Caterpillar on Track to Break Sales Slump -- Update

24 Oktober 2017 - 5:22PM

Dow Jones News

By Bob Tita and Austen Hufford

Caterpillar Inc. raised its sales and profit forecast for the

year amid rising demand for construction and mining equipment,

partly helped by an improving energy industry.

The Caterpillar, the world's largest producer of bulldozers,

excavators and other earth-moving machinery, saw widespread

improvement in sales during the third quarter.

The Deerfield, Ill.-based manufacturer said its dealers stepped

up their purchases of equipment to restock depleted inventories in

response to rising customer demand, especially from an improving

oil and gas industry in North America. Construction-equipment sales

in the region grew 31% from last year and mining-equipment sales

increased by 28%.

Caterpillar's fortunes have improved over the past year

following a years-long slump from a downturn in the global

commodities markets and slowdown in construction.

The company's stock has risen more than 50% over the past 12

months, and recently added 5.4% to $139.74.

But slow-growing economies around the world, the absence of a

major infrastructure spending plan in the U.S. and a still-fragile

mining sector threaten to undermine the prolonged upturn in

machinery demand that company executives and investors have been

expecting.

Jim Umpleby, who took over as chief executive on Jan. 1, said a

prime focus under his watch would be profitable growth, rather than

only increasing revenue and market share, with a focus on parts and

services. The third-quarter operating margin on machinery was 14%,

up from 7.8% a year ago, reflecting the company's emphasis on

profit expansion.

"Higher sales volume and our team's focus on cost discipline

resulted in improved profit margins across" the company, Mr.

Umpleby said.

Caterpillar, which had in years past released guidance for the

following year during its third quarter, didn't provide that

Tuesday, citing its new enterprise strategy.

The manufacturer also said it would raise prices early next year

through a new structural change to its machine pricing: List prices

will fall but the company will cut merchandising discounts, even

more, leading to higher prices.

Caterpillar's full-time workforce decreased to 96,700 employees

at the end of the third quarter, down from 97,100 the prior year,

amid layoffs and some factory closures.

Overall, profit from the quarter ended Sept. 30 was $1.05

billion, or $1.77 a share, up from $283 million, or 48 cents a

share, last year. Wall Street analysts had expected per-share

earnings of $1.11.

Caterpillar said revenue, including from its financing business,

rose 25% to $11.5 billion.

The company now expects full-year revenue to come in at about

$44 billion, up from its forecast in July of $43 billion. It now

expects per-share profit of $4.60, up from $3.50 earlier.

Write to Bob Tita at robert.tita@wsj.com and Austen Hufford at

austen.hufford@wsj.com

(END) Dow Jones Newswires

October 24, 2017 11:07 ET (15:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

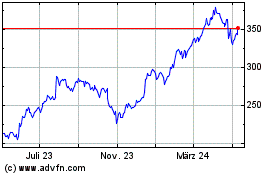

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

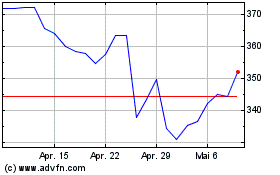

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024