UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 6, 2015 (October 5, 2015)

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34927 | | 57-6218917 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

COMPASS GROUP DIVERSIFIED

HOLDINGS LLC

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34926 | | 20-3812051 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

Sixty One Wilton Road

Second Floor

Westport, CT 06880

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (203) 221-1703

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 8 Other Events

Item 8.01 Other Events

Compass Group Diversified Holdings LLC (the “Company”) and Compass Diversified Holdings (“Holdings” and, together with the Company, collectively “CODI,” “us” or “we”) acquires and manages small to middle market businesses in the ordinary course of its business. The following description relates to the recent divestiture of one such business.

American Furniture Manufacturing, Inc.

On October 5, 2015, Spring Creek Furniture Holdings, LLC, a Mississippi limited liability company (“Buyer”), entered into a stock purchase agreement (the “AFM Purchase Agreement”) with the Company, as owner of substantially all of the issued and outstanding shares of capital stock of AFM Holding Corporation, a Delaware Corporation (“AFM”). In accordance with the AFM Purchase Agreement, on October 5, 2015, Buyer acquired all of the issued and outstanding capital stock of AFM (the “Transaction”). The Company received $23.5 million as consideration for shares it sold as part of the Transaction.

On October 6, 2015, CODI issued a Press Release announcing the sale of AFM. The foregoing description of the Press Release is qualified in its entirety by reference to the complete text of the Press Release furnished as Exhibit 99.1 hereto, which is hereby incorporated by reference herein.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

d) Exhibits

The following exhibits are furnished herewith: |

| | |

Exhibit | | Description |

99.1 | | Press Release of the Company dated October 6, 2015 announcing the sale of AFM Holding Corporation

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: October 6, 2015 | COMPASS DIVERSIFIED HOLDINGS |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Regular Trustee |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: October 6, 2015 | COMPASS GROUP DIVERSIFIED HOLDINGS LLC |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Chief Financial Officer |

Exhibit 99.1

|

| |

Compass Diversified Holdings Ryan J. Faulkingham Chief Financial Officer 203.221.1703 ryan@compassequity.com | Investor Relations and Media Contacts: The IGB Group Leon Berman / Matt Steinberg 212.477.8438 / 212.477.8261 lberman@igbir.com / msteinberg@igbir.com |

Compass Diversified Holdings Announces Sale of

American Furniture Manufacturing, Inc.

Westport, Conn., October 6, 2015 - Compass Diversified Holdings (NYSE: CODI) (“CODI” or the “Company”), an owner of leading middle market businesses, announced today that it has simultaneously entered into a definitive agreement to sell and consummated the sale of its majority owned subsidiary, American Furniture Manufacturing, Inc. (“American Furniture”) to a private investor group, including certain members of American Furniture’s management team, for a total enterprise value of $24.1 million.

After the payment of all of the transaction expenses, CODI received approximately $23.5 million of proceeds from the sale at closing. This amount was in respect of its debt and equity interests in American Furniture and the payment of accrued interest and fees. CODI acquired American Furniture on August 31, 2007 for approximately $93 million and, in addition to impairments recorded in prior years, CODI anticipates recording a loss on the sale of American Furniture of approximately $14 million. The proceeds will enhance the Company’s liquidity and strengthen its balance sheet.

“Over the past several years, we have worked closely with the new management team of American Furniture and deeply appreciate their effort and professionalism in successfully implementing a turnaround amid a challenging industry environment,” stated Alan Offenberg, CEO of Compass Diversified. “We wish the company continued success in the future.”

Mr. Offenberg added, “Looking ahead, we remain focused on drawing upon our family of leading niche businesses to grow cash flows and provide shareholders with attractive cash distributions. With significant financial flexibility, we are also well positioned to continue acquiring leading middle market companies with a reason to exist, while taking advantage of add-on acquisition opportunities and reinvesting in the growth of our current subsidiaries.”

About Compass Diversified Holdings

CODI owns and manages a diverse family of established North American middle market businesses. Each of its current subsidiaries is a leader in its niche market.

CODI maintains controlling ownership interests in each of its subsidiaries in order to maximize its ability to impact long term cash flow generation and value. The Company provides both debt and equity capital for

its subsidiaries, contributing to their financial and operating flexibility. CODI utilizes the cash flows generated by its subsidiaries to invest in the long-term growth of the Company and to make cash distributions to its shareholders.

Our eight majority-owned subsidiaries are engaged in the following lines of business:

| |

• | The manufacture of quick-turn, small-run and production rigid printed circuit boards (Advanced Circuits); |

| |

• | The design and manufacture of medical therapeutic support surfaces and other wound treatment devices (Anodyne Medical Device, also doing business and known as Tridien Medical); |

| |

• | The manufacture of engineered magnetic solutions for a wide range of specialty applications and end-markets (Arnold Magnetic Technologies); |

| |

• | Environmental services for a variety of contaminated materials including soils, dredged material, hazardous waste and drill cuttings (Clean Earth); |

| |

• | The design and marketing of wearable baby carriers, strollers and related products (Ergobaby); |

| |

• | The design and manufacture of premium home and gun safes (Liberty Safe); |

| |

• | The manufacture and marketing of branded, hemp-based food products (Manitoba Harvest); and |

| |

• | The manufacture and marketing of portable food warming fuel and creative table lighting solutions for the foodservice industry (SternoCandleLamp). |

In addition, we own approximately 41% of the common stock of Fox Factory Holding Corp. ("FOX", Nasdaq: FOXF), a former subsidiary business that completed its initial public offering in August 2013. FOX designs and manufactures high-performance suspension products primarily for mountain bikes, side-by-side vehicles, on-road and off-road vehicles and trucks, all-terrain vehicles, snowmobiles, specialty vehicles and applications, and motorcycles.

This press release may contain certain forward-looking statements, including statements with regard to the future performance of CODI. Words such as "believes," "expects," "projects," and "future" or similar expressions, are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements, and some of these factors are enumerated in the risk factor discussion in the Form 10-K filed by CODI with the SEC for the year ended December 31, 2014 and other filings with the SEC. Except as required by law, CODI undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

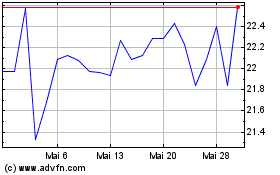

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024