SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of January, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

|

CA/CAAS

Rua da Quitanda, nº 196, 25º floor.

22210-030 Rio de Janeiro - RJ

RCA 963, ended of 01.03.2023.

|

CERTIFICATE

MINUTES OF THE NINE HUNDRED SIXTY-THIRD MEETING

OF THE BOARD OF DIRECTORS OF CENTRAIS ELÉTRICAS BRASILEIRAS S.A. – ELETROBRAS

NIRE 3330034676-7/CNPJ no. 00001180/0001-26

It certifies, for all due purposes, that the

963rd meeting of the Board of Directors of Centrais Elétricas Brasileiras S.A. – Eletrobras (“Company” or “Eletrobras”)

was installed at 5:38 pm on the second day of January of the year two thousand and twenty-three, with the closure of works recorded at

6:00 pm on the third day of January of the year two thousand and twenty-three. The meeting took place in a virtual format, with the collection

of votes through the ATLAS Governance Portal voting platform. Board member IVAN DE SOUZA MONTEIRO (ISM) virtually chaired the meeting

and spoke electronically. The Board members CARLOS EDUARDO RODRIGUES PEREIRA (CRP), DANIEL ALVES FERREIRA (DAF), FELIPE VILLELA DIAS (FVD),

MARCELO GASPARINO DA SILVA (MGS), MARCELO DE SIQUEIRA FREITAS (MSF), MARISETE FÁTIMA DADALD PEREIRA (MFP), PEDRO BATISTA DE LIMA

FILHO (PBL) and VICENTE FALCONI CAMPOS (VFC) participated virtually in the meeting and spoke electronically. There was no record of absence

from the meeting. The virtual council was chaired by the Superintendent of Governance BRUNO KLAPPER LOPES (BKL). INSTALLATION AND RESOLUTION

QUORUMS: As prescribed by art. 29, caput, of the Bylaws of Eletrobras, the deliberations of this conclave must take place in the presence

of the majority of its members, and its deliberations must be taken, as a general rule, by the majority of those present. In line with

the provisions of item 8.6.4 of the Internal Regulations of this collegiate body, the Board may, by decision of its Chairman, deliberate

between absentees in a duly convened virtual meeting and with a designated deadline for the manifestation of each Director, and the manifestations

must be formulated by electronic mail and/or through the virtual voting function of the Governance Portal, and at the end reproduced in

the minutes of the virtual meeting, which will contain the signature of the members who spoke, the voting period and the closing date

of the collection of votes which, for due legal purposes, will also be considered the date of the virtual meeting. The manifestation of

virtual vote, for legal purposes, is computed in the installation and resolution quorums. In this sense, the meeting was installed with

the presence of nine members, in compliance with the minimum quorum for installation of five members, and with a minimum quorum for taking

resolutions of five members. DECISIONS: DEL-001, of 01.03.2023. Eletrobras Share Buyback Program. RES-001, of 01.02.2023. Deliberative

quorum: The Board of Directors of Eletrobras unanimously approved, registered the abstention of the Director MGS, the proposal of the

Executive Board (RES-514, of 10.31.2022) for the creation of the Eletrobras Share Buyback Program (“Buyback Program"), effective

for 18 (eighteen) months, as of the date of this resolution, under the terms and conditions set forth in Annex I of these minutes, in

accordance with the provisions of Annex G of CVM Resolution No. 80, of March 29 of 2022. This certificate is drawn up and signed by me,

BRUNO KLAPPER LOPES, Governance Officer of Eletrobras.

Rio de Janeiro, January 11, 2023.

BRUNO KLAPPER LOPES

Governance Officer

Classification of Information: DEL-001/2023: Public. The classification of information, and the review of its classification, including after the deliberation, are attributions of the manager of the organizational unit responsible for the matter, pursuant to item 6.2.2 of Standard EDO-03/2017, approved by RES-453/2017 . |

| | CA/CAAS Rua da Quitanda, nº 196, 25º floor. 22210-030 Rio de Janeiro - RJ RCA 963, ended of 01.03.2023. |

ANNEX I TO THE MINUTES OF THE NINE HUNDRED SIXTY-THIRD

MEETING OF THE BOARD OF DIRECTORS OF ELETROBRAS CLOSED ON JANUARY 03, 2022 – APPROVAL OF THE SHARES BUYBACK PROGRAM

In accordance with Annex G to CVM Resolution No.

80, of March 29, 2022

Trading of Own Issued Shares

| 1. | Justify in detail the purpose

and expected economic effects of the operation: |

The purpose of the Share Buyback Program is

to acquire common and preferred shares issued by the Company for subsequent cancellation, disposal or maintenance in treasury, without

reducing the capital stock, to increase the Company's value to shareholders through the efficient use of funds available in cash, optimizing

the allocation of its capital. The Company may use the treasury shares to meet the Compensation Plans Based on Stock Options and Compensation

Based on Restricted Shares, approved at the 184th Extraordinary General Meeting of Shareholders of Eletrobras. Additionally, the Company

may, subject to the limits referred to in art. 4, items I and II of CVM Resolution 77, use treasury shares to settle obligations arising

from its liabilities related to lawsuits that discuss the difference in monetary restatement of Compulsory Energy Loan (“ECE”)

credits or the constitutionality of the tax.

| 2. | Inform the number of shares

(i) outstanding and (ii) already held in treasury: |

According to the definition given by article

1, sole paragraph, item I, of CVM Resolution 77/2022, the Company currently has 2,021,119,463 common shares and 275,526,814 preferred

B shares outstanding. There are no treasury shares.

| 3. | Inform the number of shares

that may be acquired or sold: |

The Company may acquire up to 202,111,946 common

shares and up to 27,552,681 preferred B shares, representing 10% of the total outstanding shares of each class and type.

| 4. | Describe the main characteristics

of the derivative instruments that the company comes to use, if applicable: |

Derivative instruments will not be used.

| 5. | Describe, if applicable,

any agreements or voting guidelines existing between the company and the counterparty of the operations; |

There are no agreements or voting guidelines

between the company and counterparties. The Company will carry out share purchase operations on B3.

| 6. | In the event of transactions

carried out outside organized securities markets, inform: |

| a. | the maximum (minimum) price

of which the shares will be acquired (disposed of); and |

Classification of Information: DEL-001/2023: Public. The classification of information, and the review of its classification, including after the deliberation, are attributions of the manager of the organizational unit responsible for the matter, pursuant to item 6.2.2 of Standard EDO-03/2017, approved by RES-453/2017 . |

| | CA/CAAS Rua da Quitanda, nº 196, 25º floor. 22210-030 Rio de Janeiro - RJ RCA 963, ended of 01.03.2023. |

| b. | if applicable, the reasons

that justify carrying out the operation at prices more than 10% (ten percent) higher, in the case of acquisition, or more than 10% (ten

percent) lower, in the case of sale, to the average quotation, weighted by volume, in the 10 (ten) previous trading sessions; |

Not applicable. The operation will be carried

out on B3, at market price.

| 7. | Inform, if applicable,

the impacts that the negotiation will have on the composition of the shareholding control or the administrative structure of the company; |

There will be no acquisition of share control

or the purpose of altering or preserving the administrative structure of the company.

| 8. | Identify the counterparties,

if known, and, in the case of a party related to the company, as defined by the accounting rules that deal with this matter, also provide

the information required by art. 9 of CVM Resolution No. 81, of March 29, 2022; |

The Company will carry out share purchase operations

on B3, at market price, and, therefore, is not aware of the counterparties.

| 9. | Indicate the allocation

of funds earned, if applicable: |

The acquired shares will be held in treasury

for sale or cancellation. The funds eventually earned will be allocated to the Company's social activities. In addition, treasury shares

may be used to meet the Compensation Plans Based on Stock Options and Compensation Based on Restricted Shares, approved at the 184th AGE.

The Company may also observe the limits referred to in art. 4, items I and II of CVM Resolution 77, use treasury shares to settle obligations

arising from its liabilities related to lawsuits that discuss the difference in monetary restatement of Compulsory Energy Loan (“ECE”)

credits or the constitutionality of the tax.

| 10. | Indicate the maximum period for the settlement of authorized operations: |

The maximum term for settlement of operations

with shares issued by the Company within the scope of this Buyback Plan is up to 18 (eighteen) months, counted from the decision of the

Board of Directors.

| 11. | Identify institutions that will act as intermediaries, if applicable. |

The Company will inform the market, in due

course, of the institutions that will be contracted to act as intermediaries.

| 12. | Specify the resources available to be used, pursuant to art. 8, paragraph 1, of CVM Resolution No.

77, of March 29, 2022. |

Operations carried out under the Buyback Plan

will be supported by the global amount of the Company's Profit Reserves (Profit Retention and Statutory Reserve), with the exception of

the reserves specified in art. 8, § 1, item I, of CVM Resolution No. 77/2022. The balance of the Profit Retention Reserve and Statutory Reserve accounts,

according to the Company's Financial Statements as of September 30, 2022, is BRL 35,745,607 (in thousands).

Classification of Information: DEL-001/2023: Public. The classification of information, and the review of its classification, including after the deliberation, are attributions of the manager of the organizational unit responsible for the matter, pursuant to item 6.2.2 of Standard EDO-03/2017, approved by RES-453/2017 . |

| | CA/CAAS Rua da Quitanda, nº 196, 25º floor. 22210-030 Rio de Janeiro - RJ RCA 963, ended of 01.03.2023. |

| 13. | Specify the reasons why members of the board of directors feel comfortable that the share buyback will

not affect the fulfillment of obligations assumed with creditors or the payment of mandatory, fixed or minimum dividends. |

The members of the Board of Directors understand

that the current financial situation of the Company is compatible with the execution of the Buyback Program, under the conditions approved,

and consider that the buyback of shares will not affect the fulfillment of the obligations assumed with creditors or shareholders in the

short term deadline. This conclusion results from the evaluation of the potential financial amount to be used in the Buyback Program when

compared to (i) the level of obligations assumed with creditors, with the Company having the capacity to pay the financial commitments

assumed; (ii) the amount available in cash, cash equivalents and financial investments of the Company; and (iii) the Company's expected

cash generation over the fiscal years 2023 and 2024. Monitoring the compatibility of repurchases with the Company's financial situation

will be carried out by the Executive

Classification of Information: DEL-001/2023: Public. The classification of information, and the review of its classification, including after the deliberation, are attributions of the manager of the organizational unit responsible for the matter, pursuant to item 6.2.2 of Standard EDO-03/2017, approved by RES-453/2017 . |

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: January 12, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

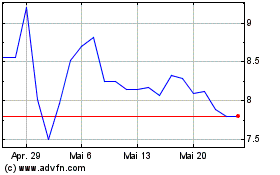

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

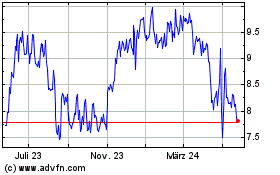

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024