0001529864false00015298642023-12-042023-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 04, 2023 |

ENOVA INTERNATIONAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

1-35503 |

45-3190813 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

175 West Jackson Boulevard |

|

Chicago, Illinois |

|

60604 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 312 568-4200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.00001 par value per share |

|

ENVA |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Notes Offering

On December 4, 2023, the Company issued a press release regarding its proposed offering of up to $400 million in aggregate principal amount of senior notes due 2028 (the “Notes”). A copy of the press release announcing the offering is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Conditional Full Redemption

On December 4, 2023, the Company issued a notice of conditional full redemption (the “Notice of Conditional Full Redemption”) to the holders of its outstanding 8.500% Senior Notes due 2024 (the “2024 Notes”). Pursuant to the Notice of Conditional Full Redemption, the Company has elected to redeem (the “Redemption”) all of the outstanding 2024 Notes on January 3, 2024 (the “Redemption Date”). The redemption price of the 2024 Notes is equal to 100.000% of the principal amount of such 2024 Notes redeemed, plus accrued and unpaid interest thereon to, but not including, the Redemption Date (the “Redemption Price”). As of December 4, 2023, the aggregate principal amount of the 2024 Notes outstanding is approximately $169 million.

The Redemption will be conditioned upon the Company’s receipt of proceeds from one or more new financing transactions sufficient, in the Company’s sole discretion, to pay the Redemption Price and to effect the other transactions contemplated by such financing transactions, including paying the related fees and expenses, on or prior to the Redemption Date. In addition, in the Company’s discretion, the Redemption Date may be delayed until such time as any or all such conditions precedent shall be satisfied, or such Redemption may not occur and the Notice of Conditional Full Redemption may be rescinded in the event that any or all such conditions shall not have been satisfied by the Redemption Date, or by the Redemption Date so delayed.

This Current Report on Form 8-K does not constitute a notice of redemption under the indenture governing the 2024 Notes, nor an offer to purchase any 2024 Notes or any other security.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished as part of this Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Enova International, Inc. |

|

|

|

|

Date: |

December 4, 2023 |

By: |

/s/ Sean Rahilly |

|

|

|

Sean Rahilly

General Counsel and Secretary |

Exhibit 99.1

ENOVA ANNOUNCES PRIVATE OFFERING OF $400.0 MILLION OF SENIOR NOTES DUE 2028

CHICAGO – December 4, 2023/PRNewswire/ -- Enova International, Inc. (NYSE: ENVA) (“Enova”) today announced that it intends to offer, subject to market and other customary conditions, $400.0 million in aggregate principal amount of senior notes due 2028 (the “Notes”). The Notes will be guaranteed, jointly and severally, on a senior unsecured basis by Enova’s existing and future domestic subsidiaries, subject to certain exceptions including for its securitization subsidiaries. The Notes and the related guarantees will be senior unsecured obligations of Enova and the guarantors.

Enova intends to use the net proceeds from the offering to redeem all of its outstanding senior notes due 2024 (the “2024 Notes”), to fund the prepayment of a portion of its outstanding borrowings under its senior revolving credit agreement, to pay the related accrued interest, fees and expenses related to the offering of the Notes and incurred in connection with the redemption of the 2024 Notes, and for general corporate purposes. Enova’s obligation to redeem the 2024 Notes is conditioned upon the consummation of the offering of the Notes described above.

The Notes and the related guarantees will be offered only to “qualified institutional buyers” pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to certain persons outside of the United States in compliance with Regulation S under the Securities Act. The Notes and the related guarantees have not been registered under the Securities Act, or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States without registration or an applicable exemption from the Securities Act and applicable state securities or blue sky laws and foreign securities laws.

This press release is issued pursuant to Rule 135c of the Securities Act for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy the Notes or any other securities. No offer, solicitation or sale of the Notes will be made in any jurisdiction in which the offer, solicitation or sale is unlawful. Any offers of the Notes will be made only by means of a private offering memorandum.

Cautionary Statement Regarding Forward Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical facts are forward looking statements. These forward-looking statements reflect the current view of management and are subject to various risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those indicated by such forward-looking statements because of various risks and uncertainties, including, without limitation, those risks and uncertainties indicated in Enova’s filings with the Securities and Exchange Commission (“SEC”), including its annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These risks and uncertainties are beyond the ability of Enova to control, and, in many cases, Enova cannot predict all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. When used in this release, the words “believes,” “estimates,” “plans,” “expects,” “anticipates” and similar expressions or variations as they relate to Enova or its management are intended to identify forward-looking statements. Enova cautions you not to put undue reliance on these statements. Enova disclaims any intention or obligation to update or revise any forward-looking statements after the date of this release.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

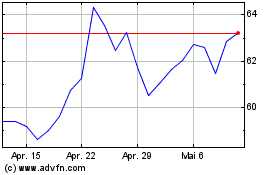

Enova (NYSE:ENVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Enova (NYSE:ENVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024