Brown-Forman Hits Record Sales - Analyst Blog

09 Dezember 2011 - 10:45AM

Zacks

Brown-Forman Corp.

(BF.B) reported a record fiscal 2012 second-quarter result, as it

is first time in the company’s history that it crossed the $1

billion sales mark.

The company’s reported earnings of

$1.09 per share came in line with Zacks Consensus Estimate and grew

3.8% from the year-ago earnings of $1.05.The robust increase in

quarterly earnings was primarily driven by strong top-line growth

and volume gains.

During the quarter earnings per

share grew 8% after excluding the net effect of Hopland-based wine

business.

Quarterly

Details

Brown-Forman's net sales recorded a

growth of 11.9% to $1,013.7 million from $905.7 million in the

prior-year quarter. The growth was primarily attributable to solid

performance in Germany, Turkey, France, the U.K., Russia, Canada,

Australia and Brazil, which was more than offset by declines in

Poland and Spain. Total Revenue beat the Zacks Consensus Estimate

of $966 million.

During the quarter, Brown-Forman's

gross profit grew 9.4% from the prior-year quarter to $501.9

million primarily driven by increased volumes. However, gross

margin contracted 120 basis points (bps) year over year to 49.5%

due to increased input and excise costs.

During the quarter, the company

made huge advertising expenses in order to support several brand

innovation launches. Advertising expenses increased 14.1% year over

year to $106.7 million. Selling, general and administrative

expenses surged 10.5% year over year to $146.8 million due to

increased salary and related expenses. Conversely, Brown-Forman's

operating profit grew 4.8% from the prior-year quarter to $246.3

million, while operating margin contracted 160 basis points to

24.3% from the prior-year period.

Balance Sheet & Cash

Flow

Brown-Forman ended the quarter with

cash and cash equivalents of $380.1 million and long-term debt of

$504.2 million.

During the first six months of

fiscal 2012, Brown-Forman generated $155.5 million of cash from

operations and deployed $92.4 million for dividend payout, and

$18.8 million on capital expenditures. On November 30, 2011,

Brown-Forman’s $250 million share repurchase program expired.

During the program period, the company repurchased a total of 3.4

million shares for $234 million, at an average price of $69.39 per

share.

Dividend

During the quarter, Brown-Forman

paid a regular quarterly cash dividend of 35 cents a share on Class

A and Class B common stock, an increase of 9.4% over the prior

dividend. This is the company’s 28th consecutive year of

dividend growth.

Guidance and Zacks

Consensus

Moving forward, Brown-Forman

expects strong improvement in customer trends in the remaining

period of fiscal 2012. However, it also anticipates that the

stronger U.S. dollar value may have an adverse impact on its

bottom-line. Accordingly, the company has lowered its upper end of

earnings guidance. Currently, Brown-Forman expects fiscal 2012

earnings in the range of $3.45 to $3.70 per share instead of $3.45

to $3.85. Currently, the Zacks Consensus Estimate stood at $3.63

per share.

Brown-Forman, which competes with

Constellation Brands Inc. (STZ) and Diageo

plc (DEO), currently holds a Zacks #4 Rank, implying a

short-term ‘Sell’ rating on the stock. Besides, the company retains

a long-term 'Outperform' recommendation on the stock.

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

Zacks Investment Research

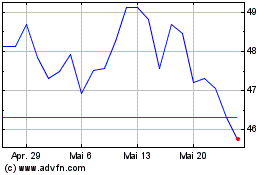

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024