STZ Closes Mark West Acquisition - Analyst Blog

18 Juli 2012 - 8:29PM

Zacks

Constellation Brands Inc. (STZ) has recently

completed the acquisition of Mark West wine brand from

California-based Purple Wine Company, LLC. Constellation Brands

paid a total sum of $160 million to complete the acquisition. This

strategic move expanded its hard beverage portfolio.

Per the agreement, the acquisition will include some grape

supply contracts and wine inventories from three California labels,

i.e. a California pinot noir, a Russian River reserve pinot noir

and a Santa Lucia reserve pinot noir.

Being the best-selling and fastest growing brand in the U.S.,

Mark West holds leadership in $10 - $12 price category, registering

a growth of 35% in volume in the last 12 weeks. At present,

approximately 600,000 cases of Mark West pinot noir are being sold

annually in U.S. We believe this acquisition will strengthen

Constellation Brands' pinot noir brand portfolio.

At the end of first-quarter fiscal 2013, Constellation Brands

had $69.1 million of cash and cash equivalents. Moreover, the

company generated $96.4 million and $76.8 million of cash from

operations and free cash flow, respectively.

Furthermore, the company has remaining $850 million under its

revolving credit facility. Although the company is silent about the

source of fund, we expect that the company has utilized a portion

of its credit facility to complete the acquisition.

We believe that the company’s strategic initiative of expanding

footholds in the U.S wine industry along with focus on brand

building and promotion will enhance its growth opportunities while

strengthening its market position.

Moreover, in an effort to generate strong margins, Constellation

Brands is also focusing on higher priced segment across all key

categories. The company in a drive to enhance its presence in the

U.S. beer market has entered into an agreement with

Anheuser-Busch InBev (BUD) to acquire the

remaining 50% stake of Crown Imports. Constellation Brands believes

that the acquisition will be significantly accretive to its

earnings per share and free cash flow.

Constellation Brands is the largest wine company in the world

and commands a dominant position in the premium wine segment in the

U.S. The company is also a leading producer of wines in Canada and

New Zealand. This provides a competitive edge to the company and

bolsters its well-established position in the market.

However, the company faces intense competition from other

well-established players in the industry, including Beam

Inc. (BEAM), Brown-Forman Corporation

(BF.B) and Diageo plc (DEO). Moreover,

Constellation Brands also encounters competition from local and

regional players in the respective countries. Consequently, this

may dent the company’s future operating performance.

We currently have a Zacks #2 Rank (short-term Buy rating) on the

stock. Our long-term recommendation on the stock remains

Neutral.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

ANHEUSER-BU ADR (BUD): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

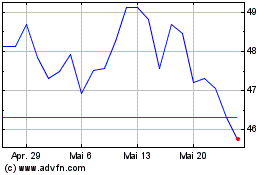

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024