Strong market demand and solid operating performance

positions Algoma to exceed expectations in 2022

Algoma Central Corporation (TSX: ALC) ("Algoma", the "Company")

today reported its results for the three and nine months ended

September 30, 2022. Revenues increased 14% during the 2022 third

quarter to $199,327 compared to $174,734 for the same period in

2021 while net earnings increased 6% in the same period. The

Company reported 2022 third quarter EBITDA(1) of $73,604 compared

to $69,415 for the same period in 2021. All amounts reported below

are in thousands of Canadian dollars, except for per share data and

where the context dictates otherwise.

"Our strategic approach to maintain disciplined growth and a

strong vessel portfolio continues to serve us well," said Gregg

Ruhl, President and CEO of Algoma. "Driving our plan forward are

our hard working seafarers and shoreside support teams who continue

to deliver exceptional service to our customers and long-term value

for our shareholders. We had another busy quarter and I am pleased

to see the significant recovery of our tanker business and

continued strength in our international segments, particularly in

our joint ventures. As we are well into the fourth quarter, I am

confident Algoma will deliver full-year results beyond our earlier

expectations as we expect steady market demand and strong operating

performance across all business units to continue through to the

end of the year," concluded Mr. Ruhl.

Financial Highlights: Third Quarter 2022 Compared to

2021

- Net earnings increased 6% to $42,533 compared to $39,984 last

year. Basic earnings per share were $1.13 compared to $1.06.

- Global Short Sea Shipping segment equity earnings increased 60%

to $12,103 compared to $7,541 for the prior year driven by

increased earnings in the cement and handy-size fleets as well as

significant freight rate increases in the mini-bulker fleet that

nearly offset the reduced revenue from three less vessels in that

fleet. Earnings for the quarter include a $2,922 gain on the sale

of two vessels in 2022 compared to a gain of $2,720 on the sale of

two vessels in the same quarter in 2021.

- Revenue for Product Tankers increased 55% to $32,749 compared

to $21,186. This was mainly driven by higher fuel cost recoveries

and improved customer demand. The increase was also attributable to

the addition of one vessel to the fleet during the second quarter

that operates internationally under bareboat charter. Despite

higher operating costs, operating earnings increased 48% to $5,888

compared to $3,969 driven by a 32% increase in revenue days

primarily due to the increased demand.

- Ocean Self-Unloader segment revenue increased 21% to $49,927

compared to $41,221 driven by higher freight rates, fuel cost

recoveries and a 10% increase in Pool volumes. Operating earnings

decreased 24% to $7,856 compared to $10,366 in 2021 due to higher

operating costs and increased dry-dock expenditures.

- Domestic Dry-Bulk segment revenue increased 6% to $115,996

compared to $109,591, reflecting increased fuel recoveries and

improved overall base freight rates. Despite lower revenue days

during the 2022 third quarter, overall volumes were slightly higher

offsetting the impact of lower vessel utilization on two vessels.

Operating earnings decreased 7% to $30,453 compared to $32,795

driven primarily by higher layup and repair spending to activate

idled vessels in preparation for the fall grain harvest in

Canada.

Consolidated Statement of

Earnings

Three Months Ended

Nine Months Ended

For the periods ended September 30

2022

2021

2022

2021

(unaudited, in thousands of dollars,

except per share data)

Revenue

$

199,327

$

174,734

$

467,893

$

420,020

Operating expenses

(133,439

)

(106,449

)

(345,612

)

(289,050

)

Selling, general and administrative

(7,764

)

(7,374

)

(24,942

)

(23,190

)

Other operating items

—

402

—

(2,081

)

Depreciation and amortization

(17,361

)

(16,675

)

(51,106

)

(51,160

)

Operating earnings

40,763

44,638

46,233

54,539

Interest expense

(5,031

)

(5,299

)

(15,064

)

(15,547

)

Interest income

498

23

537

65

Gain on sale of property

147

10

14,519

1,596

Foreign currency gain

2,172

1,065

3,662

1,645

38,549

40,437

49,887

42,298

Income tax expense

(8,776

)

(7,953

)

(7,566

)

(5,963

)

Net earnings from investments in joint

ventures

12,760

7,500

27,686

13,547

Net earnings

$

42,533

$

39,984

$

70,007

$

49,882

Basic earnings per share

$

1.13

$

1.06

$

1.85

$

1.32

Diluted earnings per share

$

1.01

$

0.96

$

1.70

$

1.23

EBITDA(1)

The Company uses EBITDA as a measure of the cash generating

capacity of its businesses. The following table provides a

reconciliation of net earnings in accordance with GAAP to the

non-GAAP EBITDA measure for the three and nine months ended

September 30, 2022 and 2021 and presented herein:

EBITDA(1)

Three Months Ended

Nine Months Ended

For the periods ended September 30

2022

2021

2022

2021

Net earnings

$

42,533

$

39,984

$

70,007

$

49,882

Depreciation and amortization

21,872

20,009

66,419

62,396

Impairment

139

—

(2,643

)

—

Interest and taxes

14,504

13,697

25,002

23,399

Foreign exchange loss (gain)

(1,738

)

(1,080

)

(3,032

)

(1,897

)

Other operating item

—

(465

)

—

(3,495

)

Investment gain on distribution

(637

)

—

(637

)

—

Gain on sale of properties

(147

)

(10

)

(14,519

)

(1,596

)

Gain on sale of vessels

(2,922

)

(2,720

)

(7,702

)

(4,066

)

EBITDA

$

73,604

$

69,415

$

132,895

$

124,623

Select Financial Performance by

Business Segment

Three Months Ended

Nine Months Ended

For the periods ended September 30

2022

2021

2022

2021

Domestic Dry-Bulk

Revenue

$

115,996

$

109,591

$

239,872

$

230,999

Operating earnings

30,453

32,795

24,738

36,662

Product Tankers

Revenue

32,749

21,186

82,708

68,091

Operating earnings

5,888

3,969

8,012

9,014

Ocean Self-Unloaders

Revenue

49,927

41,221

140,540

113,722

Operating earnings

7,856

10,366

25,102

18,599

Corporate and Other

Revenue

655

2,736

4,773

7,208

Operating loss

(3,434

)

(2,492

)

(11,619

)

(9,736

)

The MD&A for the three and nine months ended September 30,

2022 and 2021 includes further details. Full results for the three

and nine months ended September 30, 2022 and 2021 can be found on

the Company’s website at www.algonet.com/investor-relations and on

SEDAR at www.sedar.com.

2022 Business Outlook(2)

Domestic dry-bulk cargo volumes are expected to be strong across

all commodities, driving full fleet utilization for the balance of

the year. The Western Canada grain crop size has returned to trend

line level which, combined with continued demand for Eastern export

capacity due to the Ukraine conflict, has allowed any open capacity

to be filled at prices reflecting the strong market conditions.

Product Tanker demand is expected to remain steady and we expect

the fleet will continue to be well utilized in the fourth

quarter.

Customer demand and vessel supply for the Ocean segment is

fairly well balanced for the remainder of the year. Aggregate

volumes are expected to be impacted by a facility closure in Mexico

and the US residential market is expected to slow down but overall

construction sector demand remains strong as infrastructure

investments are picking up. We are expecting costs to continue to

be impacted by inflation and global fuel prices will likely remain

higher than normal.

The solid charter rates earned by the mini-bulker fleet over the

first three quarters of 2022 are expected to continue throughout

the calendar year based on the joint venture's existing vessel

commitments and on our market outlook. This outlook could change if

global markets slow appreciably. The cement sector is expected to

remain steady for the remainder of the 2022 season and the two

additional handy-size bulk carriers, which entered the handy-size

fleet in May 2022, are expected to continue to make strong

contributions in the fourth quarter.

Normal Course Issuer Bid

Effective March 21, 2022, the Company renewed its normal course

issuer bid with the intention to purchase, through the facilities

of the TSX, up to 1,890,457 of its Common Shares ("Shares")

representing approximately 5% of the 37,800,943 Shares which were

issued and outstanding as at the close of business on March 9, 2022

(the “NCIB”). Under the current NCIB, no common shares have been

purchased or cancelled for the period ended September 30, 2022.

Cash Dividends

The Company's Board of Directors have authorized payment of a

quarterly dividend to shareholders of $0.17 per common share. The

dividend will be paid on December 1, 2022 to shareholders of record

on November 17, 2022.

Director Resignation

Paul Gurtler has resigned from the Company's Board of Directors,

effective September 30, 2022. Mr. Gurtler also served as a member

of the Environmental Health and Safety Committee and the Investment

Committee.

Notes

(1) Use of Non-GAAP Measures

The Company uses several financial measures to assess its

performance including earnings before interest, income taxes,

depreciation, and amortization (EBITDA), free cash flow, return on

equity, and adjusted performance measures. Some of these measures

are not calculated in accordance with Generally Accepted Accounting

Principles (GAAP), which are based on International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB), are not defined by GAAP, and do

not have standardized meanings that would ensure consistency and

comparability among companies using these measures. From

Management’s perspective, these non-GAAP measures are useful

measures of performance as they provide readers with a better

understanding of how management assesses performance. Further

information on Non-GAAP measures please refer to page 2 in the

Company's Management's Discussion and Analysis for the three and

nine months ended September 30, 2022.

(2) Forward Looking Statements

Algoma Central Corporation’s public communications often include

written or oral forward-looking statements. Statements of this type

are included in this document and may be included in other filings

with Canadian securities regulators or in other communications. All

such statements are made pursuant to the safe harbour provisions of

any applicable Canadian securities legislation. Forward-looking

statements may involve, but are not limited to, comments with

respect to our objectives and priorities for 2023 and beyond, our

strategies or future actions, our targets, expectations for our

financial condition or share price and the results of or outlook

for our operations or for the Canadian, U.S. and global economies.

The words "may", "will", "would", "should", "could", "expects",

"plans", "intends", "trends", "indications", "anticipates",

"believes", "estimates", "predicts", "likely" or "potential" or the

negative or other variations of these words or other comparable

words or phrases, are intended to identify forward-looking

statements.

By their nature, forward-looking statements require us to make

assumptions and are subject to inherent risks and uncertainties.

There is significant risk that predictions, forecasts, conclusions

or projections will not prove to be accurate, that our assumptions

may not be correct and that actual results may differ materially

from such predictions, forecasts, conclusions or projections. We

caution readers of this document not to place undue reliance on our

forward-looking statements as a number of factors could cause

actual future results, conditions, actions or events to differ

materially from the targets, expectations, estimates or intentions

expressed in the forward-looking statements.

Algoma owns and operates the largest fleet of dry and liquid

bulk carriers operating on the Great Lakes - St. Lawrence Seaway,

including self-unloading dry-bulk carriers, gearless dry-bulk

carriers and product tankers. Since 2010 we have introduced 10 new

build vessels to our domestic dry-bulk fleet, with two under

construction and expected to arrive in 2024, making us the

youngest, most efficient and environmentally sustainable fleet on

the Great Lakes. Each new vessel reduces carbon emissions on

average by 40% versus the ship replaced. Algoma also owns ocean

self-unloading dry-bulk vessels operating in international markets

and a 50% interest in NovaAlgoma, which owns and operates the

world's largest fleet of pneumatic cement carriers and a global

fleet of mini-bulk vessels serving regional markets. Algoma truly

is Your Marine Carrier of Choice™. For more information about

Algoma, visit the Company's website at www.algonet.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221107005265/en/

Gregg A. Ruhl President & CEO 905-687-7890

Peter D. Winkley E.V.P. & Chief Financial Officer

905-687-7897

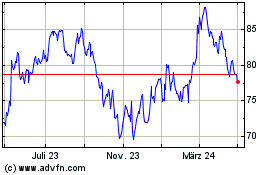

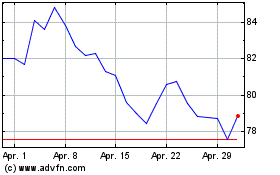

Alcon (NYSE:ALC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Alcon (NYSE:ALC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024