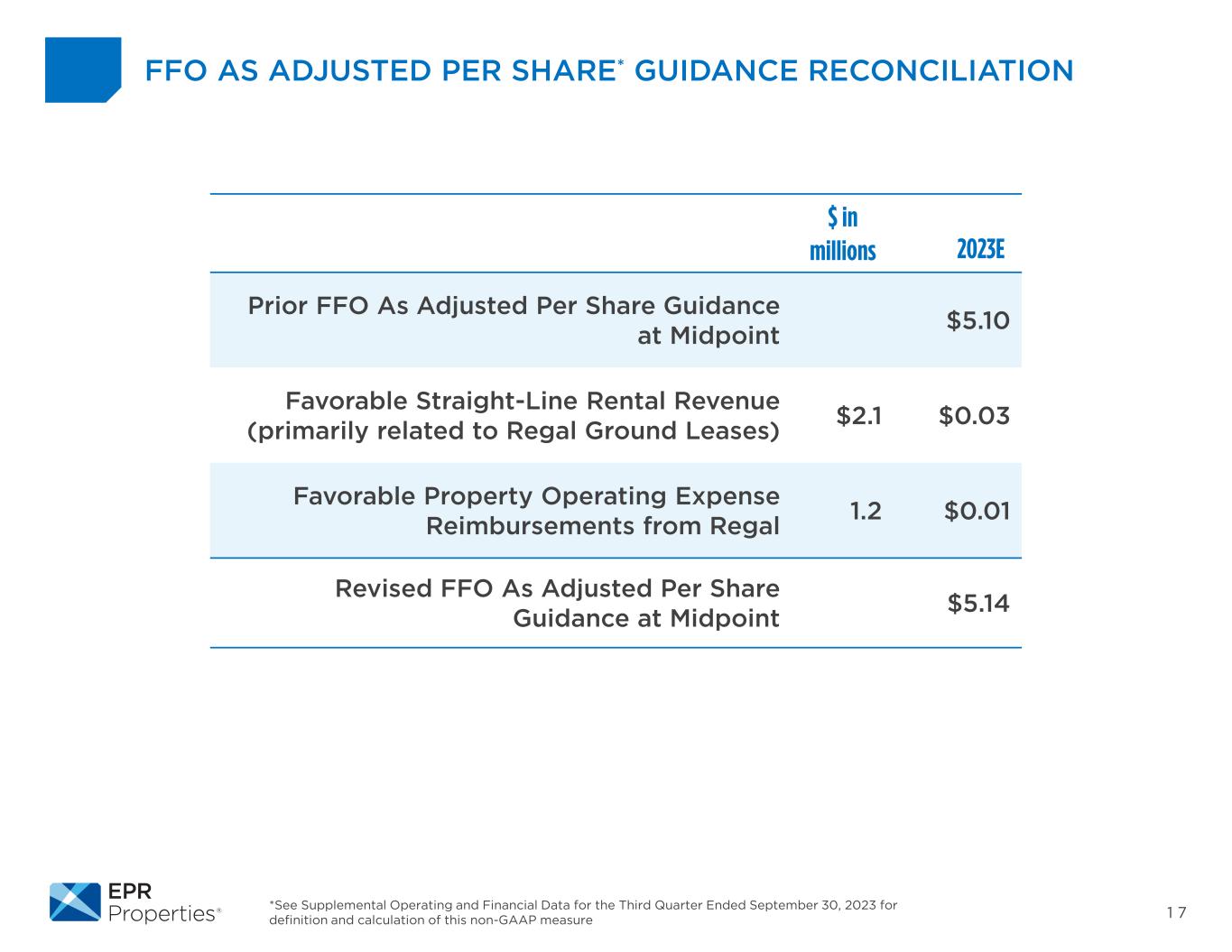

The Company is increasing its 2023 guidance for FFOAA per diluted common share from a range of $5.05 to $5.15 to a range of $5.10 to $5.18. The 2023 guidance for FFOAA per diluted common share is based on a FFO per diluted common share range of $5.06 to $5.14 adjusted for severance expense, transaction costs, provision (benefit) for credit losses, net, deferred income tax benefit and the impact of Series C and Series E dilution. FFO per diluted common share for 2023 is based on a net income available to common shareholders per diluted common share range of $1.98 to $2.06 plus impairment of real estate investments, net of $0.85, estimated real estate depreciation and amortization of $2.20 and allocated share of joint venture depreciation of $0.12, less gain on

sale of real estate of $0.04 and the impact of Series C and Series E dilution of $0.05 (in accordance with the NAREIT definition of FFO).

Additional earnings guidance detail can be found in the Company's supplemental information package available in the Investor Center of the Company's website located at https://investors.eprkc.com/earnings-supplementals.

Conference Call Information

Management will host a conference call to discuss the Company's financial results on October 26, 2023 at 8:30 a.m. Eastern Time. The call may also include discussion of Company developments and forward-looking and other material information about business and financial matters. The conference will be webcast and can be accessed via the Webcasts page in the Investor Center on the Company's website located at https://investors.eprkc.com/webcasts. To access the audio-only call, visit the Webcasts page for the link to register and receive dial-in information and a PIN providing access to the live call. It is recommended that you join 10 minutes prior to the start of the event (although you may register and dial-in at any time during the call).

You may watch a replay of the webcast by visiting the Webcasts page at https://investors.eprkc.com/webcasts.

Quarterly Supplemental

The Company's supplemental information package for the third quarter and nine months ended September 30, 2023 is available in the Investor Center on the Company's website located at https://investors.eprkc.com/earnings-supplementals.

EPR Properties

Consolidated Statements of Income

(Unaudited, dollars in thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Rental revenue | $ | 163,940 | | | $ | 140,471 | | | $ | 467,401 | | | $ | 422,949 | |

| Other income | 14,422 | | | 11,360 | | | 33,879 | | | 30,626 | |

| Mortgage and other financing income | 11,022 | | | 9,579 | | | 32,407 | | | 25,753 | |

| Total revenue | 189,384 | | | 161,410 | | | 533,687 | | | 479,328 | |

| Property operating expense | 14,592 | | | 14,707 | | | 42,719 | | | 42,238 | |

| Other expense | 13,124 | | | 9,135 | | | 31,235 | | | 26,104 | |

| General and administrative expense | 13,464 | | | 12,582 | | | 42,677 | | | 38,497 | |

| Severance expense | — | | | — | | | 547 | | | — | |

| | | | | | | |

| Transaction costs | 847 | | | 148 | | | 1,153 | | | 3,540 | |

| Provision (benefit) for credit losses, net | (719) | | | 241 | | | (407) | | | 9,447 | |

| Impairment charges | 20,887 | | | — | | | 64,672 | | | 4,351 | |

| Depreciation and amortization | 42,432 | | | 41,539 | | | 127,341 | | | 122,349 | |

| Total operating expenses | 104,627 | | | 78,352 | | | 309,937 | | | 246,526 | |

| Gain on sale of real estate | 2,550 | | | 304 | | | 1,415 | | | 304 | |

| | | | | | | |

| Income from operations | 87,307 | | | 83,362 | | | 225,165 | | | 233,106 | |

| | | | | | | |

| | | | | | | |

| Interest expense, net | 31,208 | | | 32,747 | | | 94,521 | | | 99,296 | |

| Equity in (income) loss from joint ventures | (533) | | | (572) | | | 2,067 | | | (1,887) | |

| Impairment charges on joint ventures | — | | | — | | | — | | | 647 | |

| Income before income taxes | 56,632 | | | 51,187 | | | 128,577 | | | 135,050 | |

| Income tax expense | 372 | | | 388 | | | 1,060 | | | 1,150 | |

| Net income | $ | 56,260 | | | $ | 50,799 | | | $ | 127,517 | | | $ | 133,900 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Preferred dividend requirements | 6,032 | | | 6,033 | | | 18,105 | | | 18,099 | |

| | | | | | | |

| Net income available to common shareholders of EPR Properties | $ | 50,228 | | | $ | 44,766 | | | $ | 109,412 | | | $ | 115,801 | |

| Net income available to common shareholders of EPR Properties per share: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 0.67 | | | $ | 0.60 | | | $ | 1.45 | | | $ | 1.55 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | 0.66 | | | $ | 0.60 | | | $ | 1.45 | | | $ | 1.54 | |

| Shares used for computation (in thousands): | | | | | | | |

| Basic | 75,325 | | | 75,016 | | | 75,236 | | | 74,949 | |

| Diluted | 75,816 | | | 75,183 | | | 75,655 | | | 75,102 | |

EPR Properties

Condensed Consolidated Balance Sheets

(Unaudited, dollars in thousands)

| | | | | | | | | | | |

| |

| | September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Real estate investments, net of accumulated depreciation of $1,400,642 and $1,302,640 at September 30, 2023 and December 31, 2022, respectively | $ | 4,571,514 | | | $ | 4,714,136 | |

| Land held for development | 20,168 | | | 20,168 | |

| Property under development | 101,313 | | | 76,029 | |

| Operating lease right-of-use assets | 190,309 | | | 200,985 | |

| Mortgage notes and related accrued interest receivable, net | 477,243 | | | 457,268 | |

| | | |

| Investment in joint ventures | 53,855 | | | 52,964 | |

| Cash and cash equivalents | 172,953 | | | 107,934 | |

| Restricted cash | 2,868 | | | 2,577 | |

| | | |

| Accounts receivable | 54,826 | | | 53,587 | |

| | | |

| Other assets | 74,328 | | | 73,053 | |

| Total assets | $ | 5,719,377 | | | $ | 5,758,701 | |

| Liabilities and Equity | | | |

| Accounts payable and accrued liabilities | $ | 82,804 | | | $ | 80,087 | |

| Operating lease liabilities | 230,922 | | | 241,407 | |

| Dividends payable | 28,827 | | | 27,438 | |

| Unearned rents and interest | 88,530 | | | 63,939 | |

| Debt | 2,814,497 | | | 2,810,111 | |

| Total liabilities | 3,245,580 | | | 3,222,982 | |

| | | |

| | | |

| Total equity | $ | 2,473,797 | | | $ | 2,535,719 | |

| Total liabilities and equity | $ | 5,719,377 | | | $ | 5,758,701 | |

Non-GAAP Financial Measures

Funds From Operations (FFO), Funds From Operations As Adjusted (FFOAA) and Adjusted Funds From Operations (AFFO)

The National Association of Real Estate Investment Trusts (NAREIT) developed FFO as a relative non-GAAP financial measure of performance of an equity REIT in order to recognize that income-producing real estate historically has not depreciated on the basis determined under GAAP. Pursuant to the definition of FFO by the Board of Governors of NAREIT, the Company calculates FFO as net income available to common shareholders, computed in accordance with GAAP, excluding gains and losses from disposition of real estate and impairment losses on real estate, plus real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships, joint ventures and other affiliates. Adjustments for unconsolidated partnerships, joint ventures and other affiliates are calculated to reflect FFO on the same basis. The Company has calculated FFO for all periods presented in accordance with this definition.

In addition to FFO, the Company presents FFOAA and AFFO. FFOAA is presented by adding to FFO severance expense, transaction costs, provision (benefit) for credit losses, net, costs associated with loan refinancing or payoff, preferred share redemption costs and impairment of operating lease right-of-use assets and subtracting sale participation income, gain on insurance recovery and deferred income tax (benefit) expense. AFFO is presented by adding to FFOAA non-real estate depreciation and amortization, deferred financing fees amortization, share-based compensation expense to management and Trustees and amortization of above and below market leases, net and tenant allowances; and subtracting maintenance capital expenditures (including second generation tenant improvements and leasing commissions), straight-lined rental revenue (removing the impact of straight-lined ground sublease expense), and the non-cash portion of mortgage and other financing income.

FFO, FFOAA and AFFO are widely used measures of the operating performance of real estate companies and are provided here as supplemental measures to GAAP net income available to common shareholders and earnings per share, and management provides FFO, FFOAA and AFFO herein because it believes this information is useful to investors in this regard. FFO, FFOAA and AFFO are non-GAAP financial measures. FFO, FFOAA and AFFO do not represent cash flows from operations as defined by GAAP and are not indicative that cash flows are adequate to fund all cash needs and are not to be considered alternatives to net income or any other GAAP measure as a measurement of the results of our operations or our cash flows or liquidity as defined by GAAP. It should also be noted that not all REITs calculate FFO, FFOAA and AFFO the same way so comparisons with other REITs may not be meaningful.

The following table summarizes FFO, FFOAA and AFFO for the three and nine months ended September 30, 2023 and 2022 and reconciles such measures to net income available to common shareholders, the most directly comparable GAAP measure:

EPR Properties

Reconciliation of Non-GAAP Financial Measures

(Unaudited, dollars in thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| FFO: | | | | | | | |

| Net income available to common shareholders of EPR Properties | $ | 50,228 | | | $ | 44,766 | | | $ | 109,412 | | | $ | 115,801 | |

| Gain on sale of real estate | (2,550) | | | (304) | | | (1,415) | | | (304) | |

| | | | | | | |

| Impairment of real estate investments, net | 20,887 | | | — | | | 64,672 | | | 4,351 | |

| Real estate depreciation and amortization | 42,224 | | | 41,331 | | | 126,718 | | | 121,721 | |

| Allocated share of joint venture depreciation | 2,315 | | | 2,093 | | | 6,532 | | | 5,576 | |

| Impairment charges on joint ventures | — | | | — | | | — | | | 647 | |

| FFO available to common shareholders of EPR Properties | $ | 113,104 | | | $ | 87,886 | | | $ | 305,919 | | | $ | 247,792 | |

| | | | | | | | |

| FFO available to common shareholders of EPR Properties | $ | 113,104 | | | $ | 87,886 | | | $ | 305,919 | | | $ | 247,792 | |

| Add: Preferred dividends for Series C preferred shares | 1,938 | | | 1,938 | | | 5,814 | | | 5,814 | |

| Add: Preferred dividends for Series E preferred shares | 1,938 | | | 1,939 | | | 5,814 | | | 5,817 | |

| Diluted FFO available to common shareholders of EPR Properties | $ | 116,980 | | | $ | 91,763 | | | $ | 317,547 | | | $ | 259,423 | |

| | | | | | | |

| FFOAA: | | | | | | | |

| FFO available to common shareholders of EPR Properties | $ | 113,104 | | | $ | 87,886 | | | $ | 305,919 | | | $ | 247,792 | |

| | | | | | | |

| Severance expense | — | | | — | | | 547 | | | — | |

| Transaction costs | 847 | | | 148 | | | 1,153 | | | 3,540 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Provision (benefit) for credit losses, net | (719) | | | 241 | | | (407) | | | 9,447 | |

| | | | | | | |

| Gain on insurance recovery (included in other income) | — | | | — | | | — | | | (552) | |

| Deferred income tax benefit | (76) | | | (37) | | | (258) | | | (37) | |

| FFOAA available to common shareholders of EPR Properties | $ | 113,156 | | | $ | 88,238 | | | $ | 306,954 | | | $ | 260,190 | |

| | | | | | | | |

| FFOAA available to common shareholders of EPR Properties | $ | 113,156 | | | $ | 88,238 | | | $ | 306,954 | | | $ | 260,190 | |

| Add: Preferred dividends for Series C preferred shares | 1,938 | | | 1,938 | | | 5,814 | | | 5,814 | |

| Add: Preferred dividends for Series E preferred shares | 1,938 | | | 1,939 | | | 5,814 | | | 5,817 | |

| Diluted FFOAA available to common shareholders of EPR Properties | $ | 117,032 | | | $ | 92,115 | | | $ | 318,582 | | | $ | 271,821 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| AFFO: | | | | | | |

| FFOAA available to common shareholders of EPR Properties | $ | 113,156 | | | $ | 88,238 | | | $ | 306,954 | | | $ | 260,190 | |

| Non-real estate depreciation and amortization | 208 | | | 208 | | | 623 | | | 628 | |

| Deferred financing fees amortization | 2,170 | | | 2,090 | | | 6,449 | | | 6,251 | |

| Share-based compensation expense to management and trustees | 4,354 | | | 4,138 | | | 13,153 | | | 12,552 | |

| Amortization of above and below market leases, net and tenant allowances | (182) | | | (89) | | | (456) | | | (265) | |

| Maintenance capital expenditures (1) | (1,753) | | | (386) | | | (7,384) | | | (1,871) | |

| Straight-lined rental revenue | (4,407) | | | (2,374) | | | (7,661) | | | (4,702) | |

| Straight-lined ground sublease expense | 77 | | | 602 | | | 1,043 | | | 1,111 | |

| Non-cash portion of mortgage and other financing income | (290) | | | (119) | | | (553) | | | (353) | |

| AFFO available to common shareholders of EPR Properties | $ | 113,333 | | | $ | 92,308 | | | $ | 312,168 | | | $ | 273,541 | |

| | | | | | | |

| AFFO available to common shareholders of EPR Properties | $ | 113,333 | | | $ | 92,308 | | | $ | 312,168 | | | $ | 273,541 | |

| Add: Preferred dividends for Series C preferred shares | 1,938 | | | 1,938 | | | 5,814 | | | 5,814 | |

| Add: Preferred dividends for Series E preferred shares | 1,938 | | | 1,939 | | | 5,814 | | | 5,817 | |

| Diluted AFFO available to common shareholders of EPR Properties | $ | 117,209 | | | $ | 96,185 | | | $ | 323,796 | | | $ | 285,172 | |

| | | | | | | |

| FFO per common share: | | | | | | | |

| Basic | $ | 1.50 | | | $ | 1.17 | | | $ | 4.07 | | | $ | 3.31 | |

| Diluted | 1.47 | | | 1.16 | | | 3.99 | | | 3.28 | |

| FFOAA per common share: | | | | | | | |

| Basic | $ | 1.50 | | | $ | 1.18 | | | $ | 4.08 | | | $ | 3.47 | |

| Diluted | 1.47 | | | 1.16 | | | 4.00 | | | 3.44 | |

| AFFO per common share: | | | | | | | |

| Basic | $ | 1.50 | | | $ | 1.23 | | | $ | 4.15 | | | $ | 3.65 | |

| Diluted | 1.47 | | | 1.22 | | | 4.07 | | | 3.61 | |

| Shares used for computation (in thousands): | | | | | | | |

| Basic | 75,325 | | | 75,016 | | | 75,236 | | | 74,949 | |

| Diluted | 75,816 | | | 75,183 | | | 75,655 | | | 75,102 | |

| | | | | | | | |

| Weighted average shares outstanding-diluted EPS | 75,816 | | | 75,183 | | | 75,655 | | | 75,102 | |

| Effect of dilutive Series C preferred shares | 2,287 | | | 2,250 | | | 2,279 | | | 2,245 | |

| | | | | | | |

| Effect of dilutive Series E preferred shares | 1,663 | | | 1,664 | | | 1,663 | | | 1,664 | |

| Adjusted weighted average shares outstanding-diluted Series C and Series E | 79,766 | | | 79,097 | | | 79,597 | | | 79,011 | |

| Other financial information: | | | | | | | |

| | | | | | | |

| Dividends per common share | $ | 0.8250 | | | $ | 0.8250 | | | $ | 2.4750 | | | $ | 2.4250 | |

| | | | | | | | |

(1) Includes maintenance capital expenditures and certain second generation tenant improvements and leasing commissions.

The conversion of the 5.75% Series C cumulative convertible preferred shares and the 9.00% Series E cumulative convertible preferred shares would be dilutive to FFO, FFOAA and AFFO per share for the three and nine months ended September 30, 2023 and 2022. Therefore, the additional common shares that would result from the conversion and the corresponding add-back of the preferred dividends declared on those shares are included in the calculation of diluted FFO, FFOAA and AFFO per share for those periods.

Net Debt

Net Debt represents debt (reported in accordance with GAAP) adjusted to exclude deferred financing costs, net and reduced for cash and cash equivalents. By excluding deferred financing costs, net, and reducing debt for cash and cash equivalents on hand, the result provides an estimate of the contractual amount of borrowed capital to be repaid, net of cash available to repay it. The Company believes this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding our financial condition. The Company's method of calculating Net Debt may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs.

Gross Assets

Gross Assets represents total assets (reported in accordance with GAAP) adjusted to exclude accumulated depreciation and reduced for cash and cash equivalents. By excluding accumulated depreciation and reducing cash and cash equivalents, the result provides an estimate of the investment made by the Company. The Company believes that investors commonly use versions of this calculation in a similar manner. The Company's method of calculating Gross Assets may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs.

Net Debt to Gross Assets Ratio

Net Debt to Gross Assets Ratio is a supplemental measure derived from non-GAAP financial measures that the Company uses to evaluate capital structure and the magnitude of debt to gross assets. The Company believes that investors commonly use versions of this ratio in a similar manner. The Company's method of calculating the Net Debt to Gross Assets Ratio may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs.

EBITDAre

NAREIT developed EBITDAre as a relative non-GAAP financial measure of REITs, independent of a company's capital structure, to provide a uniform basis to measure the enterprise value of a company. Pursuant to the definition of EBITDAre by the Board of Governors of NAREIT, the Company calculates EBITDAre as net income, computed in accordance with GAAP, excluding interest expense (net), income tax (benefit) expense, depreciation and amortization, gains and losses from disposition of real estate, impairment losses on real estate, costs associated with loan refinancing or payoff and adjustments for unconsolidated partnerships, joint ventures and other affiliates.

Management provides EBITDAre herein because it believes this information is useful to investors as a supplemental performance measure because it can help facilitate comparisons of operating performance between periods and with other REITs. The Company's method of calculating EBITDAre may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs. EBITDAre is not a measure of performance under GAAP, does not represent cash generated from operations as defined by GAAP and is not indicative of cash available to fund all cash needs, including distributions. This measure should not be considered an alternative to net income or any other GAAP measure as a measurement of the results of the Company's operations or cash flows or liquidity as defined by GAAP.

Adjusted EBITDAre

Management uses Adjusted EBITDAre in its analysis of the performance of the business and operations of the Company. Management believes Adjusted EBITDAre is useful to investors because it excludes various items that management believes are not indicative of operating performance, and because it is an informative measure to use in computing various financial ratios to evaluate the Company. The Company defines Adjusted EBITDAre as EBITDAre (defined above) for the quarter excluding sale participation income, gain on insurance recovery, severance expense, transaction costs, provision (benefit) for credit losses, net, impairment losses on operating lease right-of-use assets and prepayment fees.

The Company's method of calculating Adjusted EBITDAre may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs. Adjusted EBITDAre is

not a measure of performance under GAAP, does not represent cash generated from operations as defined by GAAP and is not indicative of cash available to fund all cash needs, including distributions. This measure should not be considered as an alternative to net income or any other GAAP measure as a measurement of the results of the Company's operations or cash flows or liquidity as defined by GAAP.

Net Debt to Adjusted EBITDAre Ratio

Net Debt to Adjusted EBITDAre Ratio is a supplemental measure derived from non-GAAP financial measures that the Company uses to evaluate our capital structure and the magnitude of our debt against our operating performance. The Company believes that investors commonly use versions of this ratio in a similar manner. In addition, financial institutions use versions of this ratio in connection with debt agreements to set pricing and covenant limitations. The Company's method of calculating the Net Debt to Adjusted EBITDAre Ratio may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs.

Reconciliations of debt, total assets and net income (all reported in accordance with GAAP) to Net Debt, Gross Assets, Net Debt to Gross Assets Ratio, EBITDAre, Adjusted EBITDAre and Net Debt to Adjusted EBITDAre Ratio (each of which is a non-GAAP financial measure), as applicable, are included in the following tables (unaudited, in thousands except ratios):

| | | | | | | | | | | |

| September 30, |

| 2023 | | 2022 |

| Net Debt: | | | |

| Debt | $ | 2,814,497 | | $ | 2,808,587 |

| Deferred financing costs, net | 26,732 | | 32,642 |

| Cash and cash equivalents | (172,953) | | (160,838) |

| Net Debt | $ | 2,668,276 | | $ | 2,680,391 |

| | | |

| Gross Assets: | | | |

| Total Assets | $ | 5,719,377 | | $ | 5,792,759 |

| Accumulated depreciation | 1,400,642 | | 1,278,427 |

| Cash and cash equivalents | (172,953) | | (160,838) |

| Gross Assets | $ | 6,947,066 | | $ | 6,910,348 |

| | | |

| Debt to Total Assets Ratio | 49 | % | | 48 | % |

| Net Debt to Gross Assets Ratio | 38 | % | | 39 | % |

| | | |

| Three Months Ended September 30, |

| 2023 | | 2022 |

| EBITDAre and Adjusted EBITDAre: | | | |

| Net income | $ | 56,260 | | | $ | 50,799 | |

| Interest expense, net | 31,208 | | | 32,747 | |

| Income tax expense | 372 | | | 388 | |

| Depreciation and amortization | 42,432 | | | 41,539 | |

| Gain on sale of real estate | (2,550) | | | (304) | |

| Impairment of real estate investments, net | 20,887 | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Allocated share of joint venture depreciation | 2,315 | | | 2,093 | |

| Allocated share of joint venture interest expense | 2,164 | | | 1,822 | |

| | | |

| EBITDAre | $ | 153,088 | | | $ | 129,084 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Transaction costs | 847 | | | 148 | |

| Provision (benefit) for credit losses, net | (719) | | | 241 | |

| | | |

| | | |

| | | |

| | | |

| Adjusted EBITDAre | $ | 153,216 | | | $ | 129,473 | |

| | | |

| Adjusted EBITDAre (annualized) (1) | $ | 612,864 | | | $ | 517,892 | |

| | | |

| Net Debt/Adjusted EBITDA Ratio | 4.4 | | | 5.2 | |

| | | |

|

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| (1) Adjusted EBITDA for the quarter is multiplied by four to calculate an annualized amount. |

|

Total Investments

Total investments is a non-GAAP financial measure defined as the sum of the carrying values of real estate investments (before accumulated depreciation), land held for development, property under development, mortgage notes receivable and related accrued interest receivable, net, investment in joint ventures, intangible assets, gross (before accumulated amortization and included in other assets) and notes receivable and related accrued interest receivable, net (included in other assets). Total investments is a useful measure for management and investors as it illustrates across which asset categories the Company's funds have been invested. Our method of calculating total investments may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs. A reconciliation of total assets (computed in accordance with GAAP) to total investments is included in the following table (unaudited, in thousands):

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| | | |

| Total assets | $ | 5,719,377 | | | $ | 5,758,701 | |

| Operating lease right-of-use assets | (190,309) | | | (200,985) | |

| Cash and cash equivalents | (172,953) | | | (107,934) | |

| Restricted cash | (2,868) | | | (2,577) | |

| Accounts receivable | (54,826) | | | (53,587) | |

| Add: accumulated depreciation on real estate investments | 1,400,642 | | | 1,302,640 | |

| Add: accumulated amortization on intangible assets (1) | 29,893 | | | 23,487 | |

| Prepaid expenses and other current assets (1) | (35,893) | | | (33,559) | |

| Total investments | $ | 6,693,063 | | | $ | 6,686,186 | |

| | | |

| Total Investments: | | | |

| Real estate investments, net of accumulated depreciation | $ | 4,571,514 | | | $ | 4,714,136 | |

| Add back accumulated depreciation on real estate investments | 1,400,642 | | | 1,302,640 | |

| Land held for development | 20,168 | | | 20,168 | |

| Property under development | 101,313 | | | 76,029 | |

| Mortgage notes and related accrued interest receivable, net | 477,243 | | | 457,268 | |

| | | |

| Investment in joint ventures | 53,855 | | | 52,964 | |

| Intangible assets, gross (1) | 64,156 | | | 60,109 | |

| Notes receivable and related accrued interest receivable, net (1) | 4,172 | | | 2,872 | |

| Total investments | $ | 6,693,063 | | | $ | 6,686,186 | |

| | | |

| (1) Included in other assets in the accompanying consolidated balance sheet. Other assets include the following: |

| | | |

| September 30, 2023 | | December 31, 2022 |

| Intangible assets, gross | $ | 64,156 | | | $ | 60,109 | |

| Less: accumulated amortization on intangible assets | (29,893) | | | (23,487) | |

| Notes receivable and related accrued interest receivable, net | 4,172 | | | 2,872 | |

| Prepaid expenses and other current assets | 35,893 | | | 33,559 | |

| Total other assets | $ | 74,328 | | | $ | 73,053 | |

About EPR Properties

EPR Properties (NYSE:EPR) is the leading diversified experiential net lease real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry. We focus on real estate venues that create value by facilitating out of home leisure and recreation experiences where consumers choose to spend their discretionary time and money. We have total assets of approximately $5.7 billion (after accumulated depreciation of approximately $1.4 billion) across 44 states. We adhere to rigorous underwriting and investing criteria centered on key industry, property and tenant level cash flow standards. We believe our focused approach provides a competitive advantage and the potential for stable and attractive returns. Further information is available at www.eprkc.com.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

The financial results in this press release reflect preliminary, unaudited results, which are not final until the Company’s Quarterly Report on Form 10-Q is filed. With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to our guidance, the uncertain financial impact of the COVID-19 pandemic, our capital resources and liquidity, our pursuit of growth opportunities, the timing of transaction closings and investment spending, our expected cash flows, the performance of our customers, our expected cash collections and our results of operations and financial condition. The forward-looking statements presented herein are based on the Company's current expectations. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance that the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict. For further discussion of these factors see “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q.

For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof.

EPR Properties

Brian Moriarty, 816-472-1700

www.eprkc.com

FOURTH QUARTER 2022 EARNINGS CALL February 23, 2023 EARNINGS CALL PRESENTATION Q3 2023

2 The financial results in this document reflect preliminary, unaudited results, which are not final until the Company’s Quarterly Report on Form 10-Q is filed. With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to our guidance, the uncertain financial impact of the COVID-19 pandemic, our capital resources and liquidity, our pursuit of growth opportunities, the timing of transaction closings and investment spending, our expected cash flows, the performance of our customers, our expected cash collections and our results of operations and financial condition. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance that the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict. For further discussion of these factors see “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof. DISCLAIMER

INTRODUCTORY COMMENTS

PORTFOLIO UPDATE

5 PORTFOLIO OVERVIEW Education Portfolio 71 Properties; 8 Operators Occupancy at 100%** *See Quarterly Report on Form 10-Q for quarter ended September 30, 2023 for definition and calculation of this non-GAAP measure **Excluding properties EPR intends to sell Experiential Portfolio 288 Properties; 51 Operators Occupancy at 99%** $6.2B (92%) Total Investments* Total Portfolio Snapshot ~$6.7B Total Investments* 359 Properties Occupancy at 99%** Q3 Investment Spending $36.8M YTD Investment Spending $135.5M

6 PORTFOLIO COVERAGE *Normalized theatre coverage is calculated as though the Regal restructuring had been in place for 12 months ending June, 30, 2023 **BoxOfficeMojo TTM June 2023 Normalized TTM June 2023* YE 2019 Theatre Coverage 1.4x 1.5x 1.7x Box Office** $8.1B $8.1B $11.4B Non-Theatre Coverage 2.6x 2.6x 2.0x Total Portfolio Coverage 2.0x 2.1x 1.9x Strong Total Portfolio Coverage Methodology – Coverage numerator is customer's store level EBITDARM and denominator is EPR's minimum rent or interest (excludes non-cash straight-line rent or interest income from the effective interest method of accounting) EBITDARM data is sourced from customers' reported store level profit and loss statements

7 THEATRES Tenant and Operator Updates Regal Restructuring • Entered into restructuring agreement anchored by new master lease for 41 of 57 properties • Master lease became effective August 1st 5 Former Regal Locations, Now Managed Properties • 4 managed by Cinemark, 1 managed by Phoenix • All open, ramping up and regaining market share; performance in line with expectations Santikos Acquisition of Southern Theatres on July 17 • Now 8th largest theatre circuit in North America • Southern paid entire remaining deferred rent of $11.6M Potential Restructuring • Due to potential restructuring with a small, regional theatre operator, we took impairment charge of $20.9M

8 THEATRES *BoxOfficeMojo Box Office Continued Recovery* Q3 Box Office • $7B for Q1-Q3 2023, 26% increase over 2022 • $955M combined box office from Barbie and Oppenheimer • $2.6B Q3 box office, 38% increase over 2022 Q4 Box Office • Taylor Swift: The Eras Tour grossed $93M opening weekend, the second highest October opening gross ever; has grossed $132M through 10/23 • Killers of the Flower Moon grossed $23M opening weekend Year to Date Box Office through Oct. 23 • 21 films have grossed over $100M • $7.44B box office, exceeding 2022 total box office Full Year Box Office • Box office should end up slightly above $9B, up 24% over 2022

9 PORTFOLIO UPDATE Experiential Lodging Revenue & EBITDARM growth across portfolio Eat & Play Q3 portfolio revenue & EBITDARM up Attractions & Cultural Attractions saw increased gains with some EBITDARM pressure; City Museum attendance up 11%, Titanic Museums see growth Fitness & Wellness Continued growth in membership revenue for fitness, improvements in EBITDARM; construction underway on The Springs Resort & Murietta Springs Ski Vail season pass sales up 7% over last season; Alyeska joins IKON Pass this coming season

1 0 CAPITAL RECYCLING AND INVESTMENT SPENDING Capital Recycling • During the Quarter o Sold 2 KinderCare locations for use as schools for proceeds of $13.8M & gain of ~$1.5M; have sold 3 of 5 with a signed purchase agreement for 4th o Sold former Cinemex theatre in Hialeah, FL for a non-theatre use for net proceeds of $9M; gain of ~$750K o Sold 1st of 11 Regals for net proceeds of $3.7 million; a gain of ~$300K • Year to Date o Have either executed letters of intent or purchase and sale agreements for 6 of the remaining 10 former Regal theatres o In 2023, generated approx. $35M in proceeds from dispositions Investment Spending Q3 Investment spending was $36.8M on development and redevelopment projects commenced in 2022 and 2023; YTD total is $135.5M 2023 Investment Spending Guidance $225M-$275M

FINANCIAL REVIEW

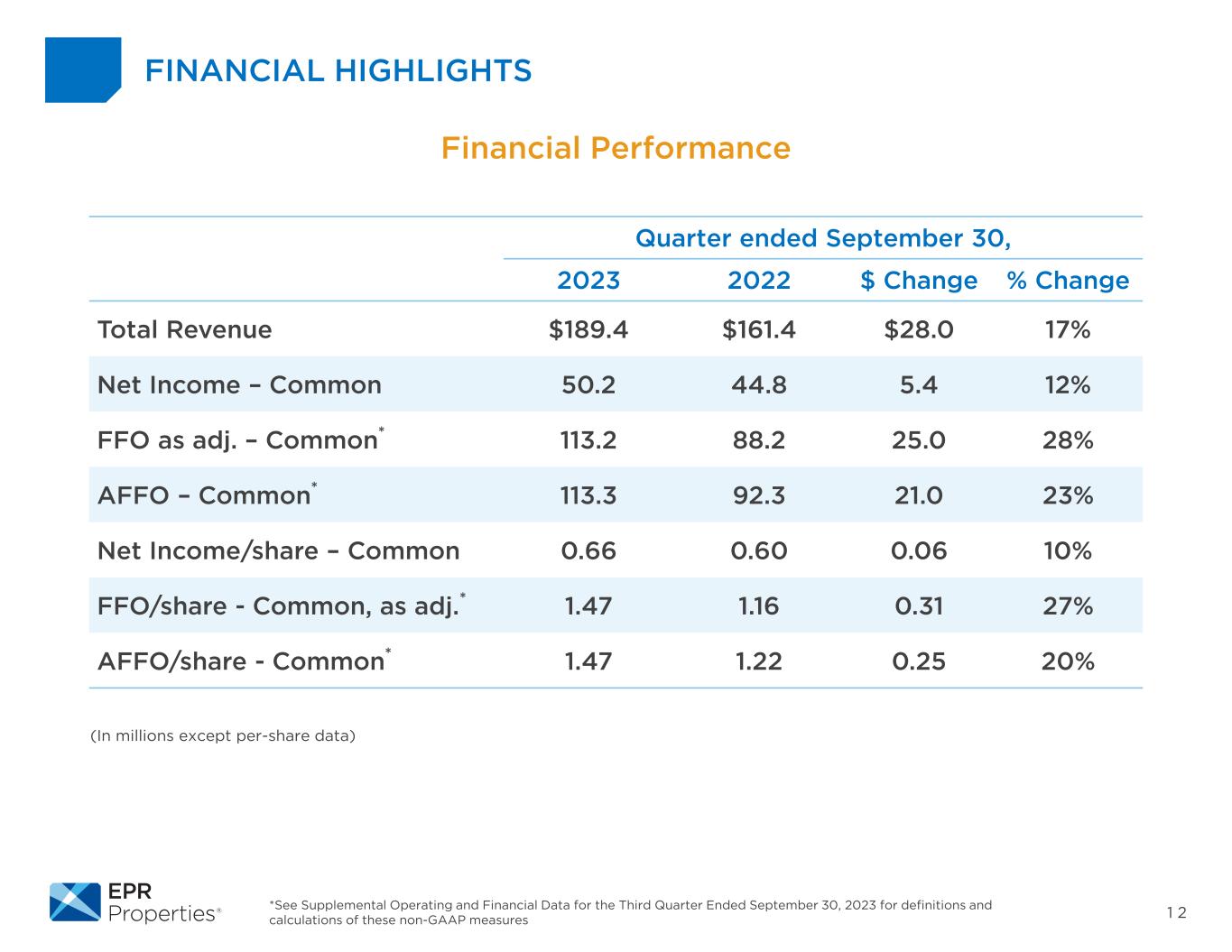

1 2 (In millions except per-share data) *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2023 for definitions and calculations of these non-GAAP measures FINANCIAL HIGHLIGHTS Financial Performance Quarter ended September 30, 2023 2022 $ Change % Change Total Revenue $189.4 $161.4 $28.0 17% Net Income – Common 50.2 44.8 5.4 12% FFO as adj. – Common* 113.2 88.2 25.0 28% AFFO – Common* 113.3 92.3 21.0 23% Net Income/share – Common 0.66 0.60 0.06 10% FFO/share - Common, as adj.* 1.47 1.16 0.31 27% AFFO/share - Common* 1.47 1.22 0.25 20%

1 3 CASH-BASIS DEFERRAL COLLECTIONS (In millions) Q1 2022 A Q2 2022 A Q3 2022 A Q4 2022 A 2022 A Q1 2023 A Q2 2023 A Q3 2023 A Q4 2023 E 2023 E 2024 E Cash-Basis Deferral Collections (1) $1.6 $4.7 $5.2 $6.2 $17.7 $6.5 $7.3 $15.5 $0.3 $29.6 $0.8 Regal Sept Stub Rent(2) $ - $ - $ - $ 0.7 $0.7 $1.9 $0.7 $2.5 $ - $ 5.1 $ - Regal Pre- Petition Rent $ - $ - $ - $ - $ - $ - $ - $1.3 $ - $1.3 $ - Total $1.6 $4.7 $5.2 $6.9 $18.4 $8.4 $8.0 $19.3 $0.3 $36.0 $0.8 (1) Includes out-of-period property expense reimbursements and excludes any amounts that could be received from a tenant whose repayment of deferred amounts is based on exceeding an EBITDA threshold. (2) Excludes deferred rent portion of September stub rent, which is included above under cash-basis deferral collections.

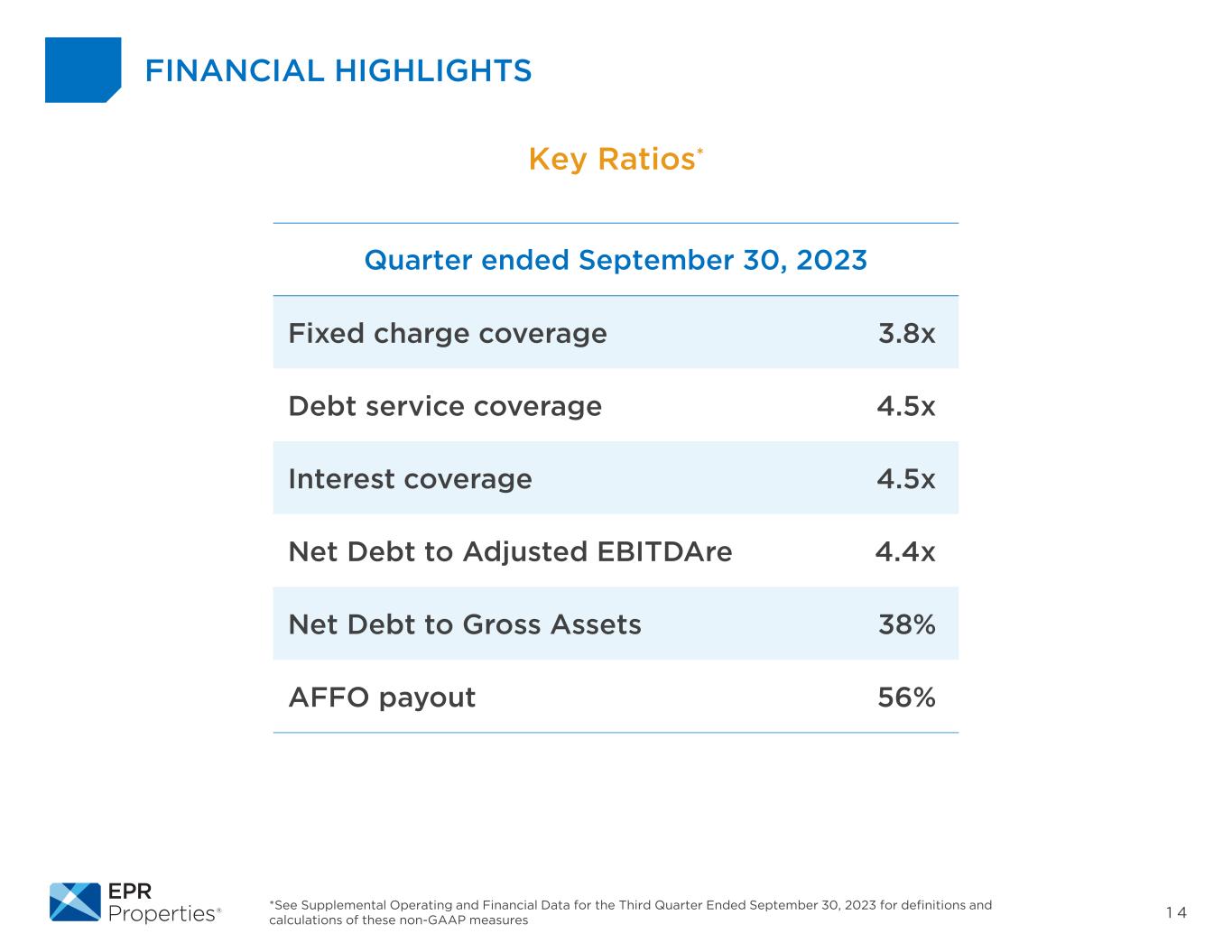

1 4 FINANCIAL HIGHLIGHTS Key Ratios* Quarter ended September 30, 2023 Fixed charge coverage 3.8x Debt service coverage 4.5x Interest coverage 4.5x Net Debt to Adjusted EBITDAre 4.4x Net Debt to Gross Assets 38% AFFO payout 56% *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2023 for definitions and calculations of these non-GAAP measures

1 5 Debt • $2.8B total debt; all fixed rate or fixed through interest rate swaps at weighted avg. = 4.3% • Weighted avg. debt maturity of 4.5 years; no scheduled debt maturities in 2023 and only $136.6M due in 2024 Liquidity Position at 9/30/2023 • $173.0M unrestricted cash • No balance on $1B revolver CAPITAL MARKETS UPDATE

1 6 2023 GUIDANCE *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2023 for definition and calculation of this non-GAAP measure FFO AS ADJUSTED PER SHARE* Revised Guidance $5.10 - $5.18 Prior Guidance $5.05 - $5.15 INVESTMENT SPENDING Revised Guidance $225M - $275M Prior Guidance $200M - $300M DISPOSITION PROCEEDS Revised Guidance $45M - $60M Prior Guidance $31M - $41M PERCENTAGE RENT AND PARTICIPATING INTEREST Guidance (Unchanged) $11 M - $13M GENERAL & ADMINISTATIVE EXPENSE Guidance (Unchanged) $56 M - $58M

1 7 FFO AS ADJUSTED PER SHARE* GUIDANCE RECONCILIATION *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2023 for definition and calculation of this non-GAAP measure $ in millions 2023E Prior FFO As Adjusted Per Share Guidance at Midpoint $5.10 Favorable Straight-Line Rental Revenue (primarily related to Regal Ground Leases) $2.1 $0.03 Favorable Property Operating Expense Reimbursements from Regal 1.2 $0.01 Revised FFO As Adjusted Per Share Guidance at Midpoint $5.14

1 8 FFO AS ADJUSTED PER SHARE* WITHOUT DEFERRAL COLLECTIONS *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2023 for definition and calculation of this non-GAAP measure $ in millions 2022 A $ in millions 2023 E (1) Growth FFO As Adjusted Per Share $4.69 $5.14 9.6% Less: Deferral Collections $18.4 ($0.24) $36.0 ($0.47) FFO As Adjusted Per Share Without Deferral Collections $4.45 $4.67 4.9% (1) Estimates for 2023 reflect the mid-point of guidance.

CLOSING COMMENTS

EPR Properties 909 Walnut Street, Suite 200 Kansas City, MO 64106 www.eprkc.com 816-472-1700 info@eprkc.com

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| TABLE OF CONTENTS |

| | | | | | | | |

| SECTION | | | | | | | | PAGE |

| | | | | | | | |

| Company Profile | |

| Investor Information | |

| Selected Financial Information | |

| Selected Balance Sheet Information | |

| Selected Operating Data | |

| Funds From Operations and Funds From Operations as Adjusted | |

| Adjusted Funds From Operations | |

| Capital Structure | |

| Summary of Ratios | |

| Summary of Mortgage Notes Receivable | |

| Summary of Unconsolidated Joint Ventures | |

| Investment Spending and Disposition Summaries | |

| Property Under Development - Investment Spending Estimates | |

| Portfolio Detail | |

| |

| Lease Expirations | |

| Top Ten Customers by Total Revenue | |

| |

| Guidance | |

| Definitions-Non-GAAP Financial Measures | |

| Appendix-Reconciliation of Certain Non-GAAP Financial Measures | |

| | | | | | | | |

| | |

| Q3 2023 Supplemental | Page 2 |

| |

| | | | | | | | | | | | | | |

| CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS |

The financial results in this document reflect preliminary, unaudited results, which are not final until the Company’s Quarterly Report on Form 10-Q is filed. With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to our guidance, the uncertain financial impact of the COVID-19 pandemic, our capital resources and liquidity, our pursuit of growth opportunities, the timing of transaction closings and investment spending, our expected cash flows, the performance of our customers, our expected cash collections and our results of operations and financial condition. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance that the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict. For further discussion of these factors see “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q.

For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof.

NON-GAAP INFORMATION

This document contains certain non-GAAP measures. These non-GAAP measures, as calculated by the Company, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measurements of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See pages 25 through 27 for definitions of certain non-GAAP financial measures used in this document and the reconciliations of certain non-GAAP measures on pages 9 and 10 and in the Appendix on pages 28 through 32.

| | | | | | | | |

| | |

| Q3 2023 Supplemental | Page 3 |

| |

| | | | | | | | |

| THE COMPANY | | COMPANY STRATEGY |

| EPR Properties ("we," "us," "our," "EPR" or the "Company") is a self-administered and self-managed real estate investment trust. EPR was formed in August 1997 as a Maryland real estate investment trust ("REIT"), and an initial public offering was completed on November 18, 1997. | | Our primary business objective is to enhance shareholder value by achieving predictable growth in Funds from Operations As Adjusted ("FFOAA") and dividends per share. |

| Our strategic growth is focused on acquiring or developing a diversified portfolio of experiential real estate venues which create value by facilitating out of home congregate entertainment, recreation and leisure experiences where consumers choose to spend their discretionary time and money. This strategy is driven by the long-term trends of the growing experience economy. |

| Since that time, the Company has been a leading Experiential net lease REIT, specializing in select enduring experiential properties. We are focused on growing our Experiential portfolio with properties that offer a variety of enduring, congregate entertainment, recreation and leisure activities. Separately, our Education portfolio is a legacy investment that provides additional geographic and operator diversity. | |

| This focus is consistent with our depth of knowledge across each of our property types, creating a competitive advantage that allows us to more quickly identify key market trends. We deliberately apply information and our ingenuity to target properties that represent logical extensions within each of our existing property types or potential future investments. |

| |

| As part of our strategic planning and portfolio management process we assess new opportunities against the following underwriting principles: |

| |

|

|

|

|

|

| | | | | | | | | | | | | | | | | | | | |

| BUILDING THE PREMIER EXPERIENTIAL REAL ESTATE PORTFOLIO |

| | | | | | |

| | | | | | |

| | | | | | | | |

| | |

| Q3 2023 Supplemental | Page 4 |

| |

| | | | | | | | |

| INVESTOR INFORMATION |

| | |

| SENIOR MANAGEMENT |

| | |

| Greg Silvers | | Mark Peterson |

| Chairman and Chief Executive Officer | | Executive Vice President and Chief Financial Officer |

| | |

| Craig Evans | | Greg Zimmerman |

| Executive Vice President, General Counsel and Secretary | | Executive Vice President and Chief Investment Officer |

| | |

| Tonya Mater | | Elizabeth Grace |

| Senior Vice President and Chief Accounting Officer | | Senior Vice President - Human Resources and Administration |

| | |

| Paul Turvey | | Gwen Johnson |

| Senior Vice President and Associate General Counsel | | Senior Vice President - Asset Management |

| | |

| | | | | | | | |

| COMPANY INFORMATION |

| | |

| CORPORATE HEADQUARTERS | | TRADING SYMBOLS |

| 909 Walnut Street, Suite 200 | | Common Stock: |

| Kansas City, MO 64106 | | EPR |

| 816-472-1700 | | Preferred Stock: |

| www.eprkc.com | | EPR-PrC |

| | EPR-PrE |

| STOCK EXCHANGE LISTING | | EPR-PrG |

| New York Stock Exchange | | |

| | | | | | | | |

| EQUITY RESEARCH COVERAGE |

| | |

| Bank of America Merrill Lynch | Jeffrey Spector/Joshua Dennerlein | 646-855-1363 |

| Citi Global Markets | Nick Joseph/Eric Wolfe | 212-816-1383 |

| | |

| Janney Montgomery Scott | Rob Stevenson | 646-840-3217 |

| J.P. Morgan | Anthony Paolone | 212-622-6682 |

| JMP Securities | Mitch Germain | 212-906-3537 |

| Kansas City Capital Associates | Jonathan Braatz | 816-932-8019 |

| Keybanc Capital Markets | Todd Thomas | 917-368-2286 |

| | |

| Raymond James & Associates | RJ Milligan | 727-567-2585 |

| RBC Capital Markets | Michael Carroll | 440-715-2649 |

| Stifel | Simon Yarmak | 443-224-1345 |

| Truist | Ki Bin Kim | 212-303-4124 |

| Wells Fargo | Connor Siversky | 212-214-8069 |

EPR Properties is followed by the analysts identified above. Please note that any opinions, estimates, forecasts or recommendations regarding EPR Properties’ performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or recommendations of EPR Properties or its management. EPR Properties does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

| | | | | | | | |

| | |

| Q3 2023 Supplemental | Page 5 |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| SELECTED FINANCIAL INFORMATION |

| (UNAUDITED, DOLLARS AND SHARES IN THOUSANDS) |

| | | | | | | |

| THREE MONTHS ENDED SEPTEMBER 30, | | NINE MONTHS ENDED SEPTEMBER 30, |

| OPERATING INFORMATION: | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 189,384 | | | $ | 161,410 | | | $ | 533,687 | | | $ | 479,328 | |

| Net income available to common shareholders of EPR Properties | 50,228 | | | 44,766 | | | 109,412 | | | 115,801 | |

| EBITDAre (1) | 153,088 | | | 129,084 | | | 426,647 | | | 371,184 | |

| Adjusted EBITDAre (1) | 153,216 | | | 129,473 | | | 427,940 | | | 383,619 | |

| Interest expense, net | 31,208 | | | 32,747 | | | 94,521 | | | 99,296 | |

| | | | | | | |

| Capitalized interest | 857 | | | 335 | | | 2,486 | | | 606 | |

| Straight-lined rental revenue | 4,407 | | | 2,374 | | | 7,661 | | | 4,702 | |

| Dividends declared on preferred shares | 6,032 | | | 6,033 | | | 18,105 | | | 18,099 | |

| Dividends declared on common shares | 62,144 | | | 61,889 | | | 186,382 | | | 181,861 | |

| General and administrative expense | 13,464 | | | 12,582 | | | 42,677 | | | 38,497 | |

| | | | | | | |

| SEPTEMBER 30, | | | | |

| BALANCE SHEET INFORMATION: | 2023 | | 2022 | | | | |

| Total assets | $ | 5,719,377 | | | $ | 5,792,759 | | | | | |

| Accumulated depreciation | 1,400,642 | | | 1,278,427 | | | | | |

| Cash and cash equivalents | 172,953 | | | 160,838 | | | | | |

| Total assets before accumulated depreciation less cash and cash equivalents (gross assets) | 6,947,066 | | | 6,910,348 | | | | | |

| Debt | 2,814,497 | | | 2,808,587 | | | | | |

| Deferred financing costs, net | 26,732 | | | 32,642 | | | | | |

| Net debt (1) | 2,668,276 | | | 2,680,391 | | | | | |

| Equity | 2,473,797 | | | 2,556,147 | | | | | |

| Common shares outstanding | 75,328 | | | 75,019 | | | | | |

| Total market capitalization (using EOP closing price and liquidation values) (2) | 6,168,364 | | | 5,741,570 | | | | | |

| Net debt/total market capitalization ratio (1) | 43 | % | | 47 | % | | | | |

| Debt to total assets ratio | 49 | % | | 48 | % | | | | |

| Net debt/gross assets ratio (1) | 38 | % | | 39 | % | | | | |

| | | | | | | |

| Net debt/Adjusted EBITDAre ratio (1) (3) | 4.4 | | | 5.2 | | | | | |

| | | | | | | |

| | | | | | | |

(1) See pages 25 through 27 for definitions. See calculation on page 31, as applicable. |

| (2) See calculation on page 15. |

(3) Adjusted EBITDAre in this calculation is for the three-month period multiplied times four. See pages 25 through 27 for definitions. See calculation on page 31. |

|

|

|

| | | | | | | | |

| | |

| Q3 2023 Supplemental | Page 6 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SELECTED BALANCE SHEET INFORMATION |

| (UNAUDITED, DOLLARS IN THOUSANDS) |

| | | | | | | | | | | | |

| ASSETS | | 3RD QUARTER 2023 | | 2ND QUARTER 2023 | | 1ST QUARTER 2023 | | 4TH QUARTER 2022 | | 3RD QUARTER 2022 | | 2ND QUARTER 2022 |

| Real estate investments | | $ | 5,972,156 | | | $ | 6,029,468 | | | $ | 6,049,869 | | | $ | 6,016,776 | | | $ | 6,048,144 | | | $ | 6,081,941 | |

| Less: accumulated depreciation | | (1,400,642) | | | (1,369,790) | | | (1,341,527) | | | (1,302,640) | | | (1,278,427) | | | (1,243,240) | |

| Land held for development | | 20,168 | | | 20,168 | | | 20,168 | | | 20,168 | | | 20,168 | | | 20,168 | |

| Property under development | | 101,313 | | | 80,650 | | | 85,829 | | | 76,029 | | | 56,347 | | | 8,241 | |

| Operating lease right-of-use assets | | 190,309 | | | 192,325 | | | 197,357 | | | 200,985 | | | 199,031 | | | 202,708 | |

| Mortgage notes and related accrued interest receivable, net | | 477,243 | | | 466,459 | | | 461,263 | | | 457,268 | | | 399,485 | | | 374,617 | |

| | | | | | | | | | | | |

| Investment in joint ventures | | 53,855 | | | 53,763 | | | 50,978 | | | 52,964 | | | 50,124 | | | 47,705 | |

| Cash and cash equivalents | | 172,953 | | | 99,711 | | | 96,438 | | | 107,934 | | | 160,838 | | | 168,266 | |

| Restricted cash | | 2,868 | | | 2,623 | | | 2,599 | | | 2,577 | | | 5,252 | | | 1,277 | |

| Accounts receivable | | 54,826 | | | 53,305 | | | 50,591 | | | 53,587 | | | 53,375 | | | 60,176 | |

| Other assets | | 74,328 | | | 74,882 | | | 83,050 | | | 73,053 | | | 78,422 | | | 71,583 | |

| Total assets | | $ | 5,719,377 | | | $ | 5,703,564 | | | $ | 5,756,615 | | | $ | 5,758,701 | | | $ | 5,792,759 | | | $ | 5,793,442 | |

| | | | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 82,804 | | | $ | 74,493 | | | $ | 76,244 | | | $ | 80,087 | | | $ | 83,384 | | | $ | 67,178 | |

| Operating lease liabilities | | 230,922 | | | 233,126 | | | 238,096 | | | 241,407 | | | 237,254 | | | 240,595 | |

| Common dividends payable | | 22,795 | | | 22,289 | | | 21,826 | | | 21,405 | | | 21,411 | | | 21,146 | |

| Preferred dividends payable | | 6,032 | | | 6,032 | | | 6,033 | | | 6,033 | | | 6,033 | | | 6,033 | |

| Unearned rents and interest | | 88,530 | | | 71,746 | | | 71,601 | | | 63,939 | | | 79,943 | | | 72,833 | |

| Line of credit | | — | | | — | | | — | | | — | | | — | | | — | |

| Deferred financing costs, net | | (26,732) | | | (28,222) | | | (29,576) | | | (31,118) | | | (32,642) | | | (34,149) | |

| Other debt | | 2,841,229 | | | 2,841,229 | | | 2,841,229 | | | 2,841,229 | | | 2,841,229 | | | 2,841,229 | |

| Total liabilities | | 3,245,580 | | | 3,220,693 | | | 3,225,453 | | | 3,222,982 | | | 3,236,612 | | | 3,214,865 | |

| Equity: | | | | | | | | | | | | |

| Common stock and additional paid-in-capital | | 3,920,714 | | | 3,916,102 | | | 3,911,064 | | | 3,900,557 | | | 3,896,179 | | | 3,891,509 | |

| Preferred stock at par value | | 148 | | | 148 | | | 148 | | | 148 | | | 148 | | | 148 | |

| Treasury stock | | (274,035) | | | (274,001) | | | (273,904) | | | (269,751) | | | (269,744) | | | (269,608) | |

| Accumulated other comprehensive income | | 2,378 | | | 3,610 | | | 1,823 | | | 1,897 | | | 1,097 | | | 10,675 | |

| Distributions in excess of net income | | (1,175,408) | | | (1,162,988) | | | (1,107,969) | | | (1,097,132) | | | (1,071,533) | | | (1,054,147) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total equity | | 2,473,797 | | | 2,482,871 | | | 2,531,162 | | | 2,535,719 | | | 2,556,147 | | | 2,578,577 | |

| Total liabilities and equity | | $ | 5,719,377 | | | $ | 5,703,564 | | | $ | 5,756,615 | | | $ | 5,758,701 | | | $ | 5,792,759 | | | $ | 5,793,442 | |

| | | | | | | | | | | | |

| | | | | | | | |

| | |

| Q3 2023 Supplemental | Page 7 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SELECTED OPERATING DATA | |

| (UNAUDITED, DOLLARS IN THOUSANDS) | |

| | | | | | | | | | | | |

| 3RD QUARTER 2023 | | 2ND QUARTER 2023 | | 1ST QUARTER 2023 | | 4TH QUARTER 2022 | | 3RD QUARTER 2022 | | 2ND QUARTER 2022 | |

| Rental revenue | $ | 163,940 | | | $ | 151,870 | | | $ | 151,591 | | | $ | 152,652 | | | $ | 140,471 | | | $ | 142,875 | | |

| Other income | 14,422 | | | 10,124 | | | 9,333 | | | 16,756 | | | 11,360 | | | 9,961 | | |

| Mortgage and other financing income | 11,022 | | | 10,913 | | | 10,472 | | | 9,295 | | | 9,579 | | | 7,610 | | |

| Total revenue | 189,384 | | | 172,907 | | | 171,396 | | | 178,703 | | | 161,410 | | | 160,446 | | |

| | | | | | | | | | | | |

| Property operating expense | 14,592 | | | 13,972 | | | 14,155 | | | 13,747 | | | 14,707 | | | 13,592 | | |

| Other expense | 13,124 | | | 9,161 | | | 8,950 | | | 7,705 | | | 9,135 | | | 8,872 | | |