Form 425 - Prospectuses and communications, business combinations

30 Juni 2023 - 6:42PM

Edgar (US Regulatory)

Filed by Aegon N.V.

Pursuant to Rule 425 Under the Securities Act of 1933

Subject Company: Aegon N.V.

Commission File No.: 1-10882

Board report of Aegon N.V.

With respect to the draft terms of the cross-border conversion of Aegon N.V. into Aegon S.A. for shareholders and employees

The Hague, 30 June, 2023

1 / 10

THE UNDERSIGNED:

together constituting the entire executive board of Aegon N.V., a public limited liability company (naamloze vennootschap) under the laws of the

Netherlands, with corporate seat in The Hague, the Netherlands, and address at Aegonplein 50, 2591 TV, The Hague, the Netherlands and registered with the Dutch Trade Register under number: 27076669 (“Aegon N.V.”),

WHEREAS:

| (A) |

Aegon N.V. intends to convert into Aegon S.A., a public limited liability company (société

anonyme), governed by the laws of the Grand Duchy of Luxembourg, with registered office in the City of Luxembourg, the Grand Duchy of Luxembourg (“Aegon S.A.”) whereby Aegon will retain its legal personality, will continue to exist

and all assets and liabilities, rights, obligations and other legal relationships of Aegon N.V. will remain with Aegon S.A. (the “Luxembourg Conversion”). |

| (B) |

This Board Report has been prepared by Aegon N.V.’s Executive Board. |

| (C) |

This Board Report will be made available (i) on the Aegon Corporate Website (www.aegon.com) and

(ii) for inspection by persons eligible under Dutch law at the offices of Aegon. |

HEREBY DECLARE THE FOLLOWING:

| 1.1 |

This Board Report must be read in conjunction with the draft terms of the Luxembourg Conversion, dated

30 June 2023 (the “Conversion Proposal’’). |

| 1.2 |

Any capitalized term, including those used in the preamble of this Board Report, has the meaning as

ascribed to it in Clause 7. |

| 1.3 |

Unless the context requires otherwise, a reference in this Board Report to a Clause is to the relevant

Clause of this Board Report. |

| 1.4 |

Any reference in this Board Report to any gender includes all genders and

non-binary individuals, and words importing the singular include the plural and vice versa. |

| 1.5 |

Headings of Clauses are for convenience only and do not affect the interpretation of this Board

Report. |

2 / 10

| 2.1 |

Subject to the terms and conditions of this Board Report and the Conversion Proposal, Aegon N.V. shall

convert into Aegon S.A., whereby Aegon will retain its legal personality and will continue to exist. All assets and liabilities, rights, obligations and other legal relationships of Aegon N.V. will remain with Aegon. |

| 2.2 |

The Luxembourg Conversion will be effective at the Luxembourg Conversion Effective Time.

|

| 3 |

REASONS FOR THE LUXEMBOURG CONVERSION |

| 3.1 |

As a result of the Transaction, the Aegon Group will no longer have a regulated insurance business in

the Netherlands. Under the Solvency II Regime, Aegon’s current supervisor, the DNB, can therefore no longer remain Aegon’s group supervisor. After consulting the members of the college of supervisors, the BMA has informed Aegon that the

BMA will become its group supervisor if Aegon were to transfer its legal seat to Bermuda. |

| 3.2 |

Bermuda hosts many respected international insurance companies, including three of Aegon’s

subsidiaries. Bermuda’s regulatory regime is well recognized, having been granted equivalent status by the EU under the Solvency II Regime, and by the UK under its own Solvency UK regime. It has also been designated as a qualified jurisdiction

and reciprocal jurisdiction by the NAIC. This enables insurance companies that are regulated by the BMA to easily conduct cross-border business. Aegon’s regulated insurance entities in the US, UK, Spain, Portugal and in other jurisdictions will

continue to be supervised by their current local regulators. In addition, Aegon’s asset management activities in the Netherlands will continue to be supervised by the AFM and the DNB. |

| 3.3 |

The change of legal domicile to Bermuda allows for continued application of the IFRS framework. In

addition to the IFRS framework, Aegon explores the implementation of the US GAAP accounting framework in the medium term to allow for better comparison against US peers and provide long-term strategic flexibility for the Aegon Group. In

addition, a change in legal domicile to Bermuda allows Aegon to maintain its headquarters in the Netherlands and remain a Dutch tax resident. Finally, Bermuda is a well-known location for insurance companies, including three of Aegon’s

subsidiaries, and has a well-developed corporate law system that fits Aegon’s intended governance, based on international governance standards, going forward. |

| 3.4 |

Dutch law currently does not facilitate a direct change of legal domicile of a Dutch public limited

liability company (such as Aegon N.V.,) to a jurisdiction outside the EEA. Therefore, Aegon as a practical matter intends to first change its legal domicile to Luxembourg, which is a jurisdiction within the EEA that does facilitate a change of legal

domicile to a jurisdiction outside the EEA and shortly thereafter change its legal domicile to Bermuda. |

3 / 10

| 4 |

CONSEQUENCES OF THE LUXEMBOURG CONVERSION |

Activities

| 4.1 |

It is intended that no changes will be made to the activities of Aegon N.V. as a holding company as a

result of the Luxembourg Conversion, it being understood that Aegon S.A. will subsequently be converted into Aegon Ltd. |

Legal consequences

| 4.2 |

The Luxembourg Conversion will, inter alia, have the following consequences:

|

| |

(a) |

Aegon will retain its legal personality without interruption and will continue to exist as a Luxembourg company

(a Luxembourg société anonyme) governed by the laws of Luxembourg throughout the Luxembourg Conversion; |

| |

(b) |

all assets and liabilities, rights, obligations and other legal relationships of Aegon N.V. will remain with

Aegon S.A. and Aegon N.V. will not be liquidated in the process; and |

| |

(c) |

Aegon N.V. Shares will automatically be converted into Aegon S.A. Shares and the Shares will at all times

continue to be outstanding without interruption and remain listed on Euronext Amsterdam and NYSE throughout the Luxembourg Conversion process. |

| 4.3 |

Contracts concluded with Aegon N.V. will remain in force unchanged following the Luxembourg Conversion

(unless provided otherwise in accordance with their existing terms), it being understood that Aegon S.A. will be converted into Aegon Ltd. |

Economic consequences

| 4.4 |

The Luxembourg Conversion and subsequent Bermuda Conversion will result in Aegon continuing as a Bermuda

Ltd. The economic aspects of the Luxembourg Conversion have been set out above in Clause 3. |

Social consequences

| 4.5 |

From a social point of view the Luxembourg Conversion has no consequence since Aegon has no employees.

|

4 / 10

| 5 |

CONSEQUENCES OF THE LUXEMBOURG CONVERSION FOR SHAREHOLDERS |

| 5.1 |

The table attached as Schedule 1 (Comparison of governance of Aegon N.V. and Aegon S.A.)

summarizes the key elements of the current governance of Aegon N.V. and the governance of Aegon S.A. following the Luxembourg Conversion and as such reflects the consequences of the Luxembourg Conversion for Shareholders. The summary as set forth

herein is qualified in its entirety by reference to the full text of the Articles of Association of Aegon S.A.. The Articles of Association of Aegon S.A. do not reflect the final governance of Aegon after completion of the Redomiciliation; the

post-Redomiciliation governance applicable to Aegon Ltd. will be reflected in the Bye-Laws. |

| 5.2 |

For information purposes only, the table attached as Schedule 1 (Comparison of governance of Aegon

N.V. and Aegon S.A.) also summarizes the main elements of the proposed governance of Aegon Ltd. following the Bermuda Conversion and the Redomiciliation as a whole. The Aegon Ltd. column does not form part of the Luxembourg Conversion and its

terms and conditions and Aegon refers to the Shareholder Circular which will be published upon convocation of the Dutch EGM for a more comprehensive comparison of the Aegon N.V. and Aegon Ltd. governance. |

| 6 |

CONSEQUENCES OF THE LUXEMBOURG CONVERSION FOR EMPLOYEES |

| 6.1 |

The Luxembourg Conversion has no impact on employment relations of Aegon since Aegon has no employees.

|

| 6.2 |

The Luxembourg Conversion does not cause any material changes in the applicable terms and conditions of

employment or places of business of Aegon. |

| 6.3 |

The Luxembourg Conversion has no impact on employment relations in the Aegon Group and the Luxembourg

Conversion does not cause any material changes in the applicable terms and conditions of employment or places of business of the Aegon Group. |

5 / 10

|

|

|

|

|

|

|

|

|

|

“Aegon” |

|

means Aegon N.V. until the Luxembourg Conversion Effective Time and (i) after the Luxembourg Conversion Effective Time and before the Bermuda Conversion Effective Time, Aegon S.A., and (ii) after the Bermuda Conversion

Effective Time, Aegon Ltd. |

|

|

|

|

|

“Aegon Corporate Website” |

|

means the corporate website of Aegon, accessible through www.aegon.com |

|

|

|

|

|

“Aegon Group” |

|

means Aegon together with its subsidiaries |

|

|

|

|

|

“Aegon Ltd.” |

|

means Aegon Ltd., a Bermuda Ltd. |

|

|

|

|

|

“Aegon Ltd. Common Share” |

|

means a common share in the share capital of Aegon Ltd. |

|

|

|

|

|

“Aegon Ltd. Common Share B” |

|

means a common share B in the share capital of Aegon Ltd. |

|

|

|

|

|

“Aegon Ltd. Share” |

|

means a share in the share capital of Aegon Ltd. |

|

|

|

|

|

“Aegon NL Business” |

|

means Aegon’s business operations in the Netherlands as will be transferred pursuant to the Business Combination Agreement |

|

|

|

|

|

“Aegon N.V.” |

|

means Aegon N.V., a Dutch public limited liability company |

|

|

|

|

|

“Aegon N.V. Common Share” |

|

means a common share in the share capital of Aegon N.V. |

|

|

|

|

|

“Aegon N.V. Common Share B” |

|

means a common share B in the share capital of Aegon N.V. |

|

|

|

|

|

“Aegon N.V. Share” |

|

means a share in the share capital of Aegon N.V. |

|

|

|

|

|

“Aegon S.A.” |

|

means Aegon S.A., a Luxembourg public limited liability company (société anonyme) |

|

|

|

|

|

“Aegon S.A. Share” |

|

means a share in the share capital of Aegon S.A. |

|

|

|

|

|

“AFM” |

|

means the Dutch Authority for the Financial Markets |

|

|

|

|

|

“Articles of Association” |

|

means the articles of association of Aegon N.V., as they will read from time to time, and following the Luxembourg Conversion Effective Time, the articles of association of Aegon S.A. |

|

|

|

|

|

“a.s.r.” |

|

means ASR Nederland N.V. |

6 / 10

|

|

|

|

|

|

|

“Bermuda Conversion” |

|

means the cross-border conversion of Aegon S.A. into Aegon Ltd. |

|

|

|

|

|

“Bermuda Conversion Effective Time” |

|

means the moment the Bermuda Conversion takes effect |

|

|

|

|

|

“Bermuda Ltd.” |

|

means an exempted company with liability limited by shares incorporated pursuant to the Companies Act 1981 of Bermuda |

|

|

|

|

|

“BMA” |

|

means the Bermuda Monetary Authority |

|

|

|

|

|

“Board Report” |

|

means this report prepared by the Executive Board, in respect of the Conversion Proposal |

|

|

|

|

|

“Business Combination Agreement” |

|

means the business combination agreement agreed between Aegon and a.s.r. on October 27, 2022 |

|

|

|

|

|

“Bye-Laws” |

|

means the bye-laws of Aegon Ltd. as they will read upon completion of the Redomiciliation |

|

|

|

|

|

“Conversion Proposal” |

|

has the meaning ascribed to it in the preamble of this document |

|

|

|

|

|

“DNB” |

|

means the Dutch Central Bank |

|

|

|

|

|

“Dutch EGM” |

|

means the extraordinary general meeting of Aegon N.V., regarding the Luxembourg Conversion |

|

|

|

|

|

“Dutch Trade Register” |

|

means the Dutch trade register (handelsregister) |

|

|

|

|

|

“EEA” |

|

means the European Economic Area |

|

|

|

|

|

“Euronext Amsterdam” |

|

means the regulated market of Euronext Amsterdam N.V. |

|

|

|

|

|

“Executive Board” |

|

means Aegon N.V.’s executive board |

|

|

|

|

|

“General Meeting” |

|

means the general meeting of Aegon |

7 / 10

|

|

|

|

|

|

|

“Luxembourg Conversion” |

|

has the meaning as set out in Recital (A) |

|

|

|

|

|

“Luxembourg Conversion Effective Time” |

|

means the moment the Luxembourg Conversion takes effect |

|

|

|

|

|

“NAIC” |

|

means the US National Association of Insurance Commissioners |

|

|

|

|

|

“NYSE” |

|

means the New York Stock Exchange |

|

|

|

|

|

“Redomiciliation” |

|

means the change in legal domicile of Aegon by means of the cross-border conversion of Aegon N.V. into Aegon S.A. and the subsequent cross- border conversion of Aegon S.A. into Aegon Ltd. |

|

|

|

|

|

“Schedule” |

|

means a schedule to this Board Report |

|

|

|

|

|

“Share” |

|

means a share in the share capital of Aegon |

|

|

|

|

|

“Shareholder” |

|

means a shareholder of Aegon |

|

|

|

|

|

“Shareholder Circular” |

|

means the shareholder circular relating to the Redomiciliation to be published on the Aegon Corporate Website together with the convening notice and agenda for the Dutch EGM |

|

|

|

|

|

“Solvency II Regime” |

|

means the Solvency II Directive and Delegated Regulation as well as implementing standards and guidelines |

|

|

|

|

|

“Transaction” |

|

means the proposed sale of the Aegon NL business to be combined with a.s.r.’s business operations in the Netherlands, in return for (i) a cash consideration of EUR 2.5 billion, subject to a downward adjustment of

approximately EUR 0.3 billion in relation to a.s.r.’s share issuance of October 28, 2022 and to certain other adjustments and (ii) a 29.99% shareholding in a.s.r. |

8 / 10

The following document is attached to this Board Report:

| |

(a) |

Schedule 1: comparison of governance of Aegon N.V. and Aegon S.A. |

9 / 10

THIS BOARD REPORT HAS BEEN SIGNED ON THE DATE

STATED AT THE BEGINNING OF THIS BOARD REPORT BY:

The executive board of AEGON N.V.

|

|

|

|

|

| /S/ E. Friese |

|

|

|

/S/ M.J. Rider |

| Name: E. Friese |

|

|

|

Name: M.J. Rider |

| Capacity: CEO |

|

|

|

Capacity: CFO |

10 / 10

| Schedule 1 |

Comparison of governance of Aegon N.V. and Aegon S.A. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

1 / 22 |

|

|

|

|

|

|

| Aegon N.V. |

|

Aegon S.A. |

|

Aegon Ltd. |

| Authorized share capital |

|

|

|

| The authorized share capital of Aegon N.V. is included in the Articles of Association and consists of: |

|

The authorized share capital of Aegon S.A. is included in the Articles of Association and consists of: |

|

The authorized share capital of Aegon Ltd. is included in the Memorandum of Association and consists of: |

|

|

|

| • 6,000,000,000 common shares; and |

|

• 4,000,000,000 common shares; and |

|

• 4,000,000,000 common shares; and |

|

|

|

| • 3,000,000,000 common shares B, |

|

• 2,000,000,000 common shares B, |

|

• 2,000,000,000 common shares B, |

|

|

|

| each with a nominal value of EUR 0.12. |

|

each with a nominal value of EUR 0.12. |

|

each with a par value of EUR 0.12. |

|

|

|

| The Aegon N.V. Common Shares B profit rights are one fortieth (1/40th) of the Aegon N.V. Common Shares. Both the Aegon N.V. Common Shares and the Aegon N.V. Common Shares B have

one vote per share. |

|

The Aegon S.A. Common Shares B profit rights are (1/40th) of the Aegon S.A. Common Shares. Both the Aegon S.A. Common Shares and the Aegon S.A. Common Shares B have one vote per

share. |

|

The Aegon Ltd. Common Shares B profit rights are one fortieth (1/40th) of the Aegon Ltd. Common Shares. Both the Aegon Ltd. Common Shares and the Aegon Ltd. Common Shares B have

one vote per share. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

2 / 22 |

|

|

|

|

|

|

| Issue of shares |

|

|

|

| Upon proposal of the Executive Board, which proposal has been approved by the Supervisory Board, the General Meeting may issue Aegon N.V.

Shares and grant rights to acquire Aegon N.V. Shares and may also authorize the Executive Board to do so. An Executive Board resolution to issue Aegon N.V. Shares or to grant rights to acquire Aegon N.V. Shares is subject to Supervisory Board

approval. Aegon N.V. Shares may be issued up to the amount of the authorized share capital.

A resolution to issue Aegon N.V. Common Shares B requires the approval of the meeting of holders of Aegon N.V. Common Shares B.

Currently, the Executive Board is typically authorized by the General Meeting on an

annual basis to, subject to the prior approval of the Supervisory Board, issue Aegon N.V. Common Shares or grant rights to acquire Aegon N.V. Common Shares (i) up to 10% of the issued share capital and (ii) up to 25% of the issued share

capital in connection with a rights issue. |

|

The General Meeting may resolve to reduce the issued share capital which requires a two-thirds

majority and requires no less than half of the issued share capital to be represented at the meeting. If this quorum is not reached, a second General Meeting shall be convened.

During a period of eighteen (18) months as from the effectiveness of the articles

of association, the Board is authorised to issue Shares, to grant options to subscribe for Shares and to issue any other instruments giving access to Shares within the limits of the authorised capital.

The issuance of Aegon S.A. Common Shares B requires the prior approval of the meeting of

holders of Aegon S.A. Common Shares B. |

|

The Board is authorized to issue Aegon Ltd. Shares for a nominal amount of less than 10% of Aegon Ltd.’s issued share capital. Any

issuance of Aegon Ltd. Shares for a nominal amount of 10% or more of Aegon Ltd.’s issued share capital requires the approval of the General Meeting, unless (i) the Board determines that the issuance of Aegon Ltd. Shares is necessary or

conducive for purposes of safeguarding, conserving or strengthening the capital position of Aegon Ltd or (ii) such Aegon Ltd. Shares are issued to a person exercising a previously granted right to subscribe for shares.

Aegon Ltd. Shares may be issued up to the amount of the authorized share capital.

The issuance of Aegon Ltd. Common Shares B requires the prior approval of the meeting of

holders of Aegon Ltd. Common Shares B. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

3 / 22 |

|

|

|

|

|

| Pre-emptive rights |

|

|

|

| Under Dutch law and the Articles of Association, Shareholders have mandatory pre-emptive rights with

respect to the issuance of Aegon N.V. Shares of the same class. Upon proposal of the

Executive Board, which proposal has been approved by the Supervisory Board, the General Meeting may limit/exclude pre-emptive rights and may also authorize the Executive Board to do so. The resolution of the

General Meeting requires a majority of not less than two-thirds of the votes cast if less than one- half of the issued share capital is represented at the meeting. |

|

Under Luxembourg law and the Articles of Association, Shareholders have preferential subscription rights with respect to the issuance of

Aegon N.V. Shares of the same class. During a period of eighteen (18) months as

from the effectiveness of the articles of association, the Board is authorised to limit or cancel the preferential subscription right of existing shareholders in the context of the authorised share capital of the company. |

|

Under Bermuda law, a holder of Aegon Ltd. Common Shares does not have mandatory pre-emptive rights

upon the issuance of Aegon Ltd. Shares. Pursuant to the Bye- Laws, the Board may resolve to grant pre- emptive rights at the occasion of an issuance of Aegon Ltd. Common Shares.

Pursuant to the Bye-Laws, a holder of Aegon Ltd.

Common Shares B has pre- emptive rights with respect to the issuance, allotment or offer of Aegon Ltd. Common Shares B. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

4 / 22 |

|

|

|

|

|

| Repurchase of shares |

|

|

|

| The General Meeting may authorize the Executive Board to repurchase Aegon N.V. Shares. The repurchase of Aegon N.V. Shares is subject to certain restrictions pursuant to the Articles of Association and Dutch law. |

|

The General Meeting may authorize the Board to repurchase Aegon S.A. Shares. The repurchase of Aegon S.A. Shares is subject to certain restrictions pursuant to the Articles of Association and Luxembourg law. |

|

The Board is authorized, subject to certain restrictions of Bermuda law and the Bye- Laws, to repurchase Aegon Ltd. Shares. |

|

| Reduction of share capital |

|

|

|

| Aegon N.V. may, subject to certain restrictions of Dutch law and the Articles of Association, reduce its issued share capital by lowering the

nominal value of the Aegon N.V. Shares, by cancelling Aegon N.V. Shares held in treasury or by cancelling all Aegon N.V. Common Shares B.

The General Meeting may, at the proposal of the Executive Board, which proposal has to be approved by the Supervisory Board, resolve to reduce the issued share

capital which requires a majority of not less than two-thirds of the votes cast if less than one-half of the issued share capital is represented at the meeting. |

|

Aegon S.A. may, subject to certain restrictions of Luxembourg law and the Articles of Association, reduce its issued share capital by

lowering the nominal value of the Aegon N.V. Shares or by cancelling Aegon N.V. Shares held in treasury.

The General Meeting may resolve to reduce the issued share capital which requires a two-thirds majority and requires no

less than half of the issued share capital to be represented at the meeting. If this quorum is not reached, a second General Meeting shall be convened. |

|

Aegon Ltd. may, subject to certain restrictions of Bermuda law and the Bye- Laws, reduce its paid-up

share capital in any way, including by:

a) extinguishing or reducing the liability on any of its shares in respect of capital not paid up;

b) cancelling any paid-up capital that is lost or unrepresented by available assets; or

c) either with or without reducing the number of such shares, paying off any paid-up capital that is in excess of the requirements of the company. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

5 / 22 |

|

|

|

|

|

| Reducing the issued share capital of Aegon N.V. Common Shares B also requires the approval of the meeting of holders of Aegon N.V. Common Shares B. |

|

Reducing the issued share capital of Aegon N.V. Common Shares B also requires the approval of the meeting of holders of Aegon N.V. Common Shares B. |

|

A reduction of paid-up share capital requires approval by the Board and the General Meeting.

Reducing the paid-up share capital of Aegon Ltd.

Common Shares B also requires the approval of the meeting of holders of Aegon Ltd. Common Shares B. |

|

| Board structure and number of Board members |

|

|

|

| Aegon N.V. has a two-tier board structure, comprising the Executive Board and the Supervisory

Board. The Executive Board is responsible for the day-to-day management and strategy of the company, under the supervision of the Supervisory Board.

The Supervisory Board determines the number of Executive Board members. |

|

Aegon S.A. has a one-tier board structure, comprising executive and

non-executive directors. Pursuant to the

Articles of Association, the Board manages and conducts the business of Aegon S.A. and prepares and implements the strategy.

The Board determines the number of Board members. |

|

Aegon Ltd. has a single tier board structure, comprising executive directors and non- executive directors.

Subject to the provisions of the Companies Act and the

Bye-Laws, the Board shall manage and conduct the business of Aegon Ltd. and is responsible for the general affairs of Aegon Ltd., which includes setting the strategy of Aegon Ltd. The non-executive directors

have an overall advisory and supervisory duty. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

6 / 22 |

|

|

|

|

|

| The Supervisory Board determines the number of Supervisory Board members, provided that the Supervisory Board must have at least seven members. |

|

|

|

The executive directors will be primarily charged with, through a delegation of such authority by the Board, Aegon Ltd.’s day-to- day operations and the developing, proposing to the Board and implementing of Aegon’s strategy.

The Board determines the number of executive directors and non-executive directors, provided that the majority of the

Board shall consist of non-executive directors. |

|

| Appointment and removal of board members |

|

|

|

| The General Meeting appoints the members of the Executive Board and the Supervisory Board.

If the appointment of an Executive Board member or a Supervisory Board member is

proposed by the Supervisory Board, the General Meeting resolution requires a simple majority of the votes cast, while otherwise, the resolution requires a two-thirds majority of the votes cast, which majority must represent more than half of the

issued share capital. |

|

The General Meeting appoints the members of the Board.

If the appointment of a Board member is proposed by the Board, the General Meeting resolution requires a simple majority of the votes cast, while otherwise,

the resolution requires a two-thirds majority of the votes cast, which majority must represent more than half of the issued share capital. |

|

The General Meeting appoints the members of the Board.

Voting in respect of Board member appointments will be based on the general voting mechanism (for / against / abstain).

If the appointment of a Board member is proposed by the Board, the General Meeting

resolution requires a simple |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

7 / 22 |

|

|

|

|

|

| If the suspension or removal of an Executive Board member or a Supervisory Board member is proposed by the Supervisory Board, the General

Meeting resolution requires a simple majority of the votes cast, while otherwise, the resolution requires a two-thirds majority of the votes cast, which majority must represent more than half of the issued

share capital. The Supervisory Board may suspend an Executive Board member. |

|

If the removal or suspension of a Board member is proposed by the Board, the General Meeting resolution requires a simple majority of the votes cast, while otherwise, the resolution requires a two- thirds majority of the votes cast,

which majority must represent more than half of the issued share capital. |

|

majority of the votes cast, while otherwise, the resolution requires a two-thirds majority of the

votes cast, which majority must represent more than half of the issued share capital.

Board members are appointed for a term of not more than four years. A term limit of a total of 12 years applies to

non-executive directors. However, for an individual case and by way of exception, the Board may, in the interest of Aegon Ltd., decide to deviate from the term limit.

If the removal or suspension of a Board member is proposed by the Board, the General

Meeting resolution requires a simple majority of the votes cast, while otherwise, the resolution requires a two- thirds majority of the votes cast, which majority must represent more than half of the issued share capital.

An executive director of the Board may also be suspended by the Board, in which case

only the non-executive directors will take part in the deliberations and decision making. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

8 / 22 |

|

|

|

|

|

| Board vacancies and inability to act |

|

|

|

| In case an Executive Board member is unable to act or when a vacancy arises, the remaining Executive Board member(s) will be temporarily

entrusted with the management of Aegon N.V. If all seats of the Executive Board

members are vacant or if all Executive Board members are unable to act, the Supervisory Board is charged with the management and may delegate this authority. |

|

In case a Board member is unable to act or when a vacancy arises, the remaining Board members will be temporarily entrusted with the

management of Aegon S.A. A vacancy may be filled on a temporary basis and for a

period of time not exceeding the initial mandate of the replaced director by the Board members until the next General Meeting which shall resolve on the permanent appointment in accordance with the applicable legal provisions, or the remaining Board

members may elect by co- optation a new Board member to fill such vacancy until the next General Meeting, which shall ratify such co-optation or elect a new Board member instead. |

|

In case a Board member is unable to act or when a vacancy arises, the remaining Board members will be temporarily entrusted with the

management of Aegon Ltd. The Board may fill a vacancy that arises at its own

discretion, such appointment to be ratified at the next General Meeting. Board

members may grant a proxy to a fellow Board member to exercise their vote at a meeting of the Board in case they are unable to act. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

9 / 22 |

|

|

|

|

|

|

| Independence of the Board |

|

|

|

| The independence standards of the Dutch Corporate Governance Code, the Audit Committee Decree and the Joint Guidelines apply to the

Supervisory Board. In addition, the independence requirements of the Sarbanes Oxley

Act and the NYSE Listing Rules are applicable. |

|

At least a majority of the Board members is to be independent.

The independence requirements of the Sarbanes Oxley Act and the NYSE Listing Rules will also be taken into account. |

|

At least a majority of the Board members must be independent, as defined in a separate document to be adopted by the Board, setting out Aegon

Ltd.’s corporate governance principles. The independence requirements of the

Sarbanes Oxley Act will also be taken into account. |

|

| Decision-making by the Board and Quorum |

|

|

|

| Resolutions of the Executive Board are adopted with a simple majority of the votes cast and may only be adopted if the majority of the

Executive Board members in office are present or represented. Resolutions of the

Supervisory Board are adopted with a simple majority of the votes cast and may only be adopted if the majority of the Supervisory Board members in office are present or represented.

In the event of a tie vote in the Executive Board, the proposal shall be rejected.

|

|

Resolutions of the Board are adopted with a simple majority of the votes cast and may only be adopted if the majority of the Board members in

office are present or represented. In the event of a tie vote, the chairperson, if

any, or, in his absence, the chairperson pro tempore, shall have a casting vote. |

|

Aegon Ltd. will adopt an inclusion and diversity policy reflecting the international nature of the business and which does not only take into

account gender diversity, but also diversity in nationality, educational, professional and geographical background and experience. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

10 / 22 |

|

|

|

|

|

| In the event of a tie vote in the Supervisory Board, the chairman has the deciding vote if more than two Supervisory Board members are present or represented. |

|

|

|

|

|

| Fiduciary duties |

|

|

|

| Each member of the Executive Board and Supervisory Board has a statutory duty to act in the corporate interest of Aegon N.V. and its business. |

|

Each member of the Board of Directors has a legal duty to act in the corporate interest of Aegon S.A. and its business. |

|

Under Bermuda law, the Board members owe a fiduciary duty to Aegon Ltd. to act in good faith in their dealings with or on behalf of Aegon Ltd. and exercise their powers and fulfil the duties of their office honestly. |

|

| Conflict of interest |

|

|

|

| An Executive Board or Supervisory Board member may not participate in the adoption of resolutions and deliberations in case of a conflict of interest. A conflict of interest exists if the Executive Board or Supervisory Board member

is unable to serve the best interests of Aegon N.V. and the business connected with it with the required level of integrity and objectivity. |

|

Save as otherwise provided by Luxembourg Law, any Board member who has, directly or indirectly, a financial interest conflicting with the interest of the Company in connection with a transaction falling with the competence of the

board of directors, must inform the Board of such conflict of interest and must have his declaration recorded in the minutes of the Board meeting. The relevant director may not take part in the discussions relating to such transaction nor vote on

such transaction. |

|

In accordance with Bermuda law, a Board member who believes that they have or might have a direct or indirect personal interest which conflicts with the interests of Aegon Ltd., whether potential or actual, must notify the Board at

the first opportunity at a meeting of the Board or by writing to the Board members as required by Bermuda law. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

11 / 22 |

|

|

|

|

|

|

|

|

|

Unless the conflict is fully disclosed, any contract entered into by Aegon Ltd. and a company in which a Board member has an interest may be

voidable at the instance of the Aegon Ltd. and any profit made recoverable by Aegon Ltd.

A member of the Board who has a conflict of interest shall not participate in any deliberations and decision-making of the Board, unless the Board decides

otherwise. |

|

| Remuneration of Board members |

|

|

|

| The General Meeting adopts a remuneration policy for the Executive Board and the Supervisory Board. Pursuant to Dutch law, the General

Meeting resolution requires a three-fourths majority. A remuneration report must

annually be submitted to a non-binding advisory vote of the General Meeting. |

|

The General Meeting approves a remuneration policy for the Board, however, the vote is only advisory unless otherwise stated in the Articles

of Association. The remuneration policy must at least be submitted to a vote every four years.

A remuneration report must annually be submitted to a non-binding advisory vote of the General Meeting. |

|

The Board establishes guidelines for the remuneration of the Board members in line with international practice.

The Board determines the remuneration and other terms of service of the executive

directors and the non-executive directors, with due observance of the remuneration guidelines. The executive directors shall not participate in the deliberations and decision-making process of the Board in

determining the remuneration and other terms of service for the executive directors and non-executive directors. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

12 / 22 |

|

|

|

|

|

|

|

|

|

Pursuant to the Bye-Laws, Shareholders are offered the opportunity to annually provide a non-binding advisory vote with respect to the past financial

year’s remuneration report. |

|

| Indemnification of Board members |

|

|

|

| The Articles of Association include an indemnification of the Executive Board and Supervisory Board members against any and all liabilities, claims, judgments, fines and penalties incurred as a result of any action, investigation or

other proceeding. An Executive Board member or a Supervisory Board member is not indemnified for gaining personal profits, advantages or remuneration to which he was not legally entitled, or if the Executive Board member or Supervisory Board member

is liable for wilful misconduct (opzet) or intentional recklessness (bewuste roekeloosheid). |

|

The Articles of Association include an indemnification of the Board members against any and all liabilities, claims, judgments, fines and

penalties incurred as a result of any action, investigation or other proceeding. A

Board member is not indemnified for gaining personal profits, advantages or remuneration to which he was not legally entitled, or if the Board member is liable for wilful misconduct or intentional recklessness. |

|

The Bye-Laws provide that Board members are indemnified in respect of, any loss arising or liability attaching to him by virtue of any rule of law in respect of any negligence, default, breach

of duty or breach of trust in relation to Aegon Ltd. or any subsidiary thereof. The indemnification does not extend to claims arising from fraud or dishonesty. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

13 / 22 |

|

|

|

|

|

|

| Discharge of Board members |

|

|

|

| The General Meeting may discharge members of the Executive Board and Supervisory Board for the performance of their management and supervision, respectively. |

|

The General Meeting may discharge members of the Board for the performance of their management. |

|

The Bye-Laws contain a waiver from each Shareholder and Aegon Ltd. of any claim or right of action it

may have against Aegon Ltd. at any time, whether individually or by or in the right of Aegon Ltd., against any Board member on account of any action taken by such Board member or the failure of such Board member to take any action in the performance

of their duties with or for Aegon Ltd. |

|

|

|

|

This waiver does not apply to claims arising out of fraud or dishonesty or to recover any gain, personal profit or advantage to which such Board member is not legally entitled. |

|

| Convocation and agenda of a General Meeting |

|

|

|

| Notice of General Meetings are given by the Supervisory Board or the Executive Board at least 42 days prior to the day of the General Meeting. |

|

Notice of General Meetings are given by the Board or, as the case may be, by the statutory auditor(s) at least 30 days prior to the day of the General Meeting. |

|

Notice of General Meetings are given by the Board. Pursuant to the Bye-Laws, General Meetings must be convened at least 30 days prior to the day of the General Meeting. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

14 / 22 |

|

|

|

|

|

| The agenda of the General Meeting includes the items proposed by the Executive Board or Supervisory Board. |

|

The agenda of the General Meeting includes the items proposed by the Board. |

|

The agenda of the General Meeting includes the items proposed by the Board. |

|

| Shareholder right to propose an agenda item |

|

|

|

| Shareholders representing at least 1% of the issued capital or shares worth at least EUR 100 million may request one or more items to be added to the agenda of a General Meeting. |

|

Shareholders representing at least 1% of the issued capital or shares worth at least EUR 100 million may request one or more items to be added to the agenda of a General Meeting. |

|

Shareholders representing at least 1% of the issued capital or 100 or more Shareholders jointly may request one or more items to be added to the agenda of a General Meeting. |

|

| Shareholder right to call a General Meeting |

|

|

|

| Shareholders representing at least 10% of the issued share capital, may request that a General Meeting be convened. |

|

Shareholders representing at least 10% of the paid-up share capital may request a General Meeting. |

|

Shareholders representing at least 10% of the paid-up share capital may request a General Meeting. |

|

| Decision-making of the General Meeting |

|

|

|

| Unless Dutch law or the Articles of Association provide otherwise, all resolutions of the General Meeting are adopted with a simple majority of the votes cast. |

|

Unless Luxembourg law or the Articles of Association provide otherwise, all resolutions of the General Meeting are adopted with a simple majority of the votes cast. |

|

Unless Bermuda law or the Bye-Laws provide otherwise, all resolutions of the General Meeting are adopted with a simple majority of the votes cast. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

15 / 22 |

|

|

|

|

|

| No quorum requirement applies when holding a General Meeting and when transacting business at such meeting. |

|

No quorum requirement applies when holding a General Meeting and when transacting business at such meeting. |

|

Resolutions may be adopted if a quorum is present. The quorum for a General Meeting is set at 1/3 of the paid-up share capital. |

|

| Shareholder vote on material transactions |

|

|

|

| Pursuant to Dutch law, the Executive Board must obtain the approval of the General Meeting for resolutions regarding a significant change in the identity or Aegon N.V. or its business. |

|

Luxembourg law does not provide for a shareholder vote for material transactions, other than if the transaction would require shareholder approval in itself (e.g. merger). |

|

Bermuda law does not provide for a shareholder vote for material transactions, other than if the transaction would require shareholder

approval in itself (e.g. merger, amalgamation). Pursuant to the Bye-Laws, any transaction which would require the issuance of more than 10% of Aegon Ltd.’s issued share capital will require approval of the General Meeting. Reference is made to the description under

“Issue of Shares”. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

16 / 22 |

|

|

|

|

|

|

| Amendment of the constitutional documents |

|

|

|

| The General Meeting resolves on the amendment of the Articles of Association upon proposal of the Executive Board with the approval of the Supervisory Board. |

|

The General Meeting may resolve to amend the Articles of Association which requires a two-thirds majority and requires no less than half of the issued share capital to be represented at the

meeting. If this quorum is not reached, a second General Meeting shall be convened. |

|

The Board resolves on the amendment of the Bye-Laws. In order for such amendment to take effect, it

must be approved by the General Meeting. An amendment of the Memorandum of

Association needs to be approved by the Board and the General Meeting. A Board

resolution to amend the Bye-Laws or the Memorandum of Association requires the consenting vote of the majority of the non-executive directors participating in the

decision. Under Bermuda law, Shareholders who, alone or jointly, represent at least

20% of Aegon Ltd.’s paid-up share capital or any class thereof have the right to, within 21 days after a resolution to amend the Memorandum of Association has been adopted by the General Meeting, apply to

the Supreme Court of Bermuda for an annulment of such amendment of the Memorandum of Association, other than an amendment which alters or reduces Aegon Ltd.’s share capital as provided in Bermuda law. No application may be made by Shareholders

voting in favor of the amendment. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

17 / 22 |

|

|

|

|

|

| Mergers; demergers |

|

|

|

| The General Meeting resolves on a merger or a demerger upon a Supervisory Board approved proposal of the Executive Board. |

|

The General Meeting resolves on a merger or a demerger. |

|

Any amalgamation or merger of Aegon Ltd. requires approval by the Board and the General Meeting.

Bermuda law does not provide for the possibility of a legal demerger. |

|

| Dissolution; winding-up |

|

|

|

| The General Meeting resolves on dissolution upon a Supervisory Board approved proposal of the Executive Board.

Any liquidation surplus is transferred to the Shareholders proportional to the profit

rights attached to the Aegon N.V. Common Shares and the Aegon N.V. Common Shares B, respectively. |

|

The General Meeting resolves on the dissolution of the Company. A resolution to dissolve the Company requires a two-thirds majority and requires no less than half of the issued share capital to be represented at the meeting. If this quorum is not reached, a second General Meeting shall be convened.

Any liquidation surplus is transferred to the Shareholders proportional to the profit

rights attached to the Aegon N.V. Common Shares and the Aegon N.V. Common Shares B, respectively. |

|

Subject to Bermuda law, a winding-up of Aegon Ltd. requires approval by the Board and the General

Meeting. In the event of a winding-up of

Aegon Ltd., the liquidator may, with the approval of a subsequent General Meeting, divide amongst the Shareholders whole or any part of the assets of Aegon Ltd. and may for such purposes set such values as they deem fair upon any property to be

divided as aforesaid and may determine how such division shall be carried out as between the Shareholders, provided that the liquidation surplus shall be transferred to the Shareholders in proportion to the profit rights attached to the Aegon Ltd.

Common Shares and the Aegon Ltd. Common Shares B respectively. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

18 / 22 |

|

|

|

|

|

| Profit reservation, dividends and other distributions |

|

|

|

| Under Dutch law, distributions may only be made to the extent Aegon N.V. has sufficient distributable reserves.

Pursuant to the Articles of Association, the Supervisory Board may decide, upon the

proposal of the Executive Board, to set aside part of the profit to increase and/or form reserves.

The profits remaining thereafter are at the disposal of the General Meeting.

The Executive Board may decide, with the approval of the Supervisory Board, to make interim distributions. |

|

Under Luxembourg law, of the annual net profits of the Company, five per cent (5%) at least shall be allocated to a Company reserve. This

allocation shall cease to be mandatory as soon and as long as the aggregate amount of such reserve amounts to at least ten per cent (10%) of the share capital of the Company.

Upon recommendation of the Board, the General Meeting shall determine how the remainder of the Company’s profits shall be used in accordance with

Luxembourg law and the Articles of Association. The Board may proceed with the

payment of interim dividends subject to the provisions of Luxembourg law and the Articles of Association. |

|

Under Bermuda law, Aegon Ltd. may declare and pay a dividend, or make a distribution out of contributed surplus, provided there are

reasonable grounds for believing that after any such payment (a) the company will be solvent and (b) the realizable value of its assets will be greater than its liabilities.

The Board may declare dividends and interim dividends and may decide to set aside part

of the profit to increase and/or form reserves. A Board resolution to declare a

dividend requires the consenting vote of the majority of the non-executive directors participating in the decision. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

19 / 22 |

|

|

|

|

|

| Annual accounts |

|

|

|

| The annual accounts of Aegon N.V. must be signed by the members of the Executive Board and the Supervisory Board.

The annual accounts are adopted annually by the General Meeting. |

|

The annual accounts of Aegon S.A. must be signed by the members of the Board.

The annual accounts are adopted annually by the General Meeting. |

|

The annual accounts of Aegon Ltd. must contain a signature of one Board member on the balance sheet. The Board adopts the annual

accounts. The annual accounts must be discussed annually in the General Meeting.

However, in accordance with Bermuda law, the annual accounts are not adopted by the General Meeting. |

|

| Auditor |

|

|

|

| Upon nomination by the Supervisory Board, the General Meeting appoints the independent external auditor of Aegon N.V. |

|

An independent auditor (réviseur d’entreprise agréé) must be appointed by the General Meeting. |

|

Upon proposal by the Board, the General Meeting appoints the independent external auditor of Aegon Ltd. for a period of one year. |

|

| Squeeze-out |

|

|

|

| Pursuant to Dutch law, a Shareholder who provides at least 95% of the issued share capital of Aegon N.V., alone or together |

|

Pursuant to Luxembourg law, a Shareholder who holds at least 95% of Aegon S.A.’s capital carrying voting rights |

|

Under Bermuda law, Shareholders who individually or jointly hold at least 95% of the issued and outstanding share capital of |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

20 / 22 |

|

|

|

|

|

| with group companies, may institute proceedings against minority Shareholders jointly for the transfer of their shares to such shareholder. The proceedings are held before the Enterprise Chamber. The Enterprise Chamber may grant the

claim for squeeze-out and determines the price to be paid for the Aegon N.V. Shares. Specific arrangements apply for squeeze-out proceedings after a public takeover offer. |

|

and 95% of Aegon S.A.’s voting rights, alone, together with group companies and/or with further persons acting in concert, may require all the holders of the remaining shares or other voting securities to sell him/her their

securities for a fair price. Such Shareholder is obliged to appoint an independent expert to determine such fair price. The Commission de Surveillance du Secteur Financier might accept this price or request a further valuation report

by another expert. Specific arrangements apply for squeeze-out proceedings after a public takeover offer. |

|

Aegon Ltd. may give notice to the remaining Shareholders and require the remaining Shareholders to sell their remaining Aegon Ltd. Shares subject to the terms set out in the notice, unless the remaining Shareholders apply to the

Supreme Court for an appraisal. |

|

| Mandatory tender offer |

|

|

|

| Under Dutch law, any person who, acting alone or in concert with others, directly or indirectly, acquires 30% or more of Aegon N.V.’s voting rights will, subject to certain exemptions, be required to make a mandatory tender

offer for all outstanding Aegon N.V. Shares. |

|

Under Luxembourg law, any person who, acting alone or in concert with others, directly or indirectly, acquires 33 1/3% or more of Aegon N.V.’s voting rights will, subject to certain exemptions, be required to make a mandatory

tender offer for all outstanding Aegon S.A. Shares. |

|

Pursuant to the Bye-Laws, any person who alone or in concert with others, directly or indirectly acquires 30% or more of Aegon Ltd.’s voting rights, except as a result of certain

permitted acquisitions, must without delay make a public announcement thereof and must within 30 days make a general offer to all holders of shares in accordance with the Bye-Laws. Where a person does not make

such offer within the prescribed time frame, such person is in breach of the Bye-Laws and the Board may take several actions as set out in the Bye-Laws, including a

suspension of voting rights or rights to dividends. |

|

|

|

| Schedule 1 Comparison of governance of Aegon N.V. and Aegon S.A. |

|

21 / 22 |

In connection with the proposed

Redomiciliation, Aegon N.V. has filed with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form F-4 that includes a U.S. Shareholder Circular that you are encouraged

to review carefully before making any decisions regarding the proposed Redomiciliation. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities and is not a substitute for the U.S. Shareholder

Circular or any other document that Aegon N.V. may file with the SEC or send to U.S. shareholders in connection with the proposed Redomiciliation. U.S. SHAREHOLDERS OF AEGON N.V. ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING

THE REGISTRATION STATEMENT ON FORM F-4 AND THE FINAL U.S. SHAREHOLDER CIRCULAR, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT AEGON LTD. AND THE PROPOSED REDOMICILIATION. This information is available to

you without charge upon your written or oral request. You will be able to obtain the documents free of charge at the SEC’s website, http://www.sec.gov. In addition, the documents may be obtained in hard copy free of charge by

directing a request in writing or by telephone to Aegon N.V. at Aegonplein 50; 2591 TV The Hague; The Netherlands; Attention: Investor Relations or by e-mail at ir@aegon.com, or by calling our agent for

service in the United States of America Andrew S. Williams Telephone: +1 443 475 3243.

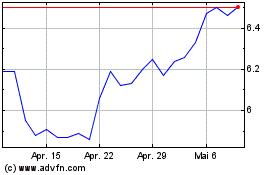

Aegon (NYSE:AEG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

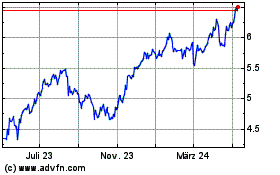

Aegon (NYSE:AEG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024