Amended Current Report Filing (8-k/a)

02 Februar 2023 - 2:01PM

Edgar (US Regulatory)

0001754820false00017548202022-06-102022-06-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 10, 2022

Desktop Metal, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware | | 001-38835 | | 83-2044042 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | |

63 Third Avenue

Burlington, Massachusetts | | 01803 |

(Address of principal executive offices) | | (Zip Code) |

(978) 224-1244

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | | DM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On June 13, 2022, Desktop Metal, Inc. (the “Company”) filed a Current Report on Form 8‐K (the “Original Form 8‐K”) to report, among other things, a strategic integration and cost optimization initiative that included a global workforce reduction, facilities consolidation and other operational savings measures (the “Initiative”). The Company is filing this Amendment No. 1 to the Original Form 8‐K in order to update the Company’s disclosure under Item 2.05 of the Original Form 8‐K, and to furnish the Company’s press release announcing additional activities under the Initiative under Item 7.01 of Form 8-K. The Original Form 8‐K otherwise remains unchanged.

Item 2.05. Costs Associated with Exit or Disposal Activities.

The Company disclosed in the Original Form 8‐K that it anticipated that it would incur one-time termination benefits and associated costs of $14.0 million and that it was conducting a facility rationalization assessment and assessing other operational savings measures. As a result, lease termination costs and other costs related to operational savings measures associated with the Initiative could not reasonably be estimated at the time.

As disclosed in the Company’s Form 10-Q for the three months ended September 30, 2022, in connection with the Initiative, the Company incurred $8.8 million of termination benefits and associated costs through September 30, 2022, and incurred an additional $1.0 million of termination benefits and associated costs in October 2022. The Company also incurred $3.1 million of charges for inventory write-off associated with discontinued equipment and parts during the three months ended September 30, 2022.

On January 31, 2023, the Company committed to additional actions to continue and expand the Initiative. These additional actions include closing and consolidating select locations in the United States and Canada and reducing the Company’s workforce by an additional 15%, prioritizing investments and operations in line with near-term revenue generation, positioning the company to achieve its long-term financial goals.

For all committed restructuring activities under the Initiative, the Company now expects to incur total pre-tax restructuring charges of $19.6 million to $26.0 million, which includes the following charges:

| • | between $15.5 million and $17.5 million of one-time termination benefits and associated costs, which includes the original estimate of $14.0 million; |

| • | between $3.1 million and $5 million of inventory write-offs, including the $3.1 million of charges for inventory write-off as of September 30, 2022; |

| • | between $0.5 million and $2.0 million of lease termination and equipment exit costs; and |

| • | between $0.5 million and $1.5 million of costs associated with termination of contracts. |

The total estimated charges are expected to result in between $10.5 million and $16.9 million of future cash expenditures. The ranges of charges described above are estimates, and actual amounts may be materially different from these estimates.

The Company continues to anticipate that the Initiative will be substantially complete by the end of 2023.

Item 7.01. Regulation FD Disclosure.

On February 2, 2023, the Company issued a press release announcing the continuation and expansion of the Initiative. A copy of the press release is attached to this Current Report on Form 8-K (the “Current Report”) as Exhibit 99.1.

The information in Exhibit 99.1 is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-looking Statements

This Current Report contains certain forward-looking statements within the meaning of the within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report that do not relate to matters of historical fact should be considered forward-looking statements, including the timing of completion of, the costs incurred, and the future charges related to, the Initiative, and the impact of the Initiative on the Company’s business, finances, and operations.

Forward-looking statements generally are identified by the words such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Current Report, including but not limited to, the risks and uncertainties set forth under the heading “Risk Factors” in the Company’s Quarterly Report on Form 10-Q filed on November 9, 2022 and the Company’s other filings with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Desktop Metal, Inc. |

| |

Date: February 2, 2023 | By: | /s/ Meg Broderick |

| Name: | Meg Broderick |

| Title: | General Counsel and Corporate Secretary |

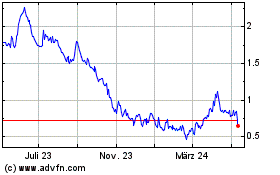

Desktop Metal (NYSE:DM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

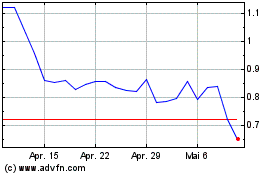

Desktop Metal (NYSE:DM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024