ALLETE shareholders approve proposed transaction with Canada Pension Plan Investment Board and Global Infrastructure Partners

21 August 2024 - 10:57PM

Business Wire

ALLETE continues to expect transaction to close

in mid-2025

ALLETE, Inc. (NYSE: ALE) announced that its shareholders voted

today to approve the company’s proposed transaction with Canada

Pension Plan Investment Board (CPP Investments) and Global

Infrastructure Partners (GIP) at a special meeting of

shareholders.

As previously announced, under the terms of the merger

agreement, CPP Investments and GIP will acquire all outstanding

common shares of ALLETE for $67 per share in cash, or $6.2 billion,

without interest.

“We thank our shareholders for this strong demonstration of

support for our transaction with CPP Investments and GIP, and for

their investment in ALLETE over the past decades,” said ALLETE

Chair, President, and CEO Bethany Owen. “Having reached this

important milestone, we are now one step closer to realizing the

meaningful benefits we see ahead for all ALLETE stakeholders as the

result of this partnership. We will continue to work closely with

our partners in the months ahead to complete this transaction and

enter our next chapter of growth for ALLETE, while continuing our

excellent customer service, commitments to our communities, and

opportunities for our employees."

Based on the preliminary vote count from today’s special

shareholder meeting, approximately 97% of votes cast were in favor

of the proposed transaction, representing approximately 74% of all

outstanding shares. The final voting results will be reported in a

Form 8-K filed with the U.S. Securities and Exchange

Commission.

Approval by ALLETE shareholders was a condition to the closing

of the transaction, which remains subject to certain regulatory

approvals, including by the Minnesota Public Utilities Commission,

the Public Service Commission of Wisconsin, and the Federal Energy

Regulatory Commission, and other customary closing conditions.

ALLETE expects to complete the transaction in mid-2025.

ALLETE, Inc. is an energy company headquartered in Duluth,

Minnesota. In addition to its electric utilities, Minnesota Power

and Superior Water, Light and Power of Wisconsin, ALLETE owns

ALLETE Clean Energy, based in Duluth, Minnesota; BNI Energy in

Bismarck, North Dakota; and New Energy Equity, headquartered in

Annapolis, Maryland; and has an 8% equity interest in the American

Transmission Co. More information about ALLETE is available at

www.allete.com. ALE-CORP

ALLETE calculates and reports carbon emissions based on the GHG

Protocol. Details are in ALLETE’s Corporate Sustainability

Report.

FORWARD-LOOKING STATEMENTS DISCLAIMER

This communication contains “forward-looking statements” within

the meaning of the federal securities laws, including safe harbor

provisions of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

statements regarding the proposed acquisition of ALLETE, regulatory

approvals, the expected timetable for completing the proposed

transaction and any other statements regarding ALLETE’s future

expectations, beliefs, plans, objectives, financial conditions,

assumptions or future events or performance that are not historical

facts. This information may involve risks and uncertainties that

could cause actual results to differ materially from such

forward-looking statements. These risks and uncertainties include,

but are not limited to: the timing to consummate the proposed

transaction; the risk that the conditions to closing of the

proposed transaction may not be satisfied; the risk that a

regulatory approval that may be required for the proposed

transaction is not obtained or is obtained subject to conditions

that are not anticipated; and the diversion of management’s time on

transaction-related issues.

When used in this communication, or any other documents, words

such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,”

“target,” “could,” “goal,” “intend,” “objective,” “plan,”

“project,” “seek,” “strategy,” “target,” “may,” “will” and similar

expressions are intended to identify forward-looking statements.

These forward-looking statements are based on the beliefs and

assumptions of management at the time that these statements were

prepared and are inherently uncertain. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in the forward-looking statements. These risks and uncertainties,

as well as other risks and uncertainties that could cause ALLETE’s

actual results to differ materially from those expressed in the

forward looking statements, are described in greater detail under

the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-Q for the

quarter ended June 30, 2024, ALLETE’s Form 10-K for the year ended

December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and

in any other SEC filings made by ALLETE. Management cautions

against putting undue reliance on forward-looking statements or

projecting any future results based on such statements or present

or prior earnings levels. Forward-looking statements speak only as

of the date hereof, and ALLETE does not undertake any obligation to

update or supplement any forward-looking statements to reflect

actual results, new information, future events, changes in its

expectations or other circumstances that exist after the date as of

which the forward-looking statements were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821839280/en/

Investor Contact: Vince Meyer Director - Investor Relations

& Treasury 218-723-3952 vmeyer@allete.com

Media Contact: Amy Rutledge Director - Corporate Communications

218-723-7400 arutledge@allete.com

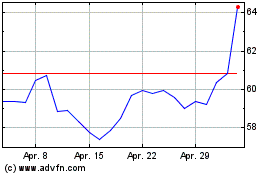

Allete (NYSE:ALE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Allete (NYSE:ALE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024