Tilray Shares Jump on Beer, Beverage Brands Acquisition from Anheuser-Busch

08 August 2023 - 5:35PM

Dow Jones News

By Adriano Marchese

Tilray Brands shares soared Tuesday morning after reporting that

it would expand its alcohol line through the acquisition of eight

beer and beverage brands from Anheuser-Busch InBev.

The U.S. pharmaceutical, cannabis and consumer packaged goods

company late Monday said that the acquisition will include Shock

Top, Redhook Brewery and Widmer Brothers Brewing, among others.

At 10:56 a.m. ET, shares were trading nearly 28% higher at

$2.84.

As part of the transaction, Tilray is set to take ownership of

the breweries and brewpubs associated with the brands.

No financial details of the acquisition were disclosed, but

Tilray said the purchase price will be paid in cash with a planned

closing date later this year.

The move comes nearly a year after Tilray agreed to buy craft

brewer and hard seltzer maker Montauk Brewing, in November

2022.

Tilray's beverage segment has been a strong contributor to the

company's revenue, which rose 20% in its fourth quarter to $184

million, beating the $154 million forecast by analysts polled by

FactSet. The growth was supported by a strong performance at its

beverage alcohol segment, which generated net revenue 43% higher

than the year prior, reaching $32.4 million.

Meanwhile, the company continues to face heavy competition in

Canada's legal cannabis industry and stalled federal reform in the

U.S.

Tilray closed its acquisition of cannabis consumer packaged

goods company Hexo in June in a bid to bolster its market position

in the cannabis space, which sits at 13% market share in Canada,

according to the company.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

August 08, 2023 11:20 ET (15:20 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

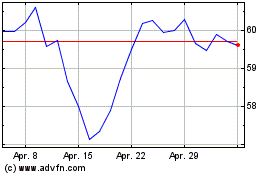

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

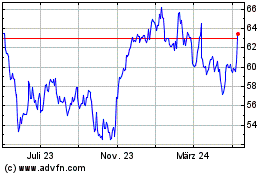

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024