Y-mAbs Therapeutics, Inc. (the “Company” or “Y-mAbs”) (Nasdaq:

YMAB), a commercial-stage biopharmaceutical company focused on the

development and commercialization of novel radioimmunotherapy and

antibody-based therapeutic products for the treatment of cancer,

today reported financial results for the third quarter ended

September 30, 2024.

“The third quarter of this year was one of continued focus and

execution across our DANYELZA commercial business and our novel

SADA PRIT radiopharmaceutical platform development pipeline,” said

Michael Rossi, President and Chief Executive Officer. “Physician

usage of DANYELZA in the U.S. continues to remain very strong for

patients with relapsed/refractory high-risk neuroblastoma. In

addition, we continue to drive ex-U.S. market expansion with our

new exclusive license and distribution agreement with Nobelpharma

in Japan and the launch of our named patient program in Turkey.

From a SADA PRIT pipeline standpoint, we expect to complete Part A

of our GD2-SADA Phase 1 trial this year and present that data in

the first quarter of next year.”

Third Quarter 2024 and Recent Corporate

Highlights

- Effective October 29, 2024, Y-mAbs entered into an exclusive

license and distribution agreement with Nobelpharma for the

development and commercialization of DANYELZA in Japan. Pursuant to

the agreement, the Company recognized an upfront payment of $2.0

million in the fourth quarter of 2024. Y-mAbs is entitled to

receive up to $31.0 million in product and commercial milestone

payments in addition to profit sharing on the commercial sales of

DANYELZA, if successfully approved and commercialized in

Japan.

- Y-mAbs received notification of the accepted patent extension

for DANYELZA, US 9,315,585, through February 2034.

- The Company’s named patient program for DANYELZA launched in

Turkey with partner TRPharm İlaç Sanayi Ticaret A.Ş. and TRPharm

FZ-LLC.

- Y-mAbs presented new clinical and preclinical data from studies

evaluating anti-GD2 therapy naxitamab and the Company’s first

program from its Self-Assembly DisAssembly Radioimmunotherapy

Technology Platform (“SADA PRIT”), GD2-SADA, respectively, in

neuroblastoma in poster presentations at the American Academy of

Cancer Research Special Conference in the Advanced in Pediatric

Cancer Research on September 6-7, 2024 in Toronto, Canada.

- The Company entered into a lease agreement for a term of ten

years and nine months for office space in Princeton, New Jersey,

where the Company plans to transition its headquarters in the first

half of 2025 upon being provided access to the location.

Financial Results

Revenues

Total net revenues for the quarter ended September 30, 2024 were

$18.5 million, a 10% decline over total net revenues for the

quarter ended September 30, 2023 of $20.5 million, which included

$0.5 million in license revenue, primarily driven by decreased net

product revenues in both U.S. and ex-U.S. markets.

Total net revenues for the nine months ended September 30, 2024

were relatively flat compared to the nine months ended September

30, 2023, at $61.2 million and $61.5 million, respectively. The

slight decrease was driven by a $0.7 million decrease in ex-U.S.

DANYELZA net product revenues in the nine months ended September

30, 2024, which was partially offset by increased net product

revenues in the U.S.

The Company’s U.S. DANYELZA net product revenues were $15.3

million and $16.1 million for the three months ended September 30,

2024 and 2023, respectively, representing a 5% decline, primarily

due to an unfavorable price mix, partially offset by increased

volume of 5% vial growth over the same time period.

Y-mAbs’ ex-U.S. DANYELZA net product revenues for the quarter

ended September 30, 2024 were $3.1 million, a 19% decline from $3.9

million in the comparable period in 2023, primarily driven by

decreased volume from Western Europe partially offset by volume

increases in the remaining ex-U.S. territories.

As of September 30, 2024, Y-mAbs had delivered DANYELZA to 68

centers across the U.S. since initial launch, with three new

accounts added in the U.S. in the third quarter of 2024. During the

quarter ended September 30, 2024, approximately 65% of the vials

sold in the U.S. were sold outside of Memorial Sloan Kettering

Cancer Center (“MSK”), compared to 67% in the second quarter ended

June 30, 2024.

The Company did not have license revenue for the quarter ended

September 30, 2024. The Company had license revenues of $0.5

million for the nine months ended September 30, 2024, from its

Latin America distribution partner, Adium, related to price

approval for DANYELZA in Brazil from the Brazilian Medicines Market

Regulation Chamber. The Company had license revenues of $0.5

million for the quarter and nine months ended September 30, 2023

from Adium, recognized upon the September 2023 achievement of

marketing authorization for DANYELZA in Mexico.

Operating Costs and Expenses

Cost of Goods Sold

Cost of goods sold were $2.3 million and $2.6 million for the

quarter ended September 30, 2024 and 2023, respectively. Cost of

goods sold were $7.4 million and $9.3 million for the nine months

ended September 30, 2024 and 2023, respectively. Cost of goods sold

included lower vial volumes of 1% and 37% in the three and nine

months ended September 30, 2024, compared to the same periods in

2023, respectively. Cost of goods sold also included $0.4 million

and $0.8 million inventory write-downs in the three and nine months

ended September 30, 2023, respectively.

The Company defines gross margin as net product revenues less

cost of goods sold divided by net product revenues. The Company’s

gross margins was relatively unchanged in the quarter ended

September 30, 2024, compared to the comparable periods in 2023. The

Company’s gross margins increased in the nine months ended

September 30, 2024, compared to the comparable period in 2023, due

to a favorable gross profit mix from revenue in international

regions, particularly Eastern Asia that had an inventory stocking

order in the nine months ended September 30, 2024, and inventory

write-downs during the comparable periods in 2023, as noted

above.

Research and Development

Research and development expenses were $11.2 million for the

quarter ended September 30, 2024, a decrease of $4.2 million when

compared with the same period in 2023. The decrease in research and

development expenses was primarily attributable to the recognition

of $4.1 million of milestone and license acquisition costs related

to the Company’s SADA license agreement during the three months

ended September 30, 2023, as certain time-based clinical milestones

within the agreement were determined to be probable based on the

availability of necessary data and the assessment of clinical

progress in the third quarter of 2023.

For the nine months ended September 30, 2024, research and

development expenses were $36.8 million, a decrease of $4.0 million

when compared with the same period in 2023. The decrease in the

research and development expenses was primarily attributable to

recognition of $4.1 million of milestone and license acquisition

costs related to the Company’s SADA license agreement during the

nine months ended September 30, 2023, as noted above.

Selling, General, and Administrative

Selling, general, and administrative expenses were $13.6 million

and $10.2 million for the quarters ended September 30, 2024 and

2023, respectively. The $3.4 million increase in the selling,

general and administrative expenses was primarily attributable to a

$1.2 million increase related to the Company’s former Chief

Financial Officer’s separation and consulting agreements, $1.1

million increase in personnel cost, inclusive of stock-based

compensation and $0.5 million in professional and consulting

fees.

For the nine months ended September 30, 2024, selling, general,

and administrative expenses were $42.3 million, an increase of $8.5

million compared with the same period in 2023. The increase was

primarily attributable to a net impact of $3.6 million related to

the settlement of a shareholder class-action lawsuit in the nine

months ended September 30, 2024, and an additional legal settlement

of $0.2 million in the nine months ended September 30, 2024. The

increase also includes a $1.2 million increase related to our

former Chief Financial Officer’s separation and consulting

agreements, a $1.1 million increase in personnel cost inclusive of

stock-based compensation and $0.8 million in professional and

consulting fees.

Interest and Other Income

Interest and other income were $1.9 million for the quarter

ended September 30, 2024, as compared to $0.2 million for the

quarter ended September 30, 2023. The increase of $1.7 million was

primarily due to a $1.9 million of foreign currency transactional

gains in the three months ended September 30, 2024, partially

offset by a $0.2 million decrease in interest earned on the

Company’s cash and cash equivalents.

For the nine months ended September 30, 2024 and 2023, the

interest and other income was $3.0 and $2.4 million, respectively.

The increase of $0.6 million was primarily due to $1.1 million of

foreign currency transactional gains, partially offset by a $0.3

million decrease in interest earned on the Company’s cash and cash

equivalents.

Net Loss

Y-mAbs reported a net loss for the quarter ended September 30,

2024, of $7.0 million, or ($0.16) per basic and diluted share,

compared to a net loss of $7.7 million, or ($0.18) per basic and

diluted share, for the quarter ended September 30, 2023. The

decrease in net loss for the quarter ended September 30, 2024 was

primarily driven by decreased operating expenses and foreign

currency transactional gains, partially offset by decreased net

product revenue.

For the nine months ended September 30, 2024, the Company

reported a net loss of $22.9 million, or ($0.52) per basic and

diluted share, as compared to net loss of $20.4 million, or ($0.47)

per basic and diluted share, for the nine months ended September

30, 2023. The increase in net loss for the nine months ended

September 30, 2024 was primarily driven by the net $3.8 million in

charges related to the Company’s two legal settlements, as

described above.

Cash and Cash Equivalents

As of September 30, 2024, Y-mAbs had approximately $68.1 million

in cash and cash equivalents. Cash utilized in the first three

quarters of 2024 was $10.5 million, which was favorable relative to

the Company’s internal forecasts, and is on track to meet its

corporate guidance for the full year 2024.

2024 Financial Guidance

Management reiterates its full year 2024 guidance:

- Anticipated Total Net Revenues expected to be between $87

million and $95 million;

- Anticipated Operating Expenses expected to remain between $115

million and $120 million;

- Anticipated Total Annual Cash Investment expected to remain

between $15 million and $20 million; and

- Cash and Cash Equivalents anticipated to continue to support

operations as currently planned into 2027.

Webcast and Conference Call

Y-mAbs will host a conference call on Friday, November 8, 2024,

at 8:00 a.m. ET. To participate in the call, please use the

following dial-in information:

Investors (domestic): (877) 407-0792

Investors (international): (201) 689-8263

To access the live webcast, please use this link. Prior to the

call and webcast, a slide presentation pertaining to the Company’s

quarterly earnings will be made available on the Investor Relations

section of the Y-mAbs website, www.ymabs.com, shortly before the

call begins.

About Y-mAbs

Y-mAbs is a commercial-stage biopharmaceutical company focused

on the development and commercialization of novel,

radioimmunotherapy and antibody-based therapeutic cancer products.

The Company’s technologies include its investigational

Self-Assembly DisAssembly (“SADA”) Pretargeted Radioimmunotherapy

Platform (“PRIT”) and bispecific antibodies generated using the

Y-BiClone platform. The Company’s broad and advanced product

pipeline includes the anti-GD2 therapy DANYELZA® (naxitamab-gqgk),

the first FDA-approved treatment for patients with relapsed or

refractory high-risk neuroblastoma in the bone or bone marrow after

a partial response, minor response, or stable disease to prior

therapy.

Forward-Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Such statements include, but are not limited

to, statements about our business model, including financial

outlook for 2024 and beyond, including estimated operating

expenses, use of cash and cash equivalents and DANYELZA product

revenue and sufficiency of cash resources and related assumptions;

expectations with respect to the Company’s future financial

performance; implied and express statements regarding the future of

the Company’s business, including with respect to expansion and its

goals; expectations with respect to the Company’s plans and

strategies, development, regulatory, commercialization and product

distribution plans, including the timing thereof; expectations with

respect to the Company’s products and product candidates, including

potential territory and label expansion of DANYELZA and the

potential market opportunity related thereto and potential benefits

thereof, and the potential of the SADA PRIT technology and

potential benefits and applications thereof; expectations relating

to key anticipated development milestones, including potential

expansion and advancement of commercialization and development

efforts, including potential indications, applications and

geographies, and the timing thereof; expectations with respect to

current and future clinical and pre-clinical studies and the

Company’s research and development programs, including with respect

to timing and results; expectations regarding collaborations or

strategic partnerships and the potential benefits thereof; and

other statements that are not historical facts. Words such as

‘‘anticipate,’’ ‘‘believe,’’ “contemplate,” ‘‘continue,’’

‘‘could,’’ ‘‘estimate,’’ ‘‘expect,’’ “hope,” ‘‘intend,’’ ‘‘may,’’

‘‘might,’’ ‘‘plan,’’ ‘‘potential,’’ ‘‘predict,’’ ‘‘project,’’

‘‘should,’’ ‘‘target,’’ “will,” ‘‘would’,’ “guidance,” “goal,”

“objective,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Our product candidates

and related technologies are novel approaches to cancer treatment

that present significant challenges. Actual results may differ

materially from those indicated by such forward-looking statements

as a result of various factors, including but not limited to: risks

associated with the Company’s financial condition and need for

additional capital; the risks that actual results of the Company’s

restructuring plan and revised business plan will not be as

expected; risks associated with the Company’s development work;

cost and success of the Company’s product development activities

and clinical trials; the risks of delay in the timing of the

Company’s or its partners’ regulatory submissions or failure to

receive approval of its drug candidates; the risks related to

commercializing any approved pharmaceutical product including the

rate and degree of market acceptance of product candidates;

development of sales and marketing capabilities and risks

associated with failure to obtain sufficient reimbursement for

products; risks related to the Company’s dependence on third

parties including for conduct of clinical testing and product

manufacture as well as regulatory submissions; the Company’s

ability to enter into new partnerships or to recognize the

anticipated benefits from its existing partnerships; risks related

to government regulation; risks related to market approval, risks

associated with protection of the Company’s intellectual property

rights; risks related to employee matters and managing growth;

risks related to the Company’s common stock, risks associated with

macroeconomic conditions, including the conflict between Russia and

Ukraine and sanctions related thereto, the state of war between

Israel and Hamas and the related risk of a larger regional

conflict, inflation, increased interest rates, uncertain global

credit and capital markets and disruptions in banking systems; and

other risks and uncertainties affecting the Company including those

described in the “Risk Factors” section included in the Company’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023, and the Company’s Quarterly Report on Form 10-Q for the

quarterly periods ended March 31, 2024, and September 30, 2024, and

future filings and reports by the Company. Any forward-looking

statements contained in this press release speak only as of the

date hereof, and the Company undertakes no obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

DANYELZA® and Y-mAbs® are registered trademarks of Y-mAbs

Therapeutics, Inc.

Investor Contact:

Courtney DuganVP, Head of Investor Relationscdu@ymabs.com

|

Y-MABS THERAPEUTICS, INC.Consolidated

Balance Sheets(unaudited)(In

thousands, except share and per share data) |

| |

| |

|

September 30, |

|

December 31, |

| |

|

2024 |

|

2023 |

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

68,122 |

|

|

$ |

78,637 |

|

|

Accounts receivable, net |

|

|

19,916 |

|

|

|

22,454 |

|

|

Inventories |

|

|

9,557 |

|

|

|

5,065 |

|

|

Other current assets |

|

|

1,462 |

|

|

|

4,955 |

|

| Total current assets |

|

|

99,057 |

|

|

|

111,111 |

|

|

Property and equipment, net |

|

|

53 |

|

|

|

224 |

|

|

Operating lease right-of-use assets |

|

|

1,075 |

|

|

|

1,412 |

|

|

Intangible assets, net |

|

|

2,366 |

|

|

|

2,631 |

|

|

Other assets |

|

|

18,366 |

|

|

|

12,491 |

|

| TOTAL ASSETS |

|

$ |

120,917 |

|

|

$ |

127,869 |

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

7,878 |

|

|

$ |

6,060 |

|

|

Accrued liabilities |

|

|

16,638 |

|

|

|

13,166 |

|

|

Operating lease liabilities, current portion |

|

|

776 |

|

|

|

902 |

|

| Total current liabilities |

|

|

25,292 |

|

|

|

20,128 |

|

|

Accrued milestones |

|

|

2,000 |

|

|

|

5,375 |

|

|

Operating lease liabilities, long-term portion |

|

|

299 |

|

|

|

517 |

|

|

Other liabilities |

|

|

897 |

|

|

|

864 |

|

| TOTAL LIABILITIES |

|

|

28,488 |

|

|

|

26,884 |

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Preferred stock, $0.0001 par

value, 5,500,000 shares authorized and none issued at

September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

| Common stock, $0.0001 par

value, 100,000,000 shares authorized at

September 30, 2024 and December 31, 2023;

44,766,802 and 43,672,112 shares issued and outstanding at

September 30, 2024 and December 31, 2023,

respectively |

|

|

4 |

|

|

|

4 |

|

| Additional paid-in

capital |

|

|

572,807 |

|

|

|

558,002 |

|

| Accumulated other

comprehensive income |

|

|

(36 |

) |

|

|

449 |

|

| Accumulated deficit |

|

|

(480,346 |

) |

|

|

(457,470 |

) |

| TOTAL STOCKHOLDERS’

EQUITY |

|

|

92,429 |

|

|

|

100,985 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

120,917 |

|

|

$ |

127,869 |

|

| |

|

Y-MABS THERAPEUTICS, INC.Consolidated

Statements of Net Loss and Comprehensive

Loss(unaudited)(In thousands,

except share and per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

| REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net |

|

$ |

18,461 |

|

|

$ |

19,954 |

|

|

$ |

60,690 |

|

|

$ |

60,956 |

|

|

License revenue |

|

|

— |

|

|

|

500 |

|

|

|

500 |

|

|

|

500 |

|

| Total revenues |

|

|

18,461 |

|

|

|

20,454 |

|

|

|

61,190 |

|

|

|

61,456 |

|

| OPERATING COSTS AND

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

2,248 |

|

|

|

2,595 |

|

|

|

7,359 |

|

|

|

9,327 |

|

|

License royalties |

|

|

— |

|

|

|

50 |

|

|

|

50 |

|

|

|

50 |

|

|

Research and development |

|

|

11,168 |

|

|

|

15,358 |

|

|

|

36,776 |

|

|

|

40,831 |

|

|

Selling, general, and administrative |

|

|

13,613 |

|

|

|

10,200 |

|

|

|

42,270 |

|

|

|

33,721 |

|

| Total operating costs and

expenses |

|

|

27,029 |

|

|

|

28,203 |

|

|

|

86,455 |

|

|

|

83,929 |

|

| Loss from operations |

|

|

(8,568 |

) |

|

|

(7,749 |

) |

|

|

(25,265 |

) |

|

|

(22,473 |

) |

| OTHER INCOME, NET |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

|

1,916 |

|

|

|

189 |

|

|

|

2,995 |

|

|

|

2,400 |

|

| LOSS BEFORE INCOME TAXES |

|

|

(6,652 |

) |

|

|

(7,560 |

) |

|

|

(22,270 |

) |

|

|

(20,073 |

) |

|

Provision for income taxes |

|

|

346 |

|

|

|

187 |

|

|

|

606 |

|

|

|

366 |

|

| NET LOSS |

|

$ |

(6,998 |

) |

|

$ |

(7,747 |

) |

|

$ |

(22,876 |

) |

|

$ |

(20,439 |

) |

| Other comprehensive

income/(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

|

(1,083 |

) |

|

|

806 |

|

|

|

(485 |

) |

|

|

518 |

|

| COMPREHENSIVE LOSS |

|

$ |

(8,081 |

) |

|

$ |

(6,941 |

) |

|

$ |

(23,361 |

) |

|

$ |

(19,921 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(0.16 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.47 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

|

44,626,943 |

|

|

|

43,620,532 |

|

|

|

44,145,183 |

|

|

|

43,651,536 |

|

| |

|

Y-MABS THERAPEUTICS, INC.Consolidated

Statements of Cash

Flows(unaudited)(In

thousands) |

| |

|

|

|

|

|

|

| |

|

Nine months ended September 30, |

| |

|

2024 |

|

2023 |

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

Net loss |

|

$ |

(22,876 |

) |

|

$ |

(20,439 |

) |

| Adjustments to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

433 |

|

|

|

574 |

|

|

Stock-based compensation |

|

|

11,480 |

|

|

|

11,330 |

|

|

Foreign currency and other transactions |

|

|

(456 |

) |

|

|

(369 |

) |

| Changes in assets

and liabilities: |

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

2,538 |

|

|

|

(6,343 |

) |

|

Inventories |

|

|

(4,492 |

) |

|

|

(411 |

) |

|

Other current assets |

|

|

3,493 |

|

|

|

2,671 |

|

|

Other assets |

|

|

(5,875 |

) |

|

|

(3,735 |

) |

|

Accounts payable |

|

|

2,274 |

|

|

|

(6,196 |

) |

|

Accrued liabilities and other |

|

|

(363 |

) |

|

|

3,722 |

|

| NET CASH USED IN

OPERATING ACTIVITIES |

|

|

(13,844 |

) |

|

|

(19,196 |

) |

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

— |

|

|

|

— |

|

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

|

|

| Proceeds from

exercised stock options |

|

|

3,325 |

|

|

|

— |

|

| NET CASH PROVIDED

BY FINANCING ACTIVITIES |

|

|

3,325 |

|

|

|

— |

|

| Effect of exchange

rates on cash and cash equivalents |

|

|

4 |

|

|

|

5 |

|

| NET DECREASE IN

CASH AND CASH EQUIVALENTS |

|

|

(10,515 |

) |

|

|

(19,191 |

) |

| Cash and cash

equivalents at the beginning of period |

|

|

78,637 |

|

|

|

105,762 |

|

| Cash and cash

equivalents at the end of period |

|

$ |

68,122 |

|

|

$ |

86,571 |

|

| |

|

|

|

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF NON-CASH ACTIVITIES |

|

|

|

|

|

|

| Right-of-use

assets obtained in exchange for lease obligations |

|

$ |

320 |

|

|

$ |

636 |

|

| Acquisition of

treasury shares upon repayment of secured promissory note |

|

$ |

— |

|

|

$ |

480 |

|

| |

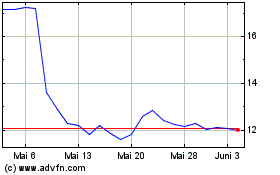

Y mAbs Therapeutics (NASDAQ:YMAB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Y mAbs Therapeutics (NASDAQ:YMAB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025