0000008947false8-KOctober 10, 2023AZZ Inc.One Museum Place, Suite 5003100 West 7th StreetFort WorthTexas76107817810-0095☐00000089472023-10-102023-10-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

October 10, 2023

Date of Report (Date of earliest event reported)

AZZ Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Texas | | 1-12777 | | 75-0948250 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Museum Place, Suite 500

3100 West 7th Street

Fort Worth, Texas 76107

(Address of principal executive offices) (Zip Code)

(817) 810-0095

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock | | AZZ | | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 10, 2023, AZZ Inc. ("AZZ") issued a press release reporting AZZ’s second quarter financial results for the period ended August 31, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 2.02 (including Exhibit 99.1) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. Nor shall the information in this Current Report be incorporated by reference in any other filing with the U.S. Securities and Exchange Commission made by AZZ, whether made before or after the date hereof, unless specifically identified therein as being incorporated therein by reference in such filing.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are filed as part of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | AZZ Inc. |

| | | | |

| Date: | October 10, 2023 | | By: | /s/ Philip A. Schlom |

| | | | Philip A. Schlom

Chief Financial Officer |

AZZ Inc. Reports Fiscal Year 2024 Second Quarter Results

Building on Profitability and Strong Cash Generation

Reaffirming Fiscal 2024 Full Year Guidance and Debt Reduction of $75-$100 million

October 10, 2023 - FORT WORTH, TX - AZZ Inc. (NYSE: AZZ), the leading independent provider of hot-dip galvanizing and coil coating solutions, today announced financial results for the second quarter ended August 31, 2023.

Second Quarter Overview (results from continuing operations as compared to prior year(1)):

◦Total Sales $398.5 million, down 2.0%

▪Metal Coatings record sales of $169.8 million up 2.4%

▪Precoat Metals sales of $228.7 million, down 5.0%

◦Diluted EPS of $0.97, up 4.3% versus prior year, Adjusted EPS of $1.27, up 5.0%

◦Net Income of $28.3 million, up 12.8%

◦Adjusted net income of $37.2 million, up 5.5%

◦Recognized a charge of $5.75 million for a litigation settlement related to the Infrastructure Solutions segment (reflected in Selling, General & Administrative Expenses)

◦Adjusted EBITDA $88.0 million or 22.1% of sales, versus prior year of $88.7 million or 21.8% of sales

◦EBITDA margin of 30.4% for Metal Coatings and 20.3% for Precoat Metals

◦Reduced debt by $40.0 million in the quarter, resulting in net leverage of 3.4x

(1) Adjusted Net Income, Adjusted EPS, and Adjusted EBITDA are non-GAAP financial measures as defined and reconciled in the tables below.

Tom Ferguson, President, and Chief Executive Officer of AZZ, commented, "I am pleased to report that our second quarter results were in line with our expectations and set us up well for the balance of the year. While Precoat Metals faced softer market conditions, particularly in certain construction and appliance markets, the team focused on driving profitability, and exceeded 20% EBITDA margin. Metal Coatings continued to benefit from infrastructure spending, posted another record quarter for sales and operating income, and exceeded 30% EBITDA margin. Through better earnings and continued good management of working capital, we reduced year-to-date debt by $60.0 million, which included $20.0 million of debt reduction from the first quarter. We also repriced our term loan B, resulting in more favorable interest rates.

"Our new plant construction in Washington, Missouri continues to progress ahead of schedule and budget. After careful consideration, we made the decision to internally fund the construction of the new plant in Washington, Missouri versus funding a portion of it through a sale/leaseback transaction. As we have stated previously, the project will not have an impact on AZZ’s debt leverage nor our previously stated goal of 3.0x debt leverage by the end of FY2024. Our business is structured for significant cash flow generation, giving us more optionality to fund capital expenditures this year totaling $125 million, which includes the new plant spend of $70 million. Additionally, we will continue to pay down debt in a range of $75 to $100 million this year and expect to continue to pay quarterly cash dividends.

"Notwithstanding our seasonally slower second half of the year, we expect a stronger second half this year as compared to last year. Secular tailwinds exist for infrastructure and renewables spending, reshoring of manufacturing, and continued migration to more environmentally friendly pre-painted steel and aluminum. I want

to thank our entire AZZ team for their dedicated performance in the second quarter of fiscal year 2024," concluded Ferguson.

Fiscal Year 2024 Second Quarter Segment Performance

AZZ Metal Coatings

Sales increased year-over-year by 2.4% to a record $169.8 million, due to both higher volume and increased selling price. EBITDA of $51.6 million or 30.4% of sales was slightly above our 25-30% targeted EBITDA range. In the prior year quarter, EBITDA of $53.0 million included $5.1 million from non-recurring items, related to a gain on sale of property and insurance proceeds.

AZZ Precoat Metals

Sales of $228.7 million decreased year-over-year by 5.0% due to lower volume in HVAC, transportation, and certain construction end markets. Average selling price increased 7% as compared to the same quarter last year, driven by value-pricing initiatives, and a shift in sales mix. EBITDA of $46.4 million or 20.3% of sales was 30 basis points lower from the prior year same quarter, and within our targeted range of 17-22%. We are carefully monitoring customer volume as we progress through the third quarter.

Balance Sheet, Liquidity and Capital Allocation

The Company generated significant operating cash flow of $118.3 million in the first six months of the year through improved earnings and prudent working capital management. At the end of the second quarter, net leverage was 3.4x TTM EBITDA. During the second quarter, the Company paid down debt of $40.0 million and returned cash to shareholders through cash dividend payments totaling $7.9 million. Capital expenditures were $25.7 million during the quarter, and fiscal year 2024 capital expenditures are expected to be approximately $125 million, which includes $70 million in cash outlays for AZZ's new coil coating plant in Washington, Missouri.

Financial Outlook - Fiscal Year 2024 Guidance

Management reaffirms fiscal year 2024 guidance:

◦Sales of $1.40 billion to $1.55 billion

◦Adjusted EBITDA of $300-$325 million

◦Adjusted earnings per diluted share of $3.85-$4.35(1)

Fiscal year 2024 guidance reflects higher interest expense, dividends on our Series A Preferred Stock, and the impact of an annualized effective tax rate of approximately 24%. This reflects our best estimates given expected market conditions for the full year, excluding any federal regulatory changes that may emerge.

(1) Fiscal Year 2024 guidance excludes equity in earnings on the investment in the AIS joint venture.

Conference Call Details

AZZ Inc. will conduct a live conference call with Tom Ferguson, Chief Executive Officer, and Philip Schlom, Chief Financial Officer to discuss financial results for the second quarter of fiscal year 2024, Wednesday, October 11, 2023, at 11:00 A.M. ET. Interested parties can access the conference call by dialing (844) 855-9499 or (412) 317-5497 (international). A webcast of the call will be available on the Company’s Investor Relations page at http://www.azz.com/investor-relations.

A replay of the call will be available at (877) 344-7529 or (412) 317-0088 (international), replay access code: 5906530, through October 18, 2023, or by visiting http://www.azz.com/investor-relations for the next 12 months.

About AZZ Inc.

AZZ Inc. is the leading independent provider of hot-dip galvanizing and coil coating solutions to a broad range of end-markets. Collectively, our business segments provide sustainable, unmatched metal coating solutions that enhance the longevity and appearance of buildings, products and infrastructure that are essential to everyday life.

Safe Harbor Statement

Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as "may," "could," "should," "expects," "plans," "will," "might," "would," "projects," "currently," "intends," "outlook," "forecasts," "targets," "anticipates," "believes," "estimates," "predicts," "potential," "continue," or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial, and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date they are made and are subject to risks that could cause them to differ materially from actual results. Certain factors could affect the outcome of the matters described herein. This press release may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand for our products and services, including demand by the construction markets, the industrial markets, and the metal coatings markets. We could also experience additional increases in labor costs, components and raw materials including zinc and natural gas, which are used in our hot-dip galvanizing process; supply-chain vendor delays; customer requested delays of our products or services; delays in additional acquisition opportunities; an increase in our debt leverage and/or interest rates on our debt, of which a significant portion is tied to variable interest rates; availability of experienced management and employees to implement AZZ’s growth strategy; a downturn in market conditions in any industry relating to the products we inventory or sell or the services that we provide; economic volatility, including a prolonged economic downturn or macroeconomic conditions such as inflation or changes in the political stability in the United States and other foreign markets in which we operate; acts of war or terrorism inside the United States or abroad; and other changes in economic and financial conditions. AZZ has provided additional information regarding risks associated with the business, including in Part I, Item 1A. Risk Factors, in AZZ's Annual Report on Form 10-K for the fiscal year ended February 28, 2023, and other filings with the SEC, available for viewing on AZZ's website at www.azz.com and on the SEC's website at www.sec.gov. You are urged to consider these factors carefully when evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Company Contact:

David Nark, Senior Vice President of Marketing, Communications, and Investor Relations

AZZ Inc.

(817) 810-0095

www.azz.com

Investor Contact:

Sandy Martin / Phillip Kupper

Three Part Advisors

(214) 616-2207

www.threepa.com

---Financial tables on the following page---

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| AZZ Inc. |

| Condensed Consolidated Statements of Income |

| (dollars in thousands, except per share data) |

| (unaudited) |

| | | | | | | | |

| | Three Months Ended August 31, | | Six Months Ended August 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Sales | | $ | 398,542 | | | $ | 406,710 | | | $ | 789,415 | | | $ | 613,844 | |

| Cost of sales | | 301,296 | | | 305,155 | | | 595,150 | | | 452,236 | |

| Gross margin | | 97,246 | | | 101,555 | | | 194,265 | | | 161,608 | |

| | | | | | | | |

| Selling, general and administrative | | 36,239 | | | 37,414 | | | 67,762 | | | 69,558 | |

| | | | | | | | |

| Operating income | | 61,007 | | | 64,141 | | | 126,503 | | | 92,050 | |

| | | | | | | | |

| Interest expense | | 27,770 | | | 28,144 | | | 56,476 | | | 35,615 | |

| Equity in (earnings) of unconsolidated subsidiaries | | (974) | | | — | | | (2,394) | | | — | |

| Other (income) expense, net | | (88) | | | 55 | | | (50) | | | 28 | |

| Income from continuing operations before income taxes | | 34,299 | | | 35,942 | | | 72,471 | | | 56,407 | |

| Income tax expense | | 5,967 | | | 10,822 | | | 15,617 | | | 15,922 | |

| Net income from continuing operations | | 28,332 | | | 25,120 | | | 56,854 | | | 40,485 | |

| Income from discontinued operations, net of tax | | — | | | 6,737 | | | — | | | 15,449 | |

| Loss on disposal of discontinued operations, net of tax | | — | | | (89,427) | | | — | | | (89,427) | |

| Net loss from discontinued operations | | — | | | (82,690) | | | — | | | (73,978) | |

| Net income (loss) | | 28,332 | | | (57,570) | | | 56,854 | | | (33,493) | |

| Dividends on preferred stock | | (3,600) | | | (1,040) | | | (7,200) | | | (1,040) | |

| Net income (loss) available to common shareholders | | $ | 24,732 | | | $ | (58,610) | | | $ | 49,654 | | | $ | (34,533) | |

| Basic earnings (loss) per share | | | | | | | | |

| Earnings per common share from continuing operations | | $ | 0.99 | | | $ | 0.97 | | | $ | 1.99 | | | $ | 1.59 | |

| Loss per common share from discontinued operations | | $ | — | | | $ | (3.33) | | | $ | — | | | $ | (2.99) | |

| Earnings (loss) per common share | | $ | 0.99 | | | $ | (2.36) | | | $ | 1.99 | | | $ | (1.39) | |

| Diluted earnings (loss) per share | | | | | | | | |

| Earnings per common share from continuing operations | | $ | 0.97 | | | $ | 0.93 | | | $ | 1.95 | | | $ | 1.57 | |

| Loss per common share from discontinued operations | | $ | — | | | $ | (2.85) | | | $ | — | | | $ | (2.70) | |

| Earnings (loss) per common share | | $ | 0.97 | | | $ | (1.91) | | | $ | 1.95 | | | $ | (1.13) | |

| | | | | | | | |

| Weighted average shares outstanding - Basic | | 25,054 | | | 24,836 | | | 24,997 | | | 24,772 | |

| Weighted average shares outstanding - Diluted | | 29,210 | | | 29,059 | | | 29,196 | | | 27,428 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| AZZ Inc. |

| Segment Reporting |

| (dollars in thousands) |

| (unaudited) |

| | | | | | | |

| Three Months Ended August 31, | | Six Months Ended August 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (In thousands) | | (In thousands) |

| Sales: | | | | | | | |

| Metal Coatings | $ | 169,837 | | | $ | 165,849 | | | $ | 338,631 | | | $ | 329,293 | |

Precoat Metals | 228,705 | | | 240,861 | | | 450,784 | | | 284,551 | |

| Total sales | $ | 398,542 | | | $ | 406,710 | | | $ | 789,415 | | | $ | 613,844 | |

| | | | | | | |

EBITDA(1) | | | | | | | |

| Metal Coatings | $ | 51,647 | | | $ | 53,026 | | | $ | 103,510 | | | $ | 106,695 | |

Precoat Metals | 46,446 | | | 49,583 | | | 89,601 | | | 59,412 | |

Infrastructure Solutions(2) | 792 | | | — | | | 2,190 | | | — | |

Total Segment EBITDA(3) | $ | 98,885 | | | $ | 102,609 | | | $ | 195,301 | | | $ | 166,107 | |

| | | | | | | |

(1) See the Non-GAAP disclosure section below for a reconciliation between the various measures calculated in accordance with GAAP to the non-GAAP financial measures. |

(2) Represents Adjusted EBITDA, which includes a settlement for a litigation matter related to the AIS segment recognized during the three months ended August 31, 2023. Infrastructure Solutions segment includes the Company’s equity in earnings from its investment in the AVAIL joint venture, as well as other expenses related to receivables that were retained by the Company following the sale of the AIS business. |

(3) Total segment EBITDA excludes Corporate EBITDA. |

| | | | | | | | | | | | | | |

| AZZ Inc. |

| Condensed Consolidated Balance Sheets |

| (dollars in thousands) |

| (unaudited) |

| | As of |

| | August 31, 2023 | | February 28, 2023 |

| Assets: | | | | |

| Current assets | | $ | 409,869 | | | $ | 417,416 | |

| Property, plant and equipment, net | | 516,499 | | | 498,503 | |

| Other assets, net | | 1,288,193 | | | 1,305,560 | |

| | | | |

| Total assets | | $ | 2,214,561 | | | $ | 2,221,479 | |

| | | | |

| Liabilities and Shareholders’ Equity: | | | | |

| Current liabilities | | $ | 206,317 | | | $ | 187,240 | |

| Long-term debt, net | | 1,002,364 | | | 1,058,120 | |

| Other liabilities | | 107,803 | | | 122,659 | |

| | | | |

| Shareholders' Equity | | 898,077 | | | 853,460 | |

| Total liabilities and shareholders' equity | | $ | 2,214,561 | | | $ | 2,221,479 | |

|

| | | | | | | | | | | | | | |

| AZZ Inc. |

| Condensed Consolidated Statements of Cash Flows |

| (dollars in thousands) |

| (unaudited) |

| | | | |

| | Six Months Ended August 31, |

| | 2023 | | 2022 |

| Net cash provided by operating activities of continuing operations | | $ | 118,340 | | | $ | 42,011 | |

| Net cash used in investing activities of continuing operations | | (42,706) | | | (1,313,120) | |

| Net cash provided by (used in) financing activities of continuing operations | | (76,379) | | | 1,245,096 | |

| Cash used in discontinued operations | | — | | | 22,770 | |

| Effect of exchange rate changes on cash | | 33 | | | 2,501 | |

| Net increase in cash and cash equivalents | | (712) | | | (742) | |

| Cash and cash equivalents at beginning of period | | 2,820 | | | 15,082 | |

| Less: Cash and cash equivalents from discontinued operations at end of year | | — | | | (3,000) | |

| Cash and cash equivalents from continuing operations at end of period | | $ | 2,108 | | | $ | 11,340 | |

AZZ Inc.

Non-GAAP Disclosure

Adjusted Net Income, Adjusted Earnings Per Share and Adjusted EBITDA

In addition to reporting financial results in accordance with Generally Accepted Accounting Principles in the United States ("GAAP"), we provided adjusted net income and adjusted earnings per share, (collectively, the "Adjusted Earnings Measures"), which are non-GAAP measures. Management believes that the presentation of these measures provides investors with greater transparency when comparing operating results across a broad spectrum of companies, which provides a more complete understanding of our financial performance, competitive position and prospects for future capital investment and debt reduction. Management also believes that investors regularly rely on non-GAAP financial measures, such as adjusted net income and adjusted earnings per share, to assess operating performance and that such measures may highlight trends in our business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP.

In calculating adjusted earnings and adjusted earnings per share, management excludes intangible asset amortization, acquisition expenses, transaction related expenses and certain legal settlements. Management also provides EBITDA and Adjusted EBITDA, which are non-GAAP measures. Management defines EBITDA as earnings excluding depreciation, amortization, interest, and provision for income taxes. Adjusted EBITDA is defined as earnings excluding depreciation, amortization, interest, provision for income taxes, acquisition expenses, transaction related expenses and certain legal settlements. Management believes EBITDA and Adjusted EBITDA are used by investors to analyze operating performance and evaluate the Company's ability to incur and service debt and its capacity for making capital expenditures in the future. EBITDA and Adjusted EBITDA are also useful to investors to help assess the Company's estimated enterprise value. In addition, management believes that the adjustments shown below are useful to investors in order to allow them to compare the Company's financial results during the periods shown without the effect of each of these adjustments.

Management provides non-GAAP financial measures for informational purposes and to enhance understanding of the Company’s GAAP consolidated financial statements. Readers should consider these measures in addition to, but not instead of or superior to, the Company's financial statements prepared in accordance with GAAP. These non-GAAP financial measures may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

The following tables provides a reconciliation for the three and six months ended August 31, 2023 and 2022 between the various measures calculated in accordance with GAAP to the Adjusted Earnings Measures (in thousands, except per share data):

Adjusted Net Income and Adjusted Earnings Per Share from Continuing Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended August 31, | | Six Months Ended August 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) |

| Net income from continuing operations | $ | 28,332 | | | | | $ | 25,120 | | | | | $ | 56,854 | | | | | $ | 40,485 | | | |

| Less: preferred stock dividends | (3,600) | | | | | (1,040) | | | | | (7,200) | | | | | (1,040) | | | |

| Net income from continuing operations available to common shareholders | 24,732 | | | | | 24,080 | | | | | 49,654 | | | | | 39,445 | | | |

| Impact of after-tax interest expense for convertible notes | — | | | | | 2,006 | | | | | — | | | | | 2,554 | | | |

| Impact of preferred stock dividends | 3,600 | | | | | 1,040 | | | | | 7,200 | | | | | 1,040 | | | |

| Net income and diluted earnings per share from continuing operations | 28,332 | | | $ | 0.97 | | | 27,126 | | | $ | 0.93 | | | 56,854 | | | $ | 1.95 | | | 43,039 | | | $ | 1.57 | |

| Adjustments: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Acquisition and transaction-related expenditures(2) | — | | | — | | | 2,706 | | | 0.09 | | | — | | | — | | | 15,320 | | | 0.56 | |

| Amortization of intangible assets | 5,882 | | | 0.20 | | | 7,941 | | | 0.27 | | | 12,236 | | | 0.42 | | | 11,482 | | | 0.42 | |

Legal settlement(3) | 5,750 | | | 0.20 | | | — | | | — | | | 5,750 | | | 0.20 | | | — | | | — | |

| Subtotal | 11,632 | | | 0.40 | | | 10,647 | | | 0.37 | | | 17,986 | | | 0.62 | | | 26,802 | | | 0.98 | |

Tax impact(4) | (2,792) | | | (0.10) | | | (2,555) | | | (0.09) | | | (4,317) | | | (0.15) | | | (6,432) | | | (0.23) | |

| Total adjustments | 8,840 | | | 0.30 | | | 8,092 | | | 0.28 | | | 13,669 | | | 0.47 | | | 20,370 | | | 0.74 | |

Adjusted net income and adjusted earnings per share from continuing operations(5) | $ | 37,172 | | | $ | 1.27 | | | $ | 35,218 | | | $ | 1.21 | | | $ | 70,523 | | | $ | 2.42 | | | $ | 63,409 | | | $ | 2.31 | |

| | | | | | | | | | | | | | | |

| Weighted average shares outstanding - Diluted | | | 29,210 | | | | | 29,059 | | | | | 29,196 | | | | | 27,428 | |

| | | | | | | | | | | | | | | |

(1) Earnings per share amounts included in the table above may not sum due to rounding differences. Year-to- date earnings per share does not always represent the sum of the quarters’ earnings per share when the preferred shares for any quarter in the year-to-date period are anti-dilutive. |

(2) Includes expenses related to the Precoat Metals acquisition and the divestiture of 60% of the AVAIL joint venture. |

(3) Related to a settlement for a litigation matter related to the AIS segment that was retained following the sale of the AIS business. |

(4) The non-GAAP effective tax rate for each of the periods presented is estimated at 24.0%. | | | | | | | | |

(5) Adjusted net income from continuing operations includes $1.0 million and $2.4 million of equity in earnings from the AVAIL joint venture for the three and six months ended August 31, 2023, respectively. |

Adjusted EBITDA from Continuing Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended August 31, | | Six Months Ended August 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income from continuing operations | $ | 28,332 | | | $ | 25,120 | | | $ | 56,854 | | | $ | 40,485 | |

| Interest expense | 27,770 | | | 28,144 | | | 56,476 | | | 35,615 | |

| Income tax expense | 5,967 | | | 10,822 | | | 15,617 | | | 15,922 | |

| Depreciation and amortization | 20,153 | | | 21,902 | | | 38,677 | | | 33,875 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Acquisition and transaction-related expenditures | — | | | 2,706 | | | — | | | 15,320 | |

| Legal settlement | 5,750 | | | — | | | 5,750 | | | — | |

| Adjusted EBITDA from continuing operations | $ | 87,972 | | | $ | 88,694 | | | $ | 173,374 | | | $ | 141,217 | |

Adjusted EBITDA from Continuing Operations by Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended August 31, | | Six Months Ended August 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Metal Coatings | | | | | | | |

| Operating income | $ | 45,081 | | | $ | 44,996 | | | $ | 90,552 | | | $ | 90,266 | |

| Depreciation and amortization expense | 6,553 | | | 8,171 | | | 12,969 | | | 16,560 | |

| Other income (expense) | 13 | | | (141) | | | (11) | | | (131) | |

| EBITDA | $ | 51,647 | | | $ | 53,026 | | | $ | 103,510 | | | $ | 106,695 | |

| | | | | | | |

| Precoat Metals | | | | | | | |

| Operating income | $ | 39,006 | | | $ | 36,213 | | | $ | 76,696 | | | $ | 42,861 | |

| Depreciation and amortization expense | 7,440 | | | 13,329 | | | 12,905 | | | 16,510 | |

| Other income (expense) | — | | | 41 | | | — | | | 41 | |

| EBITDA | $ | 46,446 | | | $ | 49,583 | | | $ | 89,601 | | | $ | 59,412 | |

| | | | | | | |

| Infrastructure Solutions | | | | | | | |

| Operating loss | $ | (5,932) | | | $ | — | | | $ | (5,954) | | | $ | — | |

| Equity in earnings of unconsolidated subsidiaries | 974 | | | — | | | 2,394 | | | — | |

| | | | | | | |

| | | | | | | |

| Legal Settlement | 5,750 | | | — | | | 5,750 | | | — | |

| Adjusted EBITDA | $ | 792 | | | $ | — | | | $ | 2,190 | | | $ | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Document and Entity Information Document and Entity Information

|

Oct. 10, 2023 |

| Document & Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 10, 2023

|

| Entity Registrant Name |

AZZ Inc.

|

| Entity File Number |

1-12777

|

| Entity Tax Identification Number |

75-0948250

|

| Entity Address, Address Line One |

One Museum Place, Suite 500

|

| Entity Address, Address Line Two |

3100 West 7th Street

|

| Entity Address, City or Town |

Fort Worth

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

76107

|

| City Area Code |

817

|

| Local Phone Number |

810-0095

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AZZ

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000008947

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

TX

|

| Document Information [Line Items] |

|

| Document Period End Date |

Oct. 10, 2023

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

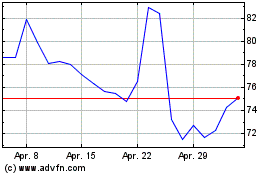

AZZ (NYSE:AZZ)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

AZZ (NYSE:AZZ)

Historical Stock Chart

Von Mai 2023 bis Mai 2024