0000109563FALSE00001095632024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

October 24, 2024

Date of Report (date of earliest event reported)

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Ohio | 1-2299 | 34-0117420 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

One Applied Plaza | Cleveland | Ohio | 44115 |

(Address of Principal Executive Offices) | | (Zip Code) |

(216) 426-4000

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, without par value | AIT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On October 24, 2024, Applied Industrial Technologies, Inc. (“Applied”) issued a press release related to its earnings for the fiscal year 2025 first quarter ended September 30, 2024. The release is attached as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K, including the Exhibit, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| APPLIED INDUSTRIAL TECHNOLOGIES, INC. |

| (Registrant) |

| |

| |

| |

| By: /s/ Jon S. Ploetz |

| Jon S. Ploetz, Vice President-General Counsel & Secretary |

| Date: October 24, 2024 | |

EXHIBIT 99.1

Applied Industrial Technologies Reports Fiscal 2025 First Quarter Results

• Net Sales of $1.1 Billion Up 0.3% YoY; Down 3.0% on an Organic Daily Basis

• Net Income of $92.1 Million, or $2.36 Per Share Down 1.0% YoY

• EBITDA of $129.0 Million Down 3.3% YoY

• Operating Cash Flow of $127.7 Million; Free Cash Flow of $122.2 Million

• Increasing FY25 EPS Guidance to $9.25 to $10.00

• Reiterate FY25 Sales and EBITDA Margin Guidance

CLEVELAND, OHIO (October 24, 2024) – Applied Industrial Technologies (NYSE: AIT), a leading value-added distributor and technical solutions provider of industrial motion, fluid power, flow control, automation technologies, and related maintenance supplies, today reported results for its fiscal 2025 first quarter ended September 30, 2024.

Net sales for the quarter of $1.1 billion increased 0.3% over the prior year. The change includes a 2.0% increase from acquisitions and a 1.6% benefit from one extra selling day, partially offset by a negative 0.3% impact from foreign currency translation. Excluding these factors, sales decreased 3.0% on an organic daily basis reflecting a 1.4% decrease in the Service Center segment and a 6.1% decrease in the Engineered Solutions segment. The Company reported net income of $92.1 million, or $2.36 per share, and EBITDA of $129.0 million. On a pre-tax basis, results include $2.0 million ($0.04 after tax per share) of LIFO expense compared to $4.6 million ($0.09 after tax per share) of LIFO expense in the prior-year period.

Neil A. Schrimsher, Applied’s President & Chief Executive Officer, commented, “I’m encouraged by the start to fiscal 2025. While the demand backdrop remains mixed, first-quarter sales exceeded our expectations and strengthened during September. Positive trends are developing across our Engineered Solutions segment including stronger orders within our Automation operations and the technology sector, while Service Center segment sales held steady as the quarter progressed. As expected, margin trends were more modest against difficult comparisons, mix dynamics, and softer volumes early in the quarter. We remain prudent with cost measures but balanced considering firming demand the past couple of months, while protecting investments in key strategic growth initiatives during the quarter. Additionally, free cash flow nearly doubled over the prior year to record first quarter levels. Our cash flow growth potential remains significant as we continue to scale our differentiated industry position, benefit from working capital initiatives, and enhance our margin profile.”

Mr. Schrimsher added, “Looking ahead, we expect near-term sales to remain choppy as customers slowly reengage production and capital investments ahead of the upcoming U.S. Election and seasonally slower fall and winter months. Organic sales month to date in October are trending down by a mid single-digit percent year over year, though partially impacted by recent hurricane disruption in the Southeast. That said, we remain constructive on our setup with various self-help and secular tailwinds supporting above market growth and ongoing margin expansion. Combined with easing interest rates and easier comparisons, we see ongoing potential for stronger sales and earnings trends as the year progresses. Lastly, we expect greater capital deployment focused on growth investments including strategic bolt-on and mid-size acquisitions, as well as opportunistic share repurchases and dividend growth.”

Fiscal 2025 Guidance

Today, the Company is modestly increasing fiscal 2025 EPS guidance to a range of $9.25 to $10.00 (prior $9.20 to $9.95) to primarily reflect updated assumptions for Interest and Other Income following fiscal 2025 first quarter results. The Company is maintaining guidance for sales of down 2.5% to up 2.5% including down 4.0% to up 1.0% on an organic daily basis, as well as EBITDA margins of 12.1% to 12.3%. Guidance incorporates ongoing economic uncertainty and potential margin pressures reflecting expense deleveraging on muted sales trends, ongoing inflationary headwinds, and growth investments. Guidance does not assume contribution from future acquisitions or share buybacks.

Dividend

Today the Company also announced that its Board of Directors declared a quarterly cash dividend of $0.37 per common share, payable on November 29, 2024, to shareholders of record on November 15, 2024.

Conference Call Information

The Company will host a conference call at 10 a.m. ET today to discuss the quarter’s results and outlook. A live audio webcast and supplemental presentation can be accessed on our Investor Relations site at https://ir.applied.com. To join by telephone, dial 800-715-9871 (toll free) or 646-307-1963 using conference ID 3459273. Replays of the call will be available via webcast, as well as by telephone for one week by dialing 800-770-2030 (toll free) using conference ID 3459273.

About Applied®

Applied Industrial Technologies is a leading value-added distributor and technical solutions provider of industrial motion, fluid power, flow control, automation technologies, and related maintenance supplies. Our leading brands, specialized services, and comprehensive knowledge serve MRO (maintenance, repair, and operations) and OEM (original equipment manufacturing), and new system install applications in virtually all industrial markets through our multi-channel capabilities that provide choice, convenience, and expertise. For more information, visit www.applied.com.

This press release contains statements that are forward-looking, as that term is defined by the Securities and Exchange Commission in its rules, regulations and releases. Applied intends that such forward-looking statements be subject to the safe harbors created thereby. Forward-looking statements are often identified by qualifiers such as “expect,” “will,” “guidance,” “assume,” “optimistic,” “believe,” and derivative or similar expressions. All forward-looking statements are based on current expectations regarding important risk factors including trends and events in the industrial sector of the economy (such as the inflationary environment and supply chain strains), results of operations, and financial condition, and other risk factors identified in Applied's most recent periodic report and other filings made with the Securities and Exchange Commission. Accordingly, actual results may differ materially from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by Applied or any other person that the results expressed therein will be achieved. Applied assumes no obligation to update publicly or revise any forward-looking statements, whether due to new information, or events, or otherwise.

# # #

CONTACT INFORMATION

Ryan D. Cieslak

Director – Investor Relations & Treasury

216-426-4887 / rcieslak@applied.com

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| APPLIED INDUSTRIAL TECHNOLOGIES, INC. AND SUBSIDIARIES | |

| CONDENSED STATEMENTS OF CONSOLIDATED INCOME | |

| (Unaudited) | |

| (In thousands, except per share data) | |

| | | | | | | |

| | | | | | | | |

| Three Months Ended

September 30, |

| 2024 | 2023 |

| Net Sales | $ | 1,098,944 | | $ | 1,095,188 | |

| Cost of sales | 773,862 | | 770,106 | |

| Gross Profit | 325,082 | | 325,082 | |

| Selling, distribution and administrative expense, | | |

| including depreciation | 211,910 | | 204,402 | |

| Operating Income | 113,172 | | 120,680 | |

| Interest (income) expense, net | (627) | | 1,320 | |

| Other (income) expense, net | (2,281) | | 431 | |

| Income Before Income Taxes | 116,080 | | 118,929 | |

| Income tax expense | 24,017 | | 25,103 | |

| Net Income | $ | 92,063 | | $ | 93,826 | |

| Net Income Per Share - Basic | $ | 2.40 | | $ | 2.42 | |

| Net Income Per Share - Diluted | $ | 2.36 | | $ | 2.39 | |

| Average Shares Outstanding - Basic | 38,398 | | 38,700 | |

| Average Shares Outstanding - Diluted | 38,944 | | 39,310 | |

| | | | | | | | | | | | | | | | | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

1) Applied uses the last-in, first-out (LIFO) method of valuing U.S. inventory. An actual valuation of inventory under the LIFO method can only be made at the end of each year based on the inventory levels and costs at that time. Accordingly, interim LIFO calculations are based on management's estimates of expected year-end inventory levels and costs and are subject to the final year-end LIFO inventory determination.

| | | | | | | | | | | | | | | | | | | | |

| APPLIED INDUSTRIAL TECHNOLOGIES, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| (In thousands) |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | September 30, | | June 30, |

| | | | 2024 | | 2024 |

| | | | | | |

| Assets | | | | | | |

| Cash and cash equivalents | | $ | 538,520 | | | $ | 460,617 | |

| Accounts receivable, net | | 691,512 | | | 724,878 | |

| Inventories | | | 497,568 | | | 488,258 | |

| Other current assets | | | 81,950 | | | 96,148 | |

| Total current assets | | 1,809,550 | | | 1,769,901 | |

| Property, net | | | 119,061 | | | 118,527 | |

| Operating lease assets, net | | 145,043 | | | 133,289 | |

| Intangibles, net | | | 242,744 | | | 245,870 | |

| Goodwill | | | | 624,217 | | | 619,395 | |

| Other assets | | | 62,596 | | | 64,928 | |

| Total Assets | | | $ | 3,003,211 | | | $ | 2,951,910 | |

| | | | | | |

| Liabilities | | | | | | |

| Accounts payable | | | $ | 265,136 | | | $ | 266,949 | |

| Current portion of long-term debt | | 25,003 | | | 25,055 | |

| Other accrued liabilities | | 188,161 | | | 209,096 | |

| Total current liabilities | | 478,300 | | | 501,100 | |

| Long-term debt | | | 572,288 | | | 572,279 | |

| Other liabilities | | | 200,546 | | | 189,750 | |

| Total Liabilities | | | 1,251,134 | | | 1,263,129 | |

| Shareholders' Equity | | 1,752,077 | | | 1,688,781 | |

| Total Liabilities and Shareholders' Equity | $ | 3,003,211 | | | $ | 2,951,910 | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| APPLIED INDUSTRIAL TECHNOLOGIES, INC. AND SUBSIDIARIES |

| CONDENSED STATEMENTS OF CONSOLIDATED CASH FLOWS |

| (Unaudited) |

| (In thousands) |

| | | | | | | | | | | | | | |

| | Three Months Ended

September 30, |

| |

| | 2024 | | 2023 |

| | | | |

| Cash Flows from Operating Activities | | | | |

| Net income | | $ | 92,063 | | | $ | 93,826 | |

| Adjustments to reconcile net income to net cash provided | | | | |

| by operating activities: | | | | |

| Depreciation and amortization of property | | 5,924 | | | 5,717 | |

| Amortization of intangibles | | 7,600 | | | 7,393 | |

| Provision for losses on accounts receivable | | 1,056 | | | 867 | |

| Amortization of stock appreciation rights and options | | 1,326 | | | 844 | |

| Other share-based compensation expense | | 1,675 | | | 1,976 | |

| Changes in assets and liabilities, net of acquisitions | | 16,587 | | | (45,245) | |

| Other, net | | 1,516 | | | 831 | |

| Net Cash provided by Operating Activities | | 127,747 | | | 66,209 | |

| Cash Flows from Investing Activities | | | | |

| Acquisition of businesses, net of cash acquired | | (10,498) | | | (21,440) | |

| Capital expenditures | | (5,549) | | | (4,340) | |

| Proceeds from property sales | | 831 | | | 123 | |

| Net Cash used in Investing Activities | | (15,216) | | | (25,657) | |

| Cash Flows from Financing Activities | | | | |

| Long-term debt repayments | | (63) | | | (62) | |

| Interest rate swap settlement receipts | | 3,738 | | | 3,558 | |

| Purchases of treasury shares | | (9,980) | | | — | |

| Dividends paid | | (14,218) | | | (13,551) | |

| Acquisition holdback payments | | (1,210) | | | (562) | |

| Taxes paid for shares withheld for equity awards | | (12,314) | | | (11,866) | |

| Net Cash used in Financing Activities | | (34,047) | | | (22,483) | |

| Effect of Exchange Rate Changes on Cash | | (581) | | | (1,690) | |

| Increase in cash and cash equivalents | | 77,903 | | | 16,379 | |

| Cash and Cash Equivalents at Beginning of Period | | 460,617 | | | 344,036 | |

| Cash and Cash Equivalents at End of Period | | $ | 538,520 | | | $ | 360,415 | |

| | | | | | | | | | | | | | |

| APPLIED INDUSTRIAL TECHNOLOGIES, INC. AND SUBSIDIARIES |

| SUPPLEMENTAL INFORMATION |

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES |

| (Unaudited) |

| (In thousands) |

| | | | | | | | | | | | | | |

| The Company supplemented the reporting of financial information determined under U.S. generally accepted accounting principles (GAAP) with reporting of non-GAAP financial measures. The Company believes that these non-GAAP measures provide meaningful information to assist shareholders in understanding financial results, assessing prospects for future performance, and provide a better baseline for analyzing trends in our underlying businesses. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures having the same or similar names. These non-GAAP financial measures should not be considered in isolation or as a substitute for reported results. These non-GAAP financial measures reflect an additional way of viewing aspects of operations that, when viewed with GAAP results, provide a more complete understanding of the business. The Company strongly encourages investors and shareholders to review company financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. |

|

|

|

| | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income, a GAAP financial measure, to EBITDA, a non-GAAP financial measure: |

| | | | | | | | | | | | | | |

| | | | |

| Three Months Ended September 30, | | |

| 2024 | 2023 | | |

| Net income | $ | 92,063 | | $ | 93,826 | | | |

| Interest (income) expense, net | (627) | | 1,320 | | | |

| Income tax expense | 24,017 | | 25,103 | | | |

| Depreciation and amortization of property | 5,924 | | 5,717 | | | |

| Amortization of intangibles | 7,600 | | 7,393 | | | |

| EBITDA | $ | 128,977 | | $ | 133,359 | | | |

| | | | |

| The Company defines EBITDA as Earnings from operations before Interest, Taxes, Depreciation, and Amortization, a non-GAAP financial measure. EBITDA excludes items that may not be indicative of core operating results. |

| | | | |

| Reconciliation of Net Cash provided by Operating activities, a GAAP financial measure, to Free Cash Flow, a non-GAAP financial measure: |

| Three Months Ended

September 30, | | |

| 2024 | 2023 | | |

| Net Cash provided by Operating Activities | $ | 127,747 | | $ | 66,209 | | | |

| Capital expenditures | (5,549) | | (4,340) | | | |

| Free Cash Flow | $ | 122,198 | | $ | 61,869 | | | |

| | | | |

| Free cash flow is defined as net cash provided by operating activities less capital expenditures, a non-GAAP financial measure. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

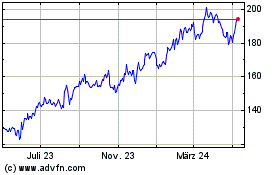

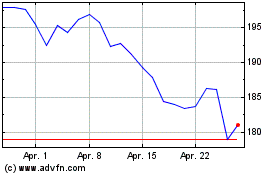

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024