BF.B Revises Charter to Ease Split - Analyst Blog

27 Juli 2012 - 7:58PM

Zacks

To facilitate the smooth completion of its previously announced

3-for-2 stock split, the shareholders of Brown-Forman

Corporation (BF.B) have amended their charter to enlarge

the total number of authorized shares for both Class A and Class B.

Per the amendment, the charter will now authorize a total of 85

million Class A shares and 400 Class B shares.

Last month, the global producer and distributor of premium

alcoholic beverages had announced its intention to split its Class

A and Class B common stocks, proposing to distribute one additional

share to shareholders for every two shares held. Brown-Forman will

distribute the new shares under the 3-for-2 stock split in the form

of a stock dividend.

Brown-Forman announced the record date for the spilt as August

3, 2012, with the shareholders receiving the additional shares on

August 10. Further, the company stated that its share price will be

adjusted accordingly on the New York Stock Exchange for trading

beginning on August 13. This split will mark the sixth stock split

in the last 35 years.

Recently, the board of directors of Brown-Forman also announced

a regular cash dividend of 23.33 cents per share on a

split-adjusted basis for both Class A and Class B shares.

This dividend will be paid on October 1, 2012 to shareholders of

record as of September 7, 2012.

Brown-Forman’s stock split reflects the company’s commitment to

enhance long-term value for shareholders. It also portrays the

company’s confidence to boost its longer-term prospects for

earnings as well as cash flows.

During fiscal 2012, Brown-Forman generated $516 million of cash

from operations and deployed $192 million for dividend payout, $220

million toward share repurchase, $58 million on capital

expenditures and $248 million toward debt repayment.

Brown-Forman ended the fiscal with cash and cash equivalents of

$338 million and long-term debt of $506 million (including the

current maturities) compared with $567 million and $759 million,

respectively, in fiscal 2011.

Brown-Forman possessing brands such as Jack Daniel’s, Finlandia,

Southern Comfort and Canadian Mist, command a strong portfolio of

globally recognized brands. We believe this provides a competitive

edge to the company and bolsters its well-established position in

the market.

Brown-Forman is in direct competition with Beam

Inc. (BEAM), Constellation Brands Inc.

(STZ) and Diageo plc (DEO). Currently,

Brown-Forman has a Zacks #3 Rank, implying a short-term Hold

rating. We maintain our long-term Neutral recommendation on the

stock.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

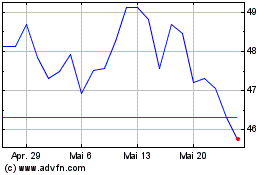

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024