Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

11 August 2023 - 2:00PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the Month of August 2023

Commission

file number: 001-39803

Meiwu

Technology Company Limited

1602,

Building C, Shenye Century Industry

No.

743 Zhoushi Road, Bao’an District

Shenzhen,

People’s Republic of China

Telephone:

+86-755-85250400

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Receipt

of Nasdaq Minimum Bid Price Extension Period Notification

As

previously disclosed, on February 7, 2023, Meiwu Technology Company Limited (the “Company”) received a deficiency letter

from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) indicating

that the Company was not in compliance with Nasdaq Rule 5450(a)(1) (the “Bid Price Rule”), as the closing bid price for the

Company’s Class A ordinary shares had been below $1.00 per share for the last 30 consecutive business days.

In

accordance with the Nasdaq Listing Rules, the Company was provided an initial period of 180 calendar days, or until August 7, 2023, to

regain compliance with the Bid Price Rule. The Company has not regained compliance with the Bid Price Rule.

On

August 9, 2023, Nasdaq notified the Company that it was eligible for an additional 180 calendar day period, or until February 5, 2024

(the “Extended Compliance Date”), to regain compliance with the Bid Price Rule.

If,

at any time before the lapse of the Extended Compliance Date, the bid price for the Company’s Class A ordinary shares closes at

$1.00 or more for a minimum of 10 consecutive business days as required under the Nasdaq Listing Rules, the Staff will provide written

notification to the Company that it complies with the Bid Price Rule, unless the Staff exercises its discretion to extend this 10 day

period pursuant to Nasdaq Listing Rule 5810(c)(3)(H). If the Company chooses to implement a reverse share split to regain compliance,

it must be completed no later than 10 business days prior to the expiration of the Extended Compliance Date in order to timely regain

compliance.

If

the Company does not regain compliance with the Bid Price Rule by February 5, 2024, Nasdaq will provide written notification to the Company

that its Class A ordinary shares will be subject to delisting. At such time, the Company may appeal the delisting determination to a

Nasdaq Hearings Panel. The Company would remain listed pending the Panel’s decision. There can be no assurance that, if the Company

does appeal a subsequent delisting determination, such appeal would be successful.

The

current notification from Nasdaq has no immediate effect on the Company’s business operations or the listing or trading of the

Company’s shares, which will continue to trade on the Nasdaq Capital Market under the symbol “WNW.” The Company intends

to monitor the closing bid price of its Class A ordinary shares and may, if appropriate, consider implementing available options, including,

but not limited to, implementing a reverse share split of its outstanding ordinary shares, to regain compliance with Bid Price Rule.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Meiwu

Technology Company Limited |

| |

|

|

| Date:

August 10, 2023 |

By: |

/s/

Xinliang Zhang |

| |

Name: |

Xinliang

Zhang |

| |

Title: |

Chief

Executive Officer |

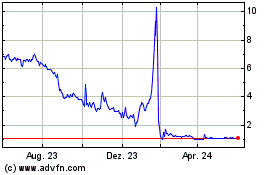

Meiwu Technology (NASDAQ:WNW)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

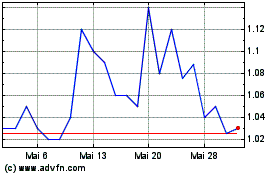

Meiwu Technology (NASDAQ:WNW)

Historical Stock Chart

Von Dez 2023 bis Dez 2024