Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

25 Oktober 2023 - 10:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

October 24, 2023

Commission File Number 001-39007

Borr Drilling Limited

2nd Floor 9 Par-la-Ville Road

Hamilton HM11

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

BORR DRILLING LIMITED

|

| |

|

|

|

Date: October 24, 2023

|

By:

|

/s/ Mi Hong Yoon

|

|

|

Name:

|

|

|

|

Title:

|

Director

|

Exhibit 99.1

Borr Drilling Limited - Completion and Pricing of Private Placement

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, CANADA, JAPAN, HONG KONG, OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, PUBLICATION OR DISTRIBUTION WOULD

BE UNLAWFUL. THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO BUY, SELL OR SUBSCRIBE FOR ANY SECURITIES DESCRIBED HEREIN.

Hamilton, Bermuda, 24 October 2023

Borr Drilling Limited (NYSE and OSE: BORR) (the “Company”) refers to the stock exchange announcement on 23 October 2023 in relation to the process of refinancing our secured debt (the “Refinancing”), and the contemplated

issue of an aggregate principal amount of USD 1.5 billion of new senior secured notes (the “Notes”) and an USD 180 million super senior revolving credit facility, to be secured on a super senior basis by the same collateral that will secure the Notes.

As a part of the Refinancing, and to facilitate attractive terms therein, the Company announced a contemplated a private placement (the “Private Placement”) of approximately USD 50 million in new shares (the “Offer Shares”), each with a par value of

USD 0.10.

The Company is pleased to announce that it has raised NOK 556,690,000 in gross proceeds in the Private Placement equivalent to USD 50,000,000 of 7,522,838 new shares (the “Offer Shares”), each at a subscription price of

NOK 74 (the “Offer Price”), equivalent to USD 6.6464 per Offer Share, subject to the satisfaction of the Conditions (as defined below). The Private Placement was significantly oversubscribed.

The completion of the Private Placement is subject to (i) all necessary corporate resolutions being validly made by the Company, including the approval by the Board, and their resolution to allocate and issue the Offer

Shares, (ii) pricing of the Notes, and (iii) the issuance of the Offer Shares in Euronext Securities Oslo (“Euronext VPS”) having taken place (the “Conditions”). Please note that our release announcing the Private Placement on 23 October 2023, by an

oversight referred to both pricing and issuance of the Notes as a condition under the Condition no. (ii) (as noted above, only pricing is a condition to completion of the Private Placement).

The conditional issue and allocation of Offer Shares is today expected to be determined by the Board at its sole discretion, in consultation with the Managers. The date for settlement of the Offer Shares allocated in the

Private Placement is expected to be settled after pricing of the Notes through a delivery versus payment (“DVP”) with the settlement of the Private Placement expected on or about 31 October 2023. The Offer Shares are expected to be pre-paid by the

Managers, pursuant to a pre-payment arrangement, to facilitate prompt issue of the Offer Shares (via DTC) in Euronext VPS. The Offer Shares will upon delivery be recorded in Euronext VPS. No Offer Shares will be offered or sold to the public in the

United States or in transactions on the NYSE. The Company may, in its own discretion, change the date for settlement at any time and for any reason.

The Company has considered the Private Placement in light of the equal treatment obligations under the Norwegian Securities Trading Act and the rules on equal treatment under Oslo Rule Book II for companies listed on the

Oslo Stock Exchange and the Oslo Stock Exchange’s Guidelines on the rule of equal treatment, and the Board is of the opinion that the transaction is in compliance with these requirements and guidelines. The Private Placement is considered by the Board

as an important part of the Refinancing to facilitate attractive terms. Taking into consideration the required coordination of timing of the Private Placement with the Refinancing process, the Board has concluded that offering of new shares in a

private placement, on a price equal to the prevailing market price, and with limited dilution, at this time to be in the common interest of the Company and its shareholders.

This information is considered to be inside information pursuant to the EU Market Abuse Regulation and subject to the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

Important note

This announcement is not being made in or into Canada, Australia, Japan, Hong Kong or in any other jurisdiction where it would be prohibited by applicable law. This distribution is for information purposes only and does

not constitute or form part of an offer or solicitation of an offer to purchase or subscribe for securities in the United States (“U.S.”) or in any jurisdiction in which, or to any persons to whom, such offering, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any jurisdiction. The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933 (the “U.S. Securities Act”) or applicable state

securities laws, and may not be offered or sold in the United States or to U.S. persons (other than distributors) unless such securities are registered under the U.S. Securities Act, or an exemption from the registration requirements of the U.S.

Securities Act is available.

Forward looking statements

This announcement includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, including a potential issuance of Notes and Offer Shares, the conditions to the Private

Placement, the use of proceeds therefrom, expected timing of the Private Placement and other statements relating to the Private Placement and other non-historical statements. These forward-looking statements are subject to numerous risks, uncertainties

and assumptions, including risks relating to the contemplated Notes and Private Placement, including conditions to closing, risks related to changes in market conditions and other risks included in our filings with the Securities and Exchange

Commission including those set forth under “Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2022 and in prospectuses filed with the Norwegian Financial Supervisory Authority (FSA). Forward-looking statements reflect

knowledge and information available at, and speak only as of, the date they are made. Except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information,

future events or otherwise, after the date hereof or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on such forward-looking statements.

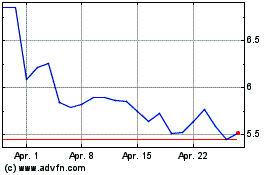

Borr Drilling (NYSE:BORR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

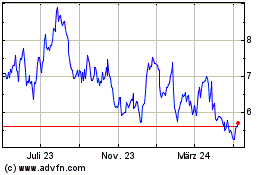

Borr Drilling (NYSE:BORR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024