false

0000026780

0000026780

2024-11-24

2024-11-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 24, 2024

Dana Incorporated

(Exact name of registrant as specified in

its charter)

| Delaware |

|

1-1063 |

|

26-1531856 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

| 3939 Technology Drive, Maumee, Ohio 43537 |

| (Address of principal executive offices) (Zip Code) |

| |

| (419) 887-3000 |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

|

Title of Each

Class |

|

Trading

Symbol |

|

Name of Each Exchange

on which Registered |

| Common Stock, $.01 par value |

|

DAN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Executive

Transition

On

November 25, 2024, Dana Incorporated (the “Company”) announced the appointment of R. Bruce McDonald to the position

of President and Chief Executive Officer (“CEO”) and Chairman of the Board of Directors (“Board”) of the Company,

effective immediately. He replaces James K. Kamsickas as CEO, who will also depart from the Board,

effective immediately.

Mr.

McDonald, 64, has served on the Board since 2014. Mr. McDonald currently serves as chairman of the board of directors of Andrew Peller

Limited. More recently, Mr. McDonald served as chairman and chief executive officer of Adient plc, a global automotive supplier from October

2016 to June 2018.

In

connection with his appointment as CEO and Chairman of the Board, Mr. McDonald has resigned

from his roles as Chair and a member of the Nominating and Corporate Governance Committee of the Board and member of the Audit Committee

of the Board. Following Mr. McDonald’s resignation as Chair of the Nominating and Corporate Governance Committee, Keith E. Wandell

will be appointed as his replacement as Chair of the Nominating and Corporate Governance Committee.

Except

as otherwise disclosed in this current report, there are no arrangements or understandings between Mr. McDonald, on the one hand, and

any other person, on the other hand, pursuant to which he was selected as an officer of the Company. Additionally, there are no family

relationships between Mr. McDonald, on the one hand, and any director or officer of the Company, on the other hand, or any other related

party transaction of the Company involving Mr. McDonald that would require disclosure under Item 404(a) of Regulation S-K.

Compensation Arrangements

In

connection with his appointment as CEO and Chairman of the Board, Mr. McDonald has entered

into an employment agreement (the “CEO Agreement”) with the Company that provides that, while he serves as CEO, his base salary

will be $1,300,000 and he will be eligible to receive a grant of 1,217,798 restricted stock units, which will vest on the one-year anniversary

of the date of grant, subject to his continued service on the Board and certain termination protections. Beginning January 1, 2025, while

serving as the CEO, Mr. McDonald will not receive additional compensation relating to his service on the Board (other than compensation

he accrued prior to his appointment as Chief Executive Officer). His outstanding equity awards previously granted in connection with his

Board service will remain outstanding and continue to vest in accordance with the applicable award agreements. The term of the CEO Agreement

is for an initial one (1) year, which may be extended for additional one-month periods at the Company’s discretion. The foregoing

summary does not purport to be a complete description and is qualified in its entirety by the CEO Agreement, a copy of which is

filed as an exhibit hereto and incorporated herein by reference.

In connection

with Mr. Kamsickas’ departure, the Company entered into a transition agreement (the “Transition Agreement”) with Mr.

Kamsickas on November 24, 2024. Pursuant to the terms of the Transition Agreement, Mr. Kamsickas will immediately step down as

President and Chief Executive Officer of the Company and will immediately resign from the Board effective as of November 25, 2024. From

November 25, 2024 through March 31, 2025, Mr. Kamsickas will continue to be a non-executive employee and serve as a special advisor, performing

transition and advisory services. During such advisory period, Mr. Kamsickas will continue to receive his existing base salary and continued

employee

benefits, including under the Company’s equity program. He will not receive any long-term incentive awards during

the advisory period. Pursuant to the Transition Agreement, on March 31, 2025, Mr. Kamsickas’ employment will terminate and he will

be eligible to receive the separation benefits pursuant to his employment agreement, subject to Mr. Kamsickas’

execution and nonrevocation of a release of claims and other conditions of his employment agreement and the Transition Agreement. For

a period of twenty-four (24) months following his termination of employment, Mr. Kamsickas is prohibited from competing against the Company,

soliciting its customers or employees, and working for a competitor. Mr. Kamsickas has also agreed that he will not disclose the Company’s

confidential information. The foregoing summary does not purport to be a complete description and

is qualified in its entirety by the Transition Agreement, a copy of which is filed as an exhibit hereto and incorporated herein

by reference.

| Items 2.02 and 7.01 | Results of Operations and Financial Condition and Regulation FD Disclosure. |

On

November 25, 2024, the Company issued a press release announcing the leadership transition and actions to drive value creation as well as reaffirming the Company’s 2024 full-year guidance ranges. A copy

of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this

item (including Exhibit 99.1) is being “furnished” and shall not be deemed “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as

shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

DANA

INCORPORATED |

|

| |

|

|

|

| Date: November 25, 2024 |

By: |

/s/ Douglas H. Liedberg |

|

| |

Name: |

Douglas H. Liedberg |

|

| |

Title: |

Senior Vice President, General Counsel and Secretary |

|

EXHIBIT 10.1

November 24, 2024

R. Bruce McDonald

Dear Mr. McDonald:

It is my pleasure to offer you the position of Chief Executive Officer

(“CEO”) of Dana Incorporated and its subsidiaries (“Dana” or the “Company”),

pursuant to the terms of this letter agreement (the “Offer Letter”).

The terms and conditions of your employment with the Company will

be as follows and shall, subject to your satisfaction of the “Conditions to Employment” listed below, become effective as

of the date on which you countersign this Offer Letter.

| 1. | Start Date: Your start date in this position will be November 25, 2024 (the “Start Date”). |

| a. | As CEO, you shall have such responsibilities, duties, and authorities as are commensurate with the position of CEO, or as are assigned

to you by the Board of Directors of the Company (the “Board”). |

| b. | During the Term (as defined below) you shall remain a member of the Board and the Company will nominate you to become the Chairman

of the Board, but you shall now also be an employee of the Company. Effective as of January 1, 2025, during the Term, you shall no longer

receive any compensation relating to your Board service; provided, however, that any outstanding equity-based awards granted

to you, prior to the Start Date, in connection with your Board service will continue to remain outstanding and continue to vest in accordance

with the applicable award agreement. |

| c. | You agree that you shall (i) resign as a member of the Board’s Audit Committee prior to the Start Date and shall not serve as

a member of the Audit Committee at any time during the Term and (ii) resign as chair of the Nominating and Corporate Governance Committee

and shall not serve as a member of the Nominating and Corporate Governance Committee at any time during the Term. |

| d. | In your role as CEO, you shall fulfill your duties and responsibilities in a diligent, trustworthy, and appropriate manner and in

compliance with the policies and practices of the Company and applicable law. |

| e. | During the Term, your primary business focus shall be on your duties as CEO and Chairman of the Board and you shall exert your reasonable

best efforts in such role and shall carry out your duties in good faith so as to promote the purpose and mission of the Company. |

| f. | You shall be allowed to continue to engage in all businesses that you engage in as of the date of this Offer Letter, including without

limitation your continued service on the Board, so long as such activities do not create an actual or reasonably foreseeable potential

conflict of interest with, or materially interfere with the performance of, your duties hereunder, in each case as determined in the reasonable

judgment of the Board. |

| 3. | Term: You shall serve as the CEO from the Start Date until the earlier of (i) the date that a permanent (non-interim)

Chief Executive Officer commences employment and (ii) the date which is one (1) year from the Start Date (the “Initial Term”).

The Initial Term may be extended on a month-to-month basis by mutual agreement (including with respect to compensation for services provided

during any such extended term) of you and the Company (the Initial Term and any such extended term, the “Term”). |

| 4. | Base Salary: During the Initial Term, your base salary will be $1,300,000 per year (the “Base Salary”),

payable in accordance with the normal payroll practices of the Company then in effect. For the avoidance of doubt, you shall not receive

an annual cash-based incentive award. |

| 5. | Equity Award: You shall be eligible to receive a grant of 1,217,798 restricted stock units (the “RSU Award”)

on or as soon as reasonably practicable following the Start Date, which shall vest on the one-year anniversary of the grant date, subject

to your continued service on the Board and the terms of the applicable Company equity compensation plans and related documents. The number

of RSUs to be granted under the RSU Award is based on the price of a share of Company common stock on the New York Stock Exchange (rounded

down to the nearest whole share) as of the November 22, 2024. |

| 6. | Benefits. You will be provided with the same benefits that senior executives of the Company are eligible to receive. |

| 7. | Expense Reimbursement: During the Term, the Company shall reimburse you for all reasonable travel and accommodation

expenses incurred in connection with the performance of your duties as CEO, subject to the approval of the Independent Lead Director of

the Board; provided that such expenses are incurred and accounted for in accordance with the policies and procedures as reasonably

established by the Company. |

| a. | In the event that (x) the Company involuntarily terminates your employment without Cause (and not due to Disability), (y) the Company

refuses to re-nominate you to the Board or (z) you are removed from the Board (other than for Cause), in each case, during the Initial

Term, you shall be entitled to (i) the portion of your Base Salary that would otherwise have been payable if you remained the CEO for

the duration of the Initial Term, payable in regular payroll installments over the twelve (12) month period commencing on the date of

your termination and (ii) full acceleration of the unvested portion of the RSU Award, payable in accordance with the terms of your applicable

award agreement and the Company’s equity compensation plan. All amounts payable under this Section 8(a) shall be in lieu of and

not in addition to any amount that otherwise might be payable under the Company’s Executive Severance Plan (or successor to such

plan) upon such a termination. Notwithstanding anything herein to the contrary, if the Board identifies, and a majority of the Board approves,

your CEO successor, then you shall not be entitled to any severance payments or benefits under this Section 8(a), provided, that

your RSU Award shall continue to vest, subject to your continued service on the Board and the terms of the applicable Company equity compensation

plans and related documents. |

| b. | In the event that the Company terminates your employment for Cause, you shall not be entitled to any of the aforementioned severance

amounts and the Company shall have no further obligation to you under this Offer Letter. |

| c. | For all purposes under this Offer Letter, “Cause” shall mean and include (i) a willful and material misappropriation

of any monies or assets or properties of the Company; (ii) a willful and material breach by you of the terms of this Offer Letter that

is demonstrably injurious to the Company and that, if capable of cure, has not been cured within thirty (30) days after written notice

to you of the breach, which notice shall specify the breach and, if applicable, the nature of conduct necessary to cure such breach; or

(iii) the conviction of, or plea of guilty or nolo contendre, by you to a felony or to any criminal offense involving moral turpitude. |

| d. | For all purposes under this Offer Letter, “Disability” shall have the meaning set forth in the Company’s

Executive Severance Plan (or successor to such plan). |

| 9. | Representations: By accepting this offer, you unconditionally agree not to use in connection with your employment with

the Company any confidential or proprietary information which you have acquired in connection with any former employment or reveal or

disclose to the Company or any of employees, agents, representatives or vendors of the Company, any confidential or proprietary information

that you have acquired in connection with any former employment. You represent that you are accepting the Company’s offer in good

faith, and that you understand that the Company will rely on your acceptance. The terms of the offer are considered confidential and should

not be shared with any other company. |

| 10. | Governing Law; Forum: This offer letter shall in all respects be governed by and construed in accordance with the laws

of the State of Delaware, not including the choice-of-law rules thereof. You and the Company consent to the exclusive and sole jurisdiction

and venue of the state and federal courts located in Delaware for the litigation of disputes not subject to arbitration and waive any

claims of improper venue, lack of personal jurisdiction, or lack of subject matter jurisdiction as to any such disputes. |

| 11. | Withholdings: All payments provided for herein in your capacity as CEO shall be reduced by any amounts required to be

withheld from time to time under applicable federal, state or local income or employment tax law or similar statutes or other provisions

of law then in effect. |

| 12. | Section 409A: This Offer Letter shall be interpreted in accordance with Section 409A of the Internal Revenue Code of

1986, as amended (the “Code”), and any Treasury Regulations or other Department of Treasury guidance issued thereunder

(“Section 409A”). If required by Section 409A, no payment or benefit constituting nonqualified deferred compensation

that would otherwise be payable or commence upon the termination of employment shall be paid or shall commence unless and until you have

had a “separation from service” within the meaning of Section 409A as determined in accordance with Section 1.409A-1(h) of

the Treasury Regulations. For purposes of Section 409A, each of the payments that may be made hereunder is designated as a separate payment.

If you are deemed on the date of termination to be a “specified employee” within the meaning of the term under Section 409A,

then with regard to any payment or the provision of any benefit under any agreement that is considered nonqualified deferred |

compensation under Section 409A payable on account of a “separation

from service,” such payment or benefit shall be made or provided on the first business day following the earlier of (A) the expiration

of the six (6)-month period measured from the date of such “separation from service,” and (B) the date of your death (the

“Delay Period”). Upon the expiration of the Delay Period, all payments and benefits delayed pursuant to this paragraph

(whether they would have otherwise been payable in a single sum or in installments in the absence of such delay) shall be paid or reimbursed

to you in a lump sum (without interest) on the first business day following the Delay Period, and any remaining payments and benefits

due under this Offer Letter shall be paid or provided in accordance with the normal payment dates specified for them herein. You agree

to negotiate with the Company in good faith to make amendments to this Offer Letter as you and the Company mutually agree, reasonably

and in good faith, are necessary or desirable to avoid the possible imposition of taxes or penalties under Section 409A, while preserving

any affected benefit or payment to the extent reasonably practicable without materially increasing the cost to the Company. Notwithstanding

the foregoing, you shall be solely responsible and liable for the satisfaction of all taxes, interest and penalties that may be imposed

on you or for your account in connection with any payment or benefit under this Offer Letter (including any taxes, interest and penalties

under Section 409A), and the Company shall have no obligation to indemnify or otherwise hold you (or any beneficiary successor or assign)

harmless from any or all such taxes, interest or penalties.

| 13. | Entire Agreement: This Offer Letter supersedes all prior and contemporaneous oral or written, express or implied understandings

or agreements regarding your employment with the Company, and contains the entire agreement between you and the Company regarding your

employment with the Company. The terms set forth in this letter may not be modified, except in writing signed by an authorized representative

of the Company, which expressly states the intention of the Company to modify the terms of this Offer Letter |

| 14. | Assignment; Binding Effect: You understand that you have been selected for employment by the Company on the basis of

your personal qualifications, experience, and skills. You agree, therefore, that you cannot assign all or any portion of your performance

under this Offer Letter. The Company may assign this Offer Letter to the purchaser of substantially all of the assets of the Company,

or to any subsidiary or parent company of the Company. Subject to the preceding two sentences, this Offer Letter shall be binding upon,

inure to the benefit of, and be enforceable by the parties and their respective heirs, legal representatives, successors, and assigns.

You acknowledge and agree that each of the Company’s subsidiaries and affiliates is a third-party beneficiary of this Offer Letter. |

| 15. | Conditions to Employment: This offer is contingent upon: (1) your execution of this Offer Letter; (2) you commencing

employment as CEO on the Start Date; and (3) you providing to the Company documentary evidence of your identity and a Form I-9 to evidence

your eligibility for employment in the United States within (3) business days from your date of hire. |

[Signature Page Follows]

Mr. McDonald, we welcome you to the Company. If you are in agreement

and plan to accept this offer, then please sign below and scan and email to .

| |

Sincerely, |

|

| |

|

|

| |

|

|

| |

/s/ Doug Liedberg |

|

| |

Doug Liedberg |

|

| |

Senior Vice President, General Counsel, Secretary |

|

| |

Chief Compliance & Sustainability Officer |

|

ACCEPTANCE:

I have read this letter and agree with the terms and conditions

of my employment as set forth above.

| |

|

|

|

|

| Dated: |

November 24, 2024 |

|

Signature: |

/s/ R. Bruce McDonald |

| |

|

|

|

R. Bruce McDonald |

EXHIBIT 10.2

DANA INCORPORATED

November 24, 2024

James K. Kamsickas

Via e-mail

Re: Retirement,

Transition and Release Agreement

Dear James:

In consideration of and subject

to the terms and conditions of this Retirement, Transition and Release Agreement (“Release and Transition Agreement”),

you agree to step down from your role as Chief Executive Officer of Dana Incorporated and its subsidiaries (collectively, the “Company”),

effective as of November 25, 2024 (“Effective Date”). Between the Effective Date and March 31, 2025, you will serve

as a special advisor to the Company, pursuant to Sections 6 and 7 of this agreement. Your last day of employment with the Company will

be March 31, 2025 (“Separation Date”) and you will receive the separation payments and benefits under Section 6.4.1

of the Executive Employment Agreement between you and the Company, dated as of July 8, 2015 (the “Employment Agreement”)

which are summarized in Exhibit A to this Release and Transition Agreement. In order to receive (i) the separation benefits provided in

Section 6.4.1 of the Employment Agreement and (ii) the equity acceleration benefits under the Dana Incorporated 2021 Omnibus Incentive

Plan (the “Equity Plan”) and your applicable award agreements as summarized in Exhibit A (collectively, the

“Separation Benefits”), you must sign this Release and Transition Agreement. All payments in respect of the Separation

Benefits shall be reduced by all applicable withholdings and deductions required by law. Capitalized terms used in this Release and Transition

Agreement that are not otherwise defined shall have the meanings attributed to them in the Employment Agreement.

Effective as of the Effective

Date, you hereby confirm your resignation from the Board of Directors of the Company (the “Board”), as required by

Section 4 of the Employment Agreement. In addition, as of the Effective Date, you acknowledge and agree that you have (a) resigned from

your role as the President and Chief Executive Officer of the Company, and relinquished and resigned from any and all titles, positions

and appointments with the Company or any of its subsidiaries or affiliates (the “Company Group”), whether as an officer,

director, employee, consultant, agent, trustee or otherwise, and (b) no authority to act on behalf of any member of the Company Group,

and shall not hold yourself out as having such authority, enter into any agreement or incur any obligations on behalf of any member of

the Company Group, commit any member of the Company Group in any manner or otherwise act in an executive or other decision-making capacity

with respect to any member of the Company Group. You agree to execute such documents promptly as may be reasonably requested by the Company

to evidence your separation from employment and cessation of service on the Separation Date. In addition, you acknowledge and agree that,

your six-month pre-Change in Control protection period, for purposes of Section 13 of your Employment Agreement, begins as of the Effective

Date.

Your participation in any Company-sponsored

health, dental and/or vision insurance benefit plans will terminate on the Separation Date. Thereafter, you will be eligible to continue

coverage under such benefit plans pursuant to the provisions of the Consolidated Omnibus Reconciliation Act of 1985 (“COBRA”)

as set forth in Exhibit A, or you may choose to purchase insurance on the public exchange or elsewhere. Except as provided herein,

all other benefits will end as of the Separation Date.

Regardless of whether you sign

this Release and Transition Agreement, you shall receive (i) payment of your accrued and unpaid Base Salary and accrued and unused vacation

through the Separation Date, payable not later than the first complete payroll payment date following the Separation Date, (ii) reimbursement

of any unreimbursed business expenses you have incurred through the Separation Date in accordance with the policies and procedures applicable

under Section 5.7 of the Employment Agreement and (iii) any unpaid annual and long-term cash bonus earned for a completed previous performance

period, payable when such bonuses are paid to other senior executives of the Company. You shall also retain any accrued and vested benefits

under all Company employee benefit plans in which you participate in accordance with the terms of such plans. You shall also be covered

under any applicable indemnification agreement and directors’ and officers’ liability insurance for any actions or inactions

through the Separation Date.

1.

No Other Compensation or Benefits. Except for the payments and benefits set forth above and

the Separation Benefits provided for in this Release and Transition Agreement, you agree you are not entitled to any other or further

compensation, remuneration, benefits, severance, reimbursement, or payments from the Company Group. You acknowledge and agree that, except

for the payments and benefits set forth above and the Separation Benefits provided for in this Release and Transition Agreement, you have

been paid any bonuses and/or any other awards you have earned under the terms of any plan or agreement with the Company where the amounts

were payable to you prior to your Separation Date. Subject to the foregoing, you acknowledge and agree that no other compensation, bonuses

or awards are payable to you, and therefore, you acknowledge and agree you have been paid for all time worked and are owed no further

wages and/or compensation of any kind.

2.

Release & Covenant Not To Sue. In exchange for the Separation Benefits, you (on behalf

of yourself, your heirs, your executors, and your assigns and all persons who might have claims deriving from your own) unconditionally,

and to the maximum extent permitted by law, waive and release any and all lawsuits, debts, obligations, demands, judgments, damages, or

causes of action that may lawfully be released by private agreement (referred to in this Release and Transition Agreement as “claims”)

you have or might have against the Company and each member of the Company Group and any of their predecessors, parents, subsidiaries,

divisions, affiliates, and related entities, including any of their past and present owners, officers, directors, shareholders, members,

managing members, agents, attorneys, employees, and successors (with regard to individuals, the definition includes in their individual

capacity and corporate capacity other than with regard to owners, shareholders, agents and attorneys whom shall only be released from

claims in their capacities as such), firms, or entities (“Released Parties”). These claims include, but are not limited

to, all claims, whether known or unknown, arising up to and including the date you sign this Release and Transition Agreement, whether

under contract, tort, statute, equity, or common law, including any and all foreign, federal, state, and/or local constitutional, statutory,

regulatory, or common law. Released claims include, but are not limited to (i) claims covered by the Americans with Disabilities Act,

the Age Discrimination in Employment Act (“ADEA”), Title VII of the Civil Rights Act, the Family and Medical Leave

Act (“FMLA”), the Employee Income Retirement and Security Act (“ERISA”) (with respect to unvested

benefits), the Equal Pay Act, the Sarbanes-Oxley Act of 2002, the Worker Adjustment and Retraining Notification Act, the National Labor

Relations Act and the Genetic Information Nondiscrimination Act of 2008, all as amended and including all of their respective implementing

regulations; (ii) any and all claims for compensation of any type whatsoever, including but not limited to claims for salary, wages, bonuses,

commissions, incentive compensation, vacation and/or severance; (iii) any and all claims arising under tort, contract and/or quasi-contract

law, including but not limited to claims of breach of an expressed or implied contract, tortious interference with contract or prospective

business advantage, breach of the covenant of

good faith and fair dealing, promissory estoppel,

detrimental reliance, invasion of privacy, nonphysical injury, personal injury or sickness or any other harm, wrongful or retaliatory

discharge, fraud, defamation, slander, libel, false imprisonment, negligent or intentional infliction of emotional distress; and (iv)

any and all claims for monetary or equitable relief, including but not limited to attorneys’ fees, back pay, front pay, reinstatement,

experts’ fees, medical fees or expenses, costs and disbursements. Damages released and waived include back pay, future pay, lost

benefits, any and all wages, compensatory damages, emotional distress, physical injury damages, pain and suffering, liquidated damages,

punitive damages, exemplary damages, attorney’s fees, costs, civil fines, penalties and interest. This is a general release. You

expressly acknowledge that this general release includes, but is not limited to, any and all claims arising out of or related to your

employment with and separation from the Company Group, whether or not they are known to you at the time you sign this Release and Transition

Agreement.

By signing this Release and Transition

Agreement, you expressly acknowledge and represent that (a) you have suffered no injuries or occupational diseases arising out of or in

connection with your employment by the Company Group; (b) you have received all wages to which you were entitled as an employee of the

Company Group; (c) you received all leave to which you were entitled under the FMLA; and (d) you are not aware of any facts or circumstances

constituting a violation of the FMLA, the Fair Labor Standards Act, or any applicable state leave or wage payment law.

You expressly agree that this

Release and Transition Agreement forever precludes you from bringing, instituting, maintaining, further pursuing, or participating in

any lawsuit against the Released Parties for any causes or claims released herein, except as stated below. You further agree that this

Release and Transition Agreement may be pleaded as a full defense to any action, suit, arbitration or other proceeding covered by the

terms hereof which is or may be initiated, prosecuted or maintained by you, your descendants, dependents, heirs, executors, administrators

or permitted assigns. You specifically waive any right to become, and promise not to become, a member of any class in which a claim against

the Released Parties is made involving any events leading up to the date you sign this Release and Transition Agreement, except where

such waiver is prohibited by law. You represent that you have not filed or otherwise initiated any lawsuit, charge, claim, or demand against

any of the Released Parties. You further agree that should you or any person, organization, or other entity bring or file, or cause or

permit to be brought or filed, any civil action, suit, or administrative or legal proceeding involving any matter occurring at any time

prior to the date you sign this Release and Transition Agreement, you shall not accept any personal, equitable, or monetary relief in

such civil action, suit, or administrative or legal proceeding, except where such waiver is prohibited by law. You agree that the Separation

Benefits fully satisfy any individual relief to which you are entitled as a result of your employment with and separation from the Company.

3.

Reservation of Your Rights. Notwithstanding the foregoing, your release of claims herein does

not apply to (i) claims for unemployment or workers’ compensation benefits, (ii) claims for the Separation Benefits or any other

consideration provided for under this Release and Transition Agreement, or claims or rights that may arise after the date that you sign

this Release and Transition Agreement, (iii) claims for reimbursement of expenses under the Company’s expense reimbursement policies,

(iv) any vested rights under the Company’s ERISA-covered employee benefit plans as applicable on the date you sign this Release

and Transition Agreement, (v) claims relating to vesting of equity awards in accordance with this Release and Transition Agreement, (vi)

claims for indemnification or for coverage under directors’ and officers’ liability insurance policies and (vii) any claims

that controlling law clearly states may not be released by private agreement.

Moreover, nothing contained in

this Release and Transition Agreement, including the Release & Covenant Not to Sue, and Confidentiality provisions, is intended to

or shall preclude you from communicating with, filing a charge or complaint with, providing documents or information voluntarily or in

response to a subpoena or other information request to, or from participating in an investigation or proceeding conducted by a government

agency, including, but not limited to, the Equal Employment Opportunity Commission and the National Labor Relations Board. However, by

signing this Release, you are waiving your right to recover any individual relief (including any backpay, front pay, reinstatement or

other legal or equitable relief) in any charge, complaint, or lawsuit or other proceeding brought by you or on your behalf by any third

party, except for any right you may have to receive a payment or award from a government agency (and not the Company) for information

provided to the government agency or where otherwise prohibited. In addition, nothing in this Release, including the Release & Covenant

Not to Sue and Confidentiality provisions prohibits you from testifying truthfully in any legal process between you and the Company or

any of its affiliates.

In addition, nothing prevents

you from discussing or disclosing conduct, or the existence of a settlement involving conduct, that you reasonably believed to be illegal

discrimination, illegal harassment, illegal retaliation, a wage and hour violation, or sexual assault, or that is recognized as illegal

under state, federal, or common law, or that is recognized as against a clear mandate of public policy, where the conduct occurred at

the workplace, at work-related events coordinated by or through the employer, between employees, or between an employer and an employee,

whether on or off the employment premises; provided, however, that you remain subject to the obligation to keep confidential

the amount paid in settlement of any claim.

Nothing in this Release waives

your right to testify in an administrative, legislative, or judicial proceeding concerning alleged criminal conduct or alleged sexual

harassment on the part of the Company, or on the part of the agents or employees of the Company, including but not limited to when you

have been required or requested to attend such a proceeding pursuant to a court order, subpoena, or written request from an administrative

agency or the legislature.

4.

Restrictive Covenants. The Company’s obligation to make the Separation Benefits is expressly

conditioned on your continued compliance with your post-employment obligations to the Company Group, including without limitation, the

obligations set forth in Section 7 (Confidential Information), Section 8 (Statements to Third Parties), Section 9 (Non-Competition), Section

10 (Non-Solicitation), Section 11 (Developments) and Section 12 (Remedies) of the Employment Agreement. If you breach of any of such obligations,

then in addition to any other remedy that may be available at law or in equity, the Company’s obligation to make any further Separation

Benefits shall cease on the date of such breach.

5.

Return of Company Property. Whether you enter into this Release and Transition Agreement or

not, within ten (10) business days of your Separation Date, you must return to the Company all of the Company’s property in your

possession (other than de minimis items) including, but not limited to: computers; PDAs; cellular phones; credit cards; files, notes,

books, binders, manuals, and other printed material; computer disks and software; and all other tangible and intangible property belonging

to the Company and obtained by you in connection with your employment with the Company, including all copies of such property, in any

form, electronic or otherwise. You agree to provide the Company with any password(s) you installed and/or used on any Company computer

or other Company property. You understand that the Company, in its sole discretion, may choose to delay any payments due to you under

this Release and Transition Agreement unless and until you comply with this paragraph, but such delay shall not relieve you

of your other obligations under this Release and Transition

Agreement or your release of claims. Notwithstanding the foregoing, you may retain your contacts, calendars and personal correspondence

and any information reasonably needed for your personal tax return preparation, and you may retain your laptop computer and related equipment

and your iPad; provided, that you shall permit the Company a reasonable opportunity to remove any confidential information of the Company

from such electronics.

6.

Transition Period. During the period between the Effective Date and the Separation Date (the

“Transition Period”) you will serve as a special advisor to the Company (“Special Advisor”), and

will perform transition and advisory services consistent with this Release and Transition Agreement. While serving as Special Advisor,

you will provide such support to the Company’s Chief Executive Officer, as requested by the Company’s Chief Executive Officer

(collectively, the “Services”). You agree and acknowledge that you will perform your Services as Special Advisor. In

addition, you agree to be available to assist the Company, as reasonably requested, on future matters for two years following the Separation

Date and the Company will (i) pay you a daily rate of $4,000 for time spent by you of any material portion of any day following the Separation

Date on such matters, and (ii) reimburse you for other pre-approved out-of-pocket expenses reasonably incurred in connection with such

cooperation, upon the presentation by you of an itemized accounting of such expenditures, with supporting receipts.

7.

Transition Fee. Subject to the terms and conditions of this Release and Transition Agreement,

your satisfactory provision of the Services and your compliance with the other terms and conditions of this Release and Transition Agreement,

during the Transition Period, the Company will pay you a monthly rate of $114,917, prorated (x) for the first month of the Transition

Period or (y) if you resign or terminate the Services before the end of the Transition Period (the “Monthly Service Fee”).

Any Monthly Service Fee earned will be payable bi-weekly through the Company’s payroll. In addition, the Company will reimburse

you for any actual, reasonable and documented expenses incurred in connection with your provision of Services hereunder, but only to the

extent that such expenses are approved in advance by the Chief Executive Officer and incurred in accordance with the Company’s travel

and expense policy. In no event will the Company be responsible for taxes on your Monthly Service Fee payable hereunder, or your internal

administrative costs or other costs of doing business. For the avoidance of doubt, during the Transition Period, you shall not be eligible

for an annual bonus or any annual long-term incentive awards.

8.

Company Representation. Subject to your resignation from the Board, the Company represents

and warrants that it, to the knowledge of its chief legal officer and members of the Board (other than you), is not aware of any claims

(whether asserted or unasserted) that it has against you as of the date of this Release and Transition Agreement.

9.

Attorney and Advisor Fees. The Company shall reimburse you for (or pay directly), your reasonable

attorneys’ and advisors’ fees and costs incurred in connection with the negotiation of this Release and Transition Agreement

and your pending employment termination, up to a cap of $50,000.

10.

Miscellaneous

(a)

Partial Invalidity. Should any portion, word, clause, phrase, sentence, or paragraph of this

Release and Transition Agreement be declared void or unenforceable, other than the Release

& Covenant Not To Sue, such portion shall be considered

independent and severable from the remainder, the validity of which shall remain unaffected.

(b)

Construction. This Release and Transition Agreement shall not be construed in favor of one

Party or against the other.

(c)

Compliance with Terms. The failure to insist upon compliance with any provision contained

in this Release and Transition Agreement shall not be deemed a waiver of that provision or condition. If on one or more occasions a party

waives or relinquishes a right or power it has in this Release and Transition Agreement, that shall not be deemed a waiver or relinquishment

of any right or power at any other time or times.

(d)

Remedy. Failure to abide by the terms of this Release and Transition Agreement shall constitute

a breach of this Release and Transition Agreement and shall entitle the Company to cease any and all severance payments and, where appropriate,

to immediate injunctive relief to enjoin further breaches of those paragraphs, consequential damages, and reimbursement of all previously

paid severance payments (with the exception of one dollar ($1.00)), fees and costs actually incurred in bringing such legal action; provided,

that the Company shall provide you with written notice of any such failure to abide and not less than 30 days to cure, if curable. However,

you shall remain subject to your obligations under this Release and Transition Agreement, including your release of claims. This paragraph

shall not limit any of your reserved rights under this Release and Transition Agreement nor impose any remedy for your doing so.

(e)

Section 409A. This Release and Transition Agreement is intended to be interpreted and applied

so that the payment of the Separation Benefits and any other benefits are exempt from, or comply with, the requirements of Internal Revenue

Code Section 409A (“Section 409A”) under the short-term deferral and separation pay exemptions set forth in Treasury

Regulation Sections 1.409A-1(b)(4) and (9), and shall be interpreted consistently with such provisions. The Company and its respective

officers, directors, employees, or agents, however, make no guarantee that the terms of this Release and Transition Agreement are exempt

from, the provisions of Section 409A, and you agree that none of them shall have any liability if the payments provided for under this

Release and Transition Agreement are subject to, but not in compliance with, the requirements of Internal Revenue Code Section 409A. Section

17.4 of the Employment Agreement is incorporated herein by reference. For purposes of Section 409A, your right to receive any installment

payments pursuant to this Release and Transition Agreement shall be treated as a right to receive a series of separate and distinct payments.

Whenever a payment under this Release and Transition Agreement specifies a payment period with reference to a number of days and such

period spans two of your taxable years, the actual date of payment within the specified period shall be in the second of the two taxable

years to the extent required by Section 409A.

11.

Older Workers Benefit Protection Act (OWBPA). Pursuant to the OWBPA, you acknowledge and understand

that:

(a)

You are waiving claims for age discrimination under the ADEA in exchange for the payments described

above;

(b)

Under this Release and Transition Agreement, you shall receive consideration beyond that to which

you would be entitled without signing this Release and Transition Agreement;

(c)

You have been advised in writing and are hereby advised through this Release and Transition Agreement

of the right to consult with an attorney before signing this Release and Transition Agreement;

(d)

You have been given a period of at least 21 days (from the original date you were given this Release

and Transition Agreement) within which to review and consider this Release and Transition Agreement before signing it; and

(e)

You may revoke this Release and Transition Agreement by providing written notice to the Company within

seven days after you sign it, and this Release and Transition Agreement shall not become effective and enforceable until such seven-day

period has expired. Any notice of revocation of this Release and Transition Agreement shall not be effective unless given in writing and

received by Company within the seven day revocation period via e-mail as follows:

Doug Liedberg

Senior Vice President, General Counsel, Secretary

Chief Compliance & Sustainability Officer

12.

Voluntary & Entire Agreement. Your signature below shall indicate that you are entering

into this Release and Transition Agreement freely and with a full understanding of its terms and not in reliance upon any representations

other than those explicitly set forth in this Release and Transition Agreement. No changes to this Release and Transition Agreement shall

be valid unless in writing and signed by both you and the Company. With the exception of any fiduciary duties you may have to the Company,

your obligation not to misappropriate trade secrets, and your obligations under any other restrictive covenants (including covenants not

to compete, not to solicit Company employees, and not to solicit Company clients, customers, or business relationships) or confidentiality

agreements you may have with the Company that survive termination, this Release and Transition Agreement constitutes the entire understanding

and agreement of the parties related to the matters discussed in this Release and Transition Agreement and supersedes any agreement or

plan that provides for severance benefits of any kind. This Release and Transition Agreement is in addition to any arbitration, confidentiality

and/or lawful restrictive covenant agreements into which you may have entered during your employment with the Company, and your obligations

under any such agreements which shall remain in full force and effect. This Release and Transition Agreement shall be interpreted and

enforced in accordance with the laws of the State of Delaware.

* ;* ;*

If you are willing to

enter into this Release and Transition Agreement with its terms becoming effective on the seventh day following the date signed below,

please signify your acceptance in the space indicated below and return to me within 21 days of receiving this Release and Transition Agreement.

| |

Sincerely, |

|

| |

|

|

| |

/s/ Doug Liedberg |

|

| |

|

|

| |

Doug Liedberg |

|

| |

Senior Vice President, General Counsel, Secretary |

|

| |

Chief Compliance & Sustainability Officer |

|

I, JAMES

K. KAMSICKAS, HAVE READ AND UNDERSTAND THIS RELEASE AND TRANSITION AGREEMENT, AND I ACCEPT AND AGREE TO ALL OF ITS TERMS AND CONDITIONS.

I ENTER INTO THIS RELEASE AND TRANSITION AGREEMENT VOLUNTARILY, WITH FULL KNOWLEDGE THAT IT SHALL BECOME EFFECTIVE FOLLOWING MY SIGNATURE

AND THE TERMS OUTLINED IN THIS RELEASE AND TRANSITION AGREEMENT.

| /s/ James K. Kamsick |

|

November 24, 2024 |

|

| Signature |

|

Date |

|

(Signature Pages to Release of Claims and Separation and Transition Agreement) |

EXHIBIT A

Exhibit A

Separation Benefits

1.

Salary Continuation. The Company shall provide you with an amount equal to twenty-four (24)

months of Base Salary. The total amount of such payments shall be $2,758,000.

2.

Annual Bonus. The Company shall pay you a cash amount equal to (i) your target annual bonus

for 2025 under the Company’s annual incentive program and (ii) your target annual bonus for 2026, each payable when annual bonuses

are paid to other senior executives. For the avoidance of doubt, you shall receive your annual bonus for 2024, in the ordinary course,

based on actual performance under the Company’s annual incentive program, which will be paid when annual bonuses are paid to other

senior executives.

3.

Health & Welfare Benefits. If you timely elect continued coverage under the Company’s

group health and welfare plans pursuant to COBRA, the Company shall provide you with medical, dental, prescription, drug, basic life insurance,

$5,000,000 MetLife Group variable life insurance and employee assistance program benefits, in each case, for twenty-four (24) months following

the Separation Date, subject to your payment of any required employee contributions consistent with those contributions required of active

employees of the Company (and which benefits shall be coterminous with your entitlement to COBRA health benefits continuation).

4.

Outplacement Benefits. The Company shall provide you with outplacement benefits up to a maximum

cost of $50,000.

5.

Equity Grants. In accordance with the Equity Plan and your applicable award agreements granted

thereunder, your outstanding equity awards shall be subject to the following treatment:

| a. | a prorated portion of your unvested RSUs (as defined

in your applicable award agreement), including any accrued dividend equivalents in respect of such RSUs, shall become nonforfeitable,

based on the number of full months you were employed during the period set forth in the vesting schedule applicable to your applicable

award agreement, which shall become payable to you in accordance with Section 7 of your applicable award agreement; |

| b. | a number of Performance Shares (as defined in your

applicable award agreement) as determined pursuant to Section 2 of your applicable award agreement at the conclusion of the Performance

Period (as defined in your applicable award agreement) shall vest as if you had remained in continuous employment with the Company Group

based on the number of whole months that you were employed by the Company Group during the Performance Period, which shall become payable

to you in accordance with Section 5(a) of your applicable award agreement. |

You acknowledge and agree that the list of your outstanding

equity grants that are eligible for the vesting treatment described above following the Separation Date (subject to performance conditions

if applicable) is set forth on Schedule I. Except as provided in this Exhibit A, all unvested equity grants shall be forfeited

as of the Separation Date. Notwithstanding anything herein to the contrary, all equity grants (whether currently vested or that shall

become vested as outlined in this paragraph) shall be governed by the relevant terms of the award agreements and the equity incentive

plan or plans under which such grants were issued, except as necessary to take into account modifications made by this paragraph.

SCHEDULE I

Schedule I

Equity Awards Eligible for Prorated Vesting

| Equity Grant* |

Grant

Date |

Vesting Schedule |

Prorated Portion Subject to Vesting |

Vesting and Settlement Date |

| 2023 RSUs |

2/14/2023 |

Vesting in 3 equal annual installments beginning on the first anniversary of the grant date |

90,394** (this reflects 13/24 months of vesting) |

As soon as reasonably practicable following the Separation Date |

| 2023 Performance Shares*** |

2/14/2023 |

Subject to 3-year performance period that ends December 31, 2025 |

27/36 months would vest (the number of Performance Shares that ultimately vest will be based on actual performance between 0% and 200% of target, depending on performance) |

Within 3 months following the Performance Period |

| 2024 RSUs |

2/13/2024 |

Vesting in 3 equal annual installments beginning on the first anniversary of the grant date |

136,546** (this reflects 13/36 months of vesting) |

As soon as reasonably practicable following the Separation Date |

| 2024 Performance Shares*** |

2/13/2024 |

Subject to 3-year performance period that ends December 31, 2026 |

15/36 months would vest (the number of Performance Shares that ultimately vest will be based on actual performance between 0% and 200% of target, depending on performance) |

Within 3 months following the Performance Period |

* Your 2022 RSUs will vest in full (i.e., no pro-ration) in February

2025 and your 2022 Performance Shares will vest in full, subject to performance achievement (i.e., the number of Performance Shares that

ultimately vest will be based on actual performance between 0% and 200% of target, depending on performance). All figures in this Schedule

I are estimates and will be finalized upon your termination of employment and applicable performance achievement.

** Amount of shares does not include accrued dividend equivalents with

respect to such award, which will also be subject to vesting.

*** Vesting and determination of amount of shares that would vest remains

subject to achievement of Company performance targets through the applicable performance period.

EXHIBIT 99.1

Dana

Announces Leadership Transition and Actions to Accelerate Value Creation

Appoints

Current Dana Director R. Bruce McDonald as Chairman and CEO

Announces

Plan to Sell Off-Highway Business

Initiates

$200 Million Cost Reduction Plan

Confirms

2024 Full-Year Guidance Ranges for Sales, Adjusted EBITDA and Free Cash Flow

MAUMEE,

Ohio, November 25, 2024 – Dana Incorporated (NYSE: DAN) today announced the appointment of R. Bruce McDonald, a member of the

Dana Board of Directors, as Chairman and Chief Executive Officer, effective immediately. Mr. McDonald’s appointment follows the

retirement of James Kamsickas as Chief Executive Officer and his departure from the Board. Mr. Kamsickas will remain as an advisor to

the Company through March 2025 to support the transition. The Board has retained a leading executive search firm to identify the Company’s

next permanent CEO.

Keith

Wandell, Dana’s Lead Independent Director, said, “Jim is an exceptional leader with more than 18 years as a CEO in the industry.

He led Dana through one of the industry’s most challenging periods while successfully building a high-performance culture, enabling

a world-class manufacturing company and assembling a portfolio of leading products and technologies. The Board and Jim agreed that now

is the right time to transition the leadership of Dana, and we thank Jim for his many contributions over his nine years leading the Company

and wish him all the best.”

Mr.

Kamsickas said, “I am proud of the work the Dana team has done over the past decade to grow revenues and successfully enhance the

technology to serve all mobility markets no matter what type of propulsion they may use. It has been an honor to lead this talented global

team during that time and I am confident the Company is well positioned for the future.”

Mr.

Wandell continued, “We continue to have confidence in the long-term opportunity in the mobility industry, however it is undergoing

a significant transformation, including protracted cost pressures and demand uncertainty. To address these challenges and deliver more

value to customers and shareholders, Dana is taking action to streamline the business, unlock the value of its Off-Highway business and

further reduce costs. Bruce is an experienced public company CEO in our industry with significant M&A expertise, and we are confident

that he is the right person to oversee this transformation while the Board conducts a search for a permanent successor.”

Plan

to Sell Off-Highway Business

Dana

today also announced it has engaged financial advisors Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC to sell its Off-Highway

business, which the Board believes will unlock substantial value for shareholders. The Off-Highway business provides drive and motion

systems for heavy-duty vehicles in markets such as agriculture, materials handling, mining, construction and forestry. A sale will position

Dana with a streamlined go-to-market approach focused on serving its light and commercial vehicle customers, with traditional and electrified

products that are largely shared across the remaining portfolio. Proceeds from a potential sale will enable Dana to strengthen its balance

sheet through substantially reduced leverage, and to return capital to shareholders.

While

the Company and its advisors believe there is strong interest in the Off-Highway business, there can be no assurance that the sale process

for Off-Highway will result in a transaction. There is no timeframe for the conclusion of the process, and the Company does not intend

to comment further regarding this matter unless and until further disclosure is determined to be appropriate.

Cost

Reduction Actions

While

Dana continues to improve its profitability in a challenging operating environment, the Company announced further actions to support

sustained long-term profitability and enhanced cash flow generation. This includes substantial reductions in selling, general & administrative

costs across all the Company’s businesses and engineering expenses to match current industry dynamics, including the ongoing delay

in the adoption of electric vehicles. The Company expects to deliver annualized savings of approximately $200 million by 2026. Furthermore,

the Company plans to reduce capital spending to reflect the revised market demand for electric vehicles.

Bruce

McDonald, Chief Executive Officer said, “Dana is committed to a strategy that accelerates value creation and has taken action to

flex its cost structure and generate efficiencies by leveraging its core strengths through current market conditions. It is clear that

further actions are needed, and I am confident that the new incremental cost reductions, paired with the benefits of a potential Off-Highway

sale, will enhance shareholder value. Following the Off-Highway business sale, we believe Dana will have an adjusted EBITDA margin and

free cash flow margin in excess of current levels.”

Mr.

McDonald continued, “Dana is differentiated by leading technology innovation and a track record of continuous improvement. My conviction

in our businesses, the team and the opportunities to capitalize on the EV transition over the long term remain strong. I look forward

to stepping into my new role as CEO at such an important time for Dana and will work diligently alongside the Board and management team

to deliver on these actions and drive value for Dana shareholders.”

Reaffirms

2024 Full-Year Guidance Ranges

Dana

is also reaffirming its previously announced guidance ranges for sales of $10.2 to $10.4 billion, Adjusted EBITDA of $855 to $895 million

and free cash flow of $90 to $110 million for full year 2024, as outlined in the Company’s third quarter 2024 earnings announcement

on October 30, 2024.

About

R. Bruce McDonald

R.

Bruce McDonald is a senior executive with over 30 years of experience in the automotive and manufacturing industries and significant

expertise. Mr. McDonald has been a member of the Dana Board of Directors since 2014. He is also the retired chairman and chief executive

officer of Adient plc., a global mobility supplier. He previously served as executive vice president and vice chairman of Johnson Controls,

Inc., a global manufacturer of automotive, power and building solutions from 2014 to 2016.

Mr.

McDonald also served as executive vice president and chief financial officer of Johnson Controls from 2005 to September 2014. Before

joining Johnson Controls as vice president and corporate controller in 2001, he was vice president for finance at TRW Automotive.

Prior

to his appointment as Chairman of the Board, Mr. McDonald served on Dana's Audit Committee and as chair of the Nominating and Corporate

Governance Committee.

Forward-Looking

Statements

Certain

statements and projections contained in this news release are, by their nature, forward-looking within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates, and projections about

our industry and business, management's beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking

statements can often be identified by words such as "anticipates," "expects," "intends," "plans,"

"predicts," "believes," "seeks," "estimates," "may," "will," "should,"

"would," "could," "potential," "continue," "ongoing," and similar expressions, and

variations or negatives of these words. These forward-looking statements are not guarantees of future results and are subject to risks,

uncertainties, and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking

statement.

Dana's

Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other Securities and Exchange

Commission filings discuss important risk factors that could affect our business, results of operations and financial condition. The

forward-looking statements in this news release speak only as of this date. Dana does not undertake any obligation to revise or update

publicly any forward-looking statement for any reason.

About

Dana Incorporated

Dana

is a leader in the design and manufacture of highly efficient propulsion and energy-management solutions that power vehicles and machines

in all mobility markets across the globe. The company is shaping sustainable progress through its conventional and clean-energy solutions

that support nearly every vehicle manufacturer with drive and motion systems; electrodynamic technologies, including software and controls;

and thermal, sealing, and digital solutions.

Based

in Maumee, Ohio, USA, the company reported sales of $10.6 billion in 2023 with 42,000 people in 31 countries across six

continents. With a history dating to 1904, Dana was named among the "World's Most Ethical Companies" for 2023 and 2024 by Ethisphere

and as one of "America's Most Responsible Companies 2023" by Newsweek. The company is driven by a high-performance culture

that focuses on valuing others, inspiring innovation, growing responsibly, and winning together, earning it global recognition as a top

employer. Learn more at dana.com.

Craig

Barber, +1-419-699-4990, craig.barber@dana.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

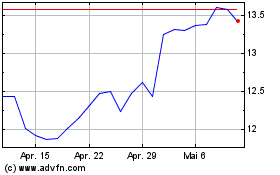

Dana (NYSE:DAN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Dana (NYSE:DAN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024