Compass Diversified (NYSE: CODI) (“CODI” or the “Company”), an

owner of leading middle market businesses, announced today its

consolidated operating results for the three months ended September

30, 2022.

“Our third quarter results yet again demonstrate

the quality of CODI’s subsidiary businesses, as we delivered

another consecutive quarter of record financial performance,” said

Elias Sabo, CEO of Compass Diversified. “Our subsidiaries on a

combined basis continue to deliver excellent results despite

inflationary pressures impacting consumer discretionary

spending. End market demand for our core consumer products

remains strong, and with many of our consumer businesses taking

market share, we believe our businesses can outperform the general

market and deliver strong financial results.”

Third Quarter 2022 Financial Highlights

vs. Same Year-Ago Quarter (where applicable)

- Net sales up 22% to $597.6 million,

and up 15% on a pro forma basis.

- Branded consumer net sales up 34%

to $378.2 million, and up 21% on a pro forma basis.

- Niche industrial net sales up 7% to

$219.4 million.

- Operating income up 16% to $48.7

million.

- Net income down to $2.6 million vs.

$90.2 million in the elevated year-ago period, primarily a result

of the $72.7 million gain on the sale of Liberty Safe in August

2021.

- Adjusted Earnings, a non-GAAP

financial measure, up 28% to $46.0 million.

- Adjusted EBITDA, a non-GAAP

financial measure, up 27% to $98.3 million.

- Paid a third quarter 2022 cash

distribution of $0.25 per share on CODI's common shares in October

2022.

Third Quarter 2022 Business

Highlights

- Appointed Mr. Larry L. Enterline as

Chairman of the Board of Directors effective July 2, 2022.

Additionally, Ms. Teri R. Shaffer was appointed to the Board and

designated as a member of the Board’s Audit Committee.

- On July 12, 2022, CODI completed

the acquisition of PrimaLoft Technologies Holdings, Inc., the

parent company of PrimaLoft, Inc. ("PrimaLoft"), a leading provider

of branded, high-performance synthetic insulation and materials

used primarily in outerwear and accessories.

- 5.11 Tactical subsidiary announced

the opening of its 100th retail store location, continuing the

execution of expanding its retail footprint.

Third Quarter 2022 Financial

Results

Net sales in the third quarter of 2022 were

$597.6 million, up 22% compared to $488.2 million in the third

quarter of 2021. The increase was due to strong performance at its

branded consumer and niche industrial subsidiaries. On a pro forma

basis, assuming CODI had acquired Lugano and PrimaLoft on January

1, 2021, net sales were up 15% compared to the prior year

period.

Branded consumer net sales, pro forma for the

Lugano and PrimaLoft acquisitions, increased 21% in the third

quarter of 2022 to $380.5 million compared to $314.8 million in the

third quarter of 2021. Niche industrial net sales increased 7% in

the third quarter of 2022 to $219.4 million compared to $205.0

million in the third quarter of 2021.

Net income for the third quarter of 2022

decreased to $2.6 million compared to net income of $90.2 million

in the third quarter of 2021. Income from continuing operations for

the third quarter of 2022 decreased to $1.1 million compared to

$18.7 million in the third quarter of 2021. The decreases in net

income and income from continuing operations were a result of

higher interest expense related to the funding of the acquisitions

of PrimaLoft and Lugano and provisions for income tax primarily as

a result of the reclassification of Advanced Circuits to continuing

operations. Additionally, the Company’s net income in the year-ago

period included a $72.7 million gain from the sale of Liberty Safe

in August 2021. Operating income for the third quarter of 2022

increased 16% to $48.7 million compared to $41.9 million in the

third quarter of 2021.

Adjusted Earnings (see “Note Regarding Use of

Non-GAAP Financial Measures” below) for the third quarter of 2022

increased 28% to $46.0 million compared to $35.8 million in the

third quarter of 2021. CODI's weighted average number of shares

outstanding for the quarter ended September 30, 2022, was 71.9

million and, for the quarter ended September 30, 2021, was 64.9

million.

Adjusted EBITDA (see "Note Regarding Use of

Non-GAAP Financial Measures" below) in the third quarter of 2022

was $98.3 million, up 27% compared to $77.6 million in the third

quarter of 2021. The increase was primarily due to the strong

performance across the branded consumer and niche industrial

businesses on a combined basis and the impact of the PrimaLoft and

Lugano acquisitions. The Company no longer adds back management

fees in its calculation of Adjusted EBITDA. Management fees

incurred during the third quarter were $16.7 million.

Liquidity and Capital

Resources

As of September 30, 2022, CODI had approximately

$61.3 million in cash and cash equivalents, $113 million

outstanding on its revolver, $397.5 million outstanding in term

loans, $1.0 billion outstanding in 5.250% Senior Notes due 2029 and

$300 million outstanding in 5.000% Senior Notes due 2032.

As of September 30, 2022, the Company had no

significant debt maturities until 2027 and had net borrowing

availability of approximately $485 million under its revolving

credit facility.

Third Quarter 2022

Distributions

On October 4, 2022, CODI's Board of Directors

(the “Board”) declared a third quarter distribution of $0.25 per

share on the Company's common shares. The cash distribution was

paid on October 27, 2022, to all holders of record of common shares

as of October 20, 2022.

The Board also declared a quarterly cash

distribution of $0.453125 per share on the Company’s 7.250% Series

A Preferred Shares (the “Series A Preferred Shares”). The

distribution on the Series A Preferred Shares covers the period

from, and including, July 30, 2022, up to, but excluding, October

30, 2022. The distribution for such period was payable on October

30, 2022, to all holders of record of Series A Preferred Shares as

of October 15, 2022. The payment occurred on October 31, 2022, the

next business day following the payment date.

The Board also declared a quarterly cash

distribution of $0.4921875 per share on the Company’s 7.875% Series

B Preferred Shares (the “Series B Preferred Shares”). The

distribution on the Series B Preferred Shares covers the period

from, and including, July 30, 2022, up to, but excluding, October

30, 2022. The distribution for such period was payable on October

30, 2022 to all holders of record of Series B Preferred Shares as

of October 15, 2022. The payment occurred on October 31, 2022, the

next business day following the payment date.

The Board also declared a quarterly cash

distribution of $0.4921875 per share on the Company’s 7.875% Series

C Preferred Shares (the “Series C Preferred Shares”). The

distribution on the Series C Preferred Shares covers the period

from, and including, July 30, 2022, up to, but excluding, October

30, 2022. The distribution for such period was payable on October

30, 2022 to all holders of record of Series C Preferred Shares as

of October 15, 2022. The payment occurred on October 31, 2022, the

next business day following the payment date.

Increases 2022 Outlook

As a result of CODI’s strong financial

performance in the third quarter, its expectations for the

remainder of 2022 and its current view of the economy, the Company

is raising its outlook. CODI expects its current subsidiaries to

produce consolidated subsidiary Adjusted EBITDA for the full year

2022 of between $460 million and $470 million. This estimate is

based on the summation of the Company’s expectations for its

current subsidiaries in 2022, absent additional acquisitions or

divestitures, includes a reduction for management fees paid at the

subsidiaries of approximately $7.5 million and excludes corporate

expenses such as interest expense, management fees paid at CODI and

corporate overhead. In addition, the Company expects to earn

between $145 million and $155 million in Adjusted Earnings for the

full year 2022.

Conference Call

Management will host a conference call on

Thursday, November 3, 2022, at 5:00 p.m. ET to discuss the latest

corporate developments and financial results. The dial-in number

for callers in the U.S. is (888) 396-8049 and the dial-in number

for international callers is (416) 764-8646. The Conference ID is

66435663. The conference call will also be available via a live

listen-only webcast and can be accessed through the Investor

Relations section of CODI's website. An online replay of the

webcast will be available on the same website following the call.

Please allow extra time prior to the call to visit the site and

download any necessary software that may be needed to listen to the

Internet broadcast. A replay of the call will be available through

Thursday, November 10, 2022. To access the replay, please dial

(877) 674-7070 in the U.S. and (416) 764-8692 outside the U.S.

Note Regarding Use of Non-GAAP Financial

Measures

Adjusted EBITDA and Adjusted Earnings are

non-GAAP measures used by the Company to assess its performance. We

have reconciled Adjusted EBITDA to Income (Loss) from Continuing

Operations and Adjusted Earnings to Net Income (Loss) on the

attached schedules. We consider Income (Loss) from Continuing

Operations to be the most directly comparable GAAP financial

measure to Adjusted EBITDA and Net Income (Loss) to be the most

directly comparable GAAP financial measure to Adjusted Earnings. We

believe that Adjusted EBITDA and Adjusted Earnings provides useful

information to investors and reflects important financial measures

as it excludes the effects of items which reflect the impact of

long-term investment decisions, rather than the performance of

near-term operations. When compared to Net Income (Loss) and Income

(Loss) from Continuing Operations, Adjusted Earnings and Adjusted

EBITDA, respectively, are each limited in that they do not reflect

the periodic costs of certain capital assets used in generating

revenues of our businesses or the non-cash charges associated with

impairments, as well as certain cash charges. The presentation of

Adjusted EBITDA allows investors to view the performance of our

businesses in a manner similar to the methods used by us and the

management of our businesses, provides additional insight into our

operating results and provides a measure for evaluating targeted

businesses for acquisition. The presentation of Adjusted Earnings

provides insight into our operating results and provides a measure

for evaluating earnings from continuing operations available to

common shareholders. We believe Adjusted EBITDA and Adjusted

Earnings are also useful in measuring our ability to service debt

and other payment obligations.

Pro forma net sales is defined as net sales

including the historical net sales relating to the pre-acquisition

periods of Lugano and PrimaLoft, assuming that the Company acquired

Lugano and PrimaLoft on January 1, 2021. We have reconciled pro

forma net sales to net sales, the most directly comparable GAAP

financial measure, on the attached schedules. We believe that pro

forma net sales is useful information for investors as it provides

a better understanding of sales performance, and relative changes

thereto, on a comparable basis. Pro forma net sales is not

necessarily indicative of what the actual results would have been

if the acquisition had in fact occurred on the date or for the

periods indicated nor does it purport to project net sales for any

future periods or as of any date.

In reliance on the unreasonable efforts

exception provided under Item 10(e)(1)(i)(B) of Regulation S-K, we

have not reconciled 2022 Adjusted EBITDA or 2022 Adjusted Earnings

to their comparable GAAP measure because we do not provide guidance

on Net Income (Loss) from Continuing Operations or Net Income

(Loss) or the applicable reconciling items as a result of the

uncertainty regarding, and the potential variability of, these

items. For the same reasons, we are unable to address the probable

significance of the unavailable information, which could be

material to future results.

Adjusted EBITDA, Adjusted Earnings and pro forma

net sales are not meant to be a substitute for GAAP measures and

may be different from or otherwise inconsistent with non-GAAP

financial measures used by other companies.

About Compass Diversified

(“CODI”)

Since its founding in 1998, CODI has

consistently executed on its strategy of owning and managing a

diverse set of highly defensible, middle-market businesses across

the niche industrial, branded consumer and healthcare sectors. The

Company leverages its permanent capital base, long-term disciplined

approach, and actionable expertise to maintain controlling

ownership interests in each of its subsidiaries, maximizing its

ability to impact long-term cash flow generation and value

creation. The Company provides both debt and equity capital for its

subsidiaries, contributing to their financial and operating

flexibility. CODI utilizes the cash flows generated by its

subsidiaries to invest in the long-term growth of the Company and

has consistently generated strong returns through its culture of

transparency, alignment and accountability. For more information,

please visit compassdiversified.com.

Forward Looking Statements

Certain statements in this press release may be

deemed forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include, but are not limited to, statements as to our

future performance or liquidity, such as expectations regarding our

results of operations and financial condition, our 2022 Adjusted

EBITDA, our 2022 Adjusted Earnings, our pending acquisitions and

divestitures, and other statements with regard to the future

performance of CODI. We may use words such as “plans,”

“anticipate,” “believe,” “expect,” “intend,” “will,” “should,”

“may,” “seek,” “look,” and similar expressions to identify

forward-looking statements. The forward-looking statements

contained in this press release involve risks and uncertainties.

Actual results could differ materially from those implied or

expressed in the forward-looking statements for any reason,

including the factors set forth in “Risk Factors” and elsewhere in

CODI’s annual report on Form 10-K and its quarterly reports on Form

10-Q. Other factors that could cause actual results to differ

materially include: changes in the economy, financial markets and

political environment; risks associated with possible disruption in

CODI’s operations or the economy generally due to terrorism,

natural disasters, social, civil and political unrest or the

COVID-19 pandemic; future changes in laws or regulations (including

the interpretation of these laws and regulations by regulatory

authorities); general considerations associated with the COVID-19

pandemic and its impact on the markets in which we operate;

disruption in the global supply chain, labor shortages and high

labor costs; our business prospects and the prospects of our

subsidiaries; the impact of, and ability to successfully complete

and integrate, acquisitions that we may make; the ability to

successfully complete divestitures when we’ve executed divestitures

agreements; the dependence of our future success on the general

economy and its impact on the industries in which we operate; the

ability of our subsidiaries to achieve their objectives; the

adequacy of our cash resources and working capital; the timing of

cash flows, if any, from the operations of our subsidiaries; and

other considerations that may be disclosed from time to time in

CODI’s publicly disseminated documents and filings. Undue reliance

should not be placed on such forward-looking statements as such

statements speak only as of the date on which they are made.

Although, except as required by law, CODI undertakes no obligation

to revise or update any forward-looking statements, whether as a

result of new information, future events or otherwise, you are

advised to consult any additional disclosures that CODI may make

directly to you or through reports that it in the future may file

with the SEC, including annual reports on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K.

|

Investor Relations: |

Media Contact: |

|

irinquiry@compassdiversified.com |

The IGB

Group |

|

|

Leon

Berman |

| Cody

Slach |

212.477.8438 |

| Gateway

Group |

lberman@igbir.com |

|

949.574.3860 |

|

|

CODI@gatewayir.com |

|

Compass Diversified

HoldingsCondensed Consolidated Balance

Sheets

| |

|

|

|

| |

September 30, 2022 |

|

December 31, 2021 |

| (in thousands) |

(Unaudited) |

|

|

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

61,252 |

|

$ |

160,733 |

|

Accounts receivable, net |

|

326,266 |

|

|

277,710 |

|

Inventories, net |

|

725,902 |

|

|

565,743 |

|

Prepaid expenses and other current assets |

|

81,130 |

|

|

57,006 |

|

Total current assets |

|

1,194,550 |

|

|

1,061,192 |

| Property, plant and equipment,

net |

|

193,749 |

|

|

186,477 |

| Goodwill |

|

1,194,251 |

|

|

882,083 |

| Intangible assets, net |

|

1,096,020 |

|

|

872,690 |

| Other non-current assets |

|

162,727 |

|

|

141,819 |

| Total

assets |

$ |

3,841,297 |

|

$ |

3,144,261 |

| |

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

100,511 |

|

$ |

124,203 |

|

Accrued expenses |

|

211,633 |

|

|

190,348 |

|

Due to related party |

|

15,368 |

|

|

12,802 |

|

Current portion, long-term debt |

|

10,000 |

|

|

— |

|

Other current liabilities |

|

39,378 |

|

|

34,269 |

|

Total current liabilities |

|

376,890 |

|

|

361,622 |

| Deferred income taxes |

|

153,202 |

|

|

97,763 |

| Long-term debt |

|

1,784,365 |

|

|

1,284,826 |

| Other non-current

liabilities |

|

134,857 |

|

|

115,520 |

|

Total liabilities |

|

2,449,314 |

|

|

1,859,731 |

| Stockholders'

equity |

|

|

|

| Total stockholders' equity

attributable to Holdings |

|

1,171,565 |

|

|

1,111,816 |

| Noncontrolling interest |

|

220,418 |

|

|

172,714 |

|

Total stockholders' equity |

|

1,391,983 |

|

|

1,284,530 |

| Total liabilities and

stockholders’ equity |

$ |

3,841,297 |

|

$ |

3,144,261 |

| |

|

|

|

Compass Diversified

HoldingsConsolidated Statements of

Operations(Unaudited)

| |

Three months ended |

|

Nine months ended |

| |

September 30, |

|

September 30, |

|

(in thousands, except per share data) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net sales |

$ |

597,607 |

|

|

$ |

488,158 |

|

|

$ |

1,669,123 |

|

|

$ |

1,372,266 |

|

| Cost of sales |

|

358,291 |

|

|

|

296,027 |

|

|

|

996,210 |

|

|

|

818,307 |

|

| Gross

profit |

|

239,316 |

|

|

|

192,131 |

|

|

|

672,913 |

|

|

|

553,959 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative expense |

|

148,700 |

|

|

|

118,818 |

|

|

|

403,428 |

|

|

|

337,815 |

|

|

Management fees |

|

16,717 |

|

|

|

12,398 |

|

|

|

46,304 |

|

|

|

34,504 |

|

|

Amortization expense |

|

25,152 |

|

|

|

19,056 |

|

|

|

67,191 |

|

|

|

56,502 |

|

| Operating

income |

|

48,747 |

|

|

|

41,859 |

|

|

|

155,990 |

|

|

|

125,138 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(22,799 |

) |

|

|

(13,855 |

) |

|

|

(57,737 |

) |

|

|

(42,607 |

) |

|

Amortization of debt issuance costs |

|

(1,004 |

) |

|

|

(759 |

) |

|

|

(2,735 |

) |

|

|

(2,167 |

) |

|

Loss on debt extinguishment |

|

(534 |

) |

|

|

— |

|

|

|

(534 |

) |

|

|

(33,305 |

) |

|

Other income (expense), net |

|

(2,141 |

) |

|

|

1,031 |

|

|

|

606 |

|

|

|

(1,906 |

) |

| Net income from

continuing operations before income taxes |

|

22,269 |

|

|

|

28,276 |

|

|

|

95,590 |

|

|

|

45,153 |

|

|

Provision for income taxes |

|

21,163 |

|

|

|

9,556 |

|

|

|

39,201 |

|

|

|

24,662 |

|

| Income from continuing

operations |

|

1,106 |

|

|

|

18,720 |

|

|

|

56,389 |

|

|

|

20,491 |

|

|

Income (loss) from discontinued operations, net of income tax |

|

— |

|

|

|

(1,309 |

) |

|

|

— |

|

|

|

7,665 |

|

|

Gain on sale of discontinued operations |

|

1,479 |

|

|

|

72,745 |

|

|

|

6,893 |

|

|

|

72,745 |

|

| Net

income |

|

2,585 |

|

|

|

90,156 |

|

|

|

63,282 |

|

|

|

100,901 |

|

|

Less: Net income from continuing operations attributable to

noncontrolling interest |

|

4,359 |

|

|

|

2,201 |

|

|

|

14,927 |

|

|

|

7,915 |

|

|

Less: Net income (loss) from discontinued operations attributable

to noncontrolling interest |

|

— |

|

|

|

(145 |

) |

|

|

— |

|

|

|

522 |

|

| Net income (loss)

attributable to Holdings |

$ |

(1,774 |

) |

|

$ |

88,100 |

|

|

$ |

48,355 |

|

|

$ |

92,464 |

|

| |

|

|

|

|

|

|

|

| Amounts attributable

to Holdings |

|

|

|

|

|

|

|

|

Income (loss) from continuing operations |

|

(3,253 |

) |

|

|

16,519 |

|

|

|

41,462 |

|

|

|

12,576 |

|

|

Income (loss) from discontinued operations |

|

— |

|

|

|

(1,164 |

) |

|

|

— |

|

|

|

7,143 |

|

|

Gain on sale of discontinued operations, net of income tax |

|

1,479 |

|

|

|

72,745 |

|

|

|

6,893 |

|

|

|

72,745 |

|

| Net income (loss)

attributable to Holdings |

$ |

(1,774 |

) |

|

$ |

88,100 |

|

|

$ |

48,355 |

|

|

$ |

92,464 |

|

| |

|

|

|

|

|

|

|

| Basic income (loss) per common

share attributable to Holdings |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.23 |

) |

|

$ |

(0.13 |

) |

|

$ |

0.10 |

|

|

$ |

(0.46 |

) |

|

Discontinued operations |

|

0.02 |

|

|

|

1.10 |

|

|

|

0.10 |

|

|

|

1.23 |

|

| |

$ |

(0.21 |

) |

|

$ |

0.97 |

|

|

$ |

0.20 |

|

|

$ |

0.77 |

|

| |

|

|

|

|

|

|

|

| Basic weighted average number

of common shares outstanding |

|

71,910 |

|

|

|

65,008 |

|

|

|

70,514 |

|

|

|

64,936 |

|

| |

|

|

|

|

|

|

|

| Cash distributions declared

per Trust common share |

$ |

0.25 |

|

|

$ |

1.24 |

|

|

$ |

0.75 |

|

|

$ |

1.96 |

|

Compass Diversified

HoldingsNet Income (Loss) to Non-GAAP Adjusted

Earnings and Non-GAAP Adjusted

EBITDA(Unaudited)

| |

Three months ended |

|

Nine months ended |

| |

September 30, |

|

September 30, |

|

(in thousands) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net income |

$ |

2,585 |

|

|

$ |

90,156 |

|

|

$ |

63,282 |

|

|

$ |

100,901 |

|

| Gain on sale of discontinued

operations |

|

1,479 |

|

|

|

72,745 |

|

|

|

6,893 |

|

|

|

72,745 |

|

| Income (loss) from

discontinued operations, net of tax |

|

— |

|

|

|

(1,309 |

) |

|

|

— |

|

|

|

7,665 |

|

| Income from continuing

operations |

$ |

1,106 |

|

|

$ |

18,720 |

|

|

$ |

56,389 |

|

|

$ |

20,491 |

|

| Less: income from continuing

operations attributable to noncontrolling interest |

|

4,359 |

|

|

|

2,201 |

|

|

|

14,927 |

|

|

|

7,915 |

|

| Net income (loss) attributable

to Holdings - continuing operations |

$ |

(3,253 |

) |

|

$ |

16,519 |

|

|

$ |

41,462 |

|

|

$ |

12,576 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Distributions paid - Preferred Shares |

|

(6,045 |

) |

|

|

(6,045 |

) |

|

|

(18,136 |

) |

|

|

(18,136 |

) |

|

Amortization expense - intangibles and inventory step up |

|

26,241 |

|

|

|

19,056 |

|

|

|

72,092 |

|

|

|

56,502 |

|

|

Loss on debt extinguishment |

|

534 |

|

|

|

— |

|

|

|

534 |

|

|

|

33,305 |

|

|

Stock compensation |

|

3,242 |

|

|

|

2,892 |

|

|

|

8,851 |

|

|

|

8,496 |

|

|

Acquisition expenses |

|

5,902 |

|

|

|

1,866 |

|

|

|

6,118 |

|

|

|

2,176 |

|

|

Integration Services Fee |

|

1,625 |

|

|

|

1,100 |

|

|

|

2,750 |

|

|

|

4,300 |

|

|

Held-for-sale tax impact - corporate |

|

16,457 |

|

|

|

— |

|

|

|

12,119 |

|

|

|

— |

|

|

Other |

|

1,287 |

|

|

|

460 |

|

|

|

4,116 |

|

|

|

(609 |

) |

| Adjusted

Earnings |

$ |

45,990 |

|

|

$ |

35,848 |

|

|

$ |

129,906 |

|

|

$ |

98,610 |

|

| Plus (less): |

|

|

|

|

|

|

|

|

Depreciation |

|

11,284 |

|

|

|

10,372 |

|

|

|

32,589 |

|

|

|

28,896 |

|

|

Income taxes |

|

21,163 |

|

|

|

9,556 |

|

|

|

39,201 |

|

|

|

24,662 |

|

|

Held-for-sale tax impact - corporate |

|

(16,457 |

) |

|

|

— |

|

|

|

(12,119 |

) |

|

|

— |

|

|

Interest expense, net |

|

22,799 |

|

|

|

13,855 |

|

|

|

57,737 |

|

|

|

42,607 |

|

|

Amortization of debt issuance |

|

1,004 |

|

|

|

759 |

|

|

|

2,735 |

|

|

|

2,167 |

|

|

Noncontrolling interest |

|

4,359 |

|

|

|

2,201 |

|

|

|

14,927 |

|

|

|

7,915 |

|

|

Preferred distributions |

|

6,045 |

|

|

|

6,045 |

|

|

|

18,136 |

|

|

|

18,136 |

|

|

Other expense (income) |

|

2,139 |

|

|

|

(1,032 |

) |

|

|

(606 |

) |

|

|

1,906 |

|

| Adjusted

EBITDA |

$ |

98,326 |

|

|

$ |

77,604 |

|

|

$ |

282,506 |

|

|

$ |

224,899 |

|

Compass Diversified

HoldingsNet Income (Loss) from Continuing

Operations to Non-GAAP Consolidated Adjusted EBITDA

ReconciliationThree months ended September 30,

2022(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Corporate |

|

|

5.11 |

|

BOA |

|

Ergo |

|

Lugano |

|

Marucci Sports |

|

PrimaLoft |

|

Velocity Outdoor |

|

ACI |

|

Altor Solutions |

|

Arnold |

|

Sterno |

|

Consolidated |

|

Income (loss) from continuing operations |

|

$ |

(29,950 |

) |

|

$ |

5,905 |

|

$ |

8,935 |

|

|

$ |

(759 |

) |

|

$ |

8,095 |

|

$ |

4,230 |

|

|

$ |

(8,492 |

) |

|

$ |

4,679 |

|

$ |

2,426 |

|

$ |

2,765 |

|

$ |

3,475 |

|

$ |

(203 |

) |

|

$ |

1,106 |

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision (benefit) for income

taxes |

|

|

16,457 |

|

|

|

1,906 |

|

|

1,776 |

|

|

|

(410 |

) |

|

|

1,166 |

|

|

1,609 |

|

|

|

(3,570 |

) |

|

|

1,416 |

|

|

671 |

|

|

805 |

|

|

537 |

|

|

(1,200 |

) |

|

|

21,163 |

| Interest expense, net |

|

|

22,725 |

|

|

|

2 |

|

|

(7 |

) |

|

|

— |

|

|

|

3 |

|

|

3 |

|

|

|

(4 |

) |

|

|

70 |

|

|

— |

|

|

— |

|

|

7 |

|

|

— |

|

|

|

22,799 |

| Intercompany interest |

|

|

(28,762 |

) |

|

|

3,503 |

|

|

1,808 |

|

|

|

1,737 |

|

|

|

3,263 |

|

|

1,812 |

|

|

|

3,251 |

|

|

|

2,997 |

|

|

1,621 |

|

|

2,821 |

|

|

1,402 |

|

|

4,547 |

|

|

|

— |

| Loss on debt

extinguishment |

|

|

534 |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

534 |

| Depreciation and amortization

expense |

|

|

285 |

|

|

|

5,766 |

|

|

5,577 |

|

|

|

2,033 |

|

|

|

3,083 |

|

|

2,504 |

|

|

|

4,194 |

|

|

|

3,420 |

|

|

538 |

|

|

4,124 |

|

|

1,936 |

|

|

5,069 |

|

|

|

38,529 |

| EBITDA |

|

|

(18,711 |

) |

|

|

17,082 |

|

|

18,089 |

|

|

|

2,601 |

|

|

|

15,610 |

|

|

10,158 |

|

|

|

(4,621 |

) |

|

|

12,582 |

|

|

5,256 |

|

|

10,515 |

|

|

7,357 |

|

|

8,213 |

|

|

|

84,131 |

| Other (income) expense |

|

|

(73 |

) |

|

|

709 |

|

|

403 |

|

|

|

— |

|

|

|

— |

|

|

(1 |

) |

|

|

260 |

|

|

|

971 |

|

|

224 |

|

|

110 |

|

|

— |

|

|

(463 |

) |

|

|

2,140 |

| Non-controlling shareholder

compensation |

|

|

— |

|

|

|

381 |

|

|

621 |

|

|

|

362 |

|

|

|

356 |

|

|

537 |

|

|

|

— |

|

|

|

240 |

|

|

124 |

|

|

375 |

|

|

13 |

|

|

232 |

|

|

|

3,241 |

| Acquisition expenses |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

5,680 |

|

|

|

222 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

5,902 |

| Integration services fee |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

562 |

|

|

— |

|

|

|

1,063 |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

1,625 |

| Other |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

853 |

|

|

— |

|

|

— |

|

|

434 |

|

|

|

1,287 |

| Adjusted

EBITDA |

|

$ |

(18,784 |

) |

|

$ |

18,172 |

|

$ |

19,113 |

|

|

$ |

2,963 |

|

|

$ |

16,528 |

|

$ |

10,694 |

|

|

$ |

2,382 |

|

|

$ |

14,015 |

|

$ |

6,457 |

|

$ |

11,000 |

|

$ |

7,370 |

|

$ |

8,416 |

|

|

$ |

98,326 |

Compass Diversified

HoldingsNet Income (Loss) from Continuing

Operations to Non-GAAP Consolidated Adjusted EBITDA

ReconciliationThree months ended September 30,

2021(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Corporate |

|

|

5.11 |

|

|

BOA |

|

Ergo |

|

Lugano |

Marucci Sports |

|

Velocity Outdoor |

|

ACI |

|

Altor Solutions |

|

Arnold |

|

Sterno |

|

Consolidated |

|

Income (loss) from continuing operations |

$ |

(10,553 |

) |

|

$ |

5,223 |

|

|

$ |

4,256 |

|

$ |

(531 |

) |

|

$ |

681 |

$ |

2,235 |

|

|

$ |

8,568 |

|

|

$ |

3,821 |

|

$ |

2,594 |

|

|

$ |

2,245 |

|

|

$ |

181 |

|

|

$ |

18,720 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (benefit) for income taxes |

|

— |

|

|

|

1,830 |

|

|

|

700 |

|

|

329 |

|

|

|

304 |

|

631 |

|

|

|

2,334 |

|

|

|

1,093 |

|

|

1,336 |

|

|

|

1,058 |

|

|

|

(58 |

) |

|

|

9,557 |

|

|

Interest expense, net |

|

13,813 |

|

|

|

1 |

|

|

|

— |

|

|

— |

|

|

|

— |

|

1 |

|

|

|

35 |

|

|

|

— |

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

13,855 |

|

|

Intercompany interest |

|

(17,717 |

) |

|

|

2,960 |

|

|

|

1,958 |

|

|

441 |

|

|

|

548 |

|

697 |

|

|

|

1,902 |

|

|

|

1,792 |

|

|

1,657 |

|

|

|

1,313 |

|

|

|

4,449 |

|

|

|

— |

|

|

Depreciation and amortization |

|

243 |

|

|

|

5,868 |

|

|

|

5,149 |

|

|

2,050 |

|

|

|

70 |

|

2,155 |

|

|

|

3,161 |

|

|

|

557 |

|

|

3,206 |

|

|

|

2,005 |

|

|

|

5,722 |

|

|

|

30,186 |

|

| EBITDA |

|

(14,214 |

) |

|

|

15,882 |

|

|

|

12,063 |

|

|

2,289 |

|

|

|

1,603 |

|

5,719 |

|

|

|

16,000 |

|

|

|

7,263 |

|

|

8,793 |

|

|

|

6,626 |

|

|

|

10,294 |

|

|

|

72,318 |

|

|

Other (income) expense |

|

(433 |

) |

|

|

(2 |

) |

|

|

110 |

|

|

— |

|

|

|

22 |

|

(11 |

) |

|

|

(2 |

) |

|

|

55 |

|

|

(267 |

) |

|

|

(51 |

) |

|

|

(453 |

) |

|

|

(1,032 |

) |

|

Non-controlling shareholder compensation |

|

— |

|

|

|

639 |

|

|

|

572 |

|

|

434 |

|

|

|

— |

|

275 |

|

|

|

253 |

|

|

|

124 |

|

|

257 |

|

|

|

8 |

|

|

|

330 |

|

|

|

2,892 |

|

|

Acquisition expenses |

|

39 |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

1,827 |

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,866 |

|

|

Integration services fees |

|

— |

|

|

|

— |

|

|

|

1,100 |

|

|

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,100 |

|

|

Other |

|

187 |

|

|

|

273 |

|

|

|

— |

|

|

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

460 |

|

| Adjusted

EBITDA(1) |

$ |

(14,421 |

) |

|

$ |

16,792 |

|

|

$ |

13,845 |

|

$ |

2,723 |

|

|

$ |

3,452 |

$ |

5,983 |

|

|

$ |

16,251 |

|

|

$ |

7,442 |

|

$ |

8,783 |

|

|

$ |

6,583 |

|

|

$ |

10,171 |

|

|

$ |

77,604 |

|

(1) As a result of the sale of Liberty Safe in August 2021,

Adjusted EBITDA for the three months ended September 30, 2021 does

not include $0.2 million in Adjusted EBITDA from Liberty.

Compass Diversified

HoldingsNet Income (Loss) from Continuing

Operations to Non-GAAP Consolidated Adjusted EBITDA

ReconciliationNine months ended September 30,

2022(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Corporate |

|

|

5.11 |

|

BOA |

|

Ergo |

|

Lugano |

|

Marucci Sports |

|

PrimaLoft |

|

Velocity Outdoor |

|

ACI |

|

Altor Solutions |

|

Arnold |

|

Sterno |

|

Consolidated |

|

Income (loss) from continuing operations |

$ |

(51,431 |

) |

|

$ |

15,540 |

|

$ |

37,122 |

|

|

$ |

(634 |

) |

|

$ |

21,871 |

|

$ |

8,374 |

|

|

$ |

(8,492 |

) |

|

$ |

7,826 |

|

$ |

9,510 |

|

$ |

7,149 |

|

$ |

7,217 |

|

$ |

2,337 |

|

|

$ |

56,389 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (benefit) for income taxes |

|

12,119 |

|

|

|

4,999 |

|

|

6,819 |

|

|

|

432 |

|

|

|

5,863 |

|

|

2,821 |

|

|

|

(3,570 |

) |

|

|

2,372 |

|

|

2,600 |

|

|

2,907 |

|

|

2,768 |

|

|

(929 |

) |

|

|

39,201 |

|

|

Interest expense, net |

|

57,559 |

|

|

|

12 |

|

|

(19 |

) |

|

|

2 |

|

|

|

12 |

|

|

13 |

|

|

|

(4 |

) |

|

|

142 |

|

|

— |

|

|

— |

|

|

20 |

|

|

— |

|

|

|

57,737 |

|

|

Intercompany interest |

|

(71,727 |

) |

|

|

9,501 |

|

|

5,634 |

|

|

|

4,000 |

|

|

|

7,841 |

|

|

4,649 |

|

|

|

3,251 |

|

|

|

6,987 |

|

|

4,851 |

|

|

7,844 |

|

|

3,947 |

|

|

13,222 |

|

|

|

— |

|

|

Loss on debt extinguishment |

|

534 |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

534 |

|

|

Depreciation and amortization expense |

|

862 |

|

|

|

16,804 |

|

|

16,345 |

|

|

|

6,061 |

|

|

|

8,385 |

|

|

9,558 |

|

|

|

4,194 |

|

|

|

9,981 |

|

|

1,634 |

|

|

12,254 |

|

|

6,065 |

|

|

15,272 |

|

|

|

107,415 |

|

| EBITDA |

|

(52,084 |

) |

|

|

46,856 |

|

|

65,901 |

|

|

|

9,861 |

|

|

|

43,972 |

|

|

25,415 |

|

|

|

(4,621 |

) |

|

|

27,308 |

|

|

18,595 |

|

|

30,154 |

|

|

20,017 |

|

|

29,902 |

|

|

|

261,276 |

|

|

Other (income) expense |

|

(73 |

) |

|

|

93 |

|

|

498 |

|

|

|

4 |

|

|

|

2 |

|

|

(1,829 |

) |

|

|

260 |

|

|

|

1,154 |

|

|

251 |

|

|

219 |

|

|

— |

|

|

(1,185 |

) |

|

|

(606 |

) |

|

Non-controlling shareholder compensation |

|

— |

|

|

|

1,210 |

|

|

1,889 |

|

|

|

1,154 |

|

|

|

800 |

|

|

1,089 |

|

|

|

— |

|

|

|

742 |

|

|

372 |

|

|

910 |

|

|

38 |

|

|

647 |

|

|

|

8,851 |

|

|

Acquisition expenses |

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

5,680 |

|

|

|

222 |

|

|

— |

|

|

216 |

|

|

— |

|

|

— |

|

|

|

6,118 |

|

|

Integration services fee |

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

1,688 |

|

|

— |

|

|

|

1,063 |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

2,751 |

|

|

Other |

|

— |

|

|

|

— |

|

|

— |

|

|

|

250 |

|

|

|

— |

|

|

1,802 |

|

|

|

— |

|

|

|

— |

|

|

853 |

|

|

— |

|

|

— |

|

|

1,211 |

|

|

|

4,116 |

|

| Adjusted

EBITDA |

$ |

(52,157 |

) |

|

$ |

48,159 |

|

$ |

68,288 |

|

|

$ |

11,269 |

|

|

$ |

46,462 |

|

$ |

26,477 |

|

|

$ |

2,382 |

|

|

$ |

29,426 |

|

$ |

20,071 |

|

$ |

31,499 |

|

$ |

20,055 |

|

$ |

30,575 |

|

|

$ |

282,506 |

|

Compass Diversified

HoldingsNet Income (Loss) from Continuing

Operations to Non-GAAP Consolidated Adjusted EBITDA

ReconciliationNine months ended September 30,

2021(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Corporate |

|

|

5.11 |

|

|

BOA |

|

Ergo |

|

Lugano |

|

Marucci Sports |

|

Velocity Outdoor |

|

ACI |

|

Altor Solutions |

|

Arnold |

|

Sterno |

|

Consolidated |

|

Income (loss) from continuing operations |

$ |

(64,717 |

) |

|

$ |

14,318 |

|

|

$ |

16,908 |

|

$ |

3,071 |

|

$ |

681 |

|

$ |

9,485 |

|

$ |

19,157 |

|

|

|

10,366 |

|

$ |

5,892 |

|

|

$ |

3,839 |

|

|

$ |

1,491 |

|

|

$ |

20,491 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (benefit) for income taxes |

|

— |

|

|

|

4,857 |

|

|

|

2,165 |

|

|

1,357 |

|

|

304 |

|

|

2,920 |

|

|

5,381 |

|

|

|

2,547 |

|

|

2,867 |

|

|

|

2,062 |

|

|

|

202 |

|

|

|

24,662 |

|

|

Interest expense, net |

|

42,464 |

|

|

|

8 |

|

|

|

— |

|

|

— |

|

|

— |

|

|

5 |

|

|

125 |

|

|

|

— |

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

42,607 |

|

|

Intercompany interest |

|

(53,234 |

) |

|

|

8,743 |

|

|

|

6,320 |

|

|

1,514 |

|

|

548 |

|

|

1,890 |

|

|

5,586 |

|

|

|

5,484 |

|

|

5,075 |

|

|

|

4,128 |

|

|

|

13,946 |

|

|

|

— |

|

|

Loss on debt extinguishment |

|

33,305 |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

33,305 |

|

|

Depreciation and amortization |

|

642 |

|

|

|

16,762 |

|

|

|

15,033 |

|

|

6,377 |

|

|

70 |

|

|

6,377 |

|

|

9,489 |

|

|

|

1,658 |

|

|

9,022 |

|

|

|

5,822 |

|

|

|

16,313 |

|

|

|

87,565 |

|

| EBITDA |

|

(41,540 |

) |

|

|

44,688 |

|

|

|

40,426 |

|

|

12,319 |

|

|

1,603 |

|

|

20,677 |

|

|

39,738 |

|

|

|

20,055 |

|

|

22,856 |

|

|

|

15,856 |

|

|

|

31,952 |

|

|

|

208,630 |

|

|

Other (income) expense |

|

(286 |

) |

|

|

(302 |

) |

|

|

190 |

|

|

— |

|

|

22 |

|

|

881 |

|

|

2,611 |

|

|

|

123 |

|

|

(399 |

) |

|

|

(51 |

) |

|

|

(883 |

) |

|

|

1,906 |

|

|

Non-controlling shareholder compensation |

|

— |

|

|

|

1,926 |

|

|

|

1,655 |

|

|

1,241 |

|

|

— |

|

|

826 |

|

|

777 |

|

|

|

372 |

|

|

770 |

|

|

|

16 |

|

|

|

913 |

|

|

|

8,496 |

|

|

Acquisition expenses |

|

39 |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

1,827 |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

310 |

|

|

|

— |

|

|

|

2,176 |

|

|

Integration services fees |

|

— |

|

|

|

— |

|

|

|

3,300 |

|

|

— |

|

|

— |

|

|

1,000 |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,300 |

|

|

Other |

|

1,085 |

|

|

|

273 |

|

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

(2,300 |

) |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

333 |

|

|

|

(609 |

) |

| Adjusted

EBITDA(1) |

$ |

(40,702 |

) |

|

$ |

46,585 |

|

|

$ |

45,571 |

|

$ |

13,560 |

|

$ |

3,452 |

|

$ |

23,384 |

|

$ |

40,826 |

|

|

$ |

20,550 |

|

$ |

23,227 |

|

|

$ |

16,131 |

|

|

$ |

32,315 |

|

|

$ |

224,899 |

|

(1) As a result of the sale of Liberty Safe in

August 2021, Adjusted EBITDA for the nine months ended September

30, 2021 does not include $12.7 million in Adjusted EBITDA from

Liberty.

Compass Diversified

HoldingsNon-GAAP Adjusted

EBITDA(Unaudited)

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

(in thousands) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

| Branded

Consumer |

|

|

|

|

|

|

|

|

| 5.11 |

|

$ |

18,172 |

|

|

$ |

16,792 |

|

|

$ |

48,159 |

|

|

$ |

46,585 |

|

| BOA |

|

|

19,113 |

|

|

|

13,845 |

|

|

|

68,288 |

|

|

|

45,571 |

|

| Ergobaby |

|

|

2,963 |

|

|

|

2,723 |

|

|

|

11,269 |

|

|

|

13,560 |

|

|

Lugano(1) |

|

|

16,528 |

|

|

|

3,452 |

|

|

|

46,462 |

|

|

|

3,452 |

|

| Marucci Sports |

|

|

10,694 |

|

|

|

5,983 |

|

|

|

26,477 |

|

|

|

23,384 |

|

|

PrimaLoft(2) |

|

|

2,382 |

|

|

|

— |

|

|

|

2,382 |

|

|

|

— |

|

| Velocity Outdoor |

|

|

14,015 |

|

|

|

16,251 |

|

|

|

29,426 |

|

|

|

40,826 |

|

|

Total Branded Consumer |

|

$ |

83,867 |

|

|

$ |

59,046 |

|

|

$ |

232,463 |

|

|

$ |

173,378 |

|

| |

|

|

|

|

|

|

|

|

| Niche

Industrial |

|

|

|

|

|

|

|

|

| Advanced Circuits |

|

$ |

6,457 |

|

|

$ |

7,442 |

|

|

$ |

20,071 |

|

|

$ |

20,550 |

|

| Altor Solutions |

|

|

11,000 |

|

|

|

8,783 |

|

|

|

31,499 |

|

|

|

23,227 |

|

| Arnold Magnetics |

|

|

7,370 |

|

|

|

6,583 |

|

|

|

20,055 |

|

|

|

16,131 |

|

| Sterno |

|

|

8,416 |

|

|

|

10,171 |

|

|

|

30,575 |

|

|

|

32,315 |

|

|

Total Niche Industrial |

|

$ |

33,243 |

|

|

$ |

32,979 |

|

|

$ |

102,200 |

|

|

$ |

92,223 |

|

| Corporate expense |

|

|

(18,784 |

) |

|

|

(14,421 |

) |

|

|

(52,157 |

) |

|

|

(40,702 |

) |

|

Total Adjusted EBITDA |

|

$ |

98,326 |

|

|

$ |

77,604 |

|

|

$ |

282,506 |

|

|

$ |

224,899 |

|

|

(1 |

) |

|

The above results for Lugano do not include management's estimate

of Adjusted EBITDA, before the Company's ownership, of $5.5 million

and $24.1 million, respectively, for the three and nine months

ended September 30, 2021. Lugano was acquired on September 3,

2021. |

| |

|

|

|

(2 |

) |

|

The above results for PrimaLoft do not include management's

estimate of Adjusted EBITDA, before the Company's ownership, of

$1.4 million and $24.8 million, respectively, for the three and

nine months ended September 30, 2022, and $4.2 million and $20.1

million, respectively, for the three and nine months ended

September 30, 2021. PrimaLoft was acquired on July 12, 2022. |

Compass Diversified

HoldingsNet Sales to Pro Forma Net Sales

Reconciliation(unaudited)

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

(in thousands) |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

| |

|

|

|

|

|

|

|

|

| Net Sales |

|

$ |

597,607 |

|

$ |

488,158 |

|

$ |

1,669,123 |

|

$ |

1,372,266 |

|

Acquisitions (1) |

|

|

2,319 |

|

|

31,581 |

|

|

55,185 |

|

|

123,446 |

| Pro Forma Net Sales |

|

$ |

599,926 |

|

$ |

519,739 |

|

$ |

1,724,308 |

|

$ |

1,495,712 |

(1) Acquisitions reflects the

net sales for Lugano and PrimaLoft on a pro forma basis as if the

Company had acquired these businesses on January 1, 2021.

Compass Diversified

HoldingsSubsidiary Pro Forma Net

Sales(unaudited)

| |

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

(in thousands) |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

| |

|

|

|

|

|

|

|

|

| Branded

Consumer |

|

|

|

|

|

|

|

|

| 5.11 |

|

$ |

126,537 |

|

$ |

111,099 |

|

$ |

350,608 |

|

$ |

321,009 |

| BOA |

|

|

50,019 |

|

|

39,496 |

|

|

166,215 |

|

|

120,033 |

| Ergobaby |

|

|

21,540 |

|

|

19,816 |

|

|

68,256 |

|

|

69,100 |

|

Lugano(1) |

|

|

51,145 |

|

|

29,498 |

|

|

137,229 |

|

|

81,881 |

| Marucci Sports |

|

|

42,753 |

|

|

25,040 |

|

|

122,481 |

|

|

86,328 |

|

PrimaLoft(1) |

|

|

13,031 |

|

|

12,906 |

|

|

65,897 |

|

|

52,388 |

| Velocity Outdoor |

|

|

75,482 |

|

|

76,901 |

|

|

180,774 |

|

|

205,891 |

|

Total Branded Consumer |

|

$ |

380,507 |

|

$ |

314,756 |

|

$ |

1,091,460 |

|

$ |

936,630 |

| |

|

|

|

|

|

|

|

|

| Niche

Industrial |

|

|

|

|

|

|

|

|

| Advanced Circuits |

|

$ |

21,788 |

|

$ |

23,182 |

|

$ |

67,194 |

|

$ |

67,209 |

| Altor Solutions |

|

|

69,618 |

|

|

44,122 |

|

|

199,590 |

|

|

122,582 |

| Arnold Magnetics |

|

|

39,377 |

|

|

36,852 |

|

|

116,319 |

|

|

101,893 |

| Sterno |

|

|

88,636 |

|

|

100,827 |

|

|

249,745 |

|

|

267,398 |

|

Total Niche Industrial |

|

$ |

219,419 |

|

$ |

204,983 |

|

$ |

632,848 |

|

$ |

559,082 |

| |

|

|

|

|

|

|

|

|

| Total Subsidiary Net

Sales |

|

$ |

599,926 |

|

$ |

519,739 |

|

$ |

1,724,308 |

|

$ |

1,495,712 |

(1) Net sales for Lugano and

PrimaLoft are pro forma as if the Company had acquired these

businesses on January 1, 2021. Historical net sales for Lugano

prior to acquisition on September 3, 2021 were $18.7 million and

$71.2 million, respectively, for the three and nine months ended

September 30, 2021. Historical net sales for PrimaLoft prior to

acquisition on July 12, 2022 were $2.3 million and $55.2 million,

respectively, for the three and nine months ended September 30,

2022, and $12.9 million and $52.4 million, respectively, for the

three and nine months ended September 30, 2021.

Compass Diversified

HoldingsCondensed Consolidated Cash Flows

(unaudited)

| |

Three months ended September 30, |

|

Nine months ended September 30, |

|

(in thousands) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

| Net cash provided by

(used in) operating activities |

$ |

(4,585 |

) |

|

$ |

37,714 |

|

|

$ |

(39,923 |

) |

|

$ |

147,148 |

|

| Net cash used in

investing activities |

|

(576,713 |

) |

|

|

(149,733 |

) |

|

|

(598,951 |

) |

|

|

(202,429 |

) |

| Net cash provided by

financing activities |

|

538,531 |

|

|

|

72,195 |

|

|

|

542,128 |

|

|

|

54,872 |

|

| Foreign currency impact on

cash |

|

(1,603 |

) |

|

|

(104 |

) |

|

|

(2,735 |

) |

|

|

(96 |

) |

| Net decrease in cash and cash

equivalents |

|

(44,370 |

) |

|

|

(39,928 |

) |

|

|

(99,481 |

) |

|

|

(505 |

) |

| Cash and cash equivalents -

beginning of the period |

|

105,622 |

|

|

|

110,167 |

|

|

|

160,733 |

|

|

|

70,744 |

|

| Cash and cash

equivalents - end of the period |

$ |

61,252 |

|

|

$ |

70,239 |

|

|

$ |

61,252 |

|

|

$ |

70,239 |

|

|

Compass Diversified Holding |

|

Selected Financial Data - Cash Flows |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

(in thousands) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

| Changes in operating assets

and liabilities |

|

$ |

(63,998 |

) |

|

$ |

(11,566 |

) |

|

$ |

(223,164 |

) |

|

$ |

(14,720 |

) |

| Purchases of property and

equipment |

|

$ |

(15,086 |

) |

|

$ |

(11,423 |

) |

|

$ |

(39,683 |

) |

|

$ |

(28,001 |

) |

| Distributions paid - common

shares |

|

$ |

(17,931 |

) |

|

$ |

(80,476 |

) |

|

$ |

(52,794 |

) |

|

$ |

(127,204 |

) |

| Distributions paid - preferred

shares |

|

$ |

(6,045 |

) |

|

$ |

(6,045 |

) |

|

$ |

(18,136 |

) |

|

$ |

(18,136 |

) |

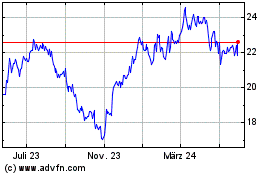

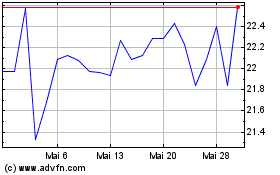

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024