false000035069800003506982023-10-272023-10-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date Of Report (Date Of Earliest Event Reported) October 27, 2023

AUTONATION, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-13107 | | 73-1105145 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

200 SW 1st Ave

Fort Lauderdale, Florida 33301

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code (954) 769-6000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On October 27, 2023, AutoNation, Inc. (the “Company”) issued a press release announcing its results of operations for the fiscal quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

104 Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | AUTONATION, INC. |

| | | | | |

| Date: | October 27, 2023 | | By: | | /s/ C. Coleman Edmunds |

| | | | | C. Coleman Edmunds |

| | | | | Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

| | | | | | | | | | | | | | |

| | | | Investor Contact: Derek Fiebig (954) 769-2227 fiebigd@autonation.com

Media Contact: Lisa Rhodes Ryans (954) 769-4120 publicrelations@autonation.com |

AutoNation Reports Third Quarter 2023 Results

•Third Quarter 2023 Revenue was $6.9 billion, compared to $6.7 billion a year ago, driven by New Vehicle and After-Sales growth

•Third Quarter 2023 After-Sales gross profit was a record $546 million, an increase of 14% compared to prior year

•Third Quarter 2023 Earnings Per Share (EPS) was $5.54, compared to EPS of $6.31 and Adjusted EPS of $6.00 a year ago

•Repurchased 1.3 million shares of common stock for an aggregate purchase price of $200 million

FORT LAUDERDALE, Fla., (October 27, 2023) — AutoNation, Inc. (NYSE: AN), America’s most admired automotive retailer, today reported Third Quarter 2023 EPS of $5.54, compared to Third Quarter 2022 EPS of $6.31 and Adjusted EPS of $6.00, which excluded $0.31 of favorable items. Third Quarter 2023 revenue was $6.9 billion compared to $6.7 billion a year ago. Reconciliations of non-GAAP financial measures are included in the attached financial tables.

“During the quarter, we saw double digit year-over-year growth in new vehicle sales and strong sequential growth in used vehicle volume. This resulted in the first year-over-year growth in total unit sales in eight quarters. We also continue to see the significant benefits of the focus in our After-Sales business, which delivered record revenue and gross profit. Overall, AutoNation delivered a solid performance in this evolving operating environment. Additionally, we continued our investments in growth initiatives and deployed capital to create value for our shareholders,” said Mike Manley, AutoNation’s CEO.

Operational Summary

Third Quarter 2023 Operational Summary compared to the year-ago period:

| | | | | | | | | | | | | | | | | | | | | | |

| Selected GAAP Financial Data |

| ($ in millions, except per share data) |

| | Three Months Ended

September 30, |

| | 2023 | | 2022 | | | | YoY |

| Revenue | | $ | 6,892.7 | | | $ | 6,666.0 | | | | | 3% |

| Gross Profit | | $ | 1,294.6 | | | $ | 1,312.8 | | | | | -1% |

| Operating Income | | $ | 419.5 | | | $ | 522.5 | | | | | -20% |

| Net Income | | $ | 243.7 | | | $ | 352.6 | | | | | -31% |

| Diluted EPS | | $ | 5.54 | | | $ | 6.31 | | | | | -12% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| New Vehicle Retail Unit Sales | | 62,289 | | | 55,565 | | | | | 12% |

| Used Vehicle Retail Unit Sales | | 72,517 | | | 75,355 | | | | | -4% |

| | | | | | | | |

|

|

| | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Selected Non-GAAP Financial Data |

| ($ in millions, except per share data) |

| | Three Months Ended

September 30, |

| | 2023 | | 2022 | | | | YoY |

| | | | | | | | |

| Adjusted Operating Income | | $ | 415.8 | | | $ | 495.3 | | | | | -16% |

| Adjusted Net Income | | $ | 243.7 | | | $ | 335.6 | | | | | -27% |

| Adjusted Diluted EPS | | $ | 5.54 | | | $ | 6.00 | | | | | -8% |

•Revenue - Revenue was $6.9 billion, an increase of $227 million or 3% from the year-ago period. Higher New Vehicle and After-Sales revenue offset the decrease in Used Vehicle revenue.

◦New Vehicle Revenue – $3.2 billion, an increase of $324 million or 11%.

◦Used Vehicle Revenue – $2.2 billion, a decrease of $230 million or 10%.

◦Customer Financial Services Revenue – $370 million, an increase of $9 million or 2%.

◦After-Sales Revenue – $1.2 billion, an increase of $125 million or 12%.

•Gross Profit - Gross profit totaled $1.29 billion, down $18 million from $1.31 billion a year ago.

◦New Vehicle Gross Profit - New vehicle gross profit decreased $79 million reflecting gross profit per vehicle retailed of $4,025 compared to $5,934 a year ago partially offset by a 12% increase in unit sales.

◦Used Vehicle Gross Profit - Used vehicle gross profit decreased $14 million reflecting a gross profit per vehicle retailed of $1,746 compared to $1,870 a year ago and a 4% decrease in unit sales.

◦Customer Financial Services Gross Profit - Customer Financial Services gross profit per vehicle retailed was $2,741, largely flat from a year ago.

◦After-Sales Gross Profit - After-Sales gross profit was a record $546 million, an increase of $67 million or 14% from a year ago.

•SG&A as a Percentage of Gross Profit –SG&A as a percentage of gross profit was 63.3%, or 63.6% on an adjusted basis, and was significantly lower than pre-pandemic levels and includes incremental investments in technology and new business initiatives as well as advertising to support the self-sourcing of used vehicles.

Capital Allocation, Liquidity, and Leverage

During the quarter, cash from operating activities totaled $256 million, capital expenditures were $87 million, and AutoNation repurchased 1.3 million shares of common stock for an aggregate purchase price of $200 million. As of October 25, 2023, AutoNation has approximately $439 million remaining under its current Board authorization for share repurchase. The Company has approximately 43 million shares outstanding, which represents a 10% decrease year-to-date and a 49% decrease from the 83 million shares outstanding at the end of 2020.

As of September 30, 2023, AutoNation had $1.6 billion of liquidity, including $64 million in cash and approximately $1.55 billion of availability under its revolving credit facility. During the third quarter of 2023, the company increased its commercial paper program capacity to $1.9 billion, matching the capacity under its revolving credit facility. The Company’s covenant leverage ratio was 2.0x at quarter end. AutoNation had approximately $3.94 billion of non-vehicle debt outstanding as of September 30, 2023.

Segment Results

Segment results(1) for the Third Quarter of 2023 were as follows:

•Domestic – Domestic segment revenue of $2.0 billion decreased $49 million from a year ago. Domestic segment income(2) was $107 million compared to $143 million a year ago and $116 million in the Second Quarter 2023.

•Import – Import segment revenue of $2.1 billion increased $202 million from a year ago. Import segment income(2) was $165 million compared to $180 million a year ago and $173 million in the Second Quarter 2023.

•Premium Luxury – Premium Luxury segment revenue of $2.5 billion increased $10 million from a year ago. Premium Luxury segment income(2) was $193 million compared to $235 million a year ago and $222 million in the Second Quarter 2023.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Selected GAAP Financial Data |

| ($ in millions, except per share data) |

| | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | | | YoY |

| Revenue | | $ | 20,181.5 | | | $ | 20,288.0 | | | | | -1% |

| Gross Profit | | $ | 3,916.3 | | | $ | 3,983.4 | | | | | -2% |

| Operating Income | | $ | 1,302.0 | | | $ | 1,599.6 | | | | | -19% |

| Net Income | | $ | 804.9 | | | $ | 1,091.0 | | | | | -26% |

| Diluted EPS | | $ | 17.65 | | | $ | 18.52 | | | | | -5% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| New Vehicle Retail Unit Sales | | 179,798 | | | 169,897 | | | | | 6% |

| Used Vehicle Retail Unit Sales | | 208,868 | | | 232,198 | | | | | -10% |

| | | | | | | | |

| Selected Non-GAAP Financial Data |

| ($ in millions, except per share data) |

| | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | | | YoY |

| | | | | | | | |

| Adjusted Operating Income | | $ | 1,324.8 | | | $ | 1,552.1 | | | | | -15% |

| Adjusted Net Income | | $ | 817.3 | | | $ | 1,074.0 | | | | | -24% |

| Adjusted Diluted EPS | | $ | 17.92 | | | $ | 18.23 | | | | | -2% |

The Third Quarter conference call will begin at 9:00 a.m. Eastern Time and may be accessed by telephone at 833-470-1428 (Conference ID:575899) or on AutoNation’s investor relations website at investors.autonation.com.

The webcast will also be available on AutoNation’s website following the call under “Events & Presentations.” A playback of the conference call will be available after 12:00 p.m. Eastern Time on October 27, 2023, through November 17, 2023, by calling 866-813-9403 (Conference ID: 534785). Additional information regarding AutoNation’s results can be found in the Investor Presentation available at investors.autonation.com.

(1)AutoNation has three reportable segments: Domestic, Import, and Premium Luxury. The Domestic segment is comprised of stores that sell vehicles manufactured by Ford, General Motors, and Stellantis; the Import segment is comprised of stores that sell vehicles manufactured primarily by Toyota, Honda, Hyundai, Subaru, and Nissan; and the Premium Luxury segment is comprised of stores that sell vehicles manufactured primarily by Mercedes-Benz, BMW, Lexus, Audi, and Jaguar Land Rover.

(2)Segment income represents income for each of AutoNation’s reportable segments and is defined as operating income less floorplan interest expense.

About AutoNation, Inc.

AutoNation, a provider of personalized transportation services, is driven by innovation and transformation. As one of America's most admired companies, AutoNation delivers a peerless Customer experience recognized by data-driven consumer insight leaders, Reputation and J.D. Power. Through its brand affinity, the AutoNation Brand is synonymous with “DRVPNK.” AutoNation has a singular focus on personalized transportation services that are easy, transparent, and Customer-centric.

Please visit www.autonation.com, investors.autonation.com, and www.twitter.com/autonation, where AutoNation discloses additional information about the Company, its business, and its results of operations. Please also visit www.autonationdrive.com, AutoNation’s automotive blog, for information regarding the AutoNation community, the automotive industry, and current automotive news and trends.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Words such as "anticipates," "expects," "intends," "goals," "targets," "projects," "plans," "believes," "continues," "may," "will," "could," and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements regarding our strategic initiatives, partnerships, and investments, including AutoNation USA, AutoNation Finance, and our mobile automotive repair and

maintenance business, statements regarding our investments in digital and online capabilities and mobility solutions, statements regarding our expectations for the future performance of our business and the automotive retail industry, and other statements that describe our objectives, goals, or plans, are forward-looking statements. Our forward-looking statements reflect our current expectations concerning future results and events, and they involve known and unknown risks, uncertainties, and other factors that are difficult to predict and may cause our actual results, performance, or achievements to be materially different from any future results, performance, and achievements expressed or implied by these statements. These risks, uncertainties, and other factors include, among others: our ability to implement successfully our strategic acquisitions, initiatives, partnerships, and investments, including our investments in digital and online capabilities and mobility solutions; our ability to identify, acquire, and build out suitable locations in a timely manner; our ability to maintain and enhance our retail brands and reputation and to attract consumers to our own digital channels; our ability to acquire and integrate successfully new acquisitions; restrictions imposed by vehicle manufacturers and our ability to obtain manufacturer approval for franchise acquisitions; economic conditions, including changes in unemployment, interest, and/or inflation rates, consumer demand, fuel prices, and tariffs; supply chain disruptions and inventory availability; new and used vehicle margins; our ability to attain planned sales volumes within our expected time frames; our ability to successfully implement and maintain expense controls; the successful resolution of labor strikes impacting domestic vehicle manufacturers; the success and financial viability and the incentive and marketing programs of vehicle manufacturers and distributors with which we hold franchises; natural disasters and other adverse weather events; the resolution of legal and administrative proceedings; regulatory factors affecting our business, including fuel economy requirements; the announcement of safety recalls; factors affecting our goodwill and other intangible asset impairment testing; and other factors described in our news releases and filings made under the securities laws, including, among others, our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. Forward-looking statements contained in this news release speak only as of the date of this news release, and we undertake no obligation to update these forward-looking statements to reflect subsequent events or circumstances.

AUTONATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | | |

| New vehicle | | $ | 3,187.6 | | | $ | 2,863.9 | | | $ | 9,400.5 | | | $ | 8,606.9 | |

| Used vehicle | | 2,172.1 | | | 2,401.7 | | | 6,292.7 | | | 7,494.5 | |

| Parts and service | | 1,157.4 | | | 1,032.1 | | | 3,392.5 | | | 3,072.3 | |

| Finance and insurance, net | | 369.5 | | | 360.7 | | | 1,071.4 | | | 1,092.2 | |

| Other | | 6.1 | | | 7.6 | | | 24.4 | | | 22.1 | |

| Total revenue | | 6,892.7 | | | 6,666.0 | | | 20,181.5 | | | 20,288.0 | |

| Cost of sales: | | | | | | | | |

| New vehicle | | 2,936.9 | | | 2,534.2 | | | 8,575.2 | | | 7,578.7 | |

| Used vehicle | | 2,044.3 | | | 2,259.7 | | | 5,876.2 | | | 7,059.4 | |

| Parts and service | | 611.6 | | | 553.5 | | | 1,793.1 | | | 1,650.9 | |

| Other | | 5.3 | | | 5.8 | | | 20.7 | | | 15.6 | |

| Total cost of sales | | 5,598.1 | | | 5,353.2 | | | 16,265.2 | | | 16,304.6 | |

| Gross profit | | 1,294.6 | | | 1,312.8 | | | 3,916.3 | | | 3,983.4 | |

| Selling, general, and administrative expenses | | 819.3 | | | 763.2 | | | 2,444.9 | | | 2,259.4 | |

| Depreciation and amortization | | 55.7 | | | 50.1 | | | 163.1 | | | 148.9 | |

| | | | | | | | |

| | | | | | | | |

Other (income) expense, net(1) | | 0.1 | | | (23.0) | | | 6.3 | | | (24.5) | |

| Operating income | | 419.5 | | | 522.5 | | | 1,302.0 | | | 1,599.6 | |

| Non-operating income (expense) items: | | | | | | | | |

| Floorplan interest expense | | (38.3) | | | (10.7) | | | (98.2) | | | (21.7) | |

| Other interest expense | | (48.8) | | | (33.7) | | | (135.9) | | | (97.4) | |

Other income (loss), net(2) | | (5.0) | | | (4.6) | | | 4.6 | | | (24.7) | |

| Income from continuing operations before income taxes | | 327.4 | | | 473.5 | | | 1,072.5 | | | 1,455.8 | |

| Income tax provision | | 83.7 | | | 120.8 | | | 268.5 | | | 364.5 | |

| Net income from continuing operations | | 243.7 | | | 352.7 | | | 804.0 | | | 1,091.3 | |

| Income (loss) from discontinued operations, net of income taxes | | — | | | (0.1) | | | 0.9 | | | (0.3) | |

| Net income | | $ | 243.7 | | | $ | 352.6 | | | $ | 804.9 | | | $ | 1,091.0 | |

Diluted earnings (loss) per share(3): | | | | | | | | |

| Continuing operations | | $ | 5.54 | | | $ | 6.31 | | | $ | 17.63 | | | $ | 18.53 | |

| Discontinued operations | | $ | — | | | $ | — | | | $ | 0.02 | | | $ | (0.01) | |

| Net income | | $ | 5.54 | | | $ | 6.31 | | | $ | 17.65 | | | $ | 18.52 | |

| Weighted average common shares outstanding | | 44.0 | | | 55.9 | | | 45.6 | | | 58.9 | |

| Common shares outstanding, net of treasury stock, at period end | | 42.8 | | | 52.3 | | | 42.8 | | | 52.3 | |

(1)Current periods primarily include results of our finance company, including expected credit loss expense and gains on asset sales, as well as gains on a legal settlement. Prior periods primarily include gains on business/property divestitures and legal settlements.

(2)Includes gains (losses) related to changes in the cash surrender value of corporate-owned life insurance for deferred compensation plan participants.

(3)Earnings per share amounts are calculated discretely and therefore may not add up to the total due to rounding.

AUTONATION, INC.

UNAUDITED SUPPLEMENTARY DATA

($ in millions, except per vehicle data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Highlights | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | $ Variance | | % Variance | | 2023 | | 2022 | | $ Variance | | % Variance |

| Revenue: | | | | | | | | | | | | | | | | |

| New vehicle | | $ | 3,187.6 | | | $ | 2,863.9 | | | $ | 323.7 | | | 11.3 | | | $ | 9,400.5 | | | $ | 8,606.9 | | | $ | 793.6 | | | 9.2 | |

| Retail used vehicle | | 2,025.1 | | | 2,253.1 | | | (228.0) | | | (10.1) | | | 5,858.4 | | | 7,007.5 | | | (1,149.1) | | | (16.4) | |

| Wholesale | | 147.0 | | | 148.6 | | | (1.6) | | | (1.1) | | | 434.3 | | | 487.0 | | | (52.7) | | | (10.8) | |

| Used vehicle | | 2,172.1 | | | 2,401.7 | | | (229.6) | | | (9.6) | | | 6,292.7 | | | 7,494.5 | | | (1,201.8) | | | (16.0) | |

| Finance and insurance, net | | 369.5 | | | 360.7 | | | 8.8 | | | 2.4 | | | 1,071.4 | | | 1,092.2 | | | (20.8) | | | (1.9) | |

| Total variable operations | | 5,729.2 | | | 5,626.3 | | | 102.9 | | | 1.8 | | | 16,764.6 | | | 17,193.6 | | | (429.0) | | | (2.5) | |

| Parts and service | | 1,157.4 | | | 1,032.1 | | | 125.3 | | | 12.1 | | | 3,392.5 | | | 3,072.3 | | | 320.2 | | | 10.4 | |

| Other | | 6.1 | | | 7.6 | | | (1.5) | | | | | 24.4 | | | 22.1 | | | 2.3 | | | |

| Total revenue | | $ | 6,892.7 | | | $ | 6,666.0 | | | $ | 226.7 | | | 3.4 | | | $ | 20,181.5 | | | $ | 20,288.0 | | | $ | (106.5) | | | (0.5) | |

| Gross profit: | | | | | | | | | | | | | | | | |

| New vehicle | | $ | 250.7 | | | $ | 329.7 | | | $ | (79.0) | | | (24.0) | | | $ | 825.3 | | | $ | 1,028.2 | | | $ | (202.9) | | | (19.7) | |

| Retail used vehicle | | 126.6 | | | 140.9 | | | (14.3) | | | (10.1) | | | 398.3 | | | 413.4 | | | (15.1) | | | (3.7) | |

| Wholesale | | 1.2 | | | 1.1 | | | 0.1 | | | | | 18.2 | | | 21.7 | | | (3.5) | | | |

| Used vehicle | | 127.8 | | | 142.0 | | | (14.2) | | | (10.0) | | | 416.5 | | | 435.1 | | | (18.6) | | | (4.3) | |

| Finance and insurance | | 369.5 | | | 360.7 | | | 8.8 | | | 2.4 | | | 1,071.4 | | | 1,092.2 | | | (20.8) | | | (1.9) | |

| Total variable operations | | 748.0 | | | 832.4 | | | (84.4) | | | (10.1) | | | 2,313.2 | | | 2,555.5 | | | (242.3) | | | (9.5) | |

| Parts and service | | 545.8 | | | 478.6 | | | 67.2 | | | 14.0 | | | 1,599.4 | | | 1,421.4 | | | 178.0 | | | 12.5 | |

| Other | | 0.8 | | | 1.8 | | | (1.0) | | | | | 3.7 | | | 6.5 | | | (2.8) | | | |

| Total gross profit | | 1,294.6 | | | 1,312.8 | | | (18.2) | | | (1.4) | | | 3,916.3 | | | 3,983.4 | | | (67.1) | | | (1.7) | |

| Selling, general, and administrative expenses | | 819.3 | | | 763.2 | | | (56.1) | | | (7.4) | | | 2,444.9 | | | 2,259.4 | | | (185.5) | | | (8.2) | |

| Depreciation and amortization | | 55.7 | | | 50.1 | | | (5.6) | | | | | 163.1 | | | 148.9 | | | (14.2) | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Other (income) expense, net | | 0.1 | | | (23.0) | | | (23.1) | | | | | 6.3 | | | (24.5) | | | (30.8) | | | |

| Operating income | | 419.5 | | | 522.5 | | | (103.0) | | | (19.7) | | | 1,302.0 | | | 1,599.6 | | | (297.6) | | | (18.6) | |

| Non-operating income (expense) items: | | | | | | | | | | | | | | | | |

| Floorplan interest expense | | (38.3) | | | (10.7) | | | (27.6) | | | | | (98.2) | | | (21.7) | | | (76.5) | | | |

| Other interest expense | | (48.8) | | | (33.7) | | | (15.1) | | | | | (135.9) | | | (97.4) | | | (38.5) | | | |

| Other income (loss), net | | (5.0) | | | (4.6) | | | (0.4) | | | | | 4.6 | | | (24.7) | | | 29.3 | | | |

| Income from continuing operations before income taxes | | $ | 327.4 | | | $ | 473.5 | | | $ | (146.1) | | | (30.9) | | | $ | 1,072.5 | | | $ | 1,455.8 | | | $ | (383.3) | | | (26.3) | |

| Retail vehicle unit sales: | | | | | | | | | | | | | | | | |

| New | | 62,289 | | | 55,565 | | | 6,724 | | | 12.1 | | | 179,798 | | | 169,897 | | | 9,901 | | | 5.8 | |

| Used | | 72,517 | | | 75,355 | | | (2,838) | | | (3.8) | | | 208,868 | | | 232,198 | | | (23,330) | | | (10.0) | |

| | 134,806 | | | 130,920 | | | 3,886 | | | 3.0 | | | 388,666 | | | 402,095 | | | (13,429) | | | (3.3) | |

| Revenue per vehicle retailed: | | | | | | | | | | | | | | | | |

| New | | $ | 51,174 | | | $ | 51,541 | | | $ | (367) | | | (0.7) | | | $ | 52,284 | | | $ | 50,660 | | | $ | 1,624 | | | 3.2 | |

| Used | | $ | 27,926 | | | $ | 29,900 | | | $ | (1,974) | | | (6.6) | | | $ | 28,048 | | | $ | 30,179 | | | $ | (2,131) | | | (7.1) | |

| Gross profit per vehicle retailed: | | | | | | | | | | | | | | | | |

| New | | $ | 4,025 | | | $ | 5,934 | | | $ | (1,909) | | | (32.2) | | | $ | 4,590 | | | $ | 6,052 | | | $ | (1,462) | | | (24.2) | |

| Used | | $ | 1,746 | | | $ | 1,870 | | | $ | (124) | | | (6.6) | | | $ | 1,907 | | | $ | 1,780 | | | $ | 127 | | | 7.1 | |

| Finance and insurance | | $ | 2,741 | | | $ | 2,755 | | | $ | (14) | | | (0.5) | | | $ | 2,757 | | | $ | 2,716 | | | $ | 41 | | | 1.5 | |

Total variable operations(1) | | $ | 5,540 | | | $ | 6,350 | | | $ | (810) | | | (12.8) | | | $ | 5,905 | | | $ | 6,301 | | | $ | (396) | | | (6.3) | |

| | | | | | | | | | | | | | | | |

(1) Total variable operations gross profit per vehicle retailed is calculated by dividing the sum of new vehicle, retail used vehicle, and finance and insurance gross profit by total retail vehicle unit sales. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Percentages | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 (%) | | 2022 (%) | | 2023 (%) | | 2022 (%) |

| Revenue mix percentages: | | | | | | | | |

| New vehicle | | 46.2 | | | 43.0 | | | 46.6 | | | 42.4 | |

| Used vehicle | | 31.5 | | | 36.0 | | | 31.2 | | | 36.9 | |

| Parts and service | | 16.8 | | | 15.5 | | | 16.8 | | | 15.1 | |

| Finance and insurance, net | | 5.4 | | | 5.4 | | | 5.3 | | | 5.4 | |

| Other | | 0.1 | | | 0.1 | | | 0.1 | | | 0.2 | |

| | 100.0 | | | 100.0 | | | 100.0 | | | 100.0 | |

| Gross profit mix percentages: | | | | | | | | |

| New vehicle | | 19.4 | | | 25.1 | | | 21.1 | | | 25.8 | |

| Used vehicle | | 9.9 | | | 10.8 | | | 10.6 | | | 10.9 | |

| Parts and service | | 42.2 | | | 36.5 | | | 40.8 | | | 35.7 | |

| Finance and insurance | | 28.5 | | | 27.5 | | | 27.4 | | | 27.4 | |

| Other | | — | | | 0.1 | | | 0.1 | | | 0.2 | |

| | 100.0 | | | 100.0 | | | 100.0 | | | 100.0 | |

| Operating items as a percentage of revenue: | | | | | | | | |

| Gross profit: | | | | | | | | |

| New vehicle | | 7.9 | | | 11.5 | | | 8.8 | | | 11.9 | |

| Used vehicle - retail | | 6.3 | | | 6.3 | | | 6.8 | | | 5.9 | |

| Parts and service | | 47.2 | | | 46.4 | | | 47.1 | | | 46.3 | |

| Total | | 18.8 | | | 19.7 | | | 19.4 | | | 19.6 | |

Selling, general, and administrative expenses | | 11.9 | | | 11.4 | | | 12.1 | | | 11.1 | |

| Operating income | | 6.1 | | | 7.8 | | | 6.5 | | | 7.9 | |

| Operating items as a percentage of total gross profit: | | | | | | | | |

Selling, general, and administrative expenses | | 63.3 | | | 58.1 | | | 62.4 | | | 56.7 | |

| Operating income | | 32.4 | | | 39.8 | | | 33.2 | | | 40.2 | |

AUTONATION, INC.

UNAUDITED SUPPLEMENTARY DATA

($ in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment Operating Highlights | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | $ Variance | | % Variance | | 2023 | | 2022 | | $ Variance | | % Variance |

| Revenue: | | | | | | | | | | | | | | | | |

| Domestic | | $ | 1,983.9 | | | $ | 2,032.8 | | | $ | (48.9) | | | (2.4) | | | $ | 5,770.5 | | | $ | 6,108.1 | | | $ | (337.6) | | | (5.5) | |

| Import | | 2,077.2 | | | 1,875.2 | | | 202.0 | | | 10.8 | | | 5,864.2 | | | 5,799.0 | | | 65.2 | | | 1.1 | |

| Premium luxury | | 2,516.1 | | | 2,506.4 | | | 9.7 | | | 0.4 | | | 7,621.5 | | | 7,601.7 | | | 19.8 | | | 0.3 | |

| Total | | 6,577.2 | | | 6,414.4 | | | 162.8 | | | 2.5 | | | 19,256.2 | | | 19,508.8 | | | (252.6) | | | (1.3) | |

| Corporate and other | | 315.5 | | | 251.6 | | | 63.9 | | | 25.4 | | | 925.3 | | | 779.2 | | | 146.1 | | | 18.8 | |

| Total consolidated revenue | | $ | 6,892.7 | | | $ | 6,666.0 | | | $ | 226.7 | | | 3.4 | | | $ | 20,181.5 | | | $ | 20,288.0 | | | $ | (106.5) | | | (0.5) | |

| | | | | | | | | | | | | | | | |

| Segment income*: | | | | | | | | | | | | | | | | |

| Domestic | | $ | 107.2 | | | $ | 142.7 | | | $ | (35.5) | | | (24.9) | | | $ | 341.5 | | | $ | 445.2 | | | $ | (103.7) | | | (23.3) | |

| Import | | 164.7 | | | 180.3 | | | (15.6) | | | (8.7) | | | 498.1 | | | 559.0 | | | (60.9) | | | (10.9) | |

| Premium luxury | | 192.9 | | | 235.2 | | | (42.3) | | | (18.0) | | | 641.2 | | | 722.2 | | | (81.0) | | | (11.2) | |

| Total | | 464.8 | | | 558.2 | | | (93.4) | | | (16.7) | | | 1,480.8 | | | 1,726.4 | | | (245.6) | | | (14.2) | |

| Corporate and other | | (83.6) | | | (46.4) | | | (37.2) | | | | | (277.0) | | | (148.5) | | | (128.5) | | | |

| Add: Floorplan interest expense | | 38.3 | | | 10.7 | | | 27.6 | | | | | 98.2 | | | 21.7 | | | 76.5 | | | |

| Operating income | | $ | 419.5 | | | $ | 522.5 | | | $ | (103.0) | | | (19.7) | | | $ | 1,302.0 | | | $ | 1,599.6 | | | $ | (297.6) | | | (18.6) | |

| * Segment income represents income for each of our reportable segments and is defined as operating income less floorplan interest expense. |

| | | | | | | | | | | | | | | | |

| Retail new vehicle unit sales: | | | | | | | | | | | | | | | | |

| Domestic | | 17,766 | | | 16,859 | | | 907 | | | 5.4 | | | 51,110 | | | 49,984 | | | 1,126 | | | 2.3 | |

| Import | | 28,232 | | | 22,309 | | | 5,923 | | | 26.5 | | | 78,502 | | | 70,457 | | | 8,045 | | | 11.4 | |

| Premium luxury | | 16,291 | | | 16,397 | | | (106) | | | (0.6) | | | 50,186 | | | 49,456 | | | 730 | | | 1.5 | |

| | 62,289 | | | 55,565 | | | 6,724 | | | 12.1 | | | 179,798 | | | 169,897 | | | 9,901 | | | 5.8 | |

| | | | | | | | | | | | | | | | |

| Retail used vehicle unit sales: | | | | | | | | | | | | | | | | |

| Domestic | | 22,406 | | | 24,827 | | | (2,421) | | | (9.8) | | | 64,914 | | | 76,603 | | | (11,689) | | | (15.3) | |

| Import | | 24,548 | | | 25,416 | | | (868) | | | (3.4) | | | 69,241 | | | 77,731 | | | (8,490) | | | (10.9) | |

| Premium luxury | | 19,710 | | | 20,677 | | | (967) | | | (4.7) | | | 57,409 | | | 64,007 | | | (6,598) | | | (10.3) | |

| | 66,664 | | | 70,920 | | | (4,256) | | | (6.0) | | | 191,564 | | | 218,341 | | | (26,777) | | | (12.3) | |

| | | | | | | | | | | | | | | | |

| Brand Mix - Retail New Vehicle Units Sold | | Three Months Ended | | Nine Months Ended | | | | | | | | |

| September 30, | | September 30, | | | | | | | | |

| | | 2023 (%) | | 2022 (%) | | 2023 (%) | | 2022 (%) | | | | | | | | |

| Domestic: | | | | | | | | | | | | | | | | |

| Ford, Lincoln | | 10.5 | | | 10.5 | | | 10.9 | | | 10.7 | | | | | | | | | |

| Chevrolet, Buick, Cadillac, GMC | | 10.8 | | | 10.8 | | | 10.4 | | | 9.8 | | | | | | | | | |

| Chrysler, Dodge, Jeep, Ram | | 7.2 | | | 9.0 | | | 7.1 | | | 8.9 | | | | | | | | | |

| Domestic total | | 28.5 | | | 30.3 | | | 28.4 | | | 29.4 | | | | | | | | | |

| Import: | | | | | | | | | | | | | | | | |

| Toyota | | 19.9 | | | 19.7 | | | 18.7 | | | 20.4 | | | | | | | | | |

| Honda | | 12.4 | | | 9.1 | | | 12.8 | | | 9.7 | | | | | | | | | |

| Nissan | | 2.2 | | | 1.7 | | | 2.2 | | | 2.1 | | | | | | | | | |

| Hyundai | | 3.4 | | | 3.4 | | | 3.4 | | | 3.2 | | | | | | | | | |

| Subaru | | 4.1 | | | 3.0 | | | 3.5 | | | 3.1 | | | | | | | | | |

| Other Import | | 3.3 | | | 3.3 | | | 3.1 | | | 3.0 | | | | | | | | | |

| Import total | | 45.3 | | | 40.2 | | | 43.7 | | | 41.5 | | | | | | | | | |

| Premium Luxury: | | | | | | | | | | | | | | | | |

| Mercedes-Benz | | 8.5 | | | 10.9 | | | 9.3 | | | 10.5 | | | | | | | | | |

| BMW | | 8.4 | | | 9.4 | | | 9.1 | | | 9.5 | | | | | | | | | |

| Lexus | | 2.8 | | | 2.8 | | | 3.0 | | | 2.8 | | | | | | | | | |

| Audi | | 2.9 | | | 2.7 | | | 2.7 | | | 2.6 | | | | | | | | | |

| Jaguar Land Rover | | 1.7 | | | 1.7 | | | 1.8 | | | 1.7 | | | | | | | | | |

| Other Premium Luxury | | 1.9 | | | 2.0 | | | 2.0 | | | 2.0 | | | | | | | | | |

| Premium Luxury total | | 26.2 | | | 29.5 | | | 27.9 | | | 29.1 | | | | | | | | | |

| | 100.0 | | | 100.0 | | | 100.0 | | | 100.0 | | | | | | | | | |

AUTONATION, INC.

UNAUDITED SUPPLEMENTARY DATA, Continued

($ in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Expenditures / Stock Repurchases | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Capital expenditures | | $ | 87.0 | | | $ | 75.9 | | | $ | 286.0 | | | $ | 236.2 | |

| Cash paid for acquisitions, net of cash acquired | | $ | 2.2 | | | $ | — | |

| $ | 271.1 | | | $ | — | |

| Deposits for investment | | $ | — | | | $ | 81.6 | | | $ | — | | | $ | 81.6 | |

| Proceeds from exercises of stock options | | $ | 0.4 | | | $ | 0.8 | | | $ | 1.9 | | | $ | 3.4 | |

| Stock repurchases: | | | | | | | | |

Aggregate purchase price (1) | | $ | 200.0 | | | $ | 428.2 | | | $ | 712.4 | | | $ | 1,213.1 | |

| Shares repurchased (in millions) | | 1.3 | | | 3.8 | | | 5.3 | | | 10.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Floorplan Assistance and Expense | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | Variance | | 2023 | | 2022 | | Variance |

| Floorplan assistance earned (included in cost of sales) | | $ | 31.5 | | | $ | 26.3 | | | $ | 5.2 | | | $ | 92.1 | | | $ | 81.1 | | | $ | 11.0 | |

| New vehicle floorplan interest expense | | (35.1) | | | (9.4) | | | (25.7) | | | (89.1) | | | (18.2) | | | (70.9) | |

| Net new vehicle inventory carrying benefit (expense) | | $ | (3.6) | | | $ | 16.9 | | | $ | (20.5) | | | $ | 3.0 | | | $ | 62.9 | | | $ | (59.9) | |

| | | | | | | | | | | | | | | | | | | | |

| Balance Sheet and Other Highlights | | September 30, 2023 | | December 31, 2022 | | September 30, 2022 |

| Cash and cash equivalents | | $ | 64.0 | | | $ | 72.6 | | | $ | 442.9 | |

| Inventory | | $ | 2,645.6 | | | $ | 2,048.3 | | | $ | 1,851.3 | |

| Floorplan notes payable | | $ | 2,814.8 | | | $ | 2,109.3 | | | $ | 1,624.8 | |

| Non-recourse debt | | $ | 246.1 | | | $ | 323.6 | | | $ | — | |

| Non-vehicle debt | | $ | 3,942.4 | | | $ | 3,649.5 | | | $ | 3,544.6 | |

| Equity | | $ | 2,142.0 | | | $ | 2,047.8 | | | $ | 2,255.2 | |

| | | | | | |

| New days supply (industry standard of selling days) | | 31 days | | 19 days | | 15 days |

| Used days supply (trailing calendar month days) | | 33 days | | 31 days | | 34 days |

| | | | | | | | |

Key Credit Agreement Covenant Compliance Calculations (2) | | |

| Leverage ratio | | 2.02x |

| Covenant | less than or equal to | 3.75x |

| | | | | | | | |

| Interest coverage ratio | | 7.15x |

| Covenant | greater than or equal to | 3.00x |

(1) Excludes excise tax accrual under Inflation Reduction Act.

(2) Calculated in accordance with our credit agreement as filed with our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023.

AUTONATION, INC.

UNAUDITED SUPPLEMENTARY DATA, Continued

($ in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Comparable Basis Reconciliations(1) |

| | | | | | Three Months Ended September 30, |

| | | | Operating Income | | Income from Continuing Operations Before Income Taxes | | Income Tax Provision(2) | | Effective Tax Rate | | Net Income | | Diluted Earnings Per Share(3) |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| From continuing operations, as reported | | | | | $ | 419.5 | | | $ | 522.5 | | | $ | 327.4 | | | $ | 473.5 | | | $ | 83.7 | | | $ | 120.8 | | | 25.6 | % | | 25.5 | % | | $ | 243.7 | | | $ | 352.7 | | | | | |

| Discontinued operations, net of income taxes | | | | | | | | | | | | | | | | | | | | | — | | | (0.1) | | | | | |

| As reported | | | | | | | | | | | | | | | | | | | | | $ | 243.7 | | | $ | 352.6 | | | $ | 5.54 | | | $ | 6.31 | |

Increase (decrease) in compensation expense related to market valuation changes in deferred compensation plans(4) | | | | | (3.7) | | | (4.8) | | | | | | | | | | | | | | | | | | | | | |

| Net gains on business/property dispositions | | | | | — | | | (16.1) | | | — | | | (16.1) | | | — | | | (4.0) | | | | | | | — | | | (12.1) | | | $ | — | | | $ | (0.22) | |

| Legal settlement | | | | | — | | | (6.3) | | | — | | | (6.3) | | | — | | | (1.4) | | | | | | | — | | | (4.9) | | | $ | — | | | $ | (0.09) | |

| Adjusted | | | | | $ | 415.8 | | | $ | 495.3 | | | $ | 327.4 | | | $ | 451.1 | | | $ | 83.7 | | | $ | 115.4 | | | 25.6 | % | | 25.6 | % | | $ | 243.7 | | | $ | 335.6 | | | $ | 5.54 | | | $ | 6.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended September 30, | | | | | | | | | | | | | | | | |

| | | | | | SG&A | | SG&A as a Percentage of Gross Profit (%) | | | | | | | | | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| As reported | | | | | $ | 819.3 | | | $ | 763.2 | | | 63.3 | | | 58.1 | | | | | | | | | | | | | | | | | |

Excluding increase (decrease) in compensation expense related to market valuation changes in deferred compensation plans | | | | | (3.7) | | | (4.8) | | | | | | | | | | | | | | | | | | | | | |

| Adjusted | | | | | $ | 823.0 | | | $ | 768.0 | | | 63.6 | | | 58.5 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Please refer to the “Non-GAAP Financial Measures” section of the Press Release. |

| (2) | Tax expense is determined based on the amount of additional taxes or tax benefits associated with each individual item. |

| (3) | Diluted earnings per share amounts are calculated discretely and therefore may not add up to the total due to rounding. |

| (4) | Increases and decreases in deferred compensation obligations, which are recorded in SG&A, are substantially offset by corresponding gains and losses, respectively, related to changes in the cash surrender value of corporate-owned life insurance ("COLI") for deferred compensation plan participants as a result of changes in market performance of the underlying investments. Gains and losses related to the COLI are recorded in non-operating Other Income (Loss), Net. |

AUTONATION, INC.

UNAUDITED SUPPLEMENTARY DATA, Continued

($ in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Comparable Basis Reconciliations(1) |

| | | | | Nine Months Ended September 30, |

| | | | Operating Income | | Income from Continuing Operations Before Income Taxes | | Income Tax Provision(2) | | Effective Tax Rate | | Net Income | | Diluted Earnings Per Share(3) |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| From continuing operations, as reported | | | | | $ | 1,302.0 | | | $ | 1,599.6 | | | $ | 1,072.5 | | | $ | 1,455.8 | | | $ | 268.5 | | | $ | 364.5 | | | 25.0 | % | | 25.0 | % | | $ | 804.0 | | | $ | 1,091.3 | | | | | |

| Discontinued operations, net of income taxes | | | | | | | | | | | | | | | | | | | | | 0.9 | | | (0.3) | | | | | |

| As reported | | | | | | | | | | | | | | | | | | | | | 804.9 | | | 1,091.0 | | | $ | 17.65 | | | $ | 18.52 | |

Increase (decrease) in compensation expense related to market valuation changes in deferred compensation plans(4) | | | | | 6.3 | | | (25.1) | | | | | | | | | | | | | | | | | | | | | |

| Losses from hail storms and other natural catastrophes | | | | | 16.5 | | | — | | | 16.5 | | | — | | | 4.1 | | | — | | | | | | | 12.4 | | | — | | | $ | 0.27 | | | $ | — | |

| Net gains on business/property dispositions | | | | | — | | | (16.1) | | | — | | | (16.1) | | | — | | | (4.0) | | | | | | | — | | | (12.1) | | | $ | — | | | $ | (0.21) | |

| Legal settlement | | | | | — | | | (6.3) | | | — | | | (6.3) | | | — | | | (1.4) | | | | | | | — | | | (4.9) | | | $ | — | | | $ | (0.08) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted | | | | | $ | 1,324.8 | | | $ | 1,552.1 | | | $ | 1,089.0 | | | $ | 1,433.4 | | | $ | 272.6 | | | $ | 359.1 | | | 25.0 | % | | 25.1 | % | | $ | 817.3 | | | $ | 1,074.0 | | | $ | 17.92 | | | $ | 18.23 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Nine Months Ended September 30, | | | | | | | | | | | | | | | | |

| | | | | | SG&A | | SG&A as a Percentage of Gross Profit (%) | | | | | | | | | | | | | | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 | | | | | | | | | | | | | | | | |

| As reported | | | | | $ | 2,444.9 | | | $ | 2,259.4 | | | 62.4 | | | 56.7 | | | | | | | | | | | | | | | | | |

Excluding increase (decrease) in compensation expense related to market valuation changes in deferred compensation plans | | | | | 6.3 | | | (25.1) | | | | | | | | | | | | | | | | | | | | | |

| Excluding losses from hail storms and other natural catastrophes | | | | | 16.5 | | | — | | | | | | | | | | | | | | | | | | | | | |

| Adjusted | | | | | $ | 2,422.1 | | | $ | 2,284.5 | | | 61.8 | | | 57.4 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Please refer to the “Non-GAAP Financial Measures” section of the Press Release. |

| (2) | Tax expense is determined based on the amount of additional taxes or tax benefits associated with each individual item. |

| (3) | Diluted earnings per share amounts are calculated discretely and therefore may not add up to the total due to rounding. |

| (4) | Increases and decreases in deferred compensation obligations, which are recorded in SG&A, are substantially offset by corresponding gains and losses, respectively, related to changes in the cash surrender value of corporate-owned life insurance ("COLI") for deferred compensation plan participants as a result of changes in market performance of the underlying investments. Gains and losses related to the COLI are recorded in non-operating Other Income (Loss), Net. |

| |

AUTONATION, INC.

UNAUDITED SAME STORE DATA

($ in millions, except per vehicle data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Highlights | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | $ Variance | | % Variance | | 2023 | | 2022 | | $ Variance | | % Variance |

| Revenue: | | | | | | | | | | | | | | | | |

| New vehicle | | $ | 3,117.8 | | | $ | 2,856.9 | | | $ | 260.9 | | | 9.1 | | | $ | 9,273.4 | | | $ | 8,572.1 | | | $ | 701.3 | | | 8.2 | |

| Retail used vehicle | | 1,955.5 | | | 2,248.4 | | | (292.9) | | | (13.0) | | | 5,685.7 | | | 6,976.6 | | | (1,290.9) | | | (18.5) | |

| Wholesale | | 142.6 | | | 147.7 | | | (5.1) | | | (3.5) | | | 424.8 | | | 484.3 | | | (59.5) | | | (12.3) | |

| Used vehicle | | 2,098.1 | | | 2,396.1 | | | (298.0) | | | (12.4) | | | 6,110.5 | | | 7,460.9 | | | (1,350.4) | | | (18.1) | |

| Finance and insurance, net | | 359.7 | | | 360.1 | | | (0.4) | | | (0.1) | | | 1,047.8 | | | 1,088.5 | | | (40.7) | | | (3.7) | |

| Total variable operations | | 5,575.6 | | | 5,613.1 | | | (37.5) | | | (0.7) | | | 16,431.7 | | | 17,121.5 | | | (689.8) | | | (4.0) | |

| Parts and service | | 1,127.3 | | | 1,027.6 | | | 99.7 | | | 9.7 | | | 3,321.6 | | | 3,052.7 | | | 268.9 | | | 8.8 | |

| Other | | 5.9 | | | 7.6 | | | (1.7) | | | | | 24.1 | | | 22.1 | | | 2.0 | | | |

| Total revenue | | $ | 6,708.8 | | | $ | 6,648.3 | | | $ | 60.5 | | | 0.9 | | | $ | 19,777.4 | | | $ | 20,196.3 | | | $ | (418.9) | | | (2.1) | |

| | | | | | | | | | | | | | | | |

| Gross profit: | | | | | | | | | | | | | | | | |

| New vehicle | | $ | 245.7 | | | $ | 328.9 | | | $ | (83.2) | | | (25.3) | | | $ | 815.2 | | | $ | 1,024.4 | | | $ | (209.2) | | | (20.4) | |

| Retail used vehicle | | 121.8 | | | 140.9 | | | (19.1) | | | (13.6) | | | 386.5 | | | 412.5 | | | (26.0) | | | (6.3) | |

| Wholesale | | 1.6 | | | 1.2 | | | 0.4 | | | | | 18.8 | | | 21.9 | | | (3.1) | | | |

| Used vehicle | | 123.4 | | | 142.1 | | | (18.7) | | | (13.2) | | | 405.3 | | | 434.4 | | | (29.1) | | | (6.7) | |

| Finance and insurance | | 359.7 | | | 360.1 | | | (0.4) | | | (0.1) | | | 1,047.8 | | | 1,088.5 | | | (40.7) | | | (3.7) | |

| Total variable operations | | 728.8 | | | 831.1 | | | (102.3) | | | (12.3) | | | 2,268.3 | | | 2,547.3 | | | (279.0) | | | (11.0) | |

| Parts and service | | 534.1 | | | 475.2 | | | 58.9 | | | 12.4 | | | 1,568.7 | | | 1,408.9 | | | 159.8 | | | 11.3 | |

| Other | | 0.6 | | | 1.7 | | | (1.1) | | | | | 3.5 | | | 6.4 | | | (2.9) | | | |

| Total gross profit | | $ | 1,263.5 | | | $ | 1,308.0 | | | $ | (44.5) | | | (3.4) | | | $ | 3,840.5 | | | $ | 3,962.6 | | | $ | (122.1) | | | (3.1) | |

| | | | | | | | | | | | | | | | |

| Retail vehicle unit sales: | | | | | | | | | | | | | | | | |

| New | | 60,690 | | | 55,464 | | | 5,226 | | | 9.4 | | | 177,094 | | | 169,391 | | | 7,703 | | | 4.5 | |

| Used | | 69,670 | | | 75,235 | | | (5,565) | | | (7.4) | | | 201,875 | | | 231,367 | | | (29,492) | | | (12.7) | |

| | 130,360 | | | 130,699 | | | (339) | | | (0.3) | | | 378,969 | | | 400,758 | | | (21,789) | | | (5.4) | |

| | | | | | | | | | | | | | | | |

| Revenue per vehicle retailed: | | | | | | | | | | | | | | | | |

| New | | $ | 51,373 | | | $ | 51,509 | | | $ | (136) | | | (0.3) | | | $ | 52,364 | | | $ | 50,605 | | | $ | 1,759 | | | 3.5 | |

| Used | | $ | 28,068 | | | $ | 29,885 | | | $ | (1,817) | | | (6.1) | | | $ | 28,164 | | | $ | 30,154 | | | $ | (1,990) | | | (6.6) | |

| | | | | | | | | | | | | | | | |

| Gross profit per vehicle retailed: | | | | | | | | | | | | | | | | |

| New | | $ | 4,048 | | | $ | 5,930 | | | $ | (1,882) | | | (31.7) | | | $ | 4,603 | | | $ | 6,048 | | | $ | (1,445) | | | (23.9) | |

| Used | | $ | 1,748 | | | $ | 1,873 | | | $ | (125) | | | (6.7) | | | $ | 1,915 | | | $ | 1,783 | | | $ | 132 | | | 7.4 | |

| Finance and insurance | | $ | 2,759 | | | $ | 2,755 | | | $ | 4 | | | 0.1 | | | $ | 2,765 | | | $ | 2,716 | | | $ | 49 | | | 1.8 | |

Total variable operations(1) | | $ | 5,578 | | | $ | 6,350 | | | $ | (772) | | | (12.2) | | | $ | 5,936 | | | $ | 6,302 | | | $ | (366) | | | (5.8) | |

| | | | | | | | | | | | | | | | |

(1) Total variable operations gross profit per vehicle retailed is calculated by dividing the sum of new vehicle, retail used vehicle, and finance and insurance gross profit by total retail vehicle unit sales. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Percentages | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 (%) | | 2022 (%) | | 2023 (%) | | 2022 (%) |

| Revenue mix percentages: | | | | | | | | |

| New vehicle | | 46.5 | | | 43.0 | | | 46.9 | | | 42.4 | |

| Used vehicle | | 31.3 | | | 36.0 | | | 30.9 | | | 36.9 | |

| Parts and service | | 16.8 | | | 15.5 | | | 16.8 | | | 15.1 | |

| Finance and insurance, net | | 5.4 | | | 5.4 | | | 5.3 | | | 5.4 | |

| Other | | — | | | 0.1 | | | 0.1 | | | 0.2 | |

| | 100.0 | | | 100.0 | | | 100.0 | | | 100.0 | |

Gross profit mix percentages: | | | | | | | | |

| New vehicle | | 19.4 | | | 25.1 | | | 21.2 | | | 25.9 | |

| Used vehicle | | 9.8 | | | 10.9 | | | 10.6 | | | 11.0 | |

| Parts and service | | 42.3 | | | 36.3 | | | 40.8 | | | 35.6 | |

| Finance and insurance | | 28.5 | | | 27.5 | | | 27.3 | | | 27.5 | |

| Other | | — | | | 0.2 | | | 0.1 | | | — | |

| | 100.0 | | | 100.0 | | | 100.0 | | | 100.0 | |

Operating items as a percentage of revenue: | | | | | | | | |

| Gross profit: | | | | | | | | |

| New vehicle | | 7.9 | | | 11.5 | | | 8.8 | | | 12.0 | |

| Used vehicle - retail | | 6.2 | | | 6.3 | | | 6.8 | | | 5.9 | |

| Parts and service | | 47.4 | | | 46.2 | | | 47.2 | | | 46.2 | |

| Total | | 18.8 | | | 19.7 | | | 19.4 | | | 19.6 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

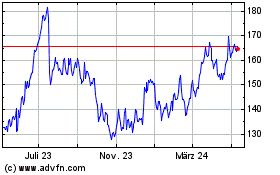

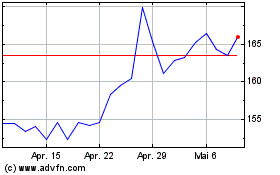

AutoNation (NYSE:AN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

AutoNation (NYSE:AN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024