UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON,

D.C. 20549

FORM 6-K

REPORT OF

FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2022

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F X

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

No X

February 3, 2022 2021 Results

Disclaimer This document is only provided

for information purposes and does not constitute, nor should it be interpreted as, an offer to sell or exchange or acquire, or an invitation for offers to buy securities issued by any of the aforementioned companies. Any decision to buy or invest in

securities in relation to a specific issue must be made solely and exclusively on the basis of the information set out in the pertinent prospectus filed by the company in relation to such specific issue. No one who becomes aware of the information

contained in this report should regard it as definitive, because it is subject to changes and modifications. This document contains or may contain forward looking statements (in the usual meaning and within the meaning of the US Private Securities

Litigation Reform Act of 1995) regarding intentions, expectations or projections of BBVA or of its management on the date thereof, that refer to or incorporate various assumptions and projections, including projections about the future earnings of

the business. The statements contained herein are based on our current projections, but the actual results may be substantially modified in the future by various risks and other factors that may cause the results or final decisions to differ from

such intentions, projections or estimates. These factors include, without limitation, (1) the market situation, macroeconomic factors, regulatory, political or government guidelines, (2) domestic and international stock market movements, exchange

rates and interest rates, (3) competitive pressures, (4) technological changes, (5) alterations in the financial situation, creditworthiness or solvency of our customers, debtors or counterparts. These factors could cause or result in actual events

differing from the information and intentions stated, projected or forecast in this document or in other past or future documents. BBVA does not undertake to publicly revise the contents of this or any other document, either if the events are not as

described herein, or if such events lead to changes in the information contained in this document. This document may contain summarised information or information that has not been audited, and its recipients are invited to consult the documentation

and public information filed by BBVA with stock market supervisory bodies, in particular, the prospectuses and periodical information filed with the Spanish Securities Exchange Commission (CNMV) and the Annual Report on Form 20-F and information on

Form 6-K that are filed with the US Securities and Exchange Commission. Distribution of this document in other jurisdictions may be prohibited, and recipients into whose possession this document comes shall be solely responsible for informing

themselves about, and observing any such restrictions. By accepting this document you agree to be bound by the foregoing restrictions.

On track to achieve our ambitious long-term

goals 2021 achievements 8.7million CUSTOMERS ACQUIRED €35.4 billion SUSTAINABLE FINANCING +10.8% €5.1 billion OPERATING INCOME NET ATTRIBUTABLE PROFIT 2 12.0% +10.1% ROTE TBV/ SHARE + DIVIDENDS €3,500 million ONE OF THE LARGEST

BUYBACK PROGRAMS (1) Digital Sales based on total units sold. (2) Net Attributable Profit excluding non-recurring impacts (discontinued operations and net cost related to the restructuring process). (3) Growth in constant Euros. (4) €8 cents

(gross) in Oct. 21 already paid and €23 cents € (gross) in Apr.22 (to be proposed for the consideration of the governing bodies). SIGNIFICANT PROGRESS IN THE EXECUTION OF OUR STRATEGY THE HIGHEST RECURRENT RESULTS IN THE PAST 10 YEARS

ACCELERATING PROFITABLE GROWTH AND VALUE CREATION FOR OUR SHAREHOLDERS INCREASING SHAREHOLDERS’ DISTRIBUTIONS €31cents/share4 growth vs. 20203 growth vs. 2020 DIGITAL SALES1 73.3% THE HIGHEST CASH DIVIDEND IN THE PAST 10 YEARS

All-time record customer acquisition (1)

Gross customer acquisition through own channels for retail segment. Excludes the US business sold to PNC NEW CUSTOMER ACQUISITION1 (MILLION; % ACQUISITION THROUGH DIGITAL CHANNELS) DIGITAL ACQUISITION +47% 2021 vs 2020 TOTAL 4% 40% millIon 8.7

DIGITAL

Leading digital transformation and

investing in innovation as key for growth Digital experience leader in European mobile banking five years in a row4 DIGITAL LEADERSHIP INVESTING IN INNOVATION units prv SPAIN 27.0% 26.8% +9.3p.p. SELECTIVE digital bank INVESTMENTS (EUROPE,

INFRASTRUCTURE) (UK) Fintech investments Fintech venture capital fund with 6 unicorns MOBILE CUSTOMERS1 (MILLION CUSTOMERS) DIGITAL SALES2 (%, UNITS AND PRV3) DIGITAL ADVICE NEW FUNDS SOLD USING BBVA INVEST NEW MORTGAGES SOLD USING BBVA VALORA NPS

(FINANCIAL HEALTH TOOLS USERS VS NON- USERS) (1) Includes USA, Paraguay and Chile until their sale. (2) Excludes units sold in USA, Venezuela, Chile and Paraguay. (3) Product Relative Value as a proxy of lifetime economic representation of units

sold. (4) According to ‘The Forrester Digital Experience Review™: European Mobile Banking Apps, Q3 2021’. BBVA ITALY (BRAZIL, THROUGH PROPEL)

Pioneering Sustainability SUSTAINABLE

FINANCING (€BILLION) 200 €Bn 2025 PLEDGE A CLEAR COMMITMENT IN PORTFOLIO ALIGNMENT TOWARDS NET ZERO 2050 2030 decarbonization goals set in selected CO2 intensive industries1 (1) These sectors account for 60% of global CO2 Emissions

worldwide (Source: “IEA and UNEP). (2) 2030 for developed countries and in 2040 for emerging countries. (3) According to the Dow Jones Sustainability Index 2021. Sharing #1 position in ranking. €35.4 Bn CHANNELED IN 2021 €86 Bn

Total channeled BBVA, top-ranking bank worldwide3 Power Steel Coal Auto Cement Reduction in 2030 Phase out2 2018 2019 2020 2022 2023 2024 2025 2021 CLIMATE CHANGE 80% INCLUSIVE GROWTH 20% -52% kg CO2e/MWh -23% kg CO2/tn -46% g CO2/km -17% kg

CO2/tn

The highest recurrent results in the past

10 years 13.16% 5.8% EPS (€) EPS (€) 1 0.19 EPS (€) 0.09 0.20 0.58 0.35 0.71 (1) Net attributable profit (NAP) and EPS excluding non-recurring impacts (Discontinued operations in 2019, 2020 and 2021, net cost related to the

restructuring process in 2Q21, and capital gains from the agreement with Allianz in 4Q20) for comparison purposes. Reported NAP including non-recurring impacts: €1,305 Mn in 2020 and €3,512 Mn in 2019. 2021 EPS, calculated

considering the average number of shares (6,647Mn), taking into account the treasury shares and the executed share buyback as of December 31, 2021 (112 Mn shares). 2019, 2020 and 2021 EPS under IAS 33: 0.47€, 0.14€ and

0.67€ respectively. €4,653M INCLUDING NON-RECURRENT IMPACTS1 NET ATTRIBUTABLE PROFIT1 (CURRENT €M) +18.7% 0.14

Delivering on our clear commitment to

shareholder value creation (1) April 2021 dividend per share (0.06 € gross) and October 2021 dividend per share (0.08 € gross). (2) Profitability metrics excluding non-recurring impacts (Discontinued operations, net cost related to the

restructuring process and corporate operations). 6.55 6.66 1 TBV / share Dividends distributed in 2021 TBV / SHARE + DIVIDENDS (€ / SHARE) PROFITABILITY METRICS2 (%) +10.1% ROTE 1 ROE

2021 Top financial messages STRONG CORE

REVENUES: NII ACCELERATING AND OUTSTANDING FEE INCOME GROWTH OPERATING INCOME GROWING AT DOUBLE-DIGIT COST OF RISK IMPROVING, BETTER THAN EXPECTATIONS STRONG CAPITAL POSITION AND AMPLE CAPITAL BUFFER LEADING EFFICIENCY WITH POSITIVE JAWS 2 3 4 5 6

NII + FEE INCOME +9.1% VS. 2020 NII FEE INCOME +6.1% +19.8% (1) Performing loans under management excluding repos. (2) European peer group: BARC, BNPP, CASA, CMZ, CS, DB, HSBC, ISP, LBG, NWG, SAN, SG, UBS, UCG. Data as of 9M21. (3) CoR figures

exclude the US business sold to PNC for comparison purposes. EFFICIENCY RATIO (YTD) 45.2% IN 2021 -53 BPS VS. 2020 62.3% PEERS AVERAGE2 OPERATING INCOME +10.8% VS. 2020 COST OF RISK (YTD)3 0.93% 1.55% IN 2020 1.04% IN 2019 CET1 FL (DEC 2021) 12.75%

1 LOAN GROWTH GAINING MOMENTUM TOTAL LOAN GROWTH (DEC 2021)1 +6.3% VS. DEC 2020 +3.9% vs. SEP 2021 Variation in constant €

2021 Profit and Loss 1 (1) Figures

include: the results from the US business sold to PNC in 2021 and 2020, the net cost related to the restructuring process in 2021 and the net capital gains from the from the agreement with Allianz in 2020.

4Q21 Profit and Loss (1) 4Q20 includes

the net capital gains from the agreement with Allianz. 1

Loan growth gaining momentum MEXICO

TURKEY2 SPAIN PERU3 BBVA GROUP COLOMBIA (1) Performing loans under management excluding repos (Turkey and Mexico, according to local GAAP). (2) Turkish lira loans. (3) Excluding Reactiva (COVID-19 Government Program) loans Mar,21 Jun,21 Sep.21

Dec,21 Loan book growth1 (Constant €; YoY change; %) Mar,21 Jun,21 Sep.21 Dec,21 Mar,21 Jun,21 Sep.21 Dec,21 Mar,21 Jun,21 Sep.21 Dec,21 Mar,21 Jun,21 Sep.21 Dec,21 Mar,21 Jun,21 Sep.21 Dec,21

Strong revenue growth (1) Deposit

Guarantee fund. NET INTEREST INCOME (CONSTANT €) NET FEES AND COMMISSIONS (CONSTANT €) NET TRADING INCOME (CONSTANT €) GROSS INCOME (CONSTANT €) +16.5% +10.5% +22.2% +7.0% +152.0% +17.8% +22.9% +7.1% NII growth accelerating

in the year driven by activity recovery, spreads improvement in the majority of countries and CPI linkers contribution in Turkey Outstanding evolution across the board. The highest quarterly figure reported over the past years Significant YoY

evolution, including a solid performance in 4Q Strong quarterly evolution despite DGF1 in Spain annual contribution in 4Q21. Excellent YoY performance

Leading efficiency and Operating Income

growing at double-digit POSITIVE JAWS (2021 YOY, %; CONSTANT €) (1) Weighted by operating expenses and excluding USA and Venezuela. (2) European Peer Group: BARC, BNPP, CASA, CMZ, CS, DB, HSBC, ISP, LBG, NWG, SAN, SG, UBS, UCG. Peers data as

of 9M21. OPERATING INCOME (2021 yoy, %; CONSTANT €) EFFICIENCY RATIO (%; constant €) #1 FOOTPRINT INFLATION1 7.8% 12M AVERAGE +10.8% RANKING EUROPEAN PEER GROUP2

Risk indicators evolution better than

expected NOTE: Excludes the US business sold to PNC for comparison purposes. NPL COVERAGE 2019 1.04% 2019 4.2% 75% Financial Assets Impairments (€M CONSTANT) NPL (€BN) Cost of risk (%, YTD) NPL & coverage ratios (%) Solid asset

quality performance across geographies and portfolios

Significant increase of

shareholders’ distribution DIVIDEND PER SHARE (DPS) (€ CENTS/ SHARE) THE HIGHEST CASH DPS IN THE PAST 10 YEARS ONE OF THE HIGHEST SHARE BUYBACK PROGRAMS IN EUROPE €1,500 million €3,500 million first tranche, 60% Total

shareholders' distributions: €5.5 billion4, 15%5 yield over BBVA’s market cap (1) To be proposed for the consideration of the governing bodies. (2) Pay-out percentage calculated taking into account the following: (i) 2021 Results,

including the results from the US business sold to PNC and the net impact of the restructuring process; and (ii) considering outstanding shares cum dividend as of January 31, 2022. (3) Considering executed share buyback until January 31, 2022

according to market communications. (4) Considering €2.0 Bn of cash distribution to shareholders in 2021 and €3.5 Bn share buyback program. (5) Calculated with the closing price as of January 31, 2022. already executed3 €31 cents

€8 cents in Oct.21 €23 cents in Apr.221 €2,000 million second tranche, starting once 1st finished 44% pay-out2

Strong capital position and ample

capital buffer 4 1 11.5-12.0% TARGET RANGE 8.60% CET1 SREP REQUIREMENT (1) Deduction of the maximum amount of €3.5 billion of the share buyback program. Such deduction has been implemented in October as per ECB Authorization. (2) It reflects

the higher final payout (44%) versus the 40% accrued during the year (-6 bps). (3) Mainly explained by the strong credit activity increase in the quarter (-29bps), Operational RWAs calculation annual update positively correlated to gross income

evolution (-9bps), and RWAs related to market activities (-11bps). (4) Including -11bps from FX and HTC&S portfolios mark-to-market, -10 bps regulatory impact from NDoD, partially compensated by real estate exposure reduction (+6bps). 3 CET1

fully-loaded (%, BpS) 2

On track to achieve our ambitious

long-term goals (1) Target customers refers to those customers in which the bank wants to grow and retain, as they are considered valuable due to their assets, liabilities and/or transactionality with BBVA. We remain committed to our 11.5%-12% CET1

target range COST-TO-INCOME (%) ROTE (%) 10.1% TBV/ SHARE + DIVIDENDS (%) 2020-2021 2021-2024 CAGR GOAL 9.0% NEW TARGET CUSTOMERS (MILLION) 3.4 2021 2022-2024 GOAL 10.0 SUSTAINABLE FINANCE (€ BILLION) 2018 2021 2025 GOAL 86 200 PLEDGE

CHANNELED

Business Areas

ACTIVITY (DEC-21) Spain Note: Activity

excludes repos. (1) Performing loans under management. PROFIT & LOSS (€m) Loan growth in the year supported by continued recovery in new lending, accelerating in 4Q (+16% QoQ) Strong core revenue growth (+6.0% YoY) levered by Fees

(+21.5%) and a broadly flat NII in 4Q21 Outstanding pre-provision income growth (+14.5% YoY). Efficiency ratio improving by 3.4pp to 51.1% Sound Asset Quality ratios, with CoR down to 30bps in 2021 Net Attributable Profit above pre-Covid levels

Customer Spread (%) Asset Quality Ratios (%) Yield on loans Customer spread Cost of deposits Coverage NPL ratio CoR (YtD) KEY RATIOS

Mexico ACTIVITY (DEC-21) (€

constant) PROFIT & LOSS (€m Constant) Sound loan growth +6.5% YoY: strong performance of retail (+9.5%) and progressive recovery of commercial segments (+3.6%) Positive trends on the NII, driven by activity growth and higher customer

spread (+36bps vs 12M20). Strong fee income, thanks to the recovery of activity and transactionality Outstanding Efficiency (35% 2021), despite cost normalization, after a very low 2020 figure Continued improvement of the CoR, favoured by good

underlying performance of loan portfolios Customer Spread (%) Asset Quality Ratios (%) Yield on loans Customer spread Cost of deposits Coverage NPL ratio CoR (YtD) KEY RATIOS (1) Performing loans and Cost. Funds under management excluding repos,

according to local GAAP.

Turkey ACTIVITY (DEC-21) (€

Constant; Bank Only) PROFIT & LOSS (€m Constant) Significant TL loan growth (+28.1% YoY), both in retail and commercial NII: Accelerating growth rate in 4Q driven by TL loan growth, higher customer spread in TL and a higher contribution

from CPI linkers Excellent performance of fees mainly driven by payments and higher activity. Strong NTI driven by GM contribution & FX results Efficiency remains strong at 29.5% despite Opex impacted by TL depreciation and higher personal

expenses in a high inflation environment (+19.4% 2021 avg). Significant improvement of the CoR in 2021. KEY RATIOS Customer Spread (%) Asset Quality Ratios (%) Coverage NPL ratio CoR (YtD) (1) FC evolution excluding FX impact. (2) Performing loans

and deposits under management, excluding repos, according to local GAAP. FC TL

South America ACTIVITY (DEC-21) (€

Constant) NET ATTRIBUTABLE PROFIT (€M Constant) Colombia: Loan growth at double digit (+13%) thanks to good performance of both retail and commercial segments. NAP growth 12M21 YoY at +45.4%, driven by core revenue growth (+5.1% YoY) and lower

impairment needs (CoR down to 185bps). Peru: Loan portfolio (+4.3%) favoured by improving economic conditions, with positive evolution in both commercial and retail. Strong core revenues performance (with NII +8.2% and fees +21.8%) and lower

impairments drive Net Attributable Profit growth to +28% 12M21 Argentina: Positive Net Attributable Profit (€63Mn in 2021) thanks to strong NII (driven by securities portfolios) and Fee performance (higher transactionality), despite a

higher hyperinflation impact. Customer Spread (%) KEY RATIOS Note: Venezuela in current €m (1) Other includes BBVA Forum, Venezuela, Paraguay, Uruguay and Bolivia. Note: Activity excludes repos. Variation excludes Paraguay. (1) Performing

loans under management. Cost of risk (YtD, %)

2021 Takeaways and 2022

outlook

2021 takeaways SIGNIFICANT PROGRESS IN

THE EXECUTION OF OUR STRATEGY: INNOVATION, SUSTAINABILITY AND GROWTH THE HIGHEST RECURRENT RESULTS IN THE PAST 10 YEARS ACCELERATING PROFITABLE GROWTH AND VALUE CREATION FOR OUR STAKEHOLDERS SIGNIFICANTLY INCREASING SHAREHOLDERS’ DISTRIBUTIONS

On track to achieve our ambitious long-term goals

2022 Outlook Core revenues expected to

grow around double-digit, maintaining our strategic focus towards the most profitable segments Costs to grow below inflation with efficiency improving across the board Sizeable distributions to our shareholders: €3.5 Bn share buyback to be

fully executed before October 2022 Cost of Risk around 100 bps

Annex 01 07 05 06 10 12 13 Gross Income

breakdown Net Attributable Profit evolution P&L Accounts by business unit Garanti BBVA: wholesale funding CET1 YTD evolution & RWAs by business Area Book Value of the main subsidiaries Digital metrics 11 02 Stages breakdown by business areas

TBV per share & dividends evolution 03 04 Customer spread by country ALCO Portfolio, NII Sensitivity and LCRs & NSFRs 08 Outstanding loan deferrals & loans backed by State guarantees CET1 Sensitivity to market impacts 09

01 Net Attributable Profit

evolution

Net Attributable Profit evolution

€M Note: Figures excluding the results from the US business sold to PNC in 2020 and 2021, the net cost related to the restructuring process in 2021 and the net capital gains from the bancassurance operation with Allianz in 2020.

+2,126€M

02 Gross Income breakdown

Gross Income breakdown Note: Figures

exclude Corporate Center. Spain 5,925€M Turkey 3,422 €M Mexico 7,603 €M South America 3,162 €M Rest of business 741 €M 12M21

03 Rest of Business Corporate Center

Argentina (hyperinflation adjustment) Colombia Peru P&L Accounts by business unit

Rest of Business Profit & Loss

€M

Corporate Center Profit & Loss (1)

Includes the results from US business sold to PNC in 2020 and 2021, the net cost related to the restructuring process in 2Q21 and the net capital gains from the bancassurance operation with Allianz in 4Q20. €M

Argentina hyperinflation adjustment

Profit & Loss €M

Colombia Profit & Loss €m

constant

Peru Profit & Loss €m

constant

04 Customer Spread by country

(1) Foreign currency Customer spreads:

quarterly evolution average

Customer spreads: YoY evolution (1)

Foreign currency average

05 Stages breakdown by business

areas

Stages breakdown by business area CREDIT

RISK BREAKDOWN BY BUSINESS AREA (DEC-21, €M)

06 Outstanding loan deferrals &

loans backed by State guarantees

Prudent deferrals’ classification

and proactive provisioning Data according to EBA criteria, excluding loans that have been cancelled.

Outstanding loan deferrals Data

according to EBA criteria, excluding loans that have been cancelled. OUTSTANDING DEFERRALS (DEC-21) €0.1bn 0.1% €0.0bn 0.0% €0.0bn 0.0% €0.0bn 0.1% €0.0bn 0.2% €0.0bn 0.0% €0.2bn 0.1 % of loans Total Group

ARGENTINA COLOMBIA PERU SPAIN MEXICO TURKEY

Government backed loans Note: data

according to EBA criteria as of December31, 2021. (1) Excludes undrawn commitments. (2) Includes mainly Spain, Rest of business and the NY branch. If we also consider undrawn credit lines, BBVA Spain has granted a total of 21.8 billion € ICO

loans as of December 31, 2021 (of which 13.2 billion € is the outstanding drawn amount). (3) Garanti bank-only. (1) (2) (3) € bn; DEC’21

07 ALCO Portfolio, NII Sensitivity and

LCRs & NSFRs

ALCO portfolio Turkey Mexico South

America Euro1 47.7 44.7 Amort Cost (HTC) Fair Value (HTC&S) Dec-21 (€BN) (€BN) (duration) South America 0.2 3.8 1.0 years Mexico 2.2 7.9 3.1 years Turkey 2.8 2.9 4.1 years Euro 14.5 11.3 3.8 years Spain 11.2 3.4 Italy 3.3 5.0 Rest

0.1 2.8 (1) Figures exclude SAREB senior bonds (€4.5bn as of Dec-20, Sep-21 and Dec-21) and High Quality Liquid Assets portfolios (€22.1bn as of Dec-20, €19.1bn as of Sep-21 and €11.3bn as of Dec-21) . (2) Note: HQLA –

High Quality Liquid Assets 45.6 ALCO PORTFOLIO BREAKDOWN BY REGION (€ BN) EURO ALCO PORTFOLIO MATURITY PROFILE (€ BN) EURO ALCO YIELD (DEC-21, %) HQLA2 PORTFOLIO (DEC-21, €) 0.8% 11.3 bn

ESTIMATED IMPACT ON NII IN THE NEXT 12

MONTHS TO PARALLEL INTEREST RATE MOVEMENTS (%) NII sensitivity to +100 bps NII sensitivity to -100bps Note: NII sensitivities calculated as moving averages of the last 12 months’ balance sheets as of Nov’21, using our dynamic internal

model. Euro NII sensitivity to downward rates according to the EBA’s “parallel-down” shock scenario. Mexico NII sensitivity for +100bps breakdown: : MXN sensitivity +1.7% and USD sensitivity +1.3%. NII sensitivity to interest rates

movements

(1) LCR of 165% does not consider the

excess liquidity of the subsidiaries outside the Eurozone. If these liquid assets are considered the ratio would reach 213%. Both LCR and NSFR significantly above the 100% requirements at a Group level and in all banking subsidiaries BBVA GROUP AND

SUBSIDIARIES LCR & NSFR (DEC-21) Liquidity and funding ratios 165% (213%)1 Total Group LCR NSFR 135% Euro Mexico Turkey S. America 190% 126% 245% 149% 211% 162% >100% >100% All countries

08 CET1 Sensitivity to market

impacts

CET1 Sensitivity to Market impacts1 TO A

10% CURRENCY DEPRECIATION (DEC-21) TO A 10% DECLINE IN TELEFONICA’S SHARE PRICE (DEC-21) TO +100 BPS MOVEMENT IN THE SPANISH SOVEREIGN BOND (DEC-21) (1) CET1 sensitivity considering the FL capital ratio as of Dec 31st,2021. -13 bps -3 bps MXN

-7bps TRY -1bps USD +18bps

09 CET1 YTD evolution & RWAs by

business area

Capital YTD Evolution (1) (1) Includes,

among others, minority interests and market related impacts CET1 FULLY-LOADED – BBVA GROUP YTD EVOLUTION (%, BPS) (2) (2) Deduction of the maximum amount of €3.5 billion of the share buyback program. Such deduction has been implemented

in October as per ECB Authorization.

Risk-Weighted Assets by business

area

10 Book Value of the main

subsidiaries

Book Value of the main subsidiaries(1,2)

€ bn; DEC’21 (1) Includes the initial investment + BBVA’s undistributed results + FX impact + other valuation adjustments. The Goodwill associate to each subsidiary has been deducted from its Book Value (2) Turkey includes the

Garanti Group

11 TBV per share & dividends

evolution

TBV Dividends 1 1 Shareholders’

return: TBV per share & dividends evolution TBV per Share & dividends (€ PER SHARE) (1) April 2021 dividend per share (0.06 €) and October 2021 dividend per share (0.08€) +10.1% 1 6.41 6.52 6.34

12 Garanti BBVA: wholesale

funding

Turkey – Liquidity & funding

sources Solid liquidity position: FC liquidity buffers External wholesale funding maturities2 (USD Bn) Note 1: All figures are Bank-only, as of Dec. 2021 Note 2: Total Liquidity Buffer is at c. USD 9.7 Bn (1) ROM: Reserve Option Mechanism (2)

Includes TRY covered bonds and excludes on balance sheet IRS transactions Short Term Swaps (3) Other includes mainly bilateral loans, secured finance and other ST funding Unencumbered FC securities FC Reserves under ROM1 Money Market Placements 3

USD 6.9 Bn total maturities c. USD 13.1 Bn FC liquidity buffer Limited external wholesale funding needs: USD 6.9 Bn Total LTD ratio is at 79.8%, decreasing by -12,71 p.p in 4Q21 mainly driven by FC LtD improvement. Foreign currency performing loans

decreased by USD 0.7 Bn (on a quarterly basis) to c. USD 10.9 Bn in 4Q21. Liquidity ratios above requirements: Liquidity Coverage Ratio (EBA) of 211% vs ≥100% required in 4Q21. Ample liquidity buffers and limited wholesale funding maturities

(3) Other includes mainly bilateral loans, secured finance and other ST funding

13 Digital metrics Digital & mobile

customers Digital sales

Outstanding trends in digital and mobile

clients CUSTOMER PENETRATION RATE 57.6% 63.8% 69.4% 52.4% 56.0% 66.0% CUSTOMER PENETRATION RATE DIGITAL CUSTOMERS (MILLION CUSTOMERs, %) MOBILE CUSTOMERS (Million customers, %) Note: data excluding USA, Paraguay and Chile. +42% +37%

Leveraging digital capabilities to grow

sales trough digital channels (% OF TOTAL SALES YTD, # OF TRANSACTIONS AND PRV1) Group exclude USA, Venezuela, Chile and Paraguay. (1) Product Relative Value as a proxy of lifetime economic representation of units sold. UNITS PRV GROUP Spain MExico

TURkey Colombia peru

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argentaria, S.A.

|

|

Date: February 3, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: /s/ María Ángeles Peláez Morón

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: María Ángeles Peláez Morón

|

|

|

|

|

|

|

|

Title: Authorized representative

|

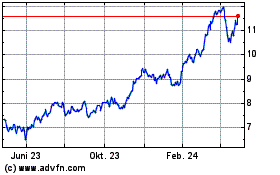

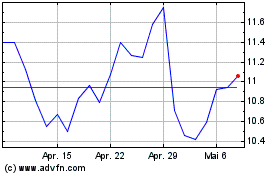

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024