Apollo Funds Complete Acquisition of Tenneco

17 November 2022 - 2:46PM

Tenneco and Apollo (NYSE: APO) today announced that funds managed

by Apollo affiliates (the “Apollo Funds”) have completed the

previously announced acquisition of Tenneco, a leading designer,

manufacturer and marketer of automotive products for OEM and

aftermarket customers. Veteran executive Jim Voss has been

appointed CEO of Tenneco, effective immediately and as previously

announced.

“We are excited for Tenneco to enter this exciting next chapter

with Apollo and together see compelling opportunities to accelerate

Tenneco’s growth trajectory and enhance operations,” said CEO Jim

Voss. “I look forward to leading the talented team at Tenneco and

serving our customers and partners around the world.”

“We’re pleased to complete this acquisition and support Jim and

the management team in making strategic investments across product

categories to accelerate growth and deliver innovative customer

solutions,” said Apollo Partner Michael Reiss.

Voss brings significant experience in industrial manufacturing,

with more than 25 years of experience in the specialty materials

industry and having served as an operating partner to Apollo Funds

since 2012. Most recently, Voss was the president and CEO of

Vectra, a technology-based industrial growth company.

Pursuant to the terms of the transaction, an affiliate of the

Apollo Funds acquired all of the outstanding shares of Tenneco

stock. Tenneco shareholders are entitled to receive $20.00 in cash

for each share of Tenneco ($TEN) common stock owned. As a result of

the transaction completion, Tenneco’s common stock no longer trades

on the New York Stock Exchange.

About TennecoTenneco is one of the world's

leading designers, manufacturers, and marketers of automotive

products for original equipment and aftermarket customers, with

full year 2021 revenues of $18 billion and approximately 71,000

team members working at more than 260 sites worldwide. Through our

four business groups, Motorparts, Performance Solutions, Clean Air

and Powertrain, Tenneco is driving advancements in global mobility

by delivering technology solutions for diversified global markets,

including light vehicle, commercial truck, off-highway, industrial,

motorsport and the aftermarket.

About ApolloApollo is a high-growth, global

alternative asset manager. In our asset management business, we

seek to provide our clients excess return at every point along the

risk-reward spectrum from investment grade to private equity with a

focus on three investing strategies: yield, hybrid, and equity. For

more than three decades, our investing expertise across our fully

integrated platform has served the financial return needs of our

clients and provided businesses with innovative capital solutions

for growth. Through Athene, our retirement services business, we

specialize in helping clients achieve financial security by

providing a suite of retirement savings products and acting as a

solutions provider to institutions. Our patient, creative, and

knowledgeable approach to investing aligns our clients, businesses

we invest in, our employees, and the communities we impact, to

expand opportunity and achieve positive outcomes. As of September

30, 2022, Apollo had approximately $523 billion of assets under

management. To learn more, please visit www.apollo.com.

Contact Information

For Tenneco investors:Linae

Golla847-482-5162lgolla@tenneco.com

Rich Kwas248-849-1340rich.kwas@tenneco.com

For Tenneco media:Bill

Dawson847-482-5807bdawson@tenneco.com

For Apollo investors:Noah GunnGlobal Head of

Investor RelationsApollo Global Management, Inc.(212)

822-0540IR@apollo.com

For Apollo media:Joanna RoseGlobal Head of

Corporate CommunicationsApollo Global Management, Inc.(212) 822

0491Communications@apollo.com

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

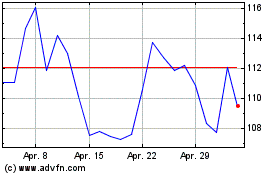

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024