0001214816AXIS CAPITAL HOLDINGS LTDfalse00012148162023-12-292023-12-290001214816us-gaap:CommonStockMember2023-12-292023-12-290001214816us-gaap:SeriesEPreferredStockMember2023-12-292023-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 29, 2023

AXIS CAPITAL HOLDINGS LIMITED

(Exact Name Of Registrant As Specified In Charter)

| | | | | | | | | | | | | | |

| Bermuda | | 001-31721 | | 98-0395986 |

| (State of Incorporation) | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

92 Pitts Bay Road

Pembroke, Bermuda HM 08

(Address of principal executive offices, including zip code)

(441) 496-2600

(Registrant’s telephone number, including area code)

Not applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e(4)(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares, par value $0.0125 per share | AXS | New York Stock Exchange |

| Depositary shares, each representing a 1/100th interest in a 5.50% Series E preferred share | AXS PRE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement |

Pursuant to a Deed of Amendment, dated December 29, 2023, AXIS Specialty Limited, AXIS Re SE, AXIS Specialty Europe SE, AXIS Insurance Company, AXIS Surplus Insurance Company and AXIS Reinsurance Company (the “Companies”) amended their existing $500 million secured letter of credit facility with Citibank Europe plc to extend the tenors of issuable letters of credit (i) denominated in a currency other than Australian or New Zealand dollars to March 31, 2025; and (ii) denominated in either Australian dollars or New Zealand dollars to March 31, 2026 (the “Amendment”). The Amendment is effective December 31, 2023. The Companies are subsidiaries of AXIS Capital Holdings Limited, a Bermuda company.

The description of the Amendment contained herein is qualified in its entirety by reference to the full text of the Amendment, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant |

The information set forth in Item 1.01 above is hereby incorporated by reference under this Item 2.03.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits | | | | | | | | |

| Exhibit Number | | Description of Document |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 3, 2024

| | | | | | | | | | | |

| | | |

| AXIS CAPITAL HOLDINGS LIMITED | |

| | | |

| | |

| By: | /s/ Conrad D. Brooks | |

| | Conrad D. Brooks | |

| | General Counsel | |

DEED OF AMENDMENT

Dated: 29 December 2023

Between:

(1) Citibank Europe plc (the “Bank”);

(2) AXIS Specialty Limited (“ASL”);

(3) AXIS Re SE (formerly, AXIS Re Limited) (“AXIS Re”);

(4) AXIS Specialty Europe SE (formerly, AXIS Specialty Europe Limited) (“ASE”);

(5) AXIS Insurance Company;

(6) AXIS Surplus Insurance Company; and

(7) AXIS Reinsurance Company,

(each a “Party” and together the “Parties”, and Parties (2), (3), (4), (5), (6) and (7) each a “Company” and together the “Companies”).

Re: Committed Letter of Credit Facility letter dated 18 December 2015 and entered into among the Bank and the Companies, as amended by amendment agreements dated 24 December 2019 and 1 April 2021 (the “Committed Facility Number 1 Letter”)

1.Background

1.1.The Parties have entered into the Committed Facility Number 1 Letter in connection with the Insurance Letters of Credit – Master Agreement (Form 3/CEP) dated 14 May 2010 as amended by amendment letters dated 27 January 2012 and 27 March 2017 (the “Master Agreement”).

1.2.The Parties hereby agree to certain further amendments to the Committed Facility Number 1 Letter as detailed in this Deed on and from the Effective Date (as defined below).

1.3.The terms and expressions defined in the Committed Facility Number 1 Letter shall have the same meanings when used in this Deed unless otherwise indicated.

2.Effective Date

The amendments set out in this Deed shall take effect on and from 31 December 2023 (“Effective Date”).

3.Amendments

With effect on and from the Effective Date, the Committed Facility Number 1 Letter shall be amended as follows:

(a)clause 5.2(b) shall be deleted and replaced with the following new clause 5.2(b):

“(b) the tenor of the Credit issued under either Tranche I or under Tranche II extends beyond 31 March 2025 or the tenor of a Credit issued under Tranche III extends beyond 31 March 2026;”;

(b)clause 5.3 shall be deleted and replaced with the following new clause 5.3:

“Subject to Section 5.4 and Section 5.5, Tranche I shall be fully utilised prior to a Company being able to utilise Tranche II so that all utilisations of a Credit with a maturity date of, on or prior to 31 March 2025 shall first be automatically allocated against Tranche I. Once the Tranche Sub-Limit for Tranche I is fully utilised, all utilisations of a Credit with a maturity date of, on or prior to 31 March 2025 shall be automatically allocated against Tranche II. All utilisations of a Credit with a maturity date between 1 April 2025 and 31 March 2026 shall be automatically allocated against Tranche III.”; and

(c)clause 5.4 shall be deleted and replaced with the following new clause 5.4:

“A Credit with a maturity date of on or prior to 31 March 2025 (and no later) may only be issued under Tranches I and II and a Credit denominated in Australian dollars or New Zealand dollars may only be issued under Tranche III.”.

4.Costs and expenses

Each Party to this Deed shall bear its own costs and expenses in relation to the amendments agreed pursuant to the terms of this Deed.

5.Affirmation and acceptance

5.1.With effect from the Effective Date, the terms and conditions of the Committed Facility Number 1 Letter shall be read and construed by reference to this Deed and all references to the Committed Facility Number 1 Letter shall be deemed to incorporate the relevant amendments contained within this Deed and all references in the Committed Facility Number 1 Letter to “this Letter” and like references shall with effect from the Effective Date be references to the Committed Facility Number 1 Letter as amended by this Deed.

5.2.In the event of any conflict between the terms of this Deed and this Committed Facility Number 1 Letter, the terms of this Deed shall prevail.

5.3.For the avoidance of doubt, except as amended by the terms of this Deed, all of the terms and conditions of the Committed Facility Number 1 Letter shall continue to apply and remain in full force and effect.

5.4.The Companies shall, at the request of the Bank, do all such acts necessary or desirable to give effect to the amendments effected or to be effected pursuant to the terms of this Deed.

6.Continuation of the Facility Documents

The Parties agree that, on and after the Effective Date:

(a)each Facility Document (as defined in the Committed Facility Number 1 Letter as amended by this Deed) to which it is a party shall continue in full force and effect; and

(b)each Pledge Agreement (as defined in the Committed Facility Number 1 Letter as amended by this Deed) to which it is a party shall continue to secure all liabilities which are expressed to be secured by it, and any security pledged thereunder shall extend to the Committed Facility Number 1 Letter, as amended pursuant to this Deed.

7.Facility Document

The Parties designate this Deed as a Facility Document.

8.Counterparts and effect as a deed

This Deed may be executed in counterparts, each of which shall be deemed to be an original, and all such counterparts taken together shall constitute one and the same agreement. This amendment shall take effect as a Deed notwithstanding it is signed under hand by the Bank.

9.Third party rights

No person shall have any right to enforce any provision of this Deed under the Contracts (Rights of Third Parties) Act 1999.

10.Governing law

This Deed (and any non-contractual obligation, dispute, controversy, proceedings or claim of whatever nature arising out of it or in any way relating to this Deed or its formation) shall be governed by and construed in accordance with English law. The Parties irrevocably submit the jurisdiction of the English Courts in respect of any dispute which may arise from or in connection with this Deed.

This Deed has been executed and delivered by the Companies as a deed and it has been signed by the Bank under hand, and shall take effect on and from the date specified above.

[Signatures follow]

Signatories to the Deed of Amendment

Executed and delivered as a deed by

AXIS Specialty Limited Signed: /s/ Peter Vogt

Acting by a director

Name: Peter Vogt

Title: Director

In the presence of

Signature of Witness: /s/ Nancy Vogt

Name of Witness: Nancy Vogt

Address: [Address]

Executed and delivered as a deed by Signed: /s/ Helen O’Sullivan

AXIS Re SE (formerly AXIS Re Limited)

Acting by a director Name: Helen O’Sullivan

Title: Director

In the presence of

Signature of Witness: /s/ Mark Hays Littlejohn

Name of Witness: Mark Hays Littlejohn

Address: [Address]

Executed and delivered as a deed by Signed: /s/ Helen O’Sullivan

AXIS Specialty Europe SE

(formerly, AXIS Specialty Europe Limited) Name: Helen O’Sullivan

Acting by a director Title: Director

In the presence of

Signature of Witness: /s/ Mark Hays Littlejohn

Name of Witness: Mark Hays Littlejohn

Address: [Address]

Executed and delivered as a deed by Signed: /s/ Andrew Weissert

AXIS Insurance Company

Acting by a director

Name: Andrew Weissert

Title: Director

In the presence of

Signature of Witness: /s/ Frances Mathis

Name of Witness: Frances R. Mathis

Address: [Address]

Executed and delivered as a deed by Signed: /s/ Andrew Weissert

AXIS Surplus Insurance Company

Acting by a director Name: Andrew Weissert

Title: Director

In the presence of

Signature of Witness: /s/ Frances Mathis

Name of Witness: Frances R. Mathis

Address: [Address]

Executed and delivered as a deed by Signed: /s/ Andrew Weissert

AXIS Reinsurance Company

Acting by a director Name: Andrew Weissert

Title: Director

In the presence of

Signature of Witness: /s/ Frances Mathis

Name of Witness: Frances R. Mathis

Address: [Address]

WE HEREBY CONFIRM OUR ACCEPTANCE ON BEHALF OF THE BANK:

For and on behalf of

Citibank Europe Plc

By: /s/ Niall Tuckey

Name: Niall Tuckey

Title: Director

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.23.4

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

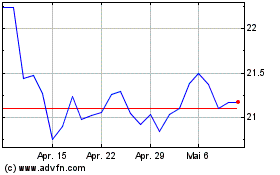

Axis Capital (NYSE:AXS-E)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Axis Capital (NYSE:AXS-E)

Historical Stock Chart

Von Mai 2023 bis Mai 2024