Form 8-K - Current report

20 August 2024 - 10:08PM

Edgar (US Regulatory)

false000166629100016662912024-08-152024-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 15, 2024 |

Claros Mortgage Trust, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-40993 |

47-4074900 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

c/o Mack Real Estate Credit Strategies, L.P. 60 Columbus Circle 20th Floor |

|

New York, New York |

|

10023 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (212) 484-0050 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value per share |

|

CMTG |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On August 15, 2024, CMTG MS Finance LLC and CMTG MS Financing Holdco LLC, each subsidiaries of Claros Mortgage Trust, Inc., entered into a Thirteenth Amendment to Master Repurchase and Securities Contract Agreement (the "Morgan Stanley Facility") with Morgan Stanley Bank, N.A. The purpose of the amendment to the Morgan Stanley Facility was, among other things, to decrease the maximum facility amount and to provide for options to extend the facility maturity date.

The foregoing description of the amendment to the Morgan Stanley Facility is only a summary of certain material provisions and is qualified in its entirety by reference to a copy of such amendment, which is filed herewith as Exhibit 10.1 and by this reference incorporated herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangement of a Registrant.

The information required by Item 2.03 contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

CLAROS MORTGAGE TRUST, INC. |

|

|

|

|

Date: |

August 20, 2024 |

By: |

/s/ J. Michael McGillis |

|

|

|

J. Michael McGillis

Chief Financial Officer, President and Director

(Principal Financial and Accounting Officer) |

Exhibit 10.1

Execution Version

THIRTEENTH AMENDMENT TO MASTER REPURCHASE AND SECURITIES CONTRACT AGREEMENT

This Thirteenth Amendment to Master Repurchase and Securities Contract Agreement (this “Amendment”), dated as of August 15 , 2024, is by and between MORGAN STANLEY BANK, N.A., a national banking association (together with its successors and assigns, “Buyer”) and CMTG MS FINANCE LLC, a Delaware limited liability company (“Seller”).

W I T N E S S E T H:

WHEREAS, Seller and Buyer are parties to that certain Master Repurchase and Securities Contract Agreement, dated as of January 26, 2017, as amended by that certain First Amendment to Master Repurchase and Securities Contract Agreement, dated as of June 26, 2018, as further amended by that certain Second Amendment to Master Repurchase and Securities Contract Agreement, dated as of March 13, 2019, as further amended by that certain Third Amendment to Master Repurchase and Securities Contract Agreement, dated as of November 1, 2019, as further amended by that certain Fourth Amendment to Master Repurchase and Securities Contract Agreement, dated as of February 3, 2020, as further amended by that certain Fifth Amendment to Master Repurchase and Securities Contract Agreement, dated as of February 21, 2020, as further amended by that certain Sixth Amendment to Master Repurchase and Securities Contract Agreement, dated as of March 17, 2020, as further amended by that certain Seventh Amendment to Master Repurchase and Securities Contract Agreement, dated as of April 10, 2020, as further amended by that certain Eighth Amendment to Master Repurchase and Securities Contract Agreement, dated as of January 29, 2021, as further amended by that certain Ninth Amendment to Master Repurchase and Securities Contract Agreement, dated as of September 9, 2021, as further amended by that certain Tenth Amendment to Master Repurchase and Securities Contract Agreement, dated as of January 25, 2022, as further amended by that certain Eleventh Amendment to Master Repurchase and Securities Contract Agreement, dated as of January 26, 2023, as further amended by that certain Twelfth Amendment to Master Repurchase and Securities Contract Agreement and First Amendment to Guaranty, dated as of March 16, 2023 (as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time, the “Master Repurchase Agreement”); and

WHEREAS, Seller and Buyer wish to modify certain terms and provisions of the Master Repurchase Agreement.

NOW, THEREFORE, the parties hereto agree as follows:

1.Amendment of Master Repurchase Agreement. The Master Repurchase Agreement is hereby amended as follows:

(a)The following definition is hereby added to Section 1 of the Master Repurchase Agreement in correct alphabetical order:

“Specified Percentage” shall have the meaning specified in the Fee Letter.

(b)The definition of Facility Amount in Article 2 of the Master Repurchase Agreement is hereby deleted in its entirety and replaced with the following:

“Facility Amount” shall mean Seven Hundred and Fifty Million Dollars ($750,000,000.00).

(c)Section 5(b)(iii) of the Master Repurchase Agreement is hereby deleted in its entirety and replaced with the following:

“third, if a Principal Payment in respect of any Purchased Asset has been made during the related Collection Period, to Buyer an amount equal to the product of (x) the amount of such Principal Payment multiplied by (y) the Specified Percentage of such Purchased Asset, which amount shall be applied by Buyer first, to reduce the Purchase Price of the Purchased Asset in respect of which such Principal Payment was received until the Purchase Price of such Purchased Asset is reduced to zero (0), and then, in Buyer’s sole discretion to reduce the Purchase Price of the remaining the Purchased Assets;”

(d)Section 9(a) of the Master Repurchase Agreement is hereby deleted in its entirety and replaced with the following:

“(a) Extension of Facility Termination Date. At the request of Seller delivered to Buyer no earlier than ninety (90) days and no later than thirty (30) days before: (i) January 26, 2025, Seller has one (1) option to extend the then current Facility Termination Date to January 26, 2026, (ii) January 26, 2026, Seller has one (1) option to extend the then current Facility Termination Date to January 26, 2027, and (iii) January 26, 2027, Seller has one (1) option to request an extension of the then current Facility Termination Date to January 26, 2028. Seller may only exercise the extension referred to in clauses (i) and

(ii) of the preceding sentence if on or before the then current Facility Termination Date, Seller shall have paid the Extension Fee to Buyer and no material monetary Event of Default shall exist on the then current Facility Termination Date. Such request referred to in clause (iii) of the second preceding sentence may be approved or denied in Buyer’s sole discretion, and in any case shall be approved only if (x) no material monetary Event of Default exists on the then current Facility Termination Date, and (y) on or before the then current Facility Termination Date, Seller shall have paid the Extension Fee to Buyer.”

2.Seller Representations. Seller hereby represents and warrants that:

(a)no Material Adverse Effect, Margin Deficit, Event of Default or, to Seller’s Knowledge, Default has occurred and is continuing as of the date hereof, and no Default, Event of Default or Margin Deficit will occur as a result of the execution, delivery and performance by Seller of this Amendment;

(b)all representations and warranties in the Master Repurchase Agreement are true, correct, complete and accurate in all respects as of the date hereof (except as may be set forth in any Exceptions Report); and

(c)(i) no amendments have been made to the organizational documents of Seller since January 26, 2017, and (ii) Seller has authority to execute and deliver this Amendment and the other Transaction Documents to be executed and delivered in connection with this Amendment.

3.Effectiveness. The effectiveness of this Amendment is subject to receipt by Buyer of the following:

(a)Amendment. This Amendment, duly executed and delivered by Seller and Pledgor.

(b)Fees. Payment by Seller of the actual costs and expenses, including, without limitation, the

reasonable fees and expenses of counsel to Buyer, incurred by Buyer in connection with this Amendment and the transactions contemplated hereby.

4.Continuing Effect; Reaffirmation of Pledge Agreement. As amended by this Amendment, all terms, covenants and provisions of the Master Repurchase Agreement and the other Transaction Documents are ratified and confirmed and shall remain in full force and effect. In addition, the Pledge and Security Agreement is hereby ratified and confirmed and shall not be released, diminished, impaired, reduced or adversely affected by this Amendment, and Pledgor hereby consents, acknowledges and agrees to the modifications set forth in this Amendment. This Amendment shall be deemed a “Transaction Document” for all purposes under the Master Repurchase Agreement.

5.Binding Effect; No Partnership; Counterparts. The provisions of the Master Repurchase Agreement, as amended hereby, shall be binding upon and inure to the benefit of the parties thereto and their respective successors and permitted assigns. Nothing herein contained shall be deemed or construed to create a partnership or joint venture between any of the parties hereto. For the purpose of facilitating the execution of this Amendment as herein provided, this Amendment may be executed simultaneously in any number of counterparts, each of which shall be deemed to be an original, and such counterparts when taken together shall constitute but one and the same instrument. Delivery of an executed counterpart of a signature page to this Amendment in Portable Document Format (.PDF) or by facsimile transmission shall be effective as delivery of a manually executed original counterpart thereof.

6.Further Agreements. Seller agrees to execute and deliver such additional documents, instruments or agreements as may be reasonably requested by Buyer and as may be necessary or appropriate from time to time to effectuate the purposes of this Amendment.

7.Governing Law. The provisions of Article 18 of the Master Repurchase Agreement are incorporated herein by reference.

8.Defined Terms. Capitalized terms used but not defined herein shall have the meanings set forth in the Master Repurchase Agreement.

9.Headings. The headings of the sections and subsections of this Amendment are for convenience of reference only and shall not be considered a part hereof nor shall they be deemed to limit or otherwise affect any of the terms or provisions hereof.

10.References to Transaction Documents. All references to the Master Repurchase Agreement in any Transaction Document, or in any other document executed or delivered in connection therewith shall, from and after the execution and delivery of this Amendment, be deemed a reference to the Master Repurchase Agreement as amended hereby, unless the context expressly requires otherwise.

11.No Waiver. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of Buyer under the Master Repurchase Agreement or any other Transaction Document, nor constitute a waiver of any provision of the Master Repurchase Agreement or any other Transaction Document by any of the parties hereto.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the day first written above.

BUYER:

MORGAN STANLEY BANK, N.A.,

a national banking association

By: /s/ Evan Hershy

Name: Evan Hershy

Title: Authorized Signatory

[Signatures continue on the following page]

SELLER:

CMTG MS FINANCE LLC,

a Delaware limited liability company

By: /s/ J. Michael McGillis

Name: J. Michael McGillis

Title: Authorized Signatory

ACKNOWLEDGED AND AGREED:

PLEDGOR:

CMTG MS FINANCE HOLDCO LLC,

a Delaware limited liability company

By: /s/ J. Michael McGillis

Name: J. Michael McGillis

Title: Authorized Signatory

[END OF SIGNATURES]

Document And Entity Information

|

Aug. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 15, 2024

|

| Entity Registrant Name |

Claros Mortgage Trust, Inc.

|

| Entity Central Index Key |

0001666291

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-40993

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

47-4074900

|

| Entity Address, Address Line One |

c/o Mack Real Estate Credit Strategies, L.P.

|

| Entity Address, Address Line Two |

60 Columbus Circle

|

| Entity Address, Address Line Three |

20th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10023

|

| City Area Code |

(212)

|

| Local Phone Number |

484-0050

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

CMTG

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

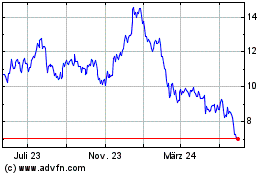

Claros Mortgage (NYSE:CMTG)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

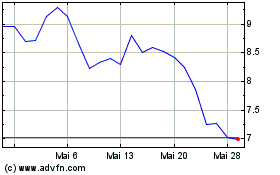

Claros Mortgage (NYSE:CMTG)

Historical Stock Chart

Von Jan 2024 bis Jan 2025