0001796209false00017962092023-07-112023-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 11, 2023 |

APi Group Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39275 |

98-1510303 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1100 Old Highway 8 NW |

|

New Brighton, Minnesota |

|

55112 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 651 636-4320 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

APG |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 11, 2023, APi Group Corporation (NYSE: APG) (“APi” or the “Company”) provided preliminary second quarter 2023 financial results. The Company also provided an update on certain M&A activities. The Company is participating in the CJS Securities “New Ideas” Summer Conference today at 1:40p.m. ET and may discuss these items while at the conference. A copy of the press release is furnished as Exhibit 99.1

Item 7.01 Regulation FD Disclosure.

In addition to announcing these preliminary results, the Company also announced the completion of a bolt-on acqusition at the end of the second quarter, and comments on potential M&A activity in the third quarter of the year.

The information furnished under Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is being furnished as part of this Current Report on Form 8-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

API GROUP CORPORATION |

|

|

|

|

Date: |

July 11, 2023 |

By: |

/s/ Kevin S. Krumm |

|

|

Name: Title: |

Kevin S. Krumm

Chief Financial Officer |

Exhibit 99.1

-APi Group Provides Preliminary Second Quarter 2023 Financial Results -

-Announces Update on M&A Activities-

-Announces Date of Second Quarter 2023 Earnings Release-

New Brighton, Minnesota – July 11, 2023 – APi Group Corporation (NYSE: APG) (“APi” or the “Company”) today provided preliminary second quarter 2023 results. The Company also provided an update on recent M&A activities. The Company is participating in the CJS Securities “New Ideas” Summer Conference today at 1:40p.m. ET and may discuss these items while at the conference.

Financial Update

The Company will not be providing actual financial results until its earnings release on August 3, 2023, (details are provided below). In advance of the CJS Securities Conference, the Company is pleased to announce that it expects to deliver a strong second quarter with organic net revenue growth in the high-single-digits, continued gross and adjusted EBITDA margin expansion, and free cash flow conversion improvements versus the prior year. Second quarter 2023 adjusted EBITDA is expected to be at or above the midpoint of the financial guidance provided on May 4, 2023.

Russ Becker, APi’s President and Chief Executive Officer stated: “As we cross the half-way point of 2023, we are pleased with the momentum the business continues to demonstrate. Demand for our services remains robust across the markets we serve, and our leaders continue to execute our value-based pricing strategy. Our ability to consistently deliver strong financial results is a testament to the commitment of our ~28,000 leaders and the benefits of our relentless focus on growing high margin, inspection, service, and monitoring revenue.

Additionally, our free cash flow generation and EBITDA growth gives us confidence in our ability to reduce net leverage to near the top end of our target net leverage range of 2.0x – 2.5x near the end of the year while returning to bolt-on M&A. The team has been hard at work taking a disciplined approach to identifying the most attractive opportunities within our robust M&A pipeline. I’m excited to continue to add new businesses and their leaders to the APi family.”

M&A Activities Update

The Company completed a bolt-on acquisition within the Safety Services segment at the end of the second quarter for total consideration of approximately $35 million. APi expects to complete at least two additional bolt-on acquisitions within the Safety Services segment during the third quarter. The combined net revenue contribution from these three acquisitions is expected to be approximately $35 million annualized in 2024. Each of these transactions is expected to be immediately accretive to the Company’s EBITDA margin.

Second Quarter Earnings Conference Call

APi will hold a webcast/dial-in conference call to discuss its financial results at 8:30 a.m. (Eastern Time) on Thursday, August 3, 2023. Participants on the call will include Russell A. Becker, President and Chief Executive Officer; Kevin S. Krumm, Executive Vice President and Chief Financial Officer; and James E. Lillie and Sir Martin E. Franklin, Co-Chairs.

To listen to the call by telephone, please dial 800-343-4136 or 203-518-9856 and provide Conference ID 8167523. You may also attend and view the presentation (live or by replay) via webcast by accessing the following URL:

https://event.on24.com/wcc/r/4088193/293AAB694F4A9B6780C369F63433A89F

A replay of the call will be available shortly after completion of the live call/webcast via telephone at 800-283-4642 or 402-220-0857 or via the webcast link above.

About APi:

APi is a global, market-leading business services provider of life safety, security and specialty services with a substantial recurring revenue base and over 500 locations worldwide. APi provides statutorily mandated and other contracted services to a strong base of long-standing customers across industries. We have a winning leadership culture driven by entrepreneurial business leaders to deliver innovative solutions for our customers. More information can be found at www.apigroupcorp.com.

Investor Relations Inquiries:

Adam Fee

Vice President of Investor Relations

Tel: +1 651-240-7252

Email: investorrelations@apigroupinc.us

Media Contact:

Liz Cohen

Kekst CNC

Tel: +1 212-521-4845

Email: Liz.Cohen@kekstcnc.com

Forward-Looking Statements and Disclaimers

Certain statements in this press release and related comments made by management may be considered forward-looking statements within the meaning of the U.S federal securities laws. Forward-looking statements are any statements other than statements of historical fact and represent our current judgment about possible future events. In some cases, you can identify forward-looking statements by terms including “expect”, “anticipate”, “project”, “will”, “should”, “believe”, “intend”, “plan”, “estimate”, “potential”, “target”, “would”, and similar expressions, although not all forward-looking statements contain these identifying terms. While we believe these statements are reasonable, they are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including (i) economic conditions, competition, inflation, or currency impacts, (ii) the ability to recognize the anticipated benefits of the Company’s acquisitions, including anticipated cost savings from the Chubb acquisition, and (iii) those risks and uncertainties discussed in the “Risk Factors” section of our Form 10-K filings, and any updates to the risk factors in our Form 10-Q and 8-K filings with the U.S. Securities and Exchange Commission. Given these risks and uncertainties, investors are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

2

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

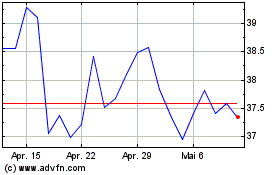

APi (NYSE:APG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

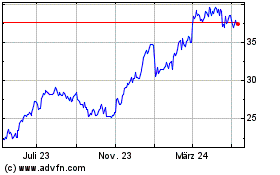

APi (NYSE:APG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024