0001045450false00010454502023-06-282023-06-280001045450us-gaap:CommonStockMember2023-06-282023-06-280001045450us-gaap:SeriesCPreferredStockMember2023-06-282023-06-280001045450us-gaap:SeriesEPreferredStockMember2023-06-282023-06-280001045450us-gaap:SeriesGPreferredStockMember2023-06-282023-06-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 28, 2023

EPR Properties

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-13561 | | 43-1790877 |

(State or other jurisdiction of

incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 909 Walnut Street, | Suite 200 |

| Kansas City, | Missouri | 64106 |

| (Address of principal executive offices) (Zip Code) |

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common shares, par value $0.01 per share | | EPR | | New York Stock Exchange |

| | | | |

| 5.75% Series C cumulative convertible preferred shares, par value $0.01 per share | | EPR PrC | | New York Stock Exchange |

| | | | |

| 9.00% Series E cumulative convertible preferred shares, par value $0.01 per share | | EPR PrE | | New York Stock Exchange |

| | | | |

| 5.75% Series G cumulative redeemable preferred shares, par value $0.01 per share | | EPR PrG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure.

On June 28, 2023, EPR Properties (the "Company") issued a press release announcing a comprehensive restructuring agreement and master lease with Regal Cinemas. The Company's press release is attached as Exhibit 99.1 hereto and is incorporated by reference in this Item 7.01. As previously announced, the Company will host a conference call to discuss the agreement and related matters on June 28, 2023 at 5:00 p.m. Eastern Time. The Company will make available on its website the slide presentation used during the call, a copy of which is attached as Exhibit 99.2 hereto and is incorporated by reference in this Item 7.01.

The information set forth in this Item 7.01, including Exhibits 99.1 and 99.2, is being "furnished" and shall not be deemed "filed" for the purposes of or otherwise subject to liabilities under Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Press Release, dated June 28, 2023, issued by EPR Properties |

| | Investor slide presentation, dated June 28, 2023, made available by EPR Properties |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| EPR PROPERTIES |

| | |

| By: | | /s/ Craig L. Evans |

| | | Craig L. Evans |

| | | Executive Vice President, General Counsel and Secretary |

Date: June 28, 2023

EPR Properties Announces Comprehensive Restructuring Agreement and Master Lease with Regal Cinemas; Management to Host Conference Call

Restructured Portfolio Expected to Achieve 96% of

Total Pre-Bankruptcy Rent In 2024

Regal’s Proposed Plan Expected to Significantly Reduce Its Leverage

Kansas City, MO, June 28, 2023 – EPR Properties (NYSE:EPR) (the “Company”) today announced that it has entered into a comprehensive restructuring agreement with Regal Cinemas and certain of its subsidiaries (collectively, “Regal”) anchored by a new master lease (“Master Lease”) for 41 of the 57 properties currently leased to Regal (“Master Lease Properties”).

The Master Lease is a triple-net lease with $65 million in total annual fixed rent (“Annual Base Rent”) escalating by 10% every five years. The Master Lease has three tranches of properties. The initial terms of the tranches are staggered, expiring on the 11th, 13th and 15th anniversaries of the Effective Date (as defined herein), respectively, and each tranche has three five-year renewal options. The weighted average lease term was increased by four years to 13 years.

Regal will also pay percentage rent for each lease year (“Annual Percentage Rent”) on gross sales exceeding $220 million, with threshold amounts increasing every five years commensurate with escalations in Annual Base Rent. Regal revenues on the 41 Master Lease Properties exceeded $220 million in 2022 as North American Box Office Gross (“NABOG”) totaled $7.4 billion.

The Company will also reduce its footprint with Regal by taking back 16 theatres previously operated by Regal (the “Surrendered Properties”).

•Pursuant to management agreements, Cinemark (NYSE:CNK) will operate four of the Surrendered Properties and Phoenix Theatres will operate one.

•As part of the Company’s strategy to reduce its overall theatre footprint, the remaining 11 theatres will be marketed for sale.

Percentage rent under the Master Lease was designed to allow the Company to participate in expected continued improvements in box office performance, and to provide for income to return to pre-pandemic levels as performance recovers.

For the initial lease year ending in 2024, assuming NABOG approximates $9.4 billion, the combined 41 Master Lease Properties and five operating properties are expected to achieve 96% of the aggregate pre-bankruptcy Regal rent for the 57 properties. The median industry analyst estimate of NABOG for 2023 is $9.0 billion and is $9.8 billion for 2024.

As previously disclosed, on September 7, 2022, Cineworld Group, plc and Regal, and certain of their subsidiaries (collectively, “Debtor”) filed for protection under Chapter 11 of the U.S. Bankruptcy Code. On June 28, 2023, a hearing was held in the case regarding the confirmation of the Debtor’s Plan of Reorganization (the “Plan”). Debtor has recently stated that it is seeking confirmation of the Plan on an expeditious basis and reiterated its expectation that it will emerge from the Chapter 11 cases in July 2023. As a result of the reorganization, it is expected that Debtor’s total debt would be reduced from $5.0 billion owed prior to the bankruptcy, to only $1.5 billion upon effectiveness of the Plan.

The lease restructuring agreement between the Company and Regal is memorialized in an Omnibus Lease Amendment Agreement (the “Omnibus Agreement”), which will be assumed pursuant to the Plan when the Plan becomes effective (the “Effective Date”). Upon confirmation by the court, the Plan will become effective, and Debtor will emerge from the Chapter 11 cases, when its conditions, including the negotiation of Debtor’s loan documents and closing of the transactions contemplated thereby, have been completed (the “Effective Date”). Under the Omnibus Agreement, the Master Lease and related agreements will become effective at the Effective Date. On the Effective Date, Regal will surrender the Surrendered Properties. Regal expects that, assuming all conditions are satisfied, the Effective Date of the Plan will occur during the third quarter of 2023.

CEO Commentary

“The resolution of the Regal bankruptcy will provide us with a much stronger tenant that has a recapitalized and improved balance sheet with significantly lower leverage.” stated Greg Silvers, Chairman and CEO of EPR Properties.

“The transition of the portfolio to a single Master Lease will provide us with a more secure long-term structure. The innovative percentage rent component allows us to more fully participate in the recovery of theatrical exhibition, with significant upside potential. The Management Agreement with Cinemark further solidifies our deep relationship with one of the nation’s leading exhibitors, and the planned disposition of 11 theatres will reduce our overall theatre footprint and provide additional investment capital. We are pleased with the resolution of the restructuring and believe it has enhanced our overall company profile.”

Other Terms of the Master Lease and Related Agreements

•A parent entity of Regal will provide a guaranty of Regal’s obligations under the Master Lease.

•As of June 28, 2023, Regal owes the Company approximately $51.8 million of deferred rent (the “Deferred Rent Balance”) related to the 41 theatres under the Master Lease. The Company will not require any payments toward the Deferred Rent Balance and if Regal has no uncured events of default prior to the 15th anniversary of the Effective Date, the Company will forgive the Deferred Rent Balance. If at any time prior to 15th anniversary of the Effective Date, Regal has an uncured event of default, the entire Deferred Rent Balance will become due and payable. The remaining balance of the deferred rent related to the Surrendered Properties will be an unsecured claim under the bankruptcy proceeding.

•Upon the fulfillment of certain conditions, the Company will reimburse Regal 50% up to a maximum of $32.5 million for revenue enhancing improvements to individual Master Lease Properties undertaken by Regal at its option and approved by the Company.

The material terms of the agreements with Regal described above will be more fully described in the Company’s next Quarterly Report on Form 10-Q.

Operating Properties

In taking back the Surrendered Properties, the Company is reducing its footprint with Regal while expanding and strengthening its long-standing relationship with Cinemark, one of the nation’s leading exhibitors, and adding to its existing managed portfolio with Phoenix Theatres.

Cinemark will manage four high performing theatres located in top 20 MSAs. Three of the theatres have recliners and two have premium large format screens. Phoenix will manage one productive smaller-market theatre.

Properties To Be Marketed for Sale

To reduce its overall theatre footprint, the Company plans to sell the remaining 11 Surrendered Properties and deploy the proceeds to acquire non-theatre experiential properties.

Pending Write-Down

In conjunction with taking back the Surrendered Properties, the Company expects to record a non-cash impairment charge in the second quarter of approximately $50 million based on recently appraised values.

Conference Call Information

Management will host a conference call to discuss the Company's restructuring agreement with Regal and related matters on June 28, 2023 at 5:00 p.m. Eastern Time. The call may also include discussion of Company developments and forward-looking and other material information about business and financial matters. The conference will be webcast and can be accessed via the Webcasts page in the Investor Center on the Company's website located at https://investors.eprkc.com/webcasts. To access the audio-only call, visit the Webcasts page for the link to register and receive dial-in information and a PIN providing access to the live call. It is recommended that you join 10 minutes prior to the start of the event (although you may register and dial-in at any time during the call).

You may watch a replay of the webcast by visiting the Webcasts page at https://investors.eprkc.com/webcasts.

About EPR Properties

EPR Properties (NYSE:EPR) is the leading diversified experiential net lease real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry. We focus on real estate venues which create value by facilitating out of home leisure and recreation experiences where consumers choose to spend their discretionary time and money. We have total assets of approximately $5.8 billion (after accumulated depreciation of approximately $1.3 billion) across 44 states. We adhere to rigorous underwriting and investing criteria centered on key industry, property and tenant level cash flow standards. We believe our focused approach provides a competitive advantage and the potential for stable and attractive returns. Further information is available at www.eprkc.com.

EPR Properties

Brian Moriarty

Vice President, Corporate Communications

brianm@eprkc.com | 816-472-1700

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to our guidance, projected percentage rent, revenues and theatre performance, the expected amount of the Company's pending write-down, the financial impact of the COVID-19 pandemic, the outcome of the Debtor's pending bankruptcy proceeding and its potential impact on our existing leases with Regal theatre tenants, and the timing of transaction closings and bankruptcy proceedings. The forward-looking statements presented herein are based on the Company's current expectations. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict, and include risks relating to the Debtor's ability to obtain approval of its Plan of Reorganization and successfully complete negotiation of its financing agreements in a timely manner; risks relating to the theatre industry, including the quality of future releases, shorter theatre windows for certain releases, continuing changes in consumer preferences and production delays relating to the Writers Guild of America strike; general economic conditions, continuing inflation and higher interest rates, as well as the factors described in “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q.

For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All

subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof.

MARKET AND INDUSTRY DATA

This release contains market and industry forecasts that have been obtained from publicly available information, various industry publications, other published industry sources and our internal data and estimates. We have not independently verified the information from third party sources and cannot make any representation as to the accuracy or completeness of such information. None of the reports and other materials of third-party sources referred to in this release were prepared for use in, or in connection with, this release. Additionally, our internal data and estimates are based upon information obtained from our past experience and our management’s understanding of industry conditions. Estimates are difficult to develop and inherently uncertain, and we cannot assure you that they are accurate. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those detailed above and under “Part I, Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q.

REGAL RESTRUCTURING AGREEMENT June 28, 2023

2 DISCLAIMER With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward- looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to our guidance, projected percentage rent, revenues and theatre performance, the expected amount of the Company's pending write-down, the financial impact of the COVID-19 pandemic, the outcome of the Debtor's pending bankruptcy proceeding and its potential impact on our existing leases with Regal theatre tenants, and the timing of transaction closings and bankruptcy proceedings. The forward-looking statements presented herein are based on the Company's current expectations. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict, and include risks relating to the Debtor's ability to obtain approval of its Plan of Reorganization and successfully complete negotiation of its financing agreements in a timely manner; risks relating to the theatre industry, including the quality of future releases, shorter theatre windows for certain releases, continuing changes in consumer preferences and production delays relating to the Writers Guild of America strike; general economic conditions, continuing inflation and higher interest rates, as well as the factors described in “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof. This release contains market and industry forecasts that have been obtained from publicly available information, various industry publications, other published industry sources and our internal data and estimates. We have not independently verified the information from third party sources and cannot make any representation as to the accuracy or completeness of such information. None of the reports and other materials of third party sources referred to in this release were prepared for use in, or in connection with, this release. Additionally, our internal data and estimates are based upon information obtained from our past experience and our management’s understanding of industry conditions. Estimates are difficult to develop and inherently uncertain, and we cannot assure you that they are accurate. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those detailed above and under “Part I, Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q.

OPENING COMMENTS

4 LEVEL SET AND GOALS Pre-Bankruptcy • 57 Regal theatres • ~$86.3M in total annualized revenues (including annual fixed rent, CAM and ground rent, and excluding deferred rent) • Represented ~13% of total revenue Transaction Goals • Limit revenue reduction • Participate in exhibition recovery • Maintain quality portfolio • Master Lease structure

5 COMPREHENSIVE RESTRUCTURING AGREEMENT Master Lease Properties: 41 properties will continue to be operated by Regal; master lease in 3 tranches with a weighted average lease term of 13 years, an increase of 4 years Rent and Charges: $65M annual fixed rent + ~$3.5M third party charges paid to EPR; Regal responsible for all triple-net charges Annual Percentage Rent: paid on all revenues exceeding $220M within a lease year; threshold amounts increasing every 5 years o Regal revenues for the Master Lease properties exceeded $220M in 2022 as North American Box Office Gross (“NABOG”) totaled $7.4B Surrendered Properties: reducing EPR’s Regal footprint; taking back 16 properties • 4 to be managed by Cinemark • 1 to be managed by Phoenix • 11 to be sold

6 ADDITIONAL TERMS & BENEFITS Other terms of Master Lease & Related Agreements • Guaranty: parent entity of Regal will provide guaranty of obligations • Deferred Rent Note: deferred rent will be forgiven unless default occurs • Capital Commitment: will reimburse Regal for 50% of revenue- enhancing improvements not to exceed $32.5M over 5-yrs; no more than $10M/year Operating Properties • Expanding long-standing relationship with Cinemark o 4 high-performing theatres located in top 20 MSAs, 3 with recliners and 2 with premium large format screens • Adding to existing portfolio with Phoenix Theatres Properties to be Marketed for Sale • Reducing overall theatre footprint by selling 11 Surrendered Properties o Deploying proceeds to acquire non-theatre experiential properties

7 BOX OFFICE RECOVERY Source: BoxOfficeMojo for 2017-May 2023 * Median of multiple analysts for 2023 and 2024 $11.4 $9.0 $9.8 $0 $2 $4 $6 $8 $10 $12 $14 2017 2018 2019 2020 2021 2022 TTM May 2023 2023 2024 Annual Box Office Recovery • Since the low in 2020, NABOG has recovered rapidly with year-over-year growth of 112% in 2021 and 64% in 2022 • 2023 NABOG* is projected at $9.0B, a 22% annual increase • 2024 NABOG* is projected at $9.8B, a 9% annual increase North American Box Office Gross (NABOG) ($B) * *

8 RECOVERY AS BOX OFFICE RAMPS (1) $9.4B of NABOG equals the average of the median of multiple analysts’ estimates of NABOG for 2023 and 2024 (i.e. estimate of NABOG for first year of Regal master lease) (2) Estimated rent coverage calculated by dividing Regal anticipated EBITDAR for the Master Lease properties divided by fixed annual rent (3) Includes $65.0M of annual fixed rent plus an estimate of $3.5M of annual triple-net charges, including ground rent (4) Estimated profit from operating 5 theatres surrendered by Regal (5) Based upon selling 11 theatres surrendered by Regal at recently appraised values and reinvesting proceeds at an 8% cap rate At $9.4B NABOG(1) Master Lease & Operating Properties anticipated to generate 96% of Pre-Bankruptcy Regal Rent (“PBRR”); Master Lease rent coverage estimated at ~1.6x(2) And with investment of proceeds from 11 sold assets, we expect to equal or exceed PBRR Numbers in thousands, except Box Office Regal Total Regal Rent Percentage Regal Operating Total % of Recovery Total % of NABOG Revenues & Charges(3) Rent Total Rent Theatres(4) Income PBRR Rent(5) Recovery PBRR $7.5B 222,800$ 68,500$ 400$ 68,900$ 2,100$ 71,000$ 82% 3,200$ 74,200$ 86% $8.5B 252,500$ 68,500$ 4,900$ 73,400$ 3,900$ 77,300$ 90% 3,200$ 80,500$ 93% $9.0B 267,400$ 68,500$ 7,100$ 75,600$ 4,800$ 80,400$ 93% 3,200$ 83,600$ 97% $9.4B 279,200$ 68,500$ 8,700$ 77,200$ 5,500$ 82,700$ 96% 3,200$ 85,900$ 100% $9.8B 291,100$ 68,500$ 10,100$ 78,600$ 6,200$ 84,800$ 98% 3,200$ 88,000$ 102% $10.5B 311,900$ 68,500$ 12,700$ 81,200$ 7,500$ 88,700$ 103% 3,200$ 91,900$ 106% $11.0B 326,800$ 68,500$ 14,600$ 83,100$ 8,300$ 91,400$ 106% 3,200$ 94,600$ 110% $11.4B 338,600$ 68,500$ 16,100$ 84,600$ 9,000$ 93,600$ 108% 3,200$ 96,800$ 112%

9 PROJECTIONS Regal Portfolio Financial Information (Unaudited, dollars in thousands) 2023 2024 Estimate Estimate (1) Minimum rent and CAM 78,200$ 68,500$ Deferral and stub rent payments 14,600 - (2) Percentage rent - 8,700 (3) Other income (5 operating theatres) 9,800 29,600 (4) Non-cash revenue (SL and other) 2,200 4,100 Total revenue 104,800 110,900 (5) Property operating expense 5,200 5,500 (3) Other expense (5 operating theatres) 9,800 23,400 (6) Transaction costs 5,000 - (7) Impairment charge 50,000 - (8) EBITDA 34,800$ 82,000$ (8) EBITDAre 84,800$ 82,000$ (9) Adjusted EBITDAre (FFO as adjusted) 89,800$ 82,000$ (10) Annualized Adjusted EBITDAre 75,200$ 82,000$ Supplemental data on operating profit of 5 operating theatres: Other income 9,800$ 29,600$ Other expense 9,800 23,400 Operating profit -$ 6,200$

1 0 PROJECTIONS Regal Portfolio Financial Information Footnotes (Unaudited, dollars in thousands) (1) (2) $9.0B $9.4B $9.8B $10.2B Estimated percentage rent for Regal 7,100$ 8,700$ 10,100$ 11,600$ (3) $9.4B $9.8B $10.2B $10.6B Other income 28,400$ 29,600$ 30,800$ 32,000$ Other expense 22,900 23,400 23,900 24,400 Estimated operating profit 5,500$ 6,200$ 6,900$ 7,600$ (4) (5) (6) Transaction costs consist of pre-opening costs related to the five operating theatres. (7) Impairment charge is an estimate and relates to theatres surrendered by Regal. (8) (9) (10) Annualized Adjusted EBITDAre is a non-GAAP financial measure and is equal to Adjusted EBITDAre less deferral and stub rent payments. See Supplemental Operating and Financial Data for the First Quarter Ended March 31, 2023 for the definition. Minimum rent and Common Area Maintenance ("CAM") for 2024 includes $65.0M of annual fixed rent, plus an estimate of $3.5M of annual triple-net charges, including ground rent. Adjusted EBITDAre is a non-GAAP financial measure and is equal to EBITDAre plus transaction costs and is what is used in the non-GAAP measure, FFO as adjusted. See Supplemental Operating and Financial Data for the First Quarter Ended March 31, 2023 for the definitions. NABOG (lease year) Percentage rent estimate for 2024 is for the estimated lease year of 7/1/23-6/30/24 and is based on the average of the median of multiple analysts’ estimates of NABOG for 2023 and 2024 of approximately $9.4B. No percentage rent is expected for 2023. Below is a sensitivity of estimated 2024 percentage rent based on various NABOG levels: Property operating expense includes estimated CAM and ground lease expenses as well as vacant property carrying costs. 2024 NABOG (calendar year) Other income and other expense for 2023 for the five theatres to be operated is based on operating the theatres for five months and assumes these theatres breakeven due to the transition of operations to Cinemark (4) and Phoenix (1). Other income and other expense for 2024 for the five theatres to be operated is based on the consensus of multiple analysts' estimates for NABOG of approximately $9.8B. Below is a sensitivity of estimated 2024 operating results for these five theatres based on NABOG levels: EBITDA and EBITDAre are non-GAAP financial measures. See Supplemental Operating and Financial Data for the First Quarter Ended March 31, 2023 for the definition of EBITDAre. EBITDA equals EBITDAre less impairment charge. The Regal portfolio is expected to move from cash basis to accrual basis accounting beginning on the Effective Date of the Master Lease, estimated at 7/1/23 for projections.

1 1 IN SUMMARY - GOALS MET Goals: Limit revenue reduction Positioned to fully recover previous Regal revenues as box office continues to rebound Participate in exhibition recovery Meaningful percentage rent Maintain quality portfolio Significantly enhanced tenant credit Sale of 11 surrendered properties will reduce overall theatre footprint All units in a Master Lease Established a multi-tranche Master Lease

v3.23.2

DEI Information Document

|

Jun. 28, 2023 |

| Document Information [Line Items] |

|

| Entity Central Index Key |

0001045450

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 28, 2023

|

| Entity Registrant Name |

EPR Properties

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-13561

|

| Entity Tax Identification Number |

43-1790877

|

| Entity Address, Address Line One |

909 Walnut Street,

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Kansas City,

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

64106

|

| City Area Code |

(816)

|

| Local Phone Number |

472-1700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common shares, par value $0.01 per share

|

| Trading Symbol |

EPR

|

| Security Exchange Name |

NYSE

|

| Series C Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.75% Series C cumulative convertible preferred shares, par value $0.01 per share

|

| Trading Symbol |

EPR PrC

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

9.00% Series E cumulative convertible preferred shares, par value $0.01 per share

|

| Trading Symbol |

EPR PrE

|

| Security Exchange Name |

NYSE

|

| Series G Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.75% Series G cumulative redeemable preferred shares, par value $0.01 per share

|

| Trading Symbol |

EPR PrG

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

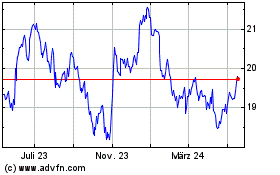

EPR Properties (NYSE:EPR-C)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

EPR Properties (NYSE:EPR-C)

Historical Stock Chart

Von Mai 2023 bis Mai 2024