Allegion plc0001579241false00015792412024-02-202024-02-200001579241us-gaap:CommonStockMember2024-02-202024-02-200001579241alle:ThreePointFivePercentSeniorNotesDue2029Member2024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________

FORM 8-K

____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): – February 20, 2024

____________________________________________

ALLEGION PUBLIC LIMITED COMPANY

(Exact Name of Registrant as Specified in Charter)

____________________________________________

| | | | | | | | |

| Ireland | 001-35971 | 98-1108930 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

Block D | |

Iveagh Court | |

Harcourt Road | |

| Dublin 2 | |

| Ireland | D02 VH94 |

| (Address of Principal Executive Offices) | (Zip Code) |

(353)(1) 2546200

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary shares, par value $0.01 per share | ALLE | New York Stock Exchange |

| 3.500% Senior Notes due 2029 | ALLE 3 ½ | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On February 20, 2024, Allegion plc (the “Company”) issued a press release announcing its fourth quarter 2023 results. The information in this Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

| (d) | Exhibits |

| | | | | | | | | | | |

Exhibit No. | | Description |

| |

| | Press Release of Allegion plc dated February 20, 2024 |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ALLEGION PLC (Registrant) |

| | |

| Date: | February 20, 2024 | /s/ Michael J. Wagnes |

| | Michael J. Wagnes

Senior Vice President and Chief Financial Officer |

Allegion (NYSE: ALLE) Reports Q4, Full-Year 2023

Financial Results, Introduces 2024 Outlook

Solid Q4 execution, record full-year results

Quarterly Financial Highlights

(All comparisons against the fourth quarter of 2022, unless otherwise noted)

•Net earnings per share (EPS) of $1.34, down 12.4% compared with $1.53; Adjusted EPS of $1.68, down 0.6% compared with $1.69

•Revenues of $897.4 million, up 4.2% on a reported basis and up 2.6% on an organic basis

•Operating margin of 17.8%, compared with 18.5%; Adjusted operating margin of 22.0%, up 130 basis points compared with 20.7%

Full-Year Financial Highlights

(All comparisons against the full year of 2022, unless otherwise noted)

•EPS of $6.12, up 17.9% compared with $5.19; Adjusted EPS of $6.96, up 16.2% compared with $5.99

•Revenues of $3,650.8 million, up 11.6% on a reported basis and up 5.2% on an organic basis

•Operating margin of 19.4%, compared with 17.9%; Adjusted operating margin of 22.1%, up 160 basis points compared with 20.5%

•Available cash flow, which is defined as net cash from operating activities minus capital expenditures, was $516.4 million for 2023, an increase of 30.6% versus the prior year

2024 Full-Year Outlook Highlights

•Full-year reported revenue growth is estimated to be 1.5% to 3.5%, with organic revenue growth estimated to be 1% to 3%

•Full-year adjusted EPS is estimated to be $7.00 to $7.15

•Available cash flow is estimated to be $540 to $570 million

DUBLIN (Feb. 20, 2024) – Allegion plc (NYSE: ALLE), a leading global security products and solutions provider, today reported financial results for its fourth quarter (ended Dec. 31, 2023).

“Allegion’s fourth quarter reflected strong execution, margin expansion and cash generation by our team,” said President and CEO John H. Stone. “Celebrating our 10th anniversary as a standalone company in December, we are proud to have closed the year with record revenue, adjusted operating income and adjusted EPS.”

“As we look ahead to 2024, we are focused on consistent execution of our strategy and balanced capital deployment, against what we expect to be a stable market backdrop. Committed to our vision of enabling seamless access and a safer world, we’ll deliver yet another year of growth.”

Q4 2023 Company Results

(All comparisons against the fourth quarter of 2022, unless otherwise noted)

Allegion reported fourth-quarter 2023 net revenues of $897.4 million and net earnings of $118.6 million, or $1.34 per share. Adjusted net earnings were $148.5 million, or $1.68 per share, down 0.6%, excluding charges related to restructuring, acquisition and integration costs and other non-cash impairment charges, as well as amortization expense related to acquired intangible assets.

Fourth-quarter 2023 net revenues increased 4.2%. Net revenues increased 2.6% on an organic basis, excluding impacts of acquisitions, divestitures and foreign currency movements. Solid growth in the company’s non-residential Americas business was partially offset by declines in its residential and Allegion International businesses. The reported revenue reflects a modest positive impact from foreign currency and acquisitions.

Fourth-quarter 2023 operating income was $159.7 million, an increase of $0.3 million or 0.2%. Adjusted operating income in fourth-quarter 2023 was $197.2 million, an increase of $18.5 million or 10.4%.

Fourth-quarter 2023 operating margin was 17.8%, compared with 18.5%. The adjusted operating margin in fourth-quarter 2023 was 22.0%, compared with 20.7%. The 130-basis-point increase in adjusted operating margin is attributable to positive price and productivity net of inflation and investments. These increases were partially offset by lower volumes.

Q4 2023 Segment Results

(All comparisons against the fourth quarter of 2022, unless otherwise noted)

The Americas segment revenues were up 3.7% (up 3.7% on an organic basis). Favorable price offset lower volumes. The segment had mid-single digit organic growth in electronics in the fourth quarter. The America’s non-residential business and the Access Technologies business both grew mid-single digits. The residential business continues to be soft and experienced a low-single digit decline. The segment’s results are up against a tough prior-year comparison, as the non-residential business had organic growth of mid-twenties percent in the fourth quarter of last year.

The International segment revenues increased 5.9% (down 1.3% on an organic basis). Positive price realization was more than offset by the impact of soft end markets. The reported revenue reflects a positive impact from foreign currency and acquisitions.

Full-Year 2023 Company Results

(All comparisons against the full year of 2022, unless otherwise noted)

Allegion reported full-year 2023 net revenues of $3,650.8 million and net earnings of $540.4 million, or $6.12 per share. Adjusted net earnings were $614.9 million, or $6.96 per share, up 16.2%, excluding charges related to restructuring, acquisition and integration costs and other non-cash impairment charges, as well as amortization expense related to acquired intangible assets.

Full-year 2023 net revenues increased 11.6%. Net revenues increased 5.2% on an organic basis, excluding impacts of acquisitions, divestitures and foreign currency movements. Favorable price was more than offset by lower volumes experienced in the mechanical portfolio. The company had approximately 20% global organic growth in electronics and software solutions in the year. The reported revenue reflects a positive impact from foreign currency and acquisitions.

Full-year 2023 operating income was $708.4 million, an increase of $122.0 million or 20.8%. Adjusted operating income for full-year 2023 was $805.6 million, an increase of $133.6 million or 19.9%.

Full-year 2023 operating margin was 19.4%, compared with 17.9%. The adjusted operating margin for full-year 2023 was 22.1%, compared with 20.5%. The 160-basis-point increase in adjusted operating margin is attributable to positive price and productivity net of inflation and investments. These increases were partially offset by lower volumes.

Additional Items

(All comparisons against the fourth quarter of 2022, unless otherwise noted)

Interest expense for fourth-quarter 2023 was $22.9 million, a decrease of $0.8 million.

Other income net for fourth-quarter 2023 was $0.1 million, compared to other income net of $4.5 million.

The company’s effective tax rate for fourth-quarter 2023 was 13.4%, compared with 3.4%. The company’s adjusted effective tax rate for fourth-quarter 2023 was 16.4%, compared with 6.2%, driven by timing of discrete items. The company’s adjusted effective tax rate for full-year 2023 was 14.3%, compared with 12.7% in 2022.

Cash Flow and Liquidity

Year-to-date available cash flow for 2023 was $516.4 million, an increase of $120.9 million versus the prior-year period. The year-over-year increase in available cash flow is due to increased year-to-date net earnings and lower cash used for net working capital, partially offset by higher capital expenditures. The company ended fourth-quarter 2023 with cash and cash equivalents of $468.1 million, as well as total debt of $2,015.0 million.

Share Repurchase and Dividends

For the year, the company repurchased approximately 0.5 million shares for approximately $60 million. As announced on Feb. 7, 2024, Allegion’s board of directors declared a quarterly dividend of $0.48 per ordinary share of the company, an increase of 7% over the prior dividend. The dividend is payable March 29, 2024, to shareholders of record on March 15, 2024.

2024 Full-Year Outlook

The company expects full-year 2024 revenues to increase 1.5% to 3.5% on a reported basis and increase 1% to 3% organically, when compared to 2023, after excluding the expected impacts of acquisitions, divestitures and foreign currency movements.

Full-year 2024 reported EPS is expected to be in the range of $6.45 to $6.60, or $7.00 to $7.15 on an adjusted basis. The outlook assumes a headwind of approximately $0.37 based on a full-year adjusted effective tax rate of 18% to 19%, inclusive of the estimated impacts of global minimum tax.

Adjustments to 2024 EPS include estimated impacts of approximately $0.46 per share for acquisition-related amortization, as well as $0.09 per share for restructuring and M&A.

The outlook assumes an average diluted share count for the full year of approximately 88 million shares.

The company expects full-year available cash flow of approximately $540 to $570 million.

Conference Call Information

On Tuesday, Feb. 20, 2024, President and CEO John H. Stone and Senior Vice President and Chief Financial Officer Mike Wagnes will conduct a conference call for analysts and investors, beginning at 8 a.m. ET, to review the company's results.

A real-time, listen-only webcast of the conference call will be broadcast live online. Individuals wishing to listen may access the call through the company's website at https://investor.allegion.com.

###

About Allegion

Allegion (NYSE: ALLE) is a global pioneer in seamless access, with leading brands like CISA®, Interflex®, LCN®, Schlage®, SimonsVoss® and Von Duprin®. Focusing on security around the door and adjacent areas, Allegion secures people and assets with a range of solutions for homes, businesses, schools and institutions. Allegion had $3.7 billion in revenue in 2023, and its security products are sold around the world.

For more, visit www.allegion.com.

Non-GAAP Measures

This news release includes adjusted non-GAAP financial information which should be considered supplemental to, not a substitute for or superior to, the financial measure calculated in accordance with GAAP. The company presents operating income, operating margin, effective tax rate, net earnings and diluted earnings per share (EPS) on both a U.S. GAAP basis and on an adjusted (non-GAAP) basis, revenue growth on a U.S. GAAP basis and organic revenue growth on a non-GAAP basis, EBITDA, adjusted EBITDA and adjusted EBITDA margin (all non-GAAP measures) and Available Cash Flow (“ACF,” a non-GAAP measure), including in certain cases, on a segment basis. The company presents these non-GAAP measures because management believes these non-GAAP measures provide management and investors useful perspective of the company’s underlying business results and trends and a more comparable measure of period-over-period results. These measures are also used to evaluate senior management and are a factor in determining at-risk compensation. Investors should not consider non-GAAP measures as alternatives to the related U.S. GAAP measures. Further information about the adjusted non-GAAP financial tables is attached to this news release. The 2024 Full Year Outlook contains non-GAAP financial measures that exclude or otherwise have been adjusted for non-GAAP adjustment items from our U.S. GAAP financial statements. When we provide forward-looking outlooks for any of the various non-GAAP metrics described above, we do not provide reconciliations of the U.S. GAAP measures as we are unable to predict with a reasonable degree of certainty the actual impact of the non-GAAP adjustment items. By their very nature, non-GAAP adjustment items are difficult to anticipate with precision because they are generally associated with unexpected and unplanned events that impact our company and its financial results. Therefore, we are unable to provide a reconciliation of these measures without unreasonable efforts.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, including, but not limited to, statements under the headings “2024 Full-Year Outlook Highlights,” “2024 Full-Year Outlook” and statements regarding the company's 2024 and future financial performance, the company’s business plans and strategy, the company’s growth strategy, the company’s capital allocation strategy, the company’s ability to successfully complete and integrate acquisitions and achieve anticipated strategic and financial benefits and the performance of the markets in which the company operates. These forward-looking statements generally are identified by the words “believe,” “aim,” “project,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” or the negative thereof or variations thereon or similar expressions generally intended to identify forward-looking statements. Forward-looking statements may relate to such matters as projections of revenue, margins, expenses, tax rate and provisions, earnings, cash flows, benefit obligations, dividends, share purchases or other financial items; any statements of the plans, strategies and objectives of management for future operations, including those relating to any statements concerning expected development, performance or market share relating to our products and services; any statements regarding future economic conditions or our performance; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any

statements of assumptions underlying any of the foregoing. Undue reliance should not be placed on any forward-looking statements, as these statements are based on the company's currently available information and our current assumptions, expectations and projections about future events. They are subject to future events, risks and uncertainties - many of which are beyond the company’s control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward-looking statements. Important factors and other risks that may affect the company's business or that could cause actual results to differ materially are included in filings the company makes with the Securities and Exchange Commission from time to time, including its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q and in its other SEC filings. All forward-looking statements in this press release are expressly qualified by such cautionary statements and by reference to the underlying assumptions. The company undertakes no obligation to update these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Media Contact: Whitney Moorman – Director, Global Communications

317-810-3241

Whitney.Moorman@allegion.com

Analyst Contact: Jobi Coyle – Director, Investor Relations 317-810-3107

Jobi.Coyle@allegion.com

Source: Allegion plc

ALLEGION PLC

Condensed and Consolidated Income Statements

(In millions, except per share data)

UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net revenues | $ | 897.4 | | | $ | 861.5 | | | $ | 3,650.8 | | | $ | 3,271.9 | |

| Cost of goods sold | 512.1 | | | 510.8 | | | 2,069.3 | | | 1,949.5 | |

| Gross profit | 385.3 | | | 350.7 | | | 1,581.5 | | | 1,322.4 | |

| | | | | | | |

| Selling and administrative expenses | 218.1 | | | 191.3 | | | 865.6 | | | 736.0 | |

| Impairment of intangible assets | 7.5 | | | — | | | 7.5 | | | — | |

| | | | | | | |

| Operating income | 159.7 | | | 159.4 | | | 708.4 | | | 586.4 | |

| | | | | | | |

| Interest expense | 22.9 | | | 23.7 | | | 93.1 | | | 75.9 | |

| Loss on divestitures | — | | | — | | | — | | | 7.6 | |

| Other income, net | (0.1) | | | (4.5) | | | (1.9) | | | (11.6) | |

| Earnings before income taxes | 136.9 | | | 140.2 | | | 617.2 | | | 514.5 | |

| | | | | | | |

| Provision for income taxes | 18.3 | | | 4.8 | | | 76.6 | | | 56.2 | |

| Net earnings | 118.6 | | | 135.4 | | | 540.6 | | | 458.3 | |

| | | | | | | |

| Less: Net earnings attributable to noncontrolling interests | — | | | 0.1 | | | 0.2 | | | 0.3 | |

| | | | | | | |

| Net earnings attributable to Allegion plc | $ | 118.6 | | | $ | 135.3 | | | $ | 540.4 | | | $ | 458.0 | |

| | | | | | | |

| Basic earnings per ordinary share | | | | | | | |

| attributable to Allegion plc shareholders: | $ | 1.35 | | | $ | 1.54 | | | $ | 6.15 | | | $ | 5.20 | |

| | | | | | | |

| Diluted earnings per ordinary share | | | | | | | |

| attributable to Allegion plc shareholders: | $ | 1.34 | | | $ | 1.53 | | | $ | 6.12 | | | $ | 5.19 | |

| | | | | | | |

| Shares outstanding - basic | 87.8 | | | 87.9 | | | 87.9 | | | 88.0 | |

| Shares outstanding - diluted | 88.2 | | | 88.3 | | | 88.3 | | | 88.3 | |

ALLEGION PLC

Condensed and Consolidated Balance Sheets

(In millions)

UNAUDITED

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 468.1 | | | $ | 288.0 | |

| | | |

| Accounts and notes receivables, net | 412.8 | | | 395.6 | |

| Inventories | 438.5 | | | 479.0 | |

| Other current assets | 41.5 | | | 48.5 | |

| Assets held for sale | — | | | 3.5 | |

| Total current assets | 1,360.9 | | | 1,214.6 | |

| Property, plant and equipment, net | 358.1 | | | 308.7 | |

| Goodwill | 1,443.1 | | | 1,413.1 | |

| Intangible assets, net | 572.8 | | | 608.9 | |

| Other noncurrent assets | 576.6 | | | 445.9 | |

| Total assets | $ | 4,311.5 | | | $ | 3,991.2 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Accounts payable | $ | 259.2 | | | $ | 280.7 | |

| Accrued expenses and other current liabilities | 407.9 | | | 410.3 | |

| Short-term borrowings and current maturities of long-term debt | 412.6 | | | 12.6 | |

| | | |

| Total current liabilities | 1,079.7 | | | 703.6 | |

| Long-term debt | 1,602.4 | | | 2,081.9 | |

| Other noncurrent liabilities | 311.1 | | | 261.2 | |

| Equity | 1,318.3 | | | 944.5 | |

| Total liabilities and equity | $ | 4,311.5 | | | $ | 3,991.2 | |

ALLEGION PLC

Condensed and Consolidated Statements of Cash Flows

(In millions)

UNAUDITED

| | | | | | | | | | | |

| Year ended December 31, |

| 2023 | | 2022 |

| Operating Activities | | | |

| Net earnings | $ | 540.6 | | | $ | 458.3 | |

| Depreciation and amortization | 111.6 | | | 97.9 | |

| | | |

| | | |

| Changes in assets and liabilities and other non-cash items | (51.6) | | | (96.7) | |

| Net cash provided by operating activities | 600.6 | | | 459.5 | |

| | | |

| Investing Activities | | | |

| Capital expenditures | (84.2) | | | (64.0) | |

| Acquisition of and equity investments in businesses, net of cash acquired | (31.7) | | | (923.1) | |

| Other investing activities, net | (13.2) | | | (7.0) | |

| Net cash used in investing activities | (129.1) | | | (994.1) | |

| | | |

| Financing Activities | | | |

| Net (repayments on) proceeds from debt | (81.6) | | | 656.4 | |

| Debt financing costs | — | | | (10.2) | |

| Dividends paid to ordinary shareholders | (158.7) | | | (143.9) | |

| Repurchase of ordinary shares | (59.9) | | | (61.0) | |

| Other financing activities, net | 1.5 | | | (4.3) | |

| Net cash provided by (used in) financing activities | (298.7) | | | 437.0 | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 7.3 | | | (12.3) | |

| Net increase (decrease) in cash and cash equivalents | 180.1 | | | (109.9) | |

| Cash and cash equivalents - beginning of period | 288.0 | | | 397.9 | |

| Cash and cash equivalents - end of period | $ | 468.1 | | | $ | 288.0 | |

SUPPLEMENTAL SCHEDULES

SELECTED OPERATING SEGMENT INFORMATION

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net revenues | | | | | | | |

| Allegion Americas | $ | 704.6 | | | $ | 679.5 | | | $ | 2,913.6 | | | $ | 2,530.7 | |

| Allegion International | 192.8 | | | 182.0 | | | 737.2 | | | 741.2 | |

| Total net revenues | $ | 897.4 | | | $ | 861.5 | | | $ | 3,650.8 | | | $ | 3,271.9 | |

| | | | | | | |

| Operating income (expense) | | | | | | | |

| Allegion Americas | $ | 175.0 | | | $ | 156.8 | | | $ | 757.2 | | | $ | 611.2 | |

| Allegion International | 17.9 | | | 23.0 | | | 58.1 | | | 70.4 | |

| Corporate unallocated | (33.2) | | | (20.4) | | | (106.9) | | | (95.2) | |

| Total operating income | $ | 159.7 | | | $ | 159.4 | | | $ | 708.4 | | | $ | 586.4 | |

The Company presents operating income, operating margin, net earnings and diluted earnings per share (EPS) on both a U.S. GAAP basis and on an adjusted (non-GAAP) basis, revenue growth on a U.S. GAAP basis and organic revenue growth on a non-GAAP basis, and adjusted EBITDA and adjusted EBITDA margin (both non-GAAP measures). The Company presents these non-GAAP measures because management believes they provide useful perspective of the Company’s underlying business results and trends and a more comparable measure of period-over-period results. These measures are also used to evaluate senior management and are a factor in determining at-risk compensation. Investors should not consider non-GAAP measures as alternatives to the related U.S. GAAP measures.

The Company defines the presented non-GAAP measures as follows:

•Adjustments to operating income, operating margin, net earnings, EPS and EBITDA include items such as goodwill, indefinite-lived trade name and other asset impairment charges, restructuring charges, acquisition and integration costs, amortization of acquired intangible assets, debt financing costs, gains or losses related to the divestiture of businesses or equity method investments and non-operating investment gains or losses;

•Organic revenue growth is defined as U.S. GAAP revenue growth excluding the impact of acquisitions, divestitures and currency effects; and

•Available cash flow is defined as U.S. GAAP net cash from operating activities less capital expenditures.

These non-GAAP measures may not be defined and calculated the same as similar measures used by other companies.

RECONCILIATION OF GAAP TO NON-GAAP NET EARNINGS

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | Three Months Ended December 31, 2022 |

| Reported | | Adjustments | | Adjusted (non-GAAP) | | Reported | | Adjustments | | Adjusted (non-GAAP) |

| Net revenues | $ | 897.4 | | | $ | — | | | $ | 897.4 | | | $ | 861.5 | | | $ | — | | | $ | 861.5 | |

| | | | | | | | | | | |

| Operating income | 159.7 | | | 37.5 | | (1) | 197.2 | | | 159.4 | | | 19.3 | | (1) | 178.7 | |

| Operating margin | 17.8 | % | | | | 22.0 | % | | 18.5 | % | | | | 20.7 | % |

| | | | | | | | | | | |

| Earnings before income taxes | 136.9 | | | 40.7 | | (2) | 177.6 | | | 140.2 | | | 19.2 | | (2) | 159.4 | |

| Provision for income taxes | 18.3 | | | 10.8 | | (3) | 29.1 | | | 4.8 | | | 5.1 | | (3) | 9.9 | |

| Effective income tax rate | 13.4 | % | | | | 16.4 | % | | 3.4 | % | | | | 6.2 | % |

| Net earnings | 118.6 | | | 29.9 | | | 148.5 | | | 135.4 | | | 14.1 | | | 149.5 | |

| | | | | | | | | | | |

| Noncontrolling interests | — | | | — | | | — | | | 0.1 | | | — | | | 0.1 | |

| | | | | | | | | | | |

| Net earnings attributable to Allegion plc | $ | 118.6 | | | $ | 29.9 | | | $ | 148.5 | | | $ | 135.3 | | | $ | 14.1 | | | $ | 149.4 | |

| | | | | | | | | | | |

| Diluted earnings per ordinary share attributable to | | | | | | | | | | | |

| Allegion plc shareholders: | $ | 1.34 | | | $ | 0.34 | | | $ | 1.68 | | | $ | 1.53 | | | $ | 0.16 | | | $ | 1.69 | |

(1)Adjustments to operating income for the three months ended December 31, 2023, consist of $16.3 million of restructuring charges and acquisition and integration expenses, $13.7 million of amortization expense related to acquired intangible assets, and $7.5 million of impairment expense related to intangible assets. Adjustments to operating income for the three months ended December 31, 2022, consist of $3.4 million of restructuring charges and acquisition and integration expenses and $15.9 million of amortization expense related to acquired intangible assets and a fair value of inventory step-up.

(2)Adjustments to earnings before income taxes for the three months ended December 31, 2023, consist of the adjustments to operating income discussed above, as well as a $3.2 million non-operating investment loss. Adjustments to earnings before income taxes for the three months ended December 31, 2022, consist of the adjustments to operating income discussed above as well as a $0.1 million non-operating investment gain.

(3)Adjustments to the provision for income taxes for the three months ended December 31, 2023 and 2022, consist of $10.8 million and $5.1 million of tax expense, respectively, related to the excluded items discussed above.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2023 | | Year ended December 31, 2022 |

| Reported | | Adjustments | | Adjusted (non-GAAP) | | Reported | | Adjustments | | Adjusted (non-GAAP) |

| Net revenues | $ | 3,650.8 | | | $ | — | | | $ | 3,650.8 | | | $ | 3,271.9 | | | $ | — | | | $ | 3,271.9 | |

| | | | | | | | | | | |

| Operating income | 708.4 | | | 97.2 | | (1) | 805.6 | | | 586.4 | | | 85.6 | | (1) | 672.0 | |

| Operating margin | 19.4 | % | | | | 22.1 | % | | 17.9 | % | | | | 20.5 | % |

| | | | | | | | | | | |

| Earnings before income taxes | 617.2 | | | 100.4 | | (2) | 717.6 | | | 514.5 | | | 91.4 | | (2) | 605.9 | |

| Provision for income taxes | 76.6 | | | 25.9 | | (3) | 102.5 | | | 56.2 | | | 20.8 | | (3) | 77.0 | |

| Effective income tax rate | 12.4 | % | | | | 14.3 | % | | 10.9 | % | | | | 12.7 | % |

| Net earnings | 540.6 | | | 74.5 | | | 615.1 | | | 458.3 | | | 70.6 | | | 528.9 | |

| | | | | | | | | | | |

| Noncontrolling interests | 0.2 | | | — | | | 0.2 | | | 0.3 | | | — | | | 0.3 | |

| | | | | | | | | | | |

| Net earnings attributable to Allegion plc | $ | 540.4 | | | $ | 74.5 | | | $ | 614.9 | | | $ | 458.0 | | | $ | 70.6 | | | $ | 528.6 | |

| | | | | | | | | | | |

| Diluted earnings per ordinary share attributable to | | | | | | | | | | | |

| Allegion plc shareholders: | $ | 6.12 | | | $ | 0.84 | | | $ | 6.96 | | | $ | 5.19 | | | $ | 0.80 | | | $ | 5.99 | |

(1)Adjustments to operating income for the year ended December 31, 2023, consist of $33.8 million of restructuring charges and acquisition and integration expenses, $55.9 million of amortization expense related to acquired intangible assets and $7.5 million of impairment expense related to intangible assets. Adjustments to operating income for the year ended December 31, 2022, consist of $35.4 million of restructuring charges and acquisition and integration expenses and $50.2 million of amortization expense related to acquired intangible assets and a fair value of inventory step-up.

(2)Adjustments to earnings before income taxes for the year ended December 31, 2023, consist of the adjustments to operating income discussed above, as well as a $3.2 million non-operating investment loss. Adjustments to earnings before income taxes for the year ended December 31, 2022, as well as a $7.6 million loss on divestiture of a business and $4.3 million of debt financing costs, partially offset by $6.1 million in non-operating investment gains.

(3)Adjustments to the provision for income taxes for the year ended December 31, 2023 and 2022, consist of $25.9 million and $20.8 million of tax expense, respectively, related to the excluded items discussed above.

RECONCILIATION OF GAAP TO NON-GAAP REVENUE AND OPERATING INCOME BY REGION

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | Three Months Ended December 31, 2022 |

| As Reported | | Margin | | As Reported | | Margin |

| Allegion Americas | | | | | | | |

| Net revenues (GAAP) | $ | 704.6 | | | | | $ | 679.5 | | | |

| | | | | | | |

| Operating income (GAAP) | $ | 175.0 | | | 24.8 | % | | $ | 156.8 | | | 23.1 | % |

| Restructuring charges | 2.9 | | | 0.4 | % | | — | | | — | % |

| Acquisition and integration costs | 2.1 | | | 0.3 | % | | 2.1 | | | 0.3 | % |

| Amortization of acquired intangible assets | 8.4 | | | 1.2 | % | | 10.7 | | | 1.5 | % |

| Amortization of inventory step up | — | | | — | % | | 0.5 | | | 0.1 | % |

| Adjusted operating income | 188.4 | | | 26.7 | % | | 170.1 | | | 25.0 | % |

| Depreciation and amortization | 8.9 | | | 1.3 | % | | 8.1 | | | 1.1 | % |

| Adjusted EBITDA | $ | 197.3 | | | 28.0 | % | | $ | 178.2 | | | 26.1 | % |

| | | | | | | |

| Allegion International | | | | | | | |

| Net revenues (GAAP) | $ | 192.8 | | | | | $ | 182.0 | | | |

| | | | | | | |

| Operating income (loss) (GAAP) | $ | 17.9 | | | 9.3 | % | | $ | 23.0 | | | 12.6 | % |

| Restructuring charges | 1.2 | | | 0.6 | % | | 0.2 | | | 0.1 | % |

| Acquisition and integration costs | 0.4 | | | 0.2 | % | | 0.7 | | | 0.4 | % |

| Amortization of acquired intangible assets | 5.3 | | | 2.8 | % | | 4.7 | | | 2.6 | % |

| Impairment of intangible assets | 7.5 | | | 3.9 | % | | — | | | — | % |

| | | | | | | |

| Adjusted operating income | 32.3 | | | 16.8 | % | | 28.6 | | | 15.7 | % |

| Depreciation and amortization | 4.3 | | | 2.2 | % | | 4.2 | | | 2.3 | % |

| Adjusted EBITDA | $ | 36.6 | | | 19.0 | % | | $ | 32.8 | | | 18.0 | % |

| | | | | | | |

| Corporate | | | | | | | |

| Operating loss (GAAP) | $ | (33.2) | | | | | $ | (20.4) | | | |

| Restructuring charges | 1.0 | | | | | — | | | |

| Acquisition and integration costs | 8.7 | | | | | 0.4 | | | |

| Adjusted operating loss | (23.5) | | | | | (20.0) | | | |

| Depreciation and amortization | 0.1 | | | | | 0.7 | | | |

| Adjusted EBITDA | $ | (23.4) | | | | | $ | (19.3) | | | |

| | | | | | | |

| Total | | | | | | | |

| Net revenues | $ | 897.4 | | | | | $ | 861.5 | | | |

| | | | | | | |

| Adjusted operating income | $ | 197.2 | | | 22.0 | % | | $ | 178.7 | | | 20.7 | % |

| Depreciation and amortization | 13.3 | | | 1.5 | % | | 13.0 | | | 1.6 | % |

| Adjusted EBITDA | $ | 210.5 | | | 23.5 | % | | $ | 191.7 | | | 22.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2023 | | Year ended December 31, 2022 |

| As Reported | | Margin | | As Reported | | Margin |

| Allegion Americas | | | | | | | |

| Net revenues (GAAP) | $ | 2,913.6 | | | | | $ | 2,530.7 | | | |

| | | | | | | |

| Operating income (GAAP) | $ | 757.2 | | | 26.0 | % | | $ | 611.2 | | | 24.2 | % |

| Restructuring charges | 3.7 | | | 0.1 | % | | — | | | — | % |

| Acquisition and integration costs | 8.4 | | | 0.3 | % | | 8.0 | | | 0.3 | % |

| Amortization of acquired intangible assets | 33.7 | | | 1.1 | % | | 24.6 | | | 1.0 | % |

| Amortization of inventory step up | — | | | — | % | | 6.0 | | | 0.2 | % |

| Adjusted operating income | 803.0 | | | 27.5 | % | | 649.8 | | | 25.7 | % |

| Depreciation and amortization | 33.8 | | | 1.2 | % | | 30.7 | | | 1.2 | % |

| Adjusted EBITDA | $ | 836.8 | | | 28.7 | % | | $ | 680.5 | | | 26.9 | % |

| | | | | | | |

| Allegion International | | | | | | | |

| Net revenues (GAAP) | $ | 737.2 | | | | | $ | 741.2 | | | |

| | | | | | | |

| Operating income (loss) (GAAP) | 58.1 | | | 7.9 | % | | 70.4 | | | 9.5 | % |

| Restructuring charges | 8.0 | | | 1.1 | % | | 4.9 | | | 0.7 | % |

| Acquisition and integration costs | 0.8 | | | 0.1 | % | | 1.1 | | | 0.1 | % |

Amortization of acquired intangible assets | 22.2 | | | 3.0 | % | | 19.6 | | | 2.7 | % |

| Impairment of intangible assets | 7.5 | | | 1.0 | % | | — | | | — | % |

| | | | | | | |

| Adjusted operating income | 96.6 | | | 13.1 | % | | 96.0 | | | 13.0 | % |

| Depreciation and amortization | 17.8 | | | 2.4 | % | | 17.0 | | | 2.3 | % |

| Adjusted EBITDA | $ | 114.4 | | | 15.5 | % | | $ | 113.0 | | | 15.3 | % |

| | | | | | | |

| Corporate | | | | | | | |

| Operating loss (GAAP) | $ | (106.9) | | | | | $ | (95.2) | | | |

| Restructuring charges | 1.0 | | | | | — | | | |

| Acquisition and integration costs | 11.9 | | | | | 21.4 | | | |

| Adjusted operating loss | (94.0) | | | | | (73.8) | | | |

| Depreciation and amortization | 1.3 | | | | | 3.2 | | | |

| Adjusted EBITDA | $ | (92.7) | | | | | $ | (70.6) | | | |

| | | | | | | |

| Total | | | | | | | |

| Net revenues | $ | 3,650.8 | | | | | $ | 3,271.9 | | | |

| | | | | | | |

| Adjusted operating income | $ | 805.6 | | | 22.1 | % | | $ | 672.0 | | | 20.5 | % |

| Depreciation and amortization | 52.9 | | | 1.4 | % | | 50.9 | | | 1.6 | % |

| Adjusted EBITDA | $ | 858.5 | | | 23.5 | % | | $ | 722.9 | | | 22.1 | % |

RECONCILIATION OF CASH PROVIDED BY OPERATING ACTIVITIES TO AVAILABLE CASH FLOW AND NET EARNINGS TO ADJUSTED EBITDA

(In millions)

| | | | | | | | | | | |

| Year ended December 31, |

| 2023 | | 2022 |

| Net cash from operating activities | $ | 600.6 | | | $ | 459.5 | |

| Capital expenditures | (84.2) | | | (64.0) | |

| Available cash flow | $ | 516.4 | | | $ | 395.5 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net earnings (GAAP) | $ | 118.6 | | | $ | 135.4 | | | $ | 540.6 | | | $ | 458.3 | |

| Provision for income taxes | 18.3 | | | 4.8 | | | 76.6 | | | 56.2 | |

| Interest expense | 22.9 | | | 23.7 | | | 93.1 | | | 75.9 | |

| Amortization of acquired intangible assets | 13.7 | | | 15.4 | | | 55.9 | | | 44.2 | |

| Amortization of inventory step-up | — | | | 0.5 | | | — | | | 6.0 | |

| Depreciation and amortization of nonacquired intangible assets | 13.3 | | | 13.0 | | | 52.9 | | | 50.9 | |

| EBITDA | 186.8 | | | 192.8 | | | 819.1 | | | 691.5 | |

| | | | | | | |

| Other income, net | (0.1) | | | (4.5) | | | (1.9) | | | (11.6) | |

| | | | | | | |

| Impairment of intangible assets | 7.5 | | | — | | | 7.5 | | | — | |

| Loss on divestitures | — | | | — | | | — | | | 7.6 | |

| Acquisition and integration costs and restructuring charges | 16.3 | | | 3.4 | | | 33.8 | | | 35.4 | |

| Adjusted EBITDA | $ | 210.5 | | | $ | 191.7 | | | $ | 858.5 | | | $ | 722.9 | |

RECONCILIATION OF GAAP REVENUE GROWTH TO NON-GAAP ORGANIC REVENUE GROWTH BY SEGMENT

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Allegion Americas | | | | | | | |

| Revenue growth (GAAP) | 3.7 | % | | 37.5 | % | | 15.1 | % | | 23.5 | % |

| | | | | | | |

| | | | | | | |

| Acquisitions and divestitures | — | % | | (19.7) | % | | (7.9) | % | | (9.1) | % |

| Currency translation effects | — | % | | 0.5 | % | | 0.2 | % | | 0.2 | % |

| Organic growth (non-GAAP) | 3.7 | % | | 18.3 | % | | 7.4 | % | | 14.6 | % |

| | | | | | | |

| Allegion International | | | | | | | |

| Revenue growth (GAAP) | 5.9 | % | | (15.3) | % | | (0.5) | % | | (9.3) | % |

| | | | | | | |

| | | | | | | |

| Acquisitions and divestitures | (2.8) | % | | 1.1 | % | | (0.7) | % | | 0.3 | % |

| Currency translation effects | (4.4) | % | | 9.5 | % | | (1.3) | % | | 9.8 | % |

| Organic growth (non-GAAP) | (1.3) | % | | (4.7) | % | | (2.5) | % | | 0.8 | % |

| | | | | | | |

| Total | | | | | | | |

| Revenue growth (GAAP) | 4.2 | % | | 21.5 | % | | 11.6 | % | | 14.1 | % |

| | | | | | | |

| | | | | | | |

| Acquisitions and divestitures | (0.6) | % | | (13.4) | % | | (6.2) | % | | (6.4) | % |

| Currency translation effects | (1.0) | % | | 3.3 | % | | (0.2) | % | | 3.0 | % |

| Organic growth (non-GAAP) | 2.6 | % | | 11.4 | % | | 5.2 | % | | 10.7 | % |

v3.24.0.1

Cover Page

|

Feb. 20, 2024 |

| Entity Information |

|

| Entity Registrant Name |

Allegion plc

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 20, 2024

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-35971

|

| Entity Tax Identification Number |

98-1108930

|

| Entity Central Index Key |

0001579241

|

| Entity Address, Address Line One |

Block D

|

| Entity Address, Address Line Two |

Iveagh Court

|

| Entity Address, Address Line Three |

Harcourt Road

|

| Entity Address, City or Town |

Dublin 2

|

| Entity Address, Country |

IE

|

| Entity Address, Postal Zip Code |

D02 VH94

|

| Country Region |

353

|

| City Area Code |

1

|

| Local Phone Number |

2546200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Common Stock |

|

| Entity Information |

|

| Title of 12(b) Security |

Ordinary shares, par value $0.01 per share

|

| Trading Symbol |

ALLE

|

| Security Exchange Name |

NYSE

|

| Three Point Five Percent Senior Notes Due 2029 |

|

| Entity Information |

|

| Title of 12(b) Security |

3.500% Senior Notes due 2029

|

| Trading Symbol |

ALLE 3 ½

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=alle_ThreePointFivePercentSeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

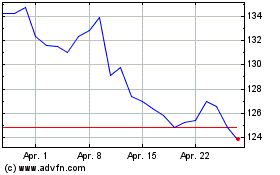

Allegion (NYSE:ALLE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Allegion (NYSE:ALLE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024